TIDMBUR

RNS Number : 8594Z

Burford Capital Limited

16 January 2024

16 January 2024

BURFORD CAPITAL ANNOUNCES PRIVATE OFFERING OF SENIOR NOTES

Burford Capital Limited ("Burford" or "Burford Capital"), the

leading global finance and asset management firm focused on law,

today announces the planned private offering of $200.0 million

aggregate principal amount of additional 9.250% senior notes due

2031 (the "Additional Notes") by its indirect, wholly owned

subsidiary, Burford Capital Global Finance LLC (the "Issuer"),

subject to market and other conditions. The Additional Notes will

be guaranteed on a senior unsecured basis by Burford Capital as

well as Burford Capital Finance LLC and Burford Capital PLC, both

indirect, wholly owned subsidiaries of Burford Capital (such

guarantees, together with the Additional Notes, the "Securities").

There is $400.0 million aggregate principal amount of the Issuer's

9.250% senior notes due 2031 (the "Initial Notes") outstanding as

of the date hereof. If issued, the Additional Notes will be issued

as "Additional Notes" under the indenture pursuant to which the

Issuer previously issued the Initial Notes, will have identical

terms to the Initial Notes (other than with respect to the date of

issuance, the issue price and the first interest payment date) and

will be treated as a single class for all purposes under such

indenture.

Burford Capital intends to use the net proceeds from the

offering of the Securities for general corporate purposes.

The Securities have not been, and will not be, registered under

the US Securities Act of 1933, as amended (the "Securities Act"),

or the laws of any other jurisdiction and may not be offered or

sold within the United States or to, or for the account or benefit

of, US persons absent registration or an applicable exemption from

registration under the Securities Act or any applicable state

securities laws. The Securities will be offered only to persons

reasonably believed to be "Qualified Institutional Buyers" within

the meaning of Rule 144A under the Securities Act or non-US persons

outside the United States pursuant to Regulation S under the

Securities Act, in each case, who are "Qualified Purchasers" as

defined in Section (2)(a)(51)(A) under the US Investment Company

Act of 1940, as amended.

For further information, please contact:

Burford Capital Limited

For investor and analyst inquiries:

Robert Bailhache, Head of Investor Relations, +44 (0)20 3530

EMEA and Asia - email 2023

Jim Ballan, Head of Investor Relations, Americas

- email +1 (646) 793 9176

For press inquiries:

David Helfenbein, Vice President, Public Relations

- email +1 (212) 235 6824

+44 (0)20 7260

Deutsche Numis - NOMAD and Joint Broker 1000

Giles Rolls

Charlie Farquhar

+44 (0)20 7029

Jefferies International Limited - Joint Broker 8000

Graham Davidson

James Umbers

+44 (0)20 3207

Berenberg - Joint Broker 7800

Toby Flaux

James Thompson

Yasmina Benchekroun

About Burford Capital

Burford Capital is the leading global finance and asset

management firm focused on law. Its businesses include litigation

finance and risk management , asset recovery and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the New York Stock Exchange (NYSE: BUR) and the London Stock

Exchange (LSE: BUR), and it works with companies and law firms

around the world from its offices in New York, London, Chicago,

Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy any securities of Burford.

This announcement does not constitute an offer of any Burford

private fund. Burford Capital Investment Management LLC, which acts

as the fund manager of all Burford private funds, is registered as

an investment adviser with the US Securities and Exchange

Commission. The information provided in this announcement is for

informational purposes only. Past performance is not indicative of

future results. The information contained in this announcement is

not, and should not be construed as, an offer to sell or the

solicitation of an offer to buy any securities (including, without

limitation, interests or shares in any of Burford private funds).

Any such offer or solicitation may be made only by means of a final

confidential private placement memorandum and other offering

documents.

Prohibition of sales to retail investors in the European

Economic Area. The Securities are not intended to be offered, sold

or otherwise made available to, and should not be offered, sold or

otherwise made available to, any retail investor in the European

Economic Area (the "EEA"). For these purposes, a retail investor

means a person who is one (or more) of: (i) a retail client as

defined in point (11) of Article 4(1) of Directive 2014/65/EU (as

amended, "MiFID II"); (ii) a customer within the meaning of

Directive 2016/97/EU (as amended, the "Insurance Distribution

Directive"), where that customer would not qualify as a

professional client as defined in point (10) of Article 4(1) of

MiFID II; or (iii) not a qualified investor as defined in

Regulation (EU) 2017/1129 (as amended or superseded, the

"Prospectus Regulation"). No key information document required by

Regulation (EU) 1286/2014 (as amended, the "PRIIPs Regulation") for

offering or selling the Securities or otherwise making them

available to retail investors in the EEA has been prepared and,

therefore, offering or selling the Securities or otherwise making

them available to any retail investor in the EEA may be unlawful

under the PRIIPs Regulation.

Prohibition of sales to retail investors in the United Kingdom.

The Securities are not intended to be offered, sold or otherwise

made available to, and should not be offered, sold or otherwise

made available to, any retail investor in the United Kingdom (the

"UK"). For these purposes, a retail investor means a person who is

one (or more) of: (i) a retail client, as defined in point (8) of

Article 2 of Regulation (EU) No 2017/565 as it forms part of

domestic law by virtue of the European Union (Withdrawal) Act 2018

(as amended, the "EUWA"); (ii) a customer within the meaning of the

provisions of the Financial Services and Markets Act 2000 (as

amended, the "FSMA") and any rules or regulations made under the

FSMA to implement Directive (EU) 2016/97, where that customer would

not qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law by virtue of the EUWA; or (iii) not a qualified

investor as defined in Article 2 of Regulation (EU) 2017/1129 as it

forms part of domestic law by virtue of the EUWA (as amended or

superseded, the "UK Prospectus Regulation"). Consequently, no key

information document required by Regulation (EU) No 1286/2014 as it

forms part of domestic law by virtue of the EUWA (as amended, the

"UK PRIIPs Regulation") for offering or selling the Securities or

otherwise making them available to retail investors in the UK has

been prepared and, therefore, offering or selling the Securities or

otherwise making them available to any retail investor in the UK

may be unlawful under the UK PRIIPs Regulation.

IN MEMBER STATES OF THE EEA, THIS ANNOUNCEMENT IS DIRECTED ONLY

AT PERSONS WHO ARE "QUALIFIED INVESTORS" WITHIN THE MEANING OF THE

PROSPECTUS REGULATION IN SUCH MEMBER STATE AND SUCH OTHER PERSONS

AS THIS ANNOUNCEMENT MAY BE ADDRESSED ON LEGAL GROUNDS, AND NO

PERSON THAT IS NOT A RELEVANT PERSON OR QUALIFIED INVESTOR MAY ACT

OR RELY ON THIS ANNOUNCEMENT OR ANY OF ITS CONTENTS. IN THE UNITED

KINGDOM, THIS ANNOUNCEMENT IS DIRECTED ONLY AT PERSONS WHO ARE

"QUALIFIED INVESTORS" WITHIN THE MEANING OF THE UK PROSPECTUS

REGULATION AND SUCH OTHER PERSONS AS THIS ANNOUNCEMENT MAY BE

ADDRESSED ON LEGAL GROUNDS, AND NO PERSON THAT IS NOT A RELEVANT

PERSON OR QUALIFIED INVESTOR MAY ACT OR RELY ON THIS ANNOUNCEMENT

OR ANY OF ITS CONTENTS.

Forward-looking statements

This announcement contains "forward-looking statements" within

the meaning of Section 21E of the US Securities Exchange Act of

1934, as amended, regarding assumptions, expectations, projections,

intentions and beliefs about future events. These statements are

intended as "forward-looking statements". In some cases,

predictive, future-tense or forward-looking words such as "aim",

"anticipate", "believe", "continue", "could", "estimate", "expect",

"forecast", "guidance", "intend", "may", "plan", "potential",

"predict", "projected", "should" or "will" or the negative of such

terms or other comparable terminology are intended to identify

forward-looking statements, but are not the exclusive means of

identifying such statements. In addition, Burford and its

representatives may from time to time make other oral or written

statements that are forward-looking, including in its periodic

reports that Burford files with, or furnishes to, the US Securities

and Exchange Commission, other information made available to

Burford's security holders and other written materials. By their

nature, forward-looking statements involve known and unknown risks,

uncertainties and other factors because they relate to events and

depend on circumstances that may or may not occur in the future.

Burford cautions you that forward-looking statements are not

guarantees of future performance and are based on numerous

assumptions, expectations, projections, intentions and beliefs and

that Burford's actual results of operations, including its

financial position and liquidity, and the development of the

industry in which it operates, may differ materially

from (and be more negative than) those made in, or suggested by,

the forward-looking statements contained in this announcement.

Significant factors that may cause actual results to differ from

those Burford expects include, among others, those discussed under

"Risk Factors" in Burford's annual report on Form 20-F for the year

ended December 31, 2022 filed with the US Securities and Exchange

Commission on May 16, 2023 and other reports or documents that

Burford files with, or furnishes to, the US Securities and Exchange

Commission from time to time . In addition, even if Burford's

results of operations, including its financial position and

liquidity, and the development of the industry in which it operates

are consistent with the forward-looking statements contained in

this announcement, those results of operations or developments may

not be indicative of results of operations or developments in

subsequent periods.

Except as required by law, Burford undertakes no obligation to

update or revise the forward-looking statements contained in this

announcement, whether as a result of new information, future events

or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IODUNRRRSRUAAAR

(END) Dow Jones Newswires

January 16, 2024 07:45 ET (12:45 GMT)

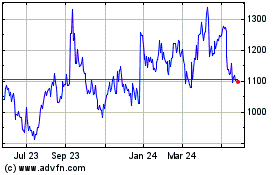

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

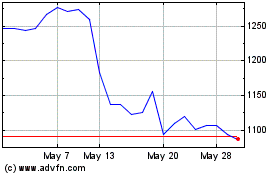

Burford Capital (AQSE:BUR.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024