CoinShares Predicts $141,000 Bitcoin Price, Forecasts $14.4 Billion Inflows From ETFs

November 17 2023 - 5:00PM

NEWSBTC

In a recently published report by CoinShares, analyst James

Butterfill delves into the relationship between inflows into

Bitcoin exchange-traded funds (ETFs) and changes in the Bitcoin

price. The report addresses the critical question of how much

inflow into ETFs could be anticipated upon launching a Bitcoin spot

ETF in the US and the potential impact of these flows on the

Bitcoin Price. Bitcoin ETFs Could Attract $14.4 Billion Inflows

Butterfill highlights Galaxy’s analysis, which estimates that the

United States has approximately $14.4 trillion in addressable

assets. Assuming a conservative scenario where 10% of these assets

invest in a spot Bitcoin ETF with an average allocation of 1%, it

could result in approximately $14.4 billion of inflows within the

first year. Per the report, this would mark the largest

inflows on record, surpassing 2021’s inflows of $7.24 billion,

which accounted for 11.5% of assets under management (AuM).

However, it is worth noting that in 2020, inflows reached $5.5

billion, representing a higher 21.6% of AuM, while Bitcoin’s price

surged by 303% compared to 60% in 2021. Related Reading: Dogecoin

Jumps 10%, But This Signal Could Bring Rally To A Stop The report

suggests a correlation between inflows as a percentage of AuM and

price changes. Inflows coincide with rising prices, indicating that

many ETF investors engage in momentum trading. Conversely, during

periods of price stagnation, inflows have tended to moderate.

However, it is important to note that exchange-traded product (ETP)

investors do not necessarily lead price action, as evidenced by

volume data indicating that ETP volumes represent an average of

3.5% of daily Bitcoin trading turnover on trusted exchanges since

2018. Bitcoin Price Surge Predicted By analyzing weekly ETP flows

and their percentage of AuM, the report identifies a trend with a

coefficient of determination (R2 ) value of 0.31, suggesting a

discernible relationship between flows and price changes.

Utilizing this trendline, the report estimates that the

aforementioned $14.4 billion of inflows could potentially drive the

price of Bitcoin up to $141,000 per coin. Nevertheless, accurately

predicting the precise level of inflows upon the launch of spot

ETFs remains challenging. The report acknowledges the difficulty in

determining the exact magnitude of inflows. It emphasizes

that regulatory approval and corporate acceptance are gradual

processes due to Bitcoin’s perceived complexity, which may require

corporations and funds to build knowledge and confidence before

committing to investment. Related Reading: Cardano Breakout Of Epic

Proportions: Analyst Predicts 1600% Rally To $6.5 The potential

wall of demand that could materialize following the introduction of

a spot-based ETF is uncertain. While such ETFs offer portfolio

diversification and enhanced Sharpe ratios, regulatory approval and

corporate adoption may take time due to perceived complexities

associated with Bitcoin. Ultimately, CoinShares believes that

Corporations and funds may require an extended period to

familiarize themselves with the asset class and gain confidence

before entering the market. All in all, the CoinShares report sheds

light on the potential impact of Bitcoin ETFs on the price of BTC.

While it is challenging to precisely determine the level of inflows

and their subsequent effect on the market, the report suggests that

launching a Bitcoin spot ETF in the US could potentially drive the

price of Bitcoin to US$141,000 per coin. Currently, Bitcoin

(BTC) is consolidating above the significant psychological level of

$36,000. Over the past 24 hours, it has experienced a minimal

decrease of 0.2%, while showing a 1.3% increase within the 1-hour

time frame. Featured image from Shutterstock, chart from

TradingView.com

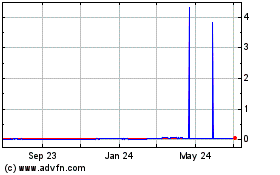

Gala (COIN:GALAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

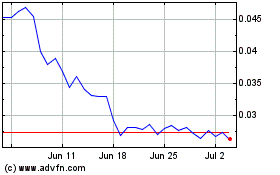

Gala (COIN:GALAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024