UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 2025

Commission File Number: 001-39368

MAXEON SOLAR TECHNOLOGIES, LTD.

(Exact Name of registrant as specified in its charter)

8 Marina Boulevard #05-02

Marina Bay Financial Centre

018981, Singapore

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Amendment of Super Senior Notes, Senior Notes and Junior Notes

On January 26, 2025, the Company entered into (a) a supplemental indenture (the “Super Senior Notes Supplemental Indenture”) to the indenture dated June 20, 2024 (the “Super Senior Notes Indenture”), relating to the 9.00% Convertible First Lien Senior Secured Notes due 2029 (the “Super Senior Notes”), by and among, Maxeon Solar Technologies, Ltd. (the “Company”), Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation; (b) a supplemental indenture (the “Senior Notes Supplemental Indenture”) to the indenture dated August 17, 2022 (as amended from time to time, the “Senior Notes Indenture”), relating to the Variable-Rate Convertible First Lien Senior Secured Notes due 2029 (the “Senior Notes”), by and among, the Company, Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation; and (c) a supplemental indenture (the “Junior Notes Supplemental Indenture”) to the indenture dated June 20, 2024 (the “Junior Notes Indenture”), relating to the Adjustable-Rate Convertible Second Lien Senior Secured Notes due 2028 (the “Junior Notes”), by and among, Maxeon Solar Technologies, Ltd., Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation. The term “Supplemental Indenture” shall refer to any of the Super Senior Notes Supplemental Indenture, the Senior Notes Supplemental Indenture, or the Junior Notes Supplemental Indenture, as the case may be.

Super Senior Notes Supplemental Indenture

The Super Senior Notes Supplemental Indenture amended the Super Senior Notes Indenture to:

(i) permit the disposition (the “Proposed SPML Disposition”) of (a) 100% of the share (the “SPML Shares”) in SunPower Philippines Manufacturing Ltd. (“SPML”) and (b) certain specifically identified assets associated with the business activities within the Philippines that are held by the Company or its subsidiaries specified in the applicable Supplemental Indenture (the “Target Assets”) to Lumetech Pte Ltd, an affiliate of Zhonghuan Singapore Investment and Development Pte. Ltd. (“TZE”);

(ii) in connection with the Proposed SPML Disposition, upon the consummation of the Proposed SPML Disposition, automatically release (a) the subsidiary guarantee provided by SPML under the Super Senior Notes Indenture; and (b) the security interest over (1) the shares of SPML, and (2) the assets of SPML; and

(iii) to amend the interest provision such that (a) for the period from the June 20, 2024 to (but excluding) June 20, 2027, the Stated Interest of the Super Senior Notes shall be reduced to 6.00% per annum, payable in cash, (b) if with respect to any Contingent Interest Calculation Date (as defined in the Super Senior Notes Supplemental Indenture), the Company’s Consolidated EBITDA for the fiscal year ended immediately prior to such Contingent Interest Calculation Date equals to or is greater than US$100 million, then the Company shall pay a Contingent Interest (as defined in the Super Senior Notes Supplemental Indenture) on the Contingent Interest Payment Date (as defined in the Super Senior Notes Supplemental Indenture), provided that the Company shall not be required to pay the Contingent Interest more than once, and (c) delay the commencement period of the financial covenant in relation to the total liquidation to first quarter of 2026.

Senior Notes Supplemental Indenture

The Senior Notes Supplemental Indenture amended the Senior Notes Indenture to:

(i) permit the Proposed SPML Disposition;

(ii) in connection with the Proposed SPML Disposition, upon the consummation of the Proposed SPML Disposition, automatically release (a) the subsidiary guarantee provided by SPML under the Senior Notes Indenture; and (b) the security interest over (1) the shares of SPML, and (2) the assets of SPML; and

(iii) to amend the interest provision such that (a) for the period from (and including) August 17, 2024 to (but excluding) August 17, 2027, the Stated Interest of the Senior Notes shall be reduced to 4.00% per annum, with 1.00% of which being payable in cash and the remaining 3.00% payable in cash or PIK Notes as the Company may elect, and (b) if with respect to any Contingent Interest Calculation Date (as defined in the Senior Notes Supplemental Indenture), the Company’s Consolidated EBITDA (as defined in the Senior Notes Supplemental Indenture) for the fiscal year ended immediately prior to such Contingent Interest Calculation Date equals to or is greater than US$100 million, then the Company shall pay a Contingent Interest (as defined in the Senior Notes Supplemental Indenture) on the Contingent Interest Payment Date (as defined in the Senior Notes Supplemental Indenture), provided that the Company shall not be required to pay the Contingent Interest more than once.

Junior Notes Supplemental Indenture

The Junior Notes Supplemental Indenture amended the Junior Notes Indenture to:

(i) in connection with the Proposed SPML Disposition, upon the consummation of the Proposed SPML Disposition, automatically release (a) the subsidiary guarantee provided by SPML under the Junior Notes Indenture; and (b) the security interest over (1) the shares of SPML, and (2) the assets of SPML.

The Company is expected to enter into the definitive agreement relating to the Proposed SPML Disposition on or about the date of this current report, which is expected to be announced through a separate current report. To the extent appropriate, the Company will announce any update through additional current reports or other filings pursuant to the Exchange Act (as defined below).

The foregoing description is only a summary and is qualified in its entirety by reference to each of the Super Senior Notes Supplemental Indenture, the Senior Notes Supplemental Indenture and the Junior Notes Supplemental Indenture, respectively, that is attached to this Form 6-K as an exhibit, and incorporated herein by reference.

Incorporation by Reference

The information contained in this report is hereby incorporated by reference into the Company’s registration statements on Form F-3 (File No. 333-248564), Form F-3 (File No. 333-265253), Form F-3 (File No. 333-268309), Form S-8 (File No. 333-277501), Form S-8 (File No. 333-241709) and Form S-8 (File No. 333-283187), each filed with the Securities and Exchange Commission.

Forward-Looking Statements

This current report on Form 6-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including but not limited to, statements regarding the Company’s anticipated use of the net proceeds from the Issuance. The forward-looking statements can be also identified by terminology such as “may,” “might,” “could,” “will,” “aims,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements.

These forward-looking statements are based on our current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. These statements are not guarantees of future performance and are subject to a number of risks. The reader should not place undue reliance on these forward-looking statements, as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. A detailed discussion of factors that could cause or contribute to such differences and other risks that affect our business is included in filings we make with the Commission from time to time, including our most recent report on Form 20-F, particularly under the heading “Risk Factors”. Copies of these filings are available online from the SEC at www.sec.gov, or on the SEC Filings section of our Investor Relations website at https://corp.maxeon.com/investor-relations. All forward-looking statements in this current report on Form 6-K are based on information currently available to us, and we assume no obligation to update these forward-looking statements in light of new information or future events.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Supplemental Indenture No. 8, dated January 26, 2025, to the indenture dated August 17, 2022, as amended, relating to the Variable-Rate Convertible First Lien Senior Secured Notes due 2029, by and among, Maxeon Solar Technologies, Ltd., Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation. |

| | Supplemental Indenture No. 1, dated January 26, 2025, to the indenture dated June 20, 2024, relating to the 9.00% Convertible First Lien Senior Secured Notes due 2029, by and among, Maxeon Solar Technologies, Ltd., Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation. |

| | Supplemental Indenture No. 1, dated January 26, 2025, to the indenture dated June 20, 2024, relating to the Adjustable-Rate Convertible Second Lien Senior Secured Notes due 2028, by and among, Maxeon Solar Technologies, Ltd., Deutsche Bank Trust Company Americas, as trustee, DB Trustees (Hong Kong) Limited, as the collateral trustee and, solely with respect to the Philippine collateral, RCBC Trust Corporation. |

* Certain of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | MAXEON SOLAR TECHNOLOGIES, LTD. (Registrant) |

| | | | |

| Date: January 27, 2025 | By: | /s/ Dmitri Hu |

| | | Name: | Dmitri Hu |

| | | Title: | Chief Financial Officer |

SUPPLEMENTAL INDENTURE NO. 8

SUPPLEMENTAL INDENTURE No. 8 (this “Supplemental Indenture”) dated as of January 26, 2025 among Maxeon Solar Technologies, Ltd. (or its successor) (the “Company”), Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), DB Trustees (Hong Kong) Limited as collateral trustee (the “Collateral Trustee”) and RCBC Trust Corporation as Philippine Supplemental Collateral Trustee (the “Philippine Supplemental Collateral Trustee”), under the indenture referred to below.

WHEREAS the Company (or its successor) has heretofore executed and delivered to the Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee an indenture (as amended by (a) that certain Supplemental Indenture No. 1, dated September 30, 2022, by and among the Company, the Trustee and the Collateral Trustee, (b) that certain Supplemental Indenture No. 2, dated October 14, 2022, by and among the Company, SunPower Systems Sàrl, the Trustee and the Collateral Trustee, (c) that certain Supplemental Indenture No. 3, dated October 14, 2022, by and among the Company, SunPower Philippines Manufacturing Ltd., the Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee, (d) that certain Supplemental Indenture No. 4, dated November 13, 2023, by and among the Company, the Trustee and the Collateral Trustee, (e) that certain Supplemental Indenture No. 5, dated January 30, 2024, by and among the Company and the Trustee, (f) that certain Supplemental Indenture No. 6, dated May 31, 2024, by and among the Company, the Trustee, the Collateral Trustee and the Supplemental Collateral Trustee named therein, and (g) that certain Supplemental Indenture No. 7, dated June 20, 2024, by and among the Company, the Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee, and as may be further amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Indenture”) dated as of August 17, 2022, relating to the Company’s Variable-Rate Convertible First Lien Senior Secured Notes due 2029 (the “Notes”);

WHEREAS the Indenture provides that, pursuant to Section 8.01(A) of the Indenture, the Company and the Trustee may, notwithstanding anything to the contrary in Section 8.02, the Company and the Trustee may amend or supplement the Indenture Documents without the consent of any Holder to cure any ambiguity or correct any omission, defect or inconsistency in any Indenture Document;

WHEREAS the Indenture provides that, pursuant to Section 8.02 of the Indenture, the Company and the Trustee may, subject to Sections 8.01, 8.03, 7.05 and 7.08 of the Indenture and clauses (i) to (x) of Section 8.02(A) of the Indenture, amend or supplement any provision of the Indenture with the consent of the Holders of a majority in aggregate principal amount of the Notes then outstanding;

WHEREAS the Indenture provides that, pursuant to Section 8.02(A)(iii) of the Indenture, the Company and the Trustee may, subject to Section 8.01, and the terms of the Intercreditor Agreement, reduce the rate, or extend the time for the payment, of interest of any Note with the consent of each Holder of the Notes then outstanding;

WHEREAS pursuant to an Acknowledgement Letter dated January 26, 2025 (the “Acknowledgement Letter”) to a Letter of Consent dated January 26, 2025 (the “Letter of Consent”), Zhonghuan Singapore Investment and Development Pte. Ltd., in its capacity as the Holder of 100% outstanding principal amount of the Notes, consents to the execution and delivery of this Supplemental Indenture and the amendments to the Indenture set forth herein;

WHEREAS the Indenture provides that, pursuant to Section 11.05(A) of the Indenture, subject to the terms of the Intercreditor Agreement and applicable law, the Liens securing the Obligations on the applicable Collateral shall be automatically terminated and released without further action by any party (other than satisfaction of any requirements in the Security Documents, if any), in whole or in part, upon any Disposition of any portion of Collateral in accordance with a Disposition permitted under the terms of any Indenture Document (other than a Disposition to a Company Indenture Party);

WHEREAS the Indenture provides that, pursuant to Section 12.04(A) of the Indenture (as amended herein), among other things, the Subsidiary Guarantee of a Guarantor shall be automatically and unconditionally released in connection with any Disposition (including by way of merger or consolidation) of the Capital Stock of such Guarantor to a Person that is not (either before or after giving effect to such transaction) a Company Indenture Party to the extent such sale is permitted under the Indenture;

WHEREAS the Indenture provides that, pursuant to Section 8.01(N) of the Indenture, the Company and the Trustee may amend or supplement the Indenture Documents without the consent of any Holder to effect, confirm and evidence the release, termination or discharge or any guarantee of or Lien of securing the Notes when such release, termination or discharge is permitted by the Indenture Documents; and

WHEREAS pursuant to Section 8.02 and Section 8.01 of the Indenture, the Company and the Trustee are authorized to execute and deliver this Supplemental Indenture;

WHEREAS (a) pursuant to Section 11.05(B) of the Indenture, without the necessity of any consent of or notice to the Trustee or any Holder of the Notes, any Company Indenture Party may request and instruct the Collateral Trustee to, on behalf of each Holder of Notes, execute and deliver to any Company Indenture Party, as the case may be, for the benefit of any Person, such release documents a may be reasonable requested, or all or any Liens held by the Collateral Trustee in any Collateral securing the Obligations and the Collateral Trustee shall as soon as practicable take such actions provided that any such release complies with and is expressly permitted in accordance with the terms of this Indenture, the Security Documents and the Intercreditor Agreement and is accompanies by an Officer’s Certificate and an Opinion of Counsel; and (b) pursuant to Section 11.10(D), the provisions of the Indenture that refer to the Collateral Trustee shall inure to the benefit of the Philippine Supplemental Collateral Trustee;

WHEREAS pursuant to the Letter of Consent, the Company has requested and instructed the Collateral Trustee and the Philippine Supplemental Collateral Trustee to effect the release of the security over the Released Collateral and pursuant to the Acknowledgement Letter,

the Collateral Trustee and the Philippine Supplemental Collateral Trustee have acknowledged such request and instruction;

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Company, the Trustee, the Collateral Trustee and the Philippine Collateral Trustee mutually covenant and agree for the equal and ratable benefit of the Holders (as defined in the Indenture) as follows:

1.Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recital hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

2.Amendments to Section 1.01 of the Indenture. Section 1.01 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

““Consolidated EBITDA” means, with respect to any Person for any period, the Consolidated Net Income of such Person for such period plus, without duplication, to the extent the same was deducted in calculating Consolidated Net Income:

(1)Consolidated Taxes; plus

(2)Consolidated Interest Expense; plus

(3)Consolidated Non-cash Charges; plus

(4)any costs or expenses realized or resulting from stock option plans, or grants or sales of stock, stock appreciation or similar rights, stock options, restricted stock, preferred stock or other rights;

(5)any loss contingency or losses for any extraordinary and nonrecurring charges, expenses or litigation not occurred in the ordinary course of such Person’s business; plus

(6)any impairment charges or asset write-offs; plus

(7)any net after-tax losses (less all fees and expenses or charges relating thereto) attributable to the early extinguishment of indebtedness, Hedging Agreements or other derivative instruments; plus

(8)any net after-tax losses attributable to the mark-to-market remeasurement of any equity forward contracts, Hedging Agreements or other derivative instruments; plus

(9)any expenses or charges related to any issuance of Capital Stock, securities convertible into or exchangeable into such Capital Stock, Investment, acquisition, Disposition, recapitalization or the incurrence or repayment of Indebtedness (including a refinancing thereof) (whether or not successful), including but not limited to such fees, expenses or charges related to the offering and issuance, or any amendment or modifications, of (i) the First Lien Notes and the Second Lien Notes and the Ordinary Shares issued upon the conversion of any such First Lien Notes or Second Lien Notes, (ii) the TZE Warrant and

the Ordinary Shares issued upon the exercise of any such TZE Warrant, (iii) Ordinary Shares in partial exchange for the 2025 Notes, and (iv) the FPA Shares; plus

(10)project start-up costs, business optimization expenses and other restructuring charges, reserves, fees or expenses (which, for the avoidance of doubt, shall include the effect of inventory optimization programs, facility closures, facility consolidations, retention, systems establishment costs, contract termination costs, future lease commitments and excess pension charges); plus

(11)any non-cash charges arising from a change in the accounting principles applied by the Company or any of its Subsidiaries; plus

(12)any currency translation losses related to currency remeasurements of Indebtedness; plus

(13)any other cash and non-cash charges that are deemed by the Chief Financial Officer and the Board of Directors of the Company not to be part of the ordinary course of business and not necessary to reflect the regular, ongoing operations of the Company and its Subsidiaries; plus

(14)any other non-cash items decreasing Consolidated Net Income for such period, (excluding an accrual or reserve for anticipated cash charges in any future period, the cash payment in respect thereof in such future period shall be subtracted from Consolidated EBITDA to such extent, and excluding amortization of a prepaid cash item that was paid in a prior period); less

(15)any net after-tax gains (less all fees and expenses or charges relating thereto) attributable to the early extinguishment of indebtedness, Hedging Agreements or other derivative instruments; less

(16)any net after-tax gains attributable to the mark-to-market remeasurement of any equity forward contracts, Hedging Agreements or other derivative instruments; less

(17)any non-cash gains arising from a change in the accounting principles applied by the Company or any of its Subsidiaries; less

(18)any currency translation gains related to currency remeasurements of Indebtedness; less

(19)any other cash and non-cash gains that are deemed by the Chief Financial Officer and the Board of Directors of the Company not to be part of the normal course of business and not necessary to reflect the regular, ongoing operations of the Company and its Subsidiaries; less

(20)any other non-cash items increasing Consolidated Net Income for such period (excluding the recognition of deferred revenue or any items that represent the reversal of any accrual of, or cash reserve for, anticipated cash charges that reduced Consolidated EBITDA in any prior period and any items for which cash was received in a prior period).

“Consolidated Interest Expense” means, with respect to any Person for any period, the amount that would be included in gross interest expense on a consolidated income statement prepared in accordance with U.S. GAAP for such period of such Person and its Subsidiaries, minus interest income for such period, and plus, to the extent not included in such gross interest expense, and to the extent incurred, accrued or payable during such period by such Person and its Subsidiaries, without duplication, (1) interest expense attributable to finance leases, (2) amortization of debt issuance costs and original issue discount expense and non-cash interest payments in respect of any Indebtedness, (3) the interest portion of any deferred payment obligation, (4) all commissions, discounts and other fees and charges with respect to letters of credit or similar instruments issued for financing purposes or in respect of any Indebtedness, (5)

the net costs associated with Hedging Agreement (including the amortization of fees, taking no account of any unrealized gains or losses or financial instruments other than any derivative instruments which are accounted for on a hedge accounting basis), (6) interest accruing on Indebtedness of any other Person that is guaranteed by, or secured by a Lien on any asset of, such Person or any of its Subsidiaries, and (7) any capitalized interest.

“Consolidated Net Income” means, with respect to any Person for any period, the net income (loss) of such Person and its Subsidiaries from continuing operations, determined in accordance with U.S. GAAP, provided, however, that the Consolidated Net Income of any Person shall be calculated without deducting the income attributable to, or adding the losses attributable to, the minority equity interests of third parties in any Subsidiary that is not a Wholly Owned Subsidiary, except to the extent of dividends declared or paid in respect of such period on the shares of Capital Stock of such Subsidiary held by such third parties.

“Consolidated Non-cash Charges” means, with respect to any Person for any period, the aggregate depreciation, amortization and other non-cash expenses of such Person and its Subsidiaries reducing Consolidated Net Income of such Person for such period on a consolidated basis and otherwise determined in accordance with U.S. GAAP, but excluding any such charge that consists of or requires an accrual of, or cash reserve for, anticipated cash charges for any future period.

“Consolidated Taxes” means, with respect to any Person for any period, the provision for taxes based on income, profits or capital, including state, franchise, property and similar taxes and non-U.S. withholding taxes (including penalties and interest related to such taxes or arising from tax examinations), as determined in accordance with U.S. GAAP.

“Contingent Interest” has the meaning assigned to such term in Section 2.05(E).

“Contingent Interest Calculation Date” means, with respect to the year ended December 31, 2027 and 2028, five (5) Business Days after the date when the Company files with the SEC its annual report on Form 20-F or, if the Company is then subject to Section 13(a) or 15(d) of the Exchange Act, Form 10-K, whichever is applicable.

“Contingent Interest Payment Date” means the date falling twenty (20) Business Days after the Contingent Interest Calculation Date.

“Contingent Interest Record Date” means the date falling five (5) Business Days after the Contingent Interest Calculation Date.

“Philippine Specified Assets” means certain equipment purchased by certain Subsidiaries of the Company under the purchase contracts specified in Annex I hereto.

“Philippine Target Assets” means 100% of the shares of SunPower Philippines Manufacturing Ltd., the Philippine Collateral and the Philippine Specified Assets.”

“Post-reset PIK Interest Rate” means (1) on and after the Rate Reset Date and prior to August 17, 2024, 7.50% per annum, (2) on and after August 17, 2024 and prior to August 17, 2027, 3.00% per annum, and (3) on and after August 17, 2027, 7.50% per annum.

“Stated Interest” means (1) prior to the Rate Reset Date, 7.50% per annum; and (2) on and after the Rate Reset Date and prior to August 17, 2024, 7.50% per annum if the Company elects to pay the interest payable on an Interest Payment Date in cash in accordance with Section 2.04(C), or 8.50% per annum if the Company elects to pay the interest payable on an Interest Payment Date in a combination of cash and PIK Notes in accordance with Section 2.04(C), (3) on and after August 17, 2024 and prior to August 17, 2027, 4.00% per annum; and (4) on and

after August 17, 2027, 7.50% per annum if the Company elects to pay the interest payable on an Interest Payment Date in cash in accordance with Section 2.04(C), or 8.50% per annum if the Company elects to pay the interest payable on an Interest Payment Date in a combination of cash and PIK Notes in accordance with Section 2.04(C).”

3.Amendments to Section 2.05 of the Indenture.

(a) Section 2.05(D) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(ii) On and after the Rate Reset Date, with respect to any Interest Payment Date on which the Company elects, or is deemed to elect, to pay PIK Interest in accordance with Section 2.04(C), (x) an amount equal to the interest payable at the Post-reset Cash Interest Rate as of such Interest Payment Date will be paid solely in cash, and (y) without duplication, an amount equal to the interest payable at the Post-reset PIK Interest Rate as of such Interest Payment Date will be paid by increasing the principal amount of the outstanding Notes or if, and in the limited circumstances where, the Notes are no longer held in global form, by issuing PIK Notes (rounded up to the nearest $1.00) under this Indenture, having the same terms and conditions as the Notes. With respect to any Interest Payment Date on which the Company elects to pay the interest payable in cash, the total 7.50% per annum interest payable applicable Stated Interest on an Interest Payment Date will be payable solely in cash.”

(b) Section 2.05 shall be further amended by adding the following clause (E):

“(E) Contingent Interest. With respect to each Contingent Interest Calculation Date, if the Company’s Consolidated EBITDA of the fiscal year ended immediately prior to such Contingent Interest Calculation Date equals to or is greater than US$100 million, the Company shall pay an additional special Interest equal to US$135 for each US$1,000 principal amount of Notes then outstanding in cash (the “Contingent Interest”) to the Holder of such Note as of the Close of Business on the immediately succeeding Contingent Interest Record Date on the immediately succeeding Contingent Interest Payment Date, provided that, as long as any Note is outstanding, the Company shall not be required to pay the Contingent Interest more than once. Any reference to the interest payable or paid on the Notes in this Indenture shall be to such interest, including the Contingent Interest if any.”

4.Amendments to Section 3.01 of the Indenture. Section 3.01 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(A) Generally. The Company will pay or cause to be paid (or as applicable by increasing the principal amount of the Notes or issuing PIK Notes, or, only prior to the Rate Reset Date, issuing Ordinary Shares) all the principal of, the Fundamental Change Repurchase Price and Redemption Price for, interest on, Contingent Interest, if any, on, and other amounts due with respect to, the Notes on the dates and in the manner set forth in this Indenture.”

5.Amendments to Section 3.06 of the Indenture. Section 3.06 of the Indenture is hereby amended by adding the following Clause (C):

“Section 3.06. COMPLIANCE, DEFAULT AND SPECIAL CONTINGENT INTEREST CERTIFICATES.

…

(C) Contingent Interest Certificate. Within five (5) Business Days after each Contingent Interest Calculation Date, the Company shall deliver an Officer’s Certificate to the Trustee and the Holder, notifying them (i) whether, with respect to such Contingent Interest Calculation Date, the Company is required to pay the Contingent Interest; (ii) the calculation setting forth the Company’s Consolidated EBITDA of the fiscal year ended immediately prior to such Contingent Interest Calculation Date; and (iii) the Contingent Interest Record Date and the Contingent Interest Payment Date with respect to the payment of the Contingent Interest, if applicable; provided that the determination and the calculation set forth in such certificate shall be binding and conclusive, except for manifest error; provided, further, that, the Company shall not be required to deliver any Officer’s Certificate hereunder after the Company has paid the Contingent Interest.”

6.Amendments to Section 3.15 of the Indenture. Section 3.15 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(U) is a transfer resulting from any casualty or condemnation of property, provided that, to the extent such transfer is by a Company Indenture Party, the relevant Company Indenture Party causes any cash proceeds arising therefrom to be deposited into a deposit account that is subject to Bank Account Perfection Actions.; and

(V) is a Disposition of all or any part of the Philippine Target Assets.”

7.Amendments to Section 6.01 of the Indenture. Section 6.01(B) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(B) Guarantors. The Company shall not permit any Guarantor to consolidate with or merge with or into, dissolve or liquidate voluntarily into, or (directly, or indirectly through one or more of its Subsidiaries) sell, lease or otherwise Dispose, in one transaction or a series of transactions, all or substantially all of the consolidated assets to another person (other than to the Company or another Guarantor) (a “Guarantor Business Combination Event” together with a Company Business Combination Event, a “Business Combination Event”) unless:

(i) the resulting, surviving or transferee Person (the “Successor Guarantor”) either (x) is the Guarantor or (y) if not the Guarantor, is a corporation duly organized and existing under the laws of the jurisdiction of the Company or any of the Guarantors that

expressly assumes (by executing and delivering to the Trustee, at or before the effective time of such Guarantor Business Combination Event, a supplemental indenture pursuant to Section 8.01(B)) all of such Guarantor’s obligations under this Indenture, the Security Documents to which it is a party, the Notes and its Guarantee (including, for the avoidance of doubt, the obligation to pay Additional Amounts pursuant to Section 3.05);

(ii) immediately after giving effect to such Guarantor Business Combination Event, no Default or Event of Default will have occurred and be continuing; and

(iii) before the effective time of any Guarantor Business Combination Event, the Company and the Guarantor, as applicable, will deliver to the Trustee an Officer’s Certificate and Opinion of Counsel, each stating that (i) such Guarantor Business Combination Event (and, if applicable, the related supplemental indenture) comply with Section 6.01(B); and (ii) all conditions precedent to such Guarantor Business Combination Event provided in this Indenture have been satisfied.;

provided, however, that neither this Section 6.01(B) nor any other provision in this Indenture is intended, or shall be construed, to prohibit or restrict in any manner the Disposition permitted under Section 3.15(V).”

8.Amendments to Section 12.04 of the Indenture. Section 12.04(A) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(A) The Subsidiary Guarantee of a Guarantor shall be automatically and unconditionally released: (1) in connection with (x) any Disposition (including by way of merger or consolidation) of the Capital Stock of such Guarantor (or the Capital Stock of the direct parent of such Guarantor) to a Person that is not (either before or after giving effect to such transaction) a Company Indenture Party or an affiliate of a Company Indenture Party, to the extent such sale is permitted hereunder or (y) any sale or other Disposition of all or substantially all of the properties or assets of that Guarantor, by way of merger, consolidation or otherwise solely to the extent that such sale or other Disposition is permitted pursuant to Section 6.01 and so long as such Disposition is not to a Company Indenture Party or an affiliate of a Company Indenture Party; (2) the liquidation or dissolution of such Guarantor; provided that no Event of Default occurs as a result thereof or has occurred or is continuing; (3) upon satisfaction and discharge of this Indenture and the other Indenture Documents in accordance with Article 9; or (4) upon payment of the Obligations in full in immediately available funds.”

9.Release of Certain Collateral.

Pursuant to Section 11.05(A) of the Indenture, only to the extent that the Released Collateral (as defined below) is Disposed as permitted under the Indenture,

(a) the Liens securing the Obligations on the following Collateral shall be released automatically upon the consummation, or the completion of the relevant Disposition permitted under Section 3.15(V) of the Indenture:

(A)100% of the shares of SunPower Philippines Manufacturing Ltd.;

(B) the Philippine Collateral; and

(C)those certain assets of SunPower Philippines Manufacturing Ltd. covered under the New York law governed first lien security agreement dated May 31, 2024, by and between, among others, SunPower Philippines Manufacturing Ltd. as grantor and DB Trustees (Hong Kong) Limited as collateral trustee, as amended and restated by the amended and restated security agreement dated the Issue Date, by and between, among others, SunPower Philippines Manufacturing Ltd. as grantor and DB Trustees (Hong Kong) Limited as collateral trustee, to secure the Notes (the “Released Collateral”).

10.Release of Certain Subsidiary Guarantor.

(a) Pursuant to Section 12.04(A) of the Indenture (as amended herein), the Subsidiary Guarantee of SunPower Philippine Manufacturing Ltd. shall be released automatically upon the completion of the Disposition of the shares of SunPower Philippine Manufacturing Ltd. as permitted under Section 3.15(V) of the Indenture.

11.Ratification of Indenture; Supplemental Indentures Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder shall be bound hereby.

12.Governing Law. THIS SUPPLEMENTAL INDENTURE AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, IS GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

13.Trustee, Collateral Trustee and Philippine Supplemental Collateral Trustee Make No Representation. The Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee make no representation as to the validity or sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by the other parties hereto.

14.Counterparts. The parties may sign any number of copies of this Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement.

15.Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction thereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

MAXEON SOLAR TECHNOLOGIES, LTD.

By:/s/ Guo AiPing

Name: Guo AiPing

Title: Director

DEUTSCHE BANK TRUST COMPANY AMERICAS, AS TRUSTEE, REGISTRAR, PAYING AGENT, CONVERSION AGENT

By:/s/ Carol Ng

Name: Carol Ng

Title: Vice President

By:/s/ Mary Miselis

Name: Mary Miselis

Title: Vice President

DB TRUSTEES (HONG KONG) LIMITED, AS COLLATERAL TRUSTEE

By: /s/ Ana Vuong

Name: Ana Vuong

Title: Authorized Signatory

By: /s/ Ka Ho Mak

Name: Ka Ho Mak

Title: Authorized Signatory

[Signature Page to Supplemental Indenture]

AS_ACTIVE:\34124800\2\77557.0003

RCBC TRUST CORPORATION, AS PHILIPPINE SUPPLEMENTAL COLLATERAL TRUSTEE

By:/s/ Ryan Roy W. Sinaon

Name: Ryan Roy W. Sinaon

Title: -

By:/s/ Justine Kim C. Marte

Name: Justine Kim C. Marte

Title:-

[Signature Page to Supplemental Indenture]

ANNEX I

List of Purchase Contracts

[******]

AS_ACTIVE:\34124800\2\77557.0003

SUPPLEMENTAL INDENTURE NO. 1

SUPPLEMENTAL INDENTURE No. 1 (this “Supplemental Indenture”) dated as of January 26, 2025 among Maxeon Solar Technologies, Ltd. (or its successor) (the “Company”), Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), DB Trustees (Hong Kong) Limited as collateral trustee (the “Collateral Trustee”) and RCBC Trust Corporation as Philippine Supplemental Collateral Trustee (the “Philippine Supplemental Collateral Trustee”), under the indenture referred to below.

WHEREAS the Company (or its successor) has heretofore executed and delivered to the Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee an indenture, dated as of June 20, 2024, (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Indenture”) relating to the Company’s 9.00% Convertible First Lien Senior Secured Notes due 2029 (the “Notes”);

WHEREAS the Indenture provides that, pursuant to Section 8.01(A) of the Indenture, the Company and the Trustee may, notwithstanding anything to the contrary in Section 8.02, amend or supplement the Indenture Documents without the consent of any Holder to cure any ambiguity or correct any omission, defect or inconsistency in any Indenture Document;

WHEREAS the Indenture provides that, pursuant to Section 8.02 of the Indenture, the Company and the Trustee may, subject to Sections 8.01, 8.03, 7.05 and 7.08 of the Indenture and clauses (i) to (x) of Section 8.02(A) of the Indenture, amend or supplement any provision of the Indenture with the consent of the Holders of a majority in aggregate principal amount of the Notes then outstanding;

WHEREAS the Indenture provides that, pursuant to Section 8.02(A)(iii) of the Indenture, the Company and the Trustee may, subject to Section 8.01, and the terms of the Intercreditor Agreement, reduce the rate, or extend the time for the payment, of interest of any Note with the consent of each Holder of the Notes then outstanding;

WHEREAS pursuant to an Acknowledgement Letter dated January 26, 2025 (the “Acknowledgement Letter”) to a Letter of Consent dated January 26, 2025 (the “Letter of Consent”), Zhonghuan Singapore Investment and Development Pte. Ltd., in its capacity as the Holder of 100% outstanding principal amount of the Notes, consents to the execution and delivery of this Supplemental Indenture and the amendments to the Indenture set forth herein;

WHEREAS the Indenture provides that, pursuant to Section 11.05(A) of the Indenture, subject to the terms of the Intercreditor Agreement and applicable law, the Liens securing the Obligations on the applicable Collateral shall be automatically terminated and released without further action by any party (other than satisfaction of any requirements in the Security Documents, if any), in whole or in part, upon any Disposition of any portion of Collateral in accordance with a Disposition permitted under the terms of any Indenture Document (other than a Disposition to a Company Indenture Party);

WHEREAS the Indenture provides that, pursuant to Section 12.04(A) of the Indenture (as amended herein), among other things, the Subsidiary Guarantee of a Guarantor shall be automatically and unconditionally released in connection with any Disposition (including by way of merger or consolidation) of the Capital Stock of such Guarantor to a Person that is not (either before or after giving effect to such transaction) a Company Indenture Party to the extent such sale is permitted under the Indenture;

WHEREAS the Indenture provides that, pursuant to Section 8.01(N) of the Indenture, the Company and the Trustee may amend or supplement the Indenture Documents without the consent of any Holder to effect, confirm and evidence the release, termination or discharge or any guarantee of or Lien of securing the Notes when such release, termination or discharge is permitted by the Indenture Documents; and

WHEREAS pursuant to Section 8.02 and Section 8.01 of the Indenture, the Company and the Trustee are authorized to execute and deliver this Supplemental Indenture;

WHEREAS (a) pursuant to Section 11.05(B) of the Indenture, without the necessity of any consent of or notice to the Trustee or any Holder of the Notes, any Company Indenture Party may request and instruct the Collateral Trustee to, on behalf of each Holder of Notes, execute and deliver to any Company Indenture Party, as the case may be, for the benefit of any Person, such release documents a may be reasonable requested, or all or any Liens held by the Collateral Trustee in any Collateral securing the Obligations and the Collateral Trustee shall as soon as practicable take such actions provided that any such release complies with and is expressly permitted in accordance with the terms of this Indenture, the Security Documents and the Intercreditor Agreement and is accompanies by an Officer’s Certificate and an Opinion of Counsel; and (b) pursuant to Section 11.10(D), the provisions of the Indenture that refer to the Collateral Trustee shall inure to the benefit of the Philippine Supplemental Collateral Trustee;

WHEREAS pursuant to the Letter of Consent, the Company has requested and instructed the Collateral Trustee and the Philippine Supplemental Collateral Trustee to effect the release of the security over the Released Collateral and pursuant to the Acknowledgement Letter, the Collateral Trustee and the Philippine Supplemental Collateral Trustee have acknowledged such request and instruction;

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Company, the Trustee, the Collateral Trustee and the Philippine Collateral Trustee mutually covenant and agree for the equal and ratable benefit of the Holders (as defined in the Indenture) as follows:

1.Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recital hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

2.Amendments to Section 1.01 of the Indenture. Section 1.01 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

““Consolidated EBITDA” means, with respect to any Person for any period, the Consolidated Net Income of such Person for such period plus, without duplication, to the extent the same was deducted in calculating Consolidated Net Income:

…

(14) any other non-cash items decreasing Consolidated Net Income for such period, (excluding an accrual or reserve for anticipated cash charges in any future period, the cash payment in respect thereof in such future period shall be subtracted from Consolidated EBITDA to such extent, and excluding amortization of a prepaid cash item that was paid in a prior period); plus, less, without duplication

…”

“Contingent Interest Calculation Date” means, with respect to the year ended December 31, 2027 and 2028, five (5) Business Days after the date when the Company files with the SEC its annual report on Form 20-F or, if the Company is then subject to Section 13(a) or 15(d) of the Exchange Act, Form 10-K, whichever is applicable.

“Contingent Interest Payment Date” means the date falling twenty (20) Business Days after the Contingent Interest Calculation Date.

“Contingent Interest Record Date” means the date falling five (5) Business Days after the Contingent Interest Calculation Date.

“Philippine Specified Assets” means certain equipment purchased by certain Subsidiaries of the Company under the purchase contracts specified in Annex I hereto.

“Philippine Target Assets” means 100% of the shares of SunPower Philippines Manufacturing Ltd., the Philippine Collateral and the Philippine Specified Assets.

“Relevant PIK Interest Rate” shall mean 3.00% per annum 0.00% per annum.

“Stated Interest” shall mean (1) prior to June 20, 2027, 6.00% per annum; and (2) on and from June 20, 2027, 9.00% per annum.”

3.Amendments to Section 2.05 of the Indenture.

(a) Section 2.05(A) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(A) Accrual of Interest. Each Note will accrue interest at a rate per annum equal to 9.00% (the “Stated Interest”)the Stated Interest, plus any Special Interest that may

accrue pursuant to Section 7.03. Stated Interest on each Note will (i) accrue from, and including, the most recent date to which Stated Interest has been paid or duly provided for (or, if no Stated Interest has theretofore been paid or duly provided for, the date set forth in the certificate representing such Note as the date from, and including, which Stated Interest will begin to accrue in such circumstance) to, but excluding, the date of payment of such Stated Interest; and (ii) be, subject to Sections 4.02(D), 4.03(F) and 5.02(D) (but without duplication of any payment of interest), payable semi-annually in arrears on each Interest Payment Date, beginning on the first Interest Payment Date set forth in the certificate representing such Note, to the Holder of such Note as of the Close of Business on the immediately preceding Regular Record Date. Stated Interest, and, if applicable, Special Interest, on the Notes will be computed on the basis of a 360-day year comprised of twelve 30-day months.”

(b) Section 2.05 shall be further amended by adding the following clause (E):

“(E) Contingent Interest. With respect to each Contingent Interest Calculation Date, if the Company’s Consolidated EBITDA of the fiscal year ended immediately prior to such Contingent Interest Calculation Date equals to or is greater than US$100 million, the Company shall pay a an additional special Interest equal to US$90 for each $1,000 principal amount of Notes then outstanding in cash (the “Contingent Interest”) to the Holder of such Note as of the Close of Business on the immediately succeeding Contingent Interest Record Date on the immediately succeeding Contingent Interest Payment Date, provided that, as long as any Note is outstanding, the Company shall not be required to pay the Contingent Interest more than once. Any reference to the interest payable or paid on the Notes in this Indenture shall be to such interest, including the Contingent Interest if any.”

4.Amendments to Section 3.01 of the Indenture. Section 3.01 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(A) Generally. The Company will pay or cause to be paid (or as applicable by increasing the principal amount of the Notes or issuing PIK Notes) all the principal of, the Fundamental Change Repurchase Price and Redemption Price for, interest on, Contingent Interest, if any, on, and other amounts due with respect to, the Notes on the dates and in the manner set forth in this Indenture.”

5.Amendments to Section 3.06 of the Indenture. Section 3.06 of the Indenture is hereby amended by adding the following Clause (C):

“Section 3.06. COMPLIANCE AND, DEFAULT AND CONTINGENT INTEREST CERTIFICATES.

…

(C) Contingent Interest Certificate. Within five (5) Business Days after each Contingent Interest Calculation Date, the Company shall deliver an Officer’s Certificate to the Trustee and the Holder, notifying them (i) whether, with respect to such Contingent Interest

Calculation Date, the Company is required to pay the Contingent Interest; (ii) the calculation setting forth the Company’s Consolidated EBITDA of the fiscal year ended immediately prior to such Contingent Interest Calculation Date; and (iii) the Contingent Interest Record and the Contingent Interest Payment Date with respect to the payment of the Contingent Interest, if applicable; provided that the determination and the calculation set forth in such certificate shall be binding and conclusive, except for manifest error; provided, further, that, the Company shall not be required to deliver any Officer’s Certificate hereunder after the Company has paid the Contingent Interest.”

6.Amendments to Section 3.11 of the Indenture. Section 3.11(B) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(B) Liquidity. With respect to each full fiscal quarter commencing with the fiscal quarter ending March 31, 20252026, the Company shall not permit the Total Liquidity of the Company as of the last Business Day of such fiscal quarter to be less than $40 million.”

7.Amendments to Section 3.15 of the Indenture. Section 3.15 of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(U) is a transfer resulting from any casualty or condemnation of property, provided that, to the extent such transfer is by a Company Indenture Party, the relevant Company Indenture Party causes any cash proceeds arising therefrom to be deposited into a deposit account that is subject to Bank Account Perfection Actions.; and

(V) is a Disposition of all or any part of the Philippine Target Assets.”

8.Amendments to Section 6.01 of the Indenture. Section 6.01(B) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(B) Guarantors. The Company shall not permit any Guarantor to consolidate with or merge with or into, dissolve or liquidate voluntarily into, or (directly, or indirectly through one or more of its Subsidiaries) sell, lease or otherwise Dispose, in one transaction or a series of transactions, all or substantially all of the consolidated assets to another Person (other than to the Company or another Guarantor) (a “Guarantor Business Combination Event” together with a Company Business Combination Event, a “Business Combination Event”) unless:

(i) the resulting, surviving or transferee Person (the “Successor Guarantor”) either (x) is the Guarantor or (y) if not the Guarantor, is a corporation duly organized and existing under the laws of the jurisdiction of the Company or any of the Guarantors that expressly assumes (by executing and delivering to the Trustee, at or before the effective time of such Guarantor Business Combination Event, a supplemental indenture pursuant to Section 8.01(B)) all of such Guarantor’s obligations under this Indenture, the Security Documents to

which it is a party, the Notes and its Guarantee (including, for the avoidance of doubt, the obligation to pay Additional Amounts pursuant to Section 3.05);

(ii) immediately after giving effect to such Guarantor Business Combination Event, no Default or Event of Default will have occurred and be continuing; and

(iii) before the effective time of any Guarantor Business Combination Event, the Company and the Guarantor, as applicable, will deliver to the Trustee an Officer’s Certificate and Opinion of Counsel, each stating that (i) such Guarantor Business Combination Event (and, if applicable, the related supplemental indenture) comply with Section 6.01(B); and (ii) all conditions precedent to such Guarantor Business Combination Event provided in this Indenture have been satisfied.;

provided, however, that neither this Section 6.01(B) nor any other provision in this Indenture is intended, or shall be construed, to prohibit or restrict in any manner the Disposition permitted under Section 3.15(V).”

9.Amendments to Section 12.04 of the Indenture. Section 12.04(A) of the Indenture is hereby amended as follows (deletions shown in strikethrough and additions shown in double-underline):

“(A) The Subsidiary Guarantee of a Guarantor shall be automatically and unconditionally released: (1) in connection with (x) any Disposition (including by way of merger or consolidation) of the Capital Stock of such Guarantor (or the Capital Stock of the direct parent of such Guarantor) to a Person that is not (either before or after giving effect to such transaction) a Company Indenture Party or an affiliate of a Company Indenture Party, to the extent such sale is permitted hereunder or (y) any sale or other Disposition of all or substantially all of the properties or assets of that Guarantor, by way of merger, consolidation or otherwise solely to the extent that such sale or other Disposition is permitted pursuant to Section 6.01 and so long as such Disposition is not to a Company Indenture Party or an affiliate of a Company Indenture Party; (2) the liquidation or dissolution of such Guarantor; provided that no Event of Default occurs as a result thereof or has occurred or is continuing; (3) upon satisfaction and discharge of this Indenture and the other Indenture Documents in accordance with Article 9; or (4) upon payment of the Obligations in full in immediately available funds.”

10.Release of Certain Collateral.

Pursuant to Section 11.05(A) of the Indenture, only to the extent the Released Collateral (as defined below) is Disposed as permitted under the Indenture,

(a) the Liens securing the Obligations on the following Collaterals shall be released automatically upon the consummation, or the completion of the relevant Disposition permitted under Section 3.15(V) of the Indenture:

(A)100% of the shares of SunPower Philippines Manufacturing Ltd.; and

(B) the Philippine Collateral; and

(C)those certain assets of SunPower Philippines Manufacturing Ltd. covered under the New York law governed super senior first lien security agreement, dated the Issue Date, by and between, among others, SunPower Philippines Manufacturing Ltd. as grantor and DB Trustees (Hong Kong) Limited as collateral trustee, to secure the Notes (the “Released Collateral”).

11.Release of Certain Subsidiary Guarantors.

(a) Pursuant to Section 12.04(A) of the Indenture (as amended herein), the Subsidiary Guarantee of SunPower Philippine Manufacturing Ltd. shall be released automatically upon the completion of the Disposition of the shares of SunPower Philippine Manufacturing Ltd. as permitted under Section 3.15(V) of the Indenture.

12.Ratification of Indenture; Supplemental Indentures Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder shall be bound hereby.

13.Governing Law. THIS SUPPLEMENTAL INDENTURE AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, IS GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

14.Trustee, Collateral Trustee and Philippine Supplemental Collateral Trustee Make No Representation. The Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee make no representation as to the validity or sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by the other parties hereto.

15.Counterparts. The parties may sign any number of copies of this Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement.

16.Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction thereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

MAXEON SOLAR TECHNOLOGIES, LTD.

By:/s/ Guo AiPing

Name: Guo AiPing

Title: Director

DEUTSCHE BANK TRUST COMPANY AMERICAS, AS TRUSTEE, REGISTRAR, PAYING AGENT, CONVERSION AGENT

By:/s/ Carol Ng

Name: Carol Ng

Title: Vice President

By:/s/ Mary Miselis

Name: Mary Miselis

Title: Vice President

DB TRUSTEES (HONG KONG) LIMITED, AS COLLATERAL TRUSTEE

By: /s/ Ana Vuong

Name: Ana Vuong

Title: Authorized Signatory

By: /s/ Ka Ho Mak

Name: Ka Ho Mak

Title: Authorized Signatory

[Signature Page to Supplemental Indenture]

AS_ACTIVE:\34124800\2\77557.0003

RCBC TRUST CORPORATION, AS PHILIPPINE SUPPLEMENTAL COLLATERAL TRUSTEE

By:/s/ Ryan Roy W. Sinaon

Name: Ryan Roy W. Sinaon

Title: -

By:/s/ Justine Kim C. Marte

Name: Justine Kim C. Marte

Title: -

[Signature Page to Supplemental Indenture]

ANNEX I

List of Purchase Contracts

[******]

AS_ACTIVE:\34124800\2\77557.0003

SUPPLEMENTAL INDENTURE NO. 1

SUPPLEMENTAL INDENTURE No. 1 (this “Supplemental Indenture”) dated as of January 26, 2025 among Maxeon Solar Technologies, Ltd. (or its successor) (the “Company”), Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), DB Trustees (Hong Kong) Limited as collateral trustee (the “Collateral Trustee”) and RCBC Trust Corporation as Philippine Supplemental Collateral Trustee (the “Philippine Supplemental Collateral Trustee”), under the indenture referred to below.

WHEREAS the Company (or its successor) has heretofore executed and delivered to the Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee an indenture, dated as of June 20, 2024 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Indenture”), relating to the Company’s Adjustable-Rate Convertible Second Lien Senior Secured Notes due 2028 (the “Notes”);

WHEREAS the Indenture provides that, pursuant to Section 8.01(A) of the Indenture, the Company and the Trustee may, notwithstanding anything to the contrary in Section 8.02, the Company and the Trustee may amend or supplement the Indenture Documents without the consent of any Holder to cure any ambiguity or correct any omission, defect or inconsistency in any Indenture Document;

WHEREAS under each of (1) the First Lien Notes Indenture (as amended by that certain Supplemental Indenture No. 1, dated January 26, 2025, by and among the Company, the First Lien Notes Trustee, the First Lien Notes Collateral Trustee and the First Lien Notes Philippine Supplemental Collateral among the Company), and (2) the Amended 2029 First Lien Notes Indenture (as amended by that certain Supplemental Indenture No. 8, dated January 26, 2025, by and among the Company, the Amended 2029 First Lien Notes Trustee, the Amended 2029 First Lien Notes Collateral Trustee and the Amended 2029 First Lien Notes Philippine Supplemental Collateral among the Company), the Company and the Company Indenture Parties are permitted to dispose all or any part of the Philippine Target Assets (as specified in Annex I hereto) (“SPML Disposition”);

WHEREAS pursuant to Section 8.01(J) of the Indenture, the Company and the Trustee may, notwithstanding anything to the contrary in Section 8.02, amend or supplement the Indenture Documents without the consent of any Holder to effect such amendment, restatement, supplement, modification, waiver or consent in respect of the Priority Lien Debt Documents that shall apply automatically to this Indenture without the consent of any Holder in accordance with the Intercreditor Agreement;

WHEREAS the Indenture provides that, pursuant to Section 11.05(A) of the Indenture, subject to the terms of the Intercreditor Agreement and Section 11.05(D) of the Indenture, the Liens securing the Obligations on the applicable Collateral shall be automatically terminated and released without further action by any party (other than satisfaction of any requirements in the Security Documents, if any), in whole or in part, upon any disposition of any portion of Collateral in accordance with a disposition permitted under the terms of any Priority Lien Debt Document (other than a Disposition to a Company Indenture Party); provided that

Liens on such Collateral under any Priority Lien Debt Document are also released under any such Priority Lien Debt Document substantially concurrently;

WHEREAS the Indenture provides that, pursuant to Section 12.04(A) of the Indenture, among other things, the Subsidiary Guarantee of a Guarantor shall be automatically and unconditionally released in connection with any disposition (including by way of merger or consolidation) of the Capital Stock of such Guarantor to a Person that is not (either before or after giving effect to such transaction) a Company Indenture Party, to the extent such sale is permitted under any Priority Lien Debt Documents;

WHEREAS the Indenture provides that, pursuant to Section 8.01(N) of the Indenture, the Company and the Trustee may amend or supplement the Indenture Documents without the consent of any Holder to, among other things, effect, confirm and evidence the release, termination or discharge or any guarantee or Lien of securing the Notes when such release, termination or discharge is permitted by the Indenture Documents; and

WHEREAS pursuant to Section 8.01 of the Indenture, the Company and the Trustee are authorized to execute and deliver this Supplemental Indenture;

WHEREAS (a) pursuant to Section 11.05(B) of the Indenture, without the necessity of any consent of or notice to the Trustee or any Holder of the Notes, any Company Indenture Party may request and instruct the Collateral Trustee to, on behalf of each Holder of Notes, execute and deliver to any Company Indenture Party, as the case may be, for the benefit of any Person, such release documents a may be reasonable requested, or all or any Liens held by the Collateral Trustee in any Collateral securing the Obligations and the Collateral Trustee shall as soon as practicable take such actions provided that any such release complies with and is expressly permitted in accordance with the terms of this Indenture, the Security Documents and the Intercreditor Agreement and is accompanies by an Officer’s Certificate and an Opinion of Counsel; and (b) pursuant to Section 11.10(D), the provisions of the Indenture that refer to the Collateral Trustee shall inure to the benefit of the Philippine Supplemental Collateral Trustee;

WHEREAS pursuant to a Letter of Consent dated January 26, 2025 (the “Letter of Consent”), the Company has requested and instructed the Collateral Trustee and the Philippine Supplemental Collateral Trustee to effect the release of the security over the Released Collateral (as defined below) and pursuant to an Acknowledgement Letter dated January 26, 2025 to the Letter of Consent, the Collateral Trustee and the Philippine Supplemental Collateral Trustee have acknowledged such request and instruction;

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is hereby acknowledged, the Company, the Trustee, the Collateral Trustee and the Philippine Collateral Trustee mutually covenant and agree for the equal and ratable benefit of the Holders (as defined in the Indenture) as follows:

1.Defined Terms. As used in this Supplemental Indenture, terms defined in the Indenture or in the preamble or recital hereto are used herein as therein defined. The words “herein,” “hereof” and “hereby” and other words of similar import used in this Supplemental

Indenture refer to this Supplemental Indenture as a whole and not to any particular section hereof.

2.Release of Certain Collateral.

(a) Subject to Section 3.13 and pursuant to Section 11.05(A) of the Indenture, the Liens securing the Obligations on the following Collaterals shall be released automatically upon the consummation, or the completion of the relevant SPML Disposition:

(1)100% of the shares of SunPower Philippines Manufacturing Ltd.;

(2) the Philippine Collateral; and

(3)those certain assets of SunPower Philippines Manufacturing Ltd. covered under the New York law governed second lien security agreement dated the Issue Date, by and between, among others, SunPower Philippines Manufacturing Ltd. as grantor and DB Trustees (Hong Kong) Limited as collateral trustee, to secure the Notes (the “Released Collateral”).

3.Release of Certain Subsidiary Guarantor.

(a) Subject to Section 3.13 and pursuant to Section 12.04(A) of the Indenture, the Subsidiary Guarantee of SunPower Philippine Manufacturing Ltd. shall be released automatically upon the completion of the disposition of the shares of SunPower Philippine Manufacturing Ltd. in connection with the SPML Disposition.

4.Ratification of Indenture; Supplemental Indentures Part of Indenture. Except as expressly amended hereby, the Indenture is in all respects ratified and confirmed and all the terms, conditions and provisions thereof shall remain in full force and effect. This Supplemental Indenture shall form a part of the Indenture for all purposes, and every Holder shall be bound hereby.

5.Governing Law. THIS SUPPLEMENTAL INDENTURE AND ANY CLAIM, CONTROVERSY OR DISPUTE ARISING UNDER OR RELATED TO THIS SUPPLEMENTAL INDENTURE, IS GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK.

6.Trustee, Collateral Trustee and Philippine Supplemental Collateral Trustee Make No Representation. The Trustee, the Collateral Trustee and the Philippine Supplemental Collateral Trustee make no representation as to the validity or sufficiency of this Supplemental Indenture or with respect to the recitals contained herein, all of which recitals are made solely by the other parties hereto.

7.Counterparts. The parties may sign any number of copies of this Supplemental Indenture. Each signed copy shall be an original, but all of them together represent the same agreement.

8.Effect of Headings. The Section headings herein are for convenience only and shall not affect the construction thereof.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

IN WITNESS WHEREOF, the parties hereto have caused this Supplemental Indenture to be duly executed as of the date first above written.

MAXEON SOLAR TECHNOLOGIES, LTD.

By:/s/ Guo AiPing

Name: Guo AiPing

Title: Director

DEUTSCHE BANK TRUST COMPANY AMERICAS, AS TRUSTEE, REGISTRAR, PAYING AGENT, CONVERSION AGENT

By:/s/ Carol Ng

Name: Carol Ng

Title: Vice President

By:/s/ Mary Miselis

Name: Mary Miselis

Title: Vice President

DB TRUSTEES (HONG KONG) LIMITED, AS COLLATERAL TRUSTEE

By: /s/ Ana Vuong

Name: Ana Vuong

Title: Authorized Signatory

By: /s/ Ka Ho Mak

Name: Ka Ho Mak

Title: Authorized Signatory

[Signature Page to Supplemental Indenture]

RCBC TRUST CORPORATION, AS PHILIPPINE SUPPLEMENTAL COLLATERAL TRUSTEE

By:/s/ Ryan Roy W. Sinaon

Name: Ryan Roy W. Sinaon

Title: -

By:/s/ Justine Kim C. Marte

Name: Justine Kim C. Marte

Title: -

[Signature Page to Supplemental Indenture]

ANNEX I

A. List of Philippine Target Assets:

1.100% of the shares of SunPower Philippines Manufacturing Ltd., and

2. certain equipment purchased by certain Subsidiaries of the Company under the purchase contracts specified in Annex II hereto.

ANNEX II

List of Purchase Contracts

[******]

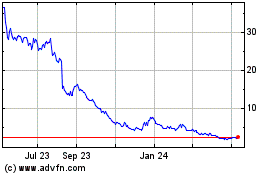

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Jan 2025 to Feb 2025

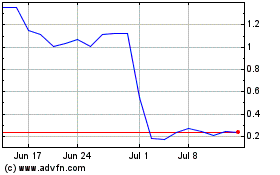

Maxeon Solar Technologies (NASDAQ:MAXN)

Historical Stock Chart

From Feb 2024 to Feb 2025