Amarin Corporation plc (NASDAQ:AMRN), today announced financial

results for the quarter and year ended December 31, 2019 and

provided an update on company operations.

Key Amarin recent achievements include:

- FDA approval for new indication: On

December 13, 2019, Amarin announced that VASCEPA® (icosapent ethyl)

became the first and only drug with its FDA-approved indication for

reducing cardiovascular risk in patients with persistent high

cardiovascular risk despite maximally tolerated statin therapy.

This approval, which followed a 16-0 favorable FDA advisory

committee recommendation, positions VASCEPA as a new treatment

option to reduce cardiovascular events in millions of high-risk

patients.

- Revenue growth: Net total revenue reached an annual record

level of $429.8 million in 2019, an increase of 87% over 2018. Net

total revenue reached a quarterly record level of $143.3 million in

the fourth quarter of 2019, an increase of 85% over the fourth

quarter of 2018.

- U.S. prescription growth: Growth in net product revenue was

driven by increased volume of VASCEPA sales supported by increased

prescription levels. Normalized prescriptions for VASCEPA in the

fourth quarter of 2019 increased by 84% and 85% compared to the

same period of 2018 based on data from Symphony Health Solutions

and IQVIA, respectively.

- Commercialization evolution: The launch of VASCEPA for its new

cardiovascular risk reduction indication commenced in January 2020

with updated educational and promotional materials for use with

healthcare professionals. Educational and promotional materials for

patients, such as a television advertisement referencing 25%

cardiovascular event reduction with VASCEPA for indicated patients,

is anticipated to commence in mid-2020 following customary review

by regulatory authorities. Thus far, while early, the launch is

proceeding as expected.

- Third-party support: Eight medical societies now recommend

icosapent ethyl (brand name VASCEPA) for reducing cardiovascular

risk in patients with persistent high cardiovascular risk despite

statin therapy as studied in REDUCE-IT. Multiple pharmacoeconomic

analyses have concluded that VASCEPA is cost effective, with the

most comprehensive of these analyses indicating that VASCEPA can

save money for society in most scenarios by reducing long term

healthcare costs. Managed care coverage, which remains dynamic, has

improved overall for VASCEPA in 2020, including expanded coverage

by various payers in January and February with additional

improvements expected in coming months on top of what was already

good coverage by most insurance companies. In addition, the unique

effects of VASCEPA were underscored by a series of failed

cardiovascular outcomes studies conducted by others of omega-3

mixtures.

- Strong balance sheet to support commercial launch: At December

31, 2019, Amarin had $644.6 million of cash and cash equivalents,

$116.4 million in net accounts receivable ($149.6 million in gross

accounts receivable before allowances and reserves), and $76.8

million in inventory. Management believes that these resources are

adequate to achieve cash flow positivity from VASCEPA based on its

current plans, assuming other significant variables remain in line

with management expectations.

- International progress: In Canada, VASCEPA was approved near

the end of 2019 and Amarin’s commercial partner in Canada very

recently began promoting VASCEPA. In Europe, in December 2019,

Amarin announced that its marketing application for VASCEPA was

accepted for review with approval anticipated in late 2020. In

China, the clinical trial of VASCEPA being conducted by Amarin’s

partner is progressing with anticipated completion before the end

of 2020.

“2019 was a transformational year for Amarin and

for preventative cardiovascular patient care,” commented John

Thero, Amarin’s president and chief executive officer. “VASCEPA

became the first and only FDA approved therapy for its new

cardiovascular risk reduction indication. Our record 2019 revenue

levels, together with the recent FDA-approved VASCEPA label

expansion, excellent employees and strong third-party support, all

position Amarin for considerably further growth in 2020 and beyond.

Based on feedback thus far, we are confident that healthcare

professionals will appreciate the clinical effectiveness and safety

profile of VASCEPA and that they will agree that many patients can

benefit from this unique product. In 2020, we plan to prioritize

market education and promotion to expand the usage of VASCEPA for

the benefit of at-risk patients. This is the advent of a new era in

preventative cardiovascular care.”

Guidance Reaffirmed

Amarin reaffirms its previously provided

guidance of 2020 net total revenue of $650 to $700 million,

predominately from sales of VASCEPA in the United States. Amarin

also reaffirms its other previously provided guidance as

follows:

- Sales force expansion: Expansion of Amarin’s sales force size

to approximately 800 sales representatives in the United States is

expected to be completed in early 2020. Amarin’s sales force

is now doubled as compared to 2019. Corresponding to this sales

force growth, health care professional targets have been expanded

from approximately 50,000 to a planned 75,000 physicians along with

scheduled increased frequency in the number of calls to these

targets.

- Inventory increases: Purchase approximately $250 million of

inventory is planned for 2020, which is approximately twice the

amount spent for inventory purchases in 2019.

- Operating expenses: Operating expenses are expected to increase

approximately $200 to $250 million over 2019 levels. Included in

this estimate are increased costs associated with the previously

described sales force expansion as well as increased costs for

other VASCEPA promotional activities such as direct-to-consumer

advertising.

ANDA Litigation

Amarin remains engaged in ongoing patent

litigation with generic pharmaceutical companies. The trial portion

of the litigation was completed in late January. Post-trial briefs

are expected to be publicly available on the court docket on

February 28th. Owing to the ongoing nature of this litigation,

Amarin does not plan to provide commentary on the litigation

outside of its court filings until publication of the court’s

decision, which, based on court proceedings, is expected near the

end of March.

Prescription Growth

Normalized prescriptions for VASCEPA

(prescription of 120 grams of VASCEPA representing a one-month

supply) increased by 78% and 77% in 2019 compared to 2018 based on

data from Symphony Health and IQVIA, respectively, and increased by

84% and 85% in the fourth quarter of 2019 compared to the same

period in 2018, respectively. Estimated normalized VASCEPA

prescriptions, based on data from Symphony Health and IQVIA,

totaled approximately 992,000 and 909,000 in the fourth quarter of

2019, respectively.

Financial Update

Net total revenue for the years ended December

31, 2019 and 2018 was $429.8 million and $229.2 million,

respectively. Net product revenue for the years ended December 31,

2019 and 2018 was $427.4 million and $228.4 million, respectively.

Net product revenue for the three months ended December 31, 2019

and 2018 was $142.0 million and $77.1 million, respectively. The

increases in net product revenue for the full year and fourth

quarter of 2019 are mainly attributed to increased volume sales of

VASCEPA in the United States.

In addition, Amarin recognized licensing revenue

of $2.4 million and $0.8 million for the years ended December 31,

2019 and 2018, respectively, under agreements for the

commercialization of VASCEPA outside the United States.

Cost of goods sold for the years ended December

31, 2019 and 2018 was $96.0 million and $54.5 million,

respectively. Cost of goods sold for the three months ended

December 31, 2019 and 2018 was $30.7 million and $17.5 million,

respectively. Gross margin on product sales was approximately 78%

in the year and quarter ended December 31, 2019, respectively, as

compared to approximately 76% and 77% in the year and quarter ended

December 31, 2018, respectively.

Selling, general and administrative expenses for

the years ended December 31, 2019 and 2018 was $323.6 million and

$227.0 million, respectively. The increase is due primarily to

increased commercial and other promotional costs for expansion

following successful REDUCE-IT results (announced on September 24,

2018), including sales force expansion costs, partially offset by

the company not extending its previous co-promotion agreement for

VASCEPA beyond December 31, 2018.

Research and development expenses for the years

ended December 31, 2019 and 2018 were $34.4 million and $55.9

million, respectively. This decrease is attributed to the decline

in REDUCE-IT related costs following presentation of such results

in November 2018.

Under U.S. GAAP, Amarin reported a net loss of

$22.6 million for the year ended December 31, 2019, or basic and

diluted loss per share of $0.07. This net loss included $30.9

million in non-cash stock-based compensation expense. For the year

ended December 31, 2018, Amarin reported a net loss of $116.4

million, or basic and diluted loss per share of $0.39. This net

loss included $18.8 million in non-cash stock-based compensation

expense.

Excluding non-cash stock-based compensation

expense, non-GAAP adjusted net income was $8.3 million for the year

ended December 31, 2019, or non-GAAP adjusted basic and diluted

earnings per share of $0.02, compared to non-GAAP adjusted net loss

of $97.6 million for the year ended December 31, 2018, or non-GAAP

adjusted basic and diluted loss per share of $0.33.

As of December 31, 2019, the company had $644.6

million in cash and cash equivalents, $116.4 million in net

accounts receivable ($149.6 million in gross accounts receivable

before allowances and reserves), which are current, and $76.8

million in inventory. The company believes that, based on its plans

and expectations, the company’s cash and cash equivalents will be

sufficient to fund the company’s projected operations and is

adequate to achieve positive cash flow from the commercial launch

of VASCEPA.

As of December 31, 2019, the company had

accounts payable and accrued expenses of $189.8 million which

increased from $121.8 million at December 31, 2018 primarily due to

the company’s growth, including supplier payments associated with

the increased levels of VASCEPA inventory associated with

supporting increased revenue and the magnitude and timing of

rebates.

As of December 31, 2019, Amarin had

approximately 360.1 million ADSs and ordinary shares outstanding,

28.9 million common share equivalents of Series A Convertible

Preferred Shares outstanding and approximately 15.6 million

equivalent shares underlying stock options at a weighted-average

exercise price of $6.43, as well as 6.9 million equivalent shares

underlying restricted or deferred stock units.

Conference Call and Webcast

Information:

Amarin will host a conference call February 25,

2020, at 4:30 p.m. ET to discuss this information. The conference

call can be heard live on the investor relations section of the

company's website at www.amarincorp.com, or via telephone by

dialing 877-407-8033 within the United States, 201-689-8033 from

outside the United States, or by using the call back feature at

https://bit.ly/2uIDg0X. A replay of the call will be made available

for a period of two weeks following the conference call. To hear a

replay of the call, dial 877-481-4010, PIN: 33174. A replay of the

call will also be available through the company's website shortly

after the call.

Use of Non-GAAP Adjusted Financial

Information

Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

condensed consolidated financial statements.

Non-GAAP adjusted net income (loss) was derived

by taking GAAP net income (loss) and adjusting it for non-cash

stock-based compensation expense. Management uses these non-GAAP

adjusted financial measures for internal reporting and forecasting

purposes, when publicly providing its business outlook, to evaluate

the company’s performance and to evaluate and compensate the

company’s executives. The company has provided these non-GAAP

financial measures in addition to GAAP financial results because it

believes that these non-GAAP adjusted financial measures provide

investors with a better understanding of the company’s historical

results from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a rapidly growing,

innovative pharmaceutical company focused on developing and

commercializing therapeutics to cost-effectively improve

cardiovascular health. Amarin’s lead product, VASCEPA® (icosapent

ethyl), is available by prescription in the United States, Canada,

Lebanon and the United Arab Emirates. Amarin, together with its

commercial partners in select geographies, is pursuing additional

regulatory approvals for VASCEPA in China, the European Union and

the Middle East. For more information about Amarin, visit

www.amarincorp.com.

About Cardiovascular Risk

The number of deaths in the United States

attributed to cardiovascular disease continues to

rise.1,2 There are 605,000 new and 200,000 recurrent heart

attacks per year (approximately 1 every 40 seconds), in the United

States. Stroke rates are similar, accounting for 1 of every 19 U.S.

deaths (approximately 1 every 40 seconds).3

Controlling bad cholesterol, also known as

LDL-C, is one way to reduce a patient’s risk for cardiovascular

events, such as heart attack, stroke or death. However, even with

the achievement of target LDL-C levels, millions of patients still

have significant and persistent risk of cardiovascular events,

especially those patients with high triglycerides. Statin therapy

has been shown to control LDL-C, thereby reducing the risk of

cardiovascular events by 25-35% – but that still leaves a 65-75%

risk remaining.4 People with high triglycerides have 35% more

cardiovascular events compared to people with normal (in range)

triglycerides taking statins.5,6,7

About VASCEPA®

(icosapent ethyl) Capsules

VASCEPA (icosapent ethyl) capsules are the

first-and-only prescription treatment approved by the FDA comprised

solely of the active ingredient, icosapent ethyl (IPE), a unique

form of eicosapentaenoic acid. VASCEPA was initially launched in

the United States in 2013 based on the drug’s initial FDA approved

indication for use as an adjunct therapy to diet to reduce

triglyceride levels in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia. Since launch, VASCEPA has been prescribed

over eight million times and is covered by most major medical

insurance plans. The new, cardiovascular risk indication for

VASCEPA was approved by the FDA in December 2019.

Indications and Limitation of Use

VASCEPA is indicated:

- As an adjunct to maximally tolerated statin therapy to reduce

the risk of myocardial infarction, stroke, coronary

revascularization and unstable angina requiring hospitalization in

adult patients with elevated triglyceride (TG) levels (≥ 150 mg/dL)

and - established cardiovascular disease or - diabetes

mellitus and two or more additional risk factors for cardiovascular

disease.

- As an adjunct to diet to reduce TG levels in adult patients

with severe (≥ 500 mg/dL) hypertriglyceridemia.

The effect of VASCEPA on the risk for

pancreatitis in patients with severe hypertriglyceridemia has not

been determined.

Important Safety Information

- VASCEPA is contraindicated in patients with known

hypersensitivity (e.g., anaphylactic reaction) to VASCEPA or any of

its components.

- VASCEPA was associated with an increased risk (3% vs 2%) of

atrial fibrillation or atrial flutter requiring hospitalization in

a double-blind, placebo-controlled trial. The incidence of atrial

fibrillation was greater in patients with a previous history of

atrial fibrillation or atrial flutter.

- It is not known whether patients with allergies to fish and/or

shellfish are at an increased risk of an allergic reaction to

VASCEPA. Patients with such allergies should discontinue VASCEPA if

any reactions occur.

- VASCEPA was associated with an increased risk (12% vs 10%) of

bleeding in a double-blind, placebo-controlled trial. The incidence

of bleeding was greater in patients receiving concomitant

antithrombotic medications, such as aspirin, clopidogrel or

warfarin.

- Common adverse reactions in the cardiovascular outcomes trial

(incidence ≥3% and ≥1% more frequent than placebo): musculoskeletal

pain (4% vs 3%), peripheral edema (7% vs 5%), constipation (5% vs

4%), gout (4% vs 3%), and atrial fibrillation (5% vs 4%).

- Common adverse reactions in the hypertriglyceridemia trials

(incidence >1% more frequent than placebo): arthralgia (2% vs

1%) and oropharyngeal pain (1% vs 0.3%).

- Adverse events may be reported by calling 1-855-VASCEPA or the

FDA at 1-800-FDA-1088.

- Patients receiving VASCEPA and concomitant anticoagulants

and/or anti-platelet agents should be monitored for bleeding.

Key clinical effects of VASCEPA on major adverse

cardiovascular events are included in the Clinical Studies section

of the prescribing information for VASCEPA, as set forth below:

Effect of VASCEPA on Time to First

Occurrence of Cardiovascular Events in Patients with Elevated

Triglyceride levels and Other Risk Factors for Cardiovascular

Disease in REDUCE-IT

|

|

VASCEPA |

Placebo |

VASCEPA vs Placebo |

|

N = 4089 n (%) |

Incidence Rate (per 100 patient years) |

N = 4090 n (%) |

Incidence Rate (per 100 patient years) |

Hazard Ratio (95% CI) |

|

Primary composite endpoint |

|

Cardiovascular death, myocardial infarction, stroke, coronary

revascularization, hospitalization for unstable angina (5-point

MACE) |

705 (17.2) |

4.3 |

901 (22.0) |

5.7 |

0.75 (0.68, 0.83) |

|

Key secondary composite endpoint |

|

Cardiovascular death, myocardial infarction, stroke (3-point

MACE) |

459 (11.2) |

2.7 |

606 (14.8) |

3.7 |

0.74 (0.65, 0.83) |

|

Other secondary endpoints |

|

Fatal or non-fatal myocardial infarction |

250 (6.1) |

1.5 |

355 (8.7) |

2.1 |

0.69 (0.58, 0.81) |

|

Emergent or urgent coronary revascularization |

216 (5.3) |

1.3 |

321 (7.8) |

1.9 |

0.65 (0.55, 0.78) |

|

Cardiovascular death [1] |

174 (4.3) |

1.0 |

213 (5.2) |

1.2 |

0.80 (0.66, 0.98) |

|

Hospitalization for unstable angina [2] |

108 (2.6) |

0.6 |

157 (3.8) |

0.9 |

0.68 (0.53, 0.87) |

|

Fatal or non-fatal stroke |

98 (2.4) |

0.6 |

134 (3.3) |

0.8 |

0.72 (0.55, 0.93) |

|

[1] Includes adjudicated cardiovascular deaths and deaths of

undetermined causality. [2] Determined to be caused by myocardial

ischemia by invasive/non-invasive testing and requiring emergent

hospitalization. |

FULL VASCEPA

PRESCRIBING INFORMATION CAN BE FOUND

AT WWW.VASCEPA.COM.

Forward-Looking Statements

This press release contains forward-looking

statements, including expectations regarding cash flow positive

status, operating expenses, inventory purchases, managed care

coverage for VASCEPA, regulatory reviews in Europe and elsewhere,

commercial and international expansion, prescription growth and

revenue growth and guidance on future revenue levels; and

expectations that REDUCE-IT results could lead to a new era in

preventative cardiovascular care. These forward-looking statements

are not promises or guarantees and involve substantial risks and

uncertainties. In addition, Amarin's ability to effectively

commercialize VASCEPA will depend in part on its ability to

continue to effectively finance its business, efforts of third

parties, its ability to create market demand for VASCEPA through

education, marketing and sales activities, to achieve broad market

acceptance of VASCEPA, to receive adequate levels of reimbursement

from third-party payers, to develop and maintain a consistent

source of commercial supply at a competitive price, to comply with

legal and regulatory requirements in connection with the sale and

promotion of VASCEPA and to maintain patent protection for VASCEPA.

Among the factors that could cause actual results to differ

materially from those described or projected herein include the

following: uncertainties associated generally with research and

development, clinical trials and related regulatory approvals; the

risk that sales may not meet expectations and related cost may

increase beyond expectations; the risk that patents may not be

determined to be infringed or upheld in patent litigation and

applications may not result in issued patents sufficient to protect

the VASCEPA franchise. A further list and description of these

risks, uncertainties and other risks associated with an investment

in Amarin can be found in Amarin's filings with the U.S. Securities

and Exchange Commission, including its most recent quarterly report

on Form 10-Q and annual report on Form 10-K. Existing and

prospective investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof. Amarin undertakes no obligation to update or revise the

information contained in this press release, whether as a result of

new information, future events or circumstances or otherwise.

Amarin’s forward-looking statements do not reflect the potential

impact of significant transactions the company may enter into, such

as mergers, acquisitions, dispositions, joint ventures or any

material agreements that Amarin may enter into, amend or

terminate.

Availability of Other Information About

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (www.amarincorp.com), the investor relations website

(investor.amarincorp.com), including but not limited to investor

presentations and investor FAQs, Securities and Exchange Commission

filings, press releases, public conference calls and webcasts. The

information that Amarin posts on these channels and websites could

be deemed to be material information. As a result, Amarin

encourages investors, the media, and others interested in Amarin to

review the information that is posted on these channels, including

the investor relations website, on a regular basis. This list of

channels may be updated from time to time on Amarin’s investor

relations website and may include social media channels. The

contents of Amarin’s website or these channels, or any other

website that may be accessed from its website or these channels,

shall not be deemed incorporated by reference in any filing under

the Securities Act of 1933.

Amarin Contact Information

Investor and Media Inquiries:Elisabeth

SchwartzInvestor RelationsAmarin Corporation plcIn U.S.: +1 (908)

719-1315investor.relations@amarincorp.com (investor

inquiries)PR@amarincorp.com (media inquiries)

Lee M. SternSolebury TroutIn U.S.: +1 (646)

378-2992lstern@soleburytrout.com

| CONSOLIDATED

BALANCE SHEET DATA |

| (U.S.

GAAP) |

| Unaudited

* |

| |

|

|

|

|

| |

|

December 31, 2019 |

|

December 31, 2018 |

| |

|

|

| |

|

(in

thousands) |

|

ASSETS |

|

|

|

|

|

Current Assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

644,588 |

|

|

$ |

249,227 |

|

|

Restricted cash |

|

|

3,907 |

|

|

|

1,500 |

|

|

Accounts receivable, net |

|

|

116,430 |

|

|

|

66,523 |

|

|

Inventory |

|

|

76,769 |

|

|

|

57,802 |

|

|

Prepaid and other current assets |

|

|

13,311 |

|

|

|

2,945 |

|

|

Total current assets |

|

|

855,005 |

|

|

|

377,997 |

|

|

Property, plant and equipment, net |

|

|

2,361 |

|

|

|

63 |

|

|

Operating lease right-of-use asset |

|

|

8,511 |

|

|

|

— |

|

|

Other long-term assets |

|

|

1,074 |

|

|

|

174 |

|

|

Intangible asset, net |

|

|

15,258 |

|

|

|

7,480 |

|

|

TOTAL ASSETS |

|

$ |

882,209 |

|

|

$ |

385,714 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

49,950 |

|

|

$ |

37,632 |

|

|

Accrued expenses and other current liabilities |

|

|

139,826 |

|

|

|

84,171 |

|

|

Current portion of long-term debt from royalty-bearing

instrument |

|

|

50,130 |

|

|

|

34,240 |

|

|

Deferred revenue, current |

|

|

2,342 |

|

|

|

1,220 |

|

|

Total current liabilities |

|

|

242,248 |

|

|

|

157,263 |

|

|

Long-Term Liabilities: |

|

|

|

|

|

Long-term debt from royalty-bearing instrument |

|

|

— |

|

|

|

46,108 |

|

|

Deferred revenue, long-term |

|

|

18,504 |

|

|

|

19,490 |

|

|

Long-term operating lease liability |

|

|

9,443 |

|

|

|

— |

|

|

Other long-term liabilities |

|

|

3,751 |

|

|

|

10,523 |

|

|

Total liabilities |

|

|

273,946 |

|

|

|

233,384 |

|

|

Stockholders’ Equity: |

|

|

|

|

|

Preferred stock |

|

|

21,850 |

|

|

|

21,850 |

|

|

Common stock |

|

|

269,173 |

|

|

|

246,663 |

|

|

Additional paid-in capital |

|

|

1,764,317 |

|

|

|

1,282,762 |

|

|

Treasury stock |

|

|

(35,900 |

) |

|

|

(10,413 |

) |

|

Accumulated deficit |

|

|

(1,411,177 |

) |

|

|

(1,388,532 |

) |

|

Total stockholders’ equity |

|

|

608,263 |

|

|

|

152,330 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

$ |

882,209 |

|

|

$ |

385,714 |

|

| |

|

|

|

|

|

* Unaudited as a standalone schedule; copied from consolidated

financial statements |

| CONSOLIDATED

STATEMENTS OF OPERATIONS DATA |

| (U.S.

GAAP) |

| Unaudited

* |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended December 31, |

|

Year Ended

December 31, |

| |

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

| |

|

|

2019 |

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

Product revenue, net |

$ |

142,044 |

|

|

$ |

77,085 |

|

|

$ |

427,391 |

|

|

$ |

228,371 |

|

|

Licensing revenue |

|

1,233 |

|

|

|

245 |

|

|

|

2,364 |

|

|

|

843 |

|

|

Total revenue, net |

|

143,277 |

|

|

|

77,330 |

|

|

|

429,755 |

|

|

|

229,214 |

|

|

Less: Cost of goods sold |

|

30,665 |

|

|

|

17,509 |

|

|

|

96,019 |

|

|

|

54,543 |

|

|

Gross margin |

|

112,612 |

|

|

|

59,821 |

|

|

|

333,736 |

|

|

|

174,671 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative (1) |

|

96,025 |

|

|

|

79,686 |

|

|

|

323,623 |

|

|

|

226,996 |

|

|

Research and development (1) |

|

11,097 |

|

|

|

11,906 |

|

|

|

34,392 |

|

|

|

55,900 |

|

|

Total operating expenses |

|

107,122 |

|

|

|

91,592 |

|

|

|

358,015 |

|

|

|

282,896 |

|

|

Operating income (loss) |

|

5,490 |

|

|

|

(31,771 |

) |

|

|

(24,279 |

) |

|

|

(108,225 |

) |

|

Interest expense |

|

(1,439 |

) |

|

|

(1,992 |

) |

|

|

(6,626 |

) |

|

|

(8,872 |

) |

|

Interest income |

|

3,074 |

|

|

|

382 |

|

|

|

8,499 |

|

|

|

1,074 |

|

|

Other income (expense), net |

|

107 |

|

|

|

(192 |

) |

|

|

(75 |

) |

|

|

(326 |

) |

|

Income (loss) from operations before taxes |

|

7,232 |

|

|

|

(33,574 |

) |

|

|

(22,481 |

) |

|

|

(116,349 |

) |

|

Provision for income taxes |

|

(164 |

) |

|

|

(96 |

) |

|

|

(164 |

) |

|

|

(96 |

) |

|

Net income (loss) |

|

7,068 |

|

|

|

(33,670 |

) |

|

|

(22,645 |

) |

|

|

(116,445 |

) |

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.02 |

|

|

$ |

(0.11 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.39 |

) |

|

Diluted |

$ |

0.02 |

|

|

$ |

(0.11 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.39 |

) |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

359,156 |

|

|

|

314,183 |

|

|

|

342,538 |

|

|

|

297,237 |

|

|

Diluted |

|

401,039 |

|

|

|

314,183 |

|

|

|

342,538 |

|

|

|

297,237 |

|

| * |

Unaudited as a standalone schedule; copied from consolidated

financial statements |

| (1) |

Excluding non-cash stock-based compensation, selling, general

and administrative expenses were $297,321 and $211,088 for 2019 and

2018, respectively, and research and development expenses were

$29,777 and $53,002, respectively, for the same periods. Excluding

non-cash stock-based compensation as well as co-promotion fees paid

to the company's U.S. co-promotion partner, selling, general and

administrative expenses were $297,321 and $164,267 for 2019 and

2018, respectively. |

|

RECONCILIATION OF NON-GAAP NET INCOME (LOSS) |

|

Unaudited |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months

ended December 31, |

|

Year Ended

December 31, |

| |

|

(in thousands, except per share amounts) |

|

(in thousands, except per share amounts) |

| |

|

2019 |

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) for EPS - GAAP |

|

|

7,068 |

|

|

|

(33,670 |

) |

|

|

|

(22,645 |

) |

|

|

|

(116,445 |

) |

| Stock-based

compensation expense |

|

|

8,188 |

|

|

|

4,775 |

|

|

|

|

30,917 |

|

|

|

|

18,806 |

|

|

Adjusted net income (loss) for EPS - non GAAP |

|

$ |

15,256 |

|

|

$ |

(28,895 |

) |

|

|

$ |

8,272 |

|

|

|

$ |

(97,639 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic - non GAAP |

|

$ |

0.04 |

|

|

$ |

(0.09 |

) |

|

|

$ |

0.02 |

|

|

|

$ |

(0.33 |

) |

|

Diluted - non GAAP |

|

$ |

0.04 |

|

|

$ |

(0.09 |

) |

|

|

$ |

0.02 |

|

|

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

359,156 |

|

|

|

314,183 |

|

|

|

|

342,538 |

|

|

|

|

297,237 |

|

|

Diluted |

|

|

401,039 |

|

|

|

314,183 |

|

|

|

|

386,797 |

|

|

|

|

297,237 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

________________________________________1 American Heart

Association. Heart Disease and Stroke Statistics – 2019 Update: A

Report from the American Heart Association. Published January 31,

2019.2 American Heart Association / American Stroke Association.

2017. Cardiovascular disease: A costly burden for America

projections through 2035.3 American Heart Association: Heart

Disease and Stroke Statistics -- 2019 At-a-Glance.4 Ganda OP, Bhatt

DL, Mason RP, et al. Unmet need for adjunctive dyslipidemia therapy

in hypertriglyceridemia management. J Am Coll Cardiol.

2018;72(3):330-343.5 Budoff M. Triglycerides and triglyceride-rich

lipoproteins in the causal pathway of cardiovascular disease. Am J

Cardiol. 2016;118:138-145.6 Toth PP, Granowitz C, Hull M, et al.

High triglycerides are associated with increased cardiovascular

events, medical costs, and resource use: A real-world

administrative claims analysis of statin-treated patients with high

residual cardiovascular risk. J Am Heart Assoc.

2018;7(15):e008740.7 Nordestgaard BG. Triglyceride-rich

lipoproteins and atherosclerotic cardiovascular disease - New

insights from epidemiology, genetics, and biology. Circ Res.

2016;118:547-563.

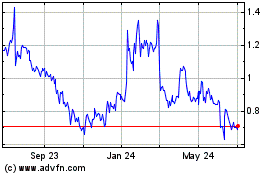

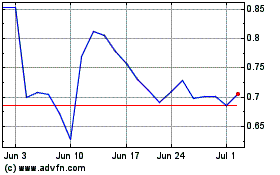

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Nov 2023 to Nov 2024