0001405495false00014054952024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 31, 2024

______________

INTERDIGITAL, INC.

(Exact name of Registrant as Specified in Charter)

| | | | | | | | |

| Pennsylvania | 1-33579 | 82-4936666 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

200 Bellevue Parkway, Suite 300

Wilmington, DE 19809-3727

(Address of principal executive offices, Zip code)

302-281-3600

Registrant's telephone number, including area code

Not Applicable

Former Name or Former Address, if Changed Since Last Report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.01 per share | | IDCC | | NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2024, InterDigital, Inc. (the "Company") issued a press release announcing its results of operations and financial condition for the fiscal quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in Item 2.02 of this report, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD.

The supplemental earnings presentation attached hereto as Exhibit 99.2 is being provided to investors in connection with the Company's earnings announcement.

The information contained in Item 7.01 of this report, including Exhibit 99.2, shall not be deemed "filed" for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filing under the Securities or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| INTERDIGITAL, INC. |

|

|

| By: /s/ Joshua D. Schmidt |

| Joshua D. Schmidt |

| Chief Legal Officer and |

| Corporate Secretary |

Date: October 31, 2024

INTERDIGITAL ANNOUNCES FINANCIAL RESULTS FOR THIRD QUARTER 2024

Company delivers Q3 results above the top end of outlook and raises FY 2024 guidance

WILMINGTON, DE. - October 31, 2024 - InterDigital, Inc. (Nasdaq: IDCC), a mobile, video, and AI technology research and development company, today announced results for the quarter ended September 30, 2024.

"In the third quarter we delivered revenues of about $129 million, exceeding the top end of our guidance, driven by a strong performance from our consumer electronics and IoT licensing program," commented InterDigital CEO and President Liren Chen. "In addition, at the start of the fourth quarter, we announced a new license agreement with OPPO Group, a top smartphone vendor, and a binding arbitration agreement with Lenovo. Given the increasing momentum across the business, we are raising the midpoint of our 2024 full-year revenue guidance by $145 million to $860 million."

Third Quarter 2024 Financial Highlights, as compared to Third Quarter 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | |

| (in millions, except per share data) | 2024 | | 2023 | | Change | | | | | | |

| GAAP Results: | | | | | | | | | | | |

Revenues (a) | $128.7 | | $140.1 | | (8)% | | | | | | |

| Operating Expenses | $89.3 | | $86.5 | | 3% | | | | | | |

Net income 1 | $34.2 | | $47.9 | | (29)% | | | | | | |

Net income 1 margin | 27% | | 34% | | (7) ppt | | | | | | |

Diluted EPS 1 | $1.14 | | $1.72 | | (34)% | | | | | | |

| | | | | | | | | | | |

| Non-GAAP Results: | | | | | | | | | | | |

Adjusted EBITDA 2 | $64.8 | | $83.5 | | (22)% | | | | | | |

Adjusted EBITDA margin 2 | 50% | | 60% | | (10) ppt | | | | | | |

Non-GAAP Net income 3 | $44.9 | | $57.7 | | (22)% | | | | | | |

Non-GAAP EPS 3 | $1.63 | | $2.13 | | (23)% | | | | | | |

| | | | | | | | | | | |

Additional Information: | | | | | | | | | | | |

Revenue by type: | | | | | | | | | | | |

| Recurring revenues | $98.6 | | $104.5 | | (6)% | | | | | | |

| Catch-up revenues | $30.0 | | $35.6 | | (16)% | | | | | | |

Revenue by program: | | | | | | | | | | | |

| Smartphone | $87.4 | | $104.3 | | (16)% | | | | | | |

| CE, IoT/Auto | $40.6 | | $35.4 | | 15% | | | | | | |

| Other | $0.6 | | $0.4 | | 41% | | | | | | |

(a) Decrease is primarily driven by lower catch-up revenues in Q3'24 and the expiration of the Huawei agreement at the end of 2023.

Return of Capital to Shareholders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in millions, except per share data) | Share Repurchases | | Dividends Declared | | Total Return

of Capital |

| Shares | | Value | | Per Share | | Value | |

| Third quarter 2024 | <0.1 | | $3.1 | | $0.45 | | $11.4 | | $14.5 |

| | | | | | | | | |

Convertibility of 2027 Notes

Pursuant to the terms of the Indenture governing InterDigital’s 3.50% Senior Convertible Notes due 2027 (the “Notes”), the Notes are convertible during its calendar quarter ending December 31, 2024. The current conversion rate of the Notes is 12.9041 shares of InterDigital’s Common Stock per $1,000 principal amount of the Notes.

Upon the conversion of any Notes, InterDigital will pay cash up to the aggregate principal amount of the Notes to be converted, and will pay cash, shares of its Common Stock or a combination of cash and shares of its Common Stock for any conversion obligation in excess of the aggregate principal amount being converted, if any, at InterDigital’s election, as set forth in the Indenture governing the Notes.

At the time InterDigital issued the Notes, InterDigital entered into call spread transactions that together were designed to have the economic effect of reducing the net number of shares that will be issued in the event of conversion of the Notes by, in effect, increasing the conversion price of the Notes from InterDigital’s economic standpoint from $77.49 to $106.31. Refer to Footnote 5 of the Financial Statements from InterDigital’s Form 10-Q for the quarter ended September 30, 2024 for more information.

Near Term Outlook

The Company raised its full year 2024 outlook and provided an initial outlook for fourth quarter 2024 in the table below. The outlook for both fourth quarter 2024 and full year 2024 is based on existing agreements only, and any new agreements that might be reached over the balance of the fourth quarter would be additive.

| | | | | | | | | | | | | | | | | |

| | | Full Year 2024 |

| (in millions, except per share data) | Q4 2024 | | Current | | Prior |

| Revenue | $239 - $249 | | $855 - $865 | | $690 - $740 |

| | | | | |

| | | | | |

Adjusted EBITDA 2 | $180 - $190 | | $533 - $543 | | $378 - $416 |

Diluted EPS 1 | $3.72 - $3.98 | | $11.63 - $11.90 | | $7.17 - $8.32 |

Non-GAAP EPS 3 | $5.42 - $5.70 | | $14.69 - $14.99 | | $9.70 - $10.95 |

| | | | | |

Conference Call Information

InterDigital will host a conference call on Thursday, October 31, 2024 at 10:00 a.m. ET to discuss its third quarter 2024 financial performance and other company matters.

For a live Internet webcast of the conference call, visit www.interdigital.com and click on the “Webcast” link on the Investors page. The company encourages participants to take advantage of the Internet option.

For telephone access to the conference call, visit www.interdigital.com and click on the “Dial In Registration” link on the Investors page. Registration is necessary to obtain a dial in phone number and PIN to join.

An Internet replay of the conference call will be available on InterDigital’s website under Events in the Investors section. The replay will be available for one year.

About InterDigital®

InterDigital is a global research and development company focused primarily on wireless, video, artificial intelligence (“AI”), and related technologies. We design and develop foundational technologies that enable connected, immersive experiences in a broad range of communications and entertainment products and services. We license our innovations worldwide to companies providing such products and services, including makers of wireless communications devices, consumer electronics, IoT devices, cars and other motor vehicles, and providers of cloud-based services such as video streaming. As a leader in wireless technology, our engineers have designed and developed a wide range of innovations that are used in wireless products and networks, from the earliest digital cellular systems to 5G and today’s most advanced Wi-Fi technologies. We are also a leader in video processing and video encoding/decoding technology, with a significant AI research effort that intersects with both wireless and video technologies. Founded in 1972, InterDigital is listed on Nasdaq.

InterDigital is a registered trademark of InterDigital, Inc.

For more information, visit the InterDigital website: www.interdigital.com.

For additional financial measures, refer to our third quarter 2024 Form 10-Q and the financial metrics tracker, which are available on the Investor Relations section of our website.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include information regarding our current beliefs, plans and expectations. Words such as “believe,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “forecast,” “goal,” “could,” "would," "should," "if," "may," "might," "future," "target," "trend," "seek to," "will continue," "predict," "likely," "in the event," and variations of any such words or similar expressions are intended to identify such forward-looking statements.

Forward-looking statements are made on the basis of management’s current views and assumptions and are not guarantees of future performance. Forward-looking statements are inherently subject to risks and uncertainties that could cause actual results, and actual events that occur, to differ materially from results contemplated by the forward-looking statements. These risks and uncertainties include, but are not limited to: (i) unanticipated delays, difficulties or accelerations in the execution of patent license agreements; (ii) the resolution of current legal proceedings, including any awards or judgments relating to such proceedings, additional or related legal proceedings, including appeals, changes in the schedules or costs associated with such proceedings or adverse rulings; (iii) our ability to leverage our strategic relationships and secure new patent license agreements on acceptable terms; (iv) our ability to enter into sales and/or licensing partnering arrangements for certain of our patent assets; (v) our ability to expand our revenue opportunities by entering into licensing arrangements with video streaming and other cloud-based service providers; (vi) our ability to enter into partnerships with leading inventors and research organizations; (vii) our ability to identify and pursue strategic acquisitions of technology and patent portfolios and other strategic growth opportunities; (viii) our ability to commercialize our technologies and enter into customer agreements; (ix) the failure of the markets for our current or new technologies to materialize to the extent or at the rate that we expect; (x) our continued ability to develop new technologies and secure new patents, including the risk of unexpected delays or difficulties related to the development of our technologies; (xi) risks associated with our capital allocation strategies, including risks associated with our planned dividend payments and share repurchases; (xii) changes in our interpretations of, and assumptions and calculations with respect to the impact on us of, the 2017 Tax Cuts and Jobs Act, as well as further guidance that may be issued regarding such act; (xiii) risks related to the potential impact of new accounting standards on our financial position, results of operations or cash flows; (xiv) failure to accurately forecast the impact of our restructuring activities on our financial statements and our business; (xv) the timing and impact of potential regulatory, administrative and legislative matters; (xvi) changes or inaccuracies in market projections; (xvii) our ability to obtain liquidity though debt and equity financings; (xviii) the potential effects that macroeconomic uncertainty could have on our financial position, results of operations and cash flows; (xix) impacts from acts of terrorism, war or political or civil unrest, or any responses thereto, in the United States or elsewhere; (xx) changes in our business strategy; (xxi) changes or inaccuracies in our expectations with respect to royalty payments by our customers and (xxii) risks related to our assumptions and application of relevant accounting standards, including with respect to revenue recognition.

We undertake no duty to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law.

Footnotes

1 Throughout this press release, net income and diluted earnings per share (“EPS”) are attributable to InterDigital, Inc. (e.g., after adjustments for non-controlling interests), unless otherwise stated. Net income margin is net income attributable to InterDigital, Inc. over total revenues.

2 Adjusted EBITDA and Adjusted EBITDA margin are supplemental non-GAAP financial measures that InterDigital believes provide investors with important insight into the Company's ongoing business performance. InterDigital defines Adjusted EBITDA as net income attributable to InterDigital Inc. plus net loss attributable to non-controlling interest, income tax (provision) benefit, other income (expense) & interest expense, depreciation and amortization, share-based compensation, and other items. Other items include restructuring costs, impairment charges and other non-recurring items. Adjusted EBITDA margin is Adjusted EBITDA over total revenues. These non-GAAP financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The presentation of these financial measures, which are not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure is provided below.

3 Non-GAAP net income, Non-GAAP EPS, and Non-GAAP weighted-average diluted shares are supplemental non-GAAP financial measures that InterDigital believes provides investors with important insight into the Company's ongoing business performance. InterDigital defines Non-GAAP net income as net income attributable to InterDigital, Inc. plus share-based compensation, acquisition related amortization, depreciation and amortization, restructuring costs, impairment charges and one-time adjustments, losses on extinguishments of long-term debt, the related income tax effect of the preceding items, and adjustments to income taxes. Non-GAAP EPS is defined as Non-GAAP net income divided by Non-GAAP weighted average diluted shares, which adjusts the weighted average number of common shares outstanding for the dilutive effect of the Company's convertible notes, offset by our hedging arrangements. InterDigital’s computation of these non-GAAP financial measures might not be comparable to similarly named measures reported by other companies. The presentation of these financial measures, which are not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A reconciliation of each of these metrics to its most directly comparable GAAP financial measure is provided below.

SUMMARY CONSOLIDATED STATEMENTS OF INCOME

(in thousands except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | $ | 128,679 | | | $ | 140,106 | | | $ | 615,714 | | | $ | 444,070 | |

| Operating expenses: | | | | | | | |

| Research and portfolio development | 48,331 | | | 50,253 | | | 147,851 | | | 149,560 | |

| Licensing | 27,467 | | | 21,522 | | | 149,212 | | | 59,534 | |

| General and administrative | 13,539 | | | 14,678 | | | 41,665 | | | 38,686 | |

| | | | | | | |

| Total operating expenses | 89,337 | | | 86,453 | | | 338,728 | | | 247,780 | |

| | | | | | | |

| Income from operations | 39,342 | | | 53,653 | | | 276,986 | | | 196,290 | |

| | | | | | | |

| Interest expense | (10,681) | | | (12,683) | | | (34,086) | | | (36,911) | |

| Other income, net | 12,554 | | | 14,725 | | | 33,483 | | | 42,303 | |

| Income before income taxes | 41,215 | | | 55,695 | | | 276,383 | | | 201,682 | |

| Income tax provision | (7,025) | | | (8,541) | | | (50,877) | | | (29,715) | |

| Net income | $ | 34,190 | | | $ | 47,154 | | | $ | 225,506 | | | $ | 171,967 | |

| Net loss attributable to noncontrolling interest | — | | | (787) | | | — | | | (3,016) | |

Net income attributable to InterDigital, Inc. | $ | 34,190 | | | $ | 47,941 | | | $ | 225,506 | | | $ | 174,983 | |

| Net income per common share — Basic | $ | 1.36 | | | $ | 1.82 | | | $ | 8.92 | | | $ | 6.42 | |

| Weighted average number of common shares outstanding — Basic | 25,149 | | | 26,285 | | | 25,286 | | | 27,259 | |

| Net income per common share — Diluted | $ | 1.14 | | | $ | 1.72 | | | $ | 7.84 | | | $ | 6.19 | |

| Weighted average number of common shares outstanding — Diluted | 30,034 | | | 27,812 | | | 28,759 | | | 28,261 | |

| | | | | | | |

| Cash dividends declared per common share | $ | 0.45 | | | $ | 0.40 | | | $ | 1.25 | | | $ | 1.10 | |

SUMMARY CONSOLIDATED CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income | $ | 34,190 | | | $ | 47,154 | | | $ | 225,506 | | | $ | 171,967 | |

| Non-cash adjustments | 64,268 | | | 99,994 | | | 86,433 | | | 67,711 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Working capital changes | (20,827) | | | 163,462 | | | (232,445) | | | (2,360) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net cash provided by operating activities | 77,631 | | | 310,610 | | | 79,494 | | | 237,318 | |

| Cash flows from investing activities: | | | | | | | |

| Net sales (purchases) of short-term investments | 54,306 | | | 2,322 | | | 173,208 | | | (43,706) | |

| Capitalized patent costs and purchases of property and equipment | (12,836) | | | (9,642) | | | (35,434) | | | (31,159) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Long-term investments | 382 | | | 567 | | | 1,576 | | | 567 | |

| Net cash provided by (used in) investing activities | 41,852 | | | (6,753) | | | 139,350 | | | (74,298) | |

| Cash flows from financing activities: | | | | | | | |

| Payments on long-term debt | — | | | — | | | (139,069) | | | — | |

| Repurchase of common stock | (3,056) | | | (56,858) | | | (66,726) | | | (302,728) | |

| Dividends paid | (10,052) | | | (9,273) | | | (30,425) | | | (29,106) | |

| Other | (4,590) | | | (2,886) | | | (14,805) | | | (8,635) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash used in financing activities | (17,698) | | | (69,017) | | | (251,025) | | | (340,469) | |

Net increase (decrease) in cash, cash equivalents and restricted cash | 101,785 | | | 234,840 | | | (32,181) | | | (177,449) | |

| Cash, cash equivalents and restricted cash, beginning of period | 308,995 | | | 290,872 | | | 442,961 | | | 703,161 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 410,780 | | | $ | 525,712 | | | $ | 410,780 | | | $ | 525,712 | |

SUMMARY CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| SEPTEMBER 30, 2024 | | DECEMBER 31, 2023 |

| Assets | | | |

| Cash, cash equivalents and short-term investments | $ | 813,210 | | | $ | 1,006,356 | |

| Accounts receivable | 212,420 | | | 117,292 | |

| Prepaid and other current assets | 128,106 | | | 43,976 | |

| Property & equipment and patents, net | 310,439 | | | 324,567 | |

| Other long-term assets, net | 261,175 | | | 278,623 | |

| Total assets | $ | 1,725,350 | | | $ | 1,770,814 | |

| Liabilities and Shareholders' equity | | | |

| Current portion of long-term debt | $ | 454,250 | | | $ | 578,752 | |

| Current deferred revenue | 156,885 | | | 153,597 | |

| Other current liabilities | 100,636 | | | 148,779 | |

| Long-term deferred revenue | 216,665 | | | 223,866 | |

| Long-term debt & other long-term liabilities | 74,377 | | | 84,271 | |

| Total liabilities | 1,002,813 | | | 1,189,265 | |

| | | |

| | | |

| Total shareholders' equity | 722,537 | | | 581,549 | |

| Total liabilities and shareholders' equity | $ | 1,725,350 | | | $ | 1,770,814 | |

RECONCILIATION OF NON-GAAP MEASURES

The following tables present InterDigital's GAAP financial measures reconciled to the non-GAAP financial measures included in this release for the third quarter and year-to-date periods ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| (in thousands) | | (in thousands) | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income attributable to InterDigital, Inc. | $ | 34,190 | | | $ | 47,941 | | | $ | 225,506 | | | $ | 174,983 | | | | | |

| Net loss attributable to non-controlling interest | — | | | (787) | | | — | | | (3,016) | | | | | |

| Income tax provision | 7,025 | | | 8,541 | | | 50,877 | | | 29,715 | | | | | |

Other income, net & interest expense | (1,873) | | | (2,042) | | | 603 | | | (5,392) | | | | | |

| Depreciation and amortization | 17,549 | | | 19,527 | | | 52,165 | | | 58,698 | | | | | |

| Share-based compensation | 9,081 | | | 10,335 | | | 28,122 | | | 26,865 | | | | | |

Other items (a) | (1,161) | | | — | | | (4,361) | | | 10,037 | | | | | |

Adjusted EBITDA 2 | $ | 64,811 | | | $ | 83,515 | | | $ | 352,912 | | | $ | 291,890 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| (in thousands, except for per share data) | | (in thousands, except for per share data) | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income attributable to InterDigital, Inc. | $ | 34,190 | | | $ | 47,941 | | | $ | 225,506 | | | $ | 174,983 | | | | | |

| Share-based compensation | 9,081 | | | 10,335 | | | 28,122 | | | 26,865 | | | | | |

| Acquisition related amortization | 8,282 | | | 10,262 | | | 25,027 | | | 30,792 | | | | | |

Other operating items (a) | (1,161) | | | — | | | (4,361) | | | 10,037 | | | | | |

Other non-operating items (b) | (262) | | | (6,112) | | | (1,788) | | | (9,370) | | | | | |

| Related income tax and noncontrolling interest effect of above items | (3,347) | | | (3,042) | | | (9,870) | | | (13,498) | | | | | |

| Adjustments to income taxes | (1,861) | | | (1,706) | | | (4,270) | | | (2,884) | | | | | |

Non-GAAP net income 3 | $ | 44,922 | | | $ | 57,678 | | | $ | 258,366 | | | $ | 216,925 | | | | | |

| | | | | | | | | | | |

| Weighted average dilutive shares - GAAP | 30,034 | | | 27,812 | | | 28,759 | | | 28,261 | | | | | |

| Less: Dilutive impact of the Convertible Notes | 2,439 | | | 743 | | | 2,084 | | | 333 | | | | | |

Weighted average dilutive shares - Non-GAAP 3 | 27,595 | | | 27,069 | | | 26,675 | | | 27,928 | | | | | |

| | | | | | | | | | | |

Diluted EPS 1 | $ | 1.14 | | | $ | 1.72 | | | $ | 7.84 | | | $ | 6.19 | | | | | |

Non-GAAP EPS 3 | $ | 1.63 | | | $ | 2.13 | | | $ | 9.69 | | | $ | 7.77 | | | | | |

(a) Other items in the above tables include one-time contra-expenses of $1.2 million and $4.4 million related to litigation fee reimbursements during the three and nine months ended September 30, 2024, respectively. The nine months ended September 30, 2023 includes $7.5 million of one-time charges for net litigation fee reimbursements and a $2.5 million one-time impairment on our patents held for sale.

(b) Other non-operating items includes net (gains) or losses from observable price changes of our long-term strategic investments.

The following tables present a reconciliation between GAAP and non-GAAP versions of the estimated financial measures for the fourth quarter of fiscal 2024 and full year fiscal 2024 included in this release:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Outlook |

| | | | | (in millions) |

| | | | | | | | | | | Full Year 2024 |

| | | | | | | | | Q4 2024 | | Current | | Prior |

| Net income attributable to InterDigital, Inc. | | | | | | | | | $118 - $126 | | $343 - $351 | | $205 - $238 |

| | | | | | | | | | | | | |

| Income tax provision | | | | | | | | | 24 - 26 | | 75 - 77 | | 55 - 60 |

Other income, net & interest expense | | | | | | | | | 1 | | 2 | | 7 |

| Depreciation and amortization | | | | | | | | | 18 | | 70 | | 73 | |

| Share-based compensation | | | | | | | | | 19 | | 47 | | 42 | |

Other items (a) | | | | | | | | | — | | | (4) | | | (4) | |

Adjusted EBITDA 2 | | | | | | | | | $180 - $190 | | $533 - $543 | | $378 - $416 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Outlook |

| | | | | (in millions, except for per share data) |

| | | | | | | | | | | Full Year |

| | | | | | | | | Q4 2024 | | Current | | Prior |

| Net income attributable to InterDigital, Inc. | | | | | | | | | $118 - $126 | | $343 - $351 | | $205 - $238 |

| Share-based compensation | | | | | | | | | 19 | | | 47 | | | 42 | |

| Acquisition related amortization | | | | | | | | | 33 | | | 33 | | | 33 | |

Other operating items (a) | | | | | | | | | — | | | (4) | | | (4) | |

Other non-operating items (b) | | | | | | | | | (2) | | | (2) | | | (2) | |

| Related income tax and noncontrolling interest effect of above items | | | | | | | | | (11) | | | (16) | | | (14) | |

| Adjustments to income taxes | | | | | | | | | (2) | | | (2) | | | (2) | |

Non-GAAP net income 3 | | | | | | | | | $155 - $163 | | $399 - $407 | | $258 - $291 |

| | | | | | | | | | | | | |

| Weighted average dilutive shares - GAAP | | | | | | | | | 31.6 | | | 29.5 | | | 28.6 | |

| Less: Dilutive impact of the Convertible Notes | | | | | | | | | 3.0 | | | 2.3 | | | 2.0 | |

Weighted average dilutive shares - Non-GAAP 3 | | | | | | | | | 28.6 | | | 27.2 | | | 26.6 | |

| | | | | | | | | | | | | |

Diluted EPS 1 | | | | | | | | | $3.72 - $3.98 | | $11.63 - $11.90 | | $7.17 - $8.32 |

Non-GAAP EPS 3 | | | | | | | | | $5.42 - $5.70 | | $14.69 - $14.99 | | $9.70 - $10.95 |

(a) Other items in the above tables includes contra-expenses related to a litigation fee reimbursement.

(b) Other non-operating items includes net (gains) or losses from observable price changes of our long-term strategic investments.

| | | | | |

| CONTACT: | InterDigital, Inc. |

| |

| Email: investor.relations@interdigital.com |

| +1 (302) 300-1857 |

I N N O V A T I N G T O D A Y E M P O W E R I N G T O M O R R O W TM Third Quarter 2024 Results October 31, 2024

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 2 Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Exchange Act. Such statements include information regarding our current beliefs, plans and expectations, including, without limitation, the matters set forth below. Words such as "believe," “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “forecast,” "goal," "could," "would," "should," "if," "may," "might," "future," "target," "trend," "seek to," "will continue," "predict," "likely," "in the event," variations of any such words or similar expressions contained herein are intended to identify such forward-looking statements. Forward-looking statements are made on the basis of management’s current views and assumptions and are not guarantees of future performance. Forward-looking statements in this presentation include but are not limited to our revenue and annual recurring revenue targets, growth prospects and anticipated industry leadership, continued growth of our IP portfolio, anticipated future demand, market and technological development including the development of 6G, the anticipated payment of dividends, and others. Although the forward-looking statements in this presentation reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements concerning our business, results of operations and financial condition are inherently subject to risks and uncertainties. We caution readers that actual results and outcomes could differ materially from those expressed in or anticipated by such forward-looking statements due to a variety of factors, including: (i) unanticipated delays, difficulties or accelerations in the execution of patent license agreements; (ii) the resolution of current legal proceedings, including any awards or judgments relating to such proceedings, additional or related legal proceedings, including appeals, changes in the schedules or costs associated with such proceedings or adverse rulings; (iii) our ability to leverage our strategic relationships and secure new patent license agreements on acceptable terms; (iv) our ability to enter into sales and/or licensing partnering arrangements for certain of our patent assets; (v) our ability to expand our revenue opportunities by entering into licensing arrangements with video streaming and other cloud-based service providers; (vi) our ability to enter into partnerships with leading inventors and research organizations; (vii) our ability to identify and pursue strategic acquisitions of technology and patent portfolios and other strategic growth opportunities; (viii) our ability to commercialize our technologies and enter into customer agreements; (ix) the failure of the markets for our current or new technologies to materialize to the extent or at the rate that we expect; (x) our continued ability to develop new technologies and secure new patents, including the risk of unexpected delays or difficulties related to the development of our technologies; (xi) risks associated with our capital allocation strategies, including risks associated with our planned dividend payments and share repurchases; (xii) changes in our interpretations of, and assumptions and calculations with respect to the impact on us of, the 2017 Tax Cuts and Jobs Act, as well as further guidance that may be issued regarding such act; (xiii) risks related to the potential impact of new accounting standards on our financial position, results of operations or cash flows; (xiv) failure to accurately forecast the impact of our restructuring activities on our financial statements and our business; (xv) the timing and impact of potential regulatory, administrative and legislative matters; (xvi) changes or inaccuracies in market projections; (xvii) our ability to obtain liquidity though debt and equity financings; (xviii) the potential effects that macroeconomic uncertainty could have on our financial position, results of operations and cash flows; (xix) impacts from acts of terrorism, war or political or civil unrest, or any responses thereto, in the United States or elsewhere; (xx) changes in our business strategy; (xxi) changes or inaccuracies in our expectations with respect to royalty payments by our customers and (xxii) risks related to our assumptions and application of relevant accounting standards, including with respect to revenue recognition. You should carefully consider these factors as well as the risks and uncertainties outlined in greater detail in Part I, Item 1A, of our Form 10-K before making any investment decision with respect to our common stock. These factors, individually or in the aggregate, may cause our actual results to differ materially from our expected and historical results. You should understand that it is not possible to predict or identify all such factors. In addition, you should not place undue reliance on the forward-looking statements contained herein, which are made only as of the date of this presentation. We undertake no obligation to revise or update publicly any forward-looking statement for any reason, except as otherwise required by law. Industry Data This presentation contains statistical data, estimates, and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. While we believe the industry and market data included in this presentation are reliable and are based on reasonable assumptions, these data involve many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Non-GAAP Financial Measures This presentation includes certain non-GAAP measures not based on generally accepted accounting principles. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP measures used by us may differ from the non-GAAP measures used by other companies. For more information and for reconciliations between GAAP and these non-GAAP measures, see the appendix to this presentation.

Q3’24 Highlights 10/31/2024 3©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 4 Financial Highlights ✓ Q3 Revenue of $129 million, Adjusted EBITDAa of $65 million, Non-GAAP EPSa of $1.63, all above the top end of the outlook ✓ CE, IoT/Auto recurring revenue increased 52% y/y to $24 million ✓ Free cash flowa of $65 million ✓ Cash balance increased to more than $800 million ✓ Increased dividend by 13% to $0.45 per share ✓ Raised midpoint of FY 2024 revenue guidance by $145 million to $860 million a Non-GAAP Measure / Please see appendix for GAAP to Non-GAAP reconciliations

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 5 Business Highlights ✓ Held an Investor Day and announced annual recurring revenue target of $1 billion by 2030 ✓ Signed new license agreements with Oppo, TPV and Panasonic ✓ In Q4, signed a binding arbitration agreement to finalize the terms of a new patent license agreement with Lenovo ✓ Record declared 5G SEPs year-to-date ✓ Ranked among the top five for Wi-Fi patent portfolio in a new report from LexisNexis ✓ Won two industry awards for best immersive video and video processing technology

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 6 License Agreement With OPPO Group signed in Q4 ▪ Oppo group is one of the largest smartphone manufacturers based in China ▪ License covers global sales of Oppo, realme and OnePlus branded mobile devices ▪ All pending litigations between the parties to be dismissed ▪ Further validates importance of our foundational innovation and strength of our IP portfolio to drive future growth ▪ Top four smartphone OEMs, including top two Chinese vendors, and ~70% of the global smartphone market are now under license

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 7 Q3’24 Results a Non-GAAP Measure / Please see appendix for GAAP to Non-GAAP reconciliations b Y/Y decrease is primarily driven by lower catch-up revenues in Q3'24 and the expiration of Huawei license agreement at the end of 2023 Revenue <8%>b Adj. EBITDAa <22%> Non-GAAP EPSa <23%> $140M $129M $0 $20 $40 $60 $80 $100 $120 $140 $160 Q3'23 Q3'24 $84M $65M $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 Q3'23 Q3'24 $2.13 $1.63 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 Q3'23 Q3'24

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 8 Q3’24 Revenue By Program $104M $87M 0 20 40 60 80 100 120 Q3'23 Q3'24 Recurring Catch Up $35M $41M 0 10 20 30 40 50 60 70 80 90 100 Q3'23 Q3'24 Recurring Catch Up Smartphone <16%>a CE, IoT/Auto +15% a Y/Y decrease is primarily driven by lower catch-up revenues in Q3'24 and the expiration of Huawei license agreement at the end of 2023

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 9 Financial Results vs. Outlook Q 3 ’ 2 4 R E S U L T S Q 3 ’ 2 4 O U T L O O K Revenue $128.7M $94M - $98M Adjusted EBITDAa $64.8M $36M - $39M Diluted EPS $1.14 $0.20 - $0.30 Non-GAAP EPSa $1.63 $0.70 - $0.80 a Non-GAAP Measure / Please see appendix for GAAP to Non-GAAP reconciliations.

FY24 Annual Guidance 10/31/2024 10©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 11 Company Raises FY 2024 Guidance As of October 31, 2024 Q 4 ’ 2 4 O U T L O O K F Y 2 4 C U R R E N T O U T L O O K F Y 2 4 P R I O R O U T L O O K Revenue $239M - $249M $855M - $865M $690M - $740M Adjusted EBITDAa $180M - $190M $533M - $543M $378M - $416M Diluted EPS $3.72 - $3.98 $11.63 - $11.90 $7.17 - $8.32 Non-GAAP EPSa $5.42 - $5.70 $14.69 - $14.99 $9.70 - $10.95 a Non-GAAP Measure / Please see appendix for GAAP to Non-GAAP reconciliations. The table above presents guidance of the Company's current outlook for fourth quarter and full year 2024. The outlook for both fourth quarter and full year 2024 is based on existing agreements only, and any new agreements that might be reached over the balance of the fourth quarter would be additive.

Upcoming Investor Events 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 12 November 19 RBC Tech Conference New York City November 20 Roth Tech Conference New York City

Background on Interdigital 10/31/2024 13©2024 InterDigital, Inc. All Rights Reserved. As of October 31, 2024

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 14 Premier Team Essential Technology Development Company Introduction Long-term Growth Strategy Accelerating Business Momentum 01 0304 0205 InterDigital Innovating Today, Empowering Tomorrow

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 15 InterDigital Pioneering Wireless, Video and AI Research 63% Adj. EBITDA Margina 82% Y/Y Increase Non-GAAP EPSa TOP CUSTOMERS: $1B Cash 2 0 2 3 F I N A NCIA L R E S U L T S ~3/4 Recurring Revenue $379M Returned to Shareholders $550M Revenue H I G H L I G H T S Driving foundational research in wireless, video & AI since 1972 World-class team Led by seasoned industry veterans Enabling ecosystem Over two billion devices and $5.7T economic value annually Industry-leading patents Evergreen patent portfolio of 32,000+ assets Long-term customers Subscription-like revenue, $3.1B in new contracts in the last four years 20% Y/Y Increase a Non-GAAP financial measure. Refer to non-GAAP reconciliation in appendix

World-Class Leadership Team Robert S. Stien Chief Communications & Public Policy Officer Ken Kaskoun Chief Growth Officer Joshua Schmidt Chief Legal Officer Michael Cortino Chief Information Officer Skip Maloney Chief People Officer Rich Brezski CFO Eeva Hakoranta Chief Licensing Officer 10/31/2024 16 Liren Chen CEO Rajesh Pankaj CTO Decades of industry experience. Strong track record. Drive deep collaboration and superb execution ©2024 InterDigital, Inc. All Rights Reserved.

Business Model: A Virtuous Cycle of Innovation We are a foundational R&D company. We share our innovation through the standards process and monetize our technology through IP licensing. 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 17 $ RESEARCH & INNOVATION PATENT PORTFOLIO LICENSING PRODUCT IMPLEMENTERS STANDARD DEVELOPMENT TECHNOLOGY SHARING

We Focus on Foundational Technologies 10/31/2024 18©2024 InterDigital, Inc. All Rights Reserved. W I R E L E S S Cellular wireless - 4G/5G/6G WiFi and wireless local area networks V I D E O Video compression, transport and enhancement Immersive media compression, transport and enhancement A I Using AI for wireless and video Video coding for use by AI Our research and patents in these areas underpin our business We solve the most complex problems in the system. The technology we created is broadly applicable to many industries

InterDigital Tech Underpins Surging Mobile Traffic 10/31/2024 19 2017 2022 2027 50 100 150 200 250 3000 10.8 EB 90.4 EB 282.8 EB Video Drives Surge in Mobile Data Traffic Estimated global media traffic by application category (in exabytes per month)* * One exabyte equals one million terabytes. Source: Ericsson Mobility Report Video Other ©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 20 Our Innovations Help Drive Video Codec Evolution 4K Movie 130-Minute Run Time (1) http://www.iam-media.com/litigation/what-will-tv-cost-you-putting-price-hevc-licences (2) Approximated based on the result from 3GPP document https://www.3gpp.org/ftp/Specs/archive/26_series/26.955/26955-h00.zip Source: Counterpoint, WINXDVD Uncompressed: 11,600GB Compressed VP9: ~15 GB HEVC: ~14 GB(1) AV1: ~11 GB VVC: ~9 GB(2) AVC: ~24 GB(1)

The Power of the Global Standards System 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 21 C O N S U M E R S A global system of standards helps ensure interoperability I M P L E M E N T E R S Standards like 5G lower barriers to entry for new entrants into a market like smartphones and benefit from economies of scale O P E R A T O R S A N D S E R V I C E P R O V I D E R S Standards increase system capacity and lower the total cost of ownership

U N I T I N G P R I N C I P L E S Strong belief in global standards Focus on technology merits and neutral on product implementation decisions S T R O N G L E A D E R S H I P Participate in 100+ standard development organizations (SDO) Hold more than 100 leadership positions in these SDOs B R O A D C O L L A B O R A T I O N S Collaborate with many industry partners and leading universities Our technologies benefit the whole eco-system: billions of devices and many cloud-based services each year InterDigital Drives Standard Development 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 22

JVT 10/31/2024 23 We Have Many Standard Development Leadership Positions Cellular & WiFi Standards Video Standards Sphere of Influence Growing: More than 100 Leadership Positions in Wireless & Video Standards RAN2 Chair SA6 Chair ETSI Board Member ISAC ISG Chair RIS ISG Chair PDL Vice Chair SAI Vice Chair Steering Committee Co-Chair SA Board of Governors Policy & Procedures C/SAB Chair AIML Standing Committee Chair Internet WG Vice Chair NNVC Co-Chair & SW Chair Beyond VVC Co-Chair of Two AHG Beyond VVC Co-Chair of Two AHG AI AHG Co-Chair AI-PCC Chair Haptic AHG Chair Steering Board Member TSAG Vice Chair ©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 24 Recognized Global Innovation Leader For the third year in a row, LexisNexis recognized InterDigital amongst the World’s 100 Most Innovative Businesses. Innovation Momentum 2024: The Global Top 100, “represents the world’s leading patent owners with the highest innovation momentum.” 2 0 2 2 : 2 0 2 3 : 2 0 2 4 :

Wireless Video Implementation DTV Broadcast & Home Network ~19,000 Assets >32,000 Assets Innovation Engine Fuels Evergreen IP Portfolio Our patent portfolio grew almost 70% between 2017 & 2024 with the addition of video & DTV related technologies and continuing growth of wireless assets 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 25 2 0 1 7 : 2 0 2 4 : Portfolio is evergreen, growing by ~5 new patents each day

Average Competitive Impact InterDigital Ranks Among the Highest in Patent Quality for 5G, Video Codec, and WiFi Patents 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 26 Video Codec Patent Holders 5G Patent Holders Source: LexisNexis PatentSight Oct 2024, top 10 Patent Asset Index owners 5G = 5G 3GPP ETSI declared, Video Codec = HEVC, VVC, AVC LexisNexis classification, WiFi = WiFi 6, WiFi 7, WiFi 8 LexisNexis classification 0 2 4 6 8 InterDigital Company # 2 Company # 3 Company # 4 Company # 5 Company # 6 Company # 7 Company # 8 Company # 9 Company # 10 WiFi Patent Holders 0 5 10 15 InterDigital Company # 2 Company # 3 Company # 4 Company # 5 Company # 6 Company # 7 Company # 8 Company # 9 Company # 10 0 2 4 6 8 Company # 1 Company # 2 Company # 3 InterDigital Company # 5 Company # 6 Company # 7 Company # 8 Company # 9 Company # 10

Accelerating Business Momentum 10/31/2024 27©2024 InterDigital, Inc. All Rights Reserved.

Licensing Success Over 40 licenses worth > $3.1B closed since the start of 2021 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 28 2021 2024 #1 Chinese Smartphone vendor 2022 2023 Top-10 TV vendor Largest license in company history Major CE/IoT License 80% of 4G connected car market under license HEVC license #1 TV vendorLicensee since 1995* Top-10 TV vendor #2 Chinese smartphone vendor Arbitration agreement

$155M $208M $255M $345M $538M 43% 49% 56% 63% 63% 0% 10% 20% 30% 40% 50% 60% 70% $0M $100M $200M $300M $400M $500M $600M $359M $425M $458M $550M $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2020 2021 2022 2023 2024G $855M - $865M Strong Revenue Growth, Margins and Return of Capital 10/31/2024 29 2020 2021 2022 2023 2024G Non-GAAP EPSa > 6.5X growth - - - - - -Adj EBITDA Margina Revenue 24% CAGR $2.27 $3.73 $5.08 $9.23 $14.84 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 2020 2021 2022 2023 2024G Adjusted EBITDA > 3X growth a a Non-GAAP financial measure. Refer to non-GAAP reconciliation in appendix $0M $500M $1,000M $1,500M $2,000M 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Dividends Repurchases Return of Capital > $1.8B cumulative since 2011 ©2024 InterDigital, Inc. All Rights Reserved. 29

Long-term Growth Strategy 10/31/2024 30©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 31 Our Technologies Benefit the Economy and the World Source: GSMA The Mobile Economy 2024 5.6 billion people globally subscribed to a mobile service, including 4.7 billion who used the mobile internet Mobile technologies and services generate $5.7 trillion economic value, 5.4% of global GDP Enables 35 million jobs across the wider mobile ecosystem 5G is projected to add nearly $1 trillion to the global economy in 2030

10/31/2024 32 We Address Three Attractive Markets Sources: Counterpoint Research, OMDIA 1 Includes only value for Consumer Electronics and IoT Devices Market 2024E TAM Key Market Dynamic ’24 – ’27E CAGR Significant Customers CONTENT & CLOUD SERVICES ~$380B High growth with increasing focus on profitability ~10% <20 CE, IoT/AUTO ~1.6B Units (~$340B)1 High shipment growth with fragmentation across segments ~6% ~100 ~1.2B Units (~$450B) Increasing concentration of top OEMs SMARTPHONES ~3% <10 ©2024 InterDigital, Inc. All Rights Reserved.

10/31/2024 33 Clear Pathway to Growth 2023 2030 SMARTPHONE I n c r e a s e p e n e t r a t i o n E n h a n c e v a l u a t i o n d u r i n g r e n e w a l s CE, IOT/AUTO I n c r e a s e p e n e t r a t i o n E x p a n d m a r k e t c o v e r a g e S T R E A M I N G & C L O U D S E R V I C E S G r o w v i d e o s e r v i c e s l i c e n s i n g p r o g r a m $347M ~$500M $60M ~$200M $0 ~$300M+ $1B+ A R R T a r g e t 2030 (by 2027) ©2024 InterDigital, Inc. All Rights Reserved.

~70%~25% ~5% Strong Runway for Continued Smartphone Growth 1.2B global device shipments 2024 Long Tail In Negotiation Licensed1 Long Tail 1. Samsung and Lenovo in binding arbitration • Large global market, projected to grow with 3% CAGR 2024-27 • Revenue growth from licensing remaining top OEMs • Driving higher value from key accounts during renewal S M A R T P H O N E S G L O B A L M A R K E T 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 34 Source: Counterpoint Research

Good Momentum in CE - Large Opportunity Remains Licensing coverage for PCs and Tablets based on HEVC - e.g. Amazon licensed for WLAN Licensing coverage for TVs based on our DTV patents – e.g. LG licensed for HEVC and VVC Deals with major OEMs such as Apple, Samsung, Lenovo, Sony, LG Licensed % global device shipments P C s : 2 8 4 M 2 0 2 4 Proof of our robust video coding portfolio, including HEVC patents that have driven successful outcomes with enforcement Approx. 40% licensing coverage across these sectors, aiming to grow T A B L E T S : 1 1 8 M 2 0 2 4 T V s : 2 0 5 M 2 0 2 4 % global device shipments % current focus area1 shipments 36% 53% 11% 51% 72%11% 17% 39% 40% 21% Primary Opportunity Long Tail 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 35 1 Current focus area for Madison Program is North America, Europe, Japan and Korea. Source: Omdia

Strong Growth Opportunity in Automotive and IoT Sources: Counterpoint Research, Omdia 85% of 4G auto market licensed 5G auto market driving value growth 2024E 2027E ~60 ~75 2024E 2027E Others Healthcare Enterprise Industrial PoS Smart Meters Asset Tracking ~200 ~350 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 36 P A S S E N G E R V E H I C L E S H I P M E N T S ( M ) C E L L U L A R I O T S H I P M E N T S ( M ) Active Licensing Program CAGR ~20% 5G 4G CAGR ~10% ~85% of 4G auto market licensed 5G auto m rket driving value growth

10/31/2024 37 SVoD and AVoD Are Our Focus Verticals Source: OMDIA 2024 TAM 2027 TAM TAM CAGR $240 B $140 B $170 B $190 B $190 B $16 B $20 B $5 B $6 B +13%+11% +7%+6% -1% SVoD AVoD GLOBAL PAY-TV VIDEO CONFERENCING CLOUD GAMING ©2024 InterDigital, Inc. All Rights Reserved. $330 B

$352M $404M $408M $22M $74M $54M $141M $0 $200 $400 $600 $800 $1,000 2020 2021 2022 2023 2030 Target Recurring Catch-up Significant Growth Potential Lies Ahead $337M $359M $425M $458M $550M 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 38 Recurring revenue growth across Smartphone, CE and IoT, and Content and Cloud Services $1B+ ARR 14% CAGR

Capital Allocation Priorities Strong cash flow maintains balance sheet strength, funds organic investment in research, and enables significant share reduction Maintain fortress balance sheet Financial strength is a strategic asset Organic investment in business Reinvest ~50% of recurring revenue into research and IP portfolio Inorganic investment Opportunistic and strategic Return Excess cash to shareholders $1.3B+ in share repurchases since ‘11 Dividend increased 13%, Sep‘24 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 39

Target Financial Model for 2030 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 40 60%+ Powerful Operating Leverage drives Adjusted EBITDA Margina Target $1B+ Annualized Recurring Revenue 14%+ Annual Growth Target High Margin Drives Strong Cash Flow $600M+ Adjusted EBITDAa Target Well positioned to drive value going forward a Non-GAAP financial measure. Refer to appendix. Calculated based on an assumed 60% Adjusted EBITDA margin.

10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 41 Key Takeaways World-class leadership and functional teams across the board Accelerating momentum for R&I, standard development, patent portfolio creation and licensing driven by continuing investment and strong execution We have a clear strategy, a world-class team and the operational discipline to drive the growth of ARR to $1B+ target by 2030 Our technologies are critical to devices and services of multiple industries, giving us large addressable markets

Appendix 10/31/2024 42©2024 InterDigital, Inc. All Rights Reserved.

Non-GAAP Financial Measures 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 43 Adjusted EBITDA and Adjusted EBITDA margin are supplemental non-GAAP financial measures that InterDigital believes provide investors with important insight into the Company's ongoing business performance. InterDigital defines Adjusted EBITDA as net income attributable to InterDigital Inc. plus net loss attributable to non- controlling interest, income tax (provision) benefit, other income (expense) & interest expense, depreciation and amortization, share-based compensation, and other items. Other items include restructuring costs, impairment charges and other non-recurring items. Adjusted EBITDA margin is Adjusted EBITDA over total revenues. These non-GAAP financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The presentation of these financial measures, which are not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A reconciliation of each of these metrics to its most directly comparable GAAP financial measure is provided above. Non-GAAP net income, Non-GAAP earnings per share (“EPS”), and Non-GAAP weighted-average dilutive shares are supplemental non-GAAP financial measures that InterDigital believes provides investors with important insight into the Company's ongoing business performance. InterDigital defines Non-GAAP net income as net income attributable to InterDigital, Inc. plus share-based compensation, acquisition related amortization, depreciation and amortization, restructuring costs, impairment charges and one-time adjustments, losses on extinguishments of long-term debt, the related income tax effect of the preceding items, and adjustments to income taxes. Non-GAAP EPS is defined as Non-GAAP net income divided by Non-GAAP weighted average number of common shares outstanding–diluted, which adjusts the weighted average number of common shares outstanding for the dilutive effect of the Company's convertible notes, offset by our hedging arrangements. InterDigital’s computation of these non-GAAP financial measures might not be comparable to similarly named measures reported by other companies. The presentation of these financial measures, which are not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A reconciliation of each of these metrics to its most directly comparable GAAP financial measure is provided above. Free cash flow is a supplemental non-GAAP financial measure that InterDigital believes is helpful in evaluating the company’s ab ility to invest in its business, make strategic acquisitions and fund share repurchases, among other things. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in the company’s cash balance for the period. InterDigital defines free cash flow as net cash from operating activities less purchases of property and equipment and capitalized patent costs. InterDigital’s computation of free cash flow might not be comparable to free cash flow reported by other companies. The presentation of free cash flow, which is not prepared under any comprehensive set of accounting rules or principles, is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP. A reconciliation of free cash flow to net cash from operating activities, the most directly comparable GAAP financial measure, is provided above.

Non-GAAP Reconciliation 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 44 (In millions) 2020 2021 2022 2023 Q3'24 Q3'23 Q3'24 Q4'24 Current Full Year 2024 Prior Full Year 2024 Net income attributable to InterDigital, Inc. 45$ 55$ 94$ 214$ 34$ 48$ $6 - 9 $118 - $126 $343 - 351 $205 - $238$205 - 238 Net loss attributable to non-controlling interest (7) (13) (2) (3) - (1) - - - - Income tax (provision) benefit (7) 15 26 24 7 9 2 24 - 26 75 - 77 55 - 605 - 60 Other income (expense) & interest expense 24 14 33 (13) (2) (2) 2 1 2 7 Depreciation and amortization 81 78 79 78 18 20 18 18 70 73 Share-based compensation 10 29 22 36 9 10 9 19 47 42 Other operating items 9 30 3 10 (1) - (1) - (4) (4) Adjusted EBITDA 155$ 208$ 255$ 345$ 65$ 84$ $36 - 39 $180 - $190 $533 - 543 $378 - $416$378 - 416 Adjusted EBITDA Margin 43% 49% 56% 63% 50% 60% 39% 76% 63% 56% Other Operating Items Restructuring - 28 3 - - - - - - - Other non-cash charges 9 - - 3 - - - - - - Non-Recurring Personnel-Related - 2 - - - - - - - - Net Litigation Fee Reimbursement - - - 8 (1) - (1) - (1) (4) Total Other Operating Items 9$ 30$ 3$ 10$ (1)$ -$ (1)$ -$ (1)$ (4)$ NOTE: Sums may not equal total due to rounding Full Year Three months ended, Outlook

Non-GAAP Reconciliation 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 45 (In millions, except per share data) 2020 2021 2022 2023 Q3'24 Q3'23 Q3'24 Q4'24 Current Full Year 2024 Prior Full Year 2024 Net income attributable to InterDigital, Inc. 45$ 55$ 94$ 214$ 34$ 48$ $6 - 9 $118 - $126 $343 - 351 $205 - $238 Share-based compensation 10 29 22 36 9 10 9 19 47 42 Acquisition related amortization 44 42 42 41 8 10 8 33 33 33 Other operating items 9 30 3 10 (1) - (1) - (4) (4) Other non-operating items (4) (11) 13 (14) - (6) - (2) (2) (2) Related income tax and noncontrolling interest effect of above items (12) (26) (17) (17) (3) (3) (3) (11) (16) (14) Adjustments to income taxes (21) (2) (2) (16) (2) (2) - (2) (2) (2) Non-GAAP net income 70$ 117$ 155$ 254$ 45$ 58$ $19 - 22 $155 - $163 $399 - 407 $258 - $291 Weighted average dilutive shares - GAAP 31.1 31.3 30.5 28.1 30.0 27.8 28.9 31.6 29.5 28.6 Less: Dilutive impact of the Convertible Notes - - - 0.5 2.4 0.7 2.1 3.0 2.3 2.0 Weighted average dilutive shares - Non-GAAP 31.1 31.3 30.5 27.6 27.6 27.1 26.8 28.6 27.2 26.6 Non-GAAP EPS 2.27$ 3.73$ 5.08$ 9.23$ 1.63$ 2.13$ $0.70 - 0.80 $5.42 - 5.70 $14.69 - 14.99 $9.70 - 10.95 Other Operating Items Restructuring - 28 3 - - - - - - - Other non-cash charges 9 - - 3 - - - - - - Non-recurring personnel-related - 2 - - - - - - - - Net litigation fee reimbursement - - - 8 (1) - (1) - (4) (4) Transaction related costs - - - - - - - - - - Total Other Operating Items 9$ 30$ 3$ 10$ (1)$ -$ (1)$ -$ (4)$ (4)$ Other Non-operating Items Fair value changes (4) (9) 2 (10) - (6) - (2) (2) (2) Loss on extinguishment of debt - - 11 - - - - - - - Other non-cash charges - (2) - (4) - - - - - - Total Other Non-operating Items (4)$ (11)$ 13$ (14)$ -$ (6)$ -$ (2)$ (2)$ (2)$ NOTE: Sums may not equal total due to rounding Three months ended,Full Year Outlook

Non-GAAP Reconciliation 10/31/2024©2024 InterDigital, Inc. All Rights Reserved. 46 2024 Cash Flow Data: Q3 Net cash provided by operating activities 78$ Purchases of property and equipment (1) Capitalized patent costs (12) Free cash flow $ 65 NOTE: Sums may not equal total due to rounding NOTE: Certain prior period amounts have been revised for current year presentation

v3.24.3

Cover

|

Oct. 31, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2024

|

| Entity Registrant Name |

INTERDIGITAL, INC.

|

| Entity Central Index Key |

0001405495

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

PA

|

| Entity File Number |

1-33579

|

| Entity Tax Identification Number |

82-4936666

|

| Entity Address, Address Line One |

200 Bellevue Parkway

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Wilmington

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19809-3727

|

| City Area Code |

302

|

| Local Phone Number |

281-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IDCC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

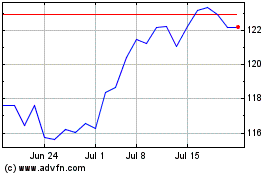

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Jan 2024 to Jan 2025