As filed with the Securities and Exchange Commission on October 9, 2024

Registration No. 333-277501

Registration No. 333-241709

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

(POST-EFFECTIVE AMENDMENT NO. 1)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MAXEON SOLAR TECHNOLOGIES, LTD.

(Exact name of registrant as specified in governing instruments)

| | | | | | | | |

| Singapore | | N/A |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

8 Marina Boulevard #05-02

Marina Bay Financial Centre

018981, Singapore

(Address, including zip code, of principal executive offices)

Maxeon Solar Technologies, Ltd.

2020 Omnibus Incentive Plan

(Full title of the plan)

Corporation Service Company

1180 Avenue of the Americas, Suite 210

New York, New York 11036-8401

(800) 927-9800

(Name, address and telephone number, including area code, of agent for service)

Copies to:

Era Anagnosti, Esq.

DLA Piper US LLP

500 8th Street, N.W.

Washington, DC 20004

(202) 799-4000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,”

“accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (the “Post-Effective Amendment No. 1”) relates to the Registration Statement on Form S-8 (File No. 333-241709) filed with the Securities and Exchange Commission (the “Commission”) on August 6, 2020 (the “2020 Registration Statement”) and the Registration Statement on Form S-8 (File No. 333-277501) filed with the Commission on February 29, 2024 (the “2024 Registration Statement”, and together with the 2020 Registration, the “Registration Statements”) by Maxeon Solar Technologies, Ltd., a Singapore corporation (the “Registrant”). This Post-Effective Amendment No. 1 is being filed to adjust the number of securities covered by the Registration Statements pursuant to Rule 416(b) of the Securities Act of 1933, as amended (the “Securities Act”), and related interpretations of the staff of the Commission.

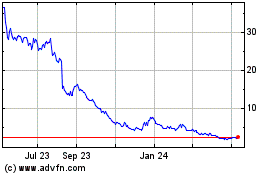

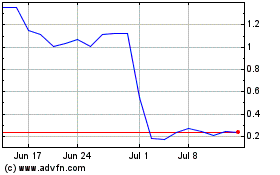

The Registration Statements registered 3,889,754 ordinary shares, no par value, of the Registrant (the “Ordinary Shares”) and 6,665,992 Ordinary Shares, respectively, to be issued pursuant to the Registrant’s 2020 Omnibus Incentive Plan. On October 8, 2024, the Registrant completed a one-for-one-hundred reverse stock split of its Ordinary Shares (the “Reverse Stock Split”). Accordingly, the purpose of this Post-Effective Amendment No. 1 is to proportionately reduce the number of Ordinary covered by the Registration Statements. As a result, as of October 9, 2024, after giving effect to the Reverse Stock Split, the 2020 Registration Statement now covers a maximum of 38,897 Ordinary Shares and the 2024 Registration Statement now covers a maximum of 66,659 Ordinary Shares.

Except to the extent specified herein, the Registration Statements, as originally filed, are not amended or otherwise affected by this Post-Effective Amendment No. 1.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which have been filed by the Registrant with the Commission, are incorporated in this Registration Statement by reference:

1.The Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023, filed with the Commission on May 30, 2024 (the “Annual Report”). 2.The Registrant’s Reports of Foreign Private Issuer on Form 6-K furnished to the Commission as follows: our Reports on Form 6-K furnished to the Commission on January 5, 2024 (Film No. 24514396), April 1, 2024 (Film No. 24805733), April 8, 2024 (Film No. 24829751), April 26, 2024 (Film No. 24878483), May 22, 2024 (Film No. 24971611), May 30, 2024 (Film No. 241000696, 241000707, 241000716, 241000725), May 31, 2024 (Film No. 241007770, 241009872), June 5, 2024 (Film No. 241020647), June 6, 2024 (Film No. 241023582), June 17, 2024 (Film No. 241046826), June 21, 2024 (Film No. 241058350), July 5, 2024 (Film No. 241101573), July 26, 2024 (Film No. 241143476), August 5, 2024 (Film No. 241173145), August 20, 2024 (Film No. 241222634), August 27, 2024 (Film No. 241249678), August 29, 2024 (Film No. 241259241), September 3, 2024 (Film No. 241271835, 241272051), September 12, 2024 (Film No. 241293836), September 19, 2024 (Film No. 241309032), September 20, 2024 (Film No. 241314115), September 24, 2024 (Film No. 241320188), October 4, 2024 (Film No. 241353485) and October 7, 2024 (Film No. 241356144). 3.The Description of Securities Registered Under Section 12 of the Securities Exchange Act of 1934, as amended, contained in Exhibit 2.7 to the Annual Report.

All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) subsequent to the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information, or portions thereof, which are furnished and not filed in accordance with the rules of the Commission shall not be deemed incorporated by reference into this Registration Statement.

Any statement contained in this Registration Statement or in a document incorporated or deemed to be incorporated by reference in this Registration Statement will be deemed to be modified or superseded to the extent that a statement contained or incorporated by reference herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this Registration Statement modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

Pursuant to the Singapore Companies Act, any provision that purports to exempt an officer of a company (to any extent) from any liability that would otherwise attach to him or her or any provision by which a company directly or indirectly provides an indemnity (to any extent) for an officer of the company against any liability attaching to him or her in connection with any negligence, default, breach of duty or breach of trust in relation to the company is void. This prohibition applies to any provision, whether contained in the company's constitution or in any contract with the company or otherwise. However, the Singapore Companies Act specifically provides that we are allowed to:

•purchase and maintain for any officer of the company insurance against any liability which by law would otherwise attach to such officer in connection with any negligence, default, breach of duty or breach of trust in relation to the company; and

•indemnify any officer against liability incurred by the officer to a person other than the company, except when the indemnity is against: (a) any liability of the officer to pay: (i) a fine in criminal proceedings; or (ii) a sum payable to a regulatory authority by way of a penalty in respect of non-compliance with any requirement of a regulatory nature (however arising); or; (b) any liability incurred by the officer: (i) in defending criminal proceedings in which the officer is convicted; (ii) in defending civil proceedings brought by the company or a related company in which judgment is given against the officer; or (iii) in connection with an application for relief under Sections 76A(13) or 391 of the Singapore Companies Act in which the court refuses to grant the officer relief.

Furthermore, the Singapore Companies Act also provides that any provision, whether in the constitution or in any contract with a company or otherwise, for exempting any auditor of the company from, or indemnifying the auditor against, any liability which by law would otherwise attach to the auditor in respect of any negligence, default, breach of duty or breach of trust of which the auditor may be guilty in relation to the company is void. However, the Singapore Companies Act specifically provides that we are allowed to:

•indemnify any auditor against any liability incurred or to be incurred by such auditor in defending any proceedings (whether civil or criminal) in which judgment is given in such auditor’s favor or in which such auditor is acquitted; and

•indemnify any auditor against any liability incurred or to be incurred by such auditor in connection with any application under Sections 76A(13) or 391 of the Singapore Companies Act in which relief is granted to such auditor by the court.

Our Constitution provides that, subject to the provisions of and so far as may be permitted by the Singapore Companies Act and any other applicable law, every director, chief executive officer, auditor, secretary or other officer of our company shall be entitled to be indemnified by our company against all costs, charges, losses, expenses and liabilities incurred or to be incurred by him or her in the execution and discharge of his or her duties or in relation thereto and in particular and without prejudice to the generality of the foregoing, no director, secretary or other officer of our company shall be liable for the acts, receipts, neglect or defaults of any other director or officer or for joining in any receipt or other act for conformity or for any loss or expense happening to our company through the insufficiency or deficiency of title to any property acquired by order of the directors for or on behalf of our company or for the insufficiency or deficiency of any security in or upon which any of the moneys of our company shall be invested or for any loss or damage arising from the bankruptcy, insolvency or tortious act of any person with whom any moneys, securities or effects shall be deposited or left or for any other loss, damage or misfortune whatsoever which shall happen to or be incurred by our company in the execution of the duties of his or her office or in relation thereto unless the same shall happen through his or her own negligence, willful default, breach of duty or breach of trust.

The limitation of liability and indemnification provisions in our Constitution may discourage shareholders from bringing a lawsuit against directors for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against directors and officers, even though an action, if successful, might benefit us and our shareholders. A shareholder’s investment may be harmed to the extent we pay the costs of settlement and damage

awards against directors and officers pursuant to these indemnification provisions. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Commission, such indemnification is against public policy as expressed in the Securities Act, and is, therefore, unenforceable.

Item 7. Exemption from Registration Claimed

Not applicable.

Item 8. Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Document |

| 4.1 | | |

| 4.2 | | |

| 5.1 | | |

| 23.1 | | |

| 23.2 | | Consent of Rajah & Tann Singapore LLP (included as part of the opinion filed as Exhibit 5.1 hereto and incorporated herein by reference)* |

| 24.1 | | Power of Attorney (contained on signature page hereto)* |

Item 9. Undertakings.

| | | | | | | | |

| (a) | The undersigned Registrant hereby undertakes: |

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

| | | | | | | | |

| (b) | | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | |

| (c) | | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Singapore, on October 9, 2024.

| | | | | | | | |

| | MAXEON SOLAR TECHNOLOGIES, LTD. |

| | | |

| | By: | /s/ William Patrick Mulligan III |

| | | William Patrick Mulligan III |

| | | Chief Executive Officer

(Principal Executive Officer) |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby makes, designates, constitutes and appoints William Patrick Mulligan III (with full power and authority to act without the other), his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this Registration Statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that the attorney-in-fact and agent or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the date indicated.

| | | | | | | | | | | | | | |

| Name | | Title | | Date |

| | | | | |

| /s/ William Patrick Mulligan III | | Chief Executive Officer and | | |

| William Patrick Mulligan III | | President (Principal Executive Officer) | | October 9, 2024 |

| | | | | |

| /s/ Ken Olson | | Interim Chief Financial Officer | | |

| Ken Olson | | (Principal Financial Officer and

Principal Accounting Officer) | | October 9, 2024 |

| | | | | |

| /s/ Donald Colvin | | | | |

| Donald Colvin | | Chair of the Board | | October 9, 2024 |

| | | | | | | | | | | | | | |

| | | | |

| /s/ Kris Sennesael | | | | |

| Kris Sennesael | | Director | | October 9, 2024 |

| | | | | |

| | | | | | | | | | | | | | |

| /s/ Steve Leonard | | | | |

| Steve Leonard | | Director | | October 9, 2024 |

| | | | | |

| /s/ David Li | | | | |

| David Li | | Director | | October 9, 2024 |

| | | | |

| /s/ Wang Yanjun | | | | |

| Wang Yanjun | | Director | | October 9, 2024 |

| | | | |

| /s/ Zhang Changxu | | | | |

| Zhang Changxu | | Director | | October 9, 2024 |

| | | | | |

| /s/ Sean Wang | | | | |

| Sean Wang | | Director | | October 9, 2024 |

| | | | | |

| /s/ Xu Luo Luo | | | | |

| Xu Luo Luo | | Director | | October 9, 2024 |

| | | | | |

| /s/ Wang Cheng | | | | |

| Wang Cheng | | Director | | October 9, 2024 |

Exhibit 4.2

MAXEON SOLAR TECHNOLOGIES, LTD. 2020 OMNIBUS INCENTIVE PLAN

(Amended and Restated by the Company Effective on 9 October 2024)

SECTION 1. ESTABLISHMENT AND PURPOSE.

The purpose of the Plan is to promote the long-term success of the Company and the creation of shareholder value by (a) encouraging Employees, Outside Directors and Consultants to focus on critical long-range objectives, (b) encouraging the attraction and retention of Employees, Outside Directors and Consultants with exceptional qualifications and (c) linking Employees, Outside Directors and Consultants directly to shareholder interests through increased share ownership. The Plan seeks to achieve this purpose by providing for Awards in the form of restricted shares, restricted share units, share options, share appreciation rights, or cash-based incentive awards. In addition, in accordance with the Employee Matters Agreement, dated as of November 8, 2019, by and between SunPower and the Company (the “Employee Matters Agreement”), the Plan permits the grant of Replacement Awards to employees of the Company and its Subsidiaries and Affiliates in substitution for certain awards made to such employees under the SunPower Corporation 2015 Omnibus Incentive Plan that were outstanding prior to the Distribution Date.

SECTION 2. DEFINITIONS.

a)“Affiliate” shall mean any entity other than a Subsidiary, if the Company and/or one of more Subsidiaries own not less than 50% of

such entity.

b)“Award” shall mean any award of an Option, a SAR, a Restricted Share a Restricted Share Unit, a Cash-Based Incentive Award, or Replacement Award granted under the Plan.

c)“Board” shall mean the Board of Directors of the Company, as constituted from time to time.

d)“Cash-Based Incentive Award” shall mean an incentive award denominated in and payable in cash that is granted pursuant to Section 12(a) hereof.

e)“Cash-Based Incentive Award Agreement” shall mean the agreement between the Company and the recipient of a Cash-Based Incentive Award which contains the terms, conditions and restrictions pertaining to such Cash-Based Award.

f)“Change in Control” shall mean the first to occur following the date hereof of:

i.a sale, transfer or other disposition of all or substantially all of the assets of the Company;

ii.the consummation of any merger, consolidation, or other business combination transaction of the Company with or into another corporation, entity, or person, other than a transaction in which the holders of at least a majority of the shares of voting capital stock of the Company outstanding immediately prior to such transaction continue to hold (either by such shares remaining outstanding or by their being converted into shares of voting capital stock of the surviving entity or a direct or indirect parent thereof) a majority of the total voting power represented by the shares of voting capital stock of the Company (or the respective surviving entity or parent thereof) outstanding immediately after such transaction;

iii.the direct or indirect acquisition (including by way of a tender or exchange offer) by any person, or persons acting as a group, of beneficial ownership or a right to acquire beneficial ownership of shares representing a majority of the voting power of the then outstanding shares of capital stock of the Company; provided that a person shall exclude a trustee or other fiduciary holding securities under an employee benefit plan maintained by the Company or a Parent, Subsidiary or Affiliate;

iv.one or more contested elections of members of the Board during a period of twenty-four (24) consecutive months, as a result of which or in connection with which the persons who were members of the Board before the first of such elections or their nominees cease to constitute a majority of the Board; or

v.dissolution or liquidation of the Company.

Any other provision of this Section 2(f) notwithstanding, a transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company’s incorporation or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction, and a Change in Control shall not be deemed to occur if the Company files a registration statement with the United States Securities and

Exchange Commission for the initial offering of Stock to the public or if there is a spinoff of the Company by a Parent resulting in a dividend or distribution payable in Stock to the Parent’s stockholders.

g)“Code” shall mean the United States Internal Revenue Code of 1986, as amended.

h)“Committee” shall mean the Committee as designated by the Board, which is authorized to administer the Plan, as described in Section 3 hereof.

i)“Company” shall mean Maxeon Solar Technologies, Ltd., a company incorporated under the laws of Singapore.

j)“Consultant” shall mean (i) a consultant or advisor who provides bona fide services to the Company, a Parent, a Subsidiary or an Affiliate as an independent contractor (not including service as a member of the Board) or a member of the board of directors of a Parent or a Subsidiary, in each case who is not an Employee, or (ii) an individual who provides Services as an Employee of an Affiliate.

k)“Distribution Date” shall mean the date that SunPower completes its distribution, in connection with the separation of the Company from SunPower, of 100% of the outstanding Shares SunPower holds to holders of shares of the common stock of SunPower.

l)“Employee” shall mean any individual who provides Services to the Company, a Parent or a Subsidiary, but shall exclude any individual who is classified by the Company, a Parent or Subsidiary as leased from or otherwise employed by a third party or as an independent contractor, even if any such classification is changed retroactively because of an audit, litigation, administrative determination or otherwise. Neither Service as a member of the Board nor payment of a director’s fee by the Company, a Parent or Subsidiary shall be sufficient to constitute “employment” by the Company, a Parent or Subsidiary.

m)“Exchange Act” shall mean the United States Securities Exchange Act of 1934, as amended.

n)“Exercise Price” shall mean, in the case of an Option, the amount for which one Share may be purchased upon exercise of such Option, as specified in the applicable Share Option Agreement. “Exercise Price,” in the case of a SAR, shall mean an amount, as specified in the applicable SAR Agreement, which is subtracted from the Fair Market Value of one Share at the time of exercise in determining the amount payable upon exercise of such SAR.

o)“Fair Market Value” with respect to a Share, shall mean the market price of one Share, determined by the Committee as follows:

i.If Shares are listed on any established share exchange or a national market system, including, without limitation, the NASDAQ Global Select Market, the NASDAQ Global Market or the NASDAQ Capital Market of The NASDAQ Stock Market, its Fair Market Value will be the closing sales price for such Share (or the closing bid, if no sales were reported) as quoted on such exchange or system on the day of determination, as reported in The Wall Street Journal or such other source as the Committee deems reliable;

ii.If the Shares are regularly quoted by a recognized securities dealer but selling prices are not reported, the Fair Market Value of a Share will be the mean between the high bid and low asked prices for the Shares on the day of determination (or, if no bids and asks were reported on that date, as applicable, on the last trading date such bids and asks were reported), as reported in The Wall Street Journal or such other source as the Committee deems reliable; and

iii.If none of the foregoing provisions is applicable, then the Fair Market Value shall be determined by the Committee in good faith on such basis as it deems appropriate, and if applicable, in compliance with Section 409A of the Code in order to permit an Award to be exempt from or comply with Section 409A of the Code.

In all cases, the determination of Fair Market Value by the Committee shall be conclusive and binding on all persons.

p)“Offeree” shall mean an individual to whom the Committee has offered the right to acquire Shares under the Plan.

q)“Option” shall mean any right granted to a Participant under the Plan allowing such Participant to purchase Shares at such price or prices and during such period or periods as the Board shall determine.

r)“Outside Director” shall mean a member of the Board who is not an Employee.

s)“Parent” shall mean any corporation (other than the Company) in an unbroken chain of corporations ending with the Company, if each of the corporations other than the Company owns shares possessing 50% or more of the total combined voting power of all classes of shares in one of the other corporations in such chain.

t)“Participant” shall mean an individual or estate (or other recipient permitted in accordance with Section 10(f) or 16(a) of the Plan) who holds an Award.

u)“Performance Criteria” shall include, but shall not be limited to, one or more of the following performance criteria, either individually, alternatively or in any combination: (a) cash flow, (b) earnings per share, (c) earnings before interest, taxes, depreciation and amortization,

(d) return on equity, (e) total shareholder return, (f) share price performance, (g) return on capital, (h) return on assets or net assets, (i) revenue, (j) income or net income, (k) operating income or net operating income, (l) operating profit or net operating profit, (m) operating margin or profit margin,

(n) return on operating revenue, (o) return on invested capital, (p) market segment shares, (q) cost per watt, (r) cost per kilowatt hour, (s) customer acquisition costs, (t) customer cost of energy, (u) cost management or process improvement, (v) net promoter score, (w) expense measures (including, but not limited to, overhead cost, research and development expenses and general and administrative expense), (x) economic value added, (y) watts produced, (z) watts shipped, (aa) watts per module, (bb) conversion efficiency, (cc) modules produced, (dd) modules shipped, (ee) production throughput rates, (ff) solar project velocity, (gg) solar project volume, (hh) production yields, (ii) solar projects developed (number or watts), (jj) solar projects financed (by value or watts), (kk) solar projects sold (by value or watts), (ll) operation or maintenance contracts signed or maintained (by value or watts), (mm) production expansion build and ramp times, (nn) module field performance, (oo) average sales price; (pp) budgeted expenses (operating and/or capital), (qq) inventory turns, (rr) accounts receivable levels, (ss) development of product, (tt) installation of product, (uu) research and development milestones, (vv) milestones related to the quality of manufactured products and/or related services, and (ww) measures promoting the safety of employees.

v)“Performance Goal” means, for a given performance period, a goal or goals established in writing by the Committee for the performance period based on Performance Criteria. Depending on the Performance Criteria used to establish such Performance Goal, the Performance Goal may be applied to either the Company as a whole or to a business unit or Subsidiary, either individually, alternatively or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group or index, in each case as specified by the Committee in the Award.

w)“Plan” shall mean this Maxeon Solar Technologies, Ltd. 2020 Omnibus Incentive Plan, as amended or amended and restated from

time to time.

x)“Purchase Price” shall mean the consideration for which one Share may be acquired under the Plan (other than upon exercise of an Option), as specified by the Committee.

y)“Restricted Share” shall mean a Share awarded pursuant to Section 6 of the Plan.

z)“Replacement Award” shall mean an Award granted under the Plan in accordance with the terms of the Employee Matters Agreement in substitution of an award representing the right to acquire shares of the common stock of SunPower granted prior to the Distribution Date. Notwithstanding any other provision of the Plan to the contrary, the number of Shares subject to a Replacement Award and the other terms and conditions of each Replacement Award shall be determined in accordance with the terms of the Employee Matters Agreement.

aa)“Restricted Share Agreement” shall mean the agreement between the Company and the recipient of a Restricted Share which contains the terms, conditions and restrictions pertaining to such Restricted Shares.

ab)“Restricted Share Unit” shall mean a bookkeeping entry representing the equivalent of one Share, as awarded pursuant to Section 10

of the Plan.

ac)“Restricted Share Unit Agreement” shall mean the agreement between the Company and the recipient of a Restricted Share Unit which contains the terms, conditions and restrictions pertaining to such Restricted Share Unit.

ad)“SAR” shall mean a share appreciation right granted pursuant to Section 9 of the Plan.

ae)“SAR Agreement” shall mean the agreement between the Company and a Participant which contains the terms, conditions and restrictions pertaining to his or her SAR.

af)“Service” shall mean service as an Employee, Consultant or Outside Director. Service does not terminate when an Employee goes on a bona fide leave of absence that was approved by the Company in writing, if the terms of the leave provide for continued service crediting, or when continued service crediting is required by applicable law. Service terminates in any event when the approved leave ends, unless such Employee immediately returns to active work or, if such Employee does not return to active work, the Employee’s right to return to work is guaranteed by law or by a contract. The Company determines which leaves count toward Service, and when Service terminates for all purposes under the Plan. Further, unless otherwise determined by the Company, a Participant’s Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant provides Service to the Company, a Subsidiary, or an Affiliate, or a transfer between entities (the Company or any Subsidiary or Affiliate), provided, that there is no interruption or other termination of Service in connection with a change in capacity or transfer between entities.

ag)“Share” shall mean one ordinary share of the Company, as adjusted in accordance with Section 11 (if applicable).

ah)“Share Option Agreement” shall mean the agreement between the Company and a Participant that contains the terms, conditions and restrictions pertaining to his Option.

ii) “Subsidiary” shall mean any corporation, if the Company and/or one or more other Subsidiaries own not less than 50% of the total combined voting power of all classes of outstanding share of such corporation.

aj)“SunPower” shall mean SunPower Corporation, a Delaware corporation, and any successor corporation thereto.

ak)“Tax-Related Items” shall mean any national or federal, state or provincial, and local taxes (including, without limitation, income tax, social insurance contributions, payment on account, employment tax obligations, stamp taxes, any other taxes that may be due) required by law to be withheld and any employer tax liability shifted to a Participant.

SECTION 3. ADMINISTRATION.

a)Committee Composition. The Plan shall be administered by the Committee. The Committee shall consist of two or more members of the Board, who shall be appointed by the Board, and shall otherwise be constituted to satisfy the requirements of applicable law.

b)Committee for Non-Officer Grants. The Board may also appoint one or more separate committees of the Board, each composed of one or more directors of the Company who need not satisfy the requirements of Section 3(a), who may administer the Plan with respect to Employees to the extent permitted by applicable law, may grant Awards under the Plan to such Employees and may determine all terms of such grants. Within the limitations of the preceding sentence, any reference in the Plan to the Committee shall include such committee or committees appointed pursuant to the preceding sentence. The Board may also authorize one or more officers of the Company to designate Employees, to receive Awards and/or to determine the number of such Awards to be received by such persons to the extent permitted under applicable law.

c)Committee Responsibilities. Subject to the provisions of the Plan, the Committee shall have full authority and discretion to take the following actions:

i.To interpret the Plan and to apply its provisions;

ii.To adopt, amend or rescind rules, procedures and forms relating to the Plan, including rules and regulations relating to sub-plans established for the purpose of satisfying applicable foreign laws including qualifying for preferred tax treatment under applicable foreign tax laws;

iii.To authorize any person to execute, on behalf of the Company, any instrument required to carry out the purposes of the Plan;

iv.To determine when Awards are to be granted under the Plan;

v.To select the Offerees;

vi.To determine the number of Shares to be made subject to each Award;

vii.To prescribe the terms and conditions of each Award, including (without limitation) the Exercise Price and Purchase Price, and the vesting or duration of the Award (including accelerating the vesting of Awards, either at the time the Award is granted or thereafter, without the consent of the Participant), and to specify the provisions of the agreement relating to such Award;

viii.To amend any outstanding Award agreement, subject to applicable law and to the consent of the Participant if the Participant’s rights would be materially impaired or obligations would be materially increased, provided that any amendment to an outstanding Award agreement that the Committee deems necessary or advisable to facilitate compliance with applicable law shall not be subject consent of a Participant;

ix.To prescribe the consideration for the grant of each Award or other right under the Plan and to determine the sufficiency of such consideration;

x.To determine the disposition of each Award or other right under the Plan in the event of a Participant’s divorce or dissolution of marriage;

xi.To determine whether Awards under the Plan will be granted in replacement of other grants under an incentive or other compensation plan of an acquired business;

xii.To correct any defect, supply any omission, or reconcile any inconsistency in the Plan or any Award agreement;

xiii.To establish or verify the extent of satisfaction of any performance goals or other conditions applicable to the grant, issuance, exercisability, vesting and/or ability to retain any Award; and

xiv.To take any other actions deemed necessary or advisable for the administration of the Plan.

Subject to the requirements of applicable law, the Committee may designate persons other than members of the Committee to carry out its responsibilities and may prescribe such conditions and limitations as it may deem appropriate. All decisions, interpretations and other actions of the Committee shall be final and binding on all Offerees, all Participant, and all persons deriving their rights from an Offeree or Participant. No member of the Committee shall be liable for any action that he has taken or has failed to take in good faith with respect to the Plan, any Option, or any right to acquire Shares under the Plan.

SECTION 4. ELIGIBILITY.

Only Employees, Consultants and Outside Directors shall be eligible for the grant of Restricted Shares, Restricted Share Units, Options or SARs.

SECTION 5. SHARES SUBJECT TO PLAN.

a)Basic Limitation. Shares offered under the Plan shall be authorized but unissued Shares, treasury Shares or Shares purchased on the open market. The aggregate number of Shares authorized for issuance as Awards under the Plan shall not exceed 105,556. Notwithstanding the foregoing, the number of Shares available for issuance under the Plan will continue to be increased on the first day of each fiscal year beginning with the 2025 fiscal year, in an amount equal to the lesser of (x) 3% of the outstanding shares of all classes of the Company on the last day of the immediately preceding fiscal year, or (y) such number of Shares determined by the Board. The limitations of this Section 5(a) shall be subject to adjustment pursuant to Section 11. The number of Shares that are subject to Awards outstanding at any time under the Plan shall not exceed the number of Shares which then remain available for issuance under the Plan. The Company, during the term of the Plan, shall at all times reserve and keep available sufficient Shares to satisfy the requirements of the Plan.

b)Share Reissuable Under Plan. If Restricted Shares or Shares issued upon the exercise of Options are forfeited, then such Shares shall again become available for Awards under the Plan. If Restricted Share Units, Options or SARs are forfeited or terminate for any other reason before being exercised, then the corresponding Shares shall become available for Awards under the Plan. If Restricted Share Units are settled, then only the number of Shares (if any) actually issued in settlement of such Restricted Share Units shall reduce the number available under Section 5(a) and the balance shall again become available for Awards under the Plan. If SARs are exercised, then only the number of Shares (if any) actually issued in settlement of such SARs shall reduce the number available in Section 5(a) and the balance shall again become available for Awards under the Plan.

c)Assumed and Substituted Awards. Notwithstanding the foregoing, to the extent permitted under applicable stock exchange rules, Shares issued pursuant to awards assumed or Awards granted in substitution of other awards in connection with the acquisition by the Company or a Subsidiary of an unrelated entity shall not reduce the maximum number of Shares issuable under the above Section 5(a).

SECTION 6. RESTRICTED SHARES.

a)Restricted Share Agreement. Each grant of Restricted Shares under the Plan shall be evidenced by a Restricted Share Agreement between the Participant and the Company. Such Restricted Shares shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Share Agreements entered into under the Plan need not be identical.

b)Payment for Awards. Restricted Shares may be sold or awarded under the Plan for such consideration as the Committee may determine, including (without limitation) cash, cash equivalents, full-recourse promissory notes, past services and future services.

c)Vesting. Each Award of Restricted Shares may or may not be subject to vesting. Vesting shall occur, in full or in installments, upon satisfaction of the conditions, including conditions based on the attainment of Performance Goals, specified in the Restricted Share Agreement. A Restricted Share Agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events.

d)Voting and Dividend Rights. The holders of Restricted Shares awarded under the Plan shall have the same voting, dividend and other rights as the Company’s other shareholders. A Restricted Share Agreement, however, may require that the holders of Restricted Shares invest any cash dividends received in additional Restricted Shares. Such additional Restricted Shares shall be subject to the same conditions and restrictions as the Award with respect to which the dividends were paid.

e)Restrictions on Transfer of Shares. Restricted Shares shall be subject to such rights of repurchase, rights of first refusal or other restrictions as the Committee may determine. Such restrictions shall be set forth in the applicable Restricted Share Agreement and shall apply in addition to any general restrictions that may apply to all holders of Shares.

SECTION 7. TERMS AND CONDITIONS OF OPTIONS.

a)Share Option Agreement. Each grant of an Option under the Plan shall be evidenced by a Share Option Agreement between the Participant and the Company. Such Option shall be subject to all applicable terms and conditions of the Plan and may be subject to any other terms and conditions which are not inconsistent with the Plan and which the Committee deems appropriate for inclusion in a Share Option Agreement. The provisions of the various Share Option Agreements entered into under the Plan need not be identical.

b)Number of Shares. Each Share Option Agreement shall specify the number of Shares that are subject to the Option and shall provide for the adjustment of such number in accordance with Section 11.

c)Exercise Price. Each Share Option Agreement shall specify the Exercise Price. The Exercise Price of an Option shall not be less than 100% of the Fair Market Value of a Share on the date of grant. Subject to the foregoing in this Section 7(c), the Exercise Price under any Option shall be determined by the Committee at its sole discretion. The Exercise Price shall be payable in one of the forms described in Section 8.

d)Exercisability and Term. Each Share Option Agreement shall specify the date when all or any installment of the Option is to become exercisable. The Share Option Agreement shall also specify the term of the Option. A Share Option Agreement may provide for accelerated exercisability in the event of the Participant’s death, disability, or retirement or other events and may provide for expiration prior to the end of its term in the event of the termination of the Participant’s Service. Options may be awarded in combination with SARs, and such an Award may provide that the Options will not be exercisable unless the related SARs are forfeited. Subject to the foregoing in this Section 7(d), the Committee at its sole discretion shall determine when all or any installment of an Option is to become exercisable and when an Option is to expire.

e)Exercise of Options. Each Share Option Agreement shall set forth the extent to which the Participant shall have the right to exercise the Option following termination of the Participant’s Service with the Company and its Subsidiaries, and the right to exercise the Option of any executors or administrators of the Participant’s estate or any person who has acquired such Option(s) directly from the Participant by bequest or inheritance. Such provisions shall be determined in the sole discretion of the Committee, need not be uniform among all Options issued pursuant to the Plan, and may reflect distinctions based on the reasons for termination of Service.

f)No Rights as a Shareholder. A Participant, or a transferee of a Participant, shall have no rights as a shareholder with respect to any Shares covered by his Option until the date of the issuance of Shares have been recorded in the books of the brokerage firm selected by the Committee or, as applicable, of the Company, its transfer agent, share plan administrator or such other outside entity which is not a brokerage firm. No adjustments shall be made, except as provided in Section 11.

g)Modification, Extension and Renewal of Options. Within the limitations of the Plan, the Committee may modify, extend or renew outstanding options or may accept the cancellation of outstanding options (to the extent not previously exercised), whether or not granted hereunder, in return for the grant of new Options for the same or a different number of Shares and at the same or a different exercise price, or in return for the grant of the same or a different number of Shares. The foregoing notwithstanding, no modification of an Option shall, without the consent of the Participant, materially impair his or her rights or materially increase his or her obligations under such Option.

h)Restrictions on Transfer of Shares. Any Shares issued upon exercise of an Option shall be subject to such special forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Committee may determine. Such restrictions shall be set forth in the applicable Share Option Agreement and shall apply in addition to any general restrictions that may apply to all holders of Shares.

i)Buyout Provisions. The Committee may at any time (a) offer to buy out for a payment in cash or cash equivalents an Option previously granted or (b) authorize a Participant to elect to cash out an Option previously granted, in either case at such time and based upon such terms and conditions as the Committee shall establish.

SECTION 8. PAYMENT FOR SHARES.

a)General Rule. The entire Exercise Price or Purchase Price of Shares issued under the Plan shall be payable at the time when such Shares are purchased, except as provided in Section 8(b) through Section 8(g) below.

b)Surrender of Share. To the extent that a Share Option Agreement so provides, payment may be made all or in part by surrendering, or attesting to the ownership of, Shares which have already been owned by the Participant or his representative. Such Shares shall be valued at their Fair Market Value on the date when the new Shares are purchased under the Plan. The Participant shall not surrender, or attest to the ownership of, Shares in payment of the Exercise Price if such action would cause the Company to recognize compensation expense (or additional compensation expense) with respect to the Option for financial reporting purposes.

c)Services Rendered. At the discretion of the Committee, Shares may be awarded under the Plan in consideration of services rendered to the Company or a Subsidiary prior to the award. If Shares are awarded without the payment of a Purchase Price in cash, the Committee shall make a determination (at the time of the award) of the value of the services rendered by the Offeree and the sufficiency of the consideration to meet the requirements of Section 6(b).

d)Cashless Exercise. To the extent that a Share Option Agreement so provides, payment may be made all or in part by delivery (on a form prescribed by the Committee) of an irrevocable direction to a securities broker to sell Shares and to deliver all or part of the sale proceeds to the Company in payment of the aggregate Exercise Price.

e)Net Exercise. To the extent that a Share Option Agreement so provides, payment may be made all or in part by a reduction in a number of Shares subject to the Option having a Fair Market Value equal to the aggregate Exercise Price.

f)Other Forms of Payment. To the extent that a Share Option Agreement or Restricted Share Agreement so provides, payment may be made in any other form that is consistent with applicable laws, regulations and rules.

g)Limitations under Applicable Law. Notwithstanding anything herein or in a Share Option Agreement or Restricted Share Agreement to the contrary, payment may not be made in any form that is unlawful, as determined by the Committee in its sole discretion.

SECTION 9. SHARE APPRECIATION RIGHTS.

a)SAR Agreement. Each grant of a SAR under the Plan shall be evidenced by a SAR Agreement between the Participant and the Company. Such SAR shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various SAR Agreements entered into under the Plan need not be identical.

b)Number of Shares. Each SAR Agreement shall specify the number of Shares to which the SAR pertains and shall provide for the adjustment of such number in accordance with Section 11.

c)Exercise Price. Each SAR Agreement shall specify the Exercise Price, which shall be no less than 100% of the Fair Market Value of a share on the date of grant.

d)Exercisability and Term. Each SAR Agreement shall specify the date when all or any installment of the SAR is to become exercisable. The SAR Agreement shall also specify the term of the SAR. A SAR Agreement may provide for accelerated exercisability in the event of the Participant’s death, disability or retirement or other events and may provide for expiration prior to the end of its term in the event of the termination of the Participant’s Service. SARs may be awarded in combination with Options, and such an Award may provide that the SARs will not be exercisable unless the related Options are forfeited. A SAR granted under the Plan may provide that it will be exercisable only in the event of a Change in Control.

e)Exercise of SARs. Upon exercise of a SAR, the Participant (or any person having the right to exercise the SAR after his or her death) shall receive from the Company (a) Shares, (b) cash or (c) a combination of Shares and cash, as the Committee shall determine. The amount of cash and/or the Fair Market Value of Shares received upon exercise of SARs shall, in the aggregate, be equal to the amount by which the Fair Market Value (on the date of surrender) of the Shares subject to the SARs exceeds the Exercise Price.

f)Modification or Assumption of SARs. Within the limitations of the Plan, the Committee may modify, extend or assume outstanding SARs or may accept the cancellation of outstanding SARs (whether granted by the Company or by another issuer) in return for the grant of new SARs for the same or a different number of shares and at the same or a different exercise price. The foregoing notwithstanding, no modification of a SAR shall, without the consent of the holder, materially impair his or her rights or materially increase his or her obligations under such SAR.

g)Buyout Provisions. The Committee may at any time (a) offer to buy out for a payment in cash or cash equivalents a SAR previously granted or (b) authorize a Participant to elect to cash out a SAR previously granted, in either case at such time and based upon such terms and conditions as the Committee shall establish.

SECTION 10. RESTRICTED SHARE UNITS.

a)Restricted Share Unit Agreement. Each grant of Restricted Share Units under the Plan shall be evidenced by a Restricted Share Unit Agreement between the recipient and the Company. Such Restricted Share Units shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Restricted Share Unit Agreements entered into under the Plan need not be identical. Restricted Share Units may be granted in consideration of a reduction in the recipient’s other compensation.

b)Payment for Awards. To the extent that an Award is granted in the form of Restricted Share Units, no cash consideration shall be required of the Award recipients.

c)Vesting Conditions. Each Award of Restricted Share Units may or may not be subject to vesting. Vesting shall occur, in full or in installments, upon satisfaction of the conditions, including conditions based on the attainment of Performance Goals, specified in the Restricted Share Unit Agreement. A Restricted Share Unit Agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events.

d)Voting and Dividend Rights. The holders of Restricted Share Units shall have no voting rights. Prior to settlement or forfeiture, any Restricted Share Unit awarded under the Plan may, at the Committee’s discretion, carry with it a right to dividend equivalents. Such right entitles the holder to be credited with an amount equal to all cash dividends paid on one Share while the Restricted Share Unit is outstanding. Dividend equivalents may be converted into additional Restricted Share Units. Settlement of dividend equivalents may be made in the form of cash, in the form of Shares, or in a combination of both. Prior to distribution, any dividend equivalents which are not paid shall be subject to the same conditions and restrictions (including without limitation, any forfeiture conditions) as the Restricted Share Units to which they attach.

e)Form and Time of Settlement of Restricted Share Units. Settlement of vested Restricted Share Units may be made in the form of (a) cash, (b) Shares or (c) any combination of both, as determined by the Committee. The actual number of Restricted Share Units eligible for settlement may be larger or smaller than the number included in the original Award, based on predetermined performance factors. Methods of converting Restricted Share Units into cash may include (without limitation) a method based on the average Fair Market Value of Shares over a series of trading days. The distribution may occur or commence when all vesting conditions applicable to the Restricted Share Units have been satisfied or have lapsed, or it may be deferred to any later date. The amount of a deferred distribution may be increased by an interest factor or by dividend equivalents. Until an Award of Restricted Share Units is settled, the number of such Restricted Share Units shall be subject to adjustment pursuant to Section 11.

f)Death of Recipient. Any Restricted Share Units Award that becomes payable after the Participant’s death shall be distributed to the Participant’s estate or as otherwise required under the laws of descent and distribution in the Participant’s country.

g)Creditors’ Rights. A holder of Restricted Share Units shall have no rights other than those of a general creditor of the Company. Restricted Share Units represent an unfunded and unsecured obligation of the Company, subject to the terms and conditions of the applicable Restricted Share Unit Agreement.

SECTION 11. ADJUSTMENT OF SHARES.

a)Adjustments. In the event of a subdivision of the outstanding Shares, a declaration of a dividend payable in Shares, a declaration of a dividend payable in a form other than Shares in an amount that has a material effect on the price of the Shares, a combination or consolidation of the outstanding Shares (by reclassification or otherwise) into a lesser number of Shares, a recapitalization, a spin-off or a similar occurrence or other similar corporate transaction or event that affects the Shares, the Committee shall make such proportionate substitution or adjustments, if any, in one or more of:

i.The number of Shares available for future Awards under Section 5 and the number of Shares subject to the automatic increase of the Share reserve contemplated under Section 5;

ii.The number of Shares covered by each outstanding Option and SAR;

iii.The Exercise Price under each outstanding Option and SAR; or

iv.The number of Shares subject to Restricted Share Units included in any prior Award which has not yet been settled.

Any adjustment affecting an Award that is subject to Section 409A of the Code shall be made in a manner that does not result in adverse tax consequences under Section 409A of the Code, except as otherwise determined by the Committee in its sole discretion.

Notwithstanding the foregoing, in the event of any “equity restructuring” (within the meaning of the Financial Accounting Standards Board Accounting Standards Codification Topic 718 (or any successor pronouncement thereto)), the Committee shall make an equitable or proportionate adjustment to outstanding Awards to reflect such equity restructuring.

Except as provided in this Section 11, a Participant shall have no rights by reason of any issue by the Company of shares of any class or securities convertible into shares of any class, any subdivision or consolidation of shares of any class, the payment of any share dividend or any other increase or decrease in the number of shares of any class.

b)Dissolution or Liquidation. To the extent not previously exercised or settled, Options, SARs and Restricted Share Units shall terminate immediately prior to the dissolution or liquidation of the Company.

c)Change in Control. The Committee may determine, at the time of granting Awards or thereafter, that all or part of such Awards shall become vested in the event that a Change in Control occurs.

d)Mergers; Reorganizations. In the event that the Company is a party to a merger or other reorganization, outstanding Awards shall be subject to the agreement of merger or reorganization. Such agreement shall provide for:

i.The continuation of the outstanding Awards by the Company, if the Company is a surviving company;

ii.The assumption of the outstanding Awards by the surviving company or its parent or subsidiary;

iii.The substitution by the surviving company or its parent or subsidiary of its own awards for the outstanding Awards;

iv.Acceleration of the expiration date of the outstanding unexercised Awards to a date not earlier than thirty (30) days after notice to the Participant; or

v.Settlement of the value of the outstanding Awards which have vested as of the consummation of such merger or other reorganization in cash or cash equivalents; in the sole discretion of the Company, settlement of the value of some or all of the outstanding Awards which have not vested as of the consummation of such merger or other reorganization in cash or cash equivalents on a deferred basis pending vesting; and the cancellation of all vested and unvested Awards as of the consummation of such merger or other reorganization.

e)Reservation of Rights. Except as provided in this Section 11, a Participant or Offeree shall have no rights by reason of any subdivision or consolidation of shares of any class, the payment of any dividend or any other increase or decrease in the number of shares of any class. Any issue by the Company of shares of any class, or securities convertible into shares of any class, shall not affect, and no adjustment by reason thereof shall be made with respect to, the number or Exercise Price, if applicable, of Shares subject to an Award. The grant of an Award pursuant to the Plan shall not affect in any way the right or power of the Company to make adjustments, reclassifications, reorganizations or changes of its capital or business structure, to merge or consolidate or to dissolve, liquidate, sell or transfer all or any part of its business or assets.

SECTION 12. CASH-BASED AWARDS; AWARDS UNDER OTHER PLANS.

a)Cash-Based Incentive Awards. Each Cash-Based Incentive Award granted under the Plan shall be evidenced by a Cash-Based Incentive Award Agreement between the recipient and the Company or Affiliate. Such Cash-Based Incentive Award shall be subject to all applicable terms of the Plan and may be subject to any other terms that are not inconsistent with the Plan. The provisions of the various Cash-Based Incentive Award Agreements entered into under the Plan need not be identical. Each Cash-Based Incentive Award shall vest in full or in installments, upon satisfaction of the conditions, including conditions based on the attainment of Performance Goals, specified in the Cash-Based Incentive Award Agreement. A Cash-Based Incentive Award Agreement may provide for accelerated vesting in the event of the Participant’s death, disability or retirement or other events.

b)Awards Under Other Plans. The Company may grant awards under other plans or programs. Such awards may be settled in the form of Shares issued under this Plan to the extent the terms of such programs are not inconsistent with the

provisions of this Plan. Such Shares shall be treated for all purposes under the Plan like Shares issued in settlement of Restricted Share Units and shall, when issued, reduce the number of Shares available under Section 5.

SECTION 13. PAYMENT OF DIRECTOR’S FEES IN SECURITIES.

c)Effective Date. No provision of this Section 13 shall be effective unless and until the Board has determined to implement such provision.

d)Elections to Receive Options, Restricted Shares or Restricted Share Units. An Outside Director may elect to receive his or her annual retainer payments and/or meeting fees from the Company in the form of cash, Options, Restricted Shares or Restricted Share Units, or a combination thereof, as determined by the Board. Such Options, Restricted Shares and Restricted Share Units shall be issued under the Plan. An election under this Section 13 shall be filed with the Company on the prescribed form.

e)Number and Terms of Options, Restricted Shares or Restricted Share Units. The number of Options, Restricted Shares or Restricted Share Units to be granted to Outside Directors in lieu of annual retainers and meeting fees that would otherwise be paid in cash shall be calculated in a manner determined by the Board. The terms of such Options, Restricted Shares or Restricted Share Units shall also be determined by the Board.

SECTION 14. LEGAL AND REGULATORY REQUIREMENTS.

Shares shall not be issued under the Plan unless the issuance and delivery of such Shares complies with (or is exempt from) all applicable requirements of law, including (without limitation) applicable securities laws, the rules and regulations promulgated thereunder, and the regulations of any stock exchange on which the Company’s securities may then be listed, and the Company has obtained the approval or favorable ruling from any governmental agency which the Company determines is necessary or advisable. The Company shall not be liable to a Participant or other persons as to: (a) the

non-issuance or sale of Shares as to which the Company has been unable to obtain from any regulatory body having jurisdiction the authority deemed by the Company’s counsel to be necessary or advisable for the lawful issuance and sale of any Shares under the Plan; and (b) any tax consequences expected, but not realized, by any Participant or other person due to the receipt, exercise or settlement of any Award granted under the Plan.

SECTION 15. TAX PROVISIONS.

a)General. The Company or any Parent or Subsidiary, as applicable, shall have the authority and right to deduct or withhold or to require a Participant to remit to the Company or any Parent or Subsidiary, as applicable, an amount sufficient to satisfy Tax-Related Items with respect to any taxable or tax withholding event concerning a Participant arising in connection with the Participant’s participation in the Plan or to take such other action as may be necessary in the opinion of the Company or any Parent or Subsidiary, as appropriate, to satisfy withholding obligations for the payment of Tax-Related Items by one or a combination of the following: (i) withholding from the Participant’s wages or other cash compensation or any and all monies due to the Participant; (ii) withholding from the proceeds of sale of Shares underlying the Award either through a voluntary sale or a mandatory sale arranged by the Company on the Participant’s behalf, without need of further authorization; (iii) withholding of any Shares that otherwise would be issued pursuant to an Award or (iii) any other method determined by the Committee. The Company shall not be required to issue any Shares or make any cash payment under the Plan to the Participant or any other person until arrangements acceptable to the Company are made by the Participant or such other person to satisfy the obligations for Tax-Related Items with respect to any taxable or tax withholding event concerning the Participant or such other person as a result of the Plan.

b)Compliance with Section 409A of the Code. To the extent that a Participant is or may be subject to taxation under the laws of the United States or any political division thereof, the following provisions shall apply:

i.To the extent applicable, it is intended that the Plan and any Awards hereunder comply with the provisions of Section 409A of the Code, so that the income inclusion provisions of Section 409A(a)(1) of the Code do not apply to Participants, and the Plan and Awards hereunder will be construed and interpreted in accordance with such intent, except as otherwise determined in the sole discretion of the Committee. The Plan and any Awards hereunder shall be designed and administered in such a manner that the grant, payment, settlement, or deferral will not be subject to the additional tax or interest applicable under Section 409A of the Code, except as determined by the Committee in its sole discretion.

ii.Neither a Participant nor any of the Participant’s creditors or beneficiaries shall have the right to subject any Awards that are subject to Section 409A of the Code to any anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, attachment, or garnishment. Except as permitted under Section 409A of the Code, any Awards subject to Section 409A of the Code may not be reduced by, or offset against, any amount owing by a Participant to the Company or any of its affiliates.

iii.If, at the time of a Participant’s separation from service (within the meaning of Section 409A of the Code), (A) the Participant is a “specified employee” (within the meaning of Section 409A of the Code and using the identification methodology selected by the Company from time to time) and (B) the

Company determined that an amount payable hereunder constitutes deferred compensation (within the meaning of Section 409A of the Code) the payment of which is required to be delayed pursuant to the six-month delay rule set forth in Section 409A of the Code in order to avoid taxes or penalties under Section 409A of the Code, then the Company shall not pay such amount on the otherwise scheduled payment date but shall instead pay it, without interest, on the first business day following the expiration of such six-month period.

iv.Notwithstanding any provision of the Plan and Awards hereunder to the contrary, the Company reserves the right to make amendments to the Plan and Awards as the Company deems necessary or desirable to avoid the imposition of taxes or penalties under Section 409A of the Code (or to mitigate adverse tax consequences if compliance is not practicable). In any case, a Participant shall be solely responsible and liable for the satisfaction of all taxes and penalties that may be imposed on a Participant or for a Participant’s account in connection with the Plan and Awards (including any taxes and penalties under Section 409A of the Code), and neither the Company nor any of its affiliates shall have any obligation to indemnify or otherwise hold a Participant or any other party harmless from any or all of such taxes or penalties.

SECTION 16. OTHER PROVISIONS APPLICABLE TO AWARDS.

a)Transferability. Unless the agreement evidencing an Award (or an amendment thereto authorized by the Committee) expressly provides otherwise, no Award granted under this Plan, nor any interest in such Award, may be sold, assigned, conveyed, gifted, pledged, hypothecated or otherwise transferred in any manner (prior to the vesting and lapse of any and all restrictions applicable to Shares issued under such Award), other than by will or the laws of descent and distribution. Any purported assignment, transfer or encumbrance in violation of this Section 16(a) shall be void and unenforceable against the Company.

b)Clawback/Recovery. All Awards granted under the Plan will be subject to recoupment in accordance with any clawback policy that the Company is required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. In addition, the plan administrator may impose such other clawback, recovery or recoupment provisions on an Award as the plan administrator determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired Shares or other cash or property upon the occurrence of cause (as determined by the Committee).

SECTION 17. NO EMPLOYMENT OR CONTINUED SERVICE RIGHTS.

No provision of the Plan, nor any Award granted under the Plan, shall be construed to give any Participant any right to become, to be treated as, or to remain an Employee or continue providing Service as a Consultant. The Company and its Subsidiaries reserve the right to terminate any person’s Service at any time and for any reason, with or without notice, to the extent permitted by applicable laws.

SECTION 18. DURATION AND AMENDMENTS.

a)Term of the Plan. The Plan, as set forth herein, shall become effective on the date the Plan is approved by the shareholders of the Company, and shall terminate automatically, on August 2, 2030, and may be terminated on any earlier date pursuant to Subsection (b) below. No Award may be granted after the date the Plan is terminated, but any Awards that are outstanding on the date the Plan terminates shall remain in force according to the terms of the Plan and the applicable Award agreement.

b)Right to Amend or Terminate the Plan. The Board may amend the Plan at any time and from time to time. Rights and obligations under any Award granted before amendment of the Plan shall not be materially impaired by such amendment, except with consent of the Participant unless such amendment is deemed necessary or desirable by the Committee, in its sole discretion, to facilitate compliance with applicable law or as contemplated under Section 18(c). An amendment of the Plan shall be subject to the approval of the Company’s shareholders only to the extent required by applicable laws, regulations or rules.

c)Effect of Termination. No Awards shall be granted under the Plan after the termination thereof. The termination of the Plan shall not affect Awards previously granted under the Plan.

SECTION 19. SEVERABILITY.

If any provision of the Plan or the application of any provision hereof to any person or circumstances is held invalid or unenforceable, the remainder of the Plan and the application of such provision to any other person or circumstances shall not be affected, and the provisions so held to be unenforceable shall be reformed to the extent (and to the extent) necessary to make it enforceable and valid.

Company, settlement of the value of some or all of the outstanding Awards which have not vested as of the consummation of such merger or other reorganization in cash or cash equivalents on a deferred basis pending vesting; and the cancellation of all vested and unvested Awards as of the consummation of such merger or other reorganization.

SECTION 20. GOVERNING LAW.

The Plan shall be governed by and construed in accordance with the internal substantive laws of Singapore, without giving effect to any principle of law that would result in the application of the law of any other jurisdiction.

1 Maxeon Solar Technologies, Ltd. 8 Marina Boulevard #05-02 Marina Bay Financial Centre Singapore 018981 Attention: The Board of Directors SENDER'S REF RECIPIENT'S REF DATE PAGE HCH/TMH/352308/04 - 9 October 2024 1/7 Dear Sirs, MAXEON SOLAR TECHNOLOGIES, LTD. (THE "COMPANY") – 2020 OMNIBUS INCENTIVE PLAN OF THE COMPANY 1. Introduction We have been requested by the Company to issue this legal opinion in connection with the filing of the post-effective amendment No.1 ("Post-Effective Amendment") to the registration statement on Form S-8 filed with the U.S. Securities and Exchange Commission (the "SEC") on 6 August 2020 (the "2020 Registration Statement") and the registration statement on Form S-8 filed with the SEC on 29 February 2024 (the "2024 Registration Statement", and together with the 2020 Registration Statement, the "Registration Statements"), with the SEC on or about the date hereof, under the U.S. Securities Act 1933, as amended (the "Securities Act"), to proportionately adjust the number of securities registered for issuance under the Registration Statements following the consolidation of every 100 existing issued ordinary shares (including treasury shares) in the capital of the Company ("Ordinary Shares") into one (1) Ordinary Share of the Company pursuant to Section 71(b) of the Companies Act 1967 of Singapore ("Companies Act") and regulation 10 of the Constitution of the Company ("Reverse Stock Split"). 2. Documents (a) In rendering this opinion, we have examined the following documents in relation to the Company, but only to the extent necessary for the purposes of rendering this opinion: (i) a copy of the Constitution of the Company; (ii) the certificate confirming incorporation of the Company ("Certificate Confirming Incorporation"); (iii) results of the following electronic searches of public record through BizFile, being the business service portal of the Accounting and Corporate Regulatory Authority ("ACRA"), and the relevant computerized search facilities of eLitigation provided by CrimsonLogic Pte Ltd (collectively, the "Services", and the searches below, the "Searches": 1. instant information (company) search ("ACRA Search") of the Company (as at the date stated in the table below); Exhibit 5.1