As filed with the Securities and Exchange Commission on January 26, 2024

Registration No. 333-276312

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

GYRODYNE, LLC

(Exact name of Registrant as specified in its charter)

|

New York

|

6512

|

46-3838291

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

One Flowerfield, Suite 24

Saint James, New York 11780

(631) 584-5400

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Gary Fitlin

President and Chief Executive Officer

Gyrodyne, LLC

One Flowerfield, Suite 24

Saint James, New York 11780

(631) 584-5400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Alon Y. Kapen, Esq.

Farrell Fritz, P.C.

400 RXR Plaza

Uniondale, New York 11556-1320

(516) 227-0700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement under the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

|

Accelerated Filer

|

☐

|

|

Non-accelerated filer

|

☒

|

|

Smaller Reporting Company

|

☒

|

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Security and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED JANUARY 22, 2024

GYRODYNE, LLC

625,000 COMMON SHARES OF LIMITED LIABILITY COMPANY INTERESTS

ISSUABLE UPON THE EXERCISE OF SUBSCRIPTION RIGHTS AT $8.00 PER SHARE

Gyrodyne, LLC (the “Company,” “we,” “us” or “our”) is distributing, at no charge to our shareholders, non-transferable subscription rights to purchase an aggregate of 625,000 common shares of limited liability company interests at a price of $8.00 per whole share. We refer to this offering as the “rights offering.” Assuming the rights offering is fully subscribed, we currently expect to receive aggregate gross proceeds of $5,000,000. You will not be entitled to receive any rights unless you are a shareholder of record as of 5:00 p.m., New York City time, on January 29, 2024 (the “record date”).

We are offering to each of our shareholders one subscription right for every five full common shares owned by each shareholder as of the close of business on January 29, 2024, the record date, provided that no fractional shares will be issued in the rights offering and exercises therefor will be rounded to the nearest whole number, with halves rounded down. Additionally, shareholders may over-subscribe for additional common shares to the extent that offered subscription rights are not exercised by other shareholders, although we cannot assure you that we will fill any over-subscriptions. If all rights are exercised and all of the shares issuable upon exercise of the rights are sold in this offering, the total purchase price of the shares offered in the rights offering would be approximately $5,000,000.

We have not entered into any standby purchase agreement or other similar arrangement in relation to this rights offering. This offering is being conducted on a best-efforts basis and there is no minimum number of shares that we must sell or amount of proceeds that we must receive in order for us to close the offering.

Certain members of our board of directors (who are also shareholders) have advised us they intend to exercise their basic subscription privilege under rights received and that they also intend to exercise their over-subscription privilege with respect to additional shares that become available for purchase. If they do so, their ownership percentage may increase significantly if shareholders do not exercise basic subscription privileges with respect to a significant number of shares. Their expressed intention, however, does not constitute a binding obligation on their part.

To the extent you properly exercise your over-subscription privilege for a number of common shares that exceeds the number of the unsubscribed shares available to you, the subscription agent will return to you any excess subscription payments, without interest or penalty, as soon as practicable following the expiration of the rights offering.

This rights offering is being made directly by us. We are not using an underwriter or selling agent. Computershare Trust Company, N.A. will serve as the subscription agent and MacKenzie Partners, Inc. will serve as the information agent for the rights offering. The subscription agent will hold the funds we receive from subscribers in a segregated account until we complete or cancel the rights offering.

If you want to participate in the rights offering and you are the record holder of your shares, we recommend that you submit a rights certificate, Notice of Guaranteed Delivery (if applicable) (as described herein) and payment to the subscription agent well before the deadline. If you want to participate in the rights offering and you hold shares through your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your rights certificate, Notice of Guaranteed Delivery (if applicable) and payment in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee. For a more detailed discussion, see “The Rights Offering — The Subscription Rights” beginning on page 25.

The subscription rights will expire if they are not exercised by 5:00 p.m., New York City time, on [●], 2024, but we may extend the rights offering for additional periods ending no later than [●], 2024.

You should carefully consider whether to exercise your subscription rights before the rights offering expires. All exercises of subscription rights are irrevocable. The purchase of common shares involves a high degree of risk.

Exercising the rights and investing in our common shares involve significant risks. You should read “Risk Factors” beginning on page 11, the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30, 2023, and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to exercise your rights.

Neither the Company nor our board of directors is making any recommendation regarding your exercise of the subscription rights.

Our board of directors reserves the right to terminate the rights offering for any reason any time before the completion of the rights offering. If we terminate the rights offering, all subscription payments received will be returned as soon as practicable, without interest or penalty.

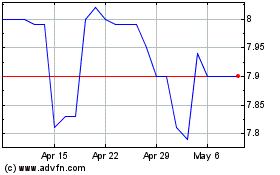

The subscription rights are non-transferable. The common shares to be issued upon exercise of the subscription rights will be listed for trading on the Nasdaq Capital Market under the symbol “GYRO.” The last reported sales price of our common shares on January 19, 2024 was $9.98 per share.

The common shares are being offered directly by us without the services of an underwriter or selling agent.

| |

|

Per Share

|

|

|

Total

|

|

|

Subscription Price

|

|

$

|

8.00

|

|

|

$

|

5,000,000

|

(1)

|

|

Proceeds to us, before expenses

|

|

$

|

8.00

|

|

|

$

|

5,000,000

|

(1)

|

|

(1)

|

Assumes the rights offering is fully subscribed

|

If you have any questions or need further information about this rights offering, please contact the information agent toll-free at 800-322-2885 or via email at proxy@mackenziepartners.com. It is anticipated that delivery of the common shares purchased in this rights offering will be made on or about [●], 2024 (the fifth business day following the expiration date), unless the expiration date is extended.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is [●], 2024.

TABLE OF CONTENTS

|

ABOUT THIS PROSPECTUS

|

(i) |

| |

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

(ii) |

| |

|

|

PROSPECTUS SUMMARY

|

1

|

| |

|

|

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

|

6

|

| |

|

|

RISK FACTORS

|

12

|

| |

|

|

USE OF PROCEEDS

|

21

|

| |

|

|

CAPITALIZATION

|

22

|

| |

|

|

DILUTION

|

23

|

| |

|

|

STOCK MARKET AND DIVIDEND INFORMATION

|

24

|

| |

|

|

THE RIGHTS OFFERING

|

24

|

| |

|

|

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

|

34

|

| |

|

|

DESCRIPTION OF CAPITAL STOCK

|

37

|

| |

|

|

PLAN OF DISTRIBUTION

|

39

|

| |

|

| EXECUTIVE COMPENSATION |

40 |

| |

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

41

|

| |

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

42

|

| |

|

|

LEGAL MATTERS

|

43

|

| |

|

|

EXPERTS

|

43

|

| |

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

43

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). The exhibits to the registration statement contain the full text of certain contracts and other important documents we have summarized in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to purchase our securities, you should review the full text of these documents. The registration statement and the exhibits can be obtained from the SEC as indicated under the sections entitled “Where You Can Find Additional Information” and “Incorporation by Reference.” You should read this prospectus, the documents incorporated by reference into this prospectus, and any prospectus supplement or free writing prospectus that we may authorize for use in connection with this offering in their entirety before making an investment decision.

Until [DATE] (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus and any free writing prospectus we may authorize to be delivered to you. We have not authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of shares.

Any reference in this prospectus to information that is “contained,” “referred to” or “included” in this prospectus, or any similar expression, includes not only the information expressly set forth in this prospectus but also the information incorporated by reference in this prospectus.

You should assume that the information in this prospectus is accurate only as of the date on the front cover of this prospectus, and any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, in each case, regardless of the time of delivery of this prospectus or any exercise of the rights. Our business, financial condition, results of operations and prospects may have changed since that date.

Market data and other statistical information incorporated by reference into this prospectus are based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data is also based on our good faith estimates, which we derive from our review of internal surveys and independent sources. Although we believe these sources are reliable, we have not independently verified the information. We neither guarantee its accuracy nor undertake a duty to provide or update such data in the future.

We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to those jurisdictions.

This rights offering is being made directly by us. We have retained Computershare Trust Company, N.A. to serve as our subscription agent (the “subscription agent”) for this rights offering. We have retained MacKenzie Partners, Inc. to serve as our information agent (the “information agent”) for this rights offering.

Unless the context indicates otherwise, all references in this prospectus to the “Company,” “Gyrodyne,” “we,” “us” and “our” refer to Gyrodyne, LLC, a New York limited liability company, and our wholly owned subsidiaries, except that in the discussion of our subscription rights and capital stock and related matters, these terms refer solely to Gyrodyne, LLC and not to its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements”, as such term is used within the meaning of the Private Securities Litigation Reform Act of 1995. These “forward-looking statements” are not based on historical fact and involve assessments of certain risks, developments, and uncertainties in our business looking to the future. Such forward-looking statements can be identified by the use of terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “estimate”, “intend”, “continue”, or “believe”, or the negatives or other variations of these terms or comparable terminology, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements may include projections, forecasts, or estimates of future performance and developments. Forward-looking statements contained in this prospectus are based upon assumptions and assessments that we believe to be reasonable as of the date of this prospectus.

These forward-looking statements are based on the current plans and expectations of management and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties relating to:

| |

●

|

our efforts to enhance the values of our remaining properties and seek the orderly, strategic sale of such properties as soon as reasonably practicable;

|

| |

●

|

the Article 78 proceeding against the Company and any other litigation that may develop in connection with our efforts to enhance the value of and sell our properties;

|

| |

●

|

our ability to obtain additional capital in order to ensure we are operating through a position of strength through the duration of the liquidation to negotiate and enforce purchase agreements and defend our property rights in the Article 78 proceeding;

|

| |

●

|

proxy contests and other actions of activist shareholders;

|

| |

●

|

ongoing community activism;

|

| |

●

|

the recent banking crisis and closure of two major banks (including one with whom we indirectly have a mortgage loan);

|

| |

●

|

regulatory enforcement;

|

| |

●

|

the real estate markets of Suffolk and Westchester Counties in New York;

|

| |

●

|

lingering effects of the COVID-19 pandemic;

|

| |

●

|

persistent inflation, rising interest rates and possible recession;

|

| |

●

|

supply chain constraints or disruptions; and

|

| |

●

|

other risks detailed from time to time in the Company’s SEC reports.

|

Risks, uncertainties, contingencies, and developments, including those identified in the “Risk Factors” section of this prospectus and in our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q and other filings we make with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference herein, could cause our future operating results to differ materially from those set forth in any forward-looking statement. There can be no assurance that any such forward-looking statement, projection, forecast or estimate contained in this prospectus can be realized or that actual returns, results, or business prospects will not differ materially from those set forth in any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments.

The forward-looking statements contained in this prospectus are set forth principally in the “Risk Factors” section of this prospectus, and in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and other sections in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. In addition, there may be events in the future that we are not able to predict accurately or control which may cause actual results to differ materially from expectations expressed or implied by forward-looking statements. Please consider our forward-looking statements in light of these risks as you read this prospectus and any prospectus supplement.

PROSPECTUS SUMMARY

This summary highlights the information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding whether to exercise your subscription rights. You should carefully read this entire prospectus, including the information under the heading “Risk Factors”. In this prospectus, all references to the “Company,” “Gyrodyne” “we,” “us” and “our” refer to Gyrodyne, LLC, a New York limited liability company, and its subsidiaries and predecessors, unless the context otherwise requires or where otherwise indicated.

Gyrodyne, LLC

Gyrodyne, LLC is a limited liability company formed under the laws of the State of New York whose primary business is the management of, and pursuit of entitlements on, a portfolio of medical office and industrial properties in Suffolk and Westchester Counties in the State of New York.

The Company’s remaining real estate investments, each of which is held in a single asset limited liability company wholly owned by the Company, consist of:

| |

●

|

Cortlandt Manor:13.8 acres in Cortlandt Manor, New York, consisting of the 31,000 square foot Cortlandt Manor Medical Center; and

|

| |

●

|

Flowerfield: 63 acres in St. James, New York, including a 14-acre multi-tenanted industrial park comprising 135,000 rentable square feet.

|

Gyrodyne’s common shares are traded on Nasdaq under the symbol GYRO. Gyrodyne’s principal executive offices are located at One Flowerfield, Suite 24, Saint James, New York 11780 and its telephone number is (631) 584-5400.

For a complete description of our business, financial condition, results of operations, corporate strategy and other important information, please read our filings with the SEC that are incorporated by reference in this prospectus, including our 2022 Form 10-K. For instructions on how to find copies of these documents, please read “Where You Can Find Additional Information.”

Strategic Plan to Enhance Property Values, Liquidate, Distribute Proceeds and Dissolve

Gyrodyne’s corporate strategy is to pursue entitlements on our two remaining properties so that they can be sold to one or more developers with increased development flexibility and thus maximize value and distributions to our shareholders. Gyrodyne intends to dissolve after it completes the disposition of its real property assets, applies the proceeds of such dispositions first to settle any debts and claims, pending or otherwise, against the Company, and then makes distributions to holders of Gyrodyne common shares.

Gyrodyne filed subdivision applications in March 2017 with respect to Cortlandt Manor and Flowerfield. The COVID-19 pandemic caused significant delays in the regulatory approval process, as state, county and local staff charged with processing our subdivision applications all postponed activity due to work-from-home transitions.

On March 30, 2022, the Town of Smithtown Planning Board (the “Planning Board”) unanimously granted Gyrodyne’s application for preliminary approval to divide the Flowerfield property into eight lots, subject to certain conditions (the “Flowerfield Subdivision Application”).

On April 26, 2022, the Incorporated Village of Head of the Harbor and certain other parties commenced a special proceeding under Article 78 of New York’s Civil Practice Law & Rules (the “Article 78 Proceeding”) against the Town of Smithtown and certain other parties, including Gyrodyne, seeking to annul the Planning Board’s determinations relating to the Flowerfield Subdivision Application. Specifically, the petition commencing the Article 78 Proceeding (the “Petition”) seeks to annul the Planning Board’s (i) approval of a findings statement pursuant to the State Environmental Quality Review Act (“SEQRA”), dated September 16, 2021, and adopted by the Planning Board on March 30, 2022, concerning the Flowerfield Subdivision Application, and (ii) preliminary approval on March 30, 2022 of the Flowerfield Subdivision Application. The arguments made in the Petition are substantially similar to those made by opponents of the Flowerfield Subdivision Application during the SEQRA and subdivision process. Challenging a government decision in an Article 78 proceeding can lead to delay in implementation of the government action, whether or not the suit is successful, and the government sometimes agrees to delay implementation until legal challenges are resolved.

Gyrodyne and the Town of Smithtown are vigorously defending the Planning Board’s determinations against the Petition. In June 2022, Gyrodyne and the Town of Smithtown filed motions to dismiss the Petition. During the third quarter of 2023, the Article 78 Proceeding was re-assigned to a different judge for the second time. Our motion to dismiss has yet to be decided. Even if Gyrodyne were to prevail in its motion to dismiss, however, the petitioners are likely to appeal. Although the posting of a bond is not generally a requirement for filing an appeal, the petitioners would likely be required to post a bond (in an amount to be determined by the court) if the petitioners were to seek a judicial stay pending appeal. Given the likelihood of appeal and the impact the pandemic has had on the court system, Gyrodyne now believes that the process of negotiating purchase agreements, securing final subdivision approval and final unappealable site plan approval and consummating the sale of our properties will extend to year-end 2025. The Company estimates that this extension of the timeline from year-end 2024 will result in a reduction of approximately $1.58 million in net assets in liquidation. There can be no assurance that Gyrodyne and the Town of Smithtown will be successful in the defense of the Planning Board’s determinations against the Petition or that other factors beyond our control will not necessitate a further extension of the timeline.

The Flowerfield subdivision will remain subject to the Article 78 Proceeding unless Gyrodyne and the Town of Smithtown prevail in their defense of the Planning Board’s determinations against the Petition. Nevertheless, the Company will continue its efforts to identify one or more purchasers for Flowerfield and execute purchase agreements, but it is unclear at this time what impact, if any, the Article 78 Proceeding will have on such efforts.

On March 20, 2023, the Town of Cortlandt Town Board adopted the SEQRA findings statement and approved a Local Law establishing the Medical Oriented Zoning District (the “MOD”) which includes Gyrodyne’s Cortlandt Manor property. Pursuant to the adopted MOD, Gyrodyne received designation for total density of 154,000 square feet to be comprised of 150,000 square feet of medical use and 4,000 square feet of retail use.

Various other factors will continue to impact the timeline to achieve approvals, including the Article 78 Proceeding and delays in securing final regulatory approvals caused by the ongoing backlog of land use applications, government labor shortages and the pandemic. Nevertheless, we will continue to market the properties and, although there can be no assurances, the Company believes subdivision approval will be received in mid-2024 for Flowerfield, and could be received for Cortlandt Manor in the fourth quarter of 2024.

Although Gyrodyne believes that selling individual lots will maximize value, we are also pursuing prospective purchasers who may be willing to pay purchase prices for the entire undivided Flowerfield or Cortlandt Manor properties, or for the entire company itself, that Gyrodyne finds more attractive from a timing and value perspective.

Rights Offering

The following summary describes the principal terms of the rights offering, but is not intended to be complete. See “The Rights Offering” for a more detailed description of the terms and conditions of the rights offering.

|

Securities Offered

|

We are distributing, at no charge, to holders of our common shares non-transferable subscription rights to purchase up to 625,000 of our common shares, subject to proration to the extent the aggregate exercise of basic subscription privileges would result in the issuance of more than 625,000 shares. You will receive one subscription right for each five common shares held of record, as of 5:00 p.m., New York City time, on January 29, 2024.

|

| |

|

|

Subscription Price

|

$8.00 per share.

|

|

Basic Subscription

Privilege

|

Under the basic subscription privilege, for each subscription right you will be entitled to purchase two common shares at a subscription price of $8.00 per full share. The number of subscription rights you may exercise appears on your rights certificate. |

| |

|

|

Over-Subscription

Privilege

|

If you exercise your basic subscription privilege in full and other shareholders do not exercise their basic subscription privilege in full, you will also have an over-subscription privilege to purchase any shares that our other subscription rights holders do not purchase under their basic subscription privilege, subject to proration of available shares. The subscription price for shares purchased pursuant to the over-subscription privilege will be the same as the subscription price for the basic subscription privilege.

|

| |

|

| |

If you are not allocated the full amount of shares for which you over-subscribe, you will receive a refund of the subscription price, without interest or penalty, that you delivered for such common shares that are not allocated to you. The subscription agent will mail such refunds as soon as practicable after the completion of the offering.

|

| |

No fractional common shares will be issued. Any fractional rights resulting from the share allocation process specified above will be rounded to the nearest whole number, with halves rounded down.

|

| |

|

|

Amount of Proceeds

|

Assuming we receive valid subscriptions for the full 625,000 shares, the gross proceeds to us will be $5,000,000 and the net proceeds to us, after deducting estimated offering expenses, will be approximately $4,400,000. However, there is no minimum amount of proceeds required to complete the rights offering.

|

| |

|

|

Limitation on the Purchase

of Shares

|

In no event may a shareholder exercise subscription and over-subscription privileges to the extent that any such exercise would result in the shareholder owning 20% or more of our issued and outstanding common shares, the ownership limitation under the Company’s Amended and Restated Limited Liability Company Agreement, after giving effect to such shareholder’s purchase under the basic subscription privilege and the over-subscription privilege. In addition, shares issued in the rights offering will be subject to proration to the extent the aggregate exercise of basic subscription privileges would result in the issuance of more than 625,000 shares. |

| |

|

|

Record Date

|

January 29, 2024

|

| |

|

|

Expiration Date

|

The subscription rights will expire at 5:00 p.m., New York City time, on [●], 2024, unless the expiration date is extended. We reserve the right to extend the subscription rights period at our sole discretion for a period not to exceed 30 days, although we do not presently intend to do so.

|

| |

|

|

Procedure for Exercising

Subscription Rights

|

The subscription rights may be exercised at any time during the subscription period, which commences on [●], 2024. To exercise your subscription rights, you must take the following steps:

|

| |

If you are a registered holder of our common shares, you may deliver payment and a properly completed rights certificate to the subscription agent before 5:00 p.m., New York City time on [●], 2024, unless the expiration date is extended. You may deliver the documents and payments by mail or commercial carrier. If regular mail is used for this purpose, we recommend using registered mail, properly insured, with return receipt requested.

If you are a beneficial owner of shares that are registered in the name of a broker, dealer, custodian bank or other nominee, or if you would rather an institution conduct the transaction on your behalf, you should instruct your broker, dealer, custodian bank or other nominee to exercise your subscription rights on your behalf and deliver all documents and payments before 5:00 p.m., New York City time, on [●], 2024, unless the expiration date is extended.

|

| |

|

|

Use of Proceeds

|

We intend to use the net proceeds received from the rights offering to ensure we are operating from a position of strength through the duration of the liquidation process in negotiating and enforcing purchase agreements and in defending our property rights in the Article 78 proceeding and in any other such proceeding that may arise. Offering proceeds may also be used to complete the pursuit of entitlements on our Flowerfield property, for necessary capital improvements to retain and or attract tenants in our real estate portfolio and for general working capital. See “Use of Proceeds.” However, there is no minimum number of shares required to complete the rights offering, and the gross and net proceeds could be considerably less than the $5,000,000 and $4,400,000, respectively, we would receive assuming full subscription.

|

| |

|

|

Non-Transferability of

Subscription Rights

|

The subscription rights may not be sold, transferred or assigned to anyone else and will not be listed for trading on the Nasdaq Capital Market or any other stock exchange or market or on the OTC Markets.

|

| |

|

|

No Revocation

|

All exercises of subscription rights are irrevocable, even if you later learn information about us that you consider unfavorable to the exercise of your subscription rights, or even in the event we extend the rights offering. However, if we extend the rights offering for a period of more than 30 days or make a fundamental change to the terms set forth in this prospectus, you may cancel your subscription and receive a refund of any money you have advanced. You should not exercise your subscription rights unless you are certain that you wish to purchase the common shares offered pursuant to this rights offering at a subscription price of $8.00 per share.

|

|

Extension; Cancellation;

Amendment

|

We have the option to extend the rights offering and the period for exercising your subscription rights, although we do not presently intend to do so. If we elect to extend the expiration of the rights offering, we will issue a press release announcing such extension no later than 9:00 a.m., New York City time, on the next business day after the most recently announced expiration of the rights offering. We will extend the duration of the rights offering as required by applicable law or regulation and may choose to extend it if we decide to give investors more time to exercise their subscription rights in this rights offering. If we elect to extend the rights offering for a period of more than 30 days, then holders who have subscribed for rights may cancel their subscriptions and receive a refund of all money advanced.

|

| |

Our board of directors also reserves the right to cancel the rights offering at any time prior to the expiration date for any reason. If the rights offering is canceled, all subscription payments received by the subscription agent will be returned, without interest or penalty, as soon as practicable to those persons who subscribed for shares in the rights offering.

|

| |

|

| |

Our board of directors also reserves the right to amend or change the terms of the rights offering. If we should make any fundamental changes to the terms set forth in this prospectus, we will file a post-effective amendment to the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions and issue a refund of any money advanced by such shareholder and recirculate an updated prospectus after the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the expiration date of this rights offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to this rights offering and the new expiration date. Although we do not presently intend to do so, we may choose to change the terms of the rights offering for any reason, including, without limitation, in order to increase participation in the rights offering. Such changes may include a change in the subscription price although no such change is presently contemplated. The terms of the rights offering cannot be changed after the expiration date of the rights offering.

|

| |

|

|

No Board

Recommendation

|

Our board of directors is making no recommendations regarding your exercise of the subscription rights. You are urged to make your own decision whether or not to exercise your subscription rights based on your own assessment of our business and the rights offering. See the section of this prospectus entitled “Risk Factors” for a discussion of some of the risks involved in investing in our common shares.

|

| |

|

|

Director Participation

|

Certain Gyrodyne directors (who are also shareholders) have indicated they will purchase shares that are subject to their subscription rights, and that they will exercise their over-subscription privilege (if available), at the same subscription price offered to our shareholders. If they do so, their ownership percentage may increase significantly if shareholders do not exercise basic subscription privileges with respect to a significant number of shares. Nevertheless, these shareholders have not executed agreements to purchase shares and there is no guarantee or commitment that they will subscribe for shares in the offering.

|

| |

|

|

Issuance of Common

Shares

|

As soon as practicable after the expiration of the rights offering, the subscription agent will arrange for the issuance of the shares purchased pursuant to the rights offering. All shares that are purchased in the rights offering will be issued in book-entry or uncertificated form, meaning that you will receive a direct registration account statement from our transfer agent reflecting ownership of these securities if you are a holder of record of shares. If you hold your shares in the name of a custodian bank, broker, dealer, or other nominee, DTC will credit your account with your nominee with the securities you purchased in the rights offering.

|

|

Listing of Common

Shares

|

Our common shares trade on the Nasdaq Capital Market under the symbol “GYRO”, and we expect the shares to be issued in connection with the rights offering will also be listed on the Nasdaq Capital Market under the same symbol.

|

| |

|

|

Certain Material U.S.

Federal Income Tax

Considerations

|

The receipt and exercise of your subscription rights will generally not be taxable under U.S. federal income tax laws. You are urged to seek specific tax advice from your personal tax advisor in light of your personal tax situation and as to the applicability and effect of any tax laws. See “Material U.S. Federal Income Tax Considerations.”

|

| |

|

|

Subscription Agent

|

Computershare Trust Company, N.A.

|

| |

|

|

Information Agent

|

MacKenzie Partners, Inc.

|

| |

|

|

Common shares Outstanding

Before the Rights Offering

|

As of January 19, 2024, 1,574,308 shares of our common shares were outstanding.

|

| |

|

|

Common Shares Outstanding

After Completion of the Rights Offering

|

We will issue 625,000 common shares in the rights offering, assuming the full number of subscription rights are exercised. Based on the number of common shares outstanding as of January 19, 2024, if we issue all 625,000 common shares available in this rights offering, we would have 2,199,308 common shares outstanding following the completion of the rights offering. However, there is no minimum number of shares required to complete the rights offering. |

| |

|

|

Risk Factors

|

Shareholders considering making an investment by exercising subscription rights in the rights offering should carefully read and consider the information set forth in “Risk Factors” beginning on page 11 of this prospectus, together with the other information contained in this prospectus, before making a decision to invest in our common shares.

|

| |

|

|

Important Dates

|

Set forth below are important dates for this offering, which generally are subject to extension:

Record date

Commencement date

Expiration Date

Deadline for delivery of subscription certificates and payment of subscription prices

Deadline for delivery of notices of guaranteed delivery

Deadline for delivery of subscription certificates and payment of subscription prices pursuant to notices of guaranteed delivery

Anticipated delivery of shares purchased in this offering

|

January 29, 2024

[●]

[●]

[●]

[●]

[●]

[●]

|

| |

|

|

Fees and Expenses

|

We will pay the fees and expenses incurred by us related to the rights offering.

|

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are what we anticipate will be common questions about the rights offering. The answers are based on selected information from this prospectus. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the rights offering. This prospectus contains more detailed descriptions of the terms and conditions of the rights offering and provides additional information about us and our business, including potential risks related to the rights offering, our common shares, and our business.

Exercising your subscription rights and investing in our common shares involves a high degree of risk. We urge you to carefully read the section entitled “Risk Factors” beginning on page 11 of this prospectus and the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30, 2023, and all other information included in this prospectus in its entirety before you decide whether to exercise your subscription rights.

What is the rights offering?

A rights offering is a distribution of subscription rights on a pro rata basis to all shareholders of a company. “Pro rata” means in proportion to the number of our common shares that our shareholders hold on the record date. We are distributing to holders of our issued and outstanding common shares as of 5:00 p.m., New York City time, as of January 29, 2024, the “record date,” at no charge, non-transferable subscription rights to purchase our common shares. You will receive one subscription right (rounded to the nearest whole number, with halves rounded down) for every five common shares you own as of 5:00 p.m., New York City time, on the record date. The subscription rights will be evidenced by rights certificates. Each subscription right consists of a basic subscription privilege and an over-subscription privilege.

What is the basic subscription privilege?

Shareholders will receive in the rights offering one subscription right for each five shares held. Each whole subscription right gives our shareholders the opportunity to purchase two of our common shares for $8.00 per share. We determined the ratio of subscription rights to distribute per our issued and outstanding shares (1,574,308) by dividing the number of shares we determined to offer in the rights offering, 625,000, by the number of shares issued and outstanding on the record date (625,000/1,574,308 shares outstanding = 1:2.5 new-to-existing share ratio). Shares issued in the rights offering will be subject to proration to the extent the aggregate exercise of basic subscription privileges would result in the issuance of more than 625,000 shares.

What is the over-subscription privilege?

We do not expect all of our shareholders to exercise all of their basic subscription privileges. The over-subscription privilege provides shareholders that do exercise their entire basic subscription privileges the opportunity to purchase the shares that are not purchased by other shareholders. Accordingly, if you fully exercise your basic subscription privilege and other shareholders do not fully exercise their basic subscription privileges, then you may also exercise an over-subscription privilege to purchase additional common shares that remain unsubscribed at the expiration of the rights offering, subject to the availability and pro rata allocation of such shares among persons exercising this over-subscription privilege. To the extent that the number of the unsubscribed shares are not sufficient to satisfy all of the properly exercised over-subscription privilege requests, then the available shares will be allocated pro rata among those who properly exercise their over-subscription privileges. “Pro rata” in this context means in proportion to the number of our common shares that you and the other shareholders have subscribed for under the over-subscription privilege, so that the number of shares that would be allocated to you would equal the number of shares you have subscribed for in your over-subscription request multiplied by a fraction, the numerator of which is the number of available shares and the denominator of which is the aggregate number of over-subscription shares requested by all shareholders.

In order to properly exercise your over-subscription privilege, you must deliver the subscription payment related to your over-subscription privilege prior to the expiration of the rights offering. Because we will not know the total number of unsubscribed shares prior to the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your over-subscription privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum number of our common shares available to you, assuming that no shareholder other than you has purchased any of our common shares pursuant to their basic subscription privilege and over-subscription privilege. See “The Rights Offering—Over-Subscription Privilege.”

How many shares may I purchase if I exercise my subscription rights?

Each subscription right entitles you to purchase two of our common shares for $8.00 per share. We will not issue fractional subscription rights or common shares in the rights offering, and holders will only be entitled to purchase a whole number of common shares. You may exercise any number of your subscription rights (including the over-subscription privilege), or you may choose not to exercise any subscription rights. As explained elsewhere in this prospectus, there is no limit on the number of offered shares that may be purchased pursuant to your over-subscription privilege.

If you hold your shares in street name through a broker, bank, or other nominee who uses the services of the Depository Trust Company, or “DTC,” then DTC will issue one subscription right to your nominee for every five common shares you own at the close of business on the record date. Each subscription right can then be used to purchase two common shares for $8.00 per share pursuant to the basic subscription privilege. For more information, see the question “What should I do if I want to participate in the rights offering, but my shares are held in the name of my broker, dealer, custodian bank or other nominees (commonly referred to as “street name”)?” below.

Will fractional subscription rights or fractional shares be issued in the rights offering?

No. We will not issue fractional subscription rights or fractional common shares in the rights offering. In allocating subscription rights among our shareholders, each five shares of capital stock held of record at the close of business on the record date will entitle the holder of such shares to receive one subscription right (rounded to the nearest whole number, with halves rounded down), and each subscription right granted in the rights offering may only be exercised for two of our common shares.

Are there backstop or standby purchasers?

No. We have not entered into any standby purchase agreement or other similar arrangement in relation to this rights offering. This offering is being conducted on a best-efforts basis and there is no minimum number of shares that we must sell or amount of proceeds that we must receive in order for us to close the offering. See “Risk Factors” beginning on page 11.

Are there any limits on the number of shares I may purchase in this rights offering?

Yes. The total number of offered shares in this rights offering represents the maximum number of shares you may potentially purchase. In all cases, you are entitled (but not required) to purchase all shares available to you under your basic subscription privilege. Shares in excess of those available to you under your basic subscription privilege may only be purchased pursuant to your over-subscription privilege. As explained elsewhere in this prospectus, other shareholders may also exercise their over-subscription privilege. If this occurs, the number of shares available for purchase by you will be reduced proportionately.

In no event may you exercise subscription and over-subscription privileges to the extent that any such exercise would result in your owning 20% or more of our issued and outstanding common shares, which is the ownership limitation under the Company’s Amended and Restated Limited Liability Company Agreement, after giving effect to your purchase under the basic subscription privilege and the over-subscription privilege.

Am I required to exercise the subscription rights I receive in the rights offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. However, if you choose not to exercise your subscription rights in full, the relative percentage of our common shares that you own will decrease, and your voting and other rights will be diluted. Furthermore, if you fail to exercise your full basic subscription privilege, you will not be eligible to exercise your over-subscription privilege. For more information, see the question “How many shares of capital stock will be issued and outstanding after the rights offering?” below.

Will our directors and significant shareholders be exercising their subscription rights?

Our directors and any greater-than-5% beneficial shareholders may participate in this offering at the same subscription price per share as all other purchasers, but none of our directors or greater-than-5% beneficial shareholders are obligated to so participate. Certain directors (who are also shareholders) have indicated that they will purchase shares that are subject to their subscription rights, and that they will exercise their over-subscription privilege (if available), at the same subscription price offered to our shareholders. If they do so, their ownership percentage may increase significantly if shareholders do not exercise basic subscription privileges with respect to a significant number of shares. Nevertheless, none of our directors have executed agreements to purchase shares and there is no guarantee or commitment that they will subscribe for shares in the offering.

Any shares purchased in the rights offering by our directors will be deemed “control securities” under federal securities rules and will likely not be eligible for public resale unless sold in accordance with the limitations of Rule 144 or the public resale of such shares is registered with the SEC.

Has our Board of Directors made a recommendation to our shareholders regarding the exercise of rights under the rights offering?

No. Our board of directors is making no recommendation regarding your exercise of the subscription rights. Shareholders who exercise their subscription rights risk loss on their investment. We cannot assure you that the market price of our common shares will be above the subscription price or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to make your decision based on your own assessment of our business and the rights offering. See the “Risk Factors” section of this prospectus for a discussion of some of the risks involved in investing in our common shares.

Why are we conducting a rights offering?

Our corporate strategy has involved the pursuit of entitlements on our remaining properties so that they can be sold to one or more developers with increased development flexibility and thus maximize value and distributions to our shareholders. Gyrodyne intends to dissolve after it completes the disposition of its properties, applies the proceeds of such dispositions first to settle any debts and claims, and then makes distributions to our shareholders.

The expenses associated with pursuing land entitlements, as well as the costs and expenses from operations, including salaries, real estate taxes, payroll and local taxes, legal, accounting and consulting fees and miscellaneous office expenses, will continue to be incurred during our process of seeking entitlements and selling assets. In addition, we have incurred and expect to continue to incur significant legal fees in defending ourselves in an Article 78 proceeding challenging the granting of preliminary approval of the subdivision of our Flowerfield property. No assurances can be given that available cash (including amounts available under our credit facilities) will be adequate to provide for our entitlement efforts, the defense of the lawsuit and ongoing operations.

Accordingly, the Company believes it is prudent to secure additional funding to ensure we are operating from a position of strength through the duration of the liquidation process as we negotiate and enforce purchase agreements, defend our property rights in the Article 78 proceeding (and in any other such proceeding that may arise). The Company has determined that the terms of the rights offering are more advantageous to the Company than other forms of financing. We are pursuing such needed additional funding through a rights offering because it provides our shareholders the opportunity to participate in an offering of our shares on a pro rata basis that minimizes the dilution of their ownership interest in the Company.

How was the subscription price of $8.00 per share determined?

The subscription price of $8.00 per share was determined by our board of directors. Factors considered by the board included historical and current trading prices of our common shares, the price at which our shareholders might be willing to participate in the rights offering, our business prospects, the condition of the trading market for our common shares, the condition of the securities and capital markets in general and comparable precedent transactions in terms of the percentage of shares offered, the terms of the subscription rights being offered, the subscription price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings. The board also considered the advice of the investment banking firm of Coady Diemar Partners, which we retained to provide financial advisory services to us in connection with the rights offering. We cannot assure you that the market price for our common shares during the rights offering will be equal to or above the subscription price or that a subscribing owner of rights will be able to sell the common shares purchased in the rights offering at a price equal to or greater than the subscription price.

How soon must I act to exercise my rights?

If you received a rights certificate and elect to exercise any or all of your subscription rights, the subscription agent must receive your completed and signed rights certificate and related payment prior to the expiration of the rights offering, which is [●], 2024 at 5:00 p.m., New York City time. If you hold your shares in the name of a custodian bank, broker, dealer or other nominee, your custodian bank, broker, dealer or other nominee may establish a deadline prior to 5:00 p.m. New York City time, on [●], 2024 by which you must provide it with your instructions to exercise your subscription rights and pay for your shares.

Although we will make reasonable attempts to provide this prospectus to all holders of subscription rights, the rights offering and all subscription rights will expire at 5:00 p.m., New York City time on [●], 2024 (unless extended for up to 30 additional days), whether or not we have been able to locate each person entitled to receive subscription rights. Although we reserve the right to extend the expiration of the rights offering for up to 30 additional days, we currently do not intend to do so.

May I transfer my subscription rights?

No. You may not sell or transfer your subscription rights to anyone.

Can the Board of Directors cancel, terminate, amend or extend the rights offering?

Yes. Although there is no present intention to do so, our board of directors may change the terms of the rights offering for any reason at any time. If we should make any fundamental changes to the terms set forth in this prospectus, we will offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions, issue a refund of any money advanced by such shareholder and recirculate an updated prospectus. In addition, upon such event, we may extend the expiration date of this rights offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation. The terms of the rights offering cannot be changed after the expiration date of the rights offering. We have the option to extend the rights offering and the period for exercising your subscription rights for up to 30 additional days, although we do not presently intend to do so. Our board of directors may cancel the rights offering at any time for any reason. If the rights offering is cancelled, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty.

Will funds be held in a segregated account pending consummation or cancelation of the rights offering?

Yes. The subscription agent will hold funds received in payment for the common shares in a segregated account pending completion of the rights offering. The subscription agent will hold this money in a segregated account until the rights offering is completed or is withdrawn and canceled. If the rights offering is canceled for any reason, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty, as soon as practicable. In addition, all subscription payments received by the subscription agent will be returned, without interest or penalty, as soon as practicable, if subscribers decide to cancel their subscription rights in the event that we extend the rights offering for a period of more than 30 days after the expiration date or if there is a fundamental change to the rights offering.

When will I receive my subscription rights certificate?

Promptly after the date of this prospectus, the subscription agent will send a subscription rights certificate to each registered holder of our common shares as of the close of business on the record date, based on our shareholder register maintained by the transfer agent for our common shares. If you hold your common shares through a brokerage account, bank, or other nominee, you will not receive an actual subscription rights certificate. Instead, as described in this prospectus, you must instruct your broker, bank or nominee whether or not to exercise rights on your behalf. If you wish to obtain a separate subscription rights certificate, you should promptly contact your broker, bank or other nominee and request a separate subscription rights certificate. If you hold your common shares through a brokerage account, bank, or other nominee, it is not necessary to have a physical subscription rights certificate in order to exercise your subscription rights.

What will happen if I choose not to exercise my subscription rights?

If you do not exercise any subscription rights, the number of our common shares you own will not change. Nevertheless, due to the fact that other shareholders may purchase shares in the rights offering, your percentage ownership of Gyrodyne will be diluted after the completion of the rights offering unless you do exercise your subscription rights. For more information, see “Risk Factors - Risks Related to the Rights Offering - If we consummate the rights offering and you do not fully exercise your basic subscription privilege, your interest in us will be diluted. In addition, if you do not exercise your basic subscription privilege in full and the subscription price is less than the market price of our common shares, then you would experience an immediate dilution of the aggregate fair value of your shares, which could be substantial”, and the question “How many shares of capital stock will be issued and outstanding after the rights offering?” below.

How do I exercise my subscription rights?

If you wish to participate in the rights offering, you must take the following steps:

| |

●

|

deliver payment to the subscription agent; and

|

| |

●

|

deliver your properly completed and signed rights certificate, and any other subscription documents, to the subscription agent.

|

Please follow the payment and delivery instructions accompanying the rights certificate. Do not deliver documents to Gyrodyne. You are solely responsible for completing delivery to the subscription agent of your subscription documents, rights certificate, and related payment on or prior to the deadline for receipt of such items. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent so that they are received by the subscription agent by 5:00 p.m., New York City time, on [●], 2024. We are not responsible for subscription materials sent directly to our offices. If you cannot deliver your rights certificate to the subscription agent prior to the expiration of the rights offering, you may follow the guaranteed delivery procedures described under the “The Rights Offering—Guaranteed Delivery Procedures” section of this prospectus.

If you send a payment that is insufficient to purchase the number of shares you requested, or if the number of shares you requested is not specified in the forms, the payment received will be applied to exercise your subscription rights to the fullest extent possible based on the amount of the payment received, subject to the availability of shares under the oversubscription privilege and purchase limitations and subject to the elimination of any fractional shares. Any excess subscription payments received by the subscription agent will be returned promptly, without interest or penalty, following the expiration of the rights offering.

What should I do if I want to participate in the rights offering but my shares are held in the name of my broker, dealer, custodian bank or other nominee (commonly referred to as “street name”)?

If you hold your common shares in the name of a broker, dealer, custodian bank or other nominee, then your broker, dealer, custodian bank or other nominee is the record holder of the shares you own. Consequently, you will not receive a rights certificate. Instead, the record holder (i.e., your broker, dealer, custodian bank or other nominee) must exercise the subscription rights on your behalf for the common shares you wish to purchase.

If you hold your Gyrodyne common shares in the name of a broker, dealer, custodian bank or other nominee and you wish to purchase shares in the rights offering, please promptly contact your broker, dealer, custodian bank or other nominee as record holder of your shares. For our part, we will ask your record holder to notify you of the rights offering. Nevertheless, if your broker, dealer, custodian bank or other nominee does not contact you regarding the rights offering, you should promptly initiate contact with that intermediary if you wish to participate in the offering. Your broker, dealer, custodian bank or other nominee may establish a deadline prior to 5:00 p.m. New York City time on [●], 2024, which we have established as the expiration date of the rights offering.

When will I receive my new shares?

We will issue shares purchased in the rights offering as soon as practicable after the expiration of the rights offering. All shares that are purchased in the rights offering will be issued in uncertificated book-entry form, meaning that you will receive a direct registration account statement from our transfer agent reflecting ownership of these securities if you are a holder of record. If you hold your shares in the name of a bank, broker, dealer or other nominee, DTC will credit your nominee with the securities you purchased in the rights offering.

After I send in my payment and rights certificate, may I change or cancel my exercise of rights?

No. All exercises of subscription rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise of your subscription rights. However, if we amend the rights offering to allow for an extension of the rights offering for a period of more than 30 days or make a fundamental change to the terms of the rights offering set forth in this prospectus, you may cancel your subscription and receive a refund of any money you have advanced. You should not exercise your subscription rights unless you are certain that you wish to purchase additional Gyrodyne common shares at a subscription price of $8.00 per share.

How many shares of capital stock will be issued and outstanding after the rights offering?

As of January 19, 2024, there were 1,574,308 of our common shares outstanding. We will issue 625,000 common shares in the rights offering, assuming the rights offering is fully subscribed, but there is no minimum number of shares required to complete the rights offering. Based on the number of shares outstanding as of January 19, 2024, if we issue all 625,000 common shares available in this rights offering, the number of common shares we would have outstanding after giving effect to the rights offering will be 2,199,308.

Are there risks in exercising my subscription rights?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional common shares and should be considered as carefully as you would consider any other equity investment. Among other things, you should carefully consider the risks described in the section of this prospectus entitled “Risk Factors.”

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The subscription agent will hold all funds it receives in a segregated bank account until completion of the rights offering. If the rights offering is not completed, all subscription payments received by the subscription agent will be returned promptly, without interest or penalty. If you own shares in “street name,” it may take longer for you to receive payment because the subscription agent will return payments through the record holder of your shares (i.e., through your custodian bank, broker, dealer or other nominee).

Will the subscription rights be listed on a stock exchange or national market?

No. The subscription rights may not be sold, transferred or assigned and will not be listed for trading on Nasdaq or on any other stock exchange or market or on the OTC Bulletin Board.

How do I exercise my rights if I live outside the United States?

If you are a shareholder whose address is outside the United States, the subscription agent will not mail rights certificates to you, and your rights certificates will be held by the subscription agent for your account until any instructions are received to exercise your rights. If you are a rights holder whose address is outside the United States, to exercise your rights, you must notify the subscription agent on or prior to 11:00 a.m., New York City time, on [●], 2024, which is five business days prior to the expiration date for the rights offering, unless extended by us, and, if we so request, must establish to our satisfaction that you are permitted to exercise your rights under applicable law. Any questions related to exercising rights should be directed to the subscription agent. If you do not follow these procedures prior to the expiration of the rights offering, your rights will expire. We will decide all questions concerning the timeliness, validity, form and eligibility of the exercise of your rights and any such determinations by us will be final and binding.

What fees or charges apply if I purchase the common shares?

We are not charging any fee or sales commission to issue subscription rights to you or to issue shares to you if you exercise your subscription rights. If, however, you exercise your subscription rights through your broker, dealer, custodian bank or other nominee, you are responsible for paying any fees your nominee may charge you.

What are the U.S. federal income tax considerations applicable to U.S. holders of receiving or exercising rights?

Although the authorities governing transactions such as the rights offering are complex and unclear in certain respects (including with respect to the effects of the oversubscription privilege), we believe and intend to take the position that a U.S. holder’s (as defined in this prospectus under “Material U.S. Federal Income Tax Consequences”) receipt of rights pursuant to the rights offering should not be treated as a taxable distribution with respect to such holder’s existing common shares for U.S. federal income tax purposes. This position regarding the non-taxable treatment of the rights offering is not binding on the IRS or the courts. If this position is finally determined by the IRS or a court to be incorrect, the fair market value of the rights would be taxable to U.S. holders of our common shares as a distribution to the extent of the U.S. holder’s pro rata share of our current and accumulated earnings and profits, if any, with any excess being treated as a return of capital to the extent thereof and then as capital gain. Although no assurance can be given, the Company anticipates that it will not have current and accumulated earnings and profits through the end of 2023. For a more detailed discussion, including U.S. federal income tax considerations applicable to Non-U.S. holders, see “Material U.S. Federal Income Tax Consequences.” You should consult your tax advisor as to the particular considerations applicable to you of the rights offering.

How much money will Gyrodyne receive from the rights offering?

If we issue all 625,000 shares available in the rights offering, the net proceeds to us, after deducting estimated offering expenses, will be approximately $4,400,000. However, there is no minimum number of shares required to complete the rights offering. We estimate that the expenses of the rights offering will be approximately $600,000, irrespective of the number of shares we sell or the amount of proceeds we raise in the offering. Accordingly, the estimated $600,000 of offering expenses will constitute approximately 12% of the offering proceeds if we issue all 625,000 shares available in the rights offering, or a greater percentage of such net proceeds to the extent that we close the offering with net proceeds below $5,000,000.

To whom should I send my forms and payment?

If you received a rights certificate with this prospectus and wish to purchase shares during the rights offering, you should send your properly completed and signed rights certificate, any other subscription documents and payment by first class mail or courier service to the subscription agent at:

|

All trackable mail, including Overnight Delivery:

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer; COY: GYRO

150 Royall Street, Suite V

Canton, MA 02021

|

If Delivering by Mail:

Computershare Trust Company, N.A.

Attn: Corporate Actions Voluntary Offer; COY: GYRO

P.O. Box 43011

Providence, RI 02940-3011

|

Delivery will only be deemed valid if delivered in line with the above delivery instructions.

You are solely responsible for completing delivery to the subscription agent of your subscription materials. The subscription materials are to be received by the subscription agent on or prior to 5:00 p.m., New York City time, on [●], 2024. We urge you to allow sufficient time for delivery of your subscription materials to the subscription agent.

Whom should I contact if I have other questions?

If you have more questions about the rights offering or need additional copies of the rights offering documents, please contact the information agent, MacKenzie Partners, Inc., 1407 Broadway, 27th Floor, New York, NY 10018, or telephone (800) 322-2885 (toll free).

For a more complete description of the rights offering, see “The Rights Offering” beginning on page 24 of this prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the specific risks described below before making an investment decision. See the section of this prospectus entitled “Where You Can Find More Information.” Any of the risks we describe below could cause our business, financial condition, results of operations or future prospects to be materially and adversely affected. The market price of our common shares could decline if one or more of these risks and uncertainties develop into actual events and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition, results of operations or future prospects. In addition, some of the statements in this section of the prospectus are forward-looking statements. For more information about forward-looking statements, see the section of this prospectus entitled “Cautionary Statement Concerning Forward-Looking Information” above.

Risks Related to the Rights Offering

If we consummate the rights offering and you do not fully exercise your basic subscription privilege, your interest in us will be diluted. In addition, if you do not exercise your basic subscription privilege in full and the subscription price is less than the market price of our common shares, then you would experience an immediate dilution of the aggregate fair value of your shares, which could be substantial.