East West Bancorp, Inc. (“East West” or the “Company”) (Nasdaq:

EWBC), parent company of East West Bank, reported its financial

results for the third quarter of 2024. Third quarter 2024 net

income was $299 million, or $2.14 per diluted share. Return on

average assets was 1.62%, return on average common equity was

16.0%, and return on average tangible common equity1 was 17.1%.

Book value per share grew 6% quarter-over-quarter and 19%

year-over-year.

“East West reported another strong quarter of balanced growth in

support of our customers,” said Dominic Ng, Chairman and Chief

Executive Officer. “We continued to grow consumer and business

banking deposits while further diversifying our loan portfolio by

emphasizing residential and C&I lending,” Ng continued. “Net

interest income and fee income both accelerated meaningfully in the

quarter, underscoring the strength of our business model.”

“Our disciplined approach to credit and expense management

continued to bear fruit this quarter,” continued Ng. “Operating

expenses were flat, while credit quality trends remained stable,

demonstrating the benefit of our diversified business

strategy.”

“We grew shareholder book value and posted a 17.1% return on

average tangible common equity1 for the quarter,” said Ng. “We

remain focused on continuing to deliver top tier returns for our

shareholders in the years ahead.”

FINANCIAL HIGHLIGHTS

Three Months Ended

Quarter-over-Quarter Change

($ in millions, except per share data)

September 30, 2024

June 30, 2024

$

%

Revenue

$657

$638

$19

3%

Pre-tax, Pre-provision Income2

432

402

30

7

Net Income

299

288

11

4

Diluted Earnings per Share

$2.14

$2.06

$0.08

4

Book Value per Share

$55.30

$52.06

$3.24

6

Tangible Book Value per Share1

$51.90

$48.65

$3.25

7%

Return on Average Common Equity

15.99%

16.36%

-37 bps

—

Return on Average Tangible Common

Equity1

17.08%

17.54%

-46 bps

—

Tangible Common Equity Ratio1

9.72%

9.37%

35 bps

—

Total Assets

$74,484

$72,468

$2,016

3%

1

Return on average tangible common equity,

tangible book value per share, and tangible common equity ratio are

non-GAAP financial measures. See reconciliation of GAAP to non-GAAP

measures in Table 13 of East West’s detailed 3Q24 earnings release

and financial tables, available at

www.eastwestbank.com/investors.

2

Pre-tax, pre-provision income is a

non-GAAP financial measure. See reconciliation of GAAP to non-GAAP

financial measures in Table 12 of East West’s detailed 3Q24

earnings release and financial tables, available at

www.eastwestbank.com/investors.

Earnings Press Release and Financial Tables

East West’s third quarter 2024 earnings press release with

accompanying financial tables can be accessed at

www.eastwestbank.com/investors.

Conference Call

East West will host a conference call to discuss third quarter

2024 earnings with the public on Tuesday, October 22, 2024, at 2:00

p.m. PT/5:00 p.m. ET. The public and investment community are

invited to listen as management discusses third quarter 2024

results and operating developments.

- The following dial-in information is provided for participation

in the conference call: calls within the U.S. – (877) 506-6399;

calls within Canada – (855) 669-9657; international calls – (412)

902-6699.

- A presentation to accompany the earnings call, a listen-only

live broadcast of the call, and information to access a replay one

hour after the call will all be available on the Investor Relations

page of the Company’s website at

www.eastwestbank.com/investors.

About East West

East West provides financial services that help customers reach

further and connect to new opportunities. East West Bancorp, Inc.

is a public company (Nasdaq: “EWBC”) with total assets of $74.5

billion as of September 30, 2024. The Company’s wholly-owned

subsidiary, East West Bank, is the largest independent bank

headquartered in Southern California, and operates over 110

locations in the United States and Asia. The Bank’s markets in the

United States include California, Georgia, Illinois, Massachusetts,

Nevada, New York, Texas, and Washington. For more information on

East West, visit www.eastwestbank.com.

Forward-Looking Statements

Certain matters set forth herein (including any exhibits hereto)

contain “forward-looking statements” that are intended to be

covered by the safe harbor for such statements provided by the

Private Securities Litigation Reform Act of 1995. East West

Bancorp, Inc. (referred to herein on an unconsolidated basis as

“East West” and on a consolidated basis as the “Company,” “we,”

“us,” “our” or “EWBC”) may make forward-looking statements in other

documents that it files with, or furnishes to, the United States

(“U.S.”) Securities and Exchange Commission (“SEC”) and management

may make forward-looking statements to analysts, investors, media

members and others. Forward-looking statements are those that do

not relate to historical facts and that are based on current

assumptions, beliefs, estimates, expectations and projections, many

of which, by their nature, are inherently uncertain and beyond the

Company’s control. Forward-looking statements may relate to various

matters, including the Company’s financial condition, results of

operations, plans, objectives, future performance, business or

industry, and usually can be identified by the use of

forward-looking words, such as “anticipates,” “assumes,”

“believes,” “can,” “continues,” “could,” “estimates,” “expects,”

“forecasts,” “goal,” “intends,” “likely,” “may,” “might,”

“objective,” “plans,” “potential,” “projects,” “remains,” “should,”

“target,” “trend,” “will,” “would,” or similar expressions or

variations thereof, and the negative thereof, but these terms are

not the exclusive means of identifying such statements. You should

not place undue reliance on forward-looking statements, as they are

subject to risks and uncertainties.

Factors that might cause future results to differ materially

from historical performance and any forward-looking statements

include, but are not limited to: changes in local, regional and

global business, economic and political conditions and natural or

geopolitical events; the soundness of other financial institutions

and the impacts related to or resulting from bank failures and

other industry volatility, including potential increased regulatory

requirements, FDIC insurance premiums and assessments, and deposit

withdrawals; changes in laws or the regulatory environment,

including trade, monetary and fiscal policies and laws and current

or potential disputes between the U.S. and the People’s Republic of

China; changes in the commercial and consumer real estate markets;

changes in consumer or commercial spending, savings and borrowing

habits, and patterns and behaviors; the Company’s ability to

compete effectively against financial institutions and other

entities, including as a result of emerging technologies; the

success and timing of the Company’s business strategies; the

Company’s ability to retain key officers and employees; changes in

key variable market interest rates, competition, regulatory

requirements and product mix; changes in the Company’s costs of

operation, compliance and expansion; disruption, failure in, or

breach of, the Company’s operational or security systems or

infrastructure, or those of third party vendors with which the

Company does business, including as a result of cyber-attacks, and

the disclosure or misuse of confidential information; the adequacy

of the Company’s risk management framework; future credit quality

and performance, including expectations regarding future credit

losses and allowance levels; adverse changes to the Company’s

credit ratings; legal proceedings, regulatory investigations and

their resolution; the Company’s capital requirements and its

ability to generate capital internally or raise capital on

favorable terms; the impact on the Company’s liquidity due to

changes in the Company’s ability to receive dividends from its

subsidiaries; any strategic acquisitions or divestitures and the

introduction of new or expanded products and services or other

events that may directly or indirectly result in a negative impact

on the financial performance of the Company and its customers.

For a more detailed discussion of some of the factors that might

cause such differences, see the Company’s Annual Report on Form

10-K for the year ended December 31, 2023 filed with the SEC on

February 29, 2024 (the “Company’s 2023 Form 10-K”) under the

heading Item 1A. Risk Factors. You should treat forward-looking

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. The Company

does not undertake, and specifically disclaims any obligation to

update or revise any forward-looking statements to reflect the

occurrence of events or circumstances after the date of such

statements except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022066535/en/

FOR INVESTOR INQUIRIES, CONTACT: Christopher Del

Moral-Niles, CFA Chief Financial Officer T: (626) 768-6860 E:

chris.delmoralniles@eastwestbank.com

Adrienne Atkinson Director of Investor Relations T: (626)

788-7536 E: adrienne.atkinson@eastwestbank.com

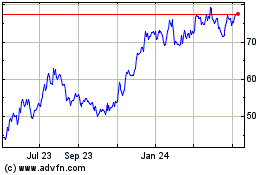

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Dec 2024 to Jan 2025

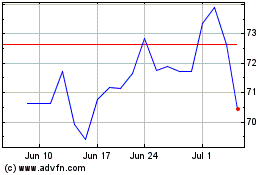

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jan 2024 to Jan 2025