EUROPE MARKETS: European Stocks Extend Declines As Global Service Sector Slows; Airbus Climbs

October 03 2019 - 10:29AM

Dow Jones News

By Steve Goldstein, MarketWatch

Remy Cointreau shares rally as cognac is to be excluded from new

tariffs

European stocks on Thursday turned lower, as a disappointing

reading on the U.S. service sector reignited worries about the

global economy.

After suffering its worst single-day loss in nearly 11 months on

Wednesday, the Stoxx Europe 600 fell further, losing 0.8% to

374.87. Banks and energy producers paced the decline.

The French CAC 40 slipped 0.4% to 5398.55 while the U.K. FTSE

100 fell 1.6% to 7007.62.

The German market was closed for a holiday.

The Institute for Supply Management reported its worst

non-manufacturing index in three years, with a reading of 51.8%.

The final reading of eurozone services PMI for September was

revised lower to 51.6 from the initial 52 reading, and U.K.

services PMI fell into contraction territory as it fell to 49.5

from 50.6.

The bad data comes on top of news the U.S. will introduce fresh

tariffs on $7.5 billion of European Union goods following a World

Trade Organization victory.

"With markets already looking vulnerable over concerns about a

manufacturing recession starting to bleed into a slowdown in the

services sector, the timing of the WTO ruling could not have come

at a worse time for already jittery investors, along with the U.S.

response to apply tariffs to a wide range of goods including malt

whisky, French wines, and a range of food items, from October

18th," said Michael Hewson, chief market analysts at CMC Markets

UK.

Analysts at Jefferies said the new tariffs actually weren't as

bad as it feared for European alcoholic beverage makers. Remy

Cointreau (RCO.FR) shares jumped 5% and Pernod Ricard (RI.FR) rose

3.2%, as cognac, champagne and liqueurs from France were excluded

from the tariff list. Diageo (DGE.LN) and Campari (CPR.MI) shares

also rose.

Airbus (AIR.FR) was another gainer, rising 3.3%, as parts made

by one of its plants in Alabama will not be subject to new

sanctions. Analysts at Bank of America Merrill Lynch said investors

had feared 100% tariff rates instead of the 10% the U.S. government

will levy.

H&M (HM-B.SK) shares jumped 7% as the retail chain reported

a stronger-than-forecast profit.

(END) Dow Jones Newswires

October 03, 2019 10:14 ET (14:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

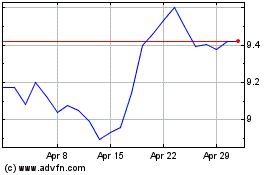

Davide Campari (BIT:CPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Davide Campari (BIT:CPR)

Historical Stock Chart

From Dec 2023 to Dec 2024