false

0001757715

0001757715

2024-08-16

2024-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 16, 2024

ATERIAN, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-38937

|

|

81-1739858

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

350 Springfield Avenue, Suite 200

Summit, New Jersey 07901

(Address of Principal Executive Offices) (Zip Code)

(347) 676-1681

Registrant’s telephone number, including area code

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

(Title of each class)

|

|

(Trading Symbol)

|

|

(Name of exchange on which registered)

|

|

Common Stock, $0.0001 Par Value

|

|

ATER

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Engagement of Advisor to Senior Management

On August 16, 2024, Mr. William Kurtz and the Company entered into an Advisor Agreement effective August 1, 2024 (the “Advisor Agreement”), pursuant to which Mr. Kurtz shall act as an advisor to senior management of the Company. The initial term of the Advisor Agreement shall be six months and, subject to the agreement of the Company and Mr. Kurtz, may be extended for an additional six month period. Mr. Kurtz will be paid $8,750 per month for his services pursuant to the Advisor Agreement.

The foregoing description of the Advisor Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Advisor Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On August 16, 2024, Aterian, Inc. (the “Company”) held its 2024 Annual Meeting of Stockholders (the “Annual Meeting”). At the Annual Meeting, a total of 4,092,148 shares of the Company’s common stock, or 47.7% %, of the Company’s issued and outstanding shares of common stock as of June 21, 2024, the record date for the Annual Meeting, were represented online or by proxy.

At the Annual Meeting, the Company’s stockholders considered two proposals, which are described in more detail in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on July 5, 2024.

Set forth below is a brief description of the matters voted upon at the Annual Meeting and the voting results with respect to such matters.

Proposal No. 1: To approve the election of Susan Lattmann as a Class II Director to serve until our 2027 Annual Meeting of Stockholders.

|

Nominee

|

|

For

|

|

Withheld

|

|

Broker Non-votes

|

|

Susan Lattmann

|

|

1,524,493

|

|

605,968

|

|

1,961,687

|

Proposal No. 2: To ratify the appointment of UHY LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

|

For

|

|

Against

|

|

Withheld

|

|

Broker Non-votes

|

|

3,969,947

|

|

89,601

|

|

32,600

|

|

0

|

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

10.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 16, 2024

|

ATERIAN, INC.

|

| |

|

|

| |

|

|

| |

By:

|

|

/s/ Arturo Rodriguez

|

| |

|

|

Arturo Rodriguez

|

| |

|

|

Chief Executive Officer

|

Exhibit 10.1

ATERIAN, INC.

ADVISOR AGREEMENT

This Advisor Agreement (“Agreement”) is entered into as of August 16, 2024, effective August 1, 2024 (the “Effective Date”), by and between Aterian, Inc., a Delaware corporation (“Company”), with a principal place of business at 350 Springfield Avenue, Suite 200, Summit, New Jersey 07901, and William H. Kurtz, an individual residing at 32 Surf Road, Westport CT 06880 (“Advisor”).

1.1 Nature of Services. Advisor will perform the services, as more particularly described on Exhibit A attached hereto, for Company as a strategic advisor (the “Services”). The Services have been specially ordered and commissioned by Company. To the extent the Services include materials subject to copyright, Advisor agrees that the Services are done as “work made for hire” as that term is defined under U.S. copyright law, and that as a result, Company will own all copyrights in the Services. Advisor will perform such services in a diligent and workmanlike manner. The content, style, form and format of any work product of the Services shall be completely satisfactory to Company and shall be consistent with Company’s standards. Company agrees that Advisor’s services need not be rendered at any specific location and may be rendered at any location selected by Advisor. Advisor hereby grants Company the right, but not the obligation, to use and to license others the right to use Advisor’s, and Advisor’s employees’, name, voice, signature, photograph, likeness and biographical information in connection with and related to the Services. Exhibit A attached hereto forms a part of this Agreement.

1.2 Relationship of the Parties. Advisor enters into this Agreement as, and shall continue to be, a strategic advisor. All Services shall be performed only by Advisor. Under no circumstances shall Advisor look to Company as Advisor’s employer, or as a partner, agent or principal. Neither Advisor, nor any of Advisor’s employees, shall be entitled to any benefits accorded to Company’s employees, including without limitation worker’s compensation, disability insurance, vacation or sick pay. Advisor shall be responsible for providing, at Advisor’s expense, and in Advisor’s name, unemployment, disability, worker’s compensation and other insurance, as well as licenses and permits usual or necessary for conducting the Services. Nothing herein shall be construed to create a partnership, joint venture, agency or employer-employee relationship between Company, on the one hand, and Advisor, on the other hand. Advisor will not represent Advisor to be, or hold Advisor out as, an employee of Company. Advisor shall not have any express or implied right or authority to assume or create any obligations on behalf of or in the name of Company, or to bind Company to any other contract, agreement or undertaking with any third party.

1.3 Compensation and Reimbursement. Advisor shall be compensated and reimbursed for the Services solely as set forth on Exhibit B attached hereto. Completeness of work product shall be determined by Company in its sole discretion, and Advisor agrees to make all revisions, additions, deletions or alterations as requested by Company. No other fees and/or expenses will be paid to Advisor, unless such fees and/or expenses have been approved in advance by the appropriate Company executive in writing. Advisor shall be solely responsible for any and all taxes, Social Security contributions or payments, disability insurance, unemployment taxes, and other payroll type taxes applicable to such compensation. Advisor hereby indemnifies and holds Company harmless from, any claims, losses, costs, fees, liabilities, damages or injuries suffered by Company arising out of Advisor’s failure with respect to its obligations in this Section 1.3.

1.4 Personnel. Advisor represents and warrants to Company that only the individual signing this Agreement shall perform the Services. Advisor will not allow any of other individual or party to perform Services for Company pursuant to this Agreement.

| |

2.

|

Protection of Company’s Confidential Information.

|

2.1 Confidential Information. Company now owns and will hereafter develop, compile and own certain proprietary techniques, trade secrets, and confidential information which have great value in its business (collectively, “Company Information”). Company will be disclosing Company Information to Advisor during Advisor’s performance of the Services. Company Information includes not only information disclosed by Company, but also information developed or learned by Advisor during Advisor’s performance of the Services. Company Information is to be broadly defined and includes all information which has or could have commercial value or other utility in the business in which Company is engaged or contemplates engaging or the unauthorized disclosure of which could be detrimental to the interests of Company, whether or not such information is identified by Company. By way of example and without limitation, Company Information includes any and all information concerning discoveries, developments, designs, improvements, inventions, formulas, software programs, processes, techniques, know-how, data, research techniques, customer and supplier lists, marketing, sales or other financial or business information, scripts, and all derivatives, improvements and enhancements to any of the above. Company Information also includes like third-party information which is in Company’s possession under an obligation of confidential treatment.

2.2 Protection of Company Information. Advisor agrees that at all times during or subsequent to the performance of the Services, Advisor will keep confidential and not divulge, communicate, or use Company Information, except for Advisor’s own use during the Term (as defined below) to the extent necessary to perform the Services. Advisor further agrees not to cause the transmission, removal or transport of tangible embodiments of, or electronic files containing, Company Information from Company’s principal place of business, without prior written approval of Company.

2.3 Exceptions. Advisor’s obligations with respect to any portion of Company Information as set forth above shall not apply when Advisor can document that: (i) such information was in the public domain at the time it was communicated to Advisor by Company; (ii) such information entered the public domain subsequent to the time it was communicated to Advisor by Company through no fault of Advisor or its representatives; (iii) such information was in Advisor’s possession free of any obligation of confidence at the time it was communicated to Advisor by Company; or (iv) such information was rightfully communicated to Advisor free of any obligation of confidence subsequent to the time it was communicated to Advisor by Company.

2.4 Notice. Advisor acknowledges receipt of the following notice pursuant to 18 U.S.C. § 1833(b)(1) (Defend Trade Secrets Act) and further acknowledges that such notice shall apply with respect to Advisor notwithstanding anything in this Agreement to the contrary:

An individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made in confidence to a federal, state, or local government official or to an attorney solely for the purpose of reporting or investigating a suspected violation of law. An individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if the individual files any document containing the trade secret under seal; and does not disclose the trade secret, except pursuant to court order.

2.5 Company Property. All materials, including without limitation documents, drawings, drafts, notes, designs, computer media, electronic files and lists, including all additions to, deletions from, alterations of, and revisions in the foregoing (together the “Materials”), which are furnished or made available to Advisor by Company or which are developed in the process of performing the Services, or embody or relate to the Services, Company Information or the Innovations (as defined below), are the property of Company, and shall be returned by Advisor to Company promptly at Company’s request together with any copies thereof, and in any event promptly upon expiration or termination of this Agreement for any reason. Advisor is granted no rights in or to such Materials, Company Information or the Innovations, except as necessary to fulfill its obligations under this Agreement. Advisor shall not use or disclose the Materials, Company Information or Innovations to any third party.

| |

3.

|

Assignment of Advisor’s Inventions and Copyrights.

|

3.1 Disclosure. Advisor will promptly disclose in writing to Company all works, products, discoveries, developments, designs, innovations, improvements, inventions, formulas, processes, techniques, knowhow and data (whether or not patentable, and whether or not at a commercial stage, or registrable under copyright or similar statutes) which are authored, made, conceived, reduced to practice or learned by Advisor (either alone or jointly with others) during the period Advisor provides the Services as a result of performing the Services, including any concepts, ideas, suggestions and approaches related thereto or contained therein (collectively, the “Innovations”).

3.2 Assignment. Advisor hereby assigns and agrees to assign to Company, without royalty or any other consideration except as expressly set forth herein, all worldwide right, title and interest Advisor may have or acquire in and to (i) all Materials, (ii) all Innovations, (iii) all worldwide patents, patent applications, copyrights, mask work rights, trade secrets rights and other intellectual property rights in any Innovations, and (iv) any and all “moral rights” or right of “droit moral” (collectively “Moral Rights”) that Advisor may have in or with respect to any Innovations. To the extent any Moral Rights are not assignable, Advisor waives, disclaims and agrees that Advisor will not enforce such Moral Rights. Advisor agrees that such assignment shall extend to all languages and including the right to make translations of the Materials and Innovations. Additionally, Advisor agrees, at no charge to Company, but at Company’s sole expense, to sign and deliver to Company (either during or subsequent to Advisor’s performance of the Services) such documents as Company considers desirable to evidence the assignment of all rights of Advisor, if any, described above to Company and Company’s ownership of such rights and to do any lawful act and to sign and deliver to Company any document necessary to apply for, register, prosecute or enforce any patent, copyright or other right or protection relating to any Innovations in any country of the world.

3.3 Power of Attorney. Advisor hereby irrevocably designates and appoints each of Company and its Chief Executive Officer as Advisor’s agent and attorneyinfact, to act for and in Advisor’s behalf and stead, for the limited purpose of executing and filing any such document and doing all other lawfully permitted acts to further the prosecution, issuance and enforcement of patents, copyrights or other protections which employ or are based on Innovations with the same force and effect as if executed and delivered by Advisor.

3.4 Representations and Warranties. Advisor represents and warrants to Company that (a) Advisor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company; that in performing under this Agreement, (b) Advisor will not violate the terms of any agreement with any third party, and (c) the Services and any work product thereof are the original work of Advisor, do not and will not infringe upon, violate or misappropriate any patent, copyright, trade secret, trademark, contract, or any other publicity right, privacy right, or proprietary right of any third party. Advisor shall defend, indemnify and hold Company and its successors, assigns and licensees harmless from any and all claims, actions and proceedings, and the resulting losses, damages, costs and expenses (including reasonable attorneys’ fees) arising from any claim, action or proceeding based upon or in any way related to Advisor’s, or Advisor’s employees, breach or alleged breach of any representation, warranty or covenant in this Agreement, and/or from the acts or omissions of Advisor or Advisor’s employees.

4. Solicitation. Advisor agrees that during the term of this Agreement and for one year thereafter, Advisor will not encourage or solicit any employee or consultant of Company to leave Company for any reason.

| |

5.

|

Termination of Agreement.

|

5.1 Term. This Agreement shall commence on the Effective Date and continue until the earliest to occur of (a) the date that is six months after the Effective Date, and (b) the date it is terminated by either party upon 30 days’ advance written notice to the other party (“Term”). Prior to the end of the Term pursuant to clause (a) of the prior sentence, the Company and Advisor may mutually agree in writing to extend the Term for up to an additional six-month period. If Company exercises its right to terminate this Agreement, any obligation it may otherwise have under this Agreement shall cease immediately, except that Company shall be obligated to compensate Advisor for work performed up to the time of termination. If Advisor exercises its right to terminate this Agreement, any obligation it may otherwise have under this Agreement shall cease immediately. Additionally, this Agreement shall automatically terminate upon Advisor’s death or permanent disability. In such event, Company shall be obligated to pay Advisor’s estate or beneficiaries only the accrued but unpaid compensation and expenses due as of the date of death.

5.2 Continuing Obligations of Advisor. The provisions of Sections 1.1 (as relates to creation and ownership of copyright), 1.2, 1.3, 2, 3, 4, 5.2, and 6 shall survive expiration or termination of this Agreement for any reason.

| |

6.

|

Additional Provisions.

|

6.1 Governing Law and Attorney’s Fees. This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its choice of law principles. The parties consent to exclusive jurisdiction and venue in the state, federal or other applicable courts sitting in the county or province of the Company’s principal place of business. In any action or suit to enforce any right or remedy under this Agreement or to interpret any provision of this Agreement, the prevailing party shall be entitled to recover its reasonable attorney’s fees, costs and other expenses.

6.2 Binding Effect. This Agreement shall be binding upon, and inure to the benefit of, the successors, executors, heirs, representatives, administrators and permitted assigns of the parties hereto. Advisor shall have no right to (a) assign this Agreement, by operation of law or otherwise, or (b) subcontract or otherwise delegate the performance of the Services without Company’s prior written consent which may be withheld as Company determines in its sole discretion. Any such purported assignment shall be void.

6.3 Severability. If any provision of this Agreement shall be found invalid or unenforceable, the remainder of this Agreement shall be interpreted so as best to reasonably effect the intent of the parties.

6.4 Entire Agreement. This Agreement, including the Exhibits, constitutes the entire understanding and agreement of the parties with respect to its subject matter and supersedes all prior and contemporaneous agreements or understandings, inducements or conditions, express or implied, written or oral, between the parties.

6.5 Injunctive Relief. Advisor acknowledges and agrees that in the event of a breach or threatened breach of this Agreement by Advisor, Company will suffer irreparable harm and will therefore be entitled to injunctive relief to enforce this Agreement.

6.6 Advisor’s Remedy. Advisor’s remedy, if any, for any breach of this Agreement shall be solely in damages and Advisor shall look solely to Company for recover of such damages. Advisor waives and relinquishes any right Advisor may otherwise have to obtain injunctive or equitable relief against any third party with respect to any dispute arising under this Agreement. Advisor shall look solely to Company for any compensation which may be due to Advisor hereunder.

6.7 Agency. In Advisor’s capacity as an advisor to the Company pursuant to this Agreement, Advisor is not Company’s agent or representative and has no authority to bind or commit Company to any agreements or other obligations.

6.8 Amendment and Waivers. Any term or provision of this Agreement may be amended, and the observance of any term of this Agreement may be waived, only by a writing signed by the party to be bound. The waiver by a party of any breach or default in performance shall not be deemed to constitute a waiver of any other or succeeding breach or default. The failure of any party to enforce any of the provisions hereof shall not be construed to be a waiver of the right of such party thereafter to enforce such provisions.

6.9 Time. Advisor agrees that time is of the essence in this Agreement.

6.10 Notices. Any notice, demand, or request with respect to this Agreement shall be in writing and shall be effective only if it is delivered by personal service, by air courier with receipt of delivery or email or mailed, certified mail, return receipt requested, postage prepaid, to the address set forth above. Such communications shall be effective when they are received by the addressee; but if sent by certified mail in the manner set forth above, they shall be effective five (5) days after being deposited in the mail. Any party may change its address for such communications by giving notice to the other party in conformity with this section.

6.11 Counterparts; Manner of Delivery. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act or other applicable law) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

CAUTION: THIS AGREEMENT AFFECTS ADVISOR’S RIGHTS TO INNOVATIONS ADVISOR MAKES PERFORMING THE SERVICES, AND RESTRICTS ADVISOR’S RIGHT TO DISCLOSE OR USE COMPANY’S CONFIDENTIAL INFORMATION DURING OR SUBSEQUENT TO ADVISOR’S SERVICES.

ADVISOR HAS READ THIS AGREEMENT CAREFULLY AND UNDERSTANDS ITS TERMS.

| ADVISOR |

|

COMPANY |

| |

|

|

| |

|

Aterian, Inc. |

| |

|

|

| |

|

|

| |

|

|

| Name: William H. Kurtz |

|

By: Christopher Porcelli |

| |

|

Its: General Counsel |

EXHIBIT A

Description of Services

Services to be provided by Advisor: Advisor will provide the following advisory services as requested by the Company’s senior management and the Board of Directors from time to time for up to 10 hours per month, including any additional services determined by the Company or the Board of Directors, on the one hand, and Advisor, on the other hand:

| |

●

|

Management advisory services as it relates to the Company including but not limited to strategy, finance and operations

|

Notwithstanding anything in the Agreement the contrary, Advisor shall not participate in the preparation of the financial statements of the Company or any subsidiary of the Company.

EXHIBIT B

Payment

Compensation

Cash Compensation: $8,750 per month (pro rated for partial months), paid within 30 days of month end.

v3.24.2.u1

Document And Entity Information

|

Aug. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ATERIAN, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 16, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38937

|

| Entity, Tax Identification Number |

81-1739858

|

| Entity, Address, Address Line One |

350 Springfield Avenue, Suite 200

|

| Entity, Address, City or Town |

Summit

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07901

|

| City Area Code |

347

|

| Local Phone Number |

676-1681

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ATER

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001757715

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

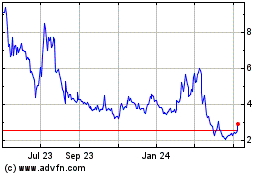

Aterian (NASDAQ:ATER)

Historical Stock Chart

From Nov 2024 to Dec 2024

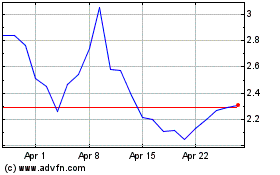

Aterian (NASDAQ:ATER)

Historical Stock Chart

From Dec 2023 to Dec 2024