Lyra Therapeutics, Inc. (Nasdaq: LYRA) (“Lyra” or the “Company”), a

clinical-stage biotechnology company developing long-acting,

anti-inflammatory sinonasal implants for the treatment of chronic

rhinosinusitis (CRS), today reported its financial results for the

first quarter ended March 31, 2024 and provided a corporate

update.

“With results imminent for our ENLIGHTEN 1

pivotal Phase 3 study of LYR-210 in CRS, we are laser-focused on

delivering the topline data in May,” said Maria Palasis, Ph.D.,

President and CEO of Lyra Therapeutics. “We believe that LYR-210

has the potential to revolutionize the treatment of CRS by

delivering a six-month therapy designed to provide long-acting

relief that addresses the widespread need to overcome current

treatment limitations faced by millions of patients.”

Lyra Therapeutics is developing LYR-210 and

LYR-220, its two product candidates in late-stage development for

the treatment of CRS. LYR-210 and LYR-220 are bioabsorbable

sinonasal implants designed to be administered in a simple,

in-office procedure and are intended to deliver six months of

continuous mometasone furoate drug therapy (7500µg MF) to the

sinonasal passages for the treatment of CRS with a single

administration. LYR-210 is intended for patients with standard

anatomy, primarily those who have not undergone ethmoid sinus

surgery. LYR-220, a larger implant, is designed for CRS patients

whose nasal cavity is enlarged due to previous surgery.

Clinical Program Highlights

ENLIGHTEN Pivotal Program of LYR-210 in CRS Patients who

have not had Ethmoid Sinus Surgery

- Results from the ENLIGHTEN 1 pivotal Phase 3 clinical trial of

LYR-210 are expected in May 2024.

- Enrollment in ENLIGHTEN 2, the second pivotal Phase 3 trial of

LYR-210, is ongoing; enrollment completion is expected in the

second half of 2024.

- Results from the ENLIGHTEN 1 52-week extension study are

expected in Q4 2024.

The ENLIGHTEN program consists of two pivotal

Phase 3 clinical trials, ENLIGHTEN 1 and ENLIGHTEN 2, to evaluate

the efficacy and safety of LYR-210 for the treatment of CRS. The

Company designed each trial to evaluate 180 CRS patients who have

failed medical management and who have not had ethmoid sinus

surgery, randomized 2:1 to either LYR-210 (7500µg mometasone

furoate (MF)) or control over 24 weeks. The ENLIGHTEN 1 trial also

includes an extension phase to further assess the safety and repeat

use of LYR-210 through 52 weeks. The goal of the two pivotal trials

is to support a New Drug Application to the U.S. Food and Drug

Administration (FDA) for LYR-210.

BEACON Phase 2 Clinical Trial of LYR-220 in CRS Patients

who Have Had Ethmoid Sinus Surgery

- The Company plans to present additional secondary endpoint data

from the BEACON Phase 2 clinical trial of LYR-220 at the 2024

Combined Otolaryngology Spring Meetings (COSM) being held May

15-19, 2024 in Chicago, IL. The presentation, “Impact of LYR-220 on

ethmoid opacification and CRS symptoms in the BEACON study,” is

scheduled to take place on May 15, 2024 by Brent A. Senior, M.D.,

Nathaniel and Sheila Harris Distinguished Professor and Chief,

Division of Rhinology, Allergy, and Endoscopic Skull Base Surgery

in the Department of Otolaryngology/Head and Neck Surgery, UNC

School of Medicine and Coordinating Investigator for the BEACON

study.

- An end-of-Phase 2 meeting for LYR-220 with the FDA is

anticipated in the second half of 2024.

The Phase 2 BEACON trial was a randomized,

controlled, parallel-group study intended to evaluate the safety

and placement feasibility of the LYR-220 (7500µg mometasone furoate

(MF)) implant, over a 28-week period, in symptomatic CRS patients

who have had ethmoid sinus surgery. In September 2023, Lyra

Therapeutics announced positive topline results from the BEACON

Phase 2 clinical trial of LYR-220 in adult patients with CRS who

have recurrent symptoms despite having had surgery.

First Quarter 2024 Financial

Highlights

Cash, cash equivalents and short-term

investments as of March 31, 2024 were $87.1 million, compared with

$102.8 million at December 31, 2023. Based on our current business

plan, we anticipate that our cash, cash equivalents and short-term

investment balance is sufficient to fund our operating expenses and

capital expenditures into the first quarter of 2025. Please see our

Quarterly Report filed on Form 10-Q for the three months ended

March 31, 2024 for further information regarding our cash runway

guidance and other financial results.

Research and development expenses for the

quarter ended March 31, 2024 were $18.2 million, an increase of

$5.6 million compared to $12.6 million for the same period in 2023.

The increase in research and development expenses for the three

months ended March 31, 2024 was primarily attributable to increased

headcount costs of $2.1 million, an increase of $2.1 million of

allocated and support costs for shared activities within the

organization, an increase of $1.0 million in professional and

consulting fees and increased clinical costs of $0.4 million as we

continued to advance our clinical trials.

General and administrative expenses for the

quarter ended March 31, 2024 were $5.8 million, an increase of $0.7

million compared to $5.1 million for the same period in 2023. The

increase in general and administrative expenses for the three

months ended March 31, 2024 was primarily attributable to an

increase of $0.7 million in headcount costs as we expand headcount

within the organization, as well as $0.4 million of support costs

for shared activities within the organization driven by headcount

allocation and rent increases. These costs were partially offset by

a decrease in other fees of $0.4 million due to prior year

write-off of deferred financing costs.

Net loss for the first quarter 2024 was $22.5

million compared to $16.3 million for the same period in

2023.

About Lyra TherapeuticsLyra

Therapeutics, Inc. is a clinical-stage biotechnology company

developing therapies for the localized treatment of patients with

chronic rhinosinusitis (CRS), a highly prevalent inflammatory

disease of the paranasal sinuses which leads to debilitating

symptoms and significant morbidities. LYR-210 and LYR-220 are

bioabsorbable sinonasal implants designed to be administered in a

simple, in-office procedure and are intended to deliver six months

of continuous mometasone furoate drug therapy (7500µg MF) to the

sinonasal passages. LYR-210 is designed for patients with standard

anatomy, primarily those who have not undergone ethmoid sinus

surgery, and is being evaluated in the ENLIGHTEN Phase 3 clinical

program, while LYR-220, an enlarged implant, was evaluated in the

BEACON Phase 2 clinical trial in patients who have recurrent

symptoms despite having had ethmoid sinus surgery. These two

product candidates are designed to treat the estimated four million

CRS patients in the United States who fail medical management each

year. For more information, please visit www.lyratx.com and follow

us on LinkedIn.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements contained in this press release that do not relate

to matters of historical fact should be considered forward-looking

statements, including statements regarding the timing of the

availability of top-line results for ENLIGHTEN 1, the results from

the 52-week extension study of ENLIGHTEN 1 being available in Q4

2024, the completion of enrollment for ENLIGHTEN 2 in the second

half of 2024, the presentation of additional secondary endpoint

data from the BEACON Phase 2 clinical trial of LYR-220 at COSM on

May 15, 2024, whether an end-of-Phase 2 meeting for LYR-220

with the FDA will take place in the second half of 2024, the

Company’s cash runway into the first quarter of 2025, , and the

safety and efficacy of the Company’s product candidates. These

statements are neither promises nor guarantees, but involve known

and unknown risks, uncertainties and other important factors that

may cause the Company's actual results, performance or achievements

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following: the fact

that the Company has incurred significant losses since inception

and expects to incur additional losses for the foreseeable future;

the Company's need for additional funding and ability to operate as

a going concern, which may not be available; the Company’s limited

operating history; the fact that the Company has no approved

products; the fact that the Company’s product candidates are in

various stages of development; the fact that the Company has never

scaled up an in-house manufacturing facility for commercial use; or

the fact that the Company may not be successful in its efforts to

successfully commercialize its product candidates; the fact that

clinical trials required for the Company’s product candidates are

expensive and time-consuming, and their outcome is uncertain; the

fact that the FDA may not conclude that certain of the Company’s

product candidates satisfy the requirements for the Section

505(b)(2) regulatory approval pathway; the Company’s inability to

obtain required regulatory approvals; effects of recently enacted

and future legislation; the possibility of system failures or

security breaches; effects of significant competition; the fact

that the successful commercialization of the Company’s product

candidates will depend in part on the extent to which governmental

authorities and health insurers establish coverage, adequate

reimbursement levels and pricing policies; failure to achieve

market acceptance; product liability lawsuits; the fact that the

Company must scale its in-house manufacturing capabilities for its

research programs, pre-clinical studies and clinical trials and

commercial supply; the Company's reliance on third parties to

conduct its preclinical studies and clinical trials; the Company's

inability to succeed in establishing and maintaining collaborative

relationships; the Company's reliance on certain suppliers critical

to its production; failure to obtain and maintain or adequately

protect the Company's intellectual property rights; failure to

retain key personnel or to recruit qualified personnel;

difficulties in managing the Company's growth; effects of natural

disasters, terrorism and wars); the fact that the price of the

Company's common stock may be volatile and fluctuate substantially;

significant costs and required management time as a result of

operating as a public company; and any securities class action

litigation. These and other important factors discussed under the

caption "Risk Factors" in the Company's Quarterly Report on Form

10-Q filed with the SEC on April 30, 2024 and its other filings

with the SEC could cause actual results to differ materially from

those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management's estimates as of the date of this press release. While

the Company may elect to update such forward-looking statements at

some point in the future, it disclaims any obligation to do so,

even if subsequent events cause its views to change.

| LYRA

THERAPEUTICS, INC. |

| Condensed

Consolidated Statements of Operations and Comprehensive Loss |

| (in thousands,

except share and per share data) |

| |

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Collaboration revenue |

$ |

532 |

|

|

$ |

410 |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

Research and development |

|

18,238 |

|

|

|

12,596 |

|

|

General and administrative |

|

5,818 |

|

|

|

5,127 |

|

| Total operating expenses |

|

24,056 |

|

|

|

17,723 |

|

| Loss from operations |

|

(23,524 |

) |

|

|

(17,313 |

) |

| Other income: |

|

|

|

|

|

|

Interest income |

|

1,086 |

|

|

|

1,072 |

|

| Total other income |

|

1,086 |

|

|

|

1,072 |

|

| Loss before income tax

expense |

|

(22,438 |

) |

|

|

(16,241 |

) |

| Income tax expense |

|

(14 |

) |

|

|

(14 |

) |

| Net loss |

|

(22,452 |

) |

|

|

(16,255 |

) |

| Other comprehensive loss: |

|

|

|

|

|

| Unrealized holding loss on

short-term investments, net of tax |

|

(8 |

) |

|

|

(22 |

) |

| Comprehensive loss |

$ |

(22,460 |

) |

|

$ |

(16,277 |

) |

| Net loss per share attributable

to common stockholders—basic and diluted |

$ |

(0.35 |

) |

|

$ |

(0.44 |

) |

| Weighted-average common shares

outstanding—basic and diluted |

|

64,011,360 |

|

|

|

36,832,747 |

|

| |

|

|

|

|

|

|

|

|

LYRA THERAPEUTICS, INC. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands, except share data) |

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

15,799 |

|

|

$ |

22,353 |

|

|

Short-term investments |

|

71,319 |

|

|

|

80,400 |

|

|

Prepaid expenses and other current assets |

|

2,325 |

|

|

|

2,068 |

|

|

Total current assets |

|

89,443 |

|

|

|

104,821 |

|

| Property and equipment, net |

|

3,783 |

|

|

|

2,043 |

|

| Operating lease right-of-use

assets |

|

45,626 |

|

|

|

33,233 |

|

| Restricted cash |

|

1,992 |

|

|

|

1,392 |

|

| Other assets |

|

683 |

|

|

|

1,111 |

|

|

Total assets |

$ |

141,527 |

|

|

$ |

142,600 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

2,844 |

|

|

$ |

3,131 |

|

|

Accrued expenses and other current liabilities |

|

10,057 |

|

|

|

9,374 |

|

|

Operating lease liabilities |

|

4,504 |

|

|

|

5,434 |

|

|

Deferred revenue |

|

1,319 |

|

|

|

1,658 |

|

|

Total current liabilities |

|

18,724 |

|

|

|

19,597 |

|

| Operating lease liabilities, net

of current portion |

|

33,356 |

|

|

|

21,447 |

|

| Deferred revenue, net of current

portion |

|

11,943 |

|

|

|

12,136 |

|

|

Total liabilities |

|

64,023 |

|

|

|

53,180 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000,000 shares authorized at March 31, 2024 and December

31, 2023; no shares issued and outstanding at March 31, 2024 and

December 31, 2023 |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par value;

200,000,000 shares authorized at March 31, 2024 and December 31,

2023; 60,964,775 and 57,214,550 shares issued and outstanding at

March 31, 2024 and December 31, 2023, respectively |

|

61 |

|

|

|

57 |

|

| Additional paid-in capital |

|

411,225 |

|

|

|

400,685 |

|

| Accumulated other comprehensive

income, net of tax |

|

25 |

|

|

|

33 |

|

| Accumulated deficit |

|

(333,807 |

) |

|

|

(311,355 |

) |

|

Total stockholders’ equity |

|

77,504 |

|

|

|

89,420 |

|

|

Total liabilities and stockholders’ equity |

$ |

141,527 |

|

|

$ |

142,600 |

|

| |

|

|

|

|

|

|

|

Contact Information:Ellen

Cavaleri, Investor Relations 615.618.6228 ecavaleri@lyratx.com

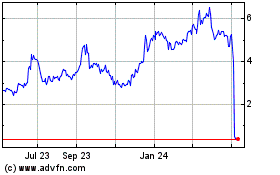

Lyra Therapeutics (NASDAQ:LYRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

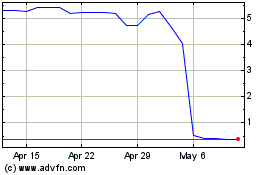

Lyra Therapeutics (NASDAQ:LYRA)

Historical Stock Chart

From Nov 2023 to Nov 2024