Cabaletta Bio Announces Closing of $100 Million Public Offering of Common Stock, Including Full Exercise of Option to Purchase Additional Shares

May 22 2023 - 4:30PM

Cabaletta Bio, Inc. (“Cabaletta” or the “Company”) (Nasdaq: CABA),

a clinical-stage biotechnology company focused on developing and

launching the first curative targeted cell therapies for patients

with autoimmune diseases, announced today the closing of an

underwritten public offering of 8,337,500 shares of its common

stock, including the exercise in full by the underwriters of their

option to purchase an additional 1,087,500 shares, at the public

offering price of $12.00 per share. The gross proceeds raised in

the offering, before underwriting discounts and commissions and

estimated expenses of the offering, were approximately $100

million.

TD Cowen, Evercore ISI and Guggenheim Securities

acted as joint book-running managers for the offering and H.C.

Wainwright & Co. acted as lead manager for the offering.

The shares of common stock were offered by

Cabaletta pursuant a registration statement on Form S-3 that was

previously filed with, and subsequently declared effective on April

26, 2023 by, the Securities and Exchange Commission (“SEC”). A

final prospectus supplement and accompanying prospectus relating to

and describing the terms of the offering was filed with the SEC on

May 18, 2023. The final prospectus supplement and accompanying

prospectus relating to the offering may be obtained from: Cowen and

Company, LLC, 599 Lexington Avenue, New York, NY 10022, by email at

Prospectus_ECM@cowen.com or by telephone at (833) 297-2926,

Evercore Group L.L.C., Attention: Equity Capital Markets, 55 East

52nd Street, 35th Floor, New York, New York 10055; by telephone at

(888) 474-0200, or by email at ecm.prospectus@evercore.com or

Guggenheim Securities, LLC Attention: Equity Syndicate Department,

330 Madison Avenue, New York, NY 10017 by telephone at (212)

518-9544, or by email at

GSEquityProspectusDelivery@guggenheimpartners.com.

This press release shall not constitute an offer to

sell or a solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification of these

securities under the securities laws of any such state or other

jurisdiction.

About Cabaletta

Bio

Cabaletta Bio (Nasdaq: CABA) is a clinical-stage

biotechnology company focused on the discovery and development of

engineered T cell therapies that have the potential to provide a

deep and durable treatment for patients with autoimmune diseases.

The CABA™ platform encompasses two strategies: the CARTA (chimeric

antigen receptor T cells for autoimmunity) strategy, with CABA-201,

a 4-1BB-containing fully human CD19-CAR T, as the lead product

candidate being evaluated in systemic lupus erythematosus and

myositis, and the CAART (chimeric autoantibody receptor T cells)

strategy, with multiple clinical-stage candidates, including

DSG3-CAART for mucosal pemphigus vulgaris and MuSK-CAART for MuSK

myasthenia gravis.

Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including, without limitation,

statements regarding Cabaletta’s public offering. The words “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “target” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release, such as the

potential of Cabaletta’s engineered T cell therapies to provide a

deep and durable treatment for patients with autoimmune diseases,

are based on management's current expectations and beliefs and are

subject to a number of risks, uncertainties and important factors

that may cause actual events or results to differ materially from

those expressed or implied by any forward-looking statements

contained in this press release, including, without limitation, the

anticipated use of proceeds from the public offering and expected

cash runway projection. These and other risks and uncertainties are

described in greater detail in the section entitled “Risk Factors”

in Cabaletta’s most recent annual report on Form 10-K filed on

March 16, 2023 and our subsequent quarterly reports on Form 10-Q

and current reports on Form 8-K filed with the SEC, as well as

discussions of potential risks, uncertainties, and other important

factors in Cabaletta’s other filings with the SEC, including those

contained or incorporated by reference in the prospectus supplement

and accompanying prospectus related to the public offering filed

with the SEC. Any forward- looking statements contained in this

press release represent Cabaletta’s views only as of the date

hereof and should not be relied upon as representing its views as

of any subsequent date. Cabaletta explicitly disclaims any

obligation to update any forward-looking statements, except as

required by law.

Contacts

Anup MardaChief Financial Officer

investors@cabalettabio.com

Sarah McCabeStern Investor Relations, Inc.

212-362-1200sarah.mccabe@sternir.com

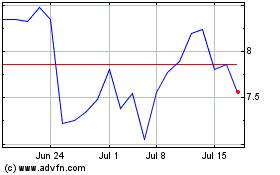

Cabaletta Bio (NASDAQ:CABA)

Historical Stock Chart

From Oct 2024 to Nov 2024

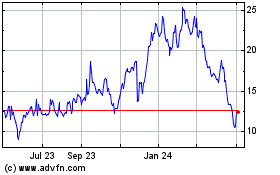

Cabaletta Bio (NASDAQ:CABA)

Historical Stock Chart

From Nov 2023 to Nov 2024