0001846017false00018460172024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 21, 2024

BLUE FOUNDRY BANCORP

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | |

| Delaware | 001-40619 | 86-2831373 |

| (State or Other Jurisdiction) | (Commission File No.) | (I.R.S. Employer |

| of Incorporation) | | Identification No.) |

| | |

19 Park Avenue, Rutherford, New Jersey | | 07070 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (201) 939-5000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | BLFY | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On February 27, 2024, Blue Foundry Bancorp (the “Company”) issued a press release announcing that it has adopted a program to repurchase up to 1,203,545 shares of its common stock, which is approximately 5% of its outstanding common stock.

Shares of Company common stock may be repurchased in open market or private transactions, through block trades, or pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities and Exchange Commission. The new repurchase program has no expiration date.

The timing and amount of share repurchases under the new repurchase program may be suspended, terminated or modified by the Company at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. The Company is not obligated to repurchase any particular number of shares or any shares in any specific time period.

A copy of the press release announcing the stock repurchase program is included as exhibit 99.1 to this report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| Blue Foundry Bancorp |

| | |

| DATE: February 27, 2024 | By: | /s/ James D. Nesci |

| | James D. Nesci |

| | President and Chief Executive Officer |

BLUE FOUNDRY BANCORP

ANNOUNCES ADOPTION OF FOURTH STOCK REPURCHASE PROGRAM

RUTHERFORD, NEW JERSEY, February 27, 2024 – Blue Foundry Bancorp (NASDAQ: BLFY), the holding company for Blue Foundry Bank, announced that it has adopted a program to repurchase up to 1,203,545 shares of its common stock, which is approximately 5% of its outstanding common stock. This is the Company’s fourth stock repurchase program since completing its mutual-to-stock conversion and related stock offering in July 2021.

Since announcing its first stock repurchase program on July 20, 2022, the Company has repurchased 5,409,022 shares. As of February 26, 2024, there were 46,736 shares remaining to be repurchased under the third plan. The fourth plan will commence immediately upon the completion of the third plan.

The repurchase program permits shares to be repurchased in open market or private transactions, through block trades or pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities and Exchange Commission. The timing and amount of any repurchases will depend on a number of factors, including the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, and the Company’s financial performance. Open market purchases will be made in accordance with Rule 10b-18 of the Securities and Exchange Commission and other applicable legal requirements. The Company is not obligated to repurchase any particular number of shares or any shares in any specific time period.

James D. Nesci, President and CEO of the Company, remarked that “We are pleased to announce our fourth repurchase program. We believe that share repurchases are a prudent use of capital and are pleased to have the strong capital position that allows us the ability to purchase stock.”

About Blue Foundry Bancorp

Blue Foundry Bancorp is the holding company for Blue Foundry Bank, a place where things are made, purpose is formed, and ideas are crafted. Headquartered in Rutherford NJ, with a presence in Bergen, Essex, Hudson, Middlesex, Morris, Passaic, Somerset and Union counties, Blue Foundry Bank is a full-service, innovative bank serving the doers, movers, and shakers in our communities. We offer individuals and businesses alike the tailored products and services they need to build their futures. With a rich history dating back more than 145 years, Blue Foundry Bank has a longstanding commitment to its customers and communities. To learn more about Blue Foundry Bank visit BlueFoundryBank.com or call (888) 931-BLUE. Member FDIC.

Forward Looking Statements

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements, which are based on certain current assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions.

Forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: inflation and changes in the interest rate environment that reduce our margins and yields, the fair value of financial instruments or our level of loan originations, or increase the level of defaults, losses and prepayments on loans we have made and make; general economic conditions, either nationally or in our market areas, that are worse than expected; changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for credit losses; our ability to access cost-effective funding; fluctuations in real estate values and both residential and commercial real estate market conditions; demand for loans and deposits in our market area; our ability to implement and change our business strategies; competition among depository and other financial institutions; the effects of the recent turmoil in the banking industry (including the failures of two financial institutions); adverse changes in the securities or secondary mortgage markets; changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees, capital requirements and insurance premiums; changes in monetary or fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; changes in the quality or composition of our loan or investment portfolios; technological changes that may be more difficult or expensive than expected; a failure or breach of our operational or security systems or infrastructure, including cyber-attacks; the inability of third party providers to perform as expected; our ability to manage market risk, credit risk and operational risk in the current economic environment; our ability to enter new markets successfully and capitalize on growth opportunities; our ability to successfully integrate into our operations any assets, liabilities, customers, systems and management personnel we may acquire and our ability to realize related revenue synergies and cost savings within expected time frames and any goodwill charges related there to; changes in consumer spending, borrowing and savings habits; changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission or the Public Company Accounting Oversight Board; our ability to retain key employees; the current or anticipated impact of military conflict, terrorism or other geopolitical events; the impact of potential government shutdown; the ability of the U.S. Government to manage federal debt

limits; and changes in the financial condition, results of operations or future prospects of issuers of securities that we own.

Because of these and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking statements. Except as required by applicable law or regulation, we do not undertake, and we specifically disclaim any obligation, to release publicly the results of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of the statements or to reflect the occurrence of anticipated or unanticipated events.

Contact Information

Elyse D. Beidner

Investor Relations

BlueFoundryBank.com

ebeidner@bluefoundrybank.com

201-939-5000

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

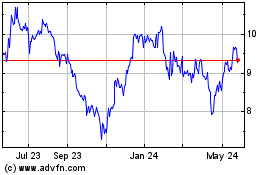

Blue Foundry Bancorp (NASDAQ:BLFY)

Historical Stock Chart

From Jun 2024 to Jul 2024

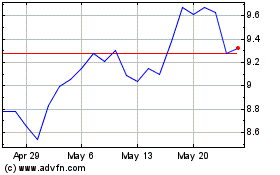

Blue Foundry Bancorp (NASDAQ:BLFY)

Historical Stock Chart

From Jul 2023 to Jul 2024