0000779152FALSE00007791522024-07-222024-07-22

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 22, 2024

JACK HENRY & ASSOCIATES, INC.

(Exact name of Registrant as specified in its Charter) | | | | | | | | |

| Delaware | 0-14112 | 43-1128385 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

663 Highway 60, P.O. Box 807, Monett, MO 65708

(Address of Principal Executive Offices) (Zip Code)

417-235-6652

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a.-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Ticker symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | JKHY | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 22, 2024, the Board of Directors (the “Board”) of Jack Henry & Associates, Inc. (the “Company”) temporarily expanded the size of the Board from nine directors to ten directors and appointed new directors to the Board. The expansion of the Board will last until the 2024 Annual Meeting of Stockholders, at which time nine director nominees are expected to stand for election to the Board. To fill the vacancies created by this expansion and the unfortunate passing of Laura G. Kelly earlier in 2024, the Board appointed Tammy S. LoCascio and Lisa M. Nelson as directors of the Company.

Tammy S. LoCascio, age 55, is Senior Executive Vice President and Chief Operating Officer of First Horizon Corporation (NYSE: FHN), the holding company for First Horizon Bank, where she also previously served as Chief Human Resources Officer, and Executive Vice President of Consumer Banking. Prior to joining First Horizon in 2011, Ms. LoCascio worked in management consulting as well as held leadership roles at various regional banks. Ms. LoCascio brings extensive experience with banking strategy, technology, and operations as well as human capital management. Ms. LoCascio is engaged in the communities she serves and was named a Woman of Impact by the American Heart Association of the Mid South in 2024 and was honored as one of Memphis’ most influential women in business by the Memphis Business Journal in 2018.

Lisa M Nelson, age 61, is President of the Equifax, Inc. (NYSE: EFX) International business, where she also previously served as President of Equifax Australia and New Zealand, President and General Manager of Equifax Canada, and Corporate Senior Vice President and Enterprise Alliance Leader. Prior to joining Equifax in 2011, Ms. Nelson held various executive leadership positions at Fair Isaac Corporation (NYSE: FICO) from 2004 to 2011, and from 1998 to 2003 held executive positions at EFunds Corporation, a payments services company that was acquired by Fidelity National Information Services, Inc. (NYSE: FIS) in 2007. Ms. Nelson brings to the Board a deep knowledge and experience of global management of technology companies, in addition to strategic acquisitions and implementation of growth initiatives. Ms. Nelson earned a Master’s in Business Administration from the University of St. Thomas. She currently serves on the private board of Equifax do Brazil.

In connection with the appointments, the Board determined each of Ms. LoCascio and Ms. Nelson to be independent directors within the meaning of the Nasdaq Stock Market listing standards and the rules and regulations of the Securities and Exchange Commission.

In connection with Ms. LoCascio’s and Ms. Nelson’s appointments, and pursuant to the Company’s compensation practices for non-employee directors, each will be granted a prorated portion of the annual director restricted stock unit award equaling approximately $61,600 and will be eligible for the $70,000 annual director cash retainer, which is paid quarterly in arrears. The Company and each of Ms. LoCascio and Ms. Nelson will enter into the Company’s standard form of indemnification agreement for directors and officers, a copy of which was previously filed as Exhibit 10.71 to the Company’s Current Report on Form 8-K filed February 17, 2022, and is incorporated herein by reference.

The Company has not entered into any transaction with either Ms. LoCascio or Ms. Nelson for which disclosure is required under Item 404(a) of Regulation S-K and neither will not be employed by the Company. Neither Ms. LoCascio nor Ms. Nelson was elected pursuant to any arrangement or understanding between such director and any other parties.

The Board has not determined at this time which committees Ms. LoCascio and Ms. Nelson will be appointed to serve on as members.

Additional information regarding the appointments of Ms. LoCascio and Ms. Nelson is detailed in the Company’s press release dated July 23, 2024, the text of which is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

Exhibits

Exhibit No. Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | JACK HENRY & ASSOCIATES, INC. |

| | | (Registrant) |

| | | |

| Date: | July 23, 2024 | | /s/ Mimi L. Carsley |

| | | Mimi L. Carsley |

| | | Chief Financial Officer and Treasurer |

| | | | | | | | | | | | | | |

| Company: | Jack Henry & Associates, Inc. | | Analyst Contact: | Vance Sherard, CFA |

| 663 Highway 60, P.O. Box 807 | | | Vice President, Investor Relations |

| Monett, MO 65708 | | | (417) 235-6652 |

| | | | |

| | | Press Contact: | Mark Folk |

| | | | Director, Corporate Communications |

| | | | (704) 890-5323 |

Tammy LoCascio and Lisa Nelson Appointed to Jack Henry Board of Directors

MONETT, Mo., July 23, 2024 – Jack Henry & Associates Inc.® (Nasdaq: JKHY) announced today that Tammy LoCascio and Lisa Nelson were appointed to its Board of Directors on July 22, 2024.

Jack Henry also announced a temporary expansion of its Board from nine to 10 directors. This expansion will last until the company’s 2024 Annual Meeting of Stockholders, at which time nine director nominees are expected to stand for election to the Board.

LoCascio, 55, is Senior Executive Vice President and Chief Operating Officer of First Horizon Corporation, the holding company for First Horizon Bank. She previously served as First Horizon’s Chief Human Resources Officer and Executive Vice President of Consumer Banking. Prior to joining First Horizon in 2011, LoCascio worked in management consulting and held leadership roles at various regional banks.

Nelson, 61, is President of the Equifax Inc. International business. She previously served as President of Equifax Australia and New Zealand, President and General Manager of Equifax Canada, and Corporate Senior Vice President and Enterprise Alliance Leader. Prior to joining Equifax in 2011, Nelson held various executive leadership positions at Fair Isaac Corporation and EFunds Corporation, a payments services company.

“We are pleased to welcome both Tammy and Lisa to our Board of Directors,” said Jack Henry Executive Board Chair David Foss. “Tammy brings extensive experience in banking strategy, technology, and operations as well as human capital management. Lisa has expertise in the management of technology companies, in addition to strategic acquisitions and the implementation of growth initiatives. We look forward to adding their unique perspectives, skills, and expertise.”

About Jack Henry & Associates, Inc.®

Jack Henry™ (Nasdaq: JKHY) is a well-rounded financial technology company that strengthens connections between financial institutions and the people and businesses they serve. We are an S&P 500 company that prioritizes openness, collaboration, and user centricity – offering banks and credit unions a vibrant ecosystem of internally developed modern capabilities as well as the ability to integrate with leading fintechs. For more than 48 years, Jack Henry has provided technology solutions to enable clients to innovate faster, strategically differentiate, and successfully compete while serving the evolving needs of their accountholders. We empower

approximately 7,500 clients with people-inspired innovation, personal service, and insight-driven solutions that help reduce the barriers to financial health. Additional information is available at www.jackhenry.com.

Statements made in this news release that are not historical facts are “forward-looking statements.” Because forward-looking statements relate to the future, they are subject to inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, but are not limited to, those discussed in the Company’s Securities and Exchange Commission filings, including the Company’s most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Any forward-looking statement made in this news release speaks only as of the date of the news release, and the Company expressly disclaims any obligation to publicly update or revise any forward-looking statement, whether because of new information, future events or otherwise.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

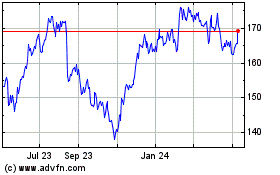

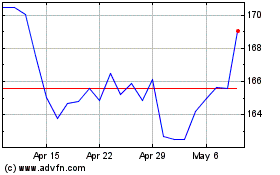

Jack Henry and Associates (NASDAQ:JKHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Jack Henry and Associates (NASDAQ:JKHY)

Historical Stock Chart

From Nov 2023 to Nov 2024