Colliers International Group Inc. Announces Normal Course Issuer Bid

July 16 2021 - 7:00AM

Colliers International Group Inc. (NASDAQ: CIGI) (TSX: CIGI)

(“Colliers”) announced today that the Toronto Stock Exchange (the

“TSX”) has accepted a notice filed by Colliers of its intention to

make a normal course issuer bid (the “NCIB”) with respect to its

outstanding subordinate voting shares (the “Subordinate Voting

Shares”).

The notice provides that Colliers may, during

the twelve month period commencing July 20, 2021 and ending no

later than July 19, 2022, purchase through the facilities of the

TSX, alternative Canadian Trading Systems or The NASDAQ Stock

Market (“Nasdaq”) up to 3,200,000 Subordinate Voting Shares in

total, being 9.7% of the 32,708,670 shares comprising the “public

float” as of July 5, 2021 of such class of shares. Purchases

of Subordinate Voting Shares through Nasdaq will be made in the

normal course and will not, during the twelve month period ending

July 19, 2022 exceed, in the aggregate, 5% of the outstanding

Subordinate Voting Shares as at the commencement of the NCIB. The

price which Colliers will pay for any such shares will be the

market price at the time of acquisition. During the period of this

NCIB, Colliers may make purchases under the NCIB by means of open

market transactions or otherwise as permitted by the Ontario

Securities Commission, Canadian Securities Administrators and/or

Nasdaq. The actual number of Subordinate Voting Shares which may be

purchased pursuant to the NCIB and the timing of any such purchases

will be determined by senior management of Colliers. The average

daily trading volume on the TSX from January 1, 2021 to June 30,

2021 was 53,602 Subordinate Voting Shares. Daily purchases under

the NCIB will be limited to 13,400 Subordinate Voting Shares, other

than block purchases. All shares purchased by Colliers under the

NCIB will be cancelled.

As of July 5, 2021, there were 42,658,300

Subordinate Voting Shares and 1,325,694 multiple voting shares of

Colliers outstanding.

Colliers may purchase its Subordinate Voting

Shares, from time to time, if it believes that the market price of

its Subordinate Voting Shares is attractive and that the purchase

would be an appropriate use of corporate funds and in the best

interests of Colliers.

Colliers’ previous NCIB authorized the purchase

of up to 3,000,000 Subordinate Voting Shares and expires on July

19, 2021. As of the date hereof, Colliers has not purchased any of

its Subordinate Voting Shares under this NCIB.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading

diversified professional services and investment management

company. With operations in 66 countries, our more than 15,000

enterprising professionals work collaboratively to provide expert

advice to real estate occupiers, owners and investors. For more

than 25 years, our experienced leadership with significant insider

ownership has delivered compound annual investment returns of

almost 20% for shareholders. With annualized revenues of $3.0

billion ($3.3 billion including affiliates) and $40 billion of

assets under management, we maximize the potential of property and

accelerate the success of our clients and our people. Learn more at

corporate.colliers.com, Twitter @Colliers or LinkedIn.

Forward-looking Statements

Certain information included in this news

release is forward-looking, within the meaning of applicable

securities laws. Much of this information can be identified by

words such as “believe”, “expects”, “expected”, “will”, “intends”,

“projects”, “anticipates”, “estimates”, “continues” or similar

expressions suggesting future outcomes or events. Colliers believes

the expectations reflected in such forward-looking statements are

reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements should

not be unduly relied upon.

Forward-looking statements are based on current

information and expectations that involve a number of risks and

uncertainties, which could cause actual results or events to differ

materially from those anticipated. These risks include, but are not

limited to, risks associated with: (i) general economic and

business conditions, which will, among other things, impact demand

for Colliers’ services and the cost of providing services; (ii) the

ability of Colliers to implement its business strategy, including

Colliers’ ability to identify and acquire suitable acquisition

candidates on acceptable terms and successfully integrate newly

acquired businesses with its existing businesses; (iii) changes in

or the failure to comply with government regulations; and (iv) such

factors as are identified in the Annual Information Form of

Colliers for the year ended December 31, 2020 under the heading

“Risk Factors” (which factors are adopted herein and a copy of

which can be obtained at www.sedar.com). Forward looking statements

contained in this news release are made as of the date hereof and

are subject to change. All forward-looking statements in this news

release are qualified by these cautionary statements. Except as

required by applicable law, Colliers undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

COMPANY CONTACTS:

Christian

MayerCFO(416)

960-9500

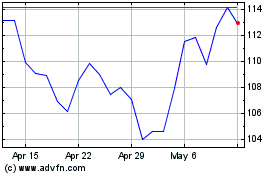

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

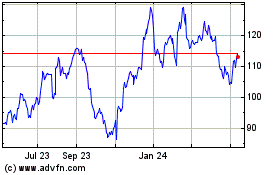

Colliers (NASDAQ:CIGI)

Historical Stock Chart

From Nov 2023 to Nov 2024