Embecta Corp. (“embecta” or the "Company") (Nasdaq: EMBC), a global

diabetes care company, today reported financial results for the

three- and twelve-month periods ended September 30, 2024.

"We are pleased to report a strong fourth

quarter and end to our fiscal year, as we once again delivered

results that exceeded our expectations across key financial

metrics. We continued to execute on our strategic priorities, and

to date, our significant accomplishments include the successful

transition of approximately 98% of our revenue to our own ERP

system, shared service capabilities, and distribution

infrastructure, with India remaining as our only deferred market.

Additionally, the recent launch of our small-pack GLP-1 needles in

Germany has gone well, and we are evaluating expanding into other

markets," said Devdatt (Dev) Kurdikar, Chief Executive Officer of

embecta.

Mr. Kurdikar continued: "As our stand-up work

nears completion and following an in-depth review of our portfolio

and strategy, we have decided to discontinue our insulin patch pump

program and initiate an organizational restructuring plan. We

believe this approach will streamline operations, reduce costs and

enhance our profitability and free cash flow profile. We intend to

concentrate our resources on our core business and to prioritize

our free cash flow towards paying down debt which we expect will

give us the financial flexibility needed for future

investments."

The Company currently expects to incur total

pre-tax charges of between $35 million and $45 million in fiscal

year 2025 related to the restructuring plan, consisting of between

$25 million and $30 million in pre-tax, cash charges for planned

workforce reductions and other associated costs from the

discontinuation of the patch pump program, and between $10 million

and $15 million in pre-tax, non-cash charges for asset impairments

and write-offs. Note, these preliminary estimates may be revised

following the completion of the ongoing analysis of the expected

additional pre-tax non-cash charges associated with the

implementation of the restructuring plan.

The Company expects the restructuring plan to be

substantially complete during the first half of fiscal year 2025

and expects the discontinuation of the patch pump program and

organizational restructuring plan to generate annualized pre-tax

cost savings of between $60 million and $65 million. Given the

organizational restructuring plan, the Company has decided to

postpone the previously announced Analyst & Investor Day to

Spring 2025.

Fourth Quarter Fiscal Year 2024 Financial

Highlights:

-

Reported Revenues of $286.1 million, up 1.5%;

-

Adjusted Revenues of $290.2 million, up 4.1% on an adjusted

constant currency basis

-

U.S. revenues increased 10.3% on both a reported and adjusted

constant currency basis

-

International revenues decreased 8.8% on a reported basis, and

decreased 3.1% on an adjusted constant currency basis

-

Gross profit and margin of $173.8 million and 60.7%, compared to

$181.8 million and 64.5% in the prior year period

-

Adjusted gross profit and margin of $178.3 million and 61.4%

compared to $182.6 million and 64.8% in the prior year period

-

Operating income and margin of $26.2 million and 9.2%, compared to

$25.8 million and 9.2% in the prior year period

- Adjusted operating

income and margin of $61.2 million and 21.1%, compared to $65.2

million and 23.1% in the prior year period

-

Net income of $14.6 million and earnings per diluted share of

$0.25. This compares to net income of $6.0 million and earnings per

diluted share of $0.10 in the prior year period.

-

Adjusted net income and adjusted earnings per diluted share of

$25.9 million and $0.45, compared to $34.1 million and $0.59 in the

prior year period

-

Adjusted EBITDA and margin of $73.0 million and 25.2%, compared to

$79.6 million and 28.2% in the prior year period

-

Announced a dividend of $0.15 per share

Twelve Months Ended September 30 Fiscal

Year 2024 Financial Highlights:

-

Reported Revenues of $1,123.1 million, up 0.2%;

-

Adjusted Revenues of $1,127.2 million, up 1.1% on an adjusted

constant currency basis

-

U.S. revenues increased 1.0% on both a reported and adjusted

constant currency basis

-

International revenues decreased 0.7% on a reported basis, and

increased 1.3% on an adjusted constant currency basis

-

Gross profit and margin of $735.2 million and 65.5%, compared to

$749.9 million and 66.9% in the prior year period

-

Adjusted gross profit and margin of $740.7 million and 65.7%,

compared to $751.2 million and 67.0% in the prior year period

-

Operating income and margin of $166.8 million and 14.9%, compared

to $221.5 million and 19.8% in the prior year period

-

Adjusted operating income and margin of $296.9 million and 26.3%,

compared to $331.5 million and 29.6% in the prior year period

-

Net income and earnings per diluted share of $78.3 million and

$1.34, respectively. This compares to net income and earnings per

diluted share of $70.4 million and $1.22, respectively, in the

prior year period.

-

Adjusted net income and adjusted earnings per diluted share of

$143.1 million and $2.45, compared to $172.6 million and $2.99 in

the prior year period

-

Adjusted EBITDA and margin of $353.4 million and 31.4%, compared to

$378.7 million and 33.8% in the prior year period

Adjusted Constant Currency Revenue Growth is

based upon Reported Revenues, adjusted to exclude, depending on the

period presented, the items described in Adjusted Revenues and to

eliminate the impact of translating the results of international

subsidiaries at different currency exchange rates from period to

period. The impact of changes in foreign currency may vary

significantly from period to period, and such changes generally are

outside of the control of our management. We believe that this

measure facilitates a comparison of our operating performance

exclusive of currency exchange rate fluctuations that do not

reflect our underlying performance or business trends. These

results should be considered in addition to, not as a substitute

for, results reported in accordance with GAAP. Results on an

Adjusted constant currency basis, as we present them, may not be

comparable to similarly titled measures used by other companies and

are not measures of performance presented in accordance with

GAAP.

Fourth Quarter Fiscal Year 2024

Results:

Revenues by geographic region are as

follows:

| |

Three months ended September 30, |

| Dollars in

millions |

|

|

|

|

|

|

|

|

|

|

|

% Increase/(Decrease) |

| |

|

2024 |

|

|

2023 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Adjustment Impact |

|

Adjusted Constant Currency Revenue Growth |

| |

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

% |

|

United States |

$ |

167.4 |

|

$ |

— |

|

|

$ |

167.4 |

|

$ |

151.8 |

|

$ |

— |

|

$ |

151.8 |

|

10.3 |

% |

|

— |

% |

|

— |

% |

|

10.3 |

% |

| International1 |

|

118.7 |

|

|

(4.1 |

) |

|

|

122.8 |

|

|

130.1 |

|

|

— |

|

|

130.1 |

|

(8.8 |

) |

|

(2.6 |

) |

|

(3.1 |

) |

|

(3.1 |

) |

| Total |

$ |

286.1 |

|

$ |

(4.1 |

) |

|

$ |

290.2 |

|

$ |

281.9 |

|

$ |

— |

|

$ |

281.9 |

|

1.5 |

% |

|

(1.2 |

)% |

|

(1.4 |

)% |

|

4.1 |

% |

| |

Revenues by product family are as follows:

| |

Three months ended September 30, |

| Dollars in

millions |

|

|

|

|

|

|

|

|

|

|

|

% Increase/(Decrease) |

| |

|

2024 |

|

|

2023 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Adjustment Impact |

|

Adjusted Constant Currency Revenue Growth |

| |

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

% |

|

Pen Needles |

$ |

215.2 |

|

|

$ |

— |

|

|

$ |

215.2 |

|

$ |

211.1 |

|

$ |

— |

|

$ |

211.1 |

|

1.9 |

% |

|

(0.9 |

)% |

|

— |

% |

|

2.8 |

% |

| Syringes |

|

33.7 |

|

|

|

— |

|

|

|

33.7 |

|

|

33.2 |

|

|

— |

|

|

33.2 |

|

1.5 |

|

|

(3.3 |

) |

|

— |

|

|

4.8 |

|

| Safety |

|

32.8 |

|

|

|

— |

|

|

|

32.8 |

|

|

31.3 |

|

|

— |

|

|

31.3 |

|

4.8 |

|

|

(1.0 |

) |

|

— |

|

|

5.8 |

|

| Other2 |

|

(0.3 |

) |

|

|

(4.1 |

) |

|

|

3.8 |

|

|

3.9 |

|

|

— |

|

|

3.9 |

|

(107.7 |

) |

|

(5.1 |

) |

|

(102.6 |

) |

|

— |

|

| Contract Manufacturing |

|

4.7 |

|

|

|

— |

|

|

|

4.7 |

|

|

2.4 |

|

|

— |

|

|

2.4 |

|

95.8 |

|

|

— |

|

|

— |

|

|

95.8 |

|

| Total |

$ |

286.1 |

|

|

$ |

(4.1 |

) |

|

$ |

290.2 |

|

$ |

281.9 |

|

$ |

— |

|

$ |

281.9 |

|

1.5 |

% |

|

(1.2 |

)% |

|

(1.4 |

)% |

|

4.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 In 2024, International includes the

recognition of incremental Italian payback accruals resulting from

the two July 22, 2024 rulings by the Constitutional Court of Italy

relating to certain prior years since 2015 in order to arrive at

Adjusted Revenues.2 Other includes product revenue for swabs and

other accessories. In 2024, Other reflects the recognition of

incremental Italian payback accruals resulting from the two July

22, 2024 rulings by the Constitutional Court of Italy relating to

certain prior years since 2015 in order to arrive at Adjusted

Revenues.

Our revenues increased by $4.2 million, or 1.5%,

to $286.1 million for the fourth quarter of 2024 as compared to

revenues of $281.9 million for the fourth quarter of 2023. Changes

in our revenues are driven by the volume of goods that we sell, the

prices we negotiate with customers and changes in foreign exchange

rates. The increase in revenues was driven by $13.7 associated with

favorable changes in price and a $2.3 increase in contract

manufacturing revenues related to sales of non-diabetes products to

BD. This was partially offset by $5.3 million of unfavorable

gross-to-net adjustments primarily attributed to the recognition of

incremental Italian payback accruals resulting from the two July

22, 2024 rulings by the Constitutional Court of Italy, $3.4 million

associated with the negative impact of foreign currency translation

primarily due to the strengthening of the U.S. dollar, and $3.1

million of unfavorable changes in volume.

Twelve Months Fiscal Year 2024

Results:

Revenues by geographic region are as

follows:

| |

Twelve months ended September 30, |

| Dollars in

millions |

|

|

|

|

|

|

|

|

|

|

|

% Increase/(Decrease) |

| |

|

2024 |

|

|

2023 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Adjustment Impact |

|

Adjusted Constant Currency Revenue Growth |

| |

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

% |

|

United States |

$ |

607.2 |

|

$ |

— |

|

|

$ |

607.2 |

|

$ |

601.4 |

|

$ |

— |

|

$ |

601.4 |

|

1.0 |

% |

|

— |

% |

|

— |

% |

|

1.0 |

% |

|

International1 |

|

515.9 |

|

|

(4.1 |

) |

|

|

520.0 |

|

|

519.4 |

|

|

— |

|

|

519.4 |

|

(0.7 |

) |

|

(1.2 |

) |

|

(0.8 |

) |

|

1.3 |

|

|

Total |

$ |

1,123.1 |

|

$ |

(4.1 |

) |

|

$ |

1,127.2 |

|

$ |

1,120.8 |

|

$ |

— |

|

$ |

1,120.8 |

|

0.2 |

% |

|

(0.5 |

)% |

|

(0.4 |

)% |

|

1.1 |

% |

|

|

Revenues by product family are as follows:

| |

Twelve months ended September 30, |

| Dollars in

millions |

|

|

|

|

|

|

|

|

|

|

|

% Increase/(Decrease) |

| |

|

2024 |

|

|

2023 |

|

Reported Revenue Growth |

|

Currency Impact |

|

Adjustment Impact |

|

Adjusted Constant Currency Revenue Growth |

| |

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

Reported Revenues |

|

Adjustment |

|

Adjusted Revenues |

|

% |

|

Pen Needles |

$ |

844.4 |

|

$ |

— |

|

|

$ |

844.4 |

|

$ |

829.2 |

|

$ |

— |

|

$ |

829.2 |

|

1.8 |

% |

|

(0.8 |

)% |

|

— |

% |

|

2.6 |

% |

|

Syringes |

|

126.2 |

|

|

— |

|

|

|

126.2 |

|

|

138.1 |

|

|

— |

|

|

138.1 |

|

(8.6 |

) |

|

0.2 |

|

|

— |

|

|

(8.8 |

) |

|

Safety |

|

129.4 |

|

|

— |

|

|

|

129.4 |

|

|

126.3 |

|

|

— |

|

|

126.3 |

|

2.5 |

|

|

— |

|

|

— |

|

|

2.5 |

|

|

Other2 |

|

10.3 |

|

|

(4.1 |

) |

|

|

14.4 |

|

|

14.2 |

|

|

— |

|

|

14.2 |

|

(27.5 |

) |

|

— |

|

|

(28.2 |

) |

|

0.7 |

|

| Contract

Manufacturing |

|

12.8 |

|

|

— |

|

|

|

12.8 |

|

|

13.0 |

|

|

— |

|

|

13.0 |

|

(1.5 |

) |

|

— |

|

|

— |

|

|

(1.5 |

) |

|

Total |

$ |

1,123.1 |

|

$ |

(4.1 |

) |

|

$ |

1,127.2 |

|

$ |

1,120.8 |

|

$ |

— |

|

$ |

1,120.8 |

|

0.2 |

% |

|

(0.5 |

)% |

|

(0.4 |

)% |

|

1.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 In 2024, International includes the

recognition of incremental Italian payback accruals resulting from

the two July 22, 2024 rulings by the Constitutional Court of Italy

relating to certain prior years since 2015 in order to arrive at

Adjusted Revenues. 2 Other includes product sales for swabs and

other accessories. In 2024, Other reflects the recognition of

incremental Italian payback accruals resulting from the two July

22, 2024 rulings by the Constitutional Court of Italy relating to

certain prior years since 2015 in order to arrive at Adjusted

Revenues.

Our revenues increased by $2.3 million, or

0.2%, to $1,123.1 million for the year ended September 30, 2024 as

compared to revenues of $1,120.8 million for the year ended

September 30, 2023. The increase in revenues was primarily driven

by $27.7 million associated with favorable changes in price. This

was partially offset by $14.5 million of unfavorable changes in

volume, $6.1 million associated with the negative impact of foreign

currency translation primarily due to the strengthening of the U.S.

dollar, $4.6 million of unfavorable gross-to-net adjustments

primarily attributed to the recognition of incremental Italian

payback accruals resulting from the two July 22, 2024 rulings by

the Constitutional Court of Italy, and a $0.2 million decrease in

contract manufacturing revenues related to sales of non-diabetes

products to BD.

Preliminary Fiscal Year 2025 Financial

Guidance:

For fiscal year 2025, excluding the patch pump

program, the Company expects:

|

Dollars in millions, except percentages and per share

data |

|

|

|

Reported Revenues |

|

$1,093 - $1,110 |

| Reported Revenue Growth

(%) |

|

(2.7)% - (1.2)% |

|

Impact of F/X (%) |

|

(0.6)% |

|

Impact of Italian Payback Measure (1) (%) |

|

0.4% |

| Adjusted Constant Currency

Revenue Growth (%) |

|

(2.5)% - (1.0)% |

| Adjusted Gross Margin (%) |

|

63.25% - 64.25% |

| Adjusted Operating Margin

(%) |

|

29.00% - 30.00% |

| Adjusted Earnings per Diluted

Share |

|

$2.70 - $2.90 |

| Adjusted EBITDA Margin

(%) |

|

35.50% - 36.50% |

|

(1) |

|

Reflects the recognition of incremental Italian payback accruals

resulting from the two July 22, 2024 rulings by the Constitutional

Court of Italy relating to certain prior years since 2015 recorded

in Revenues. |

|

|

|

|

We are unable to present a quantitative

reconciliation of our expected adjusted earnings per diluted share,

expected adjusted EBITDA and our expected adjusted EBITDA margin as

we are unable to predict with reasonable certainty and without

unreasonable effort the impact and timing of any one-time items.

The financial impact of these one-time items is uncertain and is

dependent on various factors, including timing, and could be

material to our Condensed Consolidated Statements of Income.

Balance sheet, Liquidity and Other

Updates

During the fourth quarter, the Company paid an

aggregate principal amount of approximately $27.4 million

outstanding under its term loan B facility that had an interest

rate of 300 basis points over the secured overnight financing rate

(“SOFR”), with a 0.50% SOFR floor.

As of September 30, 2024, the Company had

$274.2 million in cash and equivalents and restricted cash and

$1.601 billion of debt principal outstanding, and no amount

drawn on its $500 million Revolving Credit Facility.

The Company’s Board of Directors declared a

quarterly cash dividend of $0.15 for each issued and outstanding

share of the Company’s common stock. The dividend is payable on

December 18, 2024 to stockholders of record at the close of

business on December 6, 2024.

Fiscal 2024 Fourth Quarter and Full Year

Earnings Conference Call:

Management will host a conference call at 8:00

a.m. Eastern Time (ET) on November 26, 2024 to discuss the

results of the quarter and full year, provide an update on its

business, and host a question and answer session. Those who would

like to participate may access the live webcast here, or access the

teleconference here. The live webcast can also be accessed via the

Company’s website at investors.embecta.com.

A webcast replay of the call will be available

beginning at 11:00 a.m. ET on November 26, 2024, via the

embecta investor relations website and archived on the website for

one year.

| |

|

Condensed Consolidated Statements of Income

Embecta Corp.(Unaudited, in millions,

except per share data) |

| |

| |

Three Months EndedSeptember

30, |

|

Twelve Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

286.1 |

|

|

$ |

281.9 |

|

|

$ |

1,123.1 |

|

|

$ |

1,120.8 |

|

| Cost of

products sold |

|

112.3 |

|

|

|

100.1 |

|

|

|

387.9 |

|

|

|

370.9 |

|

|

Gross Profit |

$ |

173.8 |

|

|

$ |

181.8 |

|

|

$ |

735.2 |

|

|

$ |

749.9 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

| Selling

and administrative expense |

|

96.8 |

|

|

|

95.7 |

|

|

|

365.1 |

|

|

|

341.3 |

|

| Research

and development expense |

|

19.8 |

|

|

|

23.6 |

|

|

|

78.8 |

|

|

|

85.2 |

|

|

Impairment expense |

|

— |

|

|

|

2.5 |

|

|

|

— |

|

|

|

2.5 |

|

| Other

operating expenses |

|

31.0 |

|

|

|

34.2 |

|

|

|

124.5 |

|

|

|

99.4 |

|

|

Total Operating Expenses |

$ |

147.6 |

|

|

$ |

156.0 |

|

|

$ |

568.4 |

|

|

$ |

528.4 |

|

|

Operating Income |

$ |

26.2 |

|

|

$ |

25.8 |

|

|

$ |

166.8 |

|

|

$ |

221.5 |

|

| Interest

expense, net |

|

(29.0 |

) |

|

|

(27.6 |

) |

|

|

(112.3 |

) |

|

|

(107.0 |

) |

| Other

income (expense), net |

|

(4.2 |

) |

|

|

6.8 |

|

|

|

(10.3 |

) |

|

|

(8.8 |

) |

| Income

(Loss) Before Income Taxes |

$ |

(7.0 |

) |

|

$ |

5.0 |

|

|

$ |

44.2 |

|

|

$ |

105.7 |

|

| Income

tax provision (benefit) |

|

(21.6 |

) |

|

|

(1.0 |

) |

|

|

(34.1 |

) |

|

|

35.3 |

|

|

Net Income |

$ |

14.6 |

|

|

$ |

6.0 |

|

|

$ |

78.3 |

|

|

$ |

70.4 |

|

| |

|

|

|

|

|

|

|

| Net

Income per common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.25 |

|

|

$ |

0.10 |

|

|

$ |

1.36 |

|

|

$ |

1.23 |

|

|

Diluted |

$ |

0.25 |

|

|

$ |

0.10 |

|

|

$ |

1.34 |

|

|

$ |

1.22 |

|

|

|

| |

|

Condensed Consolidated Balance

SheetsEmbecta Corp.(Unaudited, in

millions, except share and per share data) |

| |

| |

September 30, 2024 |

|

September 30, 2023 |

|

Assets |

|

|

|

|

Current Assets |

|

|

|

|

Cash and equivalents |

$ |

267.5 |

|

|

$ |

326.3 |

|

|

Restricted cash |

|

6.7 |

|

|

|

0.2 |

|

|

Trade receivables, net (net of allowance for doubtful accounts of

$2.8 million and $1.0 million as of September 30, 2024 and

September 30, 2023, respectively) |

|

193.0 |

|

|

|

16.7 |

|

|

Inventories: |

|

|

|

|

Materials |

|

40.4 |

|

|

|

32.1 |

|

|

Work in process |

|

4.8 |

|

|

|

8.1 |

|

|

Finished products |

|

126.3 |

|

|

|

111.9 |

|

|

Total Inventories |

$ |

171.5 |

|

|

$ |

152.1 |

|

|

Amounts due from Becton, Dickinson and Company |

|

53.8 |

|

|

|

142.4 |

|

|

Prepaid expenses and other |

|

68.5 |

|

|

|

111.4 |

|

|

Total Current Assets |

$ |

761.0 |

|

|

$ |

749.1 |

|

|

Property, Plant and Equipment, Net |

|

290.4 |

|

|

|

300.2 |

|

| Goodwill

and Intangible Assets |

|

23.7 |

|

|

|

24.7 |

|

| Deferred

Income Taxes and Other Assets |

|

210.2 |

|

|

|

140.4 |

|

| Total

Assets |

$ |

1,285.3 |

|

|

$ |

1,214.4 |

|

|

Liabilities and Equity |

|

|

|

|

Current Liabilities |

|

|

|

|

Accounts payable |

$ |

91.0 |

|

|

$ |

53.5 |

|

|

Accrued expenses |

|

134.2 |

|

|

|

118.1 |

|

|

Amounts due to Becton, Dickinson and Company |

|

42.5 |

|

|

|

73.1 |

|

|

Salaries, wages and related items |

|

66.7 |

|

|

|

62.1 |

|

|

Current debt obligations |

|

9.5 |

|

|

|

9.5 |

|

|

Current finance lease liabilities |

|

3.4 |

|

|

|

3.6 |

|

|

Income taxes |

|

26.7 |

|

|

|

33.6 |

|

|

Total Current Liabilities |

$ |

374.0 |

|

|

$ |

353.5 |

|

| Deferred

Income Taxes and Other Liabilities |

|

54.1 |

|

|

|

57.2 |

|

|

Long-Term Debt |

|

1,565.3 |

|

|

|

1,593.9 |

|

| Non

Current Finance Lease Liabilities |

|

30.2 |

|

|

|

31.5 |

|

|

Contingencies |

|

|

|

|

Embecta Corp. Equity |

|

|

|

|

Common stock, $0.01 par valueAuthorized - 250,000,000Issued and

outstanding - 57,707,285 as of September 30, 2024 and

57,333,353 as of September 30, 2023 |

|

0.6 |

|

|

|

0.6 |

|

|

Additional paid-in capital |

|

52.5 |

|

|

|

27.9 |

|

|

Accumulated deficit |

|

(498.6 |

) |

|

|

(541.1 |

) |

|

Accumulated other comprehensive loss |

|

(292.8 |

) |

|

|

(309.1 |

) |

|

Total Equity |

|

(738.3 |

) |

|

|

(821.7 |

) |

| Total

Liabilities and Equity |

$ |

1,285.3 |

|

|

$ |

1,214.4 |

|

|

|

| |

|

Condensed Consolidated Statements of Cash

FlowsEmbecta Corp.(Unaudited, in

millions) |

| |

| |

Twelve Months EndedSeptember

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Operating Activities |

|

|

|

|

Net income |

$ |

78.3 |

|

|

$ |

70.4 |

|

|

Adjustments to net income to derive net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

|

36.2 |

|

|

|

32.6 |

|

|

Amortization of debt issuance costs |

|

6.9 |

|

|

|

6.4 |

|

|

Amortization of cloud computing costs |

|

6.3 |

|

|

|

— |

|

|

Impairment of property, plant and equipment |

|

— |

|

|

|

2.5 |

|

|

Stock-based compensation |

|

26.3 |

|

|

|

21.5 |

|

|

Deferred income taxes |

|

(70.6 |

) |

|

|

14.3 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

Trade receivables, net |

|

(174.7 |

) |

|

|

7.0 |

|

|

Inventories |

|

(16.5 |

) |

|

|

(28.8 |

) |

|

Due from/due to Becton, Dickinson and Company |

|

58.9 |

|

|

|

(23.2 |

) |

|

Prepaid expenses and other |

|

19.9 |

|

|

|

(14.2 |

) |

|

Accounts payable, accrued expenses and other current

liabilities |

|

60.0 |

|

|

|

7.9 |

|

|

Income and other net taxes payable |

|

32.8 |

|

|

|

(12.6 |

) |

|

Other assets and liabilities, net |

|

(28.1 |

) |

|

|

(16.1 |

) |

|

Net Cash Provided by Operating Activities |

$ |

35.7 |

|

|

$ |

67.7 |

|

|

Investing Activities |

|

|

|

|

Capital expenditures |

|

(15.8 |

) |

|

|

(26.5 |

) |

|

Net Cash Used for Investing Activities |

$ |

(15.8 |

) |

|

$ |

(26.5 |

) |

|

Financing Activities |

|

|

|

|

Payments on long-term debt |

|

(34.6 |

) |

|

|

(9.5 |

) |

|

Payments related to tax withholding for stock-based

compensation |

|

(3.0 |

) |

|

|

(3.6 |

) |

|

Payments on finance lease |

|

(1.3 |

) |

|

|

(1.2 |

) |

|

Dividend payments |

|

(34.5 |

) |

|

|

(34.4 |

) |

|

Net Cash Used for Financing Activities |

$ |

(73.4 |

) |

|

$ |

(48.7 |

) |

|

Effect of exchange rate changes on cash and equivalents and

restricted cash |

|

1.2 |

|

|

|

3.1 |

|

|

Net Change in Cash and equivalents and restricted cash |

$ |

(52.3 |

) |

|

$ |

(4.4 |

) |

|

Opening Cash and equivalents and restricted cash |

|

326.5 |

|

|

|

330.9 |

|

|

Closing Cash and equivalents and restricted cash |

$ |

274.2 |

|

|

$ |

326.5 |

|

|

|

About Non-GAAP financial

measures

In evaluating our operating performance, we

supplement the reporting of our financial information determined

under GAAP with certain non-GAAP financial measures including (i)

Adjusted Revenues, (ii) earnings before interest, taxes,

depreciation, and amortization (“EBITDA”), (iii) Adjusted EBITDA

and Adjusted EBITDA Margin, (iv) Adjusted Gross Profit and Adjusted

Gross Profit Margin, (v) Adjusted Constant Currency Revenue Growth,

(vi) Adjusted Operating Income and Adjusted Operating Income

Margin, and (vii) Adjusted Net Income and Adjusted earnings per

diluted share. These non-GAAP financial measures are indicators of

our performance that are not required by, or presented in

accordance with, GAAP. They are presented with the intent of

providing greater transparency to financial information used by us

in our financial analysis and operational decision-making. We

believe that these non-GAAP measures provide meaningful information

to assist investors, stockholders and other readers of our

consolidated financial statements in making comparisons to our

historical operating results and analyzing the underlying

performance of our results of operations. However, the presentation

of these measures has limitations as an analytical tool and should

not be considered in isolation, or as a substitute for the

company’s results as reported under GAAP. Because not all companies

use identical calculations, the presentations of these non-GAAP

measures may not be comparable to other similarly titled measures

of other companies. The Company uses non-GAAP financial measures in

its operational and financial decision making, and believes that it

is useful to exclude certain items in order to focus on what it

regards to be a meaningful alternative representation of the

underlying operating performance of the business.

For the three- and twelve-month periods ended

September 30, 2024 and 2023, the reconciliation of (1) GAAP

Revenues ("Reported Revenues") to Adjusted Revenues and (2) GAAP

Net income to EBITDA and Adjusted EBITDA was as follows (unaudited,

in millions)

| |

| |

Three Months Ended September 30, |

|

Twelve Months Ended September 30, |

| |

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Reported

Revenues |

$ |

286.1 |

|

|

$ |

281.9 |

|

|

$ |

1,123.1 |

|

|

$ |

1,120.8 |

|

| Italian payback measure

(1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

| Adjusted

Revenues |

$ |

290.2 |

|

|

$ |

281.9 |

|

|

$ |

1,127.2 |

|

|

$ |

1,120.8 |

|

| |

|

|

|

|

|

|

|

| GAAP Net

Income |

$ |

14.6 |

|

|

$ |

6.0 |

|

|

$ |

78.3 |

|

|

$ |

70.4 |

|

| Interest expense, net |

|

29.0 |

|

|

|

27.6 |

|

|

|

112.3 |

|

|

|

107.0 |

|

| Income taxes |

|

(21.6 |

) |

|

|

(1.0 |

) |

|

|

(34.1 |

) |

|

|

35.3 |

|

| Depreciation and

amortization |

|

9.5 |

|

|

|

9.3 |

|

|

|

36.2 |

|

|

|

32.6 |

|

| EBITDA |

$ |

31.5 |

|

|

$ |

41.9 |

|

|

$ |

192.7 |

|

|

$ |

245.3 |

|

| Stock-based compensation

expense (2) |

|

6.2 |

|

|

|

4.9 |

|

|

|

26.6 |

|

|

|

21.9 |

|

| One-time stand up costs

(3) |

|

26.2 |

|

|

|

31.8 |

|

|

|

111.2 |

|

|

|

93.7 |

|

| European regulatory

initiative-related costs ("EU MDR") (4) |

|

0.2 |

|

|

|

0.6 |

|

|

|

0.5 |

|

|

|

1.3 |

|

| Business optimization and

severance related costs (5) |

|

1.7 |

|

|

|

2.6 |

|

|

|

7.4 |

|

|

|

5.6 |

|

| Impairment losses (6) |

|

— |

|

|

|

2.5 |

|

|

|

— |

|

|

|

2.5 |

|

| Deferred jurisdiction

adjustments in Other income (expense), net for taxes (7) |

|

0.6 |

|

|

|

(4.7 |

) |

|

|

4.6 |

|

|

|

8.4 |

|

| Amortization of cloud

computing arrangements (8) |

|

2.5 |

|

|

|

— |

|

|

|

6.3 |

|

|

|

— |

|

| Italian payback measure

(1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

| Adjusted

EBITDA |

$ |

73.0 |

|

|

$ |

79.6 |

|

|

$ |

353.4 |

|

|

$ |

378.7 |

|

| Adjusted EBITDA

Margin |

|

25.2 |

% |

|

|

28.2 |

% |

|

|

31.4 |

% |

|

|

33.8 |

% |

|

1 |

|

Reflects the recognition of incremental Italian payback accruals

resulting from the two July 22, 2024 rulings by the Constitutional

Court of Italy relating to certain prior years since 2015 recorded

in Revenues. |

|

2. |

|

Represents stock-based compensation expense incurred during the

three and twelve months ended September 30, 2024 and 2023,

respectively. For the three months ended September 30, 2024,

$5.3 million is recorded in Selling and administrative expense,

$0.4 million is recorded in Cost of products sold, and $0.5 million

is recorded in Research and development expense. For the twelve

months ended September 30, 2024, $21.4 million is recorded in

Selling and administrative expense, $3.0 million is recorded in

Cost of products sold, and $2.2 million is recorded in Research and

development expense. For the three months ended September 30,

2023, $4.1 million is recorded in Selling and administrative

expense, $0.4 million is recorded in Cost of products sold, and

$0.4 million is recorded in Research and development expense. For

the twelve months ended September 30, 2023, $18.1 million is

recorded in Selling and administrative expense, $2.2 million is

recorded in Cost of products sold, and $1.6 million is recorded in

Research and development expense. |

|

3. |

|

One-time stand-up costs incurred primarily include: (i) product

registration and labeling costs; (ii) warehousing and distribution

set-up costs; (iii) legal costs associated with patents and

trademark work; (iv) temporary headcount resources within

accounting, tax, finance, human resources, regulatory and IT; and

(v) one-time business integration and IT related costs primarily

associated with our global ERP implementation. For the three months

ended September 30, 2024, approximately $26.0 million and

$0.2 million are recorded in Other operating expenses and

Selling and administrative expense, respectively. For the twelve

months ended September 30, 2024, approximately

$109.9 million and $1.3 million are recorded in Other

operating expenses and Selling and administrative expense,

respectively. For the three months ended September 30, 2023,

approximately $31.6 million and $0.2 million are recorded in

Other operating expenses and Selling and administrative expense,

respectively. For the twelve months ended September 30, 2023,

approximately $92.7 million and $1.0 million are recorded in Other

operating expenses and Selling and administrative expense,

respectively. |

|

4. |

|

Represents costs required to develop processes and systems to

comply with regulations such as the EU MDR and General Data

Protection Regulation ("GDPR") which represent a significant,

unusual change to the existing regulatory framework. We consider

these costs to be duplicative of previously incurred costs and/or

one-off costs, which are limited to a specific period of time.

These costs are recorded in Research and development expense. |

|

5. |

|

Represents business optimization and severance related costs

associated with standing up the organization recorded in Other

operating expenses. |

|

6. |

|

Relates to impairment charges incurred related to the abandonment

of certain manufacturing equipment in China that is no longer in

use that was inherited as part of the Separation from BD. The

impairment charges are recorded in Impairment Expense. |

|

7. |

|

Represents amounts due to BD for tax liabilities incurred in

deferred closing jurisdictions where BD is considered the primary

obligor. |

|

8. |

|

Represents amortization of implementation costs associated with

cloud computing arrangements recorded in Other operating

expenses. |

|

|

|

|

For the three- and twelve-month periods ended

September 30, 2024, the reconciliations of (1) GAAP Revenues

("Reported Revenues") to Adjusted Revenues (2) GAAP Gross Profit

and Gross Margin to Adjusted Gross Profit and Adjusted Gross

Margin, (3) GAAP Operating Income and Operating Margin to Adjusted

Operating Income and Adjusted Operating Income Margin and (4) GAAP

Net Income Per Diluted Share to Adjusted Net Income Per Diluted

Share are as follows (unaudited in millions, except per share

amounts):

| |

| |

Three Months Ended September 30, |

|

Twelve Months Ended September 30, |

| |

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Reported Revenues |

$ |

286.1 |

|

|

$ |

281.9 |

|

|

$ |

1,123.1 |

|

|

$ |

1,120.8 |

|

| Italian

payback measure (1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

|

Adjusted Revenues |

$ |

290.2 |

|

|

$ |

281.9 |

|

|

$ |

1,127.2 |

|

|

$ |

1,120.8 |

|

| |

|

|

|

|

|

|

|

|

GAAP Gross Profit |

$ |

173.8 |

|

|

$ |

181.8 |

|

|

$ |

735.2 |

|

|

$ |

749.9 |

|

|

GAAP Gross Profit Margin |

|

60.7 |

% |

|

|

64.5 |

% |

|

|

65.5 |

% |

|

|

66.9 |

% |

|

Stock-based compensation expense (2) |

|

0.1 |

|

|

|

— |

|

|

|

0.3 |

|

|

|

0.1 |

|

|

Amortization of intangible assets (3) |

|

0.3 |

|

|

|

0.8 |

|

|

|

1.1 |

|

|

|

1.2 |

|

| Italian

payback measure (1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

|

Adjusted Gross Profit |

$ |

178.3 |

|

|

$ |

182.6 |

|

|

$ |

740.7 |

|

|

$ |

751.2 |

|

|

Adjusted Gross Profit Margin |

|

61.4 |

% |

|

|

64.8 |

% |

|

|

65.7 |

% |

|

|

67.0 |

% |

| |

|

|

|

|

|

|

|

|

GAAP Operating Income |

$ |

26.2 |

|

|

$ |

25.8 |

|

|

$ |

166.8 |

|

|

$ |

221.5 |

|

|

GAAP Operating Income Margin |

|

9.2 |

% |

|

|

9.2 |

% |

|

|

14.9 |

% |

|

|

19.8 |

% |

|

Amortization of intangible assets (3) |

|

0.3 |

|

|

|

0.8 |

|

|

|

1.1 |

|

|

|

1.2 |

|

| One-time

stand up costs (4) |

|

27.5 |

|

|

|

31.8 |

|

|

|

112.5 |

|

|

|

93.7 |

|

| EU MDR

(5) |

|

0.2 |

|

|

|

0.6 |

|

|

|

0.5 |

|

|

|

1.3 |

|

|

Stock-based compensation expense (6) |

|

1.2 |

|

|

|

1.1 |

|

|

|

4.5 |

|

|

|

5.7 |

|

|

Impairment losses (7) |

|

— |

|

|

|

2.5 |

|

|

|

— |

|

|

|

2.5 |

|

| Business

optimization and severance related costs (8) |

|

1.7 |

|

|

|

2.6 |

|

|

|

7.4 |

|

|

|

5.6 |

|

| Italian

payback measure (1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

|

Adjusted Operating Income |

$ |

61.2 |

|

|

$ |

65.2 |

|

|

$ |

296.9 |

|

|

$ |

331.5 |

|

|

Adjusted Operating Income Margin |

|

21.1 |

% |

|

|

23.1 |

% |

|

|

26.3 |

% |

|

|

29.6 |

% |

| |

|

|

|

|

|

|

|

|

GAAP Net Income |

$ |

14.6 |

|

|

$ |

6.0 |

|

|

$ |

78.3 |

|

|

$ |

70.4 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

GAAP Income tax provision (benefit) |

|

(21.6 |

) |

|

|

(1.0 |

) |

|

|

(34.1 |

) |

|

|

35.3 |

|

|

Amortization of intangible assets (3) |

|

0.3 |

|

|

|

0.8 |

|

|

|

1.1 |

|

|

|

1.2 |

|

|

One-time stand up costs (4) |

|

27.5 |

|

|

|

31.8 |

|

|

|

112.5 |

|

|

|

93.7 |

|

|

EU MDR (5) |

|

0.2 |

|

|

|

0.6 |

|

|

|

0.5 |

|

|

|

1.3 |

|

|

Stock-based compensation expense (6) |

|

1.2 |

|

|

|

1.1 |

|

|

|

4.5 |

|

|

|

5.7 |

|

|

Impairment losses (7) |

|

— |

|

|

|

2.5 |

|

|

|

— |

|

|

|

2.5 |

|

|

Business optimization and severance related costs (8) |

|

1.7 |

|

|

|

2.6 |

|

|

|

7.4 |

|

|

|

5.6 |

|

|

Italian payback measure (1) |

|

4.1 |

|

|

|

— |

|

|

|

4.1 |

|

|

|

— |

|

|

Deferred jurisdiction adjustments in Other income (expense), net

for taxes (9) |

|

0.6 |

|

|

|

(4.7 |

) |

|

|

4.6 |

|

|

|

8.4 |

|

|

Non-GAAP Income tax provision (10) |

|

(2.7 |

) |

|

|

(5.6 |

) |

|

|

(35.8 |

) |

|

|

(51.5 |

) |

|

Adjusted Net Income |

$ |

25.9 |

|

|

$ |

34.1 |

|

|

$ |

143.1 |

|

|

$ |

172.6 |

|

| |

|

|

|

|

|

|

|

|

GAAP Net Income per Diluted share |

$ |

0.25 |

|

|

$ |

0.10 |

|

|

$ |

1.34 |

|

|

$ |

1.22 |

|

|

Adjusted Net Income per Diluted share |

$ |

0.45 |

|

|

$ |

0.59 |

|

|

$ |

2.45 |

|

|

$ |

2.99 |

|

| |

|

|

|

|

|

|

|

|

Diluted weighted-average shares outstanding (in

thousands) |

|

58,122 |

|

|

|

57,473 |

|

|

|

58,326 |

|

|

|

57,758 |

|

|

(1) |

|

Reflects the recognition of incremental Italian payback accruals

resulting from the two July 22, 2024 rulings by the Constitutional

Court of Italy relating to certain prior years since 2015 recorded

in Revenues. |

|

(2) |

|

Represents stock-based

compensation expense recognized during the period associated with

the incremental value of converted legacy BD share-based awards and

sign-on equity awards granted to certain members of the embecta

leadership team in connection with the Separation from BD recorded

in Cost of products sold. |

|

(3) |

|

Amortization of intangible assets

is recorded in Cost of products sold. |

|

(4) |

|

One-time stand-up costs incurred

primarily include: (i) product registration and labeling costs;

(ii) manufacturing, warehousing, and distribution set-up costs;

(iii) legal costs associated with patents and trademark work; (iv)

temporary headcount resources within accounting, tax, finance,

human resources, regulatory and IT; and (v) one-time business

integration and IT related costs primarily associated with our

global ERP implementation. For the three months ended

September 30, 2024, approximately $27.3 million and

$0.2 million are recorded in Other operating expenses and

Selling and administrative expense, respectively. For the twelve

months ended September 30, 2024, approximately

$111.2 million and $1.3 million are recorded in Other

operating expenses and Selling and administrative expense,

respectively. For the three months ended September 30, 2023,

approximately $31.6 million and $0.2 million are recorded in Other

operating expenses and Selling and administrative expense,

respectively. For the twelve months ended September 30, 2023,

approximately $92.7 million and $1.0 million are recorded in Other

operating expenses and Selling and administrative expense,

respectively. |

|

(5) |

|

Represents costs required to

develop processes and systems to comply with regulations such as

the EU MDR and GDPR which represent a significant, unusual change

to the existing regulatory framework. We consider these costs to be

duplicative of previously incurred costs and/or one-off costs,

which are limited to a specific period of time. These costs are

recorded in Research and development expense. |

|

(6) |

|

Represents stock-based

compensation expense recognized during the period associated with

the incremental value of converted legacy BD share-based awards and

sign-on equity awards granted to certain members of the embecta

leadership team in connection with the Separation from BD. For the

three months ended September 30, 2024, $1.1 million is

recorded in Selling and administrative expense and $0.1 million is

recorded in Cost of products sold. For the twelve months ended,

September 30, 2024, $4.1 million is recorded in Selling and

administrative expense, $0.1 million is recorded in Research and

development expense, and $0.3 million is recorded in Cost of

products sold. For the three months ended September 30, 2023,

$1.0 million is recorded in Selling and administrative expense

and $0.1 million is recorded in Research and development

expense. For the twelve months ended September 30, 2023,

$5.4 million is recorded in Selling and administrative

expense, $0.1 million is recorded in Cost of products sold, and

$0.2 million is recorded in Research and development

expense. |

|

(7) |

|

Relates to impairment charges

incurred related to the abandonment of certain manufacturing

equipment in China that is no longer in use that was inherited as

part of the Separation from BD. The impairment charges are recorded

in Impairment Expense. |

|

(8) |

|

Represents business optimization

and severance related costs associated with standing up the

organization recorded in Other operating expenses. |

|

(9) |

|

Represents amounts due to BD for

tax liabilities incurred in deferred jurisdictions where BD is

considered the primary obligor. |

|

(10) |

|

Represents the amount of tax

expense that the Company estimates that it would record if it used

non-GAAP results instead of GAAP results in the calculation of its

tax provision. The non-GAAP effective tax rate for the three and

twelve months ended September 30, 2024 were 9% and 20%,

respectively. The non-GAAP effective tax rates for the three and

twelve months ended September 30, 2023 were 14% and 23%,

respectively. |

| |

|

|

About embecta

embecta is a global diabetes care company that is leveraging its

nearly 100-year legacy in insulin delivery to empower people with

diabetes to live their best life through innovative solutions,

partnerships and the passion of approximately 2,000 employees

around the globe. For more information, visit embecta.com or

follow our social channels on LinkedIn, Facebook, and

Instagram.

Safe Harbor Statement Regarding

Forward-Looking Statements

This press release contains express or implied

"forward-looking statements" as that term is defined in the Private

Securities Litigation Reform Act of 1995 and other securities laws.

These forward-looking statements concern our current expectations

regarding our future results from operations, performance,

financial condition, goals, strategies, plans and achievements.

These forward-looking statements are subject to various known and

unknown risks, uncertainties and other factors, and you should not

rely upon them except as statements of our present intentions and

of our present expectations, which may or may not occur. When we

use words such as "believes," "expects," "anticipates,"

"estimates," "plans," "intends", “pursue”, “will”, “may” or similar

expressions, we are making forward-looking statements. For example,

embecta is using forward-looking statements when it discusses its

plans to discontinue its patch pump program, concentrate its

resources on its core business, prioritize free cash flow towards

paying down debt, and create financial flexibility for future

investments, its ability to reduce costs, streamline operations and

enhance profitability, its expected savings and expenses from its

organizational restructuring and the timing thereof, its fiscal

2025 financial guidance and its expectations with respect to

strengthening its base business, separating and standing up embecta

as an independent company, and investing in growth, and geographic

expansion of new product pacts for non-insulin diabetes drugs.

Although we believe that our forward-looking statements are based

on reasonable assumptions, our expected results may not be

achieved, and actual results may differ materially from our

expectations. In addition, important factors that could cause

actual results to differ from expectations include, among others:

(i) competitive factors that could adversely affect embecta’s

operations; (ii) any inability to extend or replace the services

provided by BD under the transaction documents; (iii) any failure

by BD to perform its obligations under the various separation

agreements entered into in connection with the separation and

distribution; (iv) any events that adversely affect the sale or

profitability of embecta’s products or the revenues delivered from

sales to its customers; (v) increases in operating costs, including

fluctuations in the cost and availability of raw materials or

components used in its products, the ability to maintain favorable

supplier arrangements and relationships, and the potential adverse

effects of any disruption in the availability of such items; (vi)

changes in reimbursement practices of governments or private payers

or other cost containment measures; (vii) the adverse financial

impact resulting from unfavorable changes in foreign currency

exchange rates, as well as regional, national and foreign economic

factors, including inflation, deflation, and fluctuations in

interest rates; (viii) the impact of changes in U.S. federal laws

and policy that could affect fiscal and tax policies, healthcare

and international trade, including import and export regulation and

international trade agreements; (ix) any new pandemic, or any

geopolitical instability, including disruptions in its operations

and supply chains; (x) new or changing laws and regulations, or

changes in enforcement practices, including laws relating to

healthcare, environmental protection, trade, monetary and fiscal

policies, taxation and licensing and regulatory requirements for

products; (xi) the expected benefits of the separation from BD;

(xii) risks associated with embecta’s indebtedness; (xiii) the risk

that ongoing dis-synergy costs, costs of restructuring and other

costs incurred in connection with the separation from BD will

exceed our estimates of these costs; (xiv) the risk that it will be

more difficult than expected to effect embecta’s full separation

from BD; (xv) expectations related to the costs, profitability,

timing and the estimated financial impact of, and charges and

savings associated with, the restructuring plan we announced; (xvi)

risks associated with not completing strategic collaborative

partnerships and acquisitions for innovative technologies,

complementary product lines, and new markets; and (xvii) the other

risks described in our periodic reports filed with the Securities

and Exchange Commission, including under the caption “Risk Factors”

in our most recent Annual Report on Form 10-K, as further updated

by our Quarterly Reports on Form 10-Q we have filed or will file

hereafter. Except as required by law, we undertake no obligation to

update any forward-looking statements appearing in this

release.

CONTACTS

Investors:Pravesh KhandelwalVP, Head of

Investor Relations551-264-6547Contact IR

Media: Christian GlazarSr. Director, Corporate

Communications 908-821-6922Contact Media Relations

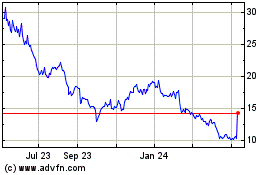

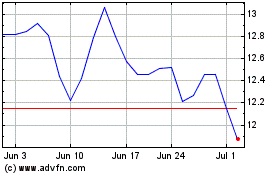

Embecta (NASDAQ:EMBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Embecta (NASDAQ:EMBC)

Historical Stock Chart

From Feb 2024 to Feb 2025