0001718405

false

0001718405

2023-07-01

2023-07-01

0001718405

HYMC:ClassCommonStockParValue0.0001PerShareMember

2023-07-01

2023-07-01

0001718405

HYMC:WarrantsToPurchaseCommonStockMember

2023-07-01

2023-07-01

0001718405

HYMC:WarrantsToPurchaseCommonStockMember1Member

2023-07-01

2023-07-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 1, 2023

HYCROFT MINING HOLDING CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38387 |

|

82-2657796 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

4300

Water Canyon Road, Unit 1

Winnemucca,

Nevada 89445

(Address

of principal executive offices) (Zip code)

(775)

304-0260

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, par value $0.0001 per share |

|

HYMC |

|

The

Nasdaq Capital Market |

| Warrants

to purchase Common Stock |

|

HYMCW |

|

The

Nasdaq Capital Market |

| Warrants

to purchase Common Stock |

|

HYMCL |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On

July 1, 2023, Hycroft Mining Holding Corporation (the “Company”) entered into a Second Amendment to Second Amended and Restated

Credit Agreement (“Second Amendment to Second A&R Agreement”), by and between the Company, Sprott Private Resource Lending

II (Collector), LP (the “Lender”), Sprott Resource Lending Corp. (“Arranger” and together with the Lender, the

“Sprott Parties”), and certain subsidiaries of the Company as guarantors. The Second Amendment to Second A&R Agreement

amends the Second Amended and Restated Credit Agreement (“Second A&R Agreement”) dated March 30, 2022, which in turn

amended the Amended and Restated Credit Agreement, dated as of May 29, 2020 (as amended, restated, supplemented or otherwise modified

from time to time, the “Sprott Credit Agreement”).

The

Second Amendment to Second A&R Agreement: (i) corrects a cross-reference error; and (ii) implements a replacement of LIBOR with three-month

Term SOFR effective July 1, 2023.

The

above description of the Second Amendment to Second A&R Agreement is qualified in its entirety by reference to the complete text

of the Second Amendment to Second A&R Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| Date:

July 3, 2023 |

HYCROFT

MINING HOLDING CORPORATION |

| |

|

|

| |

By: |

/s/

Stanton Rideout |

| |

|

Stanton

Rideout |

| |

|

Executive

Vice President and Chief Financial Officer |

Exhibit 10.1

SECOND

AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT

THIS

SECOND AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT dated as of and effective from the 1st day of July, 2023

(this “Agreement”)

BETWEEN:

HYCROFT

MINING HOLDING CORPORATION, a corporation organized

and existing under the laws of Delaware

(hereinafter

referred to as the “Borrower”)

AND:

AUXAG

MINING CORPORATION, a corporation organized and existing under the laws of Delaware

(hereinafter

referred to as “MUDS Holdco”)

AUTAR

GOLD CORPORATION, a corporation organized and existing under the laws of Delaware

(hereinafter

referred to as “MUDS Acquisition”)

HYCROFT

RESOURCES & DEVELOPMENT, LLC, a limited liability company organized and existing under the laws of Delaware

(hereinafter

referred to as “Hycroft Resources”)

ALLIED

VGH LLC, a limited liability company organized and existing under the laws of Delaware

(hereinafter

referred to as “Allied VGH”, and together with MUDS Holdco, MUDS Acquisition and Hycroft Resources, the “Original

Guarantors”)

AND:

SPROTT

PRIVATE RESOURCE LENDING II (COLLECTOR), LP, a limited partnership organized and existing under the laws of the Province of Ontario

(hereinafter

referred to as the “Lender”)

AND:

SPROTT

RESOURCE LENDING CORP.

(hereinafter

referred to as the “Arranger”)

BACKGROUND

WHEREAS

Hycroft Mining Corporation (as borrower) (the “Original Hycroft Borrower”), Hycroft Resources (as guarantor),

Allied VGH (as guarantor), the Lender and the Arranger entered into a credit agreement dated as of October 4, 2019, as amended by the

first amendment to credit agreement dated as of January 18, 2020 (collectively, the “Original Hycroft Credit Agreement”)

pursuant to which the Arranger arranged and the Lender agreed to establish a senior secured credit facility in favour of the Original

Hycroft Borrower in the principal amount of up to $110,000,000, on and subject to the terms and conditions therein set forth.

AND

WHEREAS the Borrower assumed all obligations of the Original Hycroft Borrower under the Original Hycroft Credit Agreement pursuant

to the Borrower Assignment and Transfer Agreement and became the new borrower under the amended and restated credit agreement dated as

of May 29, 2020 between the Borrower, the Guarantors, the Lender and the Arranger (the “First ARCA”).

AND

WHEREAS the Borrower, the Guarantors, the Lender and the Arranger amended and restated the First ARCA on the terms and conditions

set out in the second amended and restated credit agreement dated as of March 30, 2022 between the Borrower, the Guarantors, the Lender

and the Arranger (the “Second ARCA”).

AND

WHEREAS the Borrower, the Guarantors, the Lender and the Arranger first amended the Second ARCA on the terms and conditions set out

in a letter agreement dated April 21, 2022 between the Borrower, the Guarantors and the Lender.

AND

WHEREAS, the Borrower, the Guarantors, the Lender and the Arranger wish to further amend certain provisions of the Second ARCA to

correct a cross-reference error in Section 9.1(c) of the Second ARCA and to implement the replacement of LIBOR with three-month Term

SOFR, effective July 1, 2023, pursuant to the terms and conditions of this Agreement.

AGREEMENTS

NOW

THEREFORE THIS AGREEMENT WITNESSES that, in consideration of the mutual covenants and agreements contained herein, the parties covenant

and agree as follows:

ARTICLE

1

DEFINED TERMS

1.1

Capitalized Terms. All capitalized terms used herein without being specifically defined herein shall have the meanings ascribed thereto

in the Second ARCA.

ARTICLE

2

AMENDMENTS TO SECOND ARCA

2.1

General Rule. Subject to the terms and conditions herein contained, the Second ARCA is hereby amended to the extent necessary to

give effect to the provisions of this Agreement and to incorporate the provisions of this Agreement into the Second ARCA.

2.2

Event of Default Correction. Section 9.1(c) of the Second ARCA is hereby amended and restated in its entirety as follows:

“(c)

if any Credit Party defaults in observing or performing any covenant or condition set out in Sections 8.1(q), 8.1(r), 8.1(aa) or

Section 8.2;”.

2.3

Definitions.

(a)

The definition of “Business Day” set forth in Section 1.1 of the Second ARCA is hereby amended and restated in its entirety

as follows:

““Business

Day” means:

| (a) | for

all purposes other than as covered by (b), any day other than a Saturday, Sunday or other

day on which commercial banks in Toronto, Ontario or Denver, Colorado are authorized or required

by law to be closed for business; and |

| (b) | with

respect to all notices and determinations in connection with, and payments of principal and

interest on, Advances, any day other than (i) a Saturday, (ii) a Sunday, or (iii) a day on

which the Securities Industry and Financial Markets Association recommends that the fixed

income departments of its members be closed for the entire day for purposes of trading in

United States government securities;”. |

(b)

The definition of “Interest Period” set forth in Section 1.1 of the Second ARCA is hereby amended and restated in its entirety

as follows:

““Interest

Period” means, initially, the period commencing on the First Tranche Closing Date and ending on the last day of the calendar

month in which the First Tranche Advance is made, and thereafter each successive calendar month; provided that, in any case, (i) if any

Interest Period would otherwise end on a day that is not a Business Day, such Interest Period shall be extended to the next succeeding

Business Day unless the result of such extension would be to carry such Interest Period into another calendar month, in which event such

Interest Period shall end on the immediately preceding Business Day, (ii) no Interest Period shall extend beyond the Maturity Date and

(iii) any Interest Period that begins on the last Business Day of a calendar month (or on a day for which there is no numerically corresponding

day in the calendar month at the end of such Interest Period) shall end on the last Business Day of a calendar month;”.

(c)

The definition of “LIBOR” set forth in Section 1.1 of the Second ARCA is hereby deleted in its entirety.

(d)

The definition of “London Banking Day” set forth in Section 1.1 of the Second ARCA is hereby deleted in its entirety.

(e)

Section 1.1 of the Second ARCA is hereby amended by inserting the following definitions in alphabetical order in that section:

“Adjusted

Term SOFR” means, for purposes of any calculation, the rate per annum equal to (a) Term SOFR for such calculation, plus (b)

the Term SOFR Adjustment;

“Applicable

Margin” means, with respect to an Advance, 7.00% per annum;

“Floor”

means 1.50% per annum;

“SOFR”

means a rate per annum equal to the secured overnight financing rate for such Business Day published by the Federal Reserve Bank of New

York (or a successor administrator of the secured overnight financing rate) on the website of the Federal Reserve Bank of New York, currently

at http://www.newyorkfed.org (or any successor source for the secured overnight financing rate identified as such by the administrator

of the secured overnight financing rate from time to time);

“Term

SOFR” means, for any Interest Period, the Term SOFR Reference Rate for a three month tenor on the day (such day, the “Periodic

Term SOFR Determination Day”) that is one Business Day prior to the first day of such Interest Period, as such rate is published

by the Term SOFR Administrator; provided, however, if as of 5:00 p.m. (New York City time) on any Periodic Term SOFR Determination Day

the Term SOFR Reference Rate for a three-month tenor has not been published by the Term SOFR Administrator, then Term SOFR will be the

Term SOFR Reference Rate for a three-month tenor as published by the Term SOFR Administrator on the first Business Day of such Interest

Period for which such Term SOFR Reference Rate for a three-month tenor was published by the Term SOFR Administrator; provided that,

if Term SOFR determined as provided above shall ever be less than the Floor for any Interest Period, then Term SOFR shall be deemed to

be the Floor for such Interest Period;

“Term

SOFR Adjustment” means 0.26161% per annum;

“Term

SOFR Administrator” means CME Group Benchmark Administration Limited (CBA) (or a successor administrator of the Term SOFR Reference

Rate selected by the Lender in its reasonable discretion);

“Term

SOFR Reference Rate” means the forward-looking term rate based on SOFR;

2.4

Interest.

(a)

Section 2.7 of the Second ARCA is hereby amended and restated in its entirety as follows:

| |

“2.7 |

Interest shall accrue on the outstanding principal amount of

the Facility from and including the date of each Advance, as well as on all overdue amounts outstanding in respect of interest, costs

or other fees, expenses or other amounts payable under the Facility Documents, in each case at a floating rate equal to Adjusted Term

SOFR for the applicable Interest Period plus the Applicable Margin, accruing daily, calculated and compounded monthly on the last day

of each Interest Period, and be payable in arrears on the last Business Day of each Interest Period (each an “Interest Payment

Date”) by the Borrower by way of wire transfer, net of all applicable Taxes, as well as after each of maturity, default and

judgment. |

| |

|

If the

Term SOFR Reference Rate for a three-month tenor is not determinable at the relevant time, whether by virtue of any disruption,

replacement or abandonment of SOFR or otherwise, the applicable reference rate as used above for the determination of the applicable

rate of interest payable by the Borrower pursuant to this Section 2.7 shall be determined by the Lender in its sole discretion

acting reasonably so as to most closely approximate the Term SOFR Reference Rate to the extent possible.”. |

(b)

The last sentence of Section 2.13 of the Second ARCA is hereby amended and restated in its entirety as follows:

“The

parties hereto acknowledge and agree that when Adjusted Term SOFR is used herein as a reference rate and that while such reference rate

is based on the three-month Term SOFR rate, such rate shall be reset to the prevailing three-month Term SOFR rate as of the day which

is one Business Day prior to the first day of each Interest Period.”.

ARTICLE

3

CONDITIONS PRECEDENT

3.1

Conditions Precedent. This Agreement shall not become effective unless and until the date when the following conditions are met or

waived by the Lender in writing:

(i)

the parties hereto shall have executed and delivered this Agreement; and

(ii)

the Borrower and the Guarantors shall have delivered any other documentation or certificates the Lender may reasonably request.

ARTICLE

4

MISCELLANEOUS

4.1

Future References to the Second ARCA. On and after the date of this agreement, each reference in the Second ARCA to “this agreement”,

“hereunder”, “hereof’, or words of like import referring to the Second ARCA, and each reference in any related

document to the “Credit Agreement”, “thereunder”, “thereof’, or words of like import referring to

the Second ARCA, shall mean and be a reference to the Second ARCA as amended hereby. The Second ARCA, as amended hereby, is and shall

continue to be in full force and effect and is ratified and confirmed in all respects.

4.2

Governing Law. This Agreement shall be governed by, construed and enforced in accordance with the laws of the Province of Ontario

and the federal laws of Canada applicable therein and shall be treated in all respects as an Ontario contract.

4.3

Choice of Law and Jury Trial Waiver. SECTION 1.10 OF THE CREDIT AGREEMENT IS INCORPORATED HEREIN BY THIS REFERENCE MUTATIS MUTANDIS.

4.4

Inurement. This Agreement shall inure to the benefit of and shall be binding upon the Borrower, the Guarantors, the Lender and the

Arranger and their respective successors and permitted assigns.

4.5

Conflict. If any provision of this Agreement is inconsistent or conflicts with any provision of the Credit Agreement, the relevant

provision of this Agreement shall prevail and be paramount.

4.6

Further Assurances. The Borrower and the Guarantors shall do, execute and deliver or shall cause to be done, executed and delivered

all such further acts, documents and things as the Administrative Agent may reasonably request for the purpose of giving effect to this

Agreement and to each and every provision hereof.

4.7

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original and all

of which taken together shall be deemed to constitute one and the same instrument.

[The

remainder of this page is intentionally left blank.]

IN

WITNESS WHEREOF the parties hereto have executed this Agreement under the hands of their proper officers duly authorized in that

behalf.

| HYCROFT

MINING HOLDING CORPORATION |

|

| |

|

|

| By: |

/s/

Stanton Rideout |

|

| Name: |

Stanton

Rideout |

|

| Title: |

Executive

Vice President and Chief Financial Officer |

|

| |

|

|

| HYCROFT

RESOURCES & DEVELOPMENT, LLC |

|

| |

|

|

| By: |

/s/

Stanton Rideout |

|

| Name: |

Stanton

Rideout |

|

| Title: |

Executive

Vice President and Chief Financial Officer |

|

| |

|

|

| ALLIED

VGH LLC |

|

| |

|

|

| By: |

/s/

Stanton Rideout |

|

| Name: |

Stanton

Rideout |

|

| Title: |

Executive

Vice President and Chief Financial Officer |

|

| |

|

|

| AUTAR

GOLD CORPORATION |

|

| |

|

|

| By: |

/s/

Stanton Rideout |

|

| Name:

|

Stanton

Rideout |

|

| Title: |

Executive

Vice President and Chief Financial Officer |

|

| |

|

|

| AUXAG

MINING CORPORATION |

|

| |

|

|

| By: |

/s/

Stanton Rideout |

|

| Name:

|

Stanton

Rideout |

|

| Title: |

Executive

Vice President and Chief Financial Officer |

|

Signature

Page to Second Amendment to Second Amended and Restated Credit Agreement

| SPROTT

PRIVATE RESOURCE LENDING II (COLLECTOR), LP, by

its general partner, SPROTT RESOURCE LENDING CORP. |

|

| |

|

|

| Per: |

/s/ |

|

| |

Authorized

Signatory |

|

| |

|

|

| Per: |

/s/ |

|

| |

Authorized

Signatory |

|

| |

|

|

| SPROTT

RESOURCE LENDING CORP. |

|

| |

|

| Per: |

/s/ |

|

| |

Authorized

Signatory |

|

| |

|

|

| Per: |

/s/ |

|

| |

Authorized

Signatory |

|

Signature

Page to Second Amendment to Second Amended and Restated Credit Agreement

v3.23.2

Cover

|

Jul. 01, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 01, 2023

|

| Entity File Number |

001-38387

|

| Entity Registrant Name |

HYCROFT MINING HOLDING CORPORATION

|

| Entity Central Index Key |

0001718405

|

| Entity Tax Identification Number |

82-2657796

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4300

Water Canyon Road

|

| Entity Address, Address Line Two |

Unit 1

|

| Entity Address, City or Town |

Winnemucca

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89445

|

| City Area Code |

(775)

|

| Local Phone Number |

304-0260

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A common stock, par value $0.0001 per share

|

| Trading Symbol |

HYMC

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

HYMCW

|

| Security Exchange Name |

NASDAQ

|

| Warrants To Purchase Common Stock Member 1 [Member] |

|

| Title of 12(b) Security |

Warrants

to purchase Common Stock

|

| Trading Symbol |

HYMCL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HYMC_WarrantsToPurchaseCommonStockMember1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

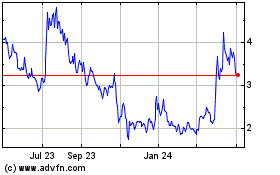

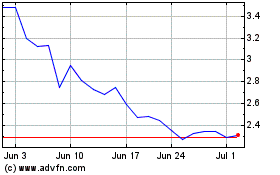

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hycroft Mining (NASDAQ:HYMC)

Historical Stock Chart

From Nov 2023 to Nov 2024