UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number 001-39476

GreenPower Motor Company Inc.

(Translation of registrant's name into English)

#240 - 209 Carrall Street, Vancouver, British Columbia V6B 2J2

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GreenPower Motors Inc.

/s/ Michael Sieffert

__________________________________________

Michael Sieffert, Chief Financial Officer

Date: March 1, 2024

GREENPOWER MOTOR COMPANY INC.

Suite 240 - 209 Carrall Street

Vancouver, B.C. V6B 2J2

Telephone: (604) 563-4144

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the "Meeting") of shareholders of GreenPower Motor Company Inc. (the "Company" or "GreenPower") will be held at Clark Wilson LLP, Suite 900 - 885 West Georgia Street, Vancouver, BC V6C 3H1 on Wednesday, March 27, 2024, at the hour of 2:00 p.m. (Pacific time) for the following purposes:

1. to receive the audited financial statements of the Company for the fiscal year ended March 31, 2023 and the accompanying report of the auditors;

2. to set the number of directors of the Company for the ensuing year at six (6) persons;

3. to elect Mark Achtemichuk, Fraser Atkinson, Malcolm Clay, Cathy McLay, David Richardson and Brendan Riley as directors of the Company;

4. to appoint BDO Canada LLP, Chartered Professional Accountants, as the auditors of the Company for the ensuing fiscal year and to authorize the directors of the Company to fix the remuneration to be paid to the auditors;

5. to consider and, if thought fit, to re-approve the Company's 2022 Equity Incentive Plan, including approval of a 10% rolling plan for stock options and approval, ratification and confirmation of an increase in the number of common shares under the fixed portion of the plan from 2,467,595 to 2,499,116 common shares for performance-based awards of restricted share units, performance share units and deferred share units, all as described in the accompanying information circular (the "Information Circular"); and

6. to transact such further or other business as may properly come before the Meeting and any adjournment or postponement thereof.

The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting and is supplemental to, and expressly made a part of, this notice of Meeting (the "Notice of Meeting").

The board of directors of the Company has fixed February 20, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof. Each registered shareholder at the close of business on that date is entitled to such notice and to vote at the Meeting in the circumstances set out in the accompanying Information Circular.

If you are a registered shareholder of the Company and unable to attend the Meeting in person, please vote by proxy by following the instructions provided in the form of proxy, at least 48 hours (excluding Saturdays, Sundays and holidays recognized in the Province of British Columbia) before the time and date of the Meeting or any adjournment or postponement thereof.

If you are a non-registered holder of common shares and have received this Notice of Meeting and accompanying materials through an intermediary, such as an investment dealer, broker, custodian, administrator a trustee or administrator of a retirement savings plan, retirement income fund, education savings plan or other similar savings or investment plan registered under the Income Tax Act (Canada), or other nominee, or a clearing agency in which the intermediary participates (each an "Intermediary"), please complete and return the materials in accordance with the instructions provided to you by your Intermediary.

Dated at Vancouver, British Columbia as of this 23rd day of February, 2024.

By Order of the Board of Directors of

GREENPOWER MOTOR COMPANY INC.

"Fraser Atkinson"

Fraser Atkinson

Chairman and Director

GREENPOWER MOTOR COMPANY INC.

Suite 240 - 209 Carrall Street

Vancouver, B.C. V6B 2J2

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

OF SHAREHOLDERS

TO BE HELD ON MARCH 27, 2024

AND

INFORMATION CIRCULAR

February 23, 2024

This document requires immediate attention. If you are in doubt as to how to deal with the documents or matters referred to in this notice and information circular, you should immediately contact your advisor.

GREENPOWER MOTOR COMPANY INC.

Suite 240 - 209 Carrall Street

Vancouver, B.C. V6B 2J2

Telephone: (604) 563-4144

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

TO THE SHAREHOLDERS:

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the "Meeting") of shareholders of GreenPower Motor Company Inc. (the "Company" or "GreenPower") will be held at Clark Wilson LLP, Suite 900 - 885 West Georgia Street, Vancouver, BC V6C 3H1 on Wednesday, March 27, 2024, at the hour of 2:00 p.m. (Pacific time) for the following purposes:

1. to receive the audited financial statements of the Company for the fiscal year ended March 31, 2023 and the accompanying report of the auditors;

2. to set the number of directors of the Company for the ensuing year at six (6) persons;

3. to elect Mark Achtemichuk, Fraser Atkinson, Malcolm Clay, Cathy McLay, David Richardson and Brendan Riley as directors of the Company;

4. to appoint BDO Canada LLP, Chartered Professional Accountants, as the auditors of the Company for the ensuing fiscal year and to authorize the directors of the Company to fix the remuneration to be paid to the auditors;

5. to consider and, if thought fit, to re-approve the Company's 2022 Equity Incentive Plan, including approval of a 10% rolling plan for stock options and approval, ratification and confirmation of an increase in the number of common shares under the fixed portion of the plan from 2,467,595 to 2,499,116 common shares for performance-based awards of restricted share units, performance share units and deferred share units, all as described in the accompanying information circular (the "Information Circular"); and

6. to transact such further or other business as may properly come before the Meeting and any adjournment or postponement thereof.

The accompanying Information Circular provides additional information relating to the matters to be dealt with at the Meeting and is supplemental to, and expressly made a part of, this notice of Meeting (the "Notice of Meeting").

The board of directors of the Company has fixed February 20, 2024 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournment or postponement thereof. Each registered shareholder at the close of business on that date is entitled to such notice and to vote at the Meeting in the circumstances set out in the accompanying Information Circular.

If you are a registered shareholder of the Company and unable to attend the Meeting in person, please vote by proxy by following the instructions provided in the form of proxy, at least 48 hours (excluding Saturdays, Sundays and holidays recognized in the Province of British Columbia) before the time and date of the Meeting or any adjournment or postponement thereof.

If you are a non-registered holder of common shares and have received this Notice of Meeting and accompanying materials through an intermediary, such as an investment dealer, broker, custodian, administrator a trustee or administrator of a retirement savings plan, retirement income fund, education savings plan or other similar savings or investment plan registered under the Income Tax Act (Canada), or other nominee, or a clearing agency in which the intermediary participates (each an "Intermediary"), please complete and return the materials in accordance with the instructions provided to you by your Intermediary.

Dated at Vancouver, British Columbia as of this 23rd day of February, 2024.

By Order of the Board of Directors of

GREENPOWER MOTOR COMPANY INC.

"Fraser Atkinson"

Fraser Atkinson

Chairman and Director

GREENPOWER MOTOR COMPANY INC.

Suite 240 - 209 Carrall Street

Vancouver, B.C. V6B 2J2

Telephone: (604) 563-4144

INFORMATION CIRCULAR

February 23, 2024

INTRODUCTION

This Information Circular accompanies the Notice of Annual General and Special Meeting (the "Notice") and is furnished to shareholders (each, a "Shareholder") holding common shares (each, a "Share") in the capital of GreenPower Motor Company Inc. (the "Company") in connection with the solicitation by the management of the Company of proxies to be voted at the annual general and special meeting (the "Meeting") of the Shareholders to be held at Clark Wilson LLP, Suite 900 - 885 West Georgia Street, Vancouver, B.C. V6C 3H1, on Wednesday, March 27, 2024, at 2:00 p.m., Pacific Time, or at any adjournment or postponement thereof.

Date and Currency

The date of this Information Circular is February 23, 2024. Unless otherwise stated, all amounts herein are in Canadian dollars.

PROXIES AND VOTING RIGHTS

Management Solicitation

The solicitation of proxies by management of the Company will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation to any of the directors, officers and employees of the Company. The Company does not reimburse Shareholders, nominees or agents for costs incurred in obtaining from their principals authorization to execute forms of proxy, except that the Company has requested brokers and nominees who hold stock in their respective names to furnish this proxy material to their customers who are NOBOs (as defined below), and the Company will reimburse such brokers and nominees for their related out of pocket expenses. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company.

No person has been authorized to give any information or to make any representation other than as contained in this Information Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Information Circular shall not create, under any circumstances, any implication that there has been no change in the information set forth herein since the date of this Information Circular. This Information Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

Appointment of Proxy

Registered Shareholders and duly appointed proxyholders are entitled to vote at the Meeting. A Shareholder is entitled to one vote for each Share that such Shareholder holds on the record date of February 20, 2024 on the resolutions to be voted upon at the Meeting, and any other matter to come before the Meeting.

The persons named as proxyholders (the "Designated Persons") in the enclosed form of proxy are directors and/or officers of the Company.

A SHAREHOLDER HAS THE RIGHT TO APPOINT A PERSON OR COMPANY (WHO NEED NOT BE A SHAREHOLDER) OTHER THAN THE DESIGNATED PERSONS NAMED IN THE ENCLOSED FORM OF PROXY TO ATTEND AND ACT FOR OR ON BEHALF OF THAT SHAREHOLDER AT THE MEETING.

A SHAREHOLDER MAY EXERCISE THIS RIGHT BY INSERTING THE NAME OF SUCH OTHER PERSON IN THE BLANK SPACE PROVIDED ON THE FORM OF PROXY. SUCH SHAREHOLDER SHOULD NOTIFY THE NOMINEE OF THE APPOINTMENT, OBTAIN THE NOMINEE'S CONSENT TO ACT AS PROXY AND SHOULD PROVIDE INSTRUCTION TO THE NOMINEE ON HOW THE SHAREHOLDER'S SHARES SHOULD BE VOTED. THE NOMINEE SHOULD BRING PERSONAL IDENTIFICATION TO THE MEETING.

The Shareholder may vote by mail, by telephone or via the Internet by following the instructions provided in the form of proxy at least 48 hours (excluding Saturdays, Sundays and holidays recognized in the Province of British Columbia) prior to the scheduled time of the Meeting (i.e. 2:00 p.m. PT on Monday March 25, 2024), or any adjournment or postponement thereof. The Chairman of the Meeting, in their sole discretion, may accept completed forms of proxy on the day of the Meeting or any adjournment or postponement thereof.

A proxy may not be valid unless it is dated and signed by the Shareholder who is giving it or by that Shareholder's attorney-in-fact duly authorized by that Shareholder in writing or, in the case of a corporation, dated and executed by a duly authorized officer or attorney-in-fact for the corporation. If a form of proxy is executed by an attorney-in-fact for an individual Shareholder or joint Shareholders, or by an officer or attorney-in-fact for a corporate Shareholder, the instrument so empowering the officer or attorney-in-fact, as the case may be, or a notarial certified copy thereof, must accompany the form of proxy.

Revocation of Proxies

A Shareholder who has given a proxy may revoke it at any time before it is exercised by an instrument in writing: (a) executed by that Shareholder or by that Shareholder's attorney-in-fact, authorized in writing, or, where the Shareholder is a corporation, by a duly authorized officer of, or attorney-in-fact for, the corporation; and (b) delivered either: (i) to the Company at the address set forth above, at any time up to and including the last business day preceding the day of the Meeting or, if adjourned or postponed, any reconvening thereof, (ii) to the Chairman of the Meeting prior to the vote on matters covered by the proxy on the day of the Meeting or, if adjourned or postponed, any reconvening thereof, or (iii) in any other manner provided by law.

Also, a proxy will automatically be revoked by either: (i) attendance at the Meeting and participation in a poll (ballot) by a Shareholder, or (ii) submission of a subsequent proxy in accordance with the foregoing procedures. A revocation of a proxy does not affect any matter on which a vote has been taken prior to any such revocation.

Voting of Shares and Proxies and Exercise of Discretion by Designated Persons

A Shareholder may indicate the manner in which the Designated Persons are to vote with respect to a matter to be voted upon at the Meeting by marking the appropriate space on the proxy. The Shares represented by a proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

IF NO CHOICE IS SPECIFIED IN THE PROXY WITH RESPECT TO A MATTER TO BE ACTED UPON, THE PROXY CONFERS DISCRETIONARY AUTHORITY WITH RESPECT TO THAT MATTER UPON THE DESIGNATED PERSONS NAMED IN THE FORM OF PROXY. IT IS INTENDED THAT THE DESIGNATED PERSONS WILL VOTE THE SHARES REPRESENTED BY THE PROXY IN FAVOUR OF EACH MATTER IDENTIFIED IN THE PROXY.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to other matters which may properly come before the Meeting, including any amendments or variations to any matters identified in the Notice, and with respect to other matters which may properly come before the Meeting. At the date of this Information Circular, management of the Company is not aware of any such amendments, variations, or other matters to come before the Meeting.

In the case of abstentions from, or withholding of, the voting of the Shares on any matter, the Shares that are the subject of the abstention or withholding will be counted for determination of a quorum, but will not be counted as affirmative or negative on the matter to be voted upon.

ADVICE TO BENEFICIAL SHAREHOLDERS

The information set out in this section is of significant importance to those Shareholders who do not hold Shares in their own name. Shareholders who do not hold their Shares in their own name (referred to in this Information Circular as "Beneficial Shareholders") should note that only proxies deposited by Shareholders whose names appear on the records of the Company as the registered holders of Shares can be recognized and acted upon at the Meeting. If Shares are listed in an account statement provided by a broker, then in almost all cases those Shares will not be registered in the Beneficial Shareholder's name on the records of the Company. Such Shares will more likely be registered under the names of the Beneficial Shareholder's broker or an agent of that broker. In the United States, the vast majority of such Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for some Canadian brokerage firms). Beneficial Shareholders should ensure that instructions respecting the voting of their Shares are communicated to the appropriate person well in advance of the Meeting.

The Company does not have access to the names of all Beneficial Shareholders. Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of Shareholders' meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Shares are voted at the Meeting. The form of proxy supplied to a Beneficial Shareholder by its broker (or the agent of the broker) is similar to the form of proxy provided to registered Shareholders by the Company. However, its purpose is limited to instructing the registered Shareholder (the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. ("Broadridge") in the United States and in Canada. Broadridge typically prepares a special voting instruction form, mails this form to the Beneficial Shareholders and asks for appropriate instructions regarding the voting of Shares to be voted at the Meeting. If Beneficial Shareholders receive the voting instruction forms from Broadridge, they are requested to complete and return the voting instruction forms to Broadridge by mail. Alternatively, Beneficial Shareholders can call a toll- free number and access Broadridge's dedicated voting website www.proxyvote.com (each as noted on the voting instruction form) to deliver their voting instructions and to vote the Shares held by them. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting. A Beneficial Shareholder receiving a Broadridge voting instruction form cannot use that form as a proxy to vote Shares directly at the Meeting - the voting instruction form must be returned to Broadridge well in advance of the Meeting in order to have the applicable Shares voted at the Meeting.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Shares registered in the name of their broker (or agent of the broker), a Beneficial Shareholder may attend at the Meeting as proxyholder for the registered Shareholder and vote the Shares in that capacity. Beneficial Shareholders who wish to attend at the Meeting and indirectly vote their Shares as proxyholder for the registered Shareholder should enter their own names in the blank space on the instrument of proxy provided to them, follow the instructions on the form, and return the same to their broker (or the broker's agent) in accordance with the instructions provided by such broker (or agent), well in advance of the Meeting.

Alternatively, a U.S. Beneficial Shareholder may request in writing that their broker send to the Beneficial Shareholder a legal proxy which would enable the Beneficial Shareholder to attend at the Meeting and vote their Shares.

Beneficial Shareholders consist of non-objecting beneficial owners ("NOBOs") and objecting beneficial owners ("OBOs"). A NOBO is a beneficial owner of securities that has provided instructions to an intermediary holding the securities in an account on behalf of the beneficial owner that the beneficial owner does not object, for that account, to the intermediary disclosing ownership information about the beneficial owner under National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer ("NI 54-101") of the Canadian Securities Administrators. An OBO means a beneficial owner of securities that has provided instructions to an intermediary holding the securities in an account on behalf of the beneficial owner that the beneficial owner objects, for that account, to the intermediary disclosing ownership information about the beneficial owner under NI 54-101.

The Company is not sending proxy-related materials directly to NOBOs or OBOs of the Shares. Management of the Company does not intend to pay for intermediaries to forward to OBOs the proxy- related materials and in the case of an OBO, the OBO of the Shares will not receive the materials unless their intermediary assumes the costs of delivery.

All references to Shareholders in this Information Circular are to registered Shareholders, unless specifically stated otherwise.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The Company is authorized to issue an unlimited number of Shares without par value. As of the record date, determined by the board of directors of the Company (the "Board") to be the close of business on February 20, 2024, a total of 24,991,162 Shares were issued and outstanding. Each Share carries the right to one vote at the Meeting.

Only registered Shareholders as of the record date are entitled to receive notice of, and to attend and vote at, the Meeting or any adjournment or postponement of the Meeting.

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Shares carrying more than

10% of the voting rights attached to the outstanding Shares of the Company, other than as set forth below:

| |

|

Percentage of |

| Name of Shareholder |

Number of Shares Owned |

Outstanding Shares |

| Fraser Atkinson |

2,903,121 (1) |

11.6% |

| David Richardson |

2,873,097 (2) |

11.5% |

(1) Mr. Atkinson holds 1,325,052 Shares directly, 28,571 Shares in the Atkinson Family Trust, 804,854 Shares indirectly with Koko Financial Services Ltd., a private company owned by Mr. Atkinson, 708,928 Shares indirectly with KFS Capital LLC, a private company owned by Mr. Atkinson, 17,858 indirectly through H. Atkinson ITF SS Atkinson and 17,858 indirectly through H. Atkinson ITF RR Atkinson.

(2) Mr. Richardson holds 115,000 Shares directly and 2,758,097 Shares indirectly through Countryman Investments Ltd.

FINANCIAL STATEMENTS

The audited financial statements of the Company for the year ended March 31, 2023, together with the auditor's report thereon, will be presented to the Shareholders at the Meeting. The Company's financial statements and management discussion and analysis are available on SEDAR+ at www.sedarplus.ca

NUMBER OF DIRECTORS

At the Meeting, Shareholders will be asked to pass an ordinary resolution to set the number of directors of the Company at six (6). An ordinary resolution needs to be passed by a simple majority of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Meeting.

Management recommends the approval of setting the number of directors of the Company at six (6).

ELECTION OF DIRECTORS

At present, the directors of the Company are elected at each annual general meeting and hold office until the next annual general meeting, or until their successors are duly elected or appointed in accordance with the Company's Articles or until such director's earlier death, resignation or removal. In the absence of instructions to the contrary, the enclosed form of proxy will be voted for the nominees listed in the form of proxy. All of the nominees listed in the form of proxy are presently members of the Board.

Management of the Company proposes to nominate the persons named in the table below for election by the Shareholders as directors of the Company. Information concerning such persons, as furnished by the individual nominees, is as follows:

Name, Province,

Country of Residence

and Position(s)

with the Company |

Principal Occupation,

Business or Employment for last

five years |

Periods during

which Nominee has

Served

as a Director |

Number of

Shares

Owned(1) |

Fraser Atkinson (3)

British Columbia, Canada

Chief Executive Officer,

Chairman and Director |

Chairman of the Company since February 2011 and CEO since June 2019; Director of Equus Total Return, Inc. since May 2010; and Director of Amego Capital Corp. since July 2021. |

February 11, 2011

to present |

2,903,121(5) |

Brendan Riley

California, United States

President and Director |

President of the Company since October 2016 and Director since July 2019; VP Bus, Truck and Material Handling of BYD Motors Inc from October 2011 to October 2016. |

July 3, 2019

to present |

81,716(6) |

Mark Achtemichuk(3)

British Columbia, Canada

Director |

Recently retired. Most recently Senior Vice President at CMLS Financial Ltd. from April 2010 to January 2021; and principal of MSA Holdings, Inc. since July 2007. |

February 22, 2011

to present |

82,078(7) |

Malcolm Clay(2)(3)(4)

British Columbia, Canada

Director |

Currently retired. Mr. Clay was a Partner with KPMG LLP from September 1975 to September 2002. Since retirement Mr.

Clay has been active as a consultant and Corporate Director for several public companies. |

February 22, 2011

to present |

605,915(8) |

David Richardson (2)(4)

British Columbia, Canada

Director |

Founder and CEO of Octaform Systems Inc. from May 1997 to present. Mr.

Richardson has served on a number of public and private boards throughout his career. Currently he is a Director of ZS2 Technologies Ltd. since October 2020. |

March 25, 2015

to present |

2,873,097(9) |

Cathy McLay(2)(4)

British Columbia, Canada

Director |

Ms. McLay retired in 2018 from Translink, a public transit service provider in Metro Vancouver as the CFO, EVP Finance and corporate services and for a period the interim CEO. She currently serves on the boards of the Vancouver Fraser Port Authority (Chair), British Columbia Hydro Authority (Chair Site C) and British Columbia Ferry Services (Chair, Audit Committee). Ms. McLay is a fellow of the Chartered Professional Accountants of British Columbia and a graduate of the Institute of Corporate Directors Education Program.

|

January 20, 2020

to present |

9,715(10) |

(1) Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at February 17, 2023 based upon information furnished to the Company by the individual directors.

(2) Member of the Audit Committee.

(3) Member of Nominating Committee.

(4) Member of Compensation Committee.

(5) Mr. Atkinson holds 1,325,052 Shares directly, 28,571 Shares in the Atkinson Family Trust, 804,854 Shares indirectly with Koko Financial Services Ltd. ("Koko"), a private company owned by Mr. Atkinson, 708,928 Shares indirectly with KFS Capital LLC ("KFS"), a private company owned by Mr. Atkinson, 17,858 indirectly through H. Atkinson ITF SS Atkinson and 17,858 indirectly through H. Atkinson ITF RR Atkinson. Mr. Atkinson also beneficially holds 238,570 stock options, each of which entitles Mr. Atkinson to purchase one Share, of which , 28,571 stock options are exercisable at a price of $2.59 per Share until January 30, 2025, 100,000 stock options are exercisable at a price of U.S. $20.00 per Share until November 19, 2025, and 50,000 stock options are exercisable at a price of $16.45 per share until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

(6) Brendan Riley holds 81,716 Shares directly. Mr. Riley also beneficially holds 245,714 stock options, each of which entitles Mr. Riley to purchase one Share, of which 35,714 stock options are exercisable at a price of $2.59 per Share until January 30, 2025, 100,000 stock options are exercisable at a price of U.S. $20.00 per Share until November 19, 2025, 50,000 stock options are exercisable at a price of $16.45 until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

(7) Mark Achtemichuk holds 72,505 Shares directly, 3,696 Shares through his TFSA account, 2,600 shares in his RRSP, and 3,277 Shares through his RESP account. Mr. Achtemichuk also beneficially holds 157,857 stock options, each of which entitles Mr. Achtemichuk to purchase one Share, of which 42,857 stock options are exercisable at a price of $2.59 per Share until January 30, 2025, 5,000 stock options are exercisable at a price of U.S. $20.00 per Share until December 4, 2025, 50,000 stock options are exercisable at a price of $16.45 per share until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

(8) Malcolm Clay holds 584,920 Shares directly, 17,070 Shares through his RRIF account and 3,925 Shares through his TFSA account. Mr. Clay also beneficially holds 143,571 stock options, each of which entitles Mr. Clay to purchase one Share, of which 28,571 stock options are exercisable at a price of $2.59 per Share until January 30, 2025, 5,000 stock options exercisable at a price of U.S. $20.00 per Share until December 4, 2025, 50,000 stock options exercisable at a price of $16.45 per Share until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

(9) David Richardson holds 115,000 Shares directly and 2,758,097 Shares indirectly through Countryman Investments Ltd. ("Countryman"). Mr. Richardson also directly holds 143,571 stock options, each of which entitles Mr. Richardson to purchase one Share, 28,571 stock options are exercisable at a price of $2.59 per Share until January 30, 2025, 5,000 stock options are exercisable at a price of U.S. $20.00 per Share until December 4, 2025, 50,000 stock options are exercisable at a price of $16.45 per share until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

(10) Cathy McLay holds 9,715 Shares directly. Ms. McLay also directly holds 157,857 stock options, 42,857 of which entitles Ms. McLay to purchase one Share which are exercisable at a price of $2.59 per Share until January 30, 2025, 5,000 stock options are exercisable at a price of U.S. $20.00 per Share until December 4, 2025, 50,000 stock options are exercisable at a price of $16.45 per share until December 10, 2026, and 60,000 stock options exercisable at a price of $3.80 per share until February 14, 2028.

It is the responsibility of the Insiders (including the directors and officers of the Company) to file in a timely fashion all of their transactions on www.sedi.ca, which the Company has relied on for the information contained in the Information Circular.

Management recommends the approval of each of the nominees listed above for election as directors of the Company for the ensuing year.

Orders

To the best of management's knowledge, no proposed director of the Company is, or within the ten (10) years before the date of this Information Circular has been, a director, chief executive officer or chief financial officer of any company that:

(a) was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or

(b) was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer.

Bankruptcies

Except as disclosed below, to the best of management's knowledge, no proposed director of the Company is, or within ten (10) years before the date of this Information Circular, has been, a director or an executive officer of any company that, while the person was acting in that capacity, or within a year of that person ceasing to act in the capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold its assets or made a proposal under any legislation relating to bankruptcies or insolvency. Mr. Fraser Atkinson is a director and officer of Alta Ready Mix Inc., which appointed Bowra Group Inc. who obtained an approval for a proposal to creditors on March 20, 2017 and court approval on April 11, 2017 for a creditor arrangement. Alta Ready Mix Inc. continues its business operations and is in good standing.

To the best of management's knowledge, no proposed director of the Company has, within 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director of the Company.

Penalties and Sanctions

To the best of management's knowledge, no proposed director of the Company has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director.

STATEMENT OF EXECUTIVE COMPENSATION

General

For the purpose of this Information Circular:

"CEO" means an individual who acted as chief executive officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

"CFO" means an individual who acted as chief financial officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

"closing market price" means the price at which the company's security was last sold, on the applicable date,

(a) in the security's principal marketplace in Canada, or

(b) if the security is not listed or quoted on a marketplace in Canada, in the security's principal marketplace;

"company" includes other types of business organizations such as partnerships, trusts and other unincorporated business entities;

"equity incentive plan" means an incentive plan, or portion of an incentive plan, under which awards are granted and that falls within the scope of IFRS 2 Share-based Payment;

"external management company" includes a subsidiary, affiliate or associate of the external management company;

"grant date" means a date determined for financial statement reporting purposes under IFRS 2 Share-based Payment;

"incentive plan" means any plan providing compensation that depends on achieving certain performance goals or similar conditions within a specified period;

"incentive plan award" means compensation awarded, earned, paid, or payable under an incentive plan;

"NEO" or "named executive officer" means each of the following individuals:

(a) a CEO;

(b) a CFO;

(c) each of the three most highly compensated executive officers of the company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than CDN$150,000, as determined in accordance with subsection 1.3(6), for that financial year; and

(d) each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year;

"non-equity incentive plan" means an incentive plan or portion of an incentive plan that is not an equity incentive plan;

"option-based award" means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar instruments that have option-like features;

"plan" includes any plan, contract, authorization, or arrangement, whether or not set out in any formal document, where cash, securities, similar instruments or any other property may be received, whether for one or more persons;

"replacement grant" means an option that a reasonable person would consider to be granted in relation to a prior or potential cancellation of an option;

"repricing" means, in relation to an option, adjusting or amending the exercise or base price of the option, but excludes any adjustment or amendment that equally affects all holders of the class of securities underlying the option and occurs through the operation of a formula or mechanism in, or applicable to, the option;

"share-based award" means an award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock.

For the purpose of this section, all amounts herein are reported in U.S. dollars unless stated otherwise.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Discussion and Analysis

The overall objective of the Company's compensation strategy is to offer short-term, medium-term and long-term compensation components to ensure that the Company has in place programs to attract, retain and develop management of the highest caliber and has in place a process to provide for the orderly succession of management, including receipt on an annual basis of any recommendations of the CEO, if any, in this regard. The Company currently has short-term, medium-term and long-term compensation components in place, and intends to further develop these compensation components. The objectives of the Company's compensation policies and procedures are to align the interests of the Company's employees with the interests of its Shareholders.

The Company has a compensation committee (the "Compensation Committee") comprised of Malcolm Clay, Cathy McLay and David Richardson and a nominating committee (the "Nominating Committee") comprised of Malcolm Clay, Fraser Atkinson and Mark Achtemichuk. Cathy McLay is the chair of the Compensation Committee and Malcolm Clay is the chair of the Nominating Committee. All tasks related to developing and monitoring the Company's approach to the compensation of officers of the Company and to developing and monitoring the Company's approach to the nomination of directors to the Board are performed by the members of these committees in consultation with the Board. The compensation of the NEOs and the Company's employees are reviewed, recommended and approved by these committees in consultation with the Board.

Compensation to NEOs may include a base salary that constitutes the Company's short-term compensation component. Such salary takes into account his or her existing professional qualifications and experience. The NEOs' performances and salaries are to be reviewed periodically on the anniversary of their employment with the Company. Increases in salary are to be evaluated on an individual basis and are performance and market-based.

The Company may also grant incentive securities to NEOs to satisfy the long-term compensation component. The Board may also award bonuses to its NEOs. The amount and award of such bonuses is discretionary, depending on, among other factors, the financial performance of the Company and the position of a NEO. The objective of the Company's base salary and bonus compensation elements is to compensate NEO's at competitive market levels in order to attract and retain the best individuals for these positions in order to achieve the Company's long-term plans and objectives. In addition, the objective of the Company's stock option compensation is to align each NEO's interests with the interests of the Shareholders. Depending on the NEO's position, the amount of the grant, and other factors, the vesting schedule of stock option grants is generally over a one year to a three-year period. This enables the stock option grant to provide both short-term and long-term incentive components to employees, which the Company believes better aligns the NEO's interests with those the Shareholders, as it provides incentives for the NEO to consider the longer-term business interests of the Company when fulfilling the duties of their role.

To make its recommendations on the compensation of our NEO's, the Compensation Committee takes into account the types of compensation and the amounts paid to directors and officers of a peer group of companies listed on the Nasdaq stock exchange in the same or similar industry with market capitalizations under $2 billion. In a review conducted during the year ended March 31, 2023, companies included in this peer group are Workhorse Group, Inc. (Nasdaq: WKHS); Lightning eMotors, Inc. (NYSE: ZEV); Arcimoto, Inc. (Nasdaq: FUV); Blink Charging Co. (Nasdaq:BLNK); Absolute Software (TSX: ABST, Nasdaq: ABST) and Kandi Technologies Group, Inc. (Nasdaq: KNDI). The Compensation Committee considers the peer group appropriate as these companies share the Company's listing exchange, are in the same or similar industry, and within a comparable market capitalization range.

In determining the amount of stock option grants to the CEO, CFO and President, the Compensation Committee considers market levels of grants to the peer group of comparable companies used to determine overall compensation levels. For grants to NEO's other than the CEO, CFO and President, the Compensation Committee considers recommendations from its senior executive officers, in addition to considering market levels of compensation for similar roles at comparable companies, and overall business performance.

During the year ended March 31, 2023, the Compensation Committee approved a bonus program for the CEO, the President and the CFO, with maximum payouts of $250,000, $137,500, and CDN$125,000 respectively. 60% of the potential bonus payout for each of these individuals was based on achieving consolidated sales revenue, based on the Issuer's audited annual financial statements for the year ended March 31, 2023, of between $30 million and $36 million, pro-rated. The remaining 40% of the potential bonus payout to these three executives was based on achieving a range of business objectives, the measurement of which is subjective, that are aligned with each executive's responsibilities, relating to areas including but not limited to production, supply chain, cost improvements, employees, financing, investor relations activities and regulatory filings and reporting. Based on these factors, the Board approved year- end bonuses for the year-ended March 31, 2023 for the CEO, President and CFO respectively, of $75,750, $82,500 and CDN$25,000 respectively.

The Company has not placed any restrictions on an NEO or a director's ability to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Risks Associated with Compensation Policies and Practices

In fulfilling its duties for oversight and administration of the Company's executive compensation program, the Compensation Committee considers risks associated with the Company's compensation policies and practices. The potential risks of the Company's compensation policies and practices are considered on an annual basis as part of the evaluation of the NEO's performance and determination of the overall compensation for the coming year, and more frequently where required or where appropriate. The Compensation Committee mitigates the risk of an NEO taking excessive or inappropriate risks by structuring the overall compensation to include both short-term and long-term components as well as fixed and variable elements. The long-term compensation includes stock options with vesting profiles between one to three years, which helps align management's interests with those of the Company, and helps to manage risk by linking a portion of the NEO's overall compensation to the longer term performance of the Company.

Performance Graph

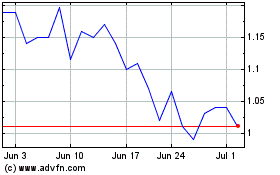

The above graph compares the total shareholder return on a CDN$100 investment in the Shares to the same investment in the S&P/TSX Venture Composite Index over the same period. The above graph shows how a CDN $100 investment in the Company on March 31, 2018 with a closing stock price of CDN $3.50 on such date (adjusted for a seven for one share consolidation in August 2020), would have decreased to CDN $89.42 on March 31, 2023, with a closing stock price of CDN $3.13 on such date.

As illustrated in the above chart, the Shares have outperformed the S&P/TSX Venture Composite Index over the past five years. The compensation to executive officers is set at levels that are comparable to similar roles at similar companies, and are comprised of base salary, bonuses, and option-based awards. The amount and award of bonuses is discretionary, depending on, among other factors, the financial performance of the Company and the position of a NEO.

Base salary and bonuses paid to NEO's has not been driven by share price performance, and rather are based on market factors. The majority of option based awards granted to the CEO, CFO and President, vest over a standard one year vesting period.

Share-based and Option-based Awards

The Company provides Option-based Awards to its employees and executive officers, and the Company does not offer Share-based Awards to executive officers, but may choose to do so in the future. Option- based Awards are generally granted to employees and executive officers on an annual basis based on the Company's performance, the individual's role, and the individual's performance based on the expectations of the role. In addition, option-based awards are typically granted to NEO's on their initial hire date as part of their long-term compensation. Previous grants are taken into account when considering new grants of options.

Compensation Governance

The Compensation Committee consists of Malcolm Clay, Cathy McLay and David Richardson. Cathy McLay is the chair of the Committee. Each of the members of the Compensation Committee are independent. All tasks related to developing and monitoring the Company's approach to the compensation of officers of the Company and to developing and monitoring the Company's approach to the nomination of directors to the Board are performed by the members of these committees in consultation with the Board. The compensation of the NEOs and the Company's employees are reviewed, recommended and approved by these committees in consultation with the Board.

Ms. McLay worked at TransLink from September 2008 to March 2018, most recently as the Chief Financial Officer and Executive Vice President Finance and Corporate Services. Previously, Ms. McLay worked in the forest sector in several senior executive roles at Canfor and Howe Sound Pulp and Paper. Ms. McLay currently serves on the boards of Insurance Corporation of British Columbia (Chair of the audit committee), Vancouver Fraser Port Authority, British Columbia Hydro Authority and British Columbia Ferry Services. She has previously served on the boards of Coast Mountain Bus Company, Providence Health Care, Transportation Property & Casualty Company Inc., British Columbia Rapid Transit Company Inc, Vancouver Coastal Health and Canfor Asia Corporation. Ms. McLay is an International Certified Business Coach, a fellow of the Chartered Professional Accountants of British Columbia and a graduate of the Institute of Corporate Directors Education Program.

Mr. Clay holds a Bachelor of Arts degree from the University of British Columbia (1965) and his designation as a CPA, CA from the Chartered Professional Accountants, British Columbia (1969), and an FCA from the Chartered Professional Accountants, British Columbia (1992). Mr. Clay is currently retired, and since retirement has been active as a financial consultant and corporate director.

Mr. Richardson is the founder and Chief Executive Officer of Octaform Systems Inc. since May 1997. Mr. Richardson is a Director of ZS2 Technologies Ltd. since October 2020 and a member of the Board of Trustees for AIP Realty Trust since December 2021. Mr. Richardson has received the ICD.D designation from the Institute of Corporate Directors.

The Board adopted a formal Compensation Committee Charter on August 23, 2020. The Compensation Committee, in consultation with the Board, conducts reviews with regards to the compensation of the Company's officers and directors once a year. Neither the Board nor the Compensation Committee has retained a compensation consultant during the year ended March 31, 2023, or between March 31, 2023 and the date of this Information Circular.

SUMMARY COMPENSATION TABLE

Summary Compensation Table

The following table sets out information concerning compensation earned by, paid to, or awarded to each NEO in the fiscal year ended March 31, 2023 for each of the Company's three most recently completed financial years (1):

| |

|

|

|

|

|

|

|

|

|

|

|

Non-equity

incentive plan

compensation

($) |

|

|

|

|

|

|

|

|

|

|

Name and Principal

Position |

Fiscal

Year |

|

Salary

($) |

|

|

Share-based

awards

($)(2) |

|

|

Option-based

awards

($)(3) |

|

|

Annual

incentive

plan

($)(2) |

|

|

Long-term

incentive

plans(2) |

|

|

Pension

value

($)(2) |

|

|

All other

compensation

($)(4) |

|

|

Total

compensation

($) |

|

Fraser Atkinson(5)

CEO, Chairman

and director |

2023 |

|

Nil |

|

|

N/A |

|

|

399,380 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

300,750(6) |

|

|

700,130 |

|

| 2022 |

|

Nil |

|

|

N/A |

|

|

467,348 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

281,250(6) |

|

|

748,598 |

|

| 2021 |

|

Nil |

|

|

N/A |

|

|

1,097,124 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

213,750(6) |

|

|

1,310,874 |

|

Brendan Riley(7) President

and director |

2023 |

|

275,000 |

|

|

N/A |

|

|

399,380 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

82,500 |

|

|

756,880 |

|

| 2022 |

|

273,990 |

|

|

N/A |

|

|

467,348 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

72,188 |

|

|

813,526 |

|

| 2021 |

|

231,875 |

|

|

N/A |

|

|

1,097,124 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

63,425 |

|

|

1,392,424 |

|

Michael Sieffert(8)

CFO and Secretary |

2023 |

|

190,000 |

(9) |

|

N/A |

|

|

399,380 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

19,000 |

|

|

608,380 |

|

| 2022 |

|

199,828 |

(9) |

|

N/A |

|

|

467,348 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

25,009 |

|

|

692,185 |

|

| 2021 |

|

159,408 |

(9) |

|

N/A |

|

|

1,097,124 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

22,928 |

|

|

1,279,460 |

|

Yanyan Zhang

Vice President of Program

Management |

2023 |

|

149,693 |

|

|

N/A |

|

|

137,191 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

286,884 |

|

| 2022 |

|

124,000 |

|

|

N/A |

|

|

191,992 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

321,992 |

|

| 2021 |

|

92,167 |

|

|

N/A |

|

|

16,546 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

146,546 |

|

Claus Tritt

Vice President of Medium

Duty and Commercial

Vehicle Sales |

2023 |

|

49,045 |

|

|

N/A |

|

|

16,149 |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

65,194 |

|

| 2022 |

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

| 2021 |

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

(1) All values in the table are expressed in US$.

(2) During the three fiscal years ending March 31, 2023, none of the NEOs were granted share based awards, nor did they receive non-equity incentive plan compensation. The Company offers an optional 401k plan for US employees under which the Company matches employee contributions made to the 401k plan up to $2,000 per annum. The Company offers an optional RSP plan for Canadian employees under which the Company matches employee contributions made to the RSP plan up to CAD2,700 per annum.

(3) Option-based awards were calculated at the fair market value at the time of grant under the Black-Scholes method. The value of options with an exercise price denominated in CDN$ was converted to US$ at exchange rates of $0.76, $0.80, and $0.76 in the years ended March 31, 2023, March 31, 2022, and March 31, 2021 respectively, and these exchange rates were the average exchange rates used for financial reporting purposes for the respective years.

(4) None of the NEOs are entitled to perquisites or other personal benefits which, in the aggregate, are worth over CDN$50,000 or over 10% of their base salary. Other compensation comprised of consulting fee, benefits and discretionary bonus.

(5) Mr. Atkinson was appointed as CEO on June 12, 2019.

(6) This consulting fee was paid to Koko Financial Services Ltd., a private company owned by Mr. Atkinson, as compensation for Mr. Atkinson's provision of services of Koko Financial Services Ltd. fulfilling the duties of CEO of the Company. Neither Mr. Atkinson nor Koko Financial Services Ltd. received additional compensation for Mr. Atkinson's services as a director of the Company. Pursuant to the amended management services agreement between the Company and Koko Financial Services Ltd. dated February 26, 2020, the Company agreed to pay Koko Financial Services Ltd. a base fee of $225,000 per annum (plus GST) payable monthly commencing January 1, 2020.

(7) Brendan Riley was appointed President of the Company on September 19, 2016 and was appointed as a director of the Company on July 3, 2019.

(8) Michael Sieffert was appointed as the CFO and secretary of the Company on December 1, 2018.

(9) Salary paid to Michael Sieffert was converted from CDN$ to US$ at exchange rates of $0.76, $0.80, and $0.76 in the years ended March 31, 2023, March 31, 2022, and March 31, 2021 respectively, and these exchange rates were the average exchange rates used for financial reporting purposes for the respective years.

(10) Yanyan Zhang was promoted to Vice President of Program Management in May of 2021.

(11) Claus Tritt was appointed as the Vice President of Medium Duty and Commercial Vehicle Sales on November 28 of 2022.

Narrative Discussion

Employment, Consulting and Management Agreements

Fraser Atkinson

On February 26, 2020, the Company entered into a management services agreement with Koko Financial Services Ltd. which was effective starting June 12, 2019 for a term of one year, however if neither party has provided the other party with a notice of termination, then the agreement automatically renews on a month-to-month basis. Pursuant to this agreement, Koko Financial Services Ltd. accepted the appointment with the designated personnel Fraser Atkinson acting as the CEO of the Company and all of the Company's subsidiary companies. Mr. Atkinson's current duties are to lead in conjunction with the Board, in the development of the Company's strategy, and to oversee the implementation of the strategy; to ensure the Company is appropriately staffed and organized, to assess business risks and ensure effective controls and systems are in place; to work with the management team to execute on the strategic direction of the Company, including overseeing the material undertakings and activities of the Company and ensure that the directors are properly informed so they can form appropriate judgments. So long as this management services agreement remains in effect, the Company agreed to pay Koko Financial Services Ltd. a base fee of $18,750 per month (plus applicable taxes) for carrying out the services payable on the last day of each month. The base fee does not include any bonuses that might be paid to Koko Financial Services Ltd. for carrying out the services. During November 2020 Mr. Atkinson received a grant of 100,000 stock options that are exercisable at a price of $20.00, have a term of five years, and vest over a three-year period. Subsequent to the year ended March 31, 2021, the Compensation Committee approved a bonus program for Mr. Atkinson with a maximum payout of $250,000. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on the Company's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Atkinson's responsibilities, the measurement of which is subjective.

On September 29, 2023 GreenPower entered into an employment agreement with Koko Financial Services Inc. and Fraser Atkinson, which was effective as of April 1, 2023. Under the terms of the employment agreement, Koko Financial Services Inc. accepted the appointment with the designated personnel Fraser Atkinson to serve as the Chief Executive Officer of the Company for a term of one year from the effective date, which shall be automatically extended for periods of one year if not otherwise terminated pursuant to the terms of the agreement. Under the terms of the employment agreement Koko Financial Services shall be paid a base fee of US$450,000 per year, plus applicable taxes, and shall be eligible for cash bonuses of up to 125% of the annual base fee. In addition and pursuant to the employment agreement, Fraser Atkinson is eligible for stock option grants and equity incentive grants.

Brendan Riley

Effective October 1, 2020 Mr. Riley's base compensation was increased to $250,000 per annum and during November 2020 Mr. Riley received a one time bonus of $50,000, and a grant of 100,000 stock options that are exercisable at a price of $20.00, have a term of five years, and vest over a three-year period. During the year ended March 31, 2022, the Compensation Committee approved an increase to the base salary of Mr. Riley to $275,000 per annum. In addition, subsequent to the year ended March 31, 2021, the Compensation Committee approved a bonus program for Mr. Riley with a maximum payout of $137,500. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on the Company's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Riley's responsibilities, the measurement of which is subjective.

On September 29, 2023 GreenPower entered into an employment agreement with Brendan Riley, which was effective as of April 1, 2023. Under the terms of the employment agreement, Brendan Riley agreed to serve as the President of the Company for a term of one year from the effective date, which shall be automatically extended for periods of one year if not otherwise terminated pursuant to the terms of the employment agreement. Under the terms of the employment agreement Brendan Riley will be paid a base salary of US$350,000 per year, and shall be eligible for cash bonuses of up to 100% of his annual base salary. In addition and pursuant to the employment agreement, Brendan Riley is eligible for stock option grants and equity incentive grants.

Michael Sieffert

During the year ended March 31, 2022, the Compensation Committee approved an increase to the base salary of Mr. Sieffert from CDN $225,000 to CDN$250,000 per annum. In addition, subsequent to the year ended March 31, 2021, the Compensation Committee approved a bonus program for Mr. Sieffert with a maximum payout of CDN$125,000. 60% of the potential bonus payout will be based on achieving consolidated sales revenue, based on the Company's audited annual financial statements for the year ended March 31, 2022, of between $30 million and $36 million, pro-rated, and the remaining 40% of the potential bonus payout be based on achieving a range of business objectives aligned with Mr. Sieffert's responsibilities, the measurement of which is subjective.

On September 29, 2023 GreenPower entered into an employment agreement with Michael Sieffert, which was effective as of April 1, 2023. Under the terms of the employment agreement, Michael Sieffert agreed to serve as the Chief Financial Officer of the Company for a term of one year from the effective date, which shall be automatically extended for periods of one year if not otherwise terminated pursuant to the terms of the employment agreement. Under the terms of the employment agreement Michael Sieffert will be paid a base salary of CAD300,000 per year, and shall be eligible for cash bonuses of up to 75% of his annual base salary. In addition and pursuant to the employment agreement, Michael Sieffert is eligible for stock option grants and equity incentive grants.

Yanyan Zhang

In March 2017, the Company entered into an employment agreement with Yanyan Zhang. Pursuant to this agreement, Ms. Yanyan Zhang agreed to be employed as the Project Manager of the Company and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Ms. Zhang's employment commenced on April 3, 2017 at a base salary of $72,000. In May 2020, Ms. Zhang was promoted to Director of operation, Effective May 4, 2020, Ms. Zhang's base compensation was increased to $94,000 per annum. In May 2021, Ms. Zhang was promoted to Vice President of Program Management. Effective June 1, 2021, Ms. Zhang's base compensation was increased to $130,000 per annum. Effective April 1, 2022, Ms. Zhang's base compensation was increased to $150,000 per annum.

Claus Tritt

On November 28, 2022, the Company entered into an employment agreement with Claus Tritt. Pursuant to this agreement, Mr. Claus Tritt agreed to be employed as the Vice President of Medium Duty and Commercial Vehicle Sales of the Company and agreed to fulfil any and all duties, roles and responsibilities relevant to this position as set out in the employment agreement. Mr. Tritt's employment commenced on November 28, 2022 at a base salary of $150,000 plus bonuses.

INCENTIVE PLAN AWARDS

Outstanding Share-based Awards and Option-based Awards

The following table sets out information concerning the option-based and share-based awards held by our NEOs as at March 31, 2023:

| |

Option-based Awards |

Share-based Awards(1) |

| Name |

Number of

securities

underlying

unexercised

options

(#) |

Option

exercise

price

(CDN$) |

Option

expiration date |

Value of

unexercised

in-the-money

options(2)

(CDN$) |

Number

of shares

or units of

shares

that have

not vested

(#) |

Market or

payout

value of

share-

based

awards

that have

not vested

($) |

Market or

payout value

of vested

share-based

awards not

paid out or

distributed

($) |

| Fraser Atkinson |

14,286 |

3.50 |

February 12, 2024 |

Nil |

Nil |

N/A |

N/A |

| 28,571 |

2.59 |

January 30, 2025 |

15,428 |

Nil |

N/A |

N/A |

| 100,000 |

20.00(3) |

November 19, 2025 |

Nil |

25,000 |

N/A |

N/A |

| 50,000 |

16.45 |

December 10, 2026 |

Nil |

Nil |

N/A |

N/A |

| 60,000 |

3.80 |

February 14, 2028 |

Nil |

60,000 |

N/A |

N/A |

| Brendan Riley |

14,286 |

3.50 |

February 12, 2024 |

Nil |

Nil |

N/A |

N/A |

| 35,714 |

2.59 |

January 30, 2025 |

19,286 |

Nil |

N/A |

N/A |

| 100,000 |

20.00(3) |

November 19, 2025 |

Nil |

25,000 |

N/A |

N/A |

| 50,000 |

16.45 |

December 10, 2026 |

Nil |

Nil |

N/A |

N/A |

| 60,000 |

3.80 |

February 14, 2028 |

Nil |

60,000 |

N/A |

N/A |

| |

Option-based Awards |

Share-based Awards(1) |

| Name |

Number of

securities

underlying

unexercised

options

(#) |

Option

exercise

price

(CDN$) |

Option

expiration date |

Value of

unexercised

in-the-money

options(2)

(CDN$) |

Number

of shares

or units of

shares

that have

not vested

(#) |

Market or

payout

value of

share-

based

awards

that have

not vested

($) |

Market or

payout value

of vested

share-based

awards not

paid out or

distributed

($) |

| Michael Sieffert |

50,000 |

3.01 |

November 30, 2023 |

6,000 |

Nil |

N/A |

N/A |

| 18,571 |

2.59 |

January 30, 2025 |

10,028 |

Nil |

N/A |

N/A |

| 100,000 |

20.00(3) |

November 19, 2025 |

Nil |

25,000 |

N/A |

N/A |

| 50,000 |

16.45 |

December 10, 2026 |

Nil |

Nil |

N/A |

N/A |

| 60,000 |

3.80 |

February 14, 2028 |

Nil |

60,000 |

N/A |

N/A |

| Yanyan Zhang |

357 |

3.50 |

February 14, 2024 |

Nil |

Nil |

N/A |

N/A |

| 7,143 |

2.59 |

January 30, 2025 |

3,857 |

Nil |

N/A |

N/A |

| 2,857 |

4.90 |

July 3, 2025 |

Nil |

1,429 |

N/A |

N/A |

| 15,000 |

19.62 |

July 3, 2025 |

Nil |

7,500 |

N/A |

N/A |

| 25,000 |

16.45 |

December 10, 2026 |

Nil |

12,500 |

N/A |

N/A |

| 20,000 |

3.80 |

February 14, 2028 |

Nil |

20,000 |

N/A |

N/A |

| Claus Tritt |

50,000 |

3.80 |

February 14, 2028 |

Nil |

50,000 |

N/A |

N/A |

(1) Our NEO's were not granted share-based awards during the year ended March 31, 2023.

(2) Based on CDN$3.13, being the closing price of the Shares on the TSX Venture Exchange on March 31, 2023. Value of unexercised in the money options are expressed in CDN$, and options with an exercise price in US$ have been converted to CDN$ at an exchange rate of $0.76. This exchange rate is the average exchange rates used for financial reporting purposes for the twelve months ended March 31, 2023.

(3) Exercise price in US$.

Incentive Plan Awards - Value vested or Earned During the Year

The following table indicates, for each of our NEOs, a summary of the value of the option-based and share-based awards vested in accordance with their terms during the year ended March 31, 2023:

| |

Option-based awards - |

Share-based awards - |

Non-equity incentive plan |

| |

Value vested during the |

Value vested during |

compensation - Value earned |

| |

year(1) |

the year(2) |

during the year(2) |

| Name |

($) |

($) |

($) |

| Fraser Atkinson |

Nil |

N/A |

N/A |

| Brendan Riley |

Nil |

N/A |

N/A |

| Michael Sieffert |

Nil |

N/A |

N/A |

| Yanyan Zhang |

Nil |

N/A |

N/A |

| Claus Tritt |

Nil |

N/A |

N/A |

(1) Calculated using the closing share price on the TSX Venture Exchange on March 31, 2023, being CDN $3.13, less the exercise price, multiplied by the number of shares vested during the year.

(2) Our NEO's did not receive share-based awards or non-equity incentive plan compensation during the year.

Narrative Discussion

Effective April 19, 2022, the Company adopted the 2022 Equity Incentive Plan (the "2022 Plan"), which was subsequently approved by the Shareholders at the Company's AGM on May 26, 2022 and re-approved on March 28, 2023. The 2022 Plan replaced the 2019 Plan and after the plan's effective date, no further stock options will be granted under the 2019 Plan. Under the 2022 Plan the Company can grant equity-based incentive awards in the form of stock options ("Options"), restricted share units ("RSUs"), performance share units ("PSUs") and deferred share units ("DSUs"). RSU's, DSU's and PSU's are collectively referred to as "Performance Based Awards". The 2022 Plan is a Rolling Plan for Options and a fixed-plan for Performance-Based Awards such that the aggregate number of Shares that: (i) may be issued upon the exercise or settlement of Options granted under the 2022 Plan (and all of the Company's other Security- Based Compensation Arrangements), shall not exceed 10% of the Company's issued and outstanding Shares from time to time, and (ii) may be issued in respect of Performance-Based Awards granted under the 2022 Plan (and all of the Company's other Security-Based Compensation Arrangements) shall not exceed 2,467,595. The 2022 Plan is considered an "evergreen" plan for Options, since Options which have been exercised, cancelled, terminated, surrendered, forfeited or expired without being exercised shall be available for subsequent Option grants under the 2022 Plan and the number of Options available to grant increases as the number of issued and outstanding Shares increases. This following description is intended as a brief description of the 2022 Plan and is qualified in its entirety by the full text of the 2022 Plan.

Purpose of the 2022 Plan

The purpose of the 2022 Plan is to promote the long-term success of the Company and the creation of Shareholder value by: (i) encouraging the attraction and retention of eligible persons; (ii) encouraging such eligible persons to focus on critical long-term objectives; and (iii) promoting greater alignment of the interests of such eligible persons with the interests of the Company. The 2022 Plan provides flexibility to the Company to grant equity-based incentive awards in the form of stock options ("Options"), restricted share units ("RSUs"), performance share units ("PSUs") and deferred share units ("DSUs" and, collectively with the RSUs and PSUs, the "Performance-Based Awards") to eligible persons.

Shares Subject to the 2022 Plan

The 2022 Plan is a rolling plan for Options and a fixed plan for Performance-Based Awards such that the aggregate number of Shares that: (i) may be issued upon the exercise or settlement of Options granted under the 2022 Plan (and all of the Company's other Security-Based Compensation Arrangements), shall not exceed 10% of the Company's issued and outstanding Shares from time to time, such number being 24,991,162 as at February 20, 2024 and (ii) may be issued in respect of Performance-Based Awards granted under the 2022 Plan (and all of the Company's other Security-Based Compensation Arrangements) shall not exceed 2,499,116. The 2022 Plan is considered an "evergreen" plan for Options, since Options which have been exercised, cancelled, terminated, surrendered, forfeited or expired without being exercised shall be available for subsequent Option grants under the 2022 Plan and the number of Options available to grant increases as the number of issued and outstanding Shares increases.

Participation Limits

The 2022 Plan provides that:

(a) unless the Company has obtained disinterested shareholder approval, the maximum aggregate number of Shares issuable to insiders under the 2022 Plan, within any 12 month period, together with Shares reserved for issuance to insiders under all of the Company's other Security-Based Compensation Arrangements (as defined in the 2022 Plan), shall not exceed ten (10%) percent of the issued and outstanding Shares (calculated as at the date of any grant);

(b) unless the Company has obtained disinterested shareholder approval, the maximum aggregate number of Shares issuable to insiders under the 2022 Plan, at any point in time, together with Shares reserved for issuance to insiders under all of the Company's other Security-Based Compensation Arrangements (as defined in the 2022 Plan), shall not exceed ten (10%) percent of the issued and outstanding Shares;

(c) unless the Company has obtained disinterested shareholder approval, the maximum aggregate number of Shares issuable to any participant (as defined in the 2022 Plan) under the 2022 Plan, within any 12 month period, together with Shares reserved for issuance to such participant (and to Companies wholly-owned by that participant) under all of the Company's other Security-Based Compensation Arrangements, shall not exceed five (5%) percent of the issued and outstanding Shares (calculated as at the date of any grant);

(d) the maximum aggregate number of Shares issuable to any one consultant (as defined in the 2022 Plan) under the 2022 Plan, within any twelve (12) month period, together with Shares issuable to such consultant under all of the Company's other Security-Based Compensation Arrangements, shall not exceed two (2%) percent of the issued and outstanding Shares (calculated as at the date of any grant); and