Community Trust Bancorp, Inc. (NASDAQ:CTBI):

Earnings

Summary

(in thousands except per share data)

4Q

2015

3Q

2015

4Q

2014

Year

2015

Year

2014

Net income $11,870 $11,222 $9,992 $46,432 $43,251 Earnings per

share $0.68 $0.64 $0.58 $2.66 $2.50 Earnings per share – diluted

$0.68 $0.64 $0.57 $2.66 $2.49 Return on average assets 1.22%

1.18% 1.07% 1.23% 1.18% Return on average equity 9.91% 9.50% 8.87%

9.97% 9.94% Efficiency ratio 56.35% 60.53% 60.76% 58.20% 59.12%

Tangible common equity 10.68% 10.82% 10.44% Dividends

declared per share $0.310 $0.310 $0.300 $1.220 $1.181 Book value

per share $27.12 $26.87 $25.64 Weighted average shares

17,464 17,440 17,351 17,431 17,326 Weighted average shares -

diluted 17,516 17,491

17,422 17,483 17,397

Community Trust Bancorp, Inc. (NASDAQ:CTBI) reports earnings for

the fourth quarter 2015 of $11.9 million, or $0.68 per basic share,

compared to $10.0 million, or $0.58 per basic share, earned during

the fourth quarter 2014 and $11.2 million, or $0.64 per basic

share, earned during the third quarter 2015. Earnings for the year

ended December 31, 2015 were a record $46.4 million, or $2.66 per

basic share compared to $43.3 million, or $2.50 per basic share,

for the year ended December 31, 2014.

4th Quarter 2015 Highlights

- Our loan portfolio increased $140.1

million from December 31, 2014 and $53.5 million during the

quarter.

- Our investment portfolio decreased

$45.2 million from December 31, 2014 but increased $18.2 million

during the quarter.

- Deposits, including repurchase

agreements, increased $122.6 million from December 31, 2014 and

$0.6 million during the quarter.

- Nonperforming loans at $28.6 million

decreased $10.3 million from December 31, 2014 and $4.1 million

from September 30, 2015. Nonperforming assets at $69.5 million

decreased $6.4 million from December 31, 2014 but increased $2.0

million from September 30, 2015.

- Net loan charge-offs for the quarter

ended December 31, 2015 were $1.4 million, or 0.19% of average

loans annualized, compared to $3.0 million, or 0.44%, experienced

for the fourth quarter 2014 and $2.2 million, or 0.31%, for the

third quarter 2015.

- CTBI’s investments in low income

housing and other community related investments provided tax

credits to offset current income tax expense for the fourth quarter

2015 in the amount of $0.3 million compared to $0.3 million in the

fourth quarter 2014 and $1.2 million in the third quarter 2015.

Credits used to offset current income tax expense totaled $2.7

million for the year 2015 compared to $1.1 million for the year

2014. The amortization of our investment in these partnerships for

the fourth quarter 2015 totaled $0.6 million compared to $0.2

million for the fourth quarter 2014 and $1.0 million for the third

quarter 2015. Amortization for the year 2015 was $2.6 million

compared to $0.9 million for the year 2014.

- In addition to the amortization expense

mentioned above, noninterest expense for the quarter was impacted

by decreases in personnel expense, data processing expense,

repossession expense, and other direct expenses, resulting in a

decrease in total noninterest expense. Noninterest expense for the

year also decreased in total from prior year as a result of

decreases in occupancy and equipment expense, data processing

expense, and repossession expense.

Net Interest Income

Net interest income for the quarter decreased $0.3 million, or

0.9%, from prior year fourth quarter but increased $0.2 million, or

0.7%, from prior quarter, while our net interest margin decreased

16 basis points and 3 basis points during the respective time

periods. Average earning assets increased $118.8 million, or 3.4%,

from fourth quarter 2014 and $54.5 million, or 1.5%, from prior

quarter, while our yield on average earning assets decreased 15

basis points and 2 basis points, respectively, during these time

periods. The cost of interest bearing funds increased 3 basis

points from prior year fourth quarter and 2 basis points from prior

quarter. Our ratio of average loans to deposits, including

repurchase agreements, for the quarter ended December 31, 2015 was

87.5% compared to 86.1% for the quarter ended December 31, 2014 and

87.5% for the quarter ended September 30, 2015. Net interest income

for the year increased $0.2 million, or 0.1%, from prior year.

Noninterest Income

Noninterest income for the quarter ended December 31, 2015

decreased $0.2 million, or 1.9%, from prior year same quarter and

$0.2 million, or 1.9%, from prior quarter. The decrease was

primarily due to decreases in gains on sales of loans and other

noninterest income items and increased securities losses, partially

offset by an increase in loan related fees. Loan related fees

increased from prior year and prior quarter as a result of a $0.4

million fluctuation in the fair value adjustments of our mortgage

servicing rights.

Noninterest income for the year ended December 31, 2015

increased $1.7 million, or 3.8%, from prior year as a result of

increases in gains on sales of loans ($0.5 million), deposit

service charges ($0.4 million), trust revenue ($0.3 million), and

loan related fees ($0.3 million) and decreased securities losses

($0.1 million). Year over year, we had a $0.5 million fluctuation

in the fair value adjustments of our mortgage servicing rights.

Noninterest Expense

Noninterest expense for the quarter ended December 31, 2015

decreased $2.2 million, or 8.0%, from prior year fourth quarter and

$1.8 million, or 6.4%, from prior quarter. The decrease in

noninterest expense was primarily due to decreases in personnel

expense, data processing expense, repossession expense, and other

direct expenses. The decrease in other direct expenses from prior

year same quarter was the result of a $0.5 million accrual for

anticipated customer refunds and a $0.2 million accrual for costs

associated with the defense of our trademark which were booked in

the fourth quarter 2014 that offset a $0.4 million increase in the

amortization of tax credits in the fourth quarter 2015.

Repossession expense decreased $0.3 million from prior year same

quarter.

Noninterest expense for the year decreased $0.6 million, or

0.5%, from prior year, as a result of decreases in occupancy and

equipment expense ($0.6 million), data processing expense ($1.1

million), and repossession expense ($0.2 million), partially offset

by the $1.7 million increase in the amortization expense related to

tax credits.

As disclosed in our September 30, 2015 Form 10-Q, CTBI was under

IRS examination of our 2013 corporate income tax return. In

November 2015, we were notified by the IRS that the review has been

completed and no changes were proposed to our return.

Balance Sheet Review

CTBI’s total assets at $3.9 billion increased $180.2 million, or

4.8%, from December 31, 2014 and $95.8 million, or an annualized

10.0%, during the quarter. Loans outstanding at December 31, 2015

were $2.9 billion, increasing $140.1 million, or 5.1%, from

December 31, 2014 and $53.5 million, or an annualized 7.5%, during

the quarter. We experienced growth during the quarter of $38.4

million in the commercial loan portfolio, $12.5 million in the

indirect loan portfolio, $2.0 million in the residential loan

portfolio, and $0.6 million in the consumer direct loan portfolio.

CTBI’s investment portfolio decreased $45.2 million, or 7.0%, from

December 31, 2014 but increased $18.2 million, or an annualized

12.5%, during the quarter. The decline in the investment portfolio

year over year was utilized to support loan growth. Deposits,

including repurchase agreements, at $3.2 billion increased $122.6

million, or 3.9%, from December 31, 2014 and $0.6 million, or an

annualized 0.1%, from prior quarter.

Shareholders’ equity at December 31, 2015 was $475.6 million

compared to $447.9 million at December 31, 2014 and $470.6 million

at September 30, 2015. CTBI’s annualized dividend yield to

shareholders as of December 31, 2015 was 3.55%.

Asset Quality

CTBI’s total nonperforming loans were $28.6 million at December

31, 2015, a 26.6% decrease from the $39.0 million at December 31,

2014 and a 12.6% decrease from the $32.7 million at September 30,

2015. Loans 90+ days past due decreased $6.0 million during the

quarter while nonaccrual loans increased $1.8 million. Loans 30-89

days past due at $14.4 million was a decrease of $4.4 million from

September 30, 2015. Our loan portfolio management processes focus

on the immediate identification, management, and resolution of

problem loans to maximize recovery and minimize loss. Impaired

loans, loans not expected to meet contractual principal and

interest payments other than insignificant delays, at December 31,

2015 totaled $49.9 million, a $9.2 million decline from the $59.1

million at December 31, 2014 and a $1.6 million increase from the

$48.3 million at September 30, 2015.

Our level of foreclosed properties at $40.7 million at December

31, 2015 was an increase from $36.8 million at December 31, 2014

and the $34.7 million at September 30, 2015. Sales of foreclosed

properties for the quarter ended December 31, 2015 totaled $2.3

million while new foreclosed properties totaled $8.9 million. The

increase in other real estate owned was primarily the result of two

commercial credits totaling $7.0 million. At December 31, 2015, the

book value of properties under contracts to sell was $3.0 million;

however, the closings had not occurred at quarter-end.

Net loan charge-offs for the quarter ended December 31, 2015

were $1.4 million, or 0.19% of average loans annualized, compared

to $3.0 million, or 0.44%, experienced for the fourth quarter 2014

and $2.2 million, or 0.31%, for the third quarter 2015. Of the net

charge-offs for the quarter, $0.4 million were in commercial loans,

$0.7 million were in indirect auto loans, $0.2 million were in

residential real estate mortgage loans, and $0.1 million were in

consumer direct loans. Allocations to loan loss reserves were $1.9

million for the quarter ended December 31, 2015 compared to $3.4

million for the quarter ended December 31, 2014 and $2.5 million

for the quarter ended September 30, 2015. Our reserve coverage

(allowance for loan and lease loss reserve to nonperforming loans)

at December 31, 2015 was 126.2% compared to 88.4% at December 31,

2014 and 108.6% at September 30, 2015. Our loan loss reserve as a

percentage of total loans outstanding remained at 1.26% at December

31, 2015 from December 31, 2014 and September 30, 2015.

Forward-Looking Statements

Certain of the statements contained herein that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act. Community Trust

Bancorp, Inc.’s (“CTBI”) actual results may differ materially from

those included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

“believe,” “expect,” “anticipate,” “intend,” “estimate,” “may

increase,” “may fluctuate,” and similar expressions or future or

conditional verbs such as “will,” “should,” “would,” and “could.”

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets,

prevailing inflation and interest rates, realized gains from sales

of investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors’ pricing policies, changes in laws and

regulations, competition, and demographic changes on target market

populations’ savings and financial planning needs; industry changes

in information technology systems on which we are highly dependent;

failure of acquisitions to produce revenue enhancements or cost

savings at levels or within the time frames originally anticipated

or unforeseen integration difficulties; and the resolution of legal

proceedings and related matters. In addition, the banking industry

in general is subject to various monetary and fiscal policies and

regulations, which include, but are not limited to, those

determined by the Federal Reserve Board, the Federal Deposit

Insurance Corporation, and state regulators, whose policies and

regulations could affect CTBI’s results. These statements are

representative only on the date hereof, and CTBI undertakes no

obligation to update any forward-looking statements made.

Community Trust Bancorp, Inc., with assets of $3.9 billion, is

headquartered in Pikeville, Kentucky and has 70 banking locations

across eastern, northeastern, central, and south central Kentucky,

six banking locations in southern West Virginia, four banking

locations in northeastern Tennessee, four trust offices across

Kentucky, and one trust office in Tennessee.

Additional information follows.

Community Trust Bancorp, Inc. Financial Summary

(Unaudited) December 31, 2015 (in thousands except per

share data and # of employees)

Three Three Three Twelve Twelve

Months Months Months Months Months Ended Ended Ended Ended Ended

December 31, 2015 September 30, 2015 December 31, 2014 December 31,

2015 December 31, 2014 Interest income $ 36,300 $ 35,912 $ 36,406 $

144,020 $ 143,867 Interest expense 3,105 2,947

2,907 11,773 11,797

Net interest income 33,195 32,965 33,499 132,247 132,070

Loan loss provision 1,910 2,520 3,375 8,650 8,755 Gains on

sales of loans 403 462 687 1,978 1,468 Deposit service charges

6,306 6,348 6,153 24,282 23,892 Trust revenue 2,384 2,297 2,308

9,286 9,011 Loan related fees 1,074 641 958 3,821 3,531 Securities

gains (losses) (248 ) 12 (66 ) (106 ) (211 ) Other noninterest

income 1,891 2,275 1,998

7,548 7,390 Total noninterest income

11,810 12,035 12,038 46,809 45,081 Personnel expense 13,321

13,975 14,337 54,563 54,493 Occupancy and equipment 2,643 2,688

2,654 10,875 11,431 Data processing expense 1,539 1,577 2,002 6,743

7,877 FDIC insurance premiums 584 606 618 2,382 2,400 Other

noninterest expense 7,691 8,688

8,408 30,880 29,798 Total

noninterest expense 25,778 27,534 28,019 105,443 105,999 Net

income before taxes 17,317 14,946 14,143 64,963 62,397 Income taxes

5,447 3,724 4,151

18,531 19,146 Net income $ 11,870 $

11,222 $ 9,992 $ 46,432 $ 43,251

Memo: TEQ interest income $ 36,797 $ 36,414 $ 36,917 $ 146,047 $

145,800 Average shares outstanding 17,464 17,440 17,351

17,431 17,326 Diluted average shares outstanding 17,516 17,491

17,422 17,483 17,397 Basic earnings per share $ 0.68 $ 0.64 $ 0.58

$ 2.66 $ 2.50 Diluted earnings per share $ 0.68 $ 0.64 $ 0.57 $

2.66 $ 2.49 Dividends per share $ 0.310 $ 0.310 $ 0.300 $ 1.220 $

1.181

Average balances: Loans $ 2,847,128 $ 2,803,332

$ 2,711,183 $ 2,791,871 $ 2,642,231 Earning assets 3,578,521

3,524,058 3,459,675 3,524,506 3,422,450 Total assets 3,844,441

3,788,917 3,720,851 3,790,282 3,679,531 Deposits, including

repurchase agreements 3,253,160 3,203,122 3,150,160 3,201,545

3,130,338 Interest bearing liabilities 2,586,609 2,562,274

2,543,308 2,569,344 2,547,267 Shareholders' equity 475,261 468,442

447,080 465,682 435,290

Performance ratios: Return on

average assets 1.22 % 1.18 % 1.07 % 1.23 % 1.18 % Return on average

equity 9.91 % 9.50 % 8.87 % 9.97 % 9.94 % Yield on average earning

assets (tax equivalent) 4.08 % 4.10 % 4.23 % 4.14 % 4.26 % Cost of

interest bearing funds (tax equivalent) 0.48 % 0.46 % 0.45 % 0.46 %

0.46 % Net interest margin (tax equivalent) 3.74 % 3.77 % 3.90 %

3.81 % 3.92 % Efficiency ratio (tax equivalent) 56.35 % 60.53 %

60.76 % 58.20 % 59.12 % Loan charge-offs $ 2,051 $ 2,899 $

3,792 $ 9,870 $ 11,436 Recoveries (695 ) (729 )

(774 ) (2,867 ) (3,120 ) Net charge-offs $

1,356 $ 2,170 $ 3,018 $ 7,003 $ 8,316

Market Price:

High $ 37.15 $ 37.63 $ 37.54 $ 37.63 $ 41.13 Low $ 33.68 $ 33.62 $

33.19 $ 31.53 $ 32.33 Close $ 34.96 $ 35.51 $ 36.61 $ 34.96 $ 36.61

Community Trust Bancorp, Inc. Financial

Summary (Unaudited) December 31, 2015 (in thousands

except per share data and # of employees)

As of As of As of December 31, 2015 September

30, 2015 December 31, 2014

Assets: Loans $ 2,873,961 $

2,820,460 $ 2,733,824 Loan loss reserve (36,094 )

(35,540 ) (34,447 ) Net loans 2,837,867 2,784,920 2,699,377

Loans held for sale 1,172 1,983 2,264 Securities AFS 594,936

576,713 640,186 Securities HTM 1,661 1,661 1,662 Other equity

investments 22,814 22,814 22,796 Other earning assets 141,313

116,754 59,259 Cash and due from banks 51,974 54,041 56,299

Premises and equipment 48,188 48,541 49,980 Goodwill and core

deposit intangible 65,781 65,821 65,967 Other assets 138,228

134,900 125,975

Total

Assets $ 3,903,934 $ 3,808,148 $ 3,723,765

Liabilities and Equity: NOW accounts $ 44,567 $

32,249 $ 31,998 Savings deposits 997,042 1,004,635 925,715 CD's

>=$100,000 559,497 561,856 575,394 Other time deposits

629,701 638,832 663,524 Total

interest bearing deposits 2,230,807 2,237,572 2,196,631 Noninterest

bearing deposits 749,975 737,657

677,626 Total deposits 2,980,782 2,975,229 2,874,257

Repurchase agreements 251,225 256,153 235,186 Other interest

bearing liabilities 165,993 71,640 133,552 Noninterest bearing

liabilities 30,351 34,541 32,893

Total liabilities 3,428,351 3,337,563 3,275,888

Shareholders' equity 475,583 470,585

447,877

Total Liabilities and Equity $

3,903,934 $ 3,808,148 $ 3,723,765

Ending shares outstanding 17,537 17,513 17,466 Memo: Market value

of HTM securities $ 1,651 $ 1,651 $ 1,644 30 - 89 days past

due loans $ 14,401 $ 18,812 $ 15,150 90 days past due loans 12,046

18,001 17,985 Nonaccrual loans 16,563 14,722 20,971 Restructured

loans (excluding 90 days past due and nonaccrual) 49,283 43,081

47,860 Foreclosed properties 40,674 34,654 36,776 Other repossessed

assets 183 136 90 Common equity Tier 1 capital 14.58 % 14.49

% - Tier 1 leverage ratio 12.40 % 12.40 % 12.04 % Tier 1 risk-based

capital ratio 16.70 % 16.63 % 16.51 % Total risk based capital

ratio 17.95 % 17.88 % 17.76 % Tangible equity to tangible assets

ratio 10.68 % 10.82 % 10.44 % FTE employees 984 980 1,012

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160120005883/en/

Community Trust Bancorp, Inc.Jean R. Hale,

606-437-3294Chairman, President, and C.E.O.

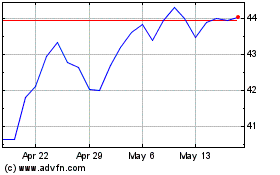

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

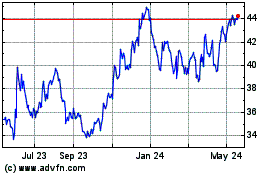

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024