- H1 2024 revenue of €4.2 million, in line with annual

guidance close to €8 million

- Strong gross margin maintained at 71%

- H1 2024 EBITDA breakeven

- Solid cash position of €4.5 million as of June 30,

2024

Regulatory News:

ALCHIMIE (FR0014000JX7 – ALCHI – PEA-PME eligible), a

channel factory enabling brands, media and companies to create,

design and animate their own themed video channels and stream their

video contents, today announces its consolidated half-year results

as of June 30, 2024.

Pauline Grimaldi d’Esdra, CEO of Alchimie, states: "The

evolution of Alchimie's historical business model in 2023 towards

SaaS and VPaaS (Video Platform as a Service) businesses has been

slow to bear fruit. Nevertheless, we are reporting revenue

exceeding €4.2 million, in line with our forecasts at the start of

the year along with positive EBITDA for the first half of the year.

The end of 2024 will be highlighted by accelerated roll-out of our

new offerings, such as the launch of Maisonsdumonde+. We confirm

our annual revenue target of approximately €8 million, while

carefully maintaining a reasonable cost structure to secure both

our margins and cash position".

Consolidated income statement (IFRS)

In thousands of euros

06.30.2024

06.30.2023

Revenue

4,239

6,214

Cost of sales

(1,250)

(2,441)

Gross margin

(2,989)

3,773

Technology and development costs

(1,578)

(1,622)

Marketing and sales expenses

(691)

(723)

General and administrative expenses

(1,404)

(2,137)

Operating income

(684)

(709)

Financial result

76

3

Consolidated net income

(737)

(845)

EBITDA

31

325

Cash position end of period

4,513

6,189

First-half 2024 revenue and financial results

As of June 30, 2024, revenue stood at €4.2 million, compared to

€6.2 million as of June 30, 2023, a level of activity in line with

the guidance announced earlier this year. Alchimie continued to

benefit from the residual historical subscriber base in France and

Germany. However, the results of the strategic shift towards

marketing of the new SaaS and VPaaS offerings, videowall and

42videobricks, fell below the Company's expectations, with a

slower-than-expected rollout.

The ongoing streamlining of content licensing and technical

costs incurred in the Video segment has enabled Alchimie to

significantly reduce its cost of sales, down 49% compared to the

first half of 2023, at €1.3 million. The gross margin rate stands

at 71%, higher than the one recorded as of June 30, 2023, following

the reversal of certain provisions which had a positive impact.

Operating expenses dropped by 18% to €3.7 million as of June 30,

2024, compared to €4.5 million a year earlier. More specifically,

Alchimie reports a moderate decrease in technology and development

costs (-3%) and in marketing and sales expenses (-4%), while

general and administrative expenses fell more sharply to €1.4

million, a reduction of around 34%.

As a result of all the measures taken by Alchimie to ensure

strict and controlled cost management, EBITDA remained positive at

the end of June 2024 (€31k), compared to €326k a year earlier.

Operating income remained stable, with a loss of €0.7 million, a

level similar to that at June 30, 2023.

After incorporating financial income of €76k, the consolidated

net loss came to -€0.7 million, compared to -€0.8 million at the

end of June 2023.

Financial situation of the Group

Consolidated shareholders' equity stood at -€3.8 million as of

June 30, 2024, down €0.9 million over the half-year. This change is

mainly due to the loss of €0.7 million incurred during the first

half of 2024.

The cash position stood at €4.5 million as of June 30, 2024,

compared to €5.3 million as of December 31, 2023, a decrease of

€0.8 million.

In terms of financial resources, and given its current cash

position, Alchimie is maintaining rigorous cost management to

preserve cash, and does not plan to call on the market.

Strategy and outlook

Alchimie continues to review its business portfolio to explore

all commercial and financial opportunities. The end of 2024 will

also be marked by the continued rollout of videowall and

42videobricks offerings, aimed at monetizing Alchimie's

technical assets. At the same time, the Company will continue to

implement new features to maintain its technological leadership and

provide its customers with an increasingly comprehensive and

intuitive solution.

Since September, we can highlight the launch of Maisonsdumonde+,

part of the Maisons du Monde Group's new loyalty program. This

latter offers top-tier customers a tailor-made experience,

combining proximity and emotion to enhance brand loyalty. Among the

initiatives introduced, the retailer has launched a streaming

platform offering over 50 hours of exclusive content, including

home decorating tutorials, committed documentaries, interior design

programs and collaborations with influential personalities in the

interior design sector.

Given the current outlook, with revenues from new activities

unable to offset the decline in revenues generated by the

historical subscriber base, the Company confirms its target of

achieving close to €8 million in revenues for 2024. Despite ongoing

efforts to optimize overhead costs, Alchimie does not expect to

generate positive EBITDA in 2024.

Alchimie publishes its 2024 half-year financial report today,

which is available on its website in the Documentation section:

www.alchimie-finance.com.

***

Next financial release: full-year 2024 revenue, on

January 30, 2025 after market close.

About Alchimie Alchimie is a unique video streaming

platform allowing companies and creators to build their own video

channel, their internal communication media, and partners. Alchimie

also offers 42videobricks, the SaaS access to the technological

building blocks (via API) for operating video and streaming

functions. Alchimie has a catalog of video content from more than

300 prestigious partners (Arte, France TV distribution, ZDF

Entreprises or Zed). For further information :

www.alchimie-finance.com / www.alchimie.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023898938/en/

Alchimie Pauline Grimaldi d’Esdra CEO

investors@alchimie.com

NewCap Thomas Grojean/Aurélie Manavarere Investor

Relations alchimie@newcap.eu 01 44 71 94 94

NewCap Nicolas Merigeau Media Relations

alchimie@newcap.eu 01 44 71 94 98

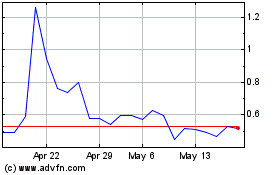

Alchimie (EU:ALCHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alchimie (EU:ALCHI)

Historical Stock Chart

From Nov 2023 to Nov 2024