0000805928December 312023Q2falseP3Yhttp://www.axogeninc.com/20230630#LeaseLiabilityCurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityCurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityNoncurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityNoncurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityCurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityCurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityNoncurrenthttp://www.axogeninc.com/20230630#LeaseLiabilityNoncurrent33800008059282023-01-012023-06-3000008059282023-08-01xbrli:shares00008059282023-06-30iso4217:USD00008059282022-12-31iso4217:USDxbrli:shares00008059282023-04-012023-06-3000008059282022-04-012022-06-3000008059282022-01-012022-06-3000008059282021-12-3100008059282022-06-300000805928us-gaap:CommonStockMember2023-03-310000805928us-gaap:AdditionalPaidInCapitalMember2023-03-310000805928us-gaap:RetainedEarningsMember2023-03-3100008059282023-03-310000805928us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000805928us-gaap:CommonStockMember2023-04-012023-06-300000805928us-gaap:CommonStockMember2023-06-300000805928us-gaap:AdditionalPaidInCapitalMember2023-06-300000805928us-gaap:RetainedEarningsMember2023-06-300000805928us-gaap:CommonStockMember2022-12-310000805928us-gaap:AdditionalPaidInCapitalMember2022-12-310000805928us-gaap:RetainedEarningsMember2022-12-310000805928us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300000805928us-gaap:CommonStockMember2023-01-012023-06-300000805928us-gaap:CommonStockMember2022-03-310000805928us-gaap:AdditionalPaidInCapitalMember2022-03-310000805928us-gaap:RetainedEarningsMember2022-03-3100008059282022-03-310000805928us-gaap:RetainedEarningsMember2022-04-012022-06-300000805928us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000805928us-gaap:CommonStockMember2022-04-012022-06-300000805928us-gaap:CommonStockMember2022-06-300000805928us-gaap:AdditionalPaidInCapitalMember2022-06-300000805928us-gaap:RetainedEarningsMember2022-06-300000805928us-gaap:CommonStockMember2021-12-310000805928us-gaap:AdditionalPaidInCapitalMember2021-12-310000805928us-gaap:RetainedEarningsMember2021-12-310000805928us-gaap:RetainedEarningsMember2022-01-012022-06-300000805928us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300000805928us-gaap:CommonStockMember2022-01-012022-06-300000805928srt:MinimumMember2023-06-300000805928srt:MaximumMember2023-06-300000805928us-gaap:ShippingAndHandlingMember2023-04-012023-06-300000805928us-gaap:ShippingAndHandlingMember2023-01-012023-06-300000805928us-gaap:ShippingAndHandlingMember2022-04-012022-06-300000805928us-gaap:ShippingAndHandlingMember2022-01-012022-06-300000805928axgn:CreditFacilityMember2023-06-292023-06-290000805928axgn:CreditFacilityMemberaxgn:SecuredOvernightFinancingRateSOFRMember2023-06-292023-06-29xbrli:pure0000805928us-gaap:LandMember2023-06-300000805928us-gaap:LandMember2022-12-310000805928us-gaap:BuildingMember2023-06-300000805928us-gaap:BuildingMember2022-12-310000805928us-gaap:LeaseholdImprovementsMember2023-06-300000805928us-gaap:LeaseholdImprovementsMember2022-12-310000805928us-gaap:EquipmentMember2023-06-300000805928us-gaap:EquipmentMember2022-12-310000805928axgn:FurnitureAndOfficeEquipmentMember2023-06-300000805928axgn:FurnitureAndOfficeEquipmentMember2022-12-310000805928us-gaap:ConstructionInProgressMember2023-06-300000805928us-gaap:ConstructionInProgressMember2022-12-310000805928us-gaap:PatentsMember2023-06-300000805928us-gaap:PatentsMember2022-12-310000805928us-gaap:LicensingAgreementsMember2023-06-300000805928us-gaap:LicensingAgreementsMember2022-12-310000805928us-gaap:TrademarksMember2023-06-300000805928us-gaap:TrademarksMember2022-12-310000805928axgn:PatentsAndLicenseAgreementsMember2023-06-300000805928us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300000805928us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300000805928us-gaap:SellingAndMarketingExpenseMember2023-01-012023-06-300000805928us-gaap:SellingAndMarketingExpenseMember2022-01-012022-06-300000805928us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-06-300000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300000805928us-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000805928us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000805928us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000805928us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000805928us-gaap:FairValueMeasurementsRecurringMember2023-03-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-04-012023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-06-300000805928us-gaap:FairValueMeasurementsRecurringMember2022-03-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-04-012022-06-300000805928us-gaap:FairValueMeasurementsRecurringMember2022-06-300000805928us-gaap:FairValueMeasurementsRecurringMember2021-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-06-300000805928axgn:OberlandFacilityMember2023-06-300000805928axgn:OberlandFacilityMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:OberlandFacilityMember2023-06-30axgn:settlementScenario0000805928axgn:DebtDerivativeLiabilityMemberaxgn:OberlandFacilityTrancheOneMemberus-gaap:MeasurementInputExpectedTermMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:OberlandFacilityTrancheOneMemberus-gaap:MeasurementInputExpectedTermMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMembersrt:MinimumMemberaxgn:OberlandFacilityTrancheOneMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMemberaxgn:OberlandFacilityTrancheOneMembersrt:MaximumMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMembersrt:MinimumMemberaxgn:OberlandFacilityTrancheOneMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMemberaxgn:OberlandFacilityTrancheOneMembersrt:MaximumMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:OberlandFacilityTrancheOneMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:OberlandFacilityTrancheOneMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventBefore2024Member2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventBefore2024Member2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:OptionalPrepaymentEventMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheOneMemberaxgn:OptionalPrepaymentEventMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMemberaxgn:OberlandFacilityTrancheTwoMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputExpectedTermMemberaxgn:OberlandFacilityTrancheTwoMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMembersrt:MinimumMemberaxgn:OberlandFacilityTrancheTwoMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMemberaxgn:OberlandFacilityTrancheTwoMembersrt:MaximumMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMembersrt:MinimumMemberaxgn:OberlandFacilityTrancheTwoMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputCouponRateMemberaxgn:OberlandFacilityTrancheTwoMembersrt:MaximumMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:OberlandFacilityTrancheTwoMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberus-gaap:MeasurementInputDiscountRateMemberaxgn:OberlandFacilityTrancheTwoMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:MandatoryPrepaymentEventBefore2024Member2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:MandatoryPrepaymentEventBefore2024Member2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMemberaxgn:OberlandFacilityTrancheTwoMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:MandatoryPrepaymentEventIn2024OrAfterMemberaxgn:OberlandFacilityTrancheTwoMember2022-12-310000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:OptionalPrepaymentEventMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:MeasurementInputMandatoryPrepaymentRateMemberaxgn:OberlandFacilityTrancheTwoMemberaxgn:OptionalPrepaymentEventMember2022-12-310000805928axgn:A2023CommercialLeaseWithJAColeLPMember2023-05-09utr:sqft0000805928axgn:A2015CommercialLeaseWithJAColeLPMember2023-05-090000805928axgn:A2015CommercialLeaseWithJAColeLPMember2023-05-092023-05-090000805928axgn:CreditFacilityTrancheOneMember2023-06-300000805928axgn:CreditFacilityTrancheOneMember2022-12-310000805928axgn:CreditFacilityTrancheTwoMember2023-06-300000805928axgn:CreditFacilityTrancheTwoMember2022-12-310000805928axgn:CreditFacilityMember2020-06-300000805928axgn:CreditFacilityMember2021-06-300000805928axgn:CreditFacilityMember2020-06-302020-06-300000805928axgn:CreditFacilityMemberaxgn:SecuredOvernightFinancingRateSOFRMember2020-06-302020-06-300000805928axgn:CreditFacilityMember2023-06-300000805928axgn:CreditFacilityMember2023-04-012023-06-300000805928axgn:CreditFacilityMember2022-04-012022-06-300000805928axgn:CreditFacilityMember2023-01-012023-06-300000805928axgn:CreditFacilityMember2022-01-012022-06-300000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2023-06-300000805928axgn:DebtDerivativeLiabilityMember2023-06-300000805928axgn:DebtDerivativeLiabilityMember2022-12-310000805928axgn:RestrictedCashMember2023-06-300000805928axgn:RestrictedCashMember2022-12-31axgn:letterOfCredit0000805928us-gaap:EmployeeStockOptionMember2023-01-012023-03-310000805928us-gaap:EmployeeStockOptionMember2023-04-012023-06-300000805928us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000805928us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300000805928us-gaap:PerformanceSharesMember2023-01-012023-03-310000805928axgn:ShareBasedPaymentArrangementOptionInducementSharesMember2023-01-012023-06-300000805928axgn:RestrictedStockUnitsRSUsInducementSharesMember2023-01-012023-06-300000805928srt:MinimumMember2023-01-012023-03-310000805928srt:MaximumMember2023-01-012023-03-310000805928us-gaap:PerformanceSharesMembersrt:MaximumMember2023-01-012023-03-3100008059282023-01-012023-03-31axgn:officer0000805928axgn:InducementSharesMemberus-gaap:EmployeeStockOptionMember2023-01-012023-03-310000805928axgn:InducementSharesMemberus-gaap:PerformanceSharesMember2023-01-012023-03-310000805928us-gaap:PerformanceSharesMember2023-04-012023-06-300000805928axgn:ShareBasedPaymentArrangementOptionInducementSharesMember2023-04-012023-06-300000805928us-gaap:EmployeeStockOptionMember2023-04-012023-06-300000805928us-gaap:EmployeeStockOptionMember2022-04-012022-06-300000805928us-gaap:EmployeeStockOptionMember2023-01-012023-06-300000805928us-gaap:EmployeeStockOptionMember2022-01-012022-06-300000805928us-gaap:RestrictedStockUnitsRSUMember2023-04-012023-06-300000805928us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-06-300000805928us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-06-300000805928us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300000805928axgn:CommunityTissuesServicesAgreementMember2023-04-012023-06-300000805928axgn:CommunityTissuesServicesAgreementMember2022-04-012022-06-300000805928axgn:CommunityTissuesServicesAgreementMember2023-01-012023-06-300000805928axgn:CommunityTissuesServicesAgreementMember2022-01-012022-06-300000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2011-12-012011-12-310000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2023-04-012023-06-300000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2022-04-012022-06-300000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2023-01-012023-06-300000805928axgn:MasterServicesAgreementForClinicalResearchAndRelatedServicesMember2022-01-012022-06-300000805928axgn:APCFacilityMember2018-07-31utr:acre0000805928axgn:APCFacilityMember2018-07-312018-07-310000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2023-04-012023-06-300000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMember2023-01-012023-06-300000805928axgn:APCFacilityMember2023-04-012023-06-300000805928srt:MinimumMemberaxgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMembersrt:ScenarioForecastMember2023-12-310000805928axgn:DesignBuildAgreementMemberus-gaap:ConstructionInProgressMembersrt:MaximumMembersrt:ScenarioForecastMember2023-12-310000805928axgn:DesignBuildAgreementMemberaxgn:APCFacilityMember2019-07-090000805928axgn:DesignBuildAgreementMemberaxgn:APCFacilityMember2023-04-012023-06-300000805928axgn:DesignBuildAgreementMemberaxgn:APCFacilityMember2023-06-300000805928axgn:DebtDerivativeLiabilityMemberaxgn:CreditFacilityMember2023-06-300000805928axgn:MariaMartinezMember2023-04-012023-06-300000805928axgn:MariaMartinezMember2023-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to______________

Commission file number: 001-36046

Axogen, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Minnesota

(State or other jurisdiction of

incorporation or organization)

13631 Progress Blvd., Suite 400 Alachua, FL

(Address of principal executive offices)

41-1301878

(I.R.S. Employer

Identification No.)

32615

(Zip Code)

386-462-6800

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

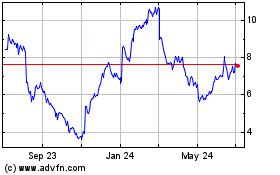

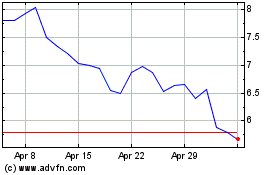

| Common Stock, $0.01 par value | AXGN | The Nasdaq Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 1, 2023, the registrant had 42,983,584 shares of common stock outstanding.

Table of Contents

| | | | | | | | |

|

| | |

| Condensed Consolidated Balance Sheets as of June 30, 2023 and December 31, 2022 (Unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Forward-Looking Statements

From time to time, in reports filed with the U.S. Securities and Exchange Commission (the “SEC”) (including this Quarterly Report on Form 10-Q), in press releases, and in other communications to shareholders or the investment community, Axogen, Inc. (including Axogen, Inc.’s wholly owned subsidiaries, Axogen Corporation, Axogen Processing Corporation and Axogen Europe GmbH, the “Company,” “Axogen,” “we,” “our,” or “us”) may provide forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, concerning possible or anticipated future results of operations or business developments. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which the Company is active, as well as its business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements.

The forward-looking statements in this Form 10-Q include, but are not limited to the following:

•Statements regarding our intentions to return Avive to the market;

•Our expectation that our request to the Food and Drug Administration ("FDA") for a rolling biologics license application ("BLA") submission for Avance Nerve Graft will occur early in the first quarter of 2024.

•Our expectation that the initial BLA submission for Avance Nerve Graft, if approved by the FDA, will begin , in the first quarter of 2024 with completion of the full submission by the second quarter of 2024;

•Our expectation that the BLA will be approved in the first half of 2025, subject to the rolling submission process being approved by the FDA;

•Our expectation that validation of and beginning tissue processing at the Axogen Processing Center ("APC Facility") will occur in the third quarter of 2023;

•Our expectation that we will incur between $2,000,000 to $3,000,000 in additional costs during the remainder of 2023 for the APC Facility;

•Our belief that our existing cash and cash equivalents and investments, as well as cash provided by sales of our products will allow us to fund our operations through at least the next 12 months;

•Our belief that any losses resulting from any claims, lawsuits, and proceedings are adequately covered by insurance or indemnified and are not expected to result in a material adverse effect on the Company’s financial condition, results of operation, or cash flow:

•Our estimates concerning the mix of scheduled procedures and emergent trauma procedures and our belief that the growth in scheduled procedures will continue to outpace emergent trauma procedure growth and continue to become a larger mix of our revenue over time; and

•Our expectation that we will fully launch the Axoguard HA+ Nerve Protector™ later this month.

The forward-looking statements are and will be subject to risks and uncertainties, which may cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements contained in this Quarterly Report on Form 10-Q should be evaluated together with the many risks and uncertainties that affect the Company’s business and its market, particularly those discussed in the risk factors and cautionary statements set forth in the Company’s filings with the SEC, including as described in “Risk Factors” included in Item 1A and "Risk Factor Summary" included in the Company's Annual Report on Form 10-K for the year ended December 31, 2022. Forward-looking statements are not guarantees of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, the Company assumes no responsibility to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or otherwise.

PART 1 — FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

Axogen, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 23,219 | | | $ | 15,284 | |

| Restricted cash | 6,252 | | | 6,251 | |

| Investments | 11,312 | | | 33,505 | |

Accounts receivable, net of allowance for doubtful accounts of $595 and $650, respectively | 21,573 | | | 22,186 | |

| Inventory | 21,237 | | | 18,905 | |

| Prepaid expenses and other | 2,583 | | | 1,944 | |

| Total current assets | 86,176 | | | 98,075 | |

| Property and equipment, net | 87,459 | | | 79,294 | |

| Operating lease right-of-use assets | 13,958 | | | 14,369 | |

| | | |

| Intangible assets, net | 4,048 | | | 3,649 | |

| | | |

| Total assets | $ | 191,641 | | | $ | 195,387 | |

| | | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 22,893 | | | $ | 22,443 | |

| Current maturities of long-term lease obligations | 1,040 | | | 1,310 | |

| Total current liabilities | 23,933 | | | 23,753 | |

| | | |

| Long-term debt, net of debt discount and financing fees | 46,154 | | | 45,712 | |

| Long-term lease obligations | 20,131 | | | 20,405 | |

| Debt derivative liabilities | 4,271 | | | 4,518 | |

| | | |

| Total liabilities | 94,489 | | | 94,388 | |

| | | |

| Commitments and contingencies - see Note 12 | | | |

| | | |

| Shareholders’ equity: | | | |

Common stock, 0.01 par value per share; 100,000,000 shares authorized; 42,979,541 and 42,445,517 shares issued and outstanding | 430 | | | 424 | |

| Additional paid-in capital | 370,036 | | | 360,155 | |

| Accumulated deficit | (273,314) | | | (259,580) | |

| Total shareholders’ equity | 97,152 | | | 100,999 | |

| Total liabilities and shareholders’ equity | $ | 191,641 | | | $ | 195,387 | |

See notes to condensed consolidated financial statements.

Axogen, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30,

2023 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| | | | | | | | |

| Revenues | | $ | 38,155 | | | $ | 34,454 | | | $ | 74,819 | | | $ | 65,461 | |

| Cost of goods sold | | 7,228 | | | 6,284 | | | 13,937 | | | 11,830 | |

| Gross profit | | 30,927 | | | 28,170 | | | 60,882 | | | 53,631 | |

| Costs and expenses: | | | | | | | | |

| Sales and marketing | | 20,838 | | | 19,669 | | | 42,456 | | | 40,557 | |

| Research and development | | 7,363 | | | 7,022 | | | 14,043 | | | 13,296 | |

| General and administrative | | 9,628 | | | 9,403 | | | 18,627 | | | 19,021 | |

| Total costs and expenses | | 37,829 | | | 36,094 | | | 75,126 | | | 72,874 | |

| Loss from operations | | (6,902) | | | (7,924) | | | (14,244) | | | (19,243) | |

| Other income (expense): | | | | | | | | |

| Investment income (loss) | | 235 | | | 32 | | | 784 | | | (15) | |

| Interest expense | | (148) | | | (249) | | | (164) | | | (603) | |

| Change in fair value of derivatives | | 432 | | | 434 | | | 247 | | | 686 | |

| Other expense | | (277) | | | (33) | | | (357) | | | (40) | |

| Total other income (expense), net | | 242 | | | 184 | | | 510 | | | 28 | |

| Net loss | | $ | (6,660) | | | $ | (7,740) | | | $ | (13,734) | | | $ | (19,215) | |

| | | | | | | | |

| Weighted average common shares outstanding — basic and diluted | | 42,862,384 | | | 41,994,618 | | | 42,719,096 | | | 41,900,000 | |

| Loss per common share — basic and diluted | | $ | (0.16) | | | $ | (0.18) | | | $ | (0.32) | | | $ | (0.46) | |

See notes to condensed consolidated financial statements.

Axogen, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(In thousands)

| | | | | | | | | | | |

| Six Months Ended |

| June 30,

2023 | | June 30,

2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (13,734) | | | $ | (19,215) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation | 1,506 | | | 1,418 | |

| Amortization of right-of-use assets | 642 | | | 859 | |

| Amortization of intangible assets | 144 | | | 132 | |

| Amortization of debt discount and deferred financing fees | 442 | | | 442 | |

| (Recovery of) provision for bad debt | (37) | | | 550 | |

| Provision for inventory write-down | 1,052 | | | 928 | |

| Change in fair value of derivatives | (247) | | | (686) | |

| Investment (gains) loss | (578) | | | 145 | |

| Stock-based compensation | 8,344 | | | 7,588 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | 650 | | | (2,719) | |

| Inventory | (3,384) | | | (3,458) | |

| Prepaid expenses and other | (639) | | | (1,081) | |

| Accounts payable and accrued expenses | (529) | | | (786) | |

| Operating lease obligations | (762) | | | (856) | |

| Cash paid for interest portion of finance leases | (1) | | | — | |

| | | |

| Net cash used in operating activities | (7,131) | | | (16,739) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (8,719) | | | (9,086) | |

| | | |

| Purchase of investments | (10,203) | | | (6,024) | |

| Proceeds from sale of investments | 32,974 | | | 11,000 | |

| Cash payments for intangible assets | (516) | | | (852) | |

| Net cash provided by (used in) investing activities | 13,536 | | | (4,962) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash paid for debt portion of finance leases | (12) | | | (1) | |

| Proceeds from exercise of stock options and ESPP stock purchases | 1,543 | | | 767 | |

| Net cash provided by financing activities | 1,531 | | | 766 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 7,936 | | | (20,935) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 21,535 | | | 39,007 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 29,471 | | | $ | 18,073 | |

| | | |

| Supplemental disclosures of cash flow activity: | | | |

| Cash paid for interest, net of capitalized interest | $ | — | | | $ | — | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Acquisition of fixed assets in accounts payable and accrued expenses | $ | 1,818 | | | $ | 1,817 | |

| Obtaining a right-of-use asset in exchange for a lease liability | $ | 268 | | | $ | 700 | |

| | | |

| | | |

| Acquisition of intangible assets in accounts payable and accrued expenses | $ | 326 | | | $ | 186 | |

See notes to condensed consolidated financial statements.

Axogen, Inc.

Condensed Consolidated Statements of Changes in Shareholders’ Equity

(unaudited)

(In thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in

Capital | | Accumulated

Deficit | | Total Shareholders'

Equity |

| Shares | | Amount | | | |

| Three Months Ended June 30, 2023 | | | | | | | | | |

| Balance at March 31, 2023 | 42,809,994 | | | $ | 428 | | | $ | 363,739 | | | $ | (266,654) | | | $ | 97,513 | |

| Net loss | — | | | — | | | — | | | (6,660) | | | (6,660) | |

| Stock-based compensation | — | | | — | | | 5,390 | | | — | | | 5,390 | |

| Issuance of restricted and performance stock units | 57,659 | | | 1 | | | (1) | | | — | | | — | |

| Exercise of stock options and employee stock purchase plan | 111,888 | | | 1 | | | 908 | | | — | | | 909 | |

| Balance at June 30, 2023 | 42,979,541 | | | $ | 430 | | | $ | 370,036 | | | $ | (273,314) | | | $ | 97,152 | |

| | | | | | | | | |

| Six Months Ended June 30, 2023 | | | | | | | | | |

| Balance at December 31, 2022 | 42,445,517 | | | $ | 424 | | | $ | 360,155 | | | $ | (259,580) | | | $ | 100,999 | |

| Net loss | — | | | — | | | — | | | (13,734) | | | (13,734) | |

| Stock-based compensation | — | | | — | | | 8,344 | | | — | | | 8,344 | |

| Issuance of restricted and performance stock units | 296,378 | | | 4 | | | (4) | | | — | | | — | |

| | | | | | | | | |

| Exercise of stock options and employee stock purchase plan | 237,646 | | | 2 | | | 1,541 | | | — | | | 1,543 | |

| Balance at June 30, 2023 | 42,979,541 | | | $ | 430 | | | $ | 370,036 | | | $ | (273,314) | | | $ | 97,152 | |

| | | | | | | | | |

| Three Months Ended June 30, 2022 | | | | | | | | | |

| Balance at March 31, 2022 | 41,972,987 | | | $ | 420 | | | $ | 345,538 | | | $ | (242,107) | | | $ | 103,851 | |

| Net loss | — | | | — | | | — | | | (7,740) | | | (7,740) | |

| Stock-based compensation | | | — | | | 4,910 | | | — | | | 4,910 | |

| Issuance of restricted and performance stock units | 44,054 | | | — | | | — | | | — | | | — | |

| Exercise of stock options and employee stock purchase plan | 117,463 | | | — | | | 669 | | | — | | | 669 | |

| Balance at June 30, 2022 | 42,134,504 | | | $ | 420 | | | $ | 351,117 | | | $ | (249,847) | | | $ | 101,690 | |

| | | | | | | | | |

| Six Months Ended June 30, 2022 | | | | | | | | | |

| Balance at December 31, 2021 | 41,736,950 | | | $ | 417 | | | $ | 342,765 | | | $ | (230,632) | | | 112,550 | |

| Net loss | — | | | — | | | — | | | (19,215) | | | (19,215) | |

| Stock-based compensation | — | | | — | | | 7,588 | | | — | | | 7,588 | |

| Issuance of restricted and performance stock units | 259,341 | | | 2 | | | (2) | | | — | | | — | |

| Exercise of stock options and employee stock purchase plan | 138,213 | | | 1 | | | 766 | | | — | | | 767 | |

| Balance at June 30, 2022 | 42,134,504 | | | $ | 420 | | | $ | 351,117 | | | $ | (249,847) | | | $ | 101,690 | |

See notes to condensed consolidated financial statements.

Axogen, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

(In thousands, except share and per share amounts)

1.Nature of Business

Axogen, Inc. (together with its wholly-owned subsidiaries, the “Company”) was incorporated in Minnesota and is the leader in the science, development and commercialization of the technologies used for peripheral nerve regeneration and repair. The Company's products include Avance® Nerve Graft, Axoguard Nerve Connector®, Axoguard Nerve Protector®, Axoguard HA+ Nerve Protector, Axoguard Nerve Cap® and Axotouch® Two-Point Discriminator. The Company is headquartered in Florida. The Company has processing, warehousing, and distribution facilities in Texas and Ohio.

The Company manages its operations as a single operating segment. Substantially all of the Company's assets are maintained in the United States. The Company derives substantially all of its revenues from sales to customers in the United States.

2.Summary of Significant Accounting Policies

Please see Note 2 to the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission ("SEC") on March 14, 2023, for a description of all significant accounting policies.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company as of June 30, 2023, and December 31, 2022, and for the three and six months ended June 30, 2023, and 2022. The Company’s condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, and; therefore, do not include all information and footnotes necessary for a fair presentation of consolidated financial position, results of operations, and cash flows in conformity with accounting principles generally accepted in the United States ("U.S. GAAP") and should be read in conjunction with the audited financial statements of the Company for the year ended December 31, 2022, which are included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

The interim condensed consolidated financial statements are unaudited, and in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of results for the periods presented. Results for interim periods are not necessarily indicative of results for the full year. All intercompany accounts and transactions have been eliminated in consolidation.

The results of operations for the three and six months ended June 30, 2023, are not necessarily indicative of the results to be expected for the full year due primarily to the impact of the continued uncertainty of general economic conditions that may impact the Company's markets for the remainder of fiscal year 2023.

Cash and Cash Equivalents and Concentration

Cash and cash equivalents consist of short-term, highly liquid investments with original maturities of three months or less from the date of acquisition. Certain of the Company's cash and cash equivalents balances exceed Federal Deposit Insurance Corporation ("FDIC") insured limits or are invested in money market accounts with investment banks that are not FDIC-insured. The Company places its cash and cash equivalents in what they believe to be credit-worthy financial institutions. As of June 30, 2023, $22,469 of the cash and cash equivalents balance was in excess of FDIC limits.

Restricted Cash

Amounts included in restricted cash represent those required to be set aside to meet contractual terms of a lease agreement held by the Company. See Note 8 - Long-Term Debt, Net of Debt Discount and Financing Fees - Other Credit Facilities.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported in the condensed consolidated balance sheets that sum to the total of the same amounts shown in the condensed consolidated statements of cash flows:

| | | | | | | | | | | |

| (In thousands) | June 30,

2023 | | December 31,

2022 |

| Cash and cash equivalents | $ | 23,219 | | | $ | 15,284 | |

| Restricted cash | 6,252 | | | 6,251 | |

| Total cash, cash equivalents, and restricted cash shown in the statement of cash flows | $ | 29,471 | | | $ | 21,535 | |

Property and Equipment, Net

Property and equipment, net are stated at historical cost less accumulated depreciation and amortization. Additions and improvements that extend the lives of the assets are capitalized, while expenditures for repairs and maintenance are expensed as incurred. Leasehold improvements are amortized on a straight-line basis over the shorter of the asset’s estimated useful life or the remaining lease term. Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets ranging from three to thirty-nine years.

Gains or losses on the disposition of property and equipment are recorded in the period incurred and recorded in general and administrative expenses on the condensed consolidated statements of operations.

Capitalized Interest

The interest cost on capital projects, including facilities build-outs, is capitalized and included in the cost of the project. Capitalization begins with the first expenditure for the project and continues until the project is substantially complete and ready for its intended use. For the three and six months ended June 30, 2023, and 2022, the Company capitalized $2,049 and $1,579, respectively, and $4,196 and $3,024, respectively, of interest expense into property and equipment.

Shipping and Handling

All shipping and handling costs, including facility and warehousing overhead, directly related to bringing the Company’s products to their final selling destination are included in sales and marketing expense. Shipping and handling costs included in sales and marketing expense were $1,284 and $2,740, and $1,214 and $2,532, for the three and six months ended, June 30, 2023, and 2022, respectively.

Recent Accounting Pronouncements

All other Accounting Standards Updates ("ASU's") issued and not yet effective as of December 31, 2022, and through the date of this report, were assessed and determined to be either not applicable or are expected to have minimal impact on the Company’s current or future financial position or results of operations except for the following:

New Accounting Pronouncements Recently Adopted

In December 2022, the Financial Accounting Standards Board issued ASU 2022-06 - Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848 ("ASU 2022-06"). ASU 2022-06 amended Accounting Standards Codification 848 Reference Rate Reform and ASU 2020 - 4, Reference Rate Reform. The amendment in ASU 2022-06 defers the sunset date of Topic 848 from December 31, 2022, to December 31, 2024, after which entities will no longer be permitted to apply the relief in Topic 848. The new guidance provides optional expedients and exceptions for applying U.S. GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. The amendments apply only to contracts and hedging relationships that reference the London Interbank Offered Rate (“LIBOR”), or another reference rate expected to be discontinued due to reference rate reform.

On June 29, 2023, the Company entered into an amendment ("the Amended Credit Facility") to its June 30, 2020, seven-year financing agreement, with Oberland Capital and its affiliates TPC Investments II LP and Argo LLC (the "Credit Facility"). Pursuant to the amendment, the Credit Facility was amended to transition the benchmark interest rate from LIBOR to Adjusted Term Secured Overnight Financing Rate ("SOFR") and corresponding changes to the mechanism for determining alternative rate of interest in the event that Adjusted Term SOFR is unavailable. Consequently, we updated the reference rate within our existing Credit Facility from three-month LIBOR to three-month SOFR plus 0.1% ("Adjusted SOFR"). Accounting Standard Codification ("ASC") 848, Reference Rate Reform, ("ASC 848") includes a provision in which a debt contract that is only a

replacement of the reference rate is accounted for as a non-substantial modification. As a result, in the second quarter of 2023, we adopted ASC 848, which had no impact on our consolidated financial statements. See Note 8 - Long-Term Debt, Net of Debt Discount and Financing Fees for further discussion of the Amended Credit Facility.

3. Inventory

Inventory consists of the following:

| | | | | | | | | | | |

| (in thousands) | June 30,

2023 | | December 31,

2022 |

| Finished goods | $ | 13,279 | | | $ | 12,651 | |

| Work in process | 1,085 | | | 1,026 | |

| Raw materials | 6,873 | | | 5,228 | |

| Inventory | $ | 21,237 | | | $ | 18,905 | |

The provision for inventory write-down is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Provision for inventory write-down | $ | 471 | | | $ | 469 | | | $ | 1,052 | | | $ | 928 | |

4. Property and Equipment, Net

Property and equipment, net consist of the following:

| | | | | | | | | | | |

| (in thousands) | June 30,

2023 | | December 31,

2022 |

| Land | $ | 731 | | | $ | 731 | |

| Building | 7,009 | | | — | |

| Leasehold improvements | 15,482 | | | 15,482 | |

| Processing equipment | 4,597 | | | 4,227 | |

| Furniture and equipment | 7,988 | | | 5,316 | |

| Projects in process | 63,323 | | | 63,703 | |

| Finance lease right-of-use assets | 131 | | | 131 | |

| Property and equipment, at cost | 99,261 | | | 89,590 | |

| Less: accumulated depreciation and amortization | (11,802) | | | (10,296) | |

| Property and equipment, net | $ | 87,459 | | | $ | 79,294 | |

Depreciation expense is as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Depreciation expense | $ | 798 | | | $ | 713 | | | $ | 1,506 | | | $ | 1,418 | |

5. Intangible Assets, Net

Intangible assets consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| (in thousands) | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount |

| Amortizable intangible assets: | | | | | | | | | | | |

| Patents | $ | 4,322 | | | $ | (711) | | | $ | 3,611 | | | $ | 3,792 | | | $ | (621) | | | $ | 3,170 | |

| License agreements | 1,101 | | | (1,068) | | | 34 | | | 1,101 | | | (1,014) | | | 87 | |

| Total amortizable intangible assets | 5,423 | | | (1,779) | | | 3,645 | | | 4,893 | | | (1,635) | | | 3,258 | |

| | | | | | | | | | | |

| Unamortized intangible assets: | | | | | | | | | | | |

| Trademarks | 403 | | | — | | | 403 | | | 391 | | | — | | | 391 | |

| Total intangible assets | $ | 5,827 | | | $ | (1,779) | | | $ | 4,048 | | | $ | 5,284 | | | $ | (1,635) | | | $ | 3,649 | |

Amortization expense is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Amortization expense | $ | 73 | | | $ | 63 | | | $ | 144 | | | $ | 132 | |

As of June 30, 2023, future amortization of patents and license agreements is as follows:

| | | | | |

| Year Ending December 31, | (in thousands) |

| 2023 (excluding the six months ended June 30, 2023) | $ | 121 | |

| 2024 | 208 | |

| 2025 | 208 | |

| 2026 | 207 | |

| 2027 | 203 | |

| Thereafter | 2,698 | |

| Total | $ | 3,645 | |

License Agreements

The Company has various license agreements that require the payment of royalty fees.

Royalty fee expense included in sales and marketing expense is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Royalty fee expense | $ | 868 | | | $ | 766 | | | $ | 1,698 | | | $ | 1,439 | | | | | |

6. Fair Value Measurement

The following tables present the Company's fair value hierarchy for its financial assets and liabilities measured at fair value on a recurring basis as of June 30, 2023, and December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2023 |

| (in thousands) | (Level 1) | | (Level 2) | | (Level 3) | | Total |

| Assets: | | | | | | | |

| Money market funds | $ | 16,521 | | | $ | — | | | $ | — | | | $ | 16,521 | |

| U.S. government securities | 7,344 | | | — | | | — | | | 7,344 | |

| Commercial paper | — | | | 3,968 | | | — | | | 3,968 | |

| Total assets | $ | 23,865 | | | $ | 3,968 | | | $ | — | | | $ | 27,833 | |

| | | | | | | |

| Liabilities: | | | | | | | |

| | | | | | | |

| Debt derivative liabilities | $ | — | | | $ | — | | | $ | 4,271 | | | $ | 4,271 | |

| Total liabilities | $ | — | | | $ | — | | | $ | 4,271 | | | $ | 4,271 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2022 |

| (in thousands) | (Level 1) | | (Level 2) | | (Level 3) | | Total |

| Assets: | | | | | | | |

| Money market funds | $ | 10,354 | | | $ | — | | | $ | — | | | $ | 10,354 | |

| U.S. government securities | 12,316 | | | — | | | — | | | 12,316 | |

| | | | | | | |

| Commercial paper | — | | | 21,189 | | | — | | | 21,189 | |

| | | | | | | |

| Total assets | $ | 22,669 | | | $ | 21,189 | | | $ | — | | | $ | 43,859 | |

| | | | | | | |

| Liabilities: | | | | | | | |

| | | | | | | |

| Debt derivative liabilities | $ | — | | | $ | — | | | $ | 4,518 | | | $ | 4,518 | |

| Total liabilities | $ | — | | | $ | — | | | $ | 4,518 | | | $ | 4,518 | |

The changes in Level 3 liabilities measured at fair value on a recurring basis for the three and six months ended June 30, 2023, were as follows (in thousands):

| | | | | | | | |

| Three Months Ended June 30, 2023 | | |

| Balance, April 1, 2023 | | $ | 4,703 | |

| | |

| | |

| | |

| Change in fair value included in net loss | | (432) | |

| Balance, June 30, 2023 | | $ | 4,271 | |

| | | | | |

| Six Months Ended June 30, 2023 | |

| Beginning Balance, January 1, 2023 | $ | 4,518 | |

| |

| |

| |

| Change in fair value included in net loss | (247) | |

| Ending Balance, June 30, 2023 | $ | 4,271 | |

The changes in Level 3 liabilities measured at fair value on a recurring basis for the three and six months ended June 30, 2022, were as follows (in thousands):

| | | | | |

| Three Months Ended June 30, 2022 | |

| Balance, April 1, 2022 | $ | 5,310 | |

| |

| |

| |

| |

| |

| |

| Change in fair value included in net loss | (434) | |

| Balance, June 30, 2022 | $ | 4,876 | |

| | | | | |

| Six Months Ended June 30, 2022 | |

| Beginning Balance, January 1, 2022 | $ | 5,562 | |

| |

| |

| |

| Change in fair value included in net loss | (686) | |

| Ending Balance, June 30, 2022 | $ | 4,876 | |

The fair value of cash, restricted cash, accounts receivable, accounts payable and accrued expenses approximates the carrying values because of the short-term nature of these instruments. The carrying value and fair value of the Credit Facility were $46,154 and $51,366 at June 30, 2023, and $45,712 and $50,293 at December 31, 2022, respectively. See Note 8 - Long-Term Debt, Net of Debt Discount and Financing Fees.

The debt derivative liabilities are measured using a ‘with and without’ valuation model to compare the fair value of each tranche of the Credit Facility including the identified embedded derivative features and the fair value of a plain vanilla note with the same terms. The fair value of the Credit Facility including the identified embedded derivative features was determined using a probability-weighted expected return model based on four potential settlement scenarios for the financing agreement as disclosed in the table below. The estimated settlement value of each scenario, which would include any required make-whole payment, (see Note 8 - Long-Term Debt, Net of Debt Discount and Financing Fees), is then discounted to present value using a discount rate that is derived based on the initial terms of the financing agreement at issuance and corroborated utilizing a synthetic credit rating analysis.

The significant inputs that are included in the valuation of the debt derivative liability - first tranche include:

| | | | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 | |

| Input | | | | |

| Remaining term (years) | 4 years | | 4.5 years | |

| Maturity date | June 30, 2027 | | June 30, 2027 | |

| Coupon rate | 9.5% - 13.1% | | 9.5% -12.7% | |

| Revenue participation payments | Maximum each year | | Maximum each year | |

| Discount rate | 13.4% | | (1) | 13.9% | | (1) |

| Probability of mandatory prepayment before 2024 | 5.0 | % | (1) | 5.0 | % | (1) |

| Estimated timing of mandatory prepayment event before 2024 | December 31, 2023 | (1) | December 31, 2023 | (1) |

| Probability of mandatory prepayment 2024 or after | 15.0 | % | (1) | 15.0 | % | (1) |

| Estimated timing of mandatory prepayment event 2024 or after | March 31, 2026 | (1) | March 31, 2026 | (1) |

| Probability of optional prepayment event | 5.0 | % | (1) | 5.0 | % | (1) |

| Estimated timing of optional prepayment event | December 31, 2025 | (1) | December 31, 2025 | (1) |

(1)Represents a significant unobservable input

The significant inputs that are included in the valuation of the debt derivative liability - second tranche include:

| | | | | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 | |

| Input | | | | |

| Remaining term (years) | 5 years | | 5.5 years | |

| Maturity date | June 30, 2028 | | June 30, 2028 | |

| Coupon rate | 9.5% - 13.1% | | 9.5% -12.7% | |

| Revenue participation payments | Maximum each year | | Maximum each year | |

| Discount rate | 16.9 | % | (1) | 17.56 | % | (1) |

| Probability of mandatory prepayment before 2024 | 5.0% | | (1) | 5.0% | | (1) |

| Estimated timing of mandatory prepayment event before 2024 | December 31, 2023 | (1) | December 31, 2023 | (1) |

| Probability of mandatory prepayment 2024 or after | 15.0% | | (1) | 15.0% | | (1) |

| Estimated timing of mandatory prepayment event 2024 or after | March 31, 2026 | (1) | March 31, 2026 | (1) |

| Probability of optional prepayment event | 5.0% | | (1) | 5.0% | | (1) |

| Estimated timing of optional prepayment event | December 31, 2025 | (1) | December 31, 2025 | (1) |

(1)Represents a significant unobservable input

7. Leases

The Company leases administrative, processing, research and distribution facilities through operating leases. Several of the leases include fixed payments, including rent and non-lease components such as common area or other maintenance costs.

Operating lease expense is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Operating lease expense | $ | 1,242 | | | $ | 1,355 | | | $ | 2,540 | | | $ | 2,763 | |

Supplemental balance sheet information related to the operating and financing leases is as follows: | | | | | | | | | | | |

| (In thousands, except lease term and discount rate) | June 30, 2023 | | December 31, 2022 |

| Operating Leases | | | |

| Right-of-use operating assets | $ | 13,958 | | | $ | 14,369 | |

| Current maturities of long-term lease obligations | $ | 1,034 | | | $ | 1,303 | |

| Long-term lease obligations | $ | 20,116 | | | $ | 20,387 | |

| Financing Leases | | | |

Right-of-use financing leases (1) | $ | 30 | | | $ | 41 | |

| Current maturities of long-term lease obligations | $ | 6 | | | $ | 7 | |

| Long-term lease obligations | $ | 15 | | | $ | 18 | |

| | | |

| Weighted average operating lease term (in years): | 10.6 | | 11 |

| Weighted average financing lease term (in years): | 3.8 | | 4 |

| | | |

| Weighted average discount rate operating leases | 10.74% | | | 10.58% | |

| Weighted average discount rate financing leases | 12.27% | | | 11.91% | |

(1) Financing leases are included in property and equipment, net on the condensed consolidated balance sheets.

Future minimum lease payments under operating and financing leases at June 30, 2023, are as follows:

| | | | | |

| (In thousands) | |

| 2023 (excluding six months ended June 30, 2023) | $ | 1,620 | |

| 2024 | 3,252 | |

| 2025 | 3,336 | |

| 2026 | 3,348 | |

| 2027 | 3,046 | |

| Thereafter | 21,588 | |

| Total | 36,190 | |

| Less: Imputed interest | (15,019) | |

| Total lease liability | 21,171 | |

| Less: Current lease liability | (1,040) | |

| Long-term lease liability | $ | 20,131 | |

New leases

The Company accounts for new leases in accordance with ASC 842, Leases.

On May 9, 2023, the Company entered into a Commercial Lease with JA-Cole L.P., with an effective date of May 9, 2023 (the "2023 JA-Cole Lease"). The 2023 JA-Cole Lease is for an additional 2,500 square feet of office and warehouse facility located in Burleson, Texas. The Commercial Lease has a commencement date of September 1, 2023, and an expiration date of September 30, 2027. The Company will value the 2015 JA-Cole Lease using an incremental borrowing rate and record a right-of-use asset and a lease liability on the commencement date.

Lease modifications

The Company accounts for lease revisions as a lease modification in accordance with ASC 842, Leases, when the modification effectively terminates the existing lease and creates a new lease.

On May 9, 2023, the Company entered into a Commercial Lease Amendment ("Amendment") with JA-Cole L.P., with an effective date of May 1, 2023, pursuant to the original Commercial Leases dated April 21, 2015, as amended (the "2015 JA-Cole Lease"). The 2015 JA-Cole Lease is for 15,000 square feet of office and warehouse facility located in Burleson, Texas. The Amendment revised the commencement date to May 1, 2023, and the expiration date to April 30, 2030. The Company valued the 2015 JA-Cole Lease using a 13.1% incremental borrowing rate and recorded a right-of-use asset and a lease liability of $268 as a result of this amendment.

8. Long-Term Debt, Net of Debt Discount and Financing Fees

Long-term debt, net of debt discount and financing fees consists of the following:

| | | | | | | | | | | |

| (in thousands) | June 30, 2023 | | December 31, 2022 |

| Credit Facility - first tranche | $ | 35,000 | | | $ | 35,000 | |

| Credit Facility - second tranche | 15,000 | | | 15,000 | |

| Less - unamortized debt discount and deferred financing fees | (3,846) | | | (4,288) | |

| Long-term debt, net of debt discount and financing fees | $ | 46,154 | | | $ | 45,712 | |

Credit Facility

On June 29, 2023, the Company amended its Credit Facility with Oberland Capital and its affiliates TPC Investments II LP and Argo LLC (collectively, the "Lender"). The term loan agreement for the Credit Facility was amended to transition the base interest rate from three month LIBOR to Adjusted SOFR. The Company obtained the first tranche of $35,000 at closing on June 30, 2020. On June 30, 2021, the second tranche of $15,000 was drawn down by the Company.

Each tranche under the Credit Facility requires quarterly interest payments for seven years. Interest is calculated as 7.5% plus the greater of Adjusted SOFR or 2.0% (12.68% at June 30, 2023). Each tranche of the Credit Facility has a term of seven years from the date of issuance (with the first tranche issued on June 30, 2020, maturing on June 30, 2027, and the second tranche issued on June 30, 2021, maturing on June 30, 2028). In connection with the Credit Facility, the Company entered into a revenue participation agreement (the “Revenue Participation Agreement”) with the Lender, which provided that, among other things, a quarterly royalty payment as a percentage of the Company’s net revenues, up to $70 million in any given year, after April 1, 2021, ending on the date upon which all amounts owed under the Credit Facility have been paid in full. This structure results in approximately 1.0% per year of additional interest payments on the outstanding loan amount. The Company recorded $360 and $372 as interest expense for this Revenue Participation Agreement for the three months ended June 30, 2023, and 2022, respectively and $756 and $707 for the six months ended June 30, 2023, and 2022, respectively. The Company pays the quarterly debt interest on the last day of the quarter and for the three months ended June 30, 2023, and 2022, paid $1,602 and $1,201, respectively, and $3,134 and $2,388 for the six months ended June 30, 2023, and 2022, respectively, to the Lender. The Company capitalized interest of $2,049 and $1,579 for the three months ended June 30, 2023, and 2022, respectively, and $4,196 and $3,024 for the six months ended June 30, 2023, and 2022, towards the costs to construct and retrofit the Axogen Processing Center ("APC Facility") in Vandalia, Ohio. See Note 12 - Commitments and Contingencies. To date, the Company has capitalized interest of $15,625 related to this project. The capitalized interest is recorded as part of property and equipment,

net in the condensed consolidated balance sheets. As of June 30, 2023, the Company was in compliance with all financial covenants.

Embedded Derivatives

The fair values of the debt derivative liabilities were $4,271 and $4,518 at June 30, 2023, and December 31, 2022, respectively. See Note 6 - Fair Value Measurement.

Unamortized Debt Discount and Financing Fees

The unamortized debt discount consists of the remaining initial fair values of the embedded derivatives related to the Credit Facility.

The financing fees for the Credit Facility were $642 and were recorded as a contra liability to long-term debt on the consolidated balance sheet.

Amortization of debt discount and deferred financing fees for the three months ended June 30, 2023, and 2022 was $223 and $223, respectively, and $442 and $442 for the six months ended June 30, 2023, and 2022, respectively.

Other Credit Facilities

The Company had restricted cash of $6,252 and $6,251 at June 30, 2023, and December 31, 2022, respectively. The June 30, 2023, and December 31, 2022, balances both include $6,000 and $250, which represent collateral for two irrevocable standby letters of credit.

9. Stock-Based Compensation

The Company's stock-based compensation plans are described in Note 11. Stock-Based Compensation to the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

During the fiscal year 2023, the following stock compensation was awarded to officers and employees. All awards were granted under the 2019 Amended and Restated Long-Term Incentive Plan ("2019 Plan"), with the exception of the inducement shares awarded as inducements material to new employees entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4).

| | | | | | | | | | | | | | | | | |

| Type of Award | Quarter Awarded | | Target Shares or Units | | Weighted Average Grant Date Fair Value |

Stock Options (1) | 1st Quarter | | 1,046,800 | | | $ | 4.96 | |

| 2nd Quarter | | 2,200 | | | $ | 5.64 | |

| | | | | |

Restricted Stock Units (2) | 1st Quarter | | 1,129,718 | | | $ | 8.39 | |

| 2nd Quarter | | 33,850 | | | $ | 9.06 | |

| | | | | |

Performance Stock Units (3)(5) | 1st Quarter | | 744,000 | | | $ | 8.27 | |

| | | | | |

| | | | | |

Inducement Shares (4)(5) | 1st Quarter | | | | |

| Stock Options | | | 150,000 | | | $ | 4.92 | |

| Restricted Stock Units | | | 75,000 | | | $ | 8.16 | |

(1) Options awarded to officers and employees during the first and second quarter, vest over a four-year period.

(2) Restricted stock units awarded to officers and employees during the first and second quarters, vest over a four-year period. Upon vesting, the outstanding number of restricted stock units vested are converted into common stock.

(3) Performance shares were issued to officers and employees during the first quarter. Vesting occurs over a three-year performance period. Participants will earn from 0% to 150% upon achievement of the target depending on the attainment of specific revenue goals. The maximum number of units that can be issued under this award is 1,116,000.

(4) Inducement shares were issued to two officers during the first quarter, as inducements material to new employees entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4). Vesting for both the stock options and restricted stock units are over a four-year period.

(5) No performance stock units or inducement shares were granted in the second quarter of 2023.

Total stock-based compensation expense is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Stock-based compensation expense | $ | 5,390 | | | $ | 4,910 | | | $ | 8,344 | | | $ | 7,588 | |

10. Net Loss Per Common Share

The following reflects the net loss attributable to common shareholders and share data used in the basic and diluted earnings per share computations using the two-class method:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (In thousands, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 | |

| Numerator: | | | | | | | | | |

| Net loss | | $ | (6,660) | | | $ | (7,740) | | | $ | (13,734) | | | $ | (19,215) | | |

| Denominator: | | | | | | | | | |

| Weighted-average common shares outstanding (Basic) | | 42,862,384 | | | 41,994,618 | | | 42,719,096 | | | 41,900,000 | | |

| Weighted-average common shares outstanding (Diluted) | | 42,862,384 | | | 41,994,618 | | | 42,719,096 | | | 41,900,000 | | |

| Net loss per common share (Basic and Diluted) | | $ | (0.16) | | | $ | (0.18) | | | $ | (0.32) | | | $ | (0.46) | | |

| | | | | | | | | |

Anti-dilutive shares excluded from the calculation of diluted earnings per share (1) | | | | | | | | | |

| Stock options | | 3,957,156 | | | 3,796,254 | | | 3,679,109 | | | 3,377,594 | | |

| Restricted stock units | | 251,112 | | | 591,824 | | | 343,089 | | | 574,431 | | |

(1) These common equivalent shares are not included in the diluted per share calculations as they would be anti-dilutive if the Company was in a net income position.

11. Income Taxes

The Company has no recorded income tax expense or income tax benefit for the three and six months ended June 30, 2023, and 2022 due to the generation of net operating losses, the benefits of which have been fully reserved.

The Company has not recorded current income tax expense due to the generation of net operating losses. Deferred income taxes are accounted for using the balance sheet approach, which requires recognition of deferred tax assets and liabilities for the expected future consequences of temporary differences between the financial reporting basis and the tax basis of assets and liabilities. A valuation allowance is provided when it is more likely than not that a deferred tax asset will not be realized. A full valuation allowance has been established on the deferred tax asset as it is more likely than not that a future tax benefit will not be realized. In addition, future utilization of the available net operating loss carryforward may be limited under Internal Revenue Code Section 382 as a result of changes in ownership.

The Company identifies and evaluates uncertain tax positions, if any, and recognizes the impact of uncertain tax positions for which there is a less than more likely than not probability of the position being upheld when reviewed by the relevant taxing authority. Such positions are deemed to be unrecognized tax benefits and a corresponding liability is established on the condensed consolidated balance sheet. The Company has not recognized a liability for uncertain tax positions. If there were an unrecognized tax benefit, the Company would recognize interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses. The Company’s remaining open tax years subject to examination by federal tax authorities include the years ended December 31, 2019, through 2022. However, for tax years 2004 through 2017, federal taxing authorities may examine and adjust loss carryforwards in the years in which those loss carryforwards are ultimately utilized.

12. Commitments and Contingencies

Service Agreements

The Company pays Community Blood Center, (d/b/a Community Tissue Service) ("CTS") a facility fee for the use of clean rooms, storage and office space and for services in support of its tissue processing including for routine sterilization of daily supplies, providing disposable supplies and microbial services, and office support. The Company paid $582 and $622 for the three months ended June 30, 2023, and 2022, respectively, and $1,311 and $1,245 during the six months ended June 30, 2023, and 2022, respectively, related to the agreement with CTS. The agreement terminates on December 31, 2023, subject to earlier termination by either party at any time for cause, or without cause upon six months prior notice. The Company expects to reduce its utilization of CTS in the second half of 2023.

In December 2011, the Company entered into a Master Services Agreement for clinical research and related services. The Company was required to pay $151 upon execution of this agreement and the remainder monthly based on activities associated with the execution of the Company's phase 3 pivotal clinical trial to support the biologics license application ("BLA") for Avance Nerve Graft. Payments made under this agreement were $56 and $356 for the three months ended June 30, 2023, and 2022, respectively and $168 and $684 for the six months ended June 30, 2023, and 2022, respectively.

Axogen Processing Center Facility

The Company is highly dependent on the continued availability of its processing facilities at the CTS facility in Dayton, Ohio and could be harmed if the physical infrastructure of this facility is unavailable for any prolonged period of time.

On July 31, 2018, the Company purchased the APC Facility in Vandalia, Ohio, located near the CTS processing facility where Avance Nerve Graft is currently processed. The APC Facility, when and if operational, will be the new processing facility for Avance Nerve Graft to provide continued capacity for growth and to support the transition of Avance Nerve Graft from a human cellular and tissue-based product to a biologic product. The APC Facility is comprised of a 107,000 square foot building on approximately 8.6 acres of land. The Company paid $731 for the land, and this is recorded as land within Property and equipment, net on the condensed consolidated balance sheets. The Company paid $4,300 for the building and this is recorded within Property and equipment, net on the condensed consolidated balance sheets.

On July 9, 2019, the Company entered into a Standard Form of Agreement Between Owner and Design-Builder with CRB Builders, L.L.C., (“CRB”), pursuant to which CRB will renovate and retrofit the APC Facility. For the three and six months ended June 30, 2023, the Company recorded $1,640 and $3,239, respectively, related to renovations and design and build in projects in progress. The Company has recorded $49,593 to date related to this project. In addition to these project costs, the Company has capitalized interest of $2,049 and $4,196 for the three and six months ended June 30, 2023. To date, the Company has capitalized interest of $15,625 related to this project. During the three months ended June 30, 2023, the Company completed construction of the APC Facility and placed $8,020 into service related to the warehouse and office spaces. These costs were recorded to their respective asset category in Property and equipment, net on the condensed consolidated balance sheet. The Company expects to complete final validation of the tissue processing center and begin operations during the third quarter of this year. The costs related to the tissue processing center are recorded in projects in process in Property and equipment, net on the condensed consolidated balance sheet. The Company anticipates recording an additional $2,000 to $3,000 in the remainder of 2023.

The Company obtained certain economic development grants from state and local authorities totaling up to $2,685 including $1,250 of cash grants to offset costs to acquire and develop the APC Facility. The economic development grants are subject to certain job creation milestones to be reached by December 31, 2023, and have clawback clauses if the Company does not meet the job creation milestones. The Company has requested extensions from the grant authorities to extend the job creation milestone date and has not yet received any decisions regarding whether the extensions will be granted. As of June 30, 2023, the Company has received $1,188 from the cash grants and has a grant receivable of $287 recorded in receivables on the condensed consolidated balance sheets.

Fair Value of the Debt Derivative Liabilities

The fair value of the debt derivative liabilities is $4,271 as of June 30, 2023. The fair value of the debt derivative liabilities was determined using a probability-weighted expected return model based upon the four potential settlement scenarios for the Credit Facility. The estimated settlement value of each scenario, which includes any required make-whole payment, is then discounted to present value using a discount rate that is derived based upon the initial terms of the Credit Facility at issuance and corroborated utilizing a synthetic rating analysis. The calculated fair values under the four scenarios are then compared to the fair value of a plain vanilla note, with the difference reflecting the fair value of the debt derivative liabilities. The Company

estimated the make-whole payments required under each scenario according to the terms of the Credit Facility to generate an internal rate of return equal to 11.5% through the scheduled maturity dates, less the total of all quarterly interest and royalty payments previously paid to the Lender. The calculation utilized the XIRR function in Microsoft Excel as required by the Credit Facility. If the debt is not prepaid but instead is held to its scheduled maturities, the Company’s estimate of the make-whole payment for the first tranche and second tranche of the Credit Facility due on June 30, 2027, and June 30, 2028, respectively, are approximately zero. The Company has consistently applied this approach since the inception of the debt agreement on June 30, 2020.

The Company is aware that the Lender may have an alternative interpretation of the calculation of the make-whole payments that the Company believes does not properly utilize the same methodology utilized by the XIRR function in Microsoft Excel as described in the Credit Facility. The Company estimates the top end of the range of the make-whole payments if the debt is held to scheduled maturity under an alternative interpretation to be approximately $9,000 for the first tranche of the Credit Facility due on June 30, 2027, and approximately $4,000 for the second tranche of the Credit Facility due on June 30, 2028. Further, if the debt is prepaid prior to the scheduled maturity dates and subject to the alternative interpretation, the make-whole payment would be larger than the amounts herein.

Legal Proceedings

The Company is and may be subject to various claims, lawsuits, and proceedings in the ordinary course of the Company's business. Such matters are subject to many uncertainties and outcomes are not predictable with assurance. While there can be no assurances as to the ultimate outcome of any legal proceeding or other loss contingency involving the Company, in the opinion of management, such claims are either adequately covered by insurance or otherwise indemnified, or are not expected individually or in the aggregate, to result in a material, adverse effect on the Company's financial condition, results of operations or cash flows. However, it is possible that the Company's results of operations, financial position and cash flows in a particular period could be materially affected by these contingencies.

13. Subsequent Events