Generali Lifts Dividend as Non-Life Business Boosts Profit -- Update

March 18 2016 - 4:53AM

Dow Jones News

By Giovanni Legorano

MILAN--Assicurazioni Generali SpA said Friday that it will lift

its dividend for 2015 after reporting higher full-year net profit

driven mainly by better results in its non-life business.

It plans to pay a dividend of EUR0.72 ($0.81) a share for 2015,

up from EUR0.60 a year earlier.

Europe's No. 3 insurer by premiums said net profit almost

quadrupled to EUR304 million in the fourth quarter, while over the

full year it was up 22% at EUR2 billion.

The company launched a new strategic plan in May last year for

the four years to 2018, hinging on a big commercial push in Europe,

Asia and Latin America to improve cash flow, with gains to be

returned to its shareholders through fatter dividends rather than

being spent on acquisitions.

At the time it said the combination of new measures should

generate cumulative net free cash flow of more than EUR7 billion

between 2015 and 2018, equivalent to around EUR1.8 billion a year.

Last year the company generated EUR1.2 billion in cash.

Late Thursday the insurer said it has appointed the head of its

Italian division, Philippe Donnet, as new chief executive, and

chief financial officer Alberto Minali as general manager,

confirming an earlier report by The Wall Street Journal. The new

executives will retain their current roles.

Mr. Donnet succeeds Mario Greco, who quit earlier this year to

head Zurich Insurance Group AG's after almost four years at the

helm.

He takes over at a time when financial market conditions make it

more difficult for insurers to generate attractive returns.

Europe's insurers and banks are grappling with tougher

regulations and low or negative interest rates in much of the

region. Those factors are putting pressure on finances and

squeezing profit margins amid volatile markets, with investors

jittery about the prospects for global economic growth.

"We have been appointed to implement the strategic plan. In its

implementation we will adapt to the conditions of the insurance and

financial markets," Mr. Donnet said when asked whether in the

future there could be changes to the insurer's four-year

strategy.

Generali said its operating result for the year rose 6% to

EUR4.79 billion, helped mainly by its non-life business, where

income grew by 9% from the previous year.

Mr. Minali said the company took an EUR88 million impairment in

the fourth quarter on its BTG Pactual stake but that part of that

write-down had already been recovered, the full effect of which

should be seen in the second quarter of this year.

He also said that market turbulence over the fourth quarter

forced the insurer to write down some stocks it holds in its

portfolio, further reducing its net profit for the period.

Generali's capital position also improved over last year to an

economic solvency ratio of 202%--a measure of an insurer's

financial solidity calculated with an internal model--compared with

186% at the end of 2014.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

March 18, 2016 04:38 ET (08:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

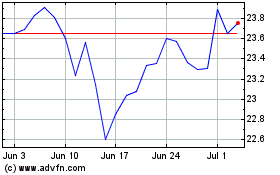

Generali (BIT:G)

Historical Stock Chart

From Jun 2024 to Jul 2024

Generali (BIT:G)

Historical Stock Chart

From Jul 2023 to Jul 2024