Form SC 13G/A - Statement of Beneficial Ownership by Certain Investors: [Amend]

November 08 2024 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

AppLovin

Corporation

(Name of Issuer)

Class A common stock, par value $0.00003 per share

(Title of Class of Securities)

03831W 108

(CUSIP

Number)

September 30, 2024

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page. |

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 03831W 108

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons.

Arash Adam Foroughi |

| 2. |

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a) ☒ (b) ☐ |

| 3. |

|

SEC Use Only

|

| 4. |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With: |

|

5. |

|

Sole Voting Power

0 |

| |

6. |

|

Shared Voting Power

43,307,451 |

| |

7. |

|

Sole Dispositive Power

31,822,124 |

| |

8. |

|

Shared Dispositive Power

0 |

|

|

|

|

|

|

|

| 9. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

43,307,451 |

| 10. |

|

Check if the Aggregate Amount

in Row (9) Excludes Certain Shares (See Instructions) ☐ |

| 11. |

|

Percent of Class Represented by

Amount in Row (9) 12.8% (See Item 4) |

| 12. |

|

Type of Reporting Person (See

Instructions) IN |

| Item 1(a) |

Name of Issuer: |

AppLovin Corporation

| Item 1(b) |

Address of Issuer’s Principal Executive Offices: |

1100 Page Mill Road

Palo Alto,

California 94304

| Item 2 (a) |

Name of Person Filing: |

Arash Adam Foroughi

| Item 2 (b) |

Address of Principal Business Office or, if none, Residence: |

c/o AppLovin Corporation

1100

Page Mill Road

Palo Alto, California 94304

The Reporting Person is a United States citizen.

| Item 2 (d) |

Title of Class of Securities: |

Class A Common Stock, par value $0.00003 per share

03831W 108

| Item 3. |

If this statement is filed pursuant to §§240.13d-1(b) or 240.13d-2(b) or (c), check whether the person filing is a: |

Not applicable.

| |

(a) |

Amount beneficially owned: |

The reporting person holds a total of 3,885,217 shares of Class A Common Stock of the Issuer (including 1,477,929 shares of Class A

Common Stock subject to restricted stock units held by the reporting person that are exercisable within 60 days of September 30, 2024) and 27,936,907 shares of Class B Common Stock of the Issuer.

Each share of Class B Common Stock is convertible into one share of Class A Common Stock at the option of the holder and has no

expiration date. Each share of Class B Common Stock is entitled to twenty votes per share, whereas each share of Class A Common Stock is entitled to one vote per share. The rights of the holders of Class A Common Stock and

Class B Common Stock are identical, except with respect to the aforementioned conversion rights and voting rights.

In addition,

Mr. Foroughi, Herald Chen, a member of the board of directors of the Issuer, and KKR Denali Holdings L.P. (“KKR Denali”) (collectively with certain affiliates, the “Voting Agreement Parties”) are parties to a Voting

Agreement (the “Voting Agreement”), which contains certain provisions relating to voting of securities of the Issuer by the parties thereto. Pursuant to the Voting Agreement, two of Mr. Foroughi, Mr. Chen, and KKR Denali (one of

which must be Mr. Foroughi) have the authority to direct the vote of all shares of Class B Common Stock, and all other shares of capital stock of the Issuer, held by the Voting Agreement Parties and their respective permitted entities and

permitted transferees on all matters to be voted upon by stockholders.

By virtue of the Voting Agreement and the obligations and rights

thereunder, the reporting person acknowledges and agrees that he is acting as a “group” within the meaning of Section 13(d) of the Securities Exchange Act of 1934 with the other Voting Agreement Parties and/or certain of their

affiliates. Based in part on information reported by the Issuer to the reporting person, such a “group” would be deemed to

beneficially own an aggregate of 43,307,451 shares of Class A Common Stock, consisting of 6,383,421 shares of Class A Common Stock (including 2,280,201 shares of Class A Common

Stock subject to options held by Mr. Chen that are exercisable within 60 days of September 30, 2024, 15,604 shares of Class A Common Stock subject to restricted stock units held by Mr. Chen that will vest within 60 days of

September 30, 2024, and 1,477,929 shares of Class A Common Stock subject to restricted stock units held by Mr. Foroughi that will vest within 60 days of September 30, 2024) and 36,924,030 shares of Class B Common Stock, each

of which is convertible into one share of Class A Common Stock, which represents 12.8% of the Class A Common Stock of the Issuer, as of September 30, 2024, calculated pursuant to Rule 13d-3. The

ownership percentage above is calculated based on 298,557,111 shares of Class A Common Stock outstanding as of September 30, 2024, as reported by the Issuer to the reporting person, plus the assumed exercise or vesting, as applicable of

2,280,201 shares of Class A Common Stock subject to options held by Mr. Chen, 15,604 shares of Class A Common Stock subject to restricted stock units held by Mr. Chen, and 1,477,929 shares of Class A Common Stock subject to

restricted stock units held by Mr. Foroughi, and conversion of 36,924,030 shares of Class B Common Stock deemed beneficially owned by such “group” into shares of Class A Common Stock. Mr. Chen and KKR Denali have

separately made Schedule 13G filings reporting their beneficial ownership of shares of Class A Common Stock.

See Item 4(a) above.

| |

(c) |

Number of shares as to which the person has: |

| |

(i) |

Sole power to vote or to direct the vote: |

See Row 5 of cover page.

| |

(ii) |

Shared power to vote or to direct the vote: |

See Row 6 of cover page.

| |

(iii) |

Sole power to dispose or to direct the disposition of: |

See Row 7 of cover page.

| |

(iv) |

Shared power to dispose or to direct the disposition of: |

See Row 8 of cover page.

| Item 5. |

Ownership of 5 Percent or Less of a Class. |

Not applicable.

| Item 6. |

Ownership of More than 5 Percent on Behalf of Another Person. |

Not applicable.

| Item 7. |

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the

Parent Holding Company or Control Person. |

Not applicable.

| Item 8. |

Identification and Classification of Members of the Group. |

See Item 4 above.

| Item 9. |

Notice of Dissolution of Group. |

Not applicable.

Not applicable.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 8, 2024

|

| /s/ Arash Adam Foroughi |

| Arash Adam Foroughi |

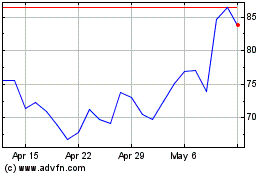

Applovin (NASDAQ:APP)

Historical Stock Chart

From Nov 2024 to Dec 2024

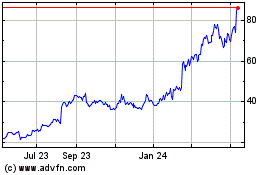

Applovin (NASDAQ:APP)

Historical Stock Chart

From Dec 2023 to Dec 2024