LiveOne (Nasdaq: LVO), an award-winning, creator-first, music,

entertainment, and technology platform, announced today its

operating results for the first fiscal quarter ended June 30, 2024

(“Q1 Fiscal 2025”).

LiveOne’s CEO and Chairman, Robert Ellin, commented, “We are

thrilled to announce another quarter of record growth, driven by

our Audio Division’s ongoing momentum. With a robust pipeline and

four newly signed partnerships, we are excited about our future

prospects. Our strategic positioning and operational efficiencies

have effectively prepared us to leverage emerging opportunities. As

we remain focused on our long-term objectives, we are committed to

maintaining our creator-first platform approach and catering to our

superfans. Additionally, our continued company share repurchases

underscore our belief in the intrinsic value of our shares and

demonstrate alignment with our dedicated shareholders.”

Recent and Q1 Fiscal 2025 Highlights

- Paid members as of June 30, 2024 increased 653K or 29%, as

compared to the prior year. Total members including free

ad-supported memberships was approximately 3.9 million at July 31,

2024.**

- PodcastOne was 11th in PODTRAC’s Podcast Industry Top

Publishers Rankings for June 2024 with a U.S. Unique Monthly

Audience of ~5.5M and Global Downloads and Streams of ~17.5M.

- As previously announced with the assistance of J.P. Morgan,

LiveOne is continuing a process to explore strategic alternatives

to enhance shareholder value. Potential alternatives may include,

among others, a strategic acquisition, divestiture, merger, sale or

other form of business combination. There can be no assurance that

LiveOne’s efforts will result in a specific transaction or any

particular outcome or its timing.

Q1 Fiscal 2025 and 2024 Results Summary (in $000’s,

except per share; unaudited)

| |

Three Months Ended |

|

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

| Revenue |

$ |

33,078 |

|

|

$ |

27,767 |

|

| Operating income (loss) |

$ |

(784 |

) |

|

$ |

(255 |

) |

| Total other income

(expense) |

$ |

(724 |

) |

|

$ |

(181 |

) |

| Net income (loss) |

$ |

(1,557 |

) |

|

$ |

(515 |

) |

| Adjusted EBITDA* |

$ |

2,903 |

|

|

$ |

2,210 |

|

| Net income (loss) per share

basic and diluted |

($ |

0.02 |

) |

|

($ |

0.01 |

) |

Q1 Fiscal 2025 Results Summary Discussion

For Q1 Fiscal 2025, LiveOne posted revenue of $33.1 million, a

19% increase, as compared to $27.8 million in the same period in

the prior year. The Audio Division revenue was a record $31.9

million, a 24% increase, as compared to revenue of $25.7 in Q1

Fiscal 2024.

Q1 Fiscal 2025 Operating Loss was ($0.8) million compared to

Operating Loss of ($0.3) million in Q1 Fiscal 2024. The $0.5

million increase in Operating Income was largely a result of an

increase in operating expenses.

Q1 Fiscal 2025 Adjusted EBITDA* improved to $2.9 million, as

compared to Q1 Fiscal 2024 Adjusted EBITDA* of $2.2 million. Q1

Fiscal 2025 Adjusted EBITDA* was comprised of Audio Division

Adjusted EBITDA* of $5.1 million, Other Operations Adjusted EBITDA*

of ($0.6) million and Corporate Adjusted EBITDA* of ($1.6) million.

Audio Division Q1 Fiscal 2024 Adjusted EBITDA* of $5.1 million was

driven by improved Contribution Margin* along with decreases in

operating expenses.

Capital expenditures for Q1 Fiscal 2024 totaled approximately

$0.7 million, which were driven by capitalized software costs

associated with development of LiveOne’s integrated music player

and pay-per-view services.

LiveOne is maintaining its guidance for its fiscal year ending

March 31, 2025 of consolidated revenue of $140 million - $155

million and Adjusted EBITDA* of $16 million - $20 million, and for

its Audio Division revenue of $130 million - $140 million and

Adjusted EBITDA* of $20 million - $25 million.

LiveOne’s senior management will host a live conference call and

audio webcast to provide a business update and discuss its

operating and financial results beginning at 10:00 a.m. ET / 7:00

a.m. PT on Tuesday, August 13, 2024.

Conference Call and Webcast:

WHEN: Tuesday, August 13thTIME: 10:00 AM ET / 7:00 AM PTDIAL-IN

(Toll Free): (833) 470-1428DIAL IN NUMBER (Local): (404)

975-4839ACCESS CODE: 808439REPLAY NUMBER: (866) 813-9403 / ACCESS

CODE: 410380

WEBCAST – Both the live webcast and a

replay can be accessed on the Investor Relations section of

LiveOne's website at Events | LiveOne.The webcast can also be

accessed at: https://events.q4inc.com/attendee/127231561

The timing, price and actual number of shares repurchased under

LiveOne’s stock repurchase program, which may include the

possibility of buying back shares of common stock of PodcastOne,

will be at the discretion of LiveOne's management and will depend

on a variety of factors, including stock price, general business

and market conditions, and alternative investment opportunities.

The repurchase program will continue to be executed consistent with

LiveOne's capital allocation strategy, which will continue to

prioritize growing LiveOne's business. Under the stock repurchase

program, repurchases can be made from time to time using a variety

of methods, including open market purchases, all in compliance with

the rules of the U.S. Securities and Exchange Commission and other

applicable legal requirements. The repurchase program does not

obligate LiveOne to acquire any particular amount of shares, and

the program may be suspended or discontinued at any time at

LiveOne's discretion. LiveOne will review the stock repurchase

program periodically and may authorize adjustment of its terms and

size.

About LiveOneHeadquartered in Los Angeles, CA,

LiveOne (Nasdaq: LVO) is an award-winning, creator-first,

music, entertainment, and technology platform focused on delivering

premium experiences and content worldwide through memberships and

live and virtual events. LiveOne's wholly-owned subsidiaries

include Slacker, PodcastOne (Nasdaq: PODC), PPVOne, CPS,

LiveXLive, DayOne Music Publishing, Drumify and Splitmind. LiveOne

is available on iOS, Android, Roku, Apple TV, Spotify, Samsung,

Amazon Fire, Android TV, and through STIRR's OTT applications. For

more information, visit liveone.com and follow us

on Facebook, Instagram, TikTok, YouTube and

Twitter at @liveone. For more investor information, please

visit ir.liveone.com.

Forward-Looking Statements All statements other

than statements of historical facts contained in this press release

are “forward-looking statements,” which may often, but not always,

be identified by the use of such words as “may,” “might,” “will,”

“will likely result,” “would,” “should,” “estimate,” “plan,”

“project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,”

“seek,” “continue,” “target” or the negative of such terms or other

similar expressions. These statements involve known and unknown

risks, uncertainties and other factors, which may cause actual

results, performance or achievements to differ materially from

those expressed or implied by such statements, including: LiveOne’s

reliance on one key customer for a substantial percentage of its

revenue; LiveOne’s ability to consummate any proposed financing,

acquisition, spin-out, special dividend, merger, distribution or

transaction, the timing of the consummation of any such proposed

event, including the risks that a condition to the consummation of

any such event would not be satisfied within the expected timeframe

or at all, or that the consummation of any proposed financing,

acquisition, spin-out, merger, special dividend, distribution or

transaction will not occur or whether any such event will enhance

shareholder value; LiveOne’s ability to continue as a going

concern; LiveOne’s ability to attract, maintain and increase the

number of its users and paid members; LiveOne identifying,

acquiring, securing and developing content; LiveOne’s intent to

repurchase shares of its and/or PodcastOne’s common stock from time

to time under LiveOne’s announced stock repurchase program and the

timing, price, and quantity of repurchases, if any, under the

program; LiveOne’s ability to maintain compliance with certain

financial and other covenants; LiveOne successfully implementing

its growth strategy, including relating to its technology platforms

and applications; management’s relationships with industry

stakeholders; uncertain and unfavorable outcomes in legal

proceedings; changes in economic conditions; competition; risks and

uncertainties applicable to the businesses of LiveOne’s

subsidiaries; and other risks, uncertainties and factors including,

but not limited to, those described in LiveOne’s Annual Report on

Form 10-K for the fiscal year ended March 31, 2024, filed with the

U.S. Securities and Exchange Commission (the “SEC”) on July 1,

2024, and in LiveOne’s other filings and submissions with the SEC.

These forward-looking statements speak only as of the date hereof,

and LiveOne disclaims any obligation to update these statements,

except as may be required by law. LiveOne intends that all

forward-looking statements be subject to the safe-harbor provisions

of the Private Securities Litigation Reform Act of 1995.**Included

in the total number of paid members for the reported periods are

certain members which are the subject of a contractual dispute.

LiveOne is currently not recognizing revenue related to these

members.

* About Non-GAAP Financial MeasuresTo

supplement our consolidated financial statements, which are

prepared and presented in accordance with the accounting principles

generally accepted in the United States of America ("GAAP"), we

present Contribution Margin (Loss) and Adjusted Earnings Before

Interest Tax Depreciation and Amortization ("Adjusted EBITDA"),

which are non-GAAP financial measures, as measures of our

performance. The presentation of these non-GAAP financial measures

is not intended to be considered in isolation from, or as a

substitute for, or superior to, operating loss and or net income

(loss) or any other performance measures derived in accordance with

GAAP or as an alternative to net cash provided by operating

activities or any other measures of our cash flows or

liquidity.

We use Contribution Margin (Loss) and Adjusted EBITDA to

evaluate the performance of our operating segment. We believe that

information about these non-GAAP financial measures assists

investors by allowing them to evaluate changes in the operating

results of our business separate from non-operational factors that

affect operating income (loss) and net income (loss), thus

providing insights into both operations and the other factors that

affect reported results. Adjusted EBITDA is not calculated or

presented in accordance with GAAP. A limitation of the use of

Adjusted EBITDA as a performance measure is that it does not

reflect the periodic costs of certain amortizing assets used in

generating revenue in our business. Accordingly, Adjusted EBITDA

should be considered in addition to, and not as a substitute for

operating income (loss), net income (loss), and other measures of

financial performance reported in accordance with GAAP.

Furthermore, this measure may vary among other companies; thus,

Adjusted EBITDA as presented herein may not be comparable to

similarly titled measures of other companies.

Contribution Margin (Loss) is defined as Revenue less Cost of

Sales. Adjusted EBITDA is defined as earnings before interest,

other (income) expense, income tax expense, depreciation and

amortization and before (a) non-cash GAAP purchase accounting

adjustments for certain deferred revenue and costs, (b) legal,

accounting and other professional fees directly attributable to

acquisition activity, (c) employee severance payments and third

party professional fees directly attributable to acquisition or

corporate realignment activities, (d) certain non-recurring

expenses associated with legal settlements or reserves for legal

settlements in the period that pertain to historical matters that

existed at acquired companies prior to their purchase date and a

one-time minimum guarantee to effectively terminate a live events

distribution agreement post COVID-19, (e) depreciation and

amortization (including goodwill impairment, if any), and (f)

certain stock-based compensation expense. Management does not

consider these costs to be indicative of our core operating

results.

With respect to projected full fiscal year 2025 Adjusted EBITDA,

a quantitative reconciliation is not available without unreasonable

efforts due to the high variability, complexity and low visibility

with respect to purchase accounting adjustments,

acquisition-related charges and legal settlement reserves excluded

from Adjusted EBITDA. We expect that the variability of these items

to have a potentially unpredictable, and potentially significant,

impact on our future GAAP financial results.

For more information on these non-GAAP financial measures,

please see the tables entitled "Reconciliation of Non-GAAP Measure

to GAAP Measure" included at the end of this release.

LiveOne IR

Contact:Liviakis Financial

Communications, Inc.(415) 389-4670john@liviakis.com

Press

Contact:LiveOnepress@liveone.com

|

Financial InformationThe tables below present

financial results for the three months ended June 30, 2024 and

2023.LiveOne ,

Inc.Consolidated Statements of Operations

(Unaudited)(In thousands, except share and per

share amounts) |

| |

|

Three Months Ended |

|

|

|

June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

| Revenue: |

|

$ |

33,078 |

|

|

$ |

27,767 |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

Cost of sales |

|

|

25,087 |

|

|

|

19,563 |

|

|

Sales and marketing |

|

|

1,431 |

|

|

|

1,904 |

|

|

Product development |

|

|

1,071 |

|

|

|

1,246 |

|

|

General and administrative |

|

|

5,505 |

|

|

|

5,063 |

|

|

Impairment of intangible assets |

|

|

176 |

|

|

|

- |

|

|

Amortization of intangible assets |

|

|

592 |

|

|

|

246 |

|

|

Total operating expenses |

|

|

33,862 |

|

|

|

28,022 |

|

| Loss from

operations |

|

|

(784 |

) |

|

|

(255 |

) |

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

Interest expense, net |

|

|

(859 |

) |

|

|

(1,418 |

) |

|

Other income (expense) |

|

|

135 |

|

|

|

1,237 |

|

|

Total other expense, net |

|

|

(724 |

) |

|

|

(181 |

) |

|

|

|

|

|

|

| Loss before provision

for income taxes |

|

|

(1,508 |

) |

|

|

(436 |

) |

|

|

|

|

|

|

| Provision for income

taxes |

|

|

49 |

|

|

|

79 |

|

| Net loss |

|

|

(1,557 |

) |

|

|

(515 |

) |

| Net loss attributable to

non-controlling interest |

|

|

(388 |

) |

|

|

- |

|

| Net loss attributed to

LiveOne |

|

$ |

(1,169 |

) |

|

$ |

(515 |

) |

|

|

|

|

|

|

| Net loss per

share – basic and diluted |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

| Weighted average

common shares – basic and diluted |

|

|

98,419,692 |

|

|

|

86,895,208 |

|

|

LiveOne ,

Inc.Consolidated Balance Sheets

(Unaudited)(In thousands) |

| |

|

June 30 |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

|

(Unaudited) |

|

(Audited) |

|

Assets |

|

|

|

|

| Current

Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,165 |

|

|

$ |

6,987 |

|

|

Restricted cash |

|

|

155 |

|

|

|

155 |

|

|

Accounts receivable, net |

|

|

14,760 |

|

|

|

13,205 |

|

|

Inventories |

|

|

2,809 |

|

|

|

2,187 |

|

|

Prepaid expense and other current assets |

|

|

1,717 |

|

|

|

1,801 |

|

| Total Current

Assets |

|

|

25,606 |

|

|

|

24,335 |

|

|

Property and equipment, net |

|

|

3,716 |

|

|

|

3,646 |

|

|

Goodwill |

|

|

23,379 |

|

|

|

23,379 |

|

|

Intangible assets, net |

|

|

11,528 |

|

|

|

12,415 |

|

|

Other assets |

|

|

400 |

|

|

|

88 |

|

| Total

Assets |

|

$ |

64,629 |

|

|

$ |

63,863 |

|

|

|

|

|

|

|

|

Liabilities, Mezzanine Equity and Stockholders’ Equity

(Deficit) |

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

27,050 |

|

|

$ |

26,953 |

|

|

Accrued royalties |

|

|

12,729 |

|

|

|

10,862 |

|

|

Notes payable, current portion |

|

|

691 |

|

|

|

692 |

|

|

Deferred revenue |

|

|

675 |

|

|

|

728 |

|

|

Senior secured line of credit |

|

|

7,000 |

|

|

|

7,000 |

|

|

Derivative liabilities |

|

|

- |

|

|

|

607 |

|

| Total Current

Liabilities |

|

|

48,145 |

|

|

|

46,842 |

|

|

Notes payable, net |

|

|

601 |

|

|

|

771 |

|

|

Other long-term liabilities |

|

|

8,934 |

|

|

|

9,354 |

|

|

Deferred income taxes |

|

|

339 |

|

|

|

339 |

|

| Total

Liabilities |

|

|

58,019 |

|

|

|

57,306 |

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

| |

|

|

|

|

| Mezzanine

Equity |

|

|

|

|

|

Redeemable convertible preferred stock, $0.001 par value; 100,000

shares authorized; none and 5,000 shares issued and outstanding as

of June 30, 2024 and March 31, 2024, respectively |

|

|

- |

|

|

|

4,962 |

|

| Stockholders’ Equity

(Deficit) |

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized;

12,797 and 18,814 shares issued and outstanding as of June 30, 2024

and March 31, 2024, respectively |

|

|

12,797 |

|

|

|

18,814 |

|

|

Common stock, $0.001 par value; 500,000,000 shares authorized;

94,578,077 and 88,627,420 shares issued and outstanding, net of

treasury shares, respectively |

|

|

98 |

|

|

|

92 |

|

|

Additional paid in capital |

|

|

229,674 |

|

|

|

216,116 |

|

|

Treasury stock |

|

|

(5,531 |

) |

|

|

(4,782 |

) |

|

Accumulated deficit |

|

|

(240,847 |

) |

|

|

(238,984 |

) |

| Total LiveOne's

Stockholders’ Deficit |

|

|

(3,809 |

) |

|

|

(8,744 |

) |

|

Non-controlling interest |

|

|

10,419 |

|

|

|

10,339 |

|

| Total equity (deficit) |

|

|

6,610 |

|

|

|

1,595 |

|

| Total Liabilities,

Mezzanine Equity and Stockholders’ Equity (Deficit) |

|

$ |

64,629 |

|

|

$ |

63,863 |

|

|

LiveOne ,

Inc.Reconciliation of Non-GAAP Measure to GAAP

MeasureAdjusted EBITDA* Reconciliation

(Unaudited)(In thousands) |

| |

|

|

|

|

|

|

Non- |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Recurring |

|

|

|

|

|

|

| |

Net |

|

Depreciation |

|

|

|

Acquisition and |

|

Other |

|

(Benefit) |

|

|

|

|

Income |

|

and |

|

Stock-Based |

|

Realignment |

|

(Income) |

|

Provision |

|

Adjusted |

|

|

(Loss) |

|

Amortization |

|

Compensation |

|

Costs (1) |

|

Expense (2) |

|

for Taxes |

|

EBITDA* |

| Three Months Ended

June 30, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operations – PodcastOne |

$ |

(1,366 |

) |

|

$ |

619 |

|

$ |

394 |

|

$ |

37 |

|

$ |

- |

|

|

$ |

- |

|

$ |

(316 |

) |

| Operations – Slacker |

|

3,352 |

|

|

|

750 |

|

|

505 |

|

|

146 |

|

|

672 |

|

|

|

- |

|

|

5,425 |

|

| Operations – Other |

|

(1,391 |

) |

|

|

217 |

|

|

318 |

|

|

197 |

|

|

31 |

|

|

|

- |

|

|

(628 |

) |

| Corporate |

|

(2,152 |

) |

|

|

2 |

|

|

483 |

|

|

19 |

|

|

21 |

|

|

|

49 |

|

|

(1,578 |

) |

| Total |

$ |

(1,557 |

) |

|

$ |

1,588 |

|

$ |

1,700 |

|

$ |

399 |

|

$ |

724 |

|

|

$ |

49 |

|

$ |

2,903 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended

June 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operations – PodcastOne |

$ |

(210 |

) |

|

$ |

86 |

|

$ |

84 |

|

$ |

- |

|

$ |

403 |

|

|

$ |

- |

|

$ |

363 |

|

| Operations – Slacker |

|

3,384 |

|

|

|

714 |

|

|

216 |

|

|

453 |

|

|

(253 |

) |

|

|

- |

|

|

4,514 |

|

| Operations – Other |

|

(848 |

) |

|

|

250 |

|

|

34 |

|

|

26 |

|

|

(643 |

) |

|

|

- |

|

|

(1,181 |

) |

| Corporate |

|

(2,841 |

) |

|

|

5 |

|

|

543 |

|

|

54 |

|

|

674 |

|

|

|

79 |

|

|

(1,486 |

) |

| Total |

$ |

(515 |

) |

|

$ |

1,055 |

|

$ |

877 |

|

$ |

533 |

|

$ |

181 |

|

|

$ |

79 |

|

$ |

2,210 |

|

|

(1 |

) |

Other Non-Operating and Non-Recurring Costs include outside legal,

accounting and other professional fees directly attributable to

acquisition activity in the period and in addition to certain

non-recurring expenses associated with legal settlements or

reserves for legal settlements in the period that pertain to

historical matters that existed at certain acquired companies prior

to their purchase date and non-recurring employee severance

payments. |

|

(2 |

) |

Other (income) expense above primarily includes interest expense

and change in fair value of derivative liabilities. These are

included in the statement of operations in other income (expense)

and are an add back to net loss above in the reconciliation of

Adjusted EBITDA* to loss. |

|

|

* |

See the definition of Adjusted EBITDA under “About Non-GAAP

Financial Measures” within this release. |

|

LiveOne ,

Inc.Reconciliation of Non-GAAP Measure to GAAP

MeasureContribution Margin* Reconciliation

(Unaudited)(In thousands) |

| |

Three Months Ended |

|

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

| Revenue: |

$ |

33,078 |

|

|

$ |

27,767 |

|

| Less: |

|

|

|

| Cost of sales |

|

(25,087 |

) |

|

|

(19,563 |

) |

| Amortization of developed

technology |

|

(775 |

) |

|

|

(747 |

) |

|

Gross Profit |

|

7,216 |

|

|

|

7,457 |

|

|

|

|

|

|

| Add back amortization

of developed technology: |

|

775 |

|

|

|

747 |

|

|

Contribution Margin* |

$ |

7,991 |

|

|

$ |

8,204 |

|

| |

* |

See the definition of Contribution Margin under “About Non-GAAP

Financial Measures” within this release. |

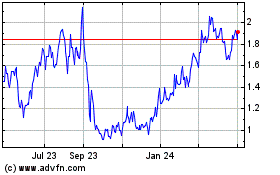

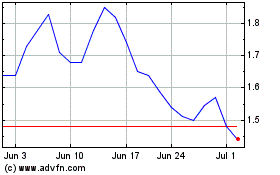

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Oct 2024 to Nov 2024

LiveOne (NASDAQ:LVO)

Historical Stock Chart

From Nov 2023 to Nov 2024