false

0001755953

0001755953

2023-12-28

2023-12-28

0001755953

KERN:CommonStockParValue0.0001PerShareMember

2023-12-28

2023-12-28

0001755953

KERN:WarrantsToPurchaseCommonStockMember

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 28, 2023

| AKERNA CORP. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

|

001-39096 |

|

83-2242651 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 1550 Larimer Street, #246, Denver, Colorado |

|

80202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 932-6537

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

KERN |

|

NASDAQ Capital Market |

| Warrants to purchase Common Stock |

|

KERNW |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement.

On December 28, 2023,

Akerna Corp., a Delaware corporation (the “Company”) and Akerna Canada Ample Exchange Inc., an Ontario corporation

and an indirect wholly-owned subsidiary of the Company (“Akerna Canada”), entered into a Share Purchase Agreement

(the “Purchase Agreement”) with Wilcompute Systems Group Inc., an Ontario corporation (“Buyer”;

together with the Company and Akerna Canada, the “Parties”; each, a “Party”), pursuant

to which the Akerna Canada agreed to sell all of the issued and outstanding capital stock of Ample Organics Inc., an Ontario corporation

(“Ample”), owned by Akerna Canada (“Ample Shares”) to Buyer for an aggregate purchase

price consisting of approximately $638,000 of cash (the “Purchase Price”), subject to post-closing adjustments

pursuant to the Purchase Agreement, and on the terms and subject to the conditions set forth in the Purchase Agreement (the “Transaction”).

The Transaction was completed

on December 28, 2023 (the “Closing Date”).

The Purchase Agreement

contains customary representations, warranties and covenants by each party that are subject, in some cases, to specified exceptions and

qualifications contained in the Purchase Agreement.

Akerna Canada agreed

to indemnify Buyer for losses arising out of or relating to (a) any inaccuracy in or breach of any of the representations or warranties

of contained in the Purchase Agreement or in any certificate or instrument delivered by or on behalf of Akerna Canada under the Purchase

Agreement; (b) any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Akerna Canada or the Company

under the Purchase Agreement; or (c) all liabilities or obligations of Akerna Canada for any time prior to Closing, including with respect

to Taxes for (i) any taxable period ending on or before the Closing Date, (ii) the portion of any taxable period ending at the close of

business on the Closing Date, other than Taxes that are adequately and fully accounted for in the closing working capital, (iii) any taxation

year or taxable period ending after the closing date that is attributable to any period ending on or before the closing date, except for

taxes that are adequately and fully accounted for in the closing working capital, and (iv) the transactions contemplated by the IP Transfer

Agreement (as defined below). Under the Purchase Agreement, the Company has guaranteed the obligations of Akerna Canada.

The representations and

warranties of Akerna Canada in the Purchase Agreement survive the closing and remain in full force and effect until the date that is the

earlier of (a) the occurrence of the closing of Akerna’s transaction with MJ Acquisition Corp. (“MJ Acquisition”)

pursuant to that certain Securities Purchase Agreement by and between Akerna, Akerna Canada and MJ Acquisition dated April 28, 2023, as

amended (“MJ SPA”); and (b) twelve (12) months from the closing date; provided that the representations and

warranties in Section 3.20 of the Purchase Agreement related to certain tax matters will survive the closing until the date which is 90

days after the last day upon which any of the relevant governmental authorities is entitled to assess or reassess Akerna Canada (or to

raise claims against the Purchaser or Akerna Canada relating to that assessment or reassessment) with respect to any pre-closing tax periods.

Each of the Company’s, Akerna Canada’s and Buyer’s indemnification obligations are subject to limitations set forth

in the Purchase Agreement, including a limitation on indemnification for losses of $106,500.

On December 28, 2023,

the Company and Ample entered into an Intellectual Property Purchase Agreement (the “IP Transfer Agreement”)

pursuant to which the Company sold, assigned and transferred to Ample certain intellectual property rights of the Company related to the

work product and associated intellectual property rights produced by certain employees of the Company related to software systems used

by Ample in its business (the “Transferred IP”).

In order to

consummate the Transaction, the Company entered into a release and agreement dated December 28, 2023 to obtain a release under the

Amended and Restated Security and Pledge Agreement dated October 5, 2021 entered into by and among the Company, certain of its

subsidiaries, and the collateral agent named therein and under the Amended and Restated Intellectual Property Security Agreement

dated October 5, 2021 by and between the Company, certain of its subsidiaries and the collateral agent named therein (the

“Collateral Agent Release”). Pursuant to the Collateral Agent Release, the collateral agent released the

Company from the Company’s pledge of 65% of the issued and outstanding shares of Ample, and the Company’s grant of a

security interest in the Transferred IP sold to Ample under the IP Transfer Agreement. Further, the Company entered into a separate

consent and agreement dated December 28, 2023 with each of the two institutions that hold its senior secured convertible notes,

severally and not jointly, pursuant to which each such holder separately consented to the Collateral Agent Release (the

“Noteholder Consents”).

The Company also entered

into a release and agreement dated December 28, 2023 to obtain a release under the Second Amended and Restated Security and Pledge Agreement

dated November 15, 2023 entered into by and among the Company, certain of its subsidiaries, and MJ Acquisition and under the Second Amended

and Restated Intellectual Property Security Agreement dated November 15, 2023 by and between the Company, certain of its subsidiaries

and MJ Acquisition (the “MJA Release”). Pursuant to the MJA Release, MJ Acquisition released the Company from

the Company’s pledge of 65% of the issued and outstanding shares of Ample, and the Company’s grant of a security interest

in the Transferred IP sold to Ample under the IP Transfer Agreement. Further, the Company entered into a separate consent and agreement

dated December 28, 2023 with MJ Acquisition, pursuant to which MJ Acquisition consented to the sale of the Ample Shares and waived certain

provisions of the MJA SPA related thereto (the “MJA Consent”).

On December 28, 2023,

the Company, Akerna Canada and MJ Acquisition entered into a third amendment to the MJA SPA (the “Third Amendment”),

to lower certain of the indemnity limits set forth therein to reflect the sale of the Ample Shares to the Buyer.

The above descriptions

of the Purchase Agreement, IP Transfer Agreement, the Collateral Agent Release, the Noteholder Consents, the MJA Release, the MJA Consent

and the Third Amendment are a summary of the material terms of such agreements only and are qualified in their entirety by reference to

the full text of Purchase Agreement, IP Transfer Agreement, the Collateral Agent Release, the Noteholder Consents, the MJA Release, the

MJA Consent and the Third Amendment, which are filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6 and 2.1, respectively, to this Current

Report on Form 8-K and are incorporated herein by reference. The representations, warranties and covenants contained in the Purchase Agreement,

IP Transfer Agreement, the Collateral Agent Release, the Noteholder Consents, the MJA Release, the MJA Consent and the Third Amendment

were made only for purposes of such agreements and as of specified dates, were solely for the benefit of the parties to such agreements

and may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures exchanged

between the parties in connection with the execution of such agreements. The representations and warranties have been made for the purpose

of allocating contractual risk between the parties to the agreements instead of establishing these matters as facts and may be subject

to a contractual standard of materiality different from what might be viewed as material to investors. Investors should not rely on the

representations, warranties and covenants or any description thereof as characterizations of the actual state of facts or condition of

the Company, Akerna Canada, MJ Acquisition or Buyer. Moreover, information concerning the subject matter of the representations, warranties

and covenants may change after the date of such agreements, which subsequent information may or may not be fully reflected in public disclosures.

Item 2.01 Completion

of Acquisition or Disposition of Assets.

The information set forth

under Item 1.01 of this Current Report is hereby incorporated by reference into this Item 2.01.

Item 9.01 Financial Statements and

Exhibits.

(b) Pro forma financial information

The unaudited pro forma

condensed consolidated financial information of the Company giving effect to the Transaction will be filed by amendment to this Form 8-K

by January 4, 2024.

(d) Exhibits

| Exhibit Number |

|

Description |

| 2.1+ |

|

Third Amendment to Securities Purchase Agreement by and between the Company, Akerna Canada Ample Exchange and MJ Acquisition Corp. incorporated by reference to Exhibit 2.11 to the Company’s Registration Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 10.1+ |

|

Share Purchase Agreement by and between Akerna, Akerna Canada Ample Exchange and Wilcompute Systems Group dated December 28, 2023 (incorporated by reference to Exhibit 10.71 to the Company’s Registration Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 10.2+ |

|

Intellectual

Property Purchase Agreement by and between the Company and Ample Organics dated December 28, 2023 (incorporated by reference to

Exhibit 10.72 to the Company’s Registration Statement on Form S-4/A as filed with the Commission on December 28,

2023) |

| 10.3+ |

|

Collateral

Agent Release and Agreement dated December 28, 2023 (incorporated by reference to Exhibit 10.73 to the Company’s Registration

Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 10.4+ |

|

Form

of Noteholder Consent and Agreement dated December 28, 2023 (incorporated by reference to Exhibit 10.74 to the Company’s

Registration Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 10.5+ |

|

Release and Consent of MJ Acquisition Corp. dated December 28, 2023 (incorporated by reference to Exhibit 10.76 to the Company’s Registration Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 10.6+ |

|

Consent and Agreement of MJ Acquisition Corp. dated December 28, 2023 (incorporated by reference to Exhibit 10.75 to the Company’s Registration Statement on Form S-4/A as filed with the Commission on December 28, 2023) |

| 104.1 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL Document). |

| + | Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A

copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

Additional Information

and Where to Find It

This Current Report on

Form 8-K may be deemed to be solicitation material with respect to the proposed transactions between Akerna and Gryphon Digital Mining,

Inc. (‘Gryphon”) and between Akerna and MJ Acquisition Corp. In connection with the proposed transactions, Akerna has filed

relevant materials with the United States Securities and Exchange Commission, or the SEC, including a registration statement on Form S-4

that contains a prospectus and a proxy statement. Akerna will mail the proxy statement/prospectus to the Akerna stockholders, and the

securities may not be sold or exchanged until the registration statement becomes effective. Investors and securityholders of Akerna and

Gryphon are urged to read these materials because they will contain important information about Akerna, Gryphon and the proposed transactions.

This Current Report on Form 8-K is not a substitute for the registration statement, definitive proxy statement/prospectus or any other

documents that Akerna may file with the SEC or send to securityholders in connection with the proposed transactions. Investors and securityholders

may obtain free copies of the documents filed with the SEC on Akerna’s website at www.akerna.com, on the SEC’s website at

www.sec.gov or by directing a request to Akerna’s Investor Relations at (516) 419-9915.

This Current Report on

Form 8-K is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to any securities or in respect

of the proposed transactions, and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the

Solicitation

Each of Akerna, Gryphon,

MJ Acquisition Corp. and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the stockholders of Akerna in connection with the proposed transactions. Information about the executive officers and directors of

Akerna are set forth in Akerna’s Definitive Proxy Statement on Schedule 14A relating to the 2022 Annual Meeting of Stockholders,

filed with the SEC on April 19, 2022. Other information regarding the interests of such individuals, who may be deemed to be participants

in the solicitation of proxies for the stockholders of Akerna, is set forth in the proxy statement/prospectus included in Akerna’s

registration statement on Form S-4 as filed with the SEC on May 12, 2023, as last amended on December 28, 2023. You may obtain free copies

of these documents as described above.

Cautionary Statements

Regarding Forward-Looking Statements

This Current Report on

Form 8-K contains forward-looking statements based upon the current expectations of Gryphon and Akerna. Actual results and the timing

of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties,

which include, without limitation: (i) the risk that the conditions to the closing of the proposed transactions are not satisfied, including

the failure to timely obtain stockholder approval for the transactions, if at all; (ii) uncertainties as to the timing of the consummation

of the proposed transactions and the ability of each of Akerna, Gryphon and MJ Acquisition Co. to consummate the proposed merger or asset

sale, as applicable; (iii) risks related to Akerna’s ability to manage its operating expenses and its expenses associated with the

proposed transactions pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental

or quasi-governmental entity necessary to consummate the proposed transactions; (v) the risk that as a result of adjustments to the exchange

ratio, Akerna stockholders and Gryphon stockholders could own more or less of the combined company than is currently anticipated; (vi)

risks related to the market price of Akerna’s common stock relative to the exchange ratio; (vii) unexpected costs, charges or expenses

resulting from either or both of the proposed transactions; (viii) potential adverse reactions or changes to business relationships resulting

from the announcement or completion of the proposed transactions; (ix) risks related to the inability of the combined company to obtain

sufficient additional capital to continue to advance its business plan; (x) risks associated with the possible failure to realize certain

anticipated benefits of the proposed transactions, including with respect to future financial and operating results and (xi) risks related

to the Panel not granting additional time for Akerna to regain compliance with the listing rules and Akerna being suspended and delisted

from The Nasdaq Capital Market. Actual results and the timing of events could differ materially from those anticipated in such forward-looking

statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic

filings with the SEC, including the factors described in the section titled “Risk Factors” in Akerna’s Annual Report

on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each filed

with the SEC, and in other filings that Akerna makes and will make with the SEC in connection with the proposed transactions, including

the proxy statement/prospectus described under “Additional Information and Where to Find It.” You should not place undue reliance

on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements.

Except as required by law, Akerna and Gryphon expressly disclaim any obligation or undertaking to update or revise any forward-looking

statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances

on which any such statements are based.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Dated: December 29, 2023 |

AKERNA CORP. |

| |

|

| |

By: |

/s/ Jessica Billingsley |

| |

|

Name: |

Jessica Billingsley |

| |

|

Title: |

Chief Executive Officer |

4

v3.23.4

Cover

|

Dec. 28, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity File Number |

001-39096

|

| Entity Registrant Name |

AKERNA CORP.

|

| Entity Central Index Key |

0001755953

|

| Entity Tax Identification Number |

83-2242651

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1550 Larimer Street

|

| Entity Address, Address Line Two |

#246

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

888)

|

| Local Phone Number |

932-6537

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

KERN

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

KERNW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=KERN_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

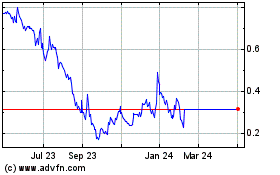

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Oct 2024 to Nov 2024

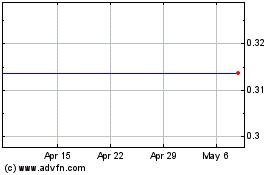

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Nov 2023 to Nov 2024