MicroStrategy’s Bitcoin Holdings Balloons Above $10 Billion, Here’s How Much Profit It Has Made

February 28 2024 - 12:00PM

NEWSBTC

MicroStrategy recently revealed that they had acquired an

additional 3,000 BTC this month, bringing its Bitcoin holdings to

193,000 BTC. Interestingly, BTC’s recent price surge caused these

holdings to cross the $10 billion mark, with the software company

currently sitting on a tremendous amount of unrealized

profits. MicroStrategy’s Unrealized Profit Reaches $5 Billion

As disclosed in the company’s filing with the Securities and

Exchange Commission (SEC), its BTC holdings have now been purchased

for an average price of $31,544. That means that MicroStrategy’s

Bitcoin investment is now at an unrealized profit of almost $5

billion, considering Bitcoin is trading just above $57,000.

Related Reading: Cardano Adoption Explodes: ADA Price Ready To

Reclaim $3.1 All-Time High? MicroStrategy’s ‘Bitcoin strategy,’

spearheaded by its co-founder Michael Saylor, began as far back as

2020 when the company started investing in the flagship crypto

token. Saylor saw this as a way to hedge against inflation and

diversify the company’s cash reserves. Since then, Saylor and his

company have continued to accumulate Bitcoin aggressively.

Saylor’s faith in Bitcoin was tested when the company’s investment

was at an unrealized loss during the height of the crypto winter

when BTC traded below the $30,000 price level. Despite that, Saylor

and MicroStrategy stayed true to their Bitcoin Strategy. Instead of

selling, they saw it as an opportunity to accumulate more BTC.

Saylor also recently made it clear that he and his company have no

intention of liquidating their BTC holdings anytime soon, stating

that “Bitcoin is the exit strategy.” This sentiment undoubtedly

provides a bullish narrative for the flagship crypto, especially

considering what could happen to the market if the company offloads

its Bitcoin. MicroStrategy is currently the largest corporate

holder of BTC and is leading the charge as institutional demand for

BTC continues to increase. This demand has mainly come from

the Spot Bitcoin ETFs, which together hold more BTC than

MicroStrategy combined. Spot Bitcoin ETFs Trading Volume

Surpass $2 Billion Again Bloomberg analyst Eric Balchunas revealed

that the newly listed Bitcoin ETFs once again surpassed the $2

billion mark on February 27. This was the second consecutive day

they achieved this, having recorded an all-time high of $2.4

billion in trading volume on February 26. Specifically, the world’s

largest asset manager, BlackRock, seems to be having a run of its

own. Related Reading: Crypto Analyst Predicts Dogecoin

Parabolic Breakout Above $3.5, Here’s When Balchunas noted that

BlackRock had broken its record again, with the iShares Bitcoin ETF

(IBIT) recording a trading volume of $1.3 billion on February 27.

The impressive demand for these funds is believed to be another

reason why BTC’s price has continued to rally. At the time of

writing, Bitcoin is trading at around $57,100, up in the last 24

hours, according to data from CoinMarketCap. BTC adds

over $2,000 in six hours | Source: BTCUSD on Tradingview.com

Featured image from Milk Road, chart from Tradingview.com

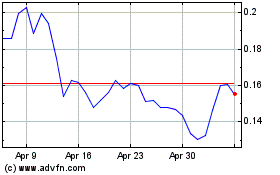

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024