0001789940FALSE00017899402025-03-112025-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 11, 2025

Date of Report (date of earliest event reported)

___________________________________

First Watch Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-40866 (Commission File Number) | 82-4271369 (I.R.S. Employer Identification Number) |

8725 Pendery Place, Suite 201, Bradenton, FL 34201 |

(Address of principal executive offices and zip code) |

(941) 907-9800 |

(Registrant's telephone number, including area code) |

___________________________________Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, $0.01 par value | FWRG | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 - Results of Operations and Financial Condition.

On March 11, 2025, First Watch Restaurant Group, Inc. (the “Company”) issued a press release announcing its financial results for the fourth fiscal quarter and fiscal year ended December 29, 2024. A copy of the release is attached as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

The Company has also posted a supplemental information presentation to its website at investors.firstwatch.com, which is attached as Exhibit 99.2 and incorporated herein by reference.

The information furnished in this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Current Report shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any general incorporation language in the filing.

Item 9.01 - Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 11th day of March, 2025.

| | | | | |

First Watch Restaurant Group, Inc. (Registrant) |

| |

By: | /s/ Mel Hope |

Name: | Mel Hope |

Title: | Chief Financial Officer and Treasurer |

First Watch Restaurant Group, Inc. Reports 2024 Financial Results and Provides Outlook for 2025

•Total revenues of $1.0 billion, up 13.9% and System-wide sales of $1.2 billion, up 7.4%

•Income from operations margin of 3.9% and Restaurant level operating profit margin of 20.1%

•Net income of $18.9 million and Adjusted EBITDA of $113.8 million

•50 system-wide restaurants opened across 19 states

BRADENTON, Fla. — March 11, 2025 — First Watch Restaurant Group, Inc. (NASDAQ: FWRG) (“First Watch” or the “Company”), the leading Daytime Dining concept serving breakfast, brunch and lunch, today reported financial results for the thirteen weeks ended December 29, 2024 (“Q4 2024”) and the 52-week fiscal year ended December 29, 2024 (“2024”) compared to the fourteen weeks ended December 31, 2023 (“Q4 2023”) and the 53-week fiscal year ended December 31, 2023 (“2023”) and provided an outlook for the 52-week fiscal year ending December 28, 2025 (“2025”).

“2024 was a pivotal year as we surpassed $1 billion in total revenues and $100 million in adjusted EBITDA for the first time. These milestones were supported and augmented by our teams’ operational acuity, successfully enhancing a variety of critical KPIs including labor efficiency, ticket times and customer experience scores, among others,” said Chris Tomasso, First Watch CEO and President. “Looking ahead, we are equally excited about the opportunities for continued growth in 2025 and beyond.”

Highlights for Q4 2024 (13-week quarter) compared to Q4 2023 (14-week quarter)

•Total revenues increased 7.6% to $263.3 million in Q4 2024 from $244.6 million in Q4 2023

•System-wide sales increased 2.6% to $304.1 million in Q4 2024 from $296.5 million in Q4 2023

•Same-restaurant sales growth of negative 0.3%*

•Same-restaurant traffic growth of negative 3.0%*

•Income from operations decreased to $3.9 million in Q4 2024 from $6.9 million in Q4 2023

•Income from operations margin decreased to 1.5% in Q4 2024 from 2.8% in Q4 2023

•Restaurant level operating profit** increased to $49.0 million in Q4 2024 from $46.8 million in Q4 2023

•Restaurant level operating profit margin** decreased to 18.8% in Q4 2024 from 19.4% in Q4 2023

•Net income of $0.7 million in Q4 2024 compared to Net income of $2.6 million in Q4 2023

•Adjusted EBITDA** decreased to $24.3 million in Q4 2024 from $24.6 million in Q4 2023

•Opened 25 system-wide restaurants (23 company-owned and 2 franchise-owned) across 12 states

________________________

*Comparison to the 13-weeks ended December 31, 2023, is provided for enhanced comparability.

**See Non-GAAP Financial Measures Reconciliations section below.

Highlights for 2024 (52-week fiscal year) compared to 2023 (53-week fiscal year):

•Total revenues increased 13.9% to $1.0 billion from $891.6 million in 2023

•System-wide sales increased to $1.2 billion from $1.1 billion in 2023

•Same-restaurant sales growth of negative 0.5%*

•Same-restaurant traffic growth of negative 4.0%*

•Income from operations decreased to $38.9 million from $41.3 million in 2023

•Income from operations margin decreased to 3.9% from 4.7% in 2023

•Restaurant level operating profit** increased to $201.8 million from $175.7 million in 2023

•Restaurant level operating profit margin** increased to 20.1% from 20.0% in 2023

•Net income decreased to $18.9 million from $25.4 million in 2023

•Adjusted EBITDA** increased to $113.8 million from $99.5 million in 2023

•Opened 50 system-wide restaurants (43 company-owned and 7 franchise-owned) across 19 states resulting in a total of 572 system-wide restaurants (489 company-owned and 83 franchise-owned) across 29 states

________________________

*Comparison to the 52-weeks ended December 31, 2023, is provided for enhanced comparability.

**See Non-GAAP Financial Measures Reconciliations section below.

Outlook Fiscal Year 2025

The Company provides the following outlook for the 52-week fiscal year ended December 28, 2025:

•Same-restaurant sales growth in the positive low-single digits with flat-to-slightly positive same-restaurant traffic growth

•Total revenue growth of ~20.0%(1)

•Adjusted EBITDA* in the range of $124.0 million to $130.0 million(1)

•Blended tax rate in the range of 31.0% to 33.0%

•Total of 59 to 64 new system-wide restaurants, net of 3 company-owned restaurant closures (55 to 58 new company-owned restaurants and 7 to 9 new franchise-owned restaurants)

•Capital expenditures in the range of $150.0 million to $160.0 million invested primarily in new restaurant projects and planned remodels(2)

The Company reiterates its long-term annual financial targets as follows:

•Percentage unit growth in the low double digits

•Same-restaurant sales growth of ~3.5%

•Restaurant sales growth in the mid-teens

•Adjusted EBITDA percentage growth in the mid-teens

The Company also believes that the brand has the potential for more than 2,200 restaurants in the United States.

______________________

(1) Includes net impact approximately 4.0% in total revenue growth and approximately $8.0 million in Adjusted EBITDA associated with completed and announced acquisitions

(2) Does not include the capital outlays associated with the acquisition of franchise-owned restaurants

*We have not reconciled guidance for Adjusted EBITDA to the corresponding GAAP financial measure because we do not provide guidance for the various reconciling items. We are unable to provide guidance for these reconciling items because we cannot determine their probable significance, as certain items are outside of our control and cannot be reasonably predicted due to the fact that these items could vary significantly from period to period. Accordingly, reconciliations to the corresponding GAAP financial measure is not available without unreasonable effort.

Conference Call and Webcast

Chris Tomasso, Chief Executive Officer and President, and Mel Hope, Chief Financial Officer, will host a conference call and webcast today to discuss these financial results for Q4 2024 at 8:00 AM ET.

Interested parties may listen to the conference call via any one of two options:

–Dial 201-389-0914, which will be answered by an operator

–Join the webcast at https://investors.firstwatch.com/news-and-events/events

The webcast will be archived shortly after the call has concluded.

Definitions

The following definitions apply to these terms as used in this release:

System-wide restaurants: the total number of restaurants, including all company-owned and franchise-owned restaurants.

System-wide sales: consists of restaurant sales from our company-owned restaurants and franchise-owned restaurants. We do not recognize the restaurant sales from our franchise-owned restaurants as revenue.

Same-restaurant sales growth: the percentage change in year-over-year restaurant sales (excluding gift card breakage) for the comparable restaurant base, which we define as the number of company-owned First Watch branded restaurants open for 18 months or longer as of the beginning of the fiscal year (“Comparable Restaurant Base”). For the year ended 2024, this operating metric compares the 52-week period ended December 29, 2024 with the 52-week period ended December 31, 2023, versus the 53-week fiscal year ended December 31, 2023, in order to compare like-for-like periods. For the 52-weeks ended December 29, 2024 and December 31, 2023, there were 344 restaurants and 327 restaurants in our Comparable Restaurant Base. Measuring our same-restaurant sales growth allows Management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors to provide a consistent comparison of restaurant sales results and trends across periods within our core, established restaurant base, unaffected by results of store openings, closings and other transitional changes.

Same-restaurant traffic growth: the percentage change in traffic counts for the 52-week period ended December 29, 2024 as compared to the 52-week ended December 31, 2023 using the Comparable Restaurant Base, versus the 53-week fiscal year ended December 31, 2023 in order to compare like-for-like periods. Measuring our same-restaurant traffic growth allows Management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors because same-restaurant traffic provides an indicator as to the development of our brand and the effectiveness of our marketing strategy.

Adjusted EBITDA: a non-GAAP measure, is defined as net income (loss) before depreciation and amortization, interest expense, income taxes and items that the Company does not consider in the evaluation of its ongoing core operating performance.

Adjusted EBITDA margin: a non-GAAP measure, is defined as Adjusted EBITDA as a percentage of total revenues.

Restaurant level operating profit: a non-GAAP measure, is defined as restaurant sales, less restaurant operating expenses, which include food and beverage costs, labor and other related expenses, other restaurant operating expenses, pre-opening expenses and occupancy expenses. Restaurant level operating profit excludes corporate-level expenses and other items that we do not consider in the evaluation of the ongoing core operating performance.

Restaurant level operating profit margin: a non-GAAP measure, is defined as Restaurant level operating profit as a percentage of restaurant sales.

About First Watch

First Watch is an award-winning Daytime Dining concept serving made-to-order breakfast, brunch and lunch using fresh ingredients. A recipient of hundreds of local “Best Breakfast” and “Best Brunch” accolades, First Watch’s award-winning chef-driven menu rotates five times a year and includes elevated executions of classic favorites alongside specialties such as its Quinoa Power Bowl, Lemon Ricotta Pancakes, Chickichanga, Morning Meditation fresh juice and signature Million Dollar Bacon. After first appearing on the list in 2022 and 2023, First Watch was named 2024’s #1 Most Loved Workplace® in America by Newsweek and the Best Practice Institute. In 2023, First Watch was named the top restaurant brand in Yelp’s inaugural list of the top 50 most-loved brands in the U.S. In 2022, First Watch was awarded a sought-after MenuMasters honor by Nation's Restaurant News for its seasonal Braised Short Rib Omelet. First Watch operates more than 570 First Watch restaurants in 30 states. For more information, visit www.firstwatch.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to any historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “outlook,” “potential,” “project,” “projection,” “plan,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other similar expressions. You should evaluate all forward-looking statements made in this press release in the context of the risks and uncertainties disclosed herein, in our Annual Report on Form 10-K, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of the Company’s website at https://investors.firstwatch.com/financial-information/sec-filings. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the following: uncertainty regarding the Russia-Ukraine war, Israel-Hamas war and the related impact on macroeconomic conditions, including inflation, as a result of such conflicts or other related events; our vulnerability to changes in economic conditions and consumer preferences; our inability to successfully open new restaurants or establish new markets; our inability to effectively manage our growth; potential negative impacts on sales at our and our franchisees’ restaurants as a result of our opening new restaurants; a decline in visitors to any of the retail centers, lifestyle centers, or entertainment centers where our restaurants are located; lower than expected same-restaurant sales growth; unsuccessful marketing programs and limited time new offerings; changes in the cost of food; unprofitability or closure of new restaurants or lower than previously experienced performance in existing restaurants; our inability to compete effectively for customers; unsuccessful financial performance of our franchisees; our limited control over our franchisees’ operations; our inability to maintain good relationships with our franchisees; conflicts of interest with our franchisees; the geographic concentration of our system-wide restaurant base in the southeast portion of the United States; damage to our reputation and negative publicity; our inability or failure to recognize, respond to and effectively manage the accelerated impact of social media; our limited number of suppliers and distributors for several of our frequently used ingredients and shortages or disruptions in the supply or delivery of such ingredients; information technology system failures or breaches of our network security; our failure to comply with federal and state laws and regulations relating to privacy, data protection, advertising and consumer protection, or the expansion of current or the enactment of new laws or regulations relating to privacy, data protection, advertising and consumer protection; our potential liability with our gift cards under the property laws of some states; our failure to enforce and maintain our trademarks and protect our other intellectual property; litigation with respect to intellectual property assets; our dependence on our executive officers and certain other key employees; our inability to identify, hire, train and retain qualified individuals for our workforce; our failure to obtain or to properly verify the employment eligibility of our employees; our failure to maintain our corporate culture as we grow; unionization activities among our employees; employment and labor law proceedings; labor shortages or increased labor costs or health care costs; risks associated with leasing property subject to long-term and non-cancelable leases; risks related to our sale of alcoholic beverages; costly and complex compliance with federal, state and local laws; changes in accounting principles applicable to us; our vulnerability to natural disasters, unusual weather conditions, pandemic outbreaks, political events, war and terrorism; our inability to secure additional capital to support business growth; our level of indebtedness; failure to comply with covenants under our credit facility; and the interests of our majority stockholder may differ from those of public stockholders. For additional discussion of factors that could impact our operational and financial results, please refer to our filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of the Company’s website at https://investors.firstwatch.com/financial-information/sec-filings. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, our actual financial condition, results of operations, future performance and business may vary in material respects from the performance projected in these forward-looking statements.

Investor Relations Contact

Steven L. Marotta

941-500-1918

investors@firstwatch.com

Media Relations Contact

Jenni Glester

407-864-5823

jglester@firstwatch.com

Non-GAAP Financial Measures (Unaudited)

To supplement the consolidated financial statements, which are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we use the following non-GAAP measures, which present operating results on an adjusted basis: (i) Adjusted EBITDA, (ii) Adjusted EBITDA margin, (iii) Restaurant level operating profit and (iv) Restaurant level operating profit margin. Our presentation of these non-GAAP financial measures includes isolating the effects of some items that are either nonrecurring in nature or have no meaningful correlation to our ongoing core operating performance. These supplemental measures of performance are not required by or presented in accordance with GAAP. Management believes these non-GAAP measures provide investors with additional visibility into our operations, facilitate analysis and comparisons of our ongoing business operations because they exclude items that may not be indicative of our ongoing operating performance, help to identify operational trends and allow for greater transparency with respect to key metrics used by Management in our financial and operational decision making. Our non-GAAP measures may not be comparable to similarly titled measures used by other companies and have important limitations as analytical tools. These non-GAAP financial measures should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP as they may not provide a complete understanding of our performance. These non-GAAP financial measures should be reviewed in conjunction with our consolidated financial statements prepared in accordance with GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin

Management uses Adjusted EBITDA and Adjusted EBITDA margin (i) as factors in evaluating management’s performance when determining incentive compensation, (ii) to evaluate the Company’s operating results and the effectiveness of our business strategies, (iii) internally as benchmarks to compare the Company’s performance to that of its competitors and (iv) to provide investors with additional transparency of the Company’s operations. The use of Adjusted EBITDA and Adjusted EBITDA margin as performance measures permit a comparative assessment of the Company’s operating performance relative to the Company’s performance based on the Company’s GAAP results, while isolating the effects of some items that are either nonrecurring in nature or vary from period to period without any correlation to the Company’s ongoing core operating performance.

The following tables reconcile Net income (loss) and Net income (loss) margin, the most directly comparable GAAP measures, to Adjusted EBITDA and Adjusted EBITDA margin for the periods indicated:

| | | | | | | | | | | | | | | | | |

| FOURTH QUARTER |

| (in thousands) | 2024 | | 2023 | | 2022 |

| Net income (loss) | $ | 699 | | | $ | 2,648 | | | $ | (486) | |

| Depreciation and amortization | 15,755 | | | 12,231 | | | 8,928 | |

| Interest expense | 3,219 | | | 2,271 | | | 1,738 | |

| Income taxes | 39 | | | 2,857 | | | 742 | |

| EBITDA | 19,712 | | | 20,007 | | | 10,922 | |

Stock-based compensation (1) | 2,131 | | | 2,218 | | | 2,553 | |

Transaction expenses, net (2) | 818 | | | 604 | | | 537 | |

Strategic transition costs (3) | 889 | | | 211 | | | 367 | |

Impairments and loss on disposal of assets (4) | 139 | | | 741 | | | 348 | |

Delaware Voluntary Disclosure Agreement Program (5) | 25 | | | 794 | | | 149 | |

Recruiting and relocation costs (6) | 254 | | | 50 | | | 111 | |

Insurance proceeds in connection with natural disasters, net (8) | 329 | | | — | | | 115 | |

| Adjusted EBITDA | $ | 24,297 | | | $ | 24,625 | | | $ | 15,102 | |

| | | | | |

| Total revenues | $ | 263,291 | | | $ | 244,633 | | | $ | 185,745 | |

| Net income (loss) margin | 0.3 | % | | 1.1 | % | | (0.3) | % |

| Adjusted EBITDA margin | 9.2 | % | | 10.1 | % | | 8.1 | % |

| | | | | |

| Additional information | | | | | |

Deferred rent expense (9) | $ | 242 | | | $ | 515 | | | $ | 507 | |

| | | | | | | | | | | | | | | | | |

| FISCAL YEAR |

| (in thousands) | 2024 | | 2023 | | 2022 |

| Net income | $ | 18,925 | | | $ | 25,385 | | | $ | 6,907 | |

| Depreciation and amortization | 57,715 | | | 41,223 | | | 34,230 | |

| Interest expense | 12,640 | | | 8,063 | | | 5,232 | |

| Income taxes | 9,101 | | | 10,690 | | | 5,684 | |

| EBITDA | 98,381 | | | 85,361 | | | 52,053 | |

Stock-based compensation (1) | 8,525 | | | 7,604 | | | 10,374 | |

Transaction expenses, net (2) | 2,587 | | | 3,147 | | | 2,513 | |

Strategic transition costs (3) | 1,843 | | | 892 | | | 2,318 | |

Impairments and loss on disposal of assets (4) | 525 | | | 1,359 | | | 920 | |

Delaware Voluntary Disclosure Agreement Program (5) | 126 | | | 1,250 | | | 149 | |

Recruiting and relocation costs (6) | 888 | | | 465 | | | 681 | |

Severance costs (7) | 204 | | | 26 | | | 155 | |

Insurance proceeds in connection with natural disasters, net (8) | 329 | | | (621) | | | 115 | |

| Loss on extinguishment of debt | 428 | | | — | | | — | |

| Adjusted EBITDA | $ | 113,836 | | | $ | 99,483 | | | $ | 69,278 | |

| | | | | |

| Total revenues | $ | 1,015,910 | | | $ | 891,551 | | | $ | 730,162 | |

| Net income margin | 1.9 | % | | 2.8 | % | | 0.9 | % |

| Adjusted EBITDA margin | 11.2 | % | | 11.2 | % | | 9.5 | % |

| | | | | |

| Additional information | | | | | |

Deferred rent expense (9) | $ | 1,318 | | | $ | 2,090 | | | $ | 2,418 | |

___________________________(1) Represents non-cash, stock-based compensation expense which is recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(2) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, expenses related to debt, secondary offering costs, costs related to restaurant closures, gains or losses associated with lease or contract terminations and revaluations of contingent consideration liability.

(3) Represents costs related to process improvements and strategic initiatives. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(4) Represents impairment charges and costs related to the disposal of assets due to retirements, replacements, restaurant closures and natural disasters.

(5) Represents professional service costs incurred in connection with the Delaware Voluntary Disclosure Agreement Program related to unclaimed or abandoned property. These costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(6) Represents costs incurred for hiring qualified individuals. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(7) Severance costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(8) Represents insurance recoveries, net of costs incurred, in connection with hurricane damage, which were recorded in Other income, net on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(9) Represents the non-cash portion of straight-line rent expense recorded within both Occupancy expenses and General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

Restaurant level operating profit and Restaurant level operating profit margin

Restaurant level operating profit and Restaurant level operating profit margin are not indicative of our overall results, and because they exclude corporate-level expenses, do not accrue directly to the benefit of our stockholders. We will continue to incur such expenses in the future. Restaurant level operating profit and Restaurant level operating profit margin are important measures we use to evaluate the performance and profitability of each operating restaurant, individually and in the aggregate and to make decisions regarding future spending and other operational decisions. We believe that Restaurant level operating profit and Restaurant level operating profit margin provide useful information about our operating results, identify operational trends and allow for transparency with respect to key metrics used by us in our financial and operational decision-making.

The following tables reconcile Income from operations and Income from operations margin, the most directly comparable GAAP financial measures, to Restaurant level operating profit and Restaurant level operating profit margin for the periods indicated:

| | | | | | | | | | | | | | | | | |

| FOURTH QUARTER |

| (in thousands) | 2024 | | 2023 | | 2022 |

| Income from operations | $ | 3,861 | | | $ | 6,855 | | | $ | 1,479 | |

| Less: Franchise revenues | (2,666) | | | (3,591) | | | (2,893) | |

| Add: | | | | | |

| General and administrative expenses | 30,743 | | | 29,953 | | | 21,765 | |

| Depreciation and amortization | 15,755 | | | 12,231 | | | 8,928 | |

Transaction expenses, net (1) | 818 | | | 604 | | | 537 | |

Impairments and loss on disposal of assets (2) | 139 | | | 741 | | | 348 | |

Costs in connection with natural disasters (3) | 312 | | | — | | | 382 | |

| Restaurant level operating profit | $ | 48,962 | | | $ | 46,793 | | | $ | 30,546 | |

| | | | | |

| Restaurant sales | $ | 260,625 | | | $ | 241,042 | | | $ | 182,852 | |

| Income from operations margin | 1.5 | % | | 2.8 | % | | 0.8 | % |

| Restaurant level operating profit margin | 18.8 | % | | 19.4 | % | | 16.7 | % |

| | | | | |

| Additional information | | | | | |

Deferred rent expense (4) | $ | 192 | | | $ | 466 | | | $ | 457 | |

| | | | | | | | | | | | | | | | | |

| FISCAL YEAR |

| (in thousands) | 2024 | | 2023 | | 2022 |

| Income from operations | $ | 38,907 | | | $ | 41,267 | | | $ | 16,913 | |

| Less: Franchise revenues | (11,555) | | | (14,459) | | | (10,981) | |

| Add: | | | | | |

| General and administrative expenses | 113,270 | | | 103,121 | | | 84,959 | |

| Depreciation and amortization | 57,715 | | | 41,223 | | | 34,230 | |

Transaction expenses, net (1) | 2,587 | | | 3,147 | | | 2,513 | |

Impairments and loss on disposal of assets (2) | 525 | | | 1,359 | | | 920 | |

Costs in connection with natural disasters (3) | 312 | | | — | | | 382 | |

| Restaurant level operating profit | $ | 201,761 | | | $ | 175,658 | | | $ | 128,936 | |

| | | | | |

| Restaurant sales | $ | 1,004,355 | | | $ | 877,092 | | | $ | 719,181 | |

| Income from operations margin | 3.9 | % | | 4.7 | % | | 2.4 | % |

| Restaurant level operating profit margin | 20.1 | % | | 20.0 | % | | 17.9 | % |

| | | | | |

| Additional information | | | | | |

Deferred rent expense (4) | $ | 1,119 | | | $ | 1,891 | | | $ | 2,219 | |

____________________________

(1) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, secondary offering costs, costs related to restaurant closures, gains or losses associated with lease or contract terminations and revaluations of contingent consideration liability.

(2) Represents impairment charges and costs related to the disposal of assets due to retirements, replacements, restaurant closures and natural disasters.

(3) Represents costs incurred in connection with hurricane damage. The costs include inventory spoilage and labor costs, which were recorded in Food and beverage costs and Labor and other expenses, respectively. on the Consolidated Statements of Operations and Comprehensive Income (Loss).

(4) Represents the non-cash portion of straight-line rent expense recorded within Occupancy expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss).

FIRST WATCH RESTAURANT GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | Fourth Quarter |

| | 2024 | | 2023 | | 2022 |

| Revenues: | | | | | |

| Restaurant sales | $ | 260,625 | | | $ | 241,042 | | | $ | 182,852 | |

| Franchise revenues | 2,666 | | | 3,591 | | | 2,893 | |

| Total revenues | 263,291 | | | 244,633 | | | 185,745 | |

| Operating costs and expenses: | | | | | |

| Restaurant operating expenses (exclusive of depreciation and amortization shown below): | | | | | |

| Food and beverage costs | 59,245 | | | 54,346 | | | 43,361 | |

| Labor and other related expenses | 87,706 | | | 81,698 | | | 63,166 | |

| Other restaurant operating expenses | 38,736 | | | 36,905 | | | 28,715 | |

| Occupancy expenses | 21,961 | | | 18,450 | | | 15,601 | |

| Pre-opening expenses | 4,327 | | | 2,850 | | | 1,845 | |

| General and administrative expenses | 30,743 | | | 29,953 | | | 21,765 | |

| Depreciation and amortization | 15,755 | | | 12,231 | | | 8,928 | |

| Impairments and loss on disposal of assets | 139 | | | 741 | | | 348 | |

| Transaction expenses, net | 818 | | | 604 | | | 537 | |

| Total operating costs and expenses | 259,430 | | | 237,778 | | | 184,266 | |

| Income from operations | 3,861 | | | 6,855 | | | 1,479 | |

| Interest expense | (3,219) | | | (2,271) | | | (1,738) | |

| Other income, net | 96 | | | 921 | | | 515 | |

| Income before income taxes | 738 | | | 5,505 | | | 256 | |

| Income tax expense | (39) | | | (2,857) | | | (742) | |

| Net income (loss) | $ | 699 | | | $ | 2,648 | | | $ | (486) | |

| | | | | |

| Net income (loss) | $ | 699 | | | $ | 2,648 | | | $ | (486) | |

| Other comprehensive income (loss): | | | | | |

| Unrealized gain (loss) on derivatives | 2,722 | | | (1,986) | | | — | |

| Income tax related to other comprehensive income (loss) | (679) | | | 494 | | | — | |

| Other comprehensive income (loss) | 2,043 | | | (1,492) | | | — | |

| Comprehensive income (loss) | $ | 2,742 | | | $ | 1,156 | | | $ | (486) | |

| | | | | |

| Net income (loss) per common share - basic | $ | 0.01 | | | $ | 0.04 | | | $ | (0.01) | |

| Net income (loss) per common share - diluted | $ | 0.01 | | | $ | 0.04 | | | $ | (0.01) | |

| Weighted average number of common shares outstanding - basic | 60,636,071 | | | 59,827,847 | | | 59,193,779 | |

| Weighted average number of common shares outstanding - diluted | 62,335,821 | | | 61,688,871 | | | 59,193,779 | |

FIRST WATCH RESTAURANT GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE DATA)

| | | | | | | | | | | | | | | | | | | | |

| | | FISCAL YEAR |

| | | 2024 | | 2023 | | 2022 |

| Revenues: | | | | | | |

| Restaurant sales | | $ | 1,004,355 | | | $ | 877,092 | | | $ | 719,181 | |

| Franchise revenues | | 11,555 | | | 14,459 | | | 10,981 | |

| Total revenues | | 1,015,910 | | | 891,551 | | | 730,162 | |

| Operating costs and expenses: | | | | | | |

| Restaurant operating expenses (exclusive of depreciation and amortization shown below): | | | | | | |

| Food and beverage costs | | 223,097 | | | 197,374 | | | 172,561 | |

| Labor and other related expenses | | 335,038 | | | 294,010 | | | 238,257 | |

| Other restaurant operating expenses | | 151,968 | | | 134,477 | | | 114,476 | |

| Occupancy expenses | | 82,694 | | | 68,400 | | | 59,919 | |

| Pre-opening expenses | | 10,109 | | | 7,173 | | | 5,414 | |

| General and administrative expenses | | 113,270 | | | 103,121 | | | 84,959 | |

| Depreciation and amortization | | 57,715 | | | 41,223 | | | 34,230 | |

| Impairments and loss on disposal of assets | | 525 | | | 1,359 | | | 920 | |

| Transaction expenses, net | | 2,587 | | | 3,147 | | | 2,513 | |

| Total operating costs and expenses | | 977,003 | | | 850,284 | | | 713,249 | |

| Income from operations | | 38,907 | | | 41,267 | | | 16,913 | |

| Interest expense | | (12,640) | | | (8,063) | | | (5,232) | |

| Other income, net | | 1,759 | | | 2,871 | | | 910 | |

| Income before income taxes | | 28,026 | | | 36,075 | | | 12,591 | |

| Income tax expense | | (9,101) | | | (10,690) | | | (5,684) | |

| Net income | | $ | 18,925 | | | $ | 25,385 | | | $ | 6,907 | |

| | | | | | |

| Net income | | $ | 18,925 | | | $ | 25,385 | | | $ | 6,907 | |

| Other comprehensive income (loss): | | | | | | |

| Unrealized gain (loss) on derivatives | | 301 | | | (889) | | | — | |

| Income tax related to other comprehensive income (loss) | | (75) | | | 222 | | | — | |

| Other comprehensive income (loss) | | 226 | | | (667) | | | — | |

| Comprehensive income | | $ | 19,151 | | | $ | 24,718 | | | $ | 6,907 | |

| | | | | | |

| Net income per common share - basic | | $ | 0.31 | | | $ | 0.43 | | | $ | 0.12 | |

| Net income per common share - diluted | | $ | 0.30 | | | $ | 0.41 | | | $ | 0.11 | |

| Weighted average number of common shares outstanding - basic | | 60,365,393 | | | 59,531,404 | | | 59,097,512 | |

| Weighted average number of common shares outstanding - diluted | | 62,351,222 | | | 61,191,613 | | | 60,140,045 | |

Same-Restaurant Sales Growth and Same-Restaurant Traffic Growth

| | | | | | | | | | | | | | | | | | | | |

| THIRTEEN WEEKS ENDED | | SAME-RESTAURANT SALES GROWTH | | SAME-RESTAURANT TRAFFIC GROWTH | | COMPARABLE RESTAURANT BASE |

| December 29, 2024 | | (0.3) | % | * | (3.0) | % | * | 344 | |

| December 31, 2023 | | 5.0 | % | ** | (1.3) | % | ** | 327 | |

| December 25, 2022 | | 7.7 | % | | (0.6) | % | | 301 | |

___________________

*Comparison to the 13 weeks ended December 31, 2023, is provided for enhanced comparability.

**Thirteen weeks ended December 31, 2023.

SUPPLEMENTAL INFORMATION Q4 2024 March 11, 2025 Exhibit 99.2

FORWARD LOOKING STATEMENTS In addition to historical information, this presentation may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to any historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “outlook,” “potential,” “project,” “projection,” “plan,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other similar expressions. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in our filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov and the Investors Relations section of the Company’s website at https://investors.firstwatch.com/financial-information/sec- filings. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the following: uncertainty regarding the Russia-Ukraine war, the Israel-Hamas war and the related impact on macroeconomic conditions, including inflation, as a result of such conflicts or other related events; our vulnerability to changes in economic conditions and consumer preferences; our inability to successfully open new restaurants or establish new markets; our inability to effectively manage our growth; potential negative impacts on sales at our and our franchisees’ restaurants as a result of our opening new restaurants; a decline in visitors to any of the retail centers, lifestyle centers, or entertainment centers where our restaurants are located; lower than expected same-restaurant sales growth; unsuccessful marketing programs and limited time new offerings; changes in the cost of food; unprofitability or closure of new restaurants or lower than previously experienced performance in existing restaurants; our inability to compete effectively for customers; unsuccessful financial performance of our franchisees; our limited control over our franchisees’ operations; our inability to maintain good relationships with our franchisees; conflicts of interest with our franchisees; the geographic concentration of our system-wide restaurant base in the southeast portion of the United States; damage to our reputation and negative publicity; our inability or failure to recognize, respond to and effectively manage the accelerated impact of social media; our limited number of suppliers and distributors for several of our frequently used ingredients and shortages or disruptions in the supply or delivery of such ingredients; information technology system failures or breaches of our network security; our failure to comply with federal and state laws and regulations relating to privacy, data protection, advertising and consumer protection, or the expansion of current or the enactment of new laws or regulations relating to privacy, data protection, advertising and consumer protection; our potential liability with our gift cards under the property laws of some states; our failure to enforce and maintain our trademarks and protect our other intellectual property; litigation with respect to intellectual property assets; our dependence on our executive officers and certain other key employees; our inability to identify, hire, train and retain qualified individuals for our workforce; our failure to obtain or to properly verify the employment eligibility of our employees; our failure to maintain our corporate culture as we grow; unionization activities among our employees; employment and labor law proceedings; labor shortages or increased labor costs or health care costs; risks associated with leasing property subject to long-term and non-cancelable leases; risks related to our sale of alcoholic beverages; costly and complex compliance with federal, state and local laws; changes in accounting principles applicable to us; our vulnerability to natural disasters, unusual weather conditions, pandemic outbreaks, political events, war and terrorism; our inability to secure additional capital to support business growth; our level of indebtedness; failure to comply with covenants under our credit facility; and the interests of our largest stockholder may differ from those of public stockholders. The forward-looking statements included in this presentation are made only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. NON-GAAP FINANCIAL MEASURES (UNAUDITED) To supplement the consolidated financial statements, which are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we use the following non-GAAP measures, which present operating results on an adjusted basis: (i) Adjusted EBITDA, (ii) Adjusted EBITDA margin, (iii) Restaurant level operating profit and (iv) Restaurant level operating profit margin. Our presentation of these non-GAAP measures includes isolating the effects of some items that are either nonrecurring in nature or have no meaningful correlation to our ongoing core operating performance. These supplemental measures of performance are not required by or presented in accordance with GAAP. Management believes these non-GAAP measures provide investors with additional visibility into our operations, facilitate analysis and comparisons of our ongoing business operations because they exclude items that may not be indicative of our ongoing operating performance, help to identify operational trends and allow for greater transparency with respect to key metrics used by Management in our financial and operational decision making. Our non-GAAP measures may not be comparable to similarly titled measures used by other companies and have important limitations as analytical tools. These non-GAAP measures should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP as they may not provide a complete understanding of our performance. These non-GAAP measures should be reviewed in conjunction with our consolidated financial statements prepared in accordance with GAAP. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. 2 CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

We are First Watch. We’re the leaders of the Daytime Dining category – a segment comprised of culinary-driven concepts operating exclusively during daytime hours. Our performance and successes are achieved during one 7½-hour shift, from 7 a.m. to 2:30 p.m. We serve made-to-order breakfast, brunch and lunch using fresh ingredients, and our culture is built around a simple, people-focused mission: “You First.” Our elevated offering capitalizes on three long-term consumer trends: the attractive breakfast daypart, an increasing demand for fresh, healthy food and the heightened importance of on-demand dining. We appeal to a broad mix of customers across generations from Gen Z to Baby Boomers. Since 1983, we have delivered sales and unit growth as a result of our broad brand appeal. At the end of the fourth quarter, we operated 572 system-wide restaurants in 29 states, and we believe we’re just getting started. G O O D M O R N IN G ! 3

PERFORMANCE & COMMENTARY Q4 2024

6 Q2 2024 HIGHLIGHTS Q4 2024 (13-week quarter) highlights compared to Q4 2023 (14-week quarter): • Total revenues increased 7.6% to $263.3 million in Q4 2024 from $244.6 million in Q4 2023 • System-wide sales increased 2.6% to $304.1 million in Q4 2024 from $296.5 million in Q4 2023 • Same-restaurant sales growth of negative 0.3%* • Same-restaurant traffic growth of negative 3.0%* • Income from operations decreased to $3.9 million in Q4 2024 from $6.9 million in Q4 2023 • Income from operations margin decreased to 1.5% in Q4 2024 from 2.8% in Q4 2023 • Restaurant level operating profit** increased to $49.0 million in Q4 2024 from $46.8 million in Q4 2023 • Restaurant level operating profit margin** decreased to 18.8% in Q4 2024 from 19.4% in Q4 2023 • Net income of $0.7 million in Q4 2024 compared to Net income of $2.6 million in Q4 2023 • Adjusted EBITDA** decreased to $24.3 million in Q4 2024 from $24.6 million in Q4 2023 • Opened 25 system-wide restaurants (23 company-owned and 2 franchise-owned) across 12 states *Comparison to the 13-weeks ended December 31, 2023, is provided for enhanced comparability. **See Non-GAAP Financial Measures Reconciliations section below.

“2024 was a pivotal year as we surpassed $1 billion in total revenues and $100 million in adjusted EBITDA for the first time. These milestones were supported and augmented by our teams’ operational acuity, successfully enhancing a variety of critical KPIs including labor efficiency, ticket times and customer experience scores, among others. Looking ahead, we are equally excited about the opportunities for continued growth in 2025 and beyond.” Chris Tomasso, First Watch CEO and President 7

Holiday | October 29, 2024 – January 6, 2025 8 Two double-layered tacos, each with a wheat-corn tortilla filled with refried black beans and Cheddar and Monterey Jack, wrapped around a crispy corn tortilla shell filled with scrambled cage-free eggs, hardwood smoked bacon and hand- pulled carnitas. Topped with lime crema, housemade pico de gallo, fresh avocado and cilantro. Served with a cup of fresh fruit sprinkled with Tajin® seasoning. A freshly baked cinnamon roll glazed with lemon cream cheese icing and gilded with luxurious gold sprinkles. Seared steak, house-roasted Crimini mushrooms and onions, Mozzarella and fresh spinach in a potato hash. Topped with two cage-free eggs any style, Parmesan cream sauce and fresh herbs. Served with Parmesan- crusted ciabatta. CINNAMON CHIP PANCAKE BREAKFAST A classic, seasonal First Watch favorite. Two cage-free eggs cooked any style with a cinnamon chip pancake and your choice of hardwood smoked bacon or chicken, pork or turkey sausage. STAY GOLDEN CINNAMON ROLL DOUBLE CRUNCH BREAKFAST TACOS STEAK & EGGS HASH A TASTE OF Q4

Jump Start | January 7 – March 17, 2025 9 Thick-cut, griddled artisan sourdough topped with thinly shaved Volpi prosciutto, scrambled cage-free eggs, Monterey Jack, freshly grated Parmesan, lemon-dressed arugula and roasted garlic aioli. Served with a cup of fresh fruit. Thinly slice carne asada, crumbled chorizo and diced red bell peppers in a potato hash topped with two cage-free eggs any style, Cheddar and Monterey Jack, housemade pico de gallo, fresh avocado, shaved radish, cilantro and jalapeño crema. Served with two warm wheat-corn tortillas. Thick-cut, custard-dipped challah bread griddled and topped with fresh raspberries, whipped lemon ricotta cream, raspberry purée and spiced gingerbread cookie crumbles. Lightly dusted with powdered cinnamon sugar. BLUE BOOSTER Fresh juice featuring blueberry, Fuji Apple, lemon and basil. PARMESAN PROSCIUTTO TOAST CARNE ASADA HASH RASPBERRY RICOTTA FRENCH TOAST A TASTE OF Q1

The Company provides the following outlook for the 52-week fiscal year ended December 28, 2025: • Same-restaurant sales growth in the positive low-single digits with flat-to-slightly positive same-restaurant traffic growth • Total revenue growth of ~20.0%(1) • Adjusted EBITDA(2) in the range of $124.0 million to $130.0 million(1) • Blended tax rate of around 31%-33.0% • Total of 59 to 64 new system-wide restaurants, net of 3 company-owned restaurant closures (55 to 58 new company-owned restaurants and 7 to 9 new franchise-owned restaurants) • Capital expenditures in the range of $150.0 million to $160.0 million invested primarily in new restaurant projects and planned remodels(3) 10 OUTLOOK _______________________________________________________________________ (1) Includes net impact of approximately 4.0% in total revenue growth and approximately $8.0 million in Adjusted EBITDA associated with completed and announced acquisitions. (2) We have not reconciled guidance for Adjusted EBITDA to the corresponding GAAP financial measure because we do not provide guidance for the various reconciling items. We are unable to provide guidance for these reconciling items because we cannot determine their probable significance, as certain items are outside of our control and cannot be reasonably predicted due to the fact that these items could vary significantly from period to period. Accordingly, a reconciliation to the corresponding GAAP financial measure is not available without unreasonable effort. (3) Does not include the capital outlays associated with the acquisition of franchise-owned restaurants. OUTLOOK FOR FISCAL YEAR 2025

11 The following table summarizes our results of operations and the percentages of items in our Consolidated Statements of Operations in relation to Total revenues or, where indicated, Restaurant sales for fiscal years 2024, 2023, 2022, the thirteen weeks ended December 29, 2024 and fourteen weeks ended December 31, 2023: CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (1) As a percentage of restaurant sales (in thousands) Revenues Restaurant sales 260,625$ 99.0% 241,042$ 98.5% 1,004,355$ 98.9% 877,092$ 98.4% 719,181$ 98.5% Franchise revenues 2,666 1.0% 3,591 1.5% 11,555 1.1% 14,459 1.6% 10,981 1.5% Total revenues 263,291 100.0% 244,633 100.0% 1,015,910 100.0% 891,551 100.0% 730,162 100.0% Operating costs and expenses Restaurant operating expenses (1) (exclusive of depreciation and amortization shown below): Food and beverage costs 59,245 22.7% 54,346 22.5% 223,097 22.2% 197,374 22.5% 172,561 24.0% Labor and other related expenses 87,706 33.7% 81,698 33.9% 335,038 33.4% 294,010 33.5% 238,257 33.1% Other restaurant operating expenses 38,736 14.9% 36,905 15.3% 151,968 15.1% 134,477 15.3% 114,476 15.9% Occupancy expenses 21,961 8.4% 18,450 7.7% 82,694 8.2% 68,400 7.8% 59,919 8.3% Pre-opening expenses 4,327 1.7% 2,850 1.2% 10,109 1.0% 7,173 0.8% 5,414 0.8% General and administrative expenses 30,743 11.7% 29,953 12.2% 113,270 11.1% 103,121 11.6% 84,959 11.6% Depreciation and amortization 15,755 6.0% 12,231 5.0% 57,715 5.7% 41,223 4.6% 34,230 4.7% Impairments and loss on disposal of assets 139 0.1% 741 0.3% 525 0.1% 1,359 0.2% 920 0.1% Transaction expenses, net 818 0.3% 604 0.2% 2,587 0.3% 3,147 0.4% 2,513 0.3% Total operating costs and expenses 259,430 98.5% 237,778 97.2% 977,003 96.2% 850,284 95.4% 713,249 97.7% Income from operations (1) 3,861 1.5% 6,855 2.8% 38,907 3.9% 41,267 4.7% 16,913 2.4% Interest expense (3,219) (1.2%) (2,271) (0.9%) (12,640) (1.2%) (8,063) (0.9%) (5,232) (0.7%) Other income, net 96 0.0% 921 0.4% 1,759 0.2% 2,871 0.3% 910 0.1% Income before income taxes 738 0.3% 5,505 2.3% 28,026 2.8% 36,075 4.0% 12,591 1.7% Income tax expense (39) (0.0%) (2,857) (1.2%) (9,101) (0.9%) (10,690) (1.2%) (5,684) (0.8%) Net income 699$ 0.3% 2,648$ 1.1% 18,925$ 1.9% 25,385$ 2.8% 6,907$ 0.9% Net income 699 2,648 18,925 25,385 6,907 Other comprehensive (loss): Unrealized gain (loss) on derivatives 2,722 (1,986) 301 (889) - Income tax related to other comprehensive (loss) income (679) 494 (75) 222 - Other comprehensive income (loss) 2,043 (1,492) 226 (667) - Comprehensive income 2,742 1,156 19,151 24,718 6,907 Net income per common share - basic 0.01$ 0.04$ 0.31$ 0.43$ 0.12$ Net income per common share - diluted 0.01$ 0.04$ 0.30$ 0.41$ 0.11$ Weighted average number of common shares outstanding - basic 60,636,071 59,827,847 60,365,393 59,531,404 59,097,512 Weighted average number of common shares outstanding - diluted 62,335,821 61,688,871 62,351,222 61,191,613 60,140,045 2022 FISCAL YEAR 2024 2023 THIRTEEN WEEKS ENDED FOURTEEN WEEKS ENDED December 29, 2024 December 31, 2023

12 SELECTED OPERATING DATA * Average unit volume presented on an annual basis only. (1) Comparing the 52-week period ended December 29, 2024 with the 52-week period ended December 31, 2023 in order to compare like-for-like periods. See “Key Performance Indicators” for additional information. (2) Reconciliations from Income from operations and Income from operations margin, the most comparable GAAP measures to Restaurant level operating profit and Restaurant level operating profit margin, are set forth in the schedules within the Non-GAAP Financial Measure Reconciliations section below. (3) Reconciliations from Net income and Net income margin, the most comparable GAAP measures to Adjusted EBITDA and Adjusted EBITDA margin, are set forth in the schedules within the Non-GAAP Financial Measure Reconciliations section below. THIRTEEN WEEKS FOURTEEN WEEKS December 29, 2024 December 31, 2023 2024 2023 2022 Operating weeks in fiscal year 13 14 52 53 52 System-wide restaurants 572 524 572 524 474 Company-owned 489 425 489 425 366 Franchise-owned 83 99 83 99 108 System-wide sales (in thousands) $304,105 $296,533 $1,184,469 $1,103,089 $914,816 Same-restaurant sales growth (1) (0.3%) 5.0% (0.5%) 7.6% 14.5% Same-restaurant traffic growth (1) (3.0%) (1.3%) (4.0%) 0.2% 7.7% AUV (in thousands)* $2,204 $2,250 $2,032 Income from operations (in thousands) $3,861 $6,855 $38,907 $41,267 $16,913 Income from operations margin 1.5% 2.8% 3.9% 4.7% 2.4% Restaurant level operating profit (in thousands) (2) $48,962 $46,793 $201,761 $175,658 $128,936 Restaurant level operating profit margin (2) 18.8% 19.4% 20.1% 20.0% 17.9% Net income (in thousands) $699 $2,648 $18,925 $25,385 $6,907 Net income margin 0.3% 1.1% 1.9% 2.8% 0.9% Adjusted EBITDA (in thousands) (3) $24,297 $24,625 $113,836 $99,483 $69,278 Adjusted EBITDA margin (3) 9.2% 10.1% 11.2% 11.2% 9.5% FISCAL YEAR

APPENDIX

SYSTEM-WIDE RESTAURANT COUNT BY STATE AS OF 2024 YEAR END ® Our flexible box size of ~3,800–6,600 sq ft with an average net build-out cost of ~$1.75M allows us to fit in any real estate and supports visibility to 2,200 restaurants (1) Representative of our target 3-year new units performance, which is comparable to the historical 3-year performance of our new restaurants. (2) Cash-on-Cash Return is defined as Restaurant Level Operating Profit (excluding gift card breakage and deferred rent expense (income)) in the third year of operation (months 25-36 of operation) for company-owned restaurants divided by their cash build-out expenses, net of landlord incentives. (3) The Internal Rate of Return (IRR) is the annual growth rate that makes the net present value (NPV) of all cash flows from the investment zero. IRR represents the minimum yearly return needed for the investment in a new restaurant location to break even over the lease term. Note: Restaurant counts represent system-wide restaurants. AUV metrics by state is for Company-Owned restaurants only, representing trailing 12 months as of the end of Q4 2024. 61 1 19 13 7 25 3 68 1 1 6 23 133 10 36 24 17 8 5 11 44 1 26 19 7 15 48 35 2 • Demonstrated success of rapid unit growth • 14.5% system-wide unit CAGR from 2014-2024 • 572 locations across the U.S. at the 2024 year end • Proven portability with restaurants in our top decile spanning 14 states and 22 DMAs $2.7M 18-20% ~35% 18%+ Year 3 Avg Sales(1) Year 3 Restaurant-Level Operating Profit (1) Year 3 Cash-On-Cash Returns(1) (2) IRR(3) ATTRACTIVE NEW UNIT ECONOMICS, FLEXIBLE SIZE, WORKS EVERYWHERE FLORIDA 133 $2.3M AUV OHIO 44 $2.2M AUV MISSOURI 25 $2.3M AUV ARIZONA 35 $2.4M AUV TEXAS 68 $2.2M AUV

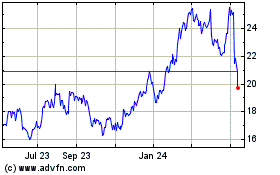

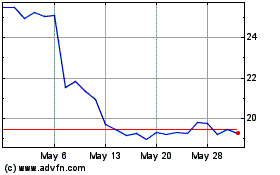

15 ** Pre-opening expenses are presented in one line item on the Consolidated Statements of Operations and Comprehensive Income (Loss) Same-Restaurant Sales & Traffic Growth Pre-opening Expenses** HISTORICAL DATA *Comparison to the 13-weeks and 52-weeks ended December 31, 2023, is provided for enhanced comparability. . Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Other restaurant operating expenses $ 957 $ 928 $ 828 $ 2,971 $ 5,684 $ 654 $ 643 $ 1,122 $ 1,956 $ 4,375 $ 648 $ 563 $ 813 $ 1,301 $ 3,325 Occupancy expenses 610 900 1,559 1,356 $ 4,425 382 609 913 894 2,798 337 531 677 544 2,089 Total Pre-opening expenses $ 1,567 $ 1,828 $ 2,387 $ 4,327 $ 10,109 $ 1,036 $ 1,252 $ 2,035 $ 2,850 $ 7,173 $ 985 $ 1,094 $ 1,490 $ 1,845 $ 5,414 2023 20222024 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Same-Restaurant Sales Growth 0.5% (0.3%) (1.9%) (0.3%)* (0.5%)* 12.9% 7.8% 4.8% 5.0% 7.6% 27.2% 13.4% 12.0% 7.7% 14.5% Same-Restaurant Traffic Growth (Decline) (4.5%) (4.0%) (4.4%) (3.0%)* (4.0%)* 5.1% (1.2%) (1.9%) (1.3%) 0.2% 21.9% 8.1% 3.7% (0.6%) 7.7% Comparable Restaurant Base 344 344 344 344 344 328 327 327 327 327 305 304 303 301 301 2024 2023 2022

16 Management uses Adjusted EBITDA and Adjusted EBITDA margin (i) as factors in evaluating management’s performance when determining incentive compensation, (ii) to evaluate the Company’s operating results and the effectiveness of our business strategies, (iii) internally as benchmarks to compare the Company’s performance to that of its competitors and (iv) to provide investors with additional transparency of the Company’s operations. The use of Adjusted EBITDA and Adjusted EBITDA margin as performance measures permit a comparative assessment of the Company’s operating performance relative to the Company’s performance based on the Company’s GAAP results, while isolating the effects of some items that are either nonrecurring in nature or vary from period to period without any correlation to the Company’s ongoing core operating performance. The adjacent table reconciles Net income (loss) and Net income (loss) margin, the most directly comparable GAAP measures, to Adjusted EBITDA and Adjusted EBITDA margin, respectively, for the periods indicated. NON-GAAP FINANCIAL MEASURES RECONCILIATIONS Adjusted EBITDA and Adjusted EBITDA margin (1) Represents non-cash, stock-based compensation expense which is recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). (2) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, expenses related to debt, secondary offering costs, costs related to restaurant closures, gains or losses associated with lease or contract terminations and revaluations of contingent consideration liability. (3) Represents costs related to process improvements and strategic initiatives. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). (4) Represents impairment charges and costs related to the disposal of assets due to retirements, replacements, restaurant closures and natural disasters. (5) Represents professional service costs incurred in connection with the Delaware Voluntary Disclosure Agreement Program related to unclaimed or abandoned property. These costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). (6) Represents costs incurred for hiring qualified individuals. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). (7) Severance costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). (8) Represents insurance recoveries, net of costs incurred, in connection with hurricane damage, which were recorded in Other income, net on the Consolidated Statements of Operations and Comprehensive Income (Loss). (9) Represents the non-cash portion of straight-line rent expense recorded within both Occupancy expenses and General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss)." THIRTEEN WEEKS FOURTEEN WEEKS (in thousands) December 29, 2024 December 31, 2023 2022 Net income (loss) $699 $2,648 $18,925 $25,385 $6,907 Depreciation and amortization 15,755 12,231 57,715 41,223 34,230 Interest expense 3,219 2,271 12,640 8,063 5,232 Income taxes 39 2,857 9,101 10,690 5,684 EBITDA 19,712 20,007 98,381 85,361 52,053 Stock-based compensation (1) 2,131 2,218 8,525 7,604 10,374 Transaction expenses (income), net (2) 818 604 2,587 3,147 2,513 Strategic transition costs (3) 889 211 1,843 892 2,318 Impairments and loss on disposal of assets (4) 139 741 525 1,359 920 Delaware Voluntary Disclosure Agreement Program (5) 25 794 126 1,250 149 Recruiting and relocation costs (6) 254 50 888 465 681 Severance costs (7) - - 204 26 155 Insurance proceeds in connection with natural disasters, net (8) 329 - 329 (621) 115 Loss on extinguishment of debt - - 428 - - Adjusted EBITDA 24,297 24,625 $113,836 $99,483 $69,278 Total revenues $263,291 $244,633 $1,015,910 $891,551 $730,162 Net income (loss) margin 0.3% 1.1% 1.9% 2.8% 0.9% Adjusted EBITDA margin 9.2% 10.1% 11.2% 11.2% 9.5% Additional information Deferred rent expense (income) (9) $242 $515 $1,318 $2,090 $2,418 FISCAL YEAR 2024 2023

17 Restaurant level operating profit and Restaurant level operating profit margin are not indicative of our overall results, and because they exclude corporate-level expenses, do not accrue directly to the benefit of our stockholders. We will continue to incur such expenses in the future. Restaurant level operating profit and Restaurant level operating profit margin are important measures we use to evaluate the performance and profitability of each operating restaurant, individually and in the aggregate and to make decisions regarding future spending and other operational decisions. We believe that Restaurant level operating profit and Restaurant level operating profit margin provide useful information about our operating results, identify operational trends and allow for transparency with respect to key metrics used by us in our financial and operational decision-making. The adjacent table reconciles Income (Loss) from operations and Income (Loss) from operations margin, the most directly comparable GAAP financial measures, to Restaurant level operating profit and Restaurant level operating profit margin, respectively, for the periods indicated. Restaurant level operating profit and Restaurant level operating profit margin NON-GAAP FINANCIAL MEASURES RECONCILIATIONS (1) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, secondary offering costs, costs related to restaurant closures, gains or losses associated with lease or contract terminations and revaluations of contingent consideration liability. (2) Represents impairment charges and costs related to the disposal of assets due to retirements, replacements, restaurant closures and natural disasters. (3) Represents costs incurred in connection with hurricane damage. The costs include inventory spoilage and labor costs, which were recorded in Food and beverage costs and Labor and other related expenses, respectively, on the Consolidated Statements of Operations and Comprehensive Income (Loss). (4) Represents the non-cash portion of straight-line rent expense recorded within Occupancy expenses on the Consolidated Statements of Operations and Comprehensive Income (Loss). THIRTEEN WEEKS FOURTEEN WEEKS (in thousands) December 29, 2024 December 31, 2023 2024 2023 2022 Income (loss) from operations $3,861 $6,855 $38,907 $41,267 $16,913 Less: Franchise revenues (2,666) (3,591) (11,555) (14,459) (10,981) Add: General and administrative expenses 30,743 29,953 113,270 103,121 84,959 Depreciation and amortization 15,755 12,231 57,715 41,223 34,230 Transaction expenses (income), net (1) 818 604 2,587 3,147 2,513 Impairments and loss on disposal of assets (2) 139 741 525 1,359 920 Costs in connection with natural disasters (3) 312 - 312 - 382 Restaurant level operating profit $48,962 $46,793 $201,761 $175,658 $128,936 Restaurant sales $260,625 $241,042 $1,004,355 $877,092 $719,181 Income from operations margin 1.5% 2.8% 3.9% 4.7% 2.4% Restaurant level operating profit margin 18.8% 19.4% 20.1% 20.0% 17.9% Additional information Deferred rent expense (income) (4) $192 $466 $1,119 $1,891 $2,219 FISCAL YEAR

18 The following definitions apply to these terms as used in this presentation: Adjusted EBITDA: a non-GAAP financial measure, is defined as net income (loss) before depreciation and amortization, interest expense, income taxes and items that the Company does not consider in the evaluation of its ongoing core operating performance. Adjusted EBITDA margin: a non-GAAP financial measure, is defined as Adjusted EBITDA as a percentage of total revenues. Average Unit Volume: the total restaurant sales (excluding gift card breakage) recognized in the comparable restaurant base, which is defined as the number of company-owned First Watch branded restaurants open for 18 months or longer as of the beginning of the fiscal year (“Comparable Restaurant Base”), divided by the number of restaurants in the Comparable Restaurant Base during the period. This measurement allows management to assess changes in consumer spending patterns at our restaurants and the overall performance of our restaurant base. Restaurant level operating profit: a non-GAAP financial measure, is defined as restaurant sales, less restaurant operating expenses, which include food and beverage costs, labor and other related expenses, other restaurant operating expenses, pre-opening expenses and occupancy expenses. Restaurant level operating profit excludes corporate-level expenses and items that are not considered in the Company’s evaluation of its ongoing core operating performance. Restaurant level operating profit margin: a non-GAAP financial measure, is defined as Restaurant level operating profit as a percentage of restaurant sales. Same-restaurant sales growth: the percentage change in year-over-year restaurant sales (excluding gift card breakage) for the comparable restaurant base, which we define as the number of company-owned First Watch branded restaurants open for 18 months or longer as of the beginning of the fiscal year (“Comparable Restaurant Base”). For the year ended 2024, this operating metric compares the 52-week period ended December 29, 2024 with the 52-week period ended December 31, 2023, versus the 53-week fiscal year ended December 31, 2023, in order to compare like-for-like periods. For the 52-weeks ended December 29, 2024 and December 31, 2023, there were 344 restaurants and 327 restaurants in our Comparable Restaurant Base. Measuring our same-restaurant sales growth allows Management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors to provide a consistent comparison of restaurant sales results and trends across periods within our core, established restaurant base, unaffected by results of store openings, closings and other transitional changes. Same-restaurant traffic growth: the percentage change in traffic counts for the 52-week period ended December 29, 2024 as compared to the 52-week period ended December 31, 2023 using the Comparable Restaurant Base, versus the 53-week fiscal year ended December 31, 2023 in order to compare like-for-like periods. Measuring our same-restaurant traffic growth allows Management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors because same-restaurant traffic provides an indicator as to the development of our brand and the effectiveness of our marketing strategy System-wide restaurants: the total number of restaurants, including all company-owned and franchise-owned restaurants. System-wide sales: consists of restaurant sales from our company-owned restaurants and franchise-owned restaurants. We do not recognize the restaurant sales from our franchise- owned restaurants as revenue. DEFINITIONS

For more information, visit investors.firstwatch.com or email investors@firstwatch.com

v3.25.0.1

Cover

|

Mar. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 11, 2025

|

| Entity Registrant Name |

First Watch Restaurant Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40866

|

| Entity Tax Identification Number |

82-4271369

|

| Entity Address, Address Line One |

8725 Pendery Place

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

Bradenton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

34201

|

| City Area Code |

941

|

| Local Phone Number |

907-9800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

FWRG

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001789940

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |