000102914512/316/30/20242024Q2falsehttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberiso4217:USDiso4217:USDxbrli:sharesxbrli:sharesgogl:segmentgogl:vesselxbrli:puregogl:leaseiso4217:USDutr:Dutr:tiso4217:USDgogl:vessel00010291452024-01-012024-06-300001029145gogl:TimeCharterRevenueMember2024-01-012024-06-300001029145gogl:TimeCharterRevenueMember2023-01-012023-06-300001029145gogl:VoyageCharterRevenueMember2024-01-012024-06-300001029145gogl:VoyageCharterRevenueMember2023-01-012023-06-300001029145gogl:OtherRevenueMember2024-01-012024-06-300001029145gogl:OtherRevenueMember2023-01-012023-06-3000010291452023-01-012023-06-300001029145us-gaap:RelatedPartyMember2024-01-012024-06-300001029145us-gaap:RelatedPartyMember2023-01-012023-06-3000010291452024-06-3000010291452023-12-310001029145us-gaap:RelatedPartyMember2024-06-300001029145us-gaap:RelatedPartyMember2023-12-3100010291452022-12-3100010291452023-06-300001029145us-gaap:CommonStockMember2023-12-310001029145us-gaap:CommonStockMember2022-12-310001029145us-gaap:CommonStockMember2023-01-012023-06-300001029145us-gaap:CommonStockMember2024-01-012024-06-300001029145us-gaap:CommonStockMember2024-06-300001029145us-gaap:CommonStockMember2023-06-300001029145us-gaap:TreasuryStockCommonMember2023-12-310001029145us-gaap:TreasuryStockCommonMember2022-12-310001029145us-gaap:TreasuryStockCommonMember2023-01-012023-06-300001029145us-gaap:TreasuryStockCommonMember2024-01-012024-06-300001029145us-gaap:TreasuryStockCommonMember2024-06-300001029145us-gaap:TreasuryStockCommonMember2023-06-300001029145us-gaap:AdditionalPaidInCapitalMember2023-12-310001029145us-gaap:AdditionalPaidInCapitalMember2022-12-310001029145us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001029145us-gaap:AdditionalPaidInCapitalMember2024-06-300001029145us-gaap:AdditionalPaidInCapitalMember2023-06-300001029145us-gaap:OtherAdditionalCapitalMember2023-12-310001029145us-gaap:OtherAdditionalCapitalMember2022-12-310001029145us-gaap:OtherAdditionalCapitalMember2024-06-300001029145us-gaap:OtherAdditionalCapitalMember2023-06-300001029145us-gaap:RetainedEarningsMember2023-12-310001029145us-gaap:RetainedEarningsMember2022-12-310001029145us-gaap:RetainedEarningsMember2024-01-012024-06-300001029145us-gaap:RetainedEarningsMember2023-01-012023-06-300001029145us-gaap:RetainedEarningsMember2024-06-300001029145us-gaap:RetainedEarningsMember2023-06-300001029145srt:ManagementMember2024-03-012024-03-310001029145srt:ManagementMember2024-06-300001029145srt:ManagementMember2023-06-300001029145gogl:DemurrageRevenueMember2024-01-012024-06-300001029145gogl:DemurrageRevenueMember2023-01-012023-06-300001029145gogl:OngoingVoyagesMember2024-06-300001029145gogl:OngoingVoyagesMember2024-01-012024-06-3000010291452023-01-012023-12-310001029145gogl:VesselsMember2024-01-012024-06-300001029145gogl:CapesizeVesselsGoldenFengAndGoldenShuiMember2023-03-012023-03-310001029145gogl:RecourseDebtMember2024-01-012024-06-300001029145gogl:VesselsandEquipmentMember2023-12-310001029145gogl:VesselsandEquipmentMember2024-01-012024-06-300001029145gogl:VesselsandEquipmentMember2024-06-300001029145gogl:NewcastlemaxVesselsMember2024-06-300001029145gogl:CapesizeVesselsMember2024-06-300001029145gogl:PanamaxVesselsMember2024-06-300001029145gogl:NewcastlemaxVesselsMember2023-12-310001029145gogl:CapesizeVesselsMember2023-12-310001029145gogl:PanamaxVesselsMember2023-12-310001029145gogl:PanamaxVesselsMember2024-06-012024-06-300001029145srt:ScenarioForecastMembergogl:PanamaxVesselsMember2024-07-012024-09-300001029145gogl:PanamaxVesselsMember2023-12-012023-12-310001029145gogl:PanamaxVesselsMember2024-01-012024-06-300001029145gogl:KamsarmaxMember2024-01-012024-06-300001029145gogl:NewbuildingsMember2024-01-012024-06-300001029145gogl:NewbuildingsMember2024-06-300001029145gogl:KamsarmaxMember2022-06-300001029145gogl:KamsarmaxMember2021-06-300001029145gogl:KamsarmaxMember2021-01-012024-06-300001029145gogl:KamsarmaxMemberus-gaap:SubsequentEventMember2024-07-012024-09-050001029145gogl:KamsarmaxMember2024-06-300001029145gogl:KamsarmaxMember2023-12-310001029145gogl:KamsarmaxMemberus-gaap:SubsequentEventMember2024-09-050001029145gogl:KamsarmaxMemberus-gaap:SubsequentEventMember2024-09-052024-09-0500010291452024-06-012024-06-300001029145gogl:SFLCorporationLtdMember2024-01-012024-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2024-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2023-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2015-04-012015-04-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2024-01-012024-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2015-01-012015-12-310001029145gogl:SFLCorporationLtdMember2015-01-012015-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2023-01-012023-06-300001029145gogl:SFLCorporationLtdMember2023-01-012023-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2015-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2016-01-012016-12-310001029145us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-300001029145us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001029145gogl:SFLCorporationLtdMember2023-12-310001029145gogl:OfficeLeasesMember2023-12-310001029145gogl:SFLCorporationLtdMember2024-01-012024-06-300001029145gogl:OfficeLeasesMember2024-01-012024-06-300001029145gogl:SFLCorporationLtdMember2024-06-300001029145gogl:OfficeLeasesMember2024-06-300001029145gogl:OfficeLeasesMember2023-06-300001029145srt:MinimumMember2024-06-300001029145srt:MaximumMember2024-06-300001029145gogl:VesselsLeasedToThirdPartiesMember2024-06-300001029145gogl:VesselsLeasedToThirdPartiesMember2023-12-310001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMembersrt:ScenarioForecastMember2022-07-012025-06-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:CharterhireexpensesMembergogl:SFLCorporationLtdMember2024-01-012024-06-300001029145gogl:SFLCorporationLtdMember2024-06-300001029145gogl:TFGMArineMember2024-06-300001029145gogl:TFGMArineMember2023-12-310001029145gogl:SwissMarineMember2024-06-300001029145gogl:SwissMarineMember2023-12-310001029145gogl:UnitedFreightCarriersMember2024-06-300001029145gogl:UnitedFreightCarriersMember2023-12-310001029145gogl:OtherMember2023-12-310001029145gogl:SwissMarineMember2024-01-012024-06-300001029145gogl:OtherMember2024-01-012024-06-300001029145gogl:OtherMember2024-06-300001029145gogl:A180.0MTermLoanFacilityMember2024-06-300001029145gogl:A180.0MTermLoanFacilityMember2023-12-310001029145gogl:A360.0MTermLoanAndRevolvingFacilityMember2024-06-300001029145gogl:A360.0MTermLoanAndRevolvingFacilityMember2023-12-310001029145gogl:A85.0MTermLoanFacilityMember2024-06-300001029145gogl:A85.0MTermLoanFacilityMember2023-12-310001029145gogl:A40.0MTermLoanFacilityMember2024-06-300001029145gogl:A40.0MTermLoanFacilityMember2023-12-310001029145gogl:TermLoanFacilityOf800MillionMember2024-06-300001029145gogl:TermLoanFacilityOf800MillionMember2023-12-310001029145gogl:TermLoanFacilityOf2330MillionMember2024-06-300001029145gogl:TermLoanFacilityOf2330MillionMember2023-12-310001029145gogl:TermLoanFacilityOf3500MillionMember2024-06-300001029145gogl:TermLoanFacilityOf3500MillionMember2023-12-310001029145gogl:A275MillionTermLoanAndRevolvingFacilityMember2024-06-300001029145gogl:A275MillionTermLoanAndRevolvingFacilityMember2023-12-310001029145gogl:A175MillionTermLoanAndRevolvingFacilityMember2024-06-300001029145gogl:A175MillionTermLoanAndRevolvingFacilityMember2023-12-310001029145gogl:A260MillionTermLoanMember2024-06-300001029145gogl:A260MillionTermLoanMember2023-12-310001029145gogl:A3044MLoanAndRevolvingFacilityMember2024-06-300001029145gogl:A3044MLoanAndRevolvingFacilityMember2023-12-310001029145gogl:TermLoanFacilityof120.0MillionMember2024-06-300001029145gogl:TermLoanFacilityof120.0MillionMember2023-12-310001029145gogl:FloatingRateDebtMember2024-06-300001029145gogl:FloatingRateDebtMember2023-12-310001029145us-gaap:SecuredDebtMember2023-12-310001029145us-gaap:SecuredDebtMember2024-01-012024-06-300001029145us-gaap:SecuredDebtMember2024-06-300001029145gogl:FloatingRateDebtMember2024-01-012024-06-300001029145gogl:TermLoanFacilitiesOf9375Million13179MillionAnd1553MillionMember2024-01-012024-06-300001029145gogl:TermLoanFacilityof93.75MillionMember2024-06-300001029145gogl:TermLoanFacilityof131.79MillionMember2024-06-300001029145gogl:TermLoanFacilityOf1553MillionMember2024-06-300001029145gogl:TermLoanFacilityOf2330MillionMember2024-01-012024-06-300001029145us-gaap:RevolvingCreditFacilityMember2024-01-012024-06-300001029145gogl:A180.0MTermLoanFacilityMember2024-04-300001029145gogl:A180.0MTermLoanFacilityMembergogl:NewcastlemaxVesselsMember2024-04-012024-04-300001029145gogl:A180.0MTermLoanFacilityMember2024-04-012024-04-300001029145gogl:A360.0MTermLoanAndRevolvingFacilityMember2024-02-2900010291452024-02-012024-02-290001029145gogl:A360.0MTermLoanAndRevolvingFacilityMember2024-02-012024-02-290001029145gogl:SaleLeasebackMember2023-12-310001029145gogl:SaleLeasebackMember2023-12-012023-12-310001029145gogl:SaleLeasebackMember2024-01-012024-06-300001029145gogl:SaleLeasebackMember2024-06-300001029145us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-06-300001029145gogl:FloatingRateDebtMemberus-gaap:CollateralPledgedMember2024-06-300001029145gogl:FloatingRateDebtMemberus-gaap:CollateralPledgedMember2023-12-310001029145us-gaap:InterestRateSwapMember2024-06-300001029145us-gaap:InterestRateSwapMember2023-12-310001029145gogl:BunkerderivativesMember2024-06-300001029145gogl:BunkerderivativesMember2023-12-310001029145us-gaap:CurrencySwapMember2024-06-300001029145us-gaap:CurrencySwapMember2023-12-310001029145gogl:ForwardFreightAgreementsMember2024-06-300001029145gogl:ForwardFreightAgreementsMember2023-12-310001029145us-gaap:InterestRateSwapMember2024-01-012024-06-300001029145us-gaap:InterestRateSwapMember2023-01-012023-06-300001029145us-gaap:CurrencySwapMember2024-01-012024-06-300001029145us-gaap:CurrencySwapMember2023-01-012023-06-300001029145gogl:ForwardFreightAgreementsMember2024-01-012024-06-300001029145gogl:ForwardFreightAgreementsMember2023-01-012023-06-300001029145gogl:BunkerderivativesMember2024-01-012024-06-300001029145gogl:BunkerderivativesMember2023-01-012023-06-300001029145gogl:ShareBuyBackProgramMember2022-10-040001029145gogl:ShareBuyBackProgramMember2022-10-042022-10-040001029145gogl:ShareBuyBackProgramMembersrt:MaximumMember2022-10-042022-10-040001029145gogl:ShareBuyBackProgramMember2024-01-012024-06-300001029145gogl:ShareBuyBackProgramMember2023-01-012023-06-300001029145gogl:ShareBuyBackProgramMember2024-06-300001029145srt:ManagementMembergogl:A2020ExercisedOptionsMember2024-01-012024-06-300001029145srt:ManagementMembergogl:A2020ExercisedOptionsMember2023-01-012023-12-310001029145gogl:A2020ExercisedOptionsMember2024-01-012024-06-300001029145gogl:A2020ExercisedOptionsMember2023-01-012023-12-310001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2024-01-012024-06-300001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2024-03-012024-03-310001029145gogl:DryBulkCarriersMembergogl:SeatankersManagementCoLtdMember2023-01-012023-06-300001029145gogl:SwissMarineMember2024-01-012024-06-300001029145gogl:SwissMarineMember2023-01-012023-06-300001029145gogl:TFGMArineMember2020-01-012020-12-310001029145gogl:TFGMArineMember2023-02-280001029145gogl:TFGMArineMembergogl:BunkerProcurementMember2024-01-012024-06-300001029145gogl:TFGMArineMembergogl:BunkerProcurementMember2023-01-012023-06-300001029145gogl:TFGMArineMembergogl:BunkerSupplyAgreementGuaranteeMember2020-01-012020-12-310001029145us-gaap:PerformanceGuaranteeMembergogl:TrafiguraMember2024-06-300001029145gogl:FrontlineManagementBermudaLtdMember2023-01-012023-12-310001029145gogl:FrontlineManagementBermudaLtdMember2024-01-012024-06-300001029145gogl:FrontlineManagementBermudaLtdMember2023-01-012023-06-300001029145gogl:SeatankersManagementCoLtdMember2024-01-012024-06-300001029145gogl:SeatankersManagementCoLtdMember2023-01-012023-06-300001029145gogl:FrontOceanManagementASMember2024-01-012024-06-300001029145gogl:FrontOceanManagementASMember2023-01-012023-06-300001029145gogl:UnitedFreightCarriersMember2024-01-012024-06-300001029145gogl:UnitedFreightCarriersMember2023-01-012023-06-300001029145srt:AffiliatedEntityMember2024-01-012024-06-300001029145srt:AffiliatedEntityMember2023-01-012023-06-300001029145us-gaap:RelatedPartyMembergogl:TimeCharterRevenueMember2024-01-012024-06-300001029145us-gaap:RelatedPartyMembergogl:TimeCharterRevenueMember2023-01-012023-06-300001029145us-gaap:RelatedPartyMembergogl:OtherRevenueMember2024-01-012024-06-300001029145us-gaap:RelatedPartyMembergogl:OtherRevenueMember2023-01-012023-06-300001029145gogl:FrontlineMember2024-06-300001029145gogl:FrontlineMember2023-12-310001029145gogl:SeatankersManagementCoLtdMember2024-06-300001029145gogl:SeatankersManagementCoLtdMember2023-12-310001029145gogl:SFLCorporationLtdMember2023-12-310001029145gogl:CreditLossAllowanceMember2024-06-300001029145gogl:CreditLossAllowanceMember2023-12-310001029145gogl:TFGMarineMember2024-06-300001029145gogl:TFGMarineMember2023-12-310001029145gogl:OtherRelatedPartyMember2024-06-300001029145gogl:OtherRelatedPartyMember2023-12-310001029145gogl:InterestRateSwap1Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap2Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap3Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap4Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap5Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap6Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap7Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap8Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap9Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap10Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap11Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:InterestRateSwap12Memberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2021Memberus-gaap:LongMember2024-01-012024-06-300001029145gogl:CapesizeForwardFreightAgreementsMaturingIn2021Memberus-gaap:LongMember2023-01-012023-12-310001029145gogl:BunkerDerivativesRemainingYearMember2024-01-012024-06-300001029145gogl:BunkerderivativesMember2023-01-012023-12-310001029145currency:NOKus-gaap:CurrencySwapMember2024-06-300001029145currency:NOKus-gaap:CurrencySwapMember2023-12-310001029145us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001029145us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001029145us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001029145us-gaap:FairValueInputsLevel1Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMember2024-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SecuredDebtMember2024-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMember2023-06-300001029145us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SecuredDebtMember2023-06-300001029145gogl:GoldenBullMember2024-01-012024-06-300001029145gogl:NewcastlemaxVesselsMember2024-01-012024-06-300001029145gogl:TimeCharterRevenueMembergogl:NewcastlemaxVesselsMember2024-06-300001029145gogl:PanamaxVesselsMember2023-03-012023-03-310001029145gogl:GoldenStrengthMember2024-01-012024-06-300001029145gogl:CapesizeVesselsGoldenFengAndGoldenShuiMember2024-01-012024-06-300001029145gogl:SFLCorporationLtdMember2015-07-012015-09-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2015-09-300001029145gogl:KSLChinaBatterseaBelgraviaGoldenFutureGoldenZhejiangGoldenZhoushanGoldenBeijingandGoldenMagnumMembergogl:SFLCorporationLtdMember2015-07-012015-09-300001029145gogl:KamsarmaxMembergogl:SaleLeasebackMember2023-12-310001029145us-gaap:PerformanceGuaranteeMembergogl:TFGMarineMember2022-05-310001029145us-gaap:PerformanceGuaranteeMembergogl:TFGMarineMember2024-06-300001029145gogl:SaleLeasebackMemberus-gaap:SubsequentEventMember2024-07-012024-09-050001029145us-gaap:SubsequentEventMember2024-08-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 000-29106

GOLDEN OCEAN GROUP LIMITED.

(Translation of registrant's name into English)

Par-la-Ville Place, 14 Par-la-Ville Road, Hamilton, HM 08, Bermuda

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 99.1 to this Report on Form 6-K are the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the unaudited condensed consolidated interim financial statements and related information and data of Golden Ocean Group Limited (the “Company”) for the six months ended June 30, 2024.

This Report on Form 6-K is hereby incorporated by reference into the Company's Registration Statement on Form F-3 (File No. 333-266220) filed with the U.S. Securities and Exchange Commission with an effective date of July 19, 2022.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Matters discussed in this report on Form 6-K, and the documents incorporated by reference herein, may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995, or the PSLRA, provides safe harbor protections for forward-looking statements, in order to encourage companies to provide prospective information about their business. Forward-looking statements include, but are not limited to, statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts.

We are taking advantage of the safe harbor provisions of the PSLRA and are including this cautionary statement in connection with this safe harbor legislation. This Form 6-K and any other written or oral statements made by us or on our behalf may include forward-looking statements, which reflect our current views with respect to future events and financial performance. This report includes assumptions, expectations, projections, intentions and beliefs about future events. These statements are intended as "forward-looking statements." We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. When used in this document, the words "believe," "expect," "anticipate," "estimate," "intend," "plan," "targets," "projects," "likely," "will," "would," "could," "seeks," "potential," "continue," "contemplate," "possible," "might," "forecasts," "may," "should" and similar expressions or phrases may identify forward-looking statements.

The forward-looking statements in this report on Form 6-K, and the documents incorporated by reference herein, are based upon various assumptions, including, without limitation, management's examination of historical operating trends, data contained in our records and data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections. As a result, you are cautioned not to rely on any forward-looking statements.

All statements in this document that are not statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

•general market trends in the dry bulk industry, which is cyclical and volatile, including fluctuations in charter hire rates and vessel values;

•a decrease in the market value of our vessels;

•changes in supply and demand in the dry bulk shipping industry, including the market for our vessels and the number of newbuildings under construction;

•delays or defaults in the construction of our newbuildings could increase our expenses and diminish our net income and cash flows;

•an oversupply of dry bulk vessels, which may depress charter rates and profitability;

•our future operating or financial results;

•our continued borrowing availability under our debt agreements and compliance with the covenants contained therein;

•our ability to procure or have access to financing, our liquidity and the adequacy of cash flows for our operations;

•the failure of our contract counterparties to meet their obligations, including changes in credit risk with respect to our counterparties on contracts;

•the loss of a large customer or significant business relationship;

•the strength of world economies;

•the volatility of prevailing spot market and charter-hire charter rates, which may negatively affect our earnings;

•our ability to successfully employ our dry bulk vessels and replace our operating leases on favorable terms, or at all;

•changes in our operating expenses and voyage costs, including bunker prices, fuel prices (including increased costs for low sulfur fuel), drydocking, crewing and insurance costs;

•the adequacy of our insurance to cover our losses, including in the case of a vessel collision;

•vessel breakdowns and instances of offhire;

•our ability to fund future capital expenditures and investments in the construction, acquisition and refurbishment of our vessels (including the amount and nature thereof and the timing of completion of vessels under construction, the delivery and commencement of operation dates, expected downtime and lost revenue);

•risks associated with any future vessel construction or the purchase of second-hand vessels;

•effects of new products and new technology in our industry, including the potential for technological innovation to reduce the value of our vessels and charter income derived therefrom;

•the impact of an interruption or failure of our information technology and communications systems, including the impact of cyber-attacks, upon our ability to operate;

•potential liability from safety, environmental, governmental and other requirements and potential significant additional expenditures (by us and our customers) related to complying with such regulations;

•changes in governmental rules and regulations or actions taken by regulatory authorities and the impact of government inquiries and investigations;

•the arrest of our vessels by maritime claimants;

•government requisition of our vessels during a period of war or emergency;

•our compliance with complex laws, regulations, including environmental laws and regulations and the U.S. Foreign Corrupt Practices Act of 1977;

•potential difference in interests between or among certain members of our board of directors, executive officers, senior management and shareholders;

•our ability to attract, retain and motivate key employees;

•work stoppages or other labor disruptions by our employees or the employees of other companies in related industries;

•potential exposure or loss from investment in derivative instruments;

•stability of Europe and the Euro or the inability of countries to refinance their debts;

•inflationary pressures and the central bank policies intended to combat overall inflation and rising interest rates and foreign exchange rates;

•fluctuations in currencies;

•the impact that any discontinuance, modification or other reform or the establishment of alternative reference rates have on our floating interest rate debt instruments;

•acts of piracy on ocean-going vessels, public health threats, terrorist attacks and international hostilities and political instability;

•potential physical disruption of shipping routes due to accidents, climate-related (acute and chronic), political instability, terrorist attacks, piracy, international sanctions or international hostilities, including the developments in the Ukraine region and in the Middle East, including the conflicts in Israel and Gaza, and the Houthi attacks in the Red Sea;

•general domestic and international political and geopolitical conditions or events, including any further changes in U.S. trade policy that could trigger retaliatory actions by affected countries;

•the impact of adverse weather and natural disasters;

•the impact of increasing scrutiny and changing expectations from investors, lenders and other market participants with respect to our Environmental, Social and Governance policies;

•changes in seaborne and other transportation;

•the length and severity of epidemics and pandemics and governmental responses thereto and the impact on the demand for seaborne transportation in the dry bulk sector;

•impacts of supply chain disruptions and market volatility surrounding impacts of the Russian-Ukrainian conflict and the developments in the Middle East;

•fluctuations in the contributions of our joint ventures to our profits and losses;

•the potential for shareholders to not be able to bring a suit against us or enforce a judgement obtained against us in the United States;

•our treatment as a "passive foreign investment company" by U.S. tax authorities;

•being required to pay taxes on U.S. source income;

•our operations being subject to economic substance requirements;

•potentially becoming subject to corporate income tax in Bermuda in the future;

•the volatility of the stock price for our common shares, from which investors could incur substantial losses, and the future sale of our common shares, which could cause the market price of our common shares to decline; and

•other factors discussed in "Item 3. Key Information D. Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2023 filed with the Commission on March 20, 2024, or our Annual Report.

We caution the reader of this report on Form 6-K not to place undue reliance on these forward-looking statements, which speak only as of their dates. Except to the extent required by applicable law or regulation, we undertake no obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events. These forward-looking statements are not guarantees of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | | GOLDEN OCEAN GROUP LIMITED (registrant) |

| | | |

| Date: | September 5, 2024 | | By: | /s/ Peder Simonsen |

| | | | Name: Peder Simonsen |

| | | | Title: Interim Principal Executive Officer and Principal Financial Officer |

| | | |

| | | |

EXHIBIT 99.1

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following presentation of management's discussion and analysis of financial condition and results of operations for the six month periods ended June 30, 2024 and 2023 should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes thereto included elsewhere herein, which have been prepared in accordance with United States generally accepted accounting principles ("U.S. GAAP"). For additional information relating to our management's discussion and analysis of results of operations and financial condition, please see our Annual Report.

As used herein, "we," "us," "our," "Golden Ocean" and the "Company" all refer to Golden Ocean Group Limited and its subsidiaries (as the context requires). The term deadweight ton, or dwt, is used in describing the size and capacity of vessels. Dwt, expressed in metric tons, each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that a vessel can carry.

We own and operate dry bulk vessels of the following sizes:

•Newcastlemax, which are vessels with carrying capacities of between 200,000 dwt and 210,000 dwt;

•Capesize, which are vessels with carrying capacities of between 105,000 dwt and 200,000 dwt; and

•Panamax (including Kamsarmax), which are vessels with carrying capacities of between 65,000 and 105,000 dwt.

Unless otherwise indicated, all references to "USD" and "$" in this report are to, and amounts are represented in U.S. dollars.

The below discussion contains forward-looking statements that reflect our current views with respect to future events and financial performance. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors, such as those set forth in the section "Risk Factors" included in our Annual Report.

General

We are Golden Ocean Group Limited, an exempted company under the Bermuda Companies Act of 1981. Our registered and principal executive offices are located at Par-la-Ville Place, 14 Par-la-Ville Road, Hamilton, HM 08, Bermuda, and our telephone number at this location is +1 (441) 295-6935.

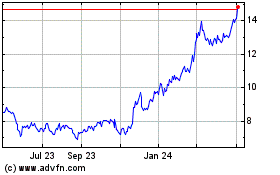

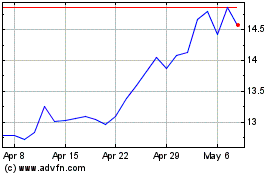

Our common shares currently trade on the NASDAQ Global Select Market and the Oslo Stock Exchange under the symbol "GOGL".

We own and operate dry bulk carriers consisting of Newcastlemax, Capesize and Panamax (including Kamsarmax) vessels. Our vessels transport a broad range of major and minor bulk commodities, including ores, coal, grains and fertilizers, along worldwide shipping routes. Our vessels operate in the spot and time charter markets. We operate through subsidiaries located in Bermuda, Liberia, the Marshall Islands, Norway, Singapore and the United Kingdom. We are also involved in the charter, purchase and sale of vessels.

As of June 30, 2024, we owned 83 dry bulk vessels. In addition, we had eight vessels chartered-in (of which seven were chartered in on financial leases and one was chartered in on an operating lease from SFL Corporation Ltd., or SFL). Each vessel is operated by one of our subsidiaries and is flagged either in the Marshall Islands or Hong Kong. In addition, in 2021 and 2022, we entered into contracts for the construction of ten Kamsarmax newbuilding vessels, eight of which were delivered by June 30, 2024 and are included into the fleet numbers above. Subsequent to June 30, 2024, we had one Kamsarmax newbuilding vessel delivered to us in August 2024 and the last Kamsarmax newbuilding vessel is scheduled to be delivered to us by the fourth quarter of 2024.

ESG update

Our comprehensive and stand-alone annual ESG report, in respect of the calendar year ended December 31, 2023, was published in August 2024 and can be found on the Company's website. The information in the ESG report and on the Company’s website is not incorporated by reference into this document.

The ESG report provides an opportunity to reflect on Golden Ocean’s ESG journey and to demonstrate its progress towards its goals. Golden Ocean has continued to make progress in managing environmental, social and governance factors (“ESG”) in 2023 and 2024.

In previous years, we set targets for scope 1 emission reduction and aim to reduce our Carbon Intensity Indicator (“CII”) by 15% by 2026 and 30% by 2030, compared to 2019 levels. We also target net-zero emissions by 2050. In 2024, we have continued to implement measures to achieve these targets. During 2023, we successfully improved the CII across all segments of our fleet. Notably, our Newcastlemax vessels achieved an 11.5% reduction in CII in 2023 compared to our 2019 baseline. Additionally, our renewal efforts for the Kamsarmax and Panamax fleets resulted in significant CII reductions of 9.9% and 8.2%, respectively. Our Capesize fleet also saw an 8.3% reduction in CII. In 2024, we aim to continue to outperform the emission trajectories set by the International Maritime Organization and the Poseidon Principles.

As of the date of this report, these CII reduction measures have not resulted in a material increase of our ESG-related expenditures. The CII reduction measures to be implemented over the longer-term is expected to create a vast array of implications for our business and the dry bulk industry in general and involve more uncertainty. As of the date of this report, we have one of the most modern and fuel-efficient fleets in the industry, and we continue to modernize our fleet by selling older tonnage. In the long-term, we are seeking zero emission propulsion technology with the ultimate aim of net zero emissions.

During the six months ended June 30, 2024, we have not incurred any material capital expenditures with regards to our environmental initiatives when compared to respective financial statement lines. In the first six months of 2024, we have incurred operating costs of $4.5 million for various energy saving devices and digitalization. In addition, in 2024 we increased drydock costs for cargo hold maintenance and hull/cargo sand blasting and painting by approximately $2 million to improve efficiency of our vessels. Further, we have incurred $0.9 million in the six months ended June 30, 2024 for ballast water treatment systems ("BWTS") upgrade costs, which were capitalized.

While decarbonization is of strategic importance to us, the costs associated with our ESG initiatives and decarbonizing efforts are not material to our business when compared to our total revenues and results of operations.

Russian-Ukrainian War

The ongoing conflict between Russia and Ukraine has disrupted supply chains and caused instability in the global economy, and the United States and the European Union, among other countries, announced sanctions against the Russian government and its supporters.

The United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) administers and enforces multiple authorities under which sanctions have been imposed on Russia, including: the Russian Harmful Foreign Activities sanctions program, established by the Russia-related national emergency declared in Executive Order (E.O.) 14024 and subsequently expanded and addressed through certain additional authorities, and the Ukraine-/Russia-related sanctions program, established with the Ukraine-related national emergency declared in E.O. 13660 and subsequently expanded and addressed through certain additional authorities. The United States has also issued several executive orders that prohibit certain transactions related to Russia, including the importation of certain energy products of Russian Federation origin, and investments in the Russian energy sector by U.S. persons, among other prohibitions and export controls. The ongoing conflict could result in the imposition of further economic sanctions or new categories of export restrictions against persons in or connected to Russia. While much uncertainty remains regarding the global impact of the conflict in Ukraine, it is possible that such tensions could adversely affect the Company’s business, financial condition, results of operation and cash flows.

Prior to the conflict, Russia and Ukraine combined accounted for approximately 10% of global steel trade and supply approximately 30% of Europe’s steel imports. Following the onset of the conflict, steel buyers had to find alternative supplies to substitute for steel and semi-finished products sourced from Russia and Ukraine, which stimulated seaborne trade routes. The impact of decreased demand for certain commodities was offset by increased demand for others, elevated port congestion and new trade routes that emerged after Russia’s incursion into Ukraine.

The direct impact of the conflict on our business has been limited to certain time charter cancellations and suspensions under time charter agreements made prior to the onset of the conflict. In March 2022, with respect to the Golden Pearl, we cancelled a time charter agreement in consequence of our counterparty’s failure to pay charter hire following the imposition of sanctions by the European Union on charterers’ beneficial owner. In addition, in April 2022, we suspended time charter agreements with respect to two vessels (Admiral Schmidt and Vitus Bering), and in May 2022 redelivered those vessels to their disponent owners, where we understand that those vessels were financed by disponent owners as part of a sale-leaseback arrangement with a Russian-state owned entity. We did not conduct any business with sanctioned counterparties in 2023 or 2024 as of the date of this report.

Conflict between Israel and Hamas

We believe that there is a limited effect of the conflict on our results and operations, since historically we do not have many port calls to Israel. Recent Houthis attacks in the Red Sea led to a short-term immaterial positive effect on our operations due to an increase in tonne-miles as a result of vessels rerouting to bypass the Suez Canal. There is still significant uncertainty relating to the conflict and we cannot guarantee that impact on our operations will remain limited in the long term.

Other

At our Annual General Meeting of Shareholders that took place on April 29, 2024, shareholders passed, among other things, a resolution to re-elect Ola Lorentzon, John Fredriksen, James O’Shaughnessy, Ben Mills and Cato Stonex as directors of the Company.

In January 2024, the Board of Directors appointed Lars-Christian Svensen, Golden Ocean’s Chief Commercial Officer and Interim Chief Executive Officer, to take the role as Chief Executive Officer of Golden Ocean Management AS. In May 2024, Lars-Christian Svensen decided to step down from his positions, and the Board of Directors appointed the company’s Chief Financial Officer, Peder Simonsen, to take the role as Interim Chief Executive Officer and Chief Financial Officer of Golden Ocean Management AS.

Results of Operations

Six-months ended June 30, 2024 compared to the six-months ended June 30, 2023

Operating revenues

We currently operate most of our vessels in the spot market, exposing us to fluctuations in spot market charter rates. As a result, our shipping revenues and financial performance are significantly affected by conditions in the dry bulk spot market, and any decrease in spot charter rates may adversely affect our earnings. In the first six months of 2024, market conditions strengthened compared to the first six months of 2023, which is illustrated by the change in the Baltic Dry Index, or BDI, from an average of 1,157 points in the six months ended June 30, 2023 to an average of 1,837 points in the six months ended June 30, 2024.

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Time charter revenues | 314,736 | | 181,693 | | | 133,043 | |

| Voyage charter revenues | 180,897 | | 226,946 | | | (46,049) | |

| Other revenues | 1,193 | | 1,261 | | | (68) | |

| Total operating revenues | 496,826 | | 409,900 | | | 86,926 | |

Time charter revenues increased by $133.0 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to:

•an increase of $96.0 million reflecting higher rates under index-linked and short-term time charters for vessels that were in our fleet through the duration of both these periods;

•an increase of $16.7 million due to delivery of eight newbuildings as per June 30, 2024, where eight of the newbuildings contributed with time charter revenues in the six months ended June 30, 2024, compared to one in the six months ended June 30, 2023;

•an increase of $13.9 million attributable to five out of the six Newcastlemax vessels acquired from H-Line during the six months ended June 30, 2023, where all six vessels were in our fleet for the entire duration of the six months ended June 30, 2024;

•an increase of $2.8 million attributable to chartered-in vessels that traded on time charters during the period;

•an increase of $2.4 million reflecting the increase in bunker prices for bunkers on board delivered to charterers;

•an increase of $5.7 million attributable to an increase in the number of time charter days for own vessels attributable to contract type mix between time charter and voyage charter for vessels that were in our fleet through the duration of both of these periods; and

•an increase of $0.3 million attributable to increase in amortization of unfavorable charter party contracts during the period.

This was partially offset by:

•a decrease of $4.8 million due to the sale of four vessels, with two vessels being delivered to new owners in May 2023, and the remaining two vessels being delivered in September 2023 and February 2024, all of which were part of the fleet during majority of the first half of 2023.

Voyage charter revenues decreased by $46.0 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to:

•a decrease of $83.0 million relating to decreased voyage activity of chartered-in vessels;

•a decrease of $8.7 million due to sale of four vessels, with two vessels being delivered to new owners in May 2023 and the remaining two vessels being delivered in September 2023 and February 2024, all of which were part of the fleet during majority of the first half of 2023; and

•a decrease of $3.2 million attributable to a decrease in the number of voyage charter days for own vessels attributable to contract type mix between time charter and voyage charter for vessels that were in our fleet through the duration of both of these periods.

This was partially offset by:

•an increase of $43.9 million attributable to an increase in the freight rates; and

•an increase of $5.0 million due to delivery of eight newbuildings as per June 30, 2024, where four of the newbuildings contributed with voyage charter revenues in the six months ended June 30, 2024, compared to one in the six months ended June 30, 2023.

Other revenues decreased by $0.1 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023.

Gain on sale of assets

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Gain on sale of assets | 1,133 | | 2,583 | | | (1,450) | |

In December 2023, we entered into an agreement to sell one Panamax vessel, Golden Bull, to an unrelated third party for a net consideration of $15.7 million. The vessel was delivered to its new owner in February 2024, upon which we recorded a gain of $1.1 million from the sale.

Gain on sale of assets of $2.6 million was recorded in the first six months of 2023 and related to the sale of Golden Strength which was delivered to its new owner during the period.

Voyage expenses and commissions | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Voyage expenses and commissions | 102,779 | | 123,626 | | | (20,847) | |

Voyage expenses and commissions decreased by $20.8 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 due to:

•a decrease of $37.9 million relating to less vessels chartered in; and

•a decrease of $4.9 million relating vessels sold in 2023 and 2024.

This was partially offset by:

•an increase of $8.8 million attributable to an increase in fuel prices;

•an increase of $6.4 million attributable to an increase in commissions; and

•an increase of $6.8 million relating to eight newbuildings being delivered as of June 30, 2024, whereby all eight of the newbuildings contributed with voyage expenses and commissions compared to four newbuildings in the six months ended June 30, 2023.

Ship operating expenses | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Ship operating expenses | 128,924 | | 124,061 | | | 4,863 | |

Ship operating expenses increased by $4.9 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to:

•an increase of $15.8 million related to running ship operating expenses, primarily as a result of higher crew costs ($4.9 million) as well as stores and spares expenses ($10.9 million). Crew costs increase of approximately $2.0 million is related to crew wage increases and the remaining $2.9 million is mainly caused by pattern of crew changes as well as more crew required for various upgrades. Increase in spares and stores relates to purchases for unscheduled repairs as well as spares and stores purchased for upcoming drydocking;

•an increase of $2.5 million relating to our decarbonization efforts; and

•an increase of $9.1 million relating to eight newbuildings delivered as per June 30, 2024, whereby all eight of the newbuildings contributed with ship operating expenses compared to four newbuildings in the six months ended June 30, 2023.

This was partially offset by:

•a decrease of $10.5 million attributable to the non-lease component, or service element, from charter hire expenses to ship operating expenses for vessels chartered in on time charters during the six months ended June 30, 2024;

•a decrease of $4.8 million related to costs due to the change of technical managers for 27 of our vessels in the first half of 2023;

•a decrease of $3.7 million in drydocking expenses after five vessels, contributing with a total of 154 drydocking days, were drydocked in the six months ended June 30, 2024, compared to nine vessels, contributing with a total of 250 drydocking days, were drydocked in the six months ended June 30, 2023; and

•a decrease of $3.5 million relating to vessels sold.

Charter hire expenses

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Charter hire expenses | 12,154 | | 26,992 | | | (14,838) | |

Charter hire expenses decreased by $14.8 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to:

•a decrease of $32.7 million related to a decrease in trading activity for short-term charter-in activity from third parties1.

This was partially offset by:

•an increase of $14.2 million related to an increase in chartered in rates; and

•an increase of $3.7 million attributable to profit share amount for SFL vessels.

Administrative expenses

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Administrative expenses | 12,539 | | 9,329 | | | 3,210 | |

Administrative expenses increased by $3.2 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 due to higher non-recurring personnel expenses.

1 Statistical formula used for calculating decrease in trading activity: (Days first half 2024 - days first half 2023) x Average charter hire rate for the first half of 2024.

Impairment loss on vessels

| | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Impairment loss on vessels | — | | 11,780 | | | (11,780) | |

No impairments were recorded in the six months ended June 30, 2024. In March 2023, the Company entered into an agreement to sell two Capesize vessels, Golden Feng and Golden Shui to an unrelated third party for an aggregate net sale price of $43.6 million. The vessels were delivered to their new owners in the second quarter of 2023. In the first quarter of 2023, the Company recorded an impairment loss of $11.8 million in connection to the sale.

Depreciation | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Depreciation | 70,254 | | 64,087 | | | 6,167 | |

Depreciation increased by $6.2 million in the six months ended June 30, 2024 compared to the six months ended June 30, 2023 primarily due to:

•an increase of $3.9 million attributable to eight Kamsarmax newbuildings, where four newbuildings were delivered in the six months ended June 30, 2023; and

•an increase of $2.6 million attributable to vessels delivered as of June 30, 2024, in connection with the acquisition of six Newcastlemax vessels in February 2023, where six vessels were delivered as of June 30, 2024 compared to five vessels as of June 30, 2023.

This was partially offset by:

•a decrease of $0.3 million due to the sale of vessels in 2023.

Interest income | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Interest income | 3,671 | | 2,685 | | | 986 | |

Interest income increased by $1.0 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to higher interest rates earned on our deposits.

Interest expense | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Interest on floating rate debt | 49,190 | | 38,951 | | | 10,239 | |

| Finance lease interest expense | 3,675 | | 4,180 | | | (505) | |

| Amortization of deferred charges | 3,321 | | 3,066 | | | 255 | |

| 56,186 | | 46,197 | | | 9,989 | |

Interest expense increased by $10.0 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to:

•an increase of $10.2 million of interest on our floating rate debt primarily due to (i) an increase in average total floating rate debt during the first six months of 2024 compared to first six months of 2023, and (ii) an increase in the Secured Overnight Financing Rate (“SOFR”), with the average SOFR rate increasing from 5.15% in the first half of 2023 to 5.32% in the first half of 2024; and

•an increase of $0.3 million of amortization of deferred charges.

This was partially offset by:

•a decrease of $0.5 million in finance lease interest expenses.

Share of results of associated companies | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Share of results of associated companies | (4,976) | | 9,868 | | | (14,844) | |

Share of results of associated companies decreased by $14.8 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023. This was primarily due to a total loss of $5.0 million in the six months ended June 30, 2024 for SwissMarine Pte. Ltd. ("SwissMarine") and TFG Marine Pte Ltd ("TFG Marine") compared to a total equity in earnings of $7.7 million in the six months ended June 30, 2023. The decrease was primarily due to worsened trading result. In addition, we had an equity in earnings of $15 thousands in the six months ended June 30, 2024 for United Freight Carriers LLC ("UFC") compared to an equity in earnings of $2.2 million in the six months ended June 30, 2023.

Gain on derivatives | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Gain on derivatives | 14,418 | | 6,962 | | | 7,456 | |

The gain on derivatives increased by $7.5 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily due to a positive development in the change of fair value for forward freight derivatives, interest rate swaps and bunker derivatives of $4.3 million, $2.7 million and $0.5 million, respectively.

Other financial items | | | | | | | | | | | | | | |

| Six Months Ended June 30, | | Change |

| (in thousands of $) | 2024 | 2023 | | |

| Other financial items | (255) | | 202 | | | (457) | |

Other financial items decreased by $0.5 million in the six months ended June 30, 2024 compared with the six months ended June 30, 2023 primarily as a result of settlement of investment in equity securities.

Recent Accounting Pronouncements

For information regarding recently adopted and recently issued accounting standards applicable to us, see Note 3, “Recently Issued Accounting Standards” to the unaudited interim condensed consolidated financial statements in this report.

LIQUIDITY AND CAPITAL RESOURCES

We operate in a capital-intensive industry and have historically financed our purchase of vessels through the issuances of equity and debt securities and borrowings from commercial banks. Our ability to generate adequate cash flows on a short and medium term basis depends substantially on the performance of our vessels in the market. Periodic adjustments to the supply of and demand for dry bulk vessels cause the industry to be cyclical in nature.

We expect continued volatility in market rates for our vessels in the foreseeable future with a consequent effect on our short and medium term liquidity.

Our funding and treasury activities are conducted within corporate policies to increase investment returns while maintaining appropriate liquidity for our requirements. Cash and cash equivalents are held primarily in U.S. dollars with some balances held in Norwegian kroner and Singapore dollars.

As of June 30, 2024, we had two vessels under construction and related outstanding contractual commitments of $43.2 million due by the fourth quarter of 2024. Remaining contractual commitments will be financed through the $85 million committed debt financing entered into in December 2023.

Our short-term liquidity requirements relate to payment of operating costs (including drydocking), payment of installments for newbuildings, activities relating to decarbonization, funding working capital requirements, repayment of bank loans, lease payments for our chartered in fleet and maintaining cash reserves against fluctuations in operating cash flows and payment of cash distributions. Sources of short-term liquidity include cash balances, restricted cash balances, short-term investments and receipts from customers, $150 million undrawn revolving credit tranche under the $360 million facility, the $275 million facility and the $175 million facility. Restricted cash consists of cash, which may only be used for certain purposes under the Company's contractual arrangements and primarily comprises collateral deposits for derivative trading. Please refer to Note 8, "Cash, cash equivalents and restricted cash", for a description of our covenant requirements.

As of June 30, 2024 and December 31, 2023, we had cash, cash equivalents and restricted cash of $103.1 million and $118.6 million, respectively. As of June 30, 2024, cash and cash equivalents included cash balances of $70.7 million (December 31, 2023: $72.9 million), which are required to be maintained by the financial covenants in our loan facilities.

As of June 30, 2024, our current portion of long-term bank debt was $115.4 million.

Other significant transactions subsequent to June 30, 2024, impacting our future cash flows include the following:

–One Kamsarmax newbuilding was delivered subsequent to June 30, 2024, and a $21.6 million drawdown on the $85 million facility mentioned above was made subsequent to the quarter. In total, subsequent to the quarter end, we paid an installment of $19.8 million for one Kamsarmax newbuilding contract, reducing the outstanding contractual commitments balance for newbuildings to $23.4 million; and

–On August 28, 2024, the Company announced a cash dividend of $0.30 per share in respect of the second quarter of 2024, which is payable on or about September 20, 2024, to shareholders of record on September 11, 2024. Shareholders holding the Company’s shares through Euronext VPS may receive this cash dividend later, on or about September 23, 2024.

Medium to Long-term Liquidity and Cash Requirements

Our medium and long-term liquidity requirements include funding drydockings, payment of installments for newbuildings, investments relating to environmental requirements and the debt and equity portion of planned and potential investments in new or replacement vessels and repayment of bank loans. Potential additional sources of funding for our medium and long-term liquidity requirements include new loans, refinancing of existing arrangements, equity issues, public and private debt offerings, sales of vessels or other assets and sale and leaseback arrangements.

Cash Flows

The following table summarizes our cash flows from operating, investing and financing activities for the periods indicated. | | | | | | | | | | | |

| | Six Months Ended June 30, |

| (in thousands of $) | | 2024 | 2023 |

| Net cash provided by operating activities | | 192,757 | | 122,068 | |

Net cash used in investing activities | | (37,716) | | (307,947) | |

| Net cash provided by (used in) financing activities | | (170,621) | | 155,129 | |

| Net change in cash, cash equivalents and restricted cash | | (15,580) | | (30,750) | |

| Cash, cash equivalents and restricted cash at beginning of period | | 118,635 | | 138,073 | |

| Cash, cash equivalents and restricted cash at end of period | | 103,055 | | 107,323 | |

Operating Activities

We have significant exposure to the spot market as on average only eleven of our vessels were fixed on long term time charter contracts during the six months ended June 30, 2024. As of the date of this report, we have seven vessels on fixed rate time charter contracts with an initial contract duration of more than eleven months. From time to time, we may also enter into forward freight agreements, or FFAs, to hedge our exposure to the charter market for a specified route and period of time. The revenues and net operating income are therefore dependent on the earnings in the spot market.

Revenues from time charters are generally received monthly or bi-weekly in advance while revenues from voyage charters are received on negotiated terms for each voyage, normally 90% or 95% after completed loading and the remaining 5-10% after completed discharge.

Net cash provided by operating activities in the six months ended June 30, 2024 was $192.8 million compared with $122.1 million in the six months ended June 30, 2023. As a substantial part of our fleet trades on either voyage charters or index linked time charter contracts, we are significantly exposed to the spot market. Therefore, our spot market exposure contributes to volatility in cash flows from operating activities. Any increase or decrease in the average rates earned by our vessels in periods subsequent to June 30, 2024, compared with the actual rates achieved during the first six months of 2024, will consequently have a positive or negative comparative impact on the amount of cash provided by operating activities.

The estimated average cash break-even rates on a time charter equivalent ("TCE") basis for the six months ended June 30, 2024 are (i) approximately $15,500 per day for our Capesize vessels without scrubbers and (ii) approximately $11,900 per day for our Panamax vessels. These are the daily rates our vessels must earn to cover current level operating expenses including dry dock expenses, estimated interest expenses, scheduled loan principal repayments, time charter hire and net general and administrative expenses. These rates do not take into account capital expenditures and contingent rental expense. The average market spot rates for the first six months of 2024 were as follows: for Capesize vessels, approximately $22,393 per day for non-scrubber vessels and for Panamax vessels, approximately $13,870 per day. The average market spot rates from July 1, 2024 to September 5, 2024, were as follows: approximately $24,003 per day for non-scrubber Capesize vessels and approximately $12,930 per day for Panamax vessels.

Investing Activities

Net cash used in investing activities was $37.7 million in the six months ended June 30, 2024 and comprised of:

•payment of $53.4 million in installments and supervision fees relating to four Kamsarmax newbuilding contracts.

This was partially offset by:

•proceeds received from the sale of Golden Bull of $15.7 million.

Net cash used in investing activities was $307.9 million in the six months ended June 30, 2023 and comprised of:

•payments totaling $241.0 million for five scrubber fitted Newcastlemax vessels acquired and delivered during six months ended June 30, 2023;

•a 10% deposit totaling $5.0 million for the remaining acquired Newcastlemax vessel;

•payment of $107.1 million in installments relating to ten Kamsarmax newbuilding contracts; and

•other investing cash outflows of approximately $7.9 million mainly related to payments for the installation of BWTS and scrubbers on the existing fleet.

This was partially offset by:

•proceeds received from the sale of Golden Feng and Golden Shui of $43.6 million;

•proceeds received from the sale of Golden Strength of $15.3 million; and

•repayment of a shareholder loan by TFG Marine of $0.9 million.

Financing Activities

Net cash used in financing activities was $170.6 million in the six months ended June 30, 2024, which was comprised of:

•distributions of $119.9 million in cash dividends to our shareholders;

•$437.9 million repayment of outstanding debt in connection with refinancing of the $233 million facility, the $120 million facility and the $304 million facility;

•$75.0 million repayment of our revolving credit facilities;

•ordinary repayment of long-term debt of $44.4 million;

•$7.7 million debt repayment on the $250 million credit facility as a result of the sale of Golden Bull previously securing the facility;

•repayments of $12.4 million in finance lease obligations; and

•$5.7 million debt fees paid in connection with the new $180 million, $85 million and $360 million facilities.

This was partially offset by:

•full draw down on the $180 million credit facility entered into in April, which refinanced the $233 million facility with outstanding balance of $178.6 million;

•a draw down of $310 million on the $360 million credit facility entered into in February, which refinanced the $120 million and $304 million facilities with outstanding balances of $256.6 million; and

•a partial $41.8 million draw down on the $85 million credit facility entered into to finance two of the four last newbuilding deliveries.

Net cash provided by financing activities was $155.1 million in the six months ended June 30, 2023, which was comprised of:

•full draw down on the new $250.0 million credit facility entered in January, which refinanced $230.4 million outstanding debt in connection with refinancing of the $93.74 million facility, the $131.79 million facility and the $155.53 million facility;

•a partial $182.0 million drawdown on the new $233.0 million facility entered into to finance acquisitions of six Newcastlemax vessels;

•a full drawdown on the new $80.0 million facility for the four newbuildings delivered during the period; and

•$25.0 million drawdown on the revolving credit facility under the $175 million facility.

This was partially offset by:

•distributions of $60.1 million in cash dividends to our shareholders;

•$230.4 million repayment of outstanding debt in connection with refinancing of the $93.74 million facility, the $131.79 million facility and the $155.53 million facility;

•ordinary repayment of long-term debt of $41.2 million;

•$25.8 million debt repayment on the $233 million debt facility as a result of the sale of Golden Feng and Golden Shui previously securing the facility;

•repayments of $12.4 million in finance lease obligation;

•$4.5 million debt fees paid in connection with the refinancing $230.4 million outstanding debt under three credit facilities and entering into a new $80 million facility; and

•$7.5 million in share repurchase payments.

Borrowing Activities

In April 2024, the Company signed a $180 million sustainability-linked term loan facility to refinance six Newcastlemax vessels acquired in February 2023. The financing has a five-year tenor and a linear age adjusted amortization profile of 20 years. The facility is priced with an interest rate of SOFR plus a margin of 160 basis points per annum, and includes a sustainability linked pricing element with an additional 5 basis points pricing adjustment dependent on emission reduction performance.

In February 2024, the Company signed a $360 million sustainability-linked credit facility to refinance a fleet of 20 vessels. The financing has a five-year tenor and has an age adjusted amortization profile of 20 years. The facility is priced with interest rate of SOFR plus a margin of 175 basis points per annum, and includes sustainability linked pricing element with an additional 5 basis points pricing adjustment, dependent on emission reduction performance. During the six months ended June 30, 2024, we drew down $310 million under the facility.

In December 2023, the Company signed a sale and leaseback agreement for an amount of $85 million to partially finance the four Kamsarmax newbuildings to be delivered during 2024. The lease financing has a ten-year tenor and an interest rate of SOFR plus a margin of 185 basis points per annum. The lease is repaid over a straight line amortization of 21 years and with purchase options throughout the term and at maturity. As of June 30, 2024, two newbuildings were delivered and we drew down $41.8 million under the facility.

In the six months ended June 30, 2024, the Company repaid $75.0 million on its revolving credit facilities, which resulted in an undrawn revolving credit facility balance of $150.0 million at the end of the period.

Debt covenants

Our loan agreements contain loan-to-value clauses, which could require us to post additional collateral or prepay a portion of the outstanding borrowings should the value of the vessels securing borrowings under each of such agreements decrease below required levels. In addition, our loan agreements contain certain financial covenants. We are required to maintain free cash of the higher of $20 million or 5% of total interest-bearing debt, maintain positive working capital as defined in our loan agreements which excludes the short-term portion of long-term borrowings and finance lease obligations, and maintain a value adjusted equity of at least 25% of value adjusted total assets. Further, under our $180 million, $360 million, $175 million, $275 million and $250 million loan facilities, the value should not fall below 130% of the outstanding loan. For the $40 million loan facility, the value should not fall below 125%. For the $80 million loan facility, the value should not fall below 120%. For the $85 million loan facility and $260 million lease financing, the value should not fall below 115%.

With regards to free cash, we have agreed under our debt arrangements to retain at least $70.7 million of cash and cash equivalents as of June 30, 2024 (December 31, 2023: $72.9 million) and in accordance with our accounting policy this is

classified under cash and cash equivalents. In addition, none of our vessel owning subsidiaries may sell, transfer or otherwise dispose of their interests in the vessels they own without the prior written consent of the applicable lenders unless, in the case of a vessel sale, the outstanding borrowings under the credit facility applicable to that vessel are repaid in full. Failure to comply with any of the covenants in the loan agreements could result in a default, which would permit the lender to accelerate the maturity of the debt and to foreclose upon any collateral securing the debt. Under those circumstances, we might not have sufficient funds or other resources to satisfy our obligations.

As of June 30, 2024, we were in compliance with all of the financial and other covenants contained in our loan agreements.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We are exposed to interest rate fluctuations primarily due to our floating interest rate bearing long term debt. The international dry bulk industry is a capital-intensive industry, which requires significant amounts of financing, typically provided in the form of secured long-term debt. Our current bank financing agreements bear floating interest rates, typically three-month USD SOFR. Significant adverse fluctuations in floating interest rates could adversely affect our operating and financial performance and our ability to service our debt.

From time to time, we may take positions in interest rate derivative contracts to manage the risk associated with fluctuations in interest payments resulting from fluctuations of the underlying floating interest rates of our long-term debt. Adverse fluctuations in floating interest rates could adversely affect our free cash position as we may be required to secure cash as collateral, under our interest rate derivative contracts.

We are exposed to credit risk in the event of non-performance by the counterparties of our interest rate derivative contracts. In order to mitigate the credit risk, we enter into derivative transactions with counterparties, usually well-established banks, which have reliable credit ratings. The possibility of a counterparty contractual non-performance event to materialize is considered remote and hence, the credit risk is considered minimal.

Our variable rate borrowings (excluding deferred charges) as of June 30, 2024 amounted to $1,347.5 million compared to $1,380.7 million as of December 31, 2023, and bear interest at SOFR plus a margin.

Interest Rate Swap Agreements

Our interest rate swaps are intended to reduce the risk associated with fluctuations in interest rates whereby the floating interest rates on a total notional principal amount of $650 million (December 31, 2023: $650 million) are swapped to fixed rate. In the six months ended June 30, 2024, we recognized a net gain of $12.3 million related to interest rate swap agreements (six months ended June 30, 2023: net gain of $9.6 million). As of June 30, 2024, a notional principal amount of $450 million, with SOFR as reference rate, had a weighted average fixed interest rate of 2.17% (December 31, 2023: 2.17%). Remaining swaps with total notional principal amount of $200 million are forward-looking.

Foreign Currency Risk

The majority of our transactions, assets and liabilities are denominated in United States dollars, our functional currency. However, we incur expenditure in currencies other than the functional currency, mainly in Norwegian kroner and Singapore dollars. There is a risk that currency fluctuations in transactions incurred in currencies other than the functional currency will have a negative effect on the value of our cash flows. We may enter into foreign currency swaps to mitigate such risk exposures. The counterparties to such contracts are major banking and financial institutions. Credit risk exists to the extent that the counterparties are unable to perform under the contracts but this risk is considered remote as the counterparties are, in our opinion, well established banks.

Foreign Currency Swap Agreements

As of June 30, 2024, we had contracts to swap United States dollars to Norwegian kroner for a notional amount of $4.5 million. In the six months ended June 30, 2024, we recognized a net gain of $4.9 thousand related to foreign currency swaps (six months ended June 30, 2023: net loss of $21.0 thousand).

Inflation

Inflation has only had a moderate effect on our expenses given current economic conditions. Significant global inflationary pressures (such as the war between Russia and Ukraine) increase operating, voyage, general and administrative, and financing costs. However, in the event of a shipping downturn, costs subject to inflation can usually be controlled as shipping companies typically monitor costs to preserve liquidity and encourage suppliers and service providers to lower rates and prices.

In the first six months of 2024, we have observed moderate inflation affecting ship operating expenses, such as crew expenses, spares and stores, however, these effects were not material in comparison to our total ship operating expenses and did not exceed 10% of the Total Operating expenses line. Please refer to “Results of Operations” for more details.

The extent of inflation’s impact on our future financial and operational results, which could be material, will depend on the duration and severity of the Russo-Ukrainian war and the overall macroeconomic impact.

Commodity Price Risk

Fuel costs represent the largest component of our voyage expenses. An increase in the price of fuel may adversely affect our profitability if these increases cannot be passed onto customers. The price and supply of fuel is unpredictable and fluctuates as a result of events outside our control, including geo-political developments, supply and demand for oil and gas, actions by members of the Organization of the Petroleum Exporting Countries and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns and regulations.

Bunker Swap Agreements

From time to time, we may enter into contracts of affreightment and time charter contracts with fixed bunker prices on redelivery. We are exposed to fluctuations in bunker prices, when the contracts of affreightment and time charter contracts are based on an assumed bunker price for the trade. There is no guarantee that a bunker swap agreement removes all the risk from the bunker exposure, due to possible differences in location and timing of the bunkering between the physical and financial position. The counterparties to such contracts are major banking and financial institutions, and fuel suppliers. Credit risk exists to the extent that the counterparties are unable to perform under the contracts but this risk is considered remote as the counterparties are, in our opinion, usually well-established banks or other well-known institutions in the market.

In the six months ended June 30, 2024, we recognized a net gain of $0.5 million related to bunker swap agreements (six months ended June 30, 2023: net gain of $47 thousand).

Spot Market Rate Risk

The cyclical nature of the dry bulk shipping industry causes significant increases or decreases in the revenue that we earn from our vessels, particularly those vessels that operate in the spot market.

FFA

From time to time, we take positions in freight derivatives, mainly through FFAs. Generally, freight derivatives may be used to hedge a vessel owner’s exposure to the charter market for a specified route and period of time. By taking positions in FFA or other derivative instruments, we could suffer losses in the settling or termination of these agreements. This could adversely affect our results of operation and cash flow. FFAs are settled on a daily basis through reputable clearing houses and also include a margin maintenance requirement based on marking the contract to market.

In the six months ended June 30, 2024, we recognized a net gain of $1.6 million related to FFAs (six months ended June 30, 2023: net loss of $2.7 million).

GOLDEN OCEAN GROUP LIMITED

INDEX TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Golden Ocean Group Limited

Unaudited Interim Condensed Consolidated Statements of Operations for the six months ended June 30, 2024 and June 30, 2023

(in thousands of $, except per share data) | | | | | | | | | | | | | | |

| | Six months ended June 30, |

| | | 2024 | | 2023 |

| Operating revenues | | | | |

Time charter revenues | | 314,736 | | | 181,693 | |

| Voyage charter revenues | | 180,897 | | | 226,946 | |

| Other revenues | | 1,193 | | | 1,261 | |

| Total operating revenues | | 496,826 | | | 409,900 | |

| | | | |

| Gain on sale of assets | | 1,133 | | | 2,583 | |

| | | | |