XRP Transactions Fall, But Active Wallets And DeFi Liquidity Tell A Different Story

October 23 2024 - 3:30AM

NEWSBTC

XRP, the sixth largest cryptocurrency by market capitalization, has

seen an interesting trend in its transaction activity, despite a

few notable declines in other metrics. A recent analysis by a

CryptoQuant analyst, Wenry, sheds light on key trends within the

XRP ecosystem, offering insights into the activity happening behind

the scenes. The analyst particularly revealed where XRP

transactions are used by category activity. Related Reading: XRP

Price Stays Range-Bound: Will It Soon Make a Move? XRP

Transactions: Decline in NFT Activity And Rise in DEX Volume

According to Wenry, XRP’s daily transaction volume has been

“competitive with major Layer 1 networks,” showing that XRP’s

Ledger remains highly active, even though it is less known to

retail investors than other blockchain networks. In his analysis

posted on the CryptoQuant QuickTake platform, Wenry highlighted

that between September 15 and October 15, 2023, the creation of new

wallets on the XRP Ledger increased by 10.39%, reaching a total of

18,321 new accounts. However, total transactions on the network

fell by 17.57% to 18.82 million, and payments dropped by 26.16% to

6.81 million. Despite these declines, the number of active wallets

on XRPL increased by 14.19%, indicating sustained user engagement

with the platform. These numbers suggest that while fewer

transactions are being processed, the active user base continues to

grow. Wenry’s analysis explored on-chain activity related to token

trading and decentralized exchange (DEX) volume. While total trades

on the XRP Ledger dropped by 6.83%, decentralized exchange volume

increased by 17.64%, from $3.91 million to $4.60 million. This

shift suggests that despite a slight decrease in overall trading,

more activity occurred on decentralized platforms, demonstrating

continued interest in decentralized finance (DeFi) solutions on the

XRP Ledger. Regarding non-fungible tokens (NFTs), the analysis

showed a significant decline in NFT-related activities on the XRPL.

NFTokenMint, which tracks new NFTs created on the network, dropped

by 70.66%, from 65,021 to 19,076. Similarly, NFTokenAcceptOffer,

which represents the acceptance of offers to buy NFTs, fell by

30.88%. Despite these declines, NFTokenCancelOffer, a metric that

tracks canceled NFT transactions, slightly increased by 0.20%,

indicating that while fewer NFTs were being minted or traded, some

stability remained in the broader NFT ecosystem. AMM Liquidity and

Increased Participation A key highlight of the analysis was the

strong growth in Automated Market Maker (AMM) liquidity on the XRP

Ledger. AMM-related metrics saw considerable increases, with

AMMDeposit rising by 62.35%, AMMCreate increasing by 143.10%, and

AMMWithdraw climbing by 42.97%. These increases reflect rising

confidence in the liquidity pools on the XRPL, as more participants

provide liquidity and create new pools. The surge in AMMCreate,

which jumped from 58 to 141, suggests that more users are

participating in liquidity provision on the network. Related

Reading: XRP Network Activity Surges As Price Seeks To Break $0.55

Resistance However, one area of decline in AMM-related activity was

the AMMBid, which dropped by 81.82%. Despite this decrease, the

overall rise in liquidity deposits and the creation of new pools

indicate that the XRP Ledger’s decentralized liquidity offerings

remain strong. According to Wenry, these metrics highlight the

growing trust in existing liquidity pools and the broader AMM

ecosystem on the XRP Ledger. Featured image created with DALL-E,

Chart from TradingView

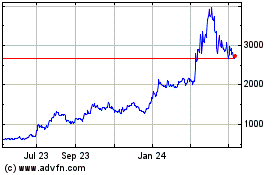

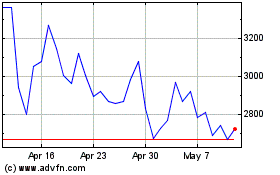

Maker (COIN:MKRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Maker (COIN:MKRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024