TIDMNTQ

RNS Number : 5220G

Enteq Technologies PLC

16 November 2022

Enteq Technologies plc

("Enteq", the "Company" or the "Group")

Interim results for the six months ended 30 September 2022

and

IMC Investor Presentation

Enteq Technologies plc (AIM: NTQ.L) the energy services

technology and equipment supplier, today announces its interim

results for the six months ended 30 September 2022.

Key Highlights

-- Measurement While Drilling revenues in H1 were significantly

up on this time last year due to North American activity, albeit at

lower margins due to share of third-party equipment sales.

-- International sales were limited due to lagging international

market recovery and ongoing China shut-downs.

-- The SABER engineering project has progressed with the initial

fleet of the latest design of SABER tools being built. The

complementary MegaHop technology development has been launched.

-- All initial testing of SABER has achieved the objectives with

encouraging results. Active drilling in hard-rock environment has

been scheduled at an independent test-site in Norway and customer

trials arranged.

-- Investment in SABER has continued using existing balance

sheet resources to progress into the final engineering phase and

SABER tool-build, resulting in a cash position of US$1.8m at the

end of the period rising to US$2.5m as at the date o f this

announcement.

Financial metrics

Six months ended

30 September:

2022 2021

US$m US$m

* Revenue 4.9 2.3

* Adjusted EBITDA* 0.1 (0.6)

* Post tax loss for the period 0.8 1.2

* Loss per share (cents) 1.1 1.8

* Cash balance 1.8 5.3

Andrew Law, CEO of Enteq Technologies plc, commented:

"Enteq continues to adapt to the changing global and industry

dynamics by focusing on the higher margin potential in the

significantly larger (>US$2bn) growth market of Rotary Steerable

Drilling where SABER can offer a differentiated and cost-effective

alternative. Progress continues with the build and test of the

SABER system. Resources from the existing balance sheet are being

used to support bringing SABER to commercialisation."

Investor Presentation

Please note that Andrew Law and David Steel, Chief Financial

Officer, will be providing a live presentation relating to these

results via the Investor Meet Company platform on 22 November 2022

at 10:30am GMT.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via the Investor

Meet Company dashboard up until 9.00am the day before the meeting

or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and

attend this presentation via

www.investormeetcompany.com/enteq-upstream-plc/register-investor .

Investors who already follow Enteq on the Investor Meet Company

platform will automatically be invited.

For further information, please contact:

Enteq Technologies plc +44 (0)1494 618739

www.enteq.com

Andrew Law, Chief Executive Officer

David Steel, Chief Financial Officer

finnCap Ltd (NOMAD and Broker) +44 (0)20 7220 0500

Ed Frisby, Fergus Sullivan (Corporate Finance)

Andrew Burdis, Barney Hayward (ECM)

(*) Adjusted EBITDA is reported profit before tax adjusted for

interest, depreciation, amortisation, foreign exchange movements,

performance share plan charges and exceptional items - see note

5

Interim Report

CHAIRMAN & CHIEF EXECUTIVE OFFICER'S REPORT

Overview

Enteq supplies and develops drilling and measurement technology

for the worldwide oil and gas, geothermal and methane capture

directional drilling markets. Enteq provides equipment through

rental or purchase, enabling independent and regional directional

drilling companies to operate as an alternative to major integrated

service companies. Directional drilling encompasses Rotary

Steerable Systems ("RSS") and Measurement While Drilling

("MWD").

As a step change to the original MWD business, Enteq is

commercialising the SABER (Steer At-Bit Enteq Rotary) RSS Tool, a

truly disruptive and unique alternative to both conventional RSS

and traditional directional drilling. SABER can allow Enteq to

access a considerably larger addressable market with notably fewer

active competitors compared to those in the MWD market. The SABER

Tool is an evolution of the intellectual property developed, proven

in concept and successfully tested downhole by Shell. Enteq has the

exclusive worldwide licence to the intellectual property and is now

progressing through the field-trial programme ahead of

commercialisation.

Enteq's MWD business has an established reputation for

reliability both in North America, where operations using Enteq

equipment are regularly being carried out on a significant number

of rigs, and in key international areas and in geothermal

operations.

Financial performance

The key driver of the half year revenue of US$4.9m has been the

steady increase in North American drilling activity, a continuation

of the recovery seen through the whole of the previous financial

year. This recovery has been a function of the relative stability

in the price of a barrel of West Texas Intermediate ("WTI"),

despite a weakening during the month of September itself. The

average price of WTI in the period under review was US$101, moving

from US$104 on 1 April to US$80 at the period end. This stability,

at a relatively high price, resulted in the North American onshore

active drilling rig count rising by 14%; from 673 on 1 April to 765

at the end of September.

As expected, the international markets have been slower to

respond to this price stability. The proportion of international

revenue, at 3% in this reporting period, continues the recent trend

with the international revenue of the second half of the previous

financial year at 9%, down from the 28% seen in the first half

year.

The reported gross margin of 28% in the first half of this year

compares to 35% in the six months to 31 March 2022 and 37% in the

equivalent period to 30 September 2021. This reduction is due to a

lower proportion of sales coming from the high margin rental

revenue stream (down from 23% in the first half year to 30

September 2021 to only 7% in this reporting period) combined with a

higher proportion coming from the electronic component product line

(up from 46% to 53% in same periods) within which an increasing

number of third party, lower margin, items were sold.

In the six months ended 30 September 2022, administrative

expenses before amortisation, depreciation and long-term incentive

scheme charges were US$1.3m. This is down from both the US$1.4m in

the equivalent period to 30 September 2021 and the US$1.8m in the

six months to 31 March 2022, reflecting the continuing focus on

cost control measures.

The adjusted EBITDA profit in the period was US$0.1m, a pleasing

improvement over the US$0.6m loss in the equivalent period last

year. The primary reason for the improvement was the uplift in

revenue and associated gross margin. A reconciliation between the

reported loss and the adjusted EBITDA profit is shown in note 5 to

the Financial Statements below.

Cash balance and cashflow

On 30 September 2022, the Group had a cash balance of US$1.8m

down US$3.0m on the US$4.8m reported as at 31 March 2022. As at the

date of this announcement the cash balance was US$2.5m.

The half year cash movement can be analysed as follows:

US$m

Adjusted EBITDA profit 0.1

Change in trade and other receivables (1.9)

Change in trade and other payables (0.2)

Change in inventory 0.4

Operational cashflow (1.6)

Increase in the rental fleet (0.3)

R&D expenditure (1.1)

Net cash movement (3.0)

Cash balances as at 1 April 2022 4.8

-------

Cash balances as at 30 September 2022 1.8

=======

The increase in trade receivables relates to strong revenues

towards the end of the period with the outstanding balances being

collectable in future months. The R&D expenditure was primarily

relating to the SABER Rotary Steerable System development program.

Management expects that the future cash balances are sufficient to

complete SABER's field-testing phase and to bring it to a

successful commercial launch.

Operations

Enteq's dedicated SABER technology and manufacturing centre is

now fully operational, having opened in February 2022. This

facility is located close to Cheltenham, UK, one of the global

centres of expertise for Rotary Steerable Systems with access to

specialised engineering and machining firms.

The engineering, manufacturing and distribution functions

related to the MWD division continues to operate from the Enteq

owned facility in Houston, Texas.

SABER field-testing is the priority for progression to the

commercialisation phase. The SABER project has continued to

progress according to the development plan, with the improved

latest design of SABER entering the downhole-readiness phase for

active drilling testing. This latest improved, simplified and

ruggedised design is an outcome of the successful initial downhole

passive testing, followed by an accelerated production and assembly

programme to deliver downhole-ready tools. Extensive testing at

surface has both re-validated this unique concept and refined the

design. Active downhole drilling field-testing has been booked at a

test site Norway, with follow-up active downhole drilling planned

with selected customer test partners keen to continue the move into

the commercialisation phase.

In line with the direction of the industry, chiefly the growth

market opportunity for Rotary Steerable Systems, the Company

strategy has been aligned with ensuring the technical and

commercial success of SABER. A concerted effort is in place to

utilise the assets on the balance sheet to provide financial

resources for SABER commercialisation and build-up of the rental

fleet. Following initial active drilling testing, the focus will be

on pre-production design improvements and building-up the SABER

rental-fleet as rapidly as possible, subject to any supply chain

constraints, to support deployment into the selected initial

regions.

To support SABER, there is a disciplined strategy to concentrate

the MWD business on cash-generative commercial deals. As the MWD

market is becoming increasingly commoditised, the decision has been

taken to focus on providing customers with differentiated

technologies with the potential to enhance SABER deployment to

customers. For example, our recent introduction of our MegaHop(1)

technology can allow communication from SABER to customers'

existing equipment.

Organisation

The MWD division has personnel operating from Houston and the

SABER division has personnel operating from Houston and

Cheltenham.

Outlook

The underlying macro-fundamentals for RSS show that the market

and RSS usage is increasing and that this market is in need of

additional competition. Extensive and continued industry engagement

by Enteq, including recent attendance at the ADIPEC global trade

show, has confirmed there is a high level of potential demand for

SABER in each of the key geographies where Enteq operates. In

particular, this potentially disruptive technology has a strong

product-market fit having the potential for lower cost of operation

as well as reduced risk.

Andrew Law Martin Perry

Chief Executive Chairman

Enteq Technologies plc

15 November 2022

(1)

www.enteq.com/news-media/2022/09/enteq-technologies-launches-real-time-communications-solution-for-rss-and-mwd-operations

Enteq Technologies plc

Condensed Consolidated Income

Statement

Six months Six months Year to

to 30 to 30 31 March

September September 2022

2022 2021

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Revenue 4,912 2,318 7,306

Cost of Sales (3,518) (1,457) (4,677)

Gross Profit 1,394 861 2,629

Administrative expenses before

amortisation (1,866) (1,877) (3,185)

Amortisation of acquired

intangibles 10 (241) (170) (199)

Other exceptional items 6 (25) (16) (7)

Foreign exchange loss on

operating activities (34) (10) (40)

----------- ----------- ----------

Total Administrative expenses (2,166) (2,073) (3,431)

Operating loss (772) (1,212) (802)

Finance income 6 7 16

Loss before tax (766) (1,205) (786)

Tax expense 9 - - -

Loss for the period 5 (766) (1,205) (786)

=========== =========== ==========

Loss attributable to:

Owners of the parent (766) (1,205) (786)

=========== =========== ==========

Loss per share (in US cents): 8

Basic (1.1) (1.8) (1.1)

Diluted (1.1) (1.8) (1.1)

Enteq Technologies plc

Condensed Statement of Financial Position

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

Notes US$ 000's US$ 000's US$ 000's

Non-current assets

Intangible assets 10 5,051 2,517 4,143

Property, plant and equipment 2,142 2,201 2,506

Rental fleet 98 851 -

Trade and other receivables

greater than one year 54 66 -

------------- ----------

Non-current assets 7,345 5,635 6,649

------------- ------------- ----------

Current assets

Trade and other receivables 5,342 2,649 3,537

Inventories 2,006 2,856 2,410

Cash and cash equivalents 319 5,335 3,296

Bank deposits 1,500 - 1,500

------------- ------------- ----------

Current assets 9,167 10,840 10,743

------------- ------------- ----------

Total assets 16,512 16,475 17,392

============= ============= ==========

Equity and liabilities

Equity

Share capital 11 1,081 1,070 1,072

Share premium 92,038 91,884 91,919

Share based payment reserve 410 315 432

Retained earnings (78,660) (78,312) (77,894)

----------

Total equity 14,869 14,957 15,529

------------- ------------- ----------

Current Liabilities

Trade and other payables 1,643 1,518 1,863

------------- ------------- ----------

Total equity and liabilities 16,512 16,475 17,392

============= ============= ==========

Enteq Technologies

plc

Condensed Consolidated Statement of Changes

in Equity

Six months to 30 September 2022

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve Equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital 9 - 119 - 128

Share based payment

charge - - - (22) (22)

---------- ----------

Transactions with owners 9 - 119 (22) 106

---------- ---------- ---------- ---------- ----------

Loss for the period - (766) - - (766)

Total comprehensive

income (766) - - (766)

---------- ---------- ---------- ---------- ----------

Movement in period: 9 (766) 119 (22) (660)

As at 1 April 2022 (audited) 1,072 (77,894) 91,919 432 15,529

---------- ---------- ---------- ---------- ----------

As at 30 September

2022 (unaudited) 1,081 (78,660) 92,038 410 14,869

========== ========== ========== ========== ==========

Six months to 30 September 2021

Share

Called

up Profit based

share and loss Share payment Total

capital account premium reserve Equity

US$ 000's US$ 000's US$ 000's US$ 000's US$ 000's

Issue of share capital 14 - 95 - 109

Transfer between reserves - 217 - (217) -

Share based payment

charge - - - 77 77

---------- ----------

Transactions with owners 14 217 95 (140) 186

---------- ---------- ---------- ---------- ----------

Loss for the period - (1,205) - - (1,205)

Total comprehensive

income - (1,205) - - (1,205)

---------- ---------- ---------- ---------- ----------

Movement in period: 14 (988) 95 (140) (1,019)

As at 1 April 2021 (audited) 1,056 (77,324) 91,789 455 15,976

---------- ---------- ---------- ---------- ----------

As at 30 September

2021 (unaudited) 1,070 (78,312) 91,884 315 14,957

========== ========== ========== ========== ==========

Enteq Technologies plc

Condensed Consolidated Statement of

Cash flows

Six months Six months Year

to to to

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

US$ 000's US$ 000's US$ 000's

Cash flows from operating

activities:

Loss for the period (766) (1,205) (787)

Gain on disposal of fixed

assets - (20) (16)

Net finance income (6) (7) (30)

Share-based payment non-cash

charges (22) 75 194

Impact of foreign exchange

movement (34) (10) (40)

Depreciation, amortisation

and exceptional charges 784 525 840

(44) (642) 161

(Increase)/decrease in

inventory 404 34 478

Decrease/(increase) in

trade and other receivables (1,859) (143) (964)

(Decrease)/increase in

trade and other payables (219) (26) 320

Increase in rental fleet

assets (256) (1,128) (817)

Net cash from operating

activities (1,974) (1,905) (822)

------------------ -------------- ----------

Investing activities

Purchase of tangible fixed

assets (22) (6) (58)

Disposal proceeds of tangible

fixed assets - 20 30

Purchase of intangible

fixed assets (1,148) (959) (2,614)

Funds placed on interest

bearing deposit - - (1,500)

Interest received 6 7 16

------------------ --------------

Net cash from investing

activities (1,164) (938) (4,126)

------------------ -------------- ----------

Financing activities

Share issue 127 109 145

------------------ --------------

Net cash from financing

activities 127 109 145

------------------ -------------- ----------

Increase/(decrease) in

cash and cash equivalents (3,011) (2,734) (4,803)

Non-cash movements - foreign

exchange 34 10 40

Cash and cash equivalents

at beginning of period 3,296 8,059 8,059

Cash and cash equivalents

at end of period 319 5,335 3,296

================== ============== ==========

Cash and cash equivalents

at end of period 319 5,335 3,296

Funds placed on interest

bearing deposit 1,500 - 1,500

------------------ -------------- ----------

1,819 5,335 4,796

================== ============== ==========

ENTEQ TECHNOLOGIES PLC

NOTES TO THE FINANCIAL STATEMENTS

For the six months to 30 September 2022

1. Reporting entity

The Company is a public limited company incorporated and

domiciled in England and Wales (registration number 07590845). The

Company's registered address is The Courtyard, High Street, Ascot,

Berkshire, SL5 7HP.

The Company's ordinary shares are traded on the AIM market of

The London Stock Exchange.

Both the Company and its subsidiaries (together referred to as

the "Group") provide equipment to energy service companies for use

in the hydrocarbon and geothermal extraction sectors.

2. General information and basis of preparation

The information for the period ended 30 September 2022 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for the period

ended 31 March 2022 has been delivered to the Registrar of

Companies. The auditors have reported on these accounts; their

reports were unqualified, but did draw attention to the uncertainty

regarding the carrying value of the inventory by way of emphasis

without qualifying their report and did not contain statements

under s498(2) or (3) Companies Act 2006.

The annual financial statements of the Group are prepared in

accordance with IFRS as adopted by the European Union. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting', as adopted by

the European Union.

The Group's consolidated interim financial statements are

presented in US Dollars (US$), which is also the functional

currency of the parent company. These condensed consolidated

interim financial statements (the interim financial statements)

have been approved for issue by the Board of directors on 15

November 2022.

This half-yearly financial report has not been audited and has

not been formally reviewed by auditors under the Auditing Practices

Board guidance in ISRE 2410.

3. Accounting policies

The interim financial statements have been prepared on the basis

of the accounting policies and methods of computation applicable

for the period ended 31 March 2022. These accounting policies are

consistent with those applied in the preparation of the accounts

for the period ended 31 March 2022.

4. Estimates

When preparing the interim financial statements, management

undertakes a number of judgements, estimates and assumptions about

recognition and measurement of assets, liabilities, income and

expenses. The actual results may differ from the judgements,

estimates and assumptions made by management, and will seldom equal

the estimated results. The judgements, estimates and assumptions

applied in the interim financial statements, including the key

sources of estimation uncertainty were the same as those applied in

the Group's last annual financial statements for the year ended 31

March 2022.

5. Adjusted earnings and adjusted EBITDA

The following analysis illustrates the performance of the

Group's activities, and reconciles the Group's loss, as shown in

the condensed consolidated interim income statement, to adjusted

earnings. Adjusted earnings are presented to provide a better

indication of overall financial performance and to reflect how the

business is managed and measured on a day-today basis. Adjusted

earnings before interest, taxation, depreciation and amortisation

("adjusted EBITDA") is also presented as it is a key performance

indicator used by management.

Six months Six months Year to

to 30 September to 30 September 31 March

2022 2021 2022

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Loss attributable to ordinary

shareholders (766) (1,205) (787)

Exceptional items 25 16 7

Amortisation of acquired intangible

assets 240 170 199

Foreign exchange movements 34 10 40

----------------- ----------------- --------------

Adjusted earnings (467) (1,009) (541)

Depreciation charge 543 355 643

Finance income (6) (7) (16)

PSP credit/(charge) (49) 100 220

Other 34 - -

Adjusted EBITDA 55 (561) 306

================= ================= ==============

6. Exceptional items

The exceptional items can be analysed as follows:

Six months Six months Year to

to 30 September to 30 September 31 March

2022 2021 2022

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Severance payments 20 38 37

Loss/(gain) on sale of fixed

assets 5 (20) (30)

Other - (2) -

----------------- ----------------- --------------

Exceptional items 25 16 7

================= ================= ==============

7. Segmental Reporting

For management purposes, the Group is currently organised into a

single business unit, the Drilling Division, which is based,

operationally, primarily in the USA but with a technology centre

based in the UK.

The principal activities of the Drilling Division are the

design, manufacture and selling of specialised products and

technologies for Directional Drilling and Measurement While

Drilling operations used in the energy exploration and services

sector of the oil and gas industry.

At present, there is only one operating segment and the

information presented to the Board is consistent with the

consolidated income statement and the consolidated statement of

financial position.

The net assets of the Group by geographic location

(post-consolidation adjustments) are as follows:

Net Assets 30 September 30 September 31 March

2022 2021 2022

US$ 000's US$ 000's US$ 000's

Unaudited Unaudited Audited

Europe (UK) 1,282 4,512 3,649

United States 13,587 10,445 11,880

------------- ------------- -------------

Total Net Assets 14,869 14,957 15,529

============= ============= =============

The net assets in Europe (UK) are represented, primarily, by

cash balances denominated in US$.

8. Earnings Per Share

Basic earnings per share

Basic earnings per share is calculated by dividing the loss

attributable to ordinary shareholders for the six months of

US$766,000 (September 2021: loss of US$1,205,000) by the weighted

average number of ordinary shares in issue during the period of

69,247,129 (September 2021: 68,415,563).

9. Income Tax

No tax liability arose on ordinary activities for the six months

under review.

10. Intangible Fixed Assets

Other Intangible Fixed Assets

Developed IPR&D Brand

technology technology names Total

US$ 000's US$ 000's US$ 000's US$ 000's

Cost:

As at 1 April 2022 13,237 15,267 1,240 29,744

Capitalised in period 212 937 - 1,149

------------ ------------ ---------- ----------

As at 30 September

2022 13,449 16,204 1,240 30,893

------------ ------------ ---------- ----------

Amortisation:

As at 1 April 2022 13,041 11,320 1,240 25,601

Charge for the period 241 - - 241

As at 30 September

2022 13,282 11,320 1,240 25,842

------------ ------------ ---------- ----------

Net Book Value:

------------ ------------ ---------- ----------

As at 1 April 2022 196 3,947 - 4,143

============ ============ ========== ==========

As at 30 September

2022 167 4,884 - 5,051

============ ============ ========== ==========

The main categories of Intangible Fixed Assets are as

follows:

Developed technology:

This is technology which is currently commercialised and

embedded within the current product offering.

IPR&D technology:

This is technology, which is in the final stages of field

testing, has demonstrable commercial value and is expected to be

launched in the foreseeable future.

Brand names:

The value associated with various trading names used within the

Group.

Customer relationships:

The value associated with the on-going trading relationships

with the key customers acquired.

11. Share capital

Share capital as at 30 September 2022 amounted to US$1,081,000

(31 March 2022: US$1,072,000 and 30 September 2021:

US$1,070,000).

12. Going concern

The Directors have carried out a review of the Group's financial

position and cash flow forecasts for the next 12 months by way of a

review of whether the Group satisfies the going concern tests.

These have been based on a comprehensive review of revenue,

expenditure and cash flows, taking into account specific business

risks and the current economic environment. With regards to the

Group's financial position, it had cash and cash equivalents at 30

September 2022 of US$1.8 million.

Having taken the above into consideration the Directors have

reached a conclusion that the Group is well placed to manage its

business risks in the current economic environment. Accordingly,

they continue to adopt the going concern basis in preparing the

Interim Condensed Financial Statements.

13. Principal risks and uncertainties

Further detail concerning the principal risks affecting the

business activities of the Group is detailed on pages 11 to 13 of

the Annual Report and Accounts for the period ended 31 March 2022.

Consideration has been given to whether there have been any changes

to the risks and uncertainties previously reported. None have been

identified.

14. Events after the balance sheet date

There have been no material events subsequent to the end of the

interim reporting period ended 30 September 2022.

15. Copies of the interim results

Copies of the interim results are available from the Group's

website at www.enteq.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFIFAIEESEFF

(END) Dow Jones Newswires

November 16, 2022 02:00 ET (07:00 GMT)

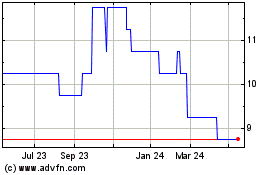

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enteq Technologies (AQSE:NTQ.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024