false000165064800016506482024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 13, 2024 |

4D Molecular Therapeutics Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39782 |

47-3506994 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5858 HORTON STREET #455 |

|

EMERYVILLE, California |

|

94608 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 510 505-2680 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

FDMT |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2024, 4D Molecular Therapeutics, Inc. (“4DMT”) announced its financial results for the three months ended September 30, 2024. A copy of 4DMT’s press release, titled “4DMT Reports Third Quarter 2024 Financial Results, Operational Highlights and Expected Upcoming Milestones” is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

4D MOLECULAR THERAPEUTICS, INC. |

|

|

|

|

Date: |

November 13, 2024 |

By: |

/s/ Uneek Mehra |

|

|

|

Uneek Mehra

Chief Financial and Business Officer |

Exhibit 99.1

4DMT Reports Third Quarter 2024 Financial Results, Operational Highlights

and Expected Upcoming Milestones

•Presented positive interim data for 4D-150 in wet age-related macular degeneration (wet AMD) from PRISM Phase 1/2 clinical trial highlighting robust and durable clinical activity across diverse patient populations and intraocular inflammation (IOI) profile numerically similar to approved anti-VEGF agents

•4D-150 4FRONT Phase 3 program in wet AMD designed to maximize probability of success, continues to be on track with 4FRONT-1 trial initiation expected in Q1 2025

•Continuing KOL engagement to expand awareness of the potential differentiated product profile of 4D-150

•Company product portfolio strategy and cash utilization updates, together with SPECTRA clinical trial program and interim data updates in diabetic macular edema (DME), expected in early January 2025

•$551 million in cash, cash equivalents and marketable securities as of September 30, 2024, expected to fund planned operations at least into H1 2027, with update expected as noted above in early January 2025

EMERYVILLE, Calif., November 13, 2024 (GLOBE NEWSWIRE) -- 4D Molecular Therapeutics (Nasdaq: FDMT, 4DMT or the Company), a leading clinical-stage genetic medicines company focused on unlocking the full potential of genetic medicines to treat large market diseases, today reported third quarter 2024 financial results, provided operational highlights and outlined expected upcoming milestones.

“Throughout 2024, 4DMT has generated compelling Phase 1/2 data and executed on Phase 3 preparations for 4D-150 in wet AMD in support of our mission to bring transformative genetic medicines to patients globally. We have built an experienced clinical and commercial team to execute this mission, including with the upcoming initiation of the 4FRONT Phase 3 program expected in Q1 2025,” said David Kirn, M.D., Co-founder and Chief Executive Officer of 4DMT. “In September, we hosted our 4D-150 Wet AMD Development Day, where we presented positive interim data demonstrating the impressive tolerability and clinical activity of 4D-150 and showcased its potential across multiple populations, from the most severe to recently diagnosed patients. The strong data and enthusiastic feedback from our advisors, clinical trial investigators, the retina physician community and the FDA support pivotal development of 4D-150 in the treatment naïve wet AMD population. We believe that these clinical data and this trial design will enable rapid enrollment and achieve positive topline data in the 4FRONT Phase 3 studies.”

Recent Corporate Highlights

•Bolstered Senior Ophthalmology Leadership Team:

oDhaval Desai, PharmD, joined as Chief Development Officer; overseeing late-stage product development, Medical Affairs, Scientific Communications, Regulatory and Quality operations. Dr. Desai was most recently SVP & Chief Development Officer at Iveric Bio (an Astellas company), where he led development and approval of IZERVAY

oChristopher Simms joined as Chief Commercial Officer; overseeing Pre-commercial and Commercial organizations and pre-launch preparations and development. Mr. Simms was most recently SVP & Chief Commercial Officer at Iveric Bio (an Astellas company), where he led commercial strategy and execution for the launch of IZERVAY

oCarlos Quezada-Ruiz, M.D., FASRS, joined as SVP, Therapeutic Area Head, Ophthalmology; leading the Ophthalmology franchise and overseeing early- and late-stage clinical development. Dr. Quezada-Ruiz was most recently Group Medical Director, Ophthalmology at Genentech, where he led clinical development and approval of VABYSMO and SUSVIMO

•Formed Ophthalmology Advisory Board comprised of world-renowned retina specialists and thought leaders to support development strategy and registration across large market ophthalmology indications including wet AMD, DME, diabetic retinopathy, and geographic atrophy: Dr. Arshad Khanani (Chair), Dr. David Boyer, Dr. Frank Holz, Dr. Anat Loewenstein and Dr. Dante Pieramici

•Expanded Scientific Advisory Board with Three New Members:

oJohn P. Atkinson, M.D., is Samuel B. Grant Professor of Clinical Medicine at Washington University Division of Biology and Biomedical Sciences. He is a leading expert in rheumatology and innate immunity, specifically the complement system’s role in infectious, autoimmune and inflammatory diseases

oNapoleone Ferrara, M.D., is currently Distinguished Professor of Pathology and Adjunct Professor of Ophthalmology and Pharmacology at University of California, San Diego. He is also the Hildyard Endowed Chair in Eye Disease. His main research interests are the biology of angiogenesis and its regulators. His discovery of VEGF as a key mediator of angiogenesis associated with intraocular neovascular syndromes resulted in the clinical development of ranibizumab, which was approved as the first therapy for wet AMD. He was awarded the Lasker–DeBakey Clinical Medical Research Award in 2010

oWenchao Song, Ph.D., is a Professor of Pharmacology in the Department of Systems Pharmacology and Translational Therapeutics at the Perelman School of Medicine of the University of Pennsylvania. Dr. Song is an internationally renowned expert on complement biology. His research group pioneered studies of mouse models of complement-mediated diseases. His work has helped reveal fundamental knowledge of how complement is regulated in vivo, with translational relevance to anti-complement therapeutics

oMore details on our members can be found in the SAB section of our website

Recent Highlights in Large Market Ophthalmology Portfolio

oPresented positive interim data from the ongoing PRISM Phase 1/2 clinical trial at 4D-150 Wet AMD Development Day:

▪Robust and durable reduction in anti-VEGF injection treatment burden observed in all populations studied with the planned Phase 3 dose (3E10 vg/eye) through up to 52 weeks, including overall reduction of 83% in severe population and Kaplan-Meier method estimated 52-week injection-free rates of 70% and 87% in broad and recently diagnosed populations, respectively

▪Strong and sustained disease control achieved: stable retinal anatomy with fewer fluctuations and stable visual acuity

▪4D-150 continues to be safe and well tolerated with rate of IOI numerically similar to that reported for approved anti-VEGF agents and 99% of patients completing topical steroid prophylaxis taper on schedule

oPresented design of 4FRONT-1 Phase 3 clinical trial at its 4D-150 Wet AMD Development Day:

▪First study in global 4FRONT Phase 3 development program comparing a single dose of 4D-150 3E10 vg/eye to on-label aflibercept 2mg Q8 weeks

▪Eligibility criteria: 1) Patients must be both recently diagnosed and treatment naïve wet AMD patients, and 2) Randomization requires on study demonstration of aflibercept responsiveness

▪Supplemental aflibercept injection criteria for 4D-150 arm optimized to protect primary BCVA endpoint and to maximize reduction of supplemental treatment burden; criteria to be disclosed prior to trial initiation. No supplemental injections allowed in control arm

▪Study design has been aligned with feedback from U.S. Food and Drug Administration (FDA) under RMAT designation

▪Alignment ongoing with European Medicines Agency under PRIME designation

Recent Highlights in Other Pipeline Programs

•4D-710 for Cystic Fibrosis (CF) Lung Disease:

oPresented preclinical data for 4D-710 in combination with CFTR modulators in a poster presentation at the 2024 North American Cystic Fibrosis Conference

oEnrollment continues in AEROW Phase 1 clinical trial

•4D-310 for Fabry Disease Cardiomyopathy:

oFDA removed clinical hold on the Phase 1/2 INGLAXA clinical trial for 4D-310 in Fabry disease cardiomyopathy; trial resumption underway

Expected Upcoming Milestones in Large Market Ophthalmology Portfolio

o52-week interim data from Phase 2b cohort of PRISM clinical trial expected in February 2025

o4FRONT-1 Phase 3 clinical trial initiation expected in Q1 2025

oSPECTRA clinical trial program and interim data updates expected in early January 2025

•4D-175 for Geographic Atrophy:

oPhase 1 enrollment expected to begin in Q1 2025

Expected Upcoming Milestones in Other Pipeline Programs

•4D-710 for CF Lung Disease:

oInterim data and program update from AEROW clinical trial is expected in mid-2025

•4D-725 for Alpha-1-Antitrypsin Deficiency Lung Disease:

oProgram update expected in early January 2025

•4D-310 for Fabry Disease Cardiomyopathy:

oInterim data and program update expected in 2025

•4D-110 for Choroideremia and 4D-125 for X-Linked Retinitis Pigmentosa:

oProgram updates expected in early January 2025

Q3 2024 Financial Results

Cash position: Cash, cash equivalents and marketable securities were $551 million as of September 30, 2024. We currently expect cash, cash equivalents and marketable securities to be sufficient to fund planned operations at least into the first half of 2027.

R&D Expenses: Research and development expenses were $38.5 million for the third quarter of 2024, as compared to $25.1 million for the third quarter of 2023. This increase was driven by the progression of our existing clinical trials, primarily Phase 2 4D-150 trials in wet AMD and DME, along with increased payroll and stock-based compensation expense due to higher headcount.

G&A Expenses: General and administrative expenses were $12.7 million for the third quarter of 2024, as compared to $9.1 million for the third quarter of 2023.

Net Loss: Net loss was $43.8 million for the third quarter of 2024, as compared to net loss of $10.3 million for the third quarter of 2023.

About 4DMT

4DMT is a leading clinical-stage genetic medicines company focused on unlocking the full potential of genetic medicines to treat large market diseases in ophthalmology and pulmonology. 4DMT’s proprietary invention platform, Therapeutic Vector Evolution, combines the power of the Nobel Prize-winning technology, directed evolution, with approximately one billion synthetic AAV capsid-derived sequences to invent customized and evolved vectors for use in our wholly owned and partnered product candidates. Our product design, development, and manufacturing engine helps us efficiently create and advance our diverse product pipeline with the goal of revolutionizing medicine with potential curative therapies for millions of patients. Currently, 4DMT is advancing six clinical-stage and one preclinical product candidate, each tailored to address rare and large market diseases in ophthalmology, pulmonology and cardiology. In addition, 4DMT is also advancing programs in CNS through a gene editing partnership. 4D Molecular Therapeutics™, 4DMT™, Therapeutic Vector Evolution™, and the 4DMT logo are trademarks of 4DMT.

All of our product candidates are in clinical or preclinical development and have not yet been approved for marketing by the U.S. Food and Drug Administration (FDA) or any other regulatory authority. No representation is made as to the safety or effectiveness of our product candidates for the therapeutic uses for which they are being studied.

Learn more at www.4DMT.com and follow us on LinkedIn.

Forward Looking Statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, without limitation, implied and express statements regarding the therapeutic potential and clinical benefits of, as well as the plans, announcements and related timing for the clinical development of, 4DMT’s product candidates, and statements regarding our financial performance, results of operations and anticipated cash runway. The words "may," “might,” "will," "could," "would," "should," "expect," "plan," "anticipate," "intend," "believe," “expect,” "estimate," “seek,” "predict," “future,” "project," "potential," "continue," "target" and similar words or expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward looking statements in this press release are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and important factors that may cause actual events or results to differ materially from those expressed or implied by any forward-looking statements contained in this press release, including risks and uncertainties that are described in greater detail in the section entitled "Risk Factors" in 4D Molecular Therapeutics’ most recent

Quarterly Report on Form 10-Q to be filed on or about the date hereof, as well as any subsequent filings with the Securities and Exchange Commission. In addition, any forward-looking statements represent 4D Molecular Therapeutics' views only as of today and should not be relied upon as representing its views as of any subsequent date. 4D Molecular Therapeutics explicitly disclaims any obligation to update any forward-looking statements. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements.

4D Molecular Therapeutics, Inc.

Statements of Operations

(Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration and license revenue |

|

$ |

3 |

|

|

$ |

20,204 |

|

|

$ |

36 |

|

|

$ |

20,742 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

38,484 |

|

|

|

25,066 |

|

|

|

98,212 |

|

|

|

71,068 |

|

General and administrative |

|

|

12,651 |

|

|

|

9,112 |

|

|

|

33,548 |

|

|

|

25,889 |

|

Total operating expenses |

|

|

51,135 |

|

|

|

34,178 |

|

|

|

131,760 |

|

|

|

96,957 |

|

Loss from operations |

|

|

(51,132 |

) |

|

|

(13,974 |

) |

|

|

(131,724 |

) |

|

|

(76,215 |

) |

Other income, net |

|

|

7,289 |

|

|

|

3,718 |

|

|

|

20,527 |

|

|

|

7,661 |

|

Net loss |

|

$ |

(43,843 |

) |

|

$ |

(10,256 |

) |

|

$ |

(111,197 |

) |

|

$ |

(68,554 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.79 |

) |

|

$ |

(0.24 |

) |

|

$ |

(2.08 |

) |

|

$ |

(1.81 |

) |

Weighted-average shares outstanding used in computing net loss per share, basic and diluted |

|

|

55,554,476 |

|

|

|

42,256,629 |

|

|

|

53,377,712 |

|

|

|

37,884,363 |

|

4D Molecular Therapeutics, Inc.

Balance Sheet Data

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and marketable securities |

|

$ |

550,671 |

|

|

$ |

299,186 |

|

Total assets |

|

|

604,028 |

|

|

|

339,891 |

|

Total liabilities |

|

|

51,080 |

|

|

|

32,062 |

|

Accumulated deficit |

|

|

(526,524 |

) |

|

|

(415,327 |

) |

Total stockholders’ equity |

|

|

552,948 |

|

|

|

307,829 |

|

Contacts:

Media:

Katherine Smith

Inizio Evoke Comms

Media@4DMT.com

Investors:

Julian Pei

Head of Investor Relations and Corporate Finance

Investor.Relations@4DMT.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

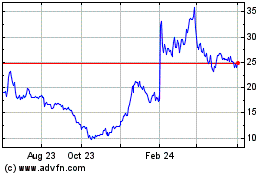

4D Molecular Therapeutics (NASDAQ:FDMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

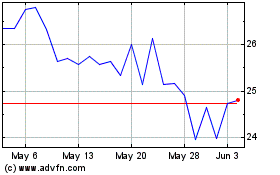

4D Molecular Therapeutics (NASDAQ:FDMT)

Historical Stock Chart

From Nov 2023 to Nov 2024