Adeia Successfully Completes Second Debt Repricing in Past 8 Months

January 30 2025 - 4:05PM

Adeia Inc. (Nasdaq: ADEA), the company whose patented innovations

enhance billions of devices and shape the way the world explores

and experiences entertainment, today announced the successful

repricing of its Term Loan B, thereby reducing its future interest

expense. The repricing lowers the applicable fixed interest rate by

50 basis points on the company’s Term Loan B remaining balance of

approximately $487.1 million. The new interest rate is SOFR + 250

basis points. There is no change to the original June 2028 maturity

date and all other terms remain substantially unchanged. The

company estimates that repricing will reduce the annual cash

interest expense by approximately $2.4 million.

“One of our top priorities has been to strengthen

our balance sheet and lower our interest expense through

accelerated debt repayments,” said Keith A. Jones, chief financial

officer of Adeia. “Since we began operating as an independent

company in October of 2022, we have paid down $272.3 million on our

Term Loan B. We are very pleased to have completed our second

repricing in the past 8 months, as favorable market conditions and

our highly cash generative business model have again provided an

opportunity for us to improve our cost structure by reducing our

annual interest costs by $2.4 million.”

About Adeia Inc.

Adeia is a leading R&D and intellectual

property (IP) licensing company that accelerates the adoption of

innovative technologies in the media and semiconductor industries.

Adeia’s fundamental innovations underpin technology solutions that

are shaping and elevating the future of digital entertainment and

electronics. Adeia’s IP portfolios power the connected devices that

touch the lives of millions of people around the world every day as

they live, work and play. For more, please visit www.adeia.com.

Safe Harbor Statement

This press release contains “forward-looking statements” within

the meaning of the federal securities laws, including Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on information available to the Company as of

the date hereof, as well as the Company’s current expectations,

assumptions, estimates and projections that involve risks and

uncertainties. In this context, forward-looking statements often

address expected future business, financial performance and

financial condition, and often contain words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “see,”

“will,” “may,” “would,” “might,” “potentially,” “estimate,”

“continue,” “target,” similar expressions or the negatives of these

words or other comparable terminology that convey uncertainty of

future events or outcomes. All forward-looking statements by their

nature address matters that involve risks and uncertainties, many

of which are beyond the Company’s control, and are not guarantees

of future results. Forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results to

differ materially from those expressed in any forward-looking

statements. Accordingly, there are or will be important factors

that could cause actual results to differ materially from those

indicated in such statements and, therefore, you should not place

undue reliance on any such statements and caution must be exercised

in relying on forward-looking statements. Important risk factors

that may cause such a difference include, but are not limited to:

the Company’s ability to implement its business strategy; the

Company’s ability to enter into new and renewal license agreements

with customers on favorable terms; the Company’s ability to retain

and hire key personnel; uncertainty as to the long-term value of

the Company’s common stock; legislative, regulatory and economic

developments affecting the Company’s business; general economic and

market developments and conditions; the Company’s ability to grow

and expand its patent portfolios; changes in technology and

development of new technology in the industries in which in which

the Company operates; the evolving legal, regulatory and tax

regimes under which the Company operates; unforeseen liabilities

and expenses; risks associated with the Company’s indebtedness; the

Company’s ability to achieve the intended benefits of, and its

ability to recognize the anticipated tax treatment of, the spin-off

of its product business; unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, natural disasters and

future outbreaks or pandemics, each of which may have an adverse

impact on the Company’s business, results of operations, and

financial condition. These risks, as well as other risks associated

with the Company’s business, are more fully discussed in the

Company’s filings with the U.S. Securities and Exchange Commission

(“SEC”), including the Company’s Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. While the list of factors presented

here is, and the list of factors presented in the Company’s filings

with the SEC are, considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional

obstacles to the realization of forward-looking statements.

Causes of material differences in results as compared with those

anticipated in the forward-looking statements could include, among

other things, business disruption, operational problems, failure to

complete licensing arrangements on anticipated terms and timeline,

failure to prevail in litigation we may bring against third

parties, financial loss, legal liability to third parties and

similar risks, any of which could have a material adverse effect on

the Company’s consolidated financial condition, results of

operations, liquidity or trading price of common stock. The Company

does not assume any obligation to publicly provide revisions or

updates to any forward-looking statements, whether as a result of

new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities

and other applicable laws.

Investor Contact:Chris ChaneyVice President,

Investor RelationsIR@adeia.com

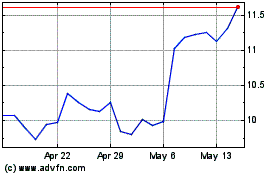

Adeia (NASDAQ:ADEA)

Historical Stock Chart

From Jan 2025 to Feb 2025

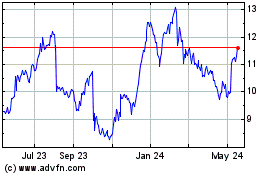

Adeia (NASDAQ:ADEA)

Historical Stock Chart

From Feb 2024 to Feb 2025