0001069530 False 0001069530 2023-11-07 2023-11-07 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

_______________________________

Cassava Sciences, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-29959 | 91-1911336 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6801 N Capital of Texas Highway, Building 1; Suite 300

Austin, Texas 78731

(Address of Principal Executive Offices) (Zip Code)

(512) 501-2444

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | SAVA | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2023, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information provided in this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Such information shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Cassava Sciences, Inc. |

| | | |

| | | |

| Date: November 7, 2023 | By: | /s/ Eric J. Schoen |

| | | Eric J. Schoen |

| | | Chief Financial Officer |

| | | |

EXHIBIT 99.1

Cassava Sciences Reports Third Quarter 2023 Financial and Operating Results

- Enrollment completed for Phase 3 trials evaluating oral simufilam in Alzheimer's.

- Over 1,900 patients randomized in on-going Phase 3 trials.

- Top-line results for 52-week Phase 3 trial expected approximately year-end 2024; top-line results for 76-week Phase 3 trial expected approximately mid-year 2025.

- MRI safety data suggests simufilam is not associated with ARIA.

- $142.4 Million in cash and cash equivalents at September 30, 2023.

AUSTIN, Texas, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Cassava Sciences, Inc. (Nasdaq: SAVA), a biotechnology company focused on Alzheimer’s disease, today reported financial and operating results for the third quarter ended September 30, 2023.

“In the third quarter, Cassava Sciences made important progress with simufilam, our lead drug candidate,” said Remi Barbier, President & CEO. “This progress exemplifies our unwavering commitment to develop a new treatment option for people with Alzheimer’s.”

Simufilam is Cassava Sciences’ proprietary oral drug candidate. This investigational drug binds to altered filamin A protein in the brain and restores its normal shape and function. By targeting altered filamin A, simufilam may help patients with Alzheimer’s achieve better health outcomes.

Cassava Sciences recently announced the completion of enrollment in a pair of on-going Phase 3 trials to evaluate the safety and efficacy of oral simufilam versus placebo in Alzheimer's disease dementia. A total of 1,929 patients were randomized in these two Phase 3 trials.

The first Phase 3 trial (NCT04994483) has a 52-week treatment period; 804 Alzheimer’s patients were randomized into this study. Top-line results for the 52-week Phase 3 study are currently expected approximately year-end 2024.

The second Phase 3 trial (NCT05026177) has a 76-week treatment period; 1,125 Alzheimer’s patients were randomized into this study. Top-line results for the 76-week Phase 3 study are currently expected approximately mid-year 2025.

Cassava Sciences recently presented interim safety MRI data that suggests simufilam is not associated with treatment-emergent ARIA, which are imaging abnormalities. In addition, in September 2023, a Data and Safety Monitoring Board (DSMB), recommended that the Phase 3 studies continue as planned, without modification. Finally, in September 2023, a fourth academic institution showed non-clinical data in support of the biological activity of simufilam.

Financial Results for Third Quarter 2023

- At September 30, 2023, cash and cash equivalents were $142.4 million, with no debt.

- Net loss was $25.7 million, or $0.61 per share. This compares to a net loss of $20.3 million, or $0.51 per share, for the same period in 2022. Net loss increased due primarily to increases in patient enrollment and associated costs to conduct the Phase 3 clinical program, as well as other studies with simufilam.

- Net cash used in operations was $59.7 million during the first nine months of 2023.

- Net cash use in operations for second half 2023 is expected to be $40 to $50 million, consistent with previous guidance and driven primarily by expenses for our clinical program in Alzheimer’s disease.

- Research and development (R&D) expenses were $23.6 million. This compared to $18.5 million for the same period in 2022. R&D expenses increased due primarily to increasing patient enrollment and costs to conduct the Phase 3 clinical program, as well as other studies with simufilam.

- General and administrative (G&A) expenses were $4.3 million. This compared to $2.8 million for the same period in 2022. G&A expenses increased due to activities and expenses related to legal services as well as increases in stock-based compensation.

About Cassava Sciences, Inc.

Cassava Sciences is a clinical-stage biotechnology company based in Austin, Texas. Our mission is to detect and treat neurodegenerative diseases, such as Alzheimer’s disease. Our novel science is based on stabilizing—but not removing—a critical protein in the brain. Our product candidates have not been approved by any regulatory authority, and their safety, efficacy or other desirable attributes have not been established.

For more information, please visit: https://www.CassavaSciences.com

For More Information Contact:

Eric Schoen, Chief Financial Officer

(512) 501-2450 or ESchoen@CassavaSciences.com

Cautionary Note Regarding Forward-Looking Statements:

This news release contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that may include but are not limited to: the design, scope, conduct, continuation, completion, intended purpose, or future results of our on-going Phase 3 program of simufilam in patients with Alzheimer's disease; the suitability of clinical data from our Phase 3 program to support the filing of an NDA; any findings or recommendations by the DSMB relating to the interim safety of simufilam in our on-going Phase 3 clinical trials; interim MRI safety data for the Phase 3 program, including ARIA; the risk of current or future findings of treatment-emergent ARIA in our clinical program of simufilam; any expected clinical results of Phase 3 studies; the treatment of people with Alzheimer’s disease dementia; the safety or efficacy of simufilam in people with Alzheimer’s disease dementia; expected cash use in future periods; comments made by our employees regarding simufilam, drug effect, and the treatment of Alzheimer’s disease; and potential benefits, if any, of our product candidates. These statements may be identified by words such as “may,” “anticipate,” “believe,” “could,” “expect,” “forecast,” “intend,” “plan,” “possible,” “potential,” and other words and terms of similar meaning.

Simufilam is our investigational product candidate. It is not approved by any regulatory authority in any jurisdiction and its safety, efficacy or other desirable attributes have not been established in patients.

Drug development and commercialization involve a high degree of risk, and only a small number of research and development programs result in commercialization of a product. Clinical results and analyses of our previous studies should not be relied upon as predictive of Phase 3 studies or any other study. Our clinical results from earlier-stage clinical trials may not be indicative of full results or results from later-stage or larger scale clinical trials and do not ensure regulatory approval. You should not place undue reliance on these statements or any scientific data we present or publish.

Such statements are based largely on our current expectations and projections about future events. Such statements speak only as of the date of this news release and are subject to a number of risks, uncertainties and assumptions, including, but not limited to, those risks relating to the ability to conduct or complete clinical studies on expected timelines, to demonstrate the specificity, safety, efficacy or potential health benefits of our product candidates, any unanticipated impacts of inflation on our business operations, and including those described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, and future reports to be filed with the SEC. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from expectations in any forward-looking statement. In light of these risks, uncertainties and assumptions, the forward-looking statements and events discussed in this news release are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by law, we disclaim any intention or responsibility for updating or revising any forward-looking statements contained in this news release. For further information regarding these and other risks related to our business, investors should consult our filings with the SEC, which are available on the SEC's website at www.sec.gov.

– Financial Tables Follow –

| CASSAVA SCIENCES, INC. | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (unaudited, in thousands, except per share amounts) | |

| | | | | | | | | | | |

| | Three months ended September 30, | | | Nine months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Operating expenses | | | | | | | | | | | | |

| Research and development, net of grant reimbursement | $ | 23,603 | | | $ | 18,526 | | | $ | 70,692 | | | $ | 50,380 | |

| General and administrative | | 4,276 | | | | 2,819 | | | | 12,476 | | | | 8,703 | |

| Total operating expenses | | 27,879 | | | | 21,345 | | | | 83,168 | | | | 59,083 | |

| Operating loss | | (27,879 | ) | | | (21,345 | ) | | | (83,168 | ) | | | (59,083 | ) |

| Interest income | | 2,005 | | | | 878 | | | | 6,254 | | | | 1,223 | |

| Other income, net | | 223 | | | | 210 | | | | 616 | | | | 748 | |

| Net loss | $ | (25,651 | ) | | $ | (20,257 | ) | | $ | (76,298 | ) | | $ | (57,112 | ) |

| | | | | | | | | | | | | |

| Net loss per share, basic and diluted | $ | (0.61 | ) | | $ | (0.51 | ) | | $ | (1.82 | ) | | $ | (1.43 | ) |

| | | | | | | | | | | | | |

| Weighted-average shares used in computing net loss per share, basic and diluted | | 42,002 | | | | 40,050 | | | | 41,845 | | | | 40,009 | |

| | | | | | | | | | | | | |

| | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | | | | |

| (unaudited, in thousands) | | | | |

| | | | | | | | September 30,

2023 | | December 31,

2022 | |

| Assets | | | | | | | | | | | | |

| Current assets | | | | | | | | | | | | |

| Cash and cash equivalents | | | | | | | $ | 142,350 | | | $ | 201,015 | |

| Prepaid expenses and other current assets | | | | | | | | 7,834 | | | | 10,211 | |

| Total current assets | | | | | | | | 150,184 | | | | 211,226 | |

| Property and equipment, net | | | | | | | | 22,077 | | | | 22,864 | |

| Operating lease right-of-use assets | | | | | | | | — | | | | 122 | |

| Intangible assets, net | | | | | | | | 268 | | | | 622 | |

| Total assets | | | | | | | $ | 172,529 | | | $ | 234,834 | |

| Liabilities and stockholders' equity | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | |

| Accounts payable | | | | | | | $ | 9,492 | | | $ | 4,017 | |

| Accrued development expense | | | | | | | | 7,344 | | | | 2,280 | |

| Accrued compensation and benefits | | | | | | | | 187 | | | | 170 | |

| Operating lease liabilities, current | | | | | | | | — | | | | 104 | |

| Other accrued liabilities | | | | | | | | 391 | | | | 492 | |

| Total current liabilities | | | | | | | | 17,414 | | | | 7,063 | |

| Operating lease liabilities, non-current | | | | | | | | — | | | | 35 | |

| Other non- current liabilities | | | | | | | | — | | | | 197 | |

| Total liabilities | | | | | | | | 17,414 | | | | 7,295 | |

| Stockholders' equity | | | | | | | | | | | | |

| Common Stock and additional paid-in-capital | | | | | | | | 514,965 | | | | 511,091 | |

| Accumulated deficit | | | | | | | | (359,850 | ) | | | (283,552 | ) |

| Total stockholders' equity | | | | | | | | 155,115 | | | | 227,539 | |

| Total liabilities and stockholders' equity | | | | | | | $ | 172,529 | | | $ | 234,834 | |

| | | | | | | | | | | | | |

v3.23.3

Cover

|

Nov. 07, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity File Number |

000-29959

|

| Entity Registrant Name |

Cassava Sciences, Inc.

|

| Entity Central Index Key |

0001069530

|

| Entity Tax Identification Number |

91-1911336

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

6801 N Capital of Texas Highway, Building 1; Suite 300

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78731

|

| City Area Code |

512

|

| Local Phone Number |

501-2444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

SAVA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

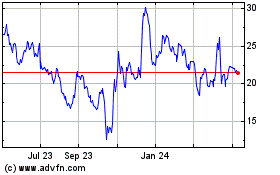

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Dec 2024 to Jan 2025

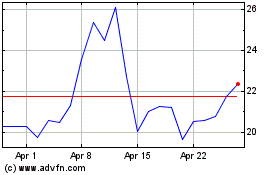

Cassava Sciences (NASDAQ:SAVA)

Historical Stock Chart

From Jan 2024 to Jan 2025