Recall Announces Facility Optimisation Program 2

June 21 2015 - 7:30PM

Business Wire

Provides M&A update

Confirms earnings guidance for FY15

Recall Holdings Limited (ASX: REC), a global leader in

information management, today announces the implementation of the

second Facility Optimisation Program (FOP 2), provides an update on

M&A activity, and confirms its earnings guidance for FY15.

Recall and Iron Mountain are working closely to prepare the

regulatory filings required in relation to the Scheme

Implementation Deed announced June 8, 2015, and progress is being

made in line with expectations. The investment programs, related

charges, expected EBITDA contribution from the items noted below,

and the anticipated FX impact on FY15 financial results are

included in the base business assumptions used by Iron Mountain

during the transaction due diligence process.

Facility Optimisation Program 2 (FOP

2)

FOP 2 builds upon the first Facility Optimisation Program (FOP

1) announced in June 2014, which is progressing well and in line

with the original plan. Since announcing FOP 1 and as communicated

in our H1 FY15 results, Recall has sought new opportunities that

will further improve facility utilisation, drive operational

efficiencies and reduce real estate costs. FOP 2 identifies such

opportunities in Australia, Brazil, France, Denmark and the United

Kingdom. It focuses on the Document Management Services (DMS)

service line and includes exiting 16 facilities and the development

of four new custom built facilities. Recall customers will not

experience any interruption to their service while FOP 2 is being

implemented, and the highest level of service and security will

continue to be provided. FOP 2 is due to be completed by September

2017.

Once fully implemented, FOP 2 will improve annual EBITDA by over

US$6.5 million, with savings mainly associated with reduced

property and operational costs. The EBITDA impact in FY16 will be

negligible, in FY17 it should be approximately US$4 million, with

the full US$6.5 million benefit realised in FY18 and beyond. This

program has targeted IRRs in excess of 20 percent.

A restructuring charge of approximately US$16 million will be

incurred in the period ended June 30, 2015 as a result of FOP 2.

The restructuring charge comprises a non-cash cost of approximately

US$5 million relating to surplus plant and equipment and net cash

costs of approximately US$11 million, which principally relate to

lease exit, relocation and other operational costs that will be

incurred during the course of FOP 2. Cash incentives of US$8

million, that are not considered part of the restructuring charge,

will be received as lease incentives for new facilities entered

during the course of FOP 2. Accordingly, excluding capex, the net

cash cost will be approximately US$1 million in FY16, with a total

net cash cost of US$3 million for the project.

FOP 2 will require capex investment of US$30 million, primarily

related to additional racking to accommodate the consolidated

holdings. Of this amount, US$22 million is expected to be incurred

prior to the end of FY16.

M&A update

In H2FY15, Recall has completed six acquisitions, with another

in Brazil scheduled to close at the end of June. These acquisitions

include three in the U.S., two in Australia and two in Brazil.

Purchase price consideration for the seven acquisitions will be

approximately US$67 million, and while these acquisitions will not

be material to FY15, they will contribute approximately US$27

million to FY16 revenue.

For the full 2015 financial year, Recall will have closed 13

acquisitions, for total purchase consideration of US$175 million,

which are expected to generate revenue in FY16 of US$58 million.

The average acquisition EBITDA multiple, post synergies, of these

transactions is less than 6.5x. Recall’s acquisition pipeline

remains strong and a number of deals consistent with our core

business strategy are at an advanced stage, and are expected to

close in the coming months.

Earnings guidance confirmation

Recall expects FY15 revenue growth, in constant currency terms,

to be approximately 7-8 percent, after adjusting for the disposal

of SDS Germany, which was owned by Recall for the first five months

of FY15. Consistent with guidance, FY15 EBITDA growth, in constant

currency, is expected to be approximately 10-12 percent, (8-10

percent excluding SDS Germany) with FY15 EBITDA expected to be

between US$215 million - US$220 million, in constant currency.

As expected, FY15 results on an actual FX basis will be

negatively impacted by approximately 7-9 percent, as compared to

constant currency, due to the significant strengthening of the USD

during FY15, primarily against the AUD, Euro and Brazilian

REAL.

About Recall

Recall is a global leader in information management solutions,

offering customers complete management of their physical and

digital information. Recall’s innovative solutions empower

organizations to make better business decisions throughout the

information lifecycle, while assuring regulatory compliance and

eliminating unnecessary resources, time and costs. Recall services

more than 80,000 customer accounts in over 300 dedicated

facilities, spanning five continents in 24 countries. For more

information, please visit recall.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150621005025/en/

For further information, please contact:Recall Holdings

LimitedInvestor RelationsBill Frith, +61 2 9582 0244Senior

Director, Investor RelationsBill.Frith@recall.comorUS Media

enquiriesMSL GROUPDavid Sprague or Amanda Fountain,

+1-781-684-0770Recall@mslgroup.comorAustralian MediaGRACoswayGeoff

Elliott, +61 2 8353 0420gelliott@gracosway.com

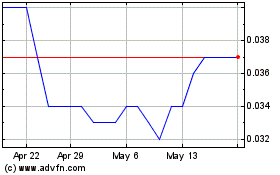

Recharge Metals (ASX:REC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Recharge Metals (ASX:REC)

Historical Stock Chart

From Jul 2023 to Jul 2024