Adoption of Smart Beta ETFs Increasing Among Institutional Asset Managers

January 23 2014 - 11:29AM

Marketwired

Adoption of Smart Beta ETFs Increasing Among Institutional Asset

Managers

Independent Research Reveals Use of Low Volatility & High

Dividend Strategies Will Escalate

CHICAGO, IL--(Marketwired - Jan 23, 2014) - Today, 1 in 4

institutional investors report using smart beta ETFs, and adoption

among non-users is likely to accelerate in the near future,

according to a new study conducted by Cogent Research, a division

of Market Strategies International. The results reveal that nearly

half (46%) of institutional decision makers not currently using

smart beta ETFs indicate they are likely to start using the

products over the next three years, particularly institutional

investors with assets in excess of $500M.

Within the smart beta ETF category, low volatility funds have

experienced the greatest growth in 2013: an impressive 99% increase

in assets.1 This trend is expected to continue as two-thirds (67%)

of institutional decision-makers not currently using smart beta

ETFs indicate they are most likely to use low volatility funds

moving forward. In addition to low-volatility products, nearly

half (46%) of non-smart beta ETF users anticipate using high

dividend ETFs and over a third (34%) plan on using fundamentally

weighted investment strategies.

"We have been seeing increased interest in smart beta ETFs with

various institutional segments, and the research findings confirm

that increasingly institutions are implementing smart beta ETFs,"

said John Hoffman, Invesco PowerShares director of ETF

institutional sales and capital markets. "Smart beta ETFs make a

lot of sense for institutional investors seeking lower costs,

intraday liquidity, increased transparency, ease of implementation,

and strategies that go beyond market cap weighting."

Non-users indicate that the primary drivers of future usage

include making tactical adjustments to asset allocation (42%),

accessing higher beta strategies (40%), portfolio completion (40%),

and to reduce portfolio volatility (39%).

"We educate both users and non-users about the many benefits of

PowerShares smart beta ETFs, and these results reinforce our belief

that these products are great investment tools for institutional

asset managers as well as retail investors," said Dan Draper,

Invesco PowerShares managing director of global ETFs. "We're very

excited about the future potential of our investment category."

Full research results and analysis can be accessed by visiting

PowerShares.com/Institutional.

About The Study The data contained within this analysis was

collected from 193 participants between September 5 and October 2,

2013. A 15-minute online survey was administered by Cogent Research

to institutional decision makers, including pensions,

endowments/foundations, non-profit institutions, mutual funds, as

well RIAs who manage institutional assets.

Invesco PowerShares is not affiliated with Cogent Research.

Cogent Research is an independent full-service market research and

consulting firm, specializing in wealth management. Cogent Research

was hired by Invesco PowerShares to conduct the research used in

the creation of this study. Respondents were not made aware of

Invesco PowerShares' involvement in this research initiative.

About Invesco PowerShares Capital Management LLC and Invesco,

Ltd. Invesco PowerShares Capital Management LLC is leading the

Intelligent ETF Revolution® through its family of more than 140

domestic and international exchange-traded funds, which seek to

outperform traditional benchmark indexes while providing advisors

and investors access to an innovative array of focused investment

opportunities. With franchise assets over $87 billion as of

September 30, 2013, PowerShares ETFs trade on both US stock

exchanges. For more information, please visit us

at invescopowershares.com or follow us on Twitter

@PowerShares.

Invesco Ltd. is a leading independent global investment

management firm, dedicated to helping investors worldwide achieve

their financial objectives. By delivering the combined power of our

distinctive investment management capabilities, Invesco provides a

wide range of investment strategies and vehicles to our clients

around the world. Operating in more than 20 countries, the firm is

listed on the New York Stock Exchange under the symbol IVZ.

Additional information is available at www.invesco.com

1 Bloomberg LP, as of December 31, 2013

Glossary & Terms Beta: is a measure of risk representing how

a security is expected to respond to general market movements. For

example, a beta of one means that the security is expected to move

with the market. A beta of less than one means the security is

expected to be less volatile than the overall market. Betas greater

than one are expected to exhibit more volatility or movement than

the general market.

Market-Cap-Weighted: A type of index in which individual

components are weighted according to market capitalization. Index

value can be calculated by adding the market capitalizations of

each index component and dividing that sum by the number of

securities in the index.

Smart Beta: An alternative and selection index based methodology

that seeks to outperform a benchmark or reduce portfolio risk, or

both. Smart beta funds may underperform cap-weighted benchmarks and

increase portfolio risk.

Volatility: the annualized standard deviation of monthly index

returns.

General Risk Information There are risks involved with investing

in ETFs, including possible loss of money. Index-based ETFs are not

actively managed. Investments focused in a particular industry are

subject to greater risk, and are more greatly impacted by market

volatility, than more diversified investments. Shares are not

actively managed and are subject to risks similar to those of

stocks, including those regarding short selling and margin

maintenance requirements. Ordinary brokerage commissions apply. The

Fund's return may not match the return of the Underlying Index.

An investor should consider the Funds' investment objectives,

risks, charges and expenses carefully before investing. For this

and more complete information about the Funds call 800 983 0903 or

visit invescopowershares.com for a prospectus. Please read the

prospectus carefully before investing.

Media Contacts: Kristin Sadlon Porter Novelli 212-601-8192 Email

Contact Bill Conboy 303-415-2290 Email Contact

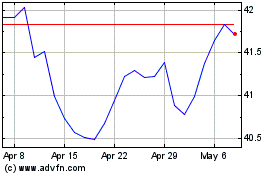

Invesco Dividend Achieve... (NASDAQ:PFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

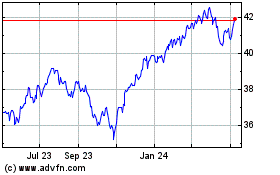

Invesco Dividend Achieve... (NASDAQ:PFM)

Historical Stock Chart

From Mar 2024 to Mar 2025