S&P Global Upgrades Vallourec’s Long Term Issuer Credit Rating to 'BB-' with Positive Outlook

March 06 2023 - 12:39PM

S&P Global Upgrades

Vallourec’s Long Term Issuer Credit Rating

to 'BB-' with Positive Outlook

Meudon (France),

6 March

2023 – S&P Global has

upgraded Vallourec’s long-term issuer credit rating to 'BB-' from

‘B+’ with a positive outlook.

S&P Global affirmed the 'BB-' issue rating

on its senior unsecured notes as well as the 'B' rating on its

commercial paper program.

S&P Global’s positive outlook reflects its

expectation of higher EBITDA in 2023 vs. 2022 and a reduction in

net debt in the coming years, in line with Vallourec’s latest

published financial objectives of:

- An improvement in EBITDA in 2023

year-over-year, driven by both the Tubes business and Mine and

Forest business

- An objective of being Free Cash

Flow positive for the Full Year 2023, despite CAPEX of around 220

million euros and the expected one-time New Vallourec restructuring

cash outflows of about 350 million euros (a)7

- Further Net

Debt reduction in 2023 (b)

Philippe Guillemot, Chairman of the Board of Directors,

and Chief Executive Officer declared:

“We are delighted with this latest credit rating

upgrade which further vindicates the success of our New Vallourec

strategic plan. In particular we made strong progress in net debt

reduction in the fourth quarter of 2022, and this will continue in

the next two years, on the way towards an objective zero net debt

at the latest end of FY 2025”.

On February 3, 2021 Vallourec communicated a net

leverage objective of 2.5x by FY 2022, and 1.2x by FY 2025 (c). At

the end of FY 2022 net leverage actually stood at 1.6x.

About Vallourec

Vallourec is a world

leader in premium tubular solutions for the energy markets and for

demanding industrial applications such as oil & gas wells in

harsh environments, new generation power plants, challenging

architectural projects, and high-performance mechanical equipment.

Vallourec’s pioneering spirit and cutting edge R&D open new

technological frontiers. With close to 16,000 dedicated and

passionate employees in more than 20 countries, Vallourec works

hand-in-hand with its customers to offer more than just tubes:

Vallourec delivers innovative, safe, competitive and smart tubular

solutions, to make every project possible.

Listed on Euronext in

Paris (ISIN code: FR0013506730, Ticker VK), Vallourec is part of

the CAC Mid 60, SBF 120 and Next 150 indices and is eligible for

Deferred Settlement Service. In the United States, Vallourec has

established a sponsored Level 1 American Depositary Receipt (ADR)

program (ISIN code: US92023R4074, Ticker: VLOWY). Parity between

ADR and a Vallourec ordinary share has been set at 5:1.

Financial

Calendar

|

May

17th 2023

May 25th 2023

September 12th

2023 |

First Quarter 2023 results Ordinary and Extraordinary Shareholders’

Meeting Capital Markets Day in London |

For further information, please

contact:

| Investor

relations Investor.relations@vallourec.com |

Press

relations Héloïse RothenbühlerTel: +33 (0)1 41 03 77

50 heloise.rothenbuhler@vallourec.com

|

| Individual

shareholdersToll Free Number (from France): 0 800 505 110

actionnaires@vallourec.com |

|

a Free Cash Flow defined as EBITDA adjusted for changes in

provisions, less Interest and Tax Payments, changes in Working

Capital, less Capex, and less Restructuring/Other Cash Outflowsb

Change in Net Debt defined as Free Cash Flow less Asset

Disposals/Otherc Net Leverage is defined as: Net debt at end of

period / last 12 months EBITDA

- Vallourec-press-release - SP Upgrades Vallourec Long-Term

Issuer Credit Rating to 'BB-' with Positive Outlook

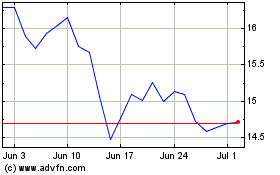

Vallourec (EU:VK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vallourec (EU:VK)

Historical Stock Chart

From Jan 2024 to Jan 2025