TIDMBMS

RNS Number : 0788K

Braemar PLC

19 December 2022

19 December 2022

BRAEMAR PLC

("Braemar" or the "Group")

Braemar strategically acquires leading US shipbroker

Braemar Plc (LSE: BMS), a leading international shipbroker and

provider of expert investment, chartering, and risk management

advice to the shipping and energy markets, is pleased to announce

the strategic acquisition of Southport Maritime Inc. ("Southport")

in the USA.

Enhancing the Group's coverage in the Americas has been an

important strategic goal of Braemar since the board launched its

growth agenda in November 2021. Southport is one of the highest

volume US-based shipbroking tanker companies. They are recognised

as a leader for crude and refined products in the North American

export market, as well as in the Latin American and Caribbean

markets.

With a particular focus on spot tanker fixtures, Southport's

18-strong team has a reputation for high performance within the

industry. Since it was founded, Southport has enabled its clients

to transport billions of barrels of liquid petroleum and oil

products worldwide, helping them to benefit from both short-term

volatility and long-term industry trends.

The Southport team complements Braemar's existing Tanker desks

in London, Singapore, Madrid, Houston, and Geneva, as well as

significantly enhancing Braemar's presence in the Americas.

Braemar's new offices in West Palm Beach and Winter Park

Florida, will continue to be led by Michael Corey and Peter

Tornaben from Southport. The new offices augment the Group's

existing regional coverage in Houston and Sao Paulo, and these

combined locations provide the ideal platform for the Group to

penetrate the North and South American markets and add further

scale to the Group's activities.

The transaction is expected to be earnings enhancing for the

year ending February 2024. Southport's gross assets at completion

are estimated to be $6.4m. In the year to 31 December 2021,

Southport made a profit before tax of $1.1m with an average of

$1.5m profit before tax in the three years ended 31 December

2021.

The consideration comprises $7.25m in cash paid on completion,

together with up to 1,888,942 Braemar Ordinary Shares, which will

be delivered on the third anniversary of the transaction. The share

consideration is to be issued to the previous owners of the

business and certain other employees, contingent on them remaining

employed in the business for the full three-year period.

Tris Simmonds, Braemar COO, said,

" The acquisition of Southport represents the next key component

of our global growth plan.

Michael Corey and Peter Tornaben are extremely well - recognised

figures in the North American s hipping m arkets , and they and the

team at Southport have an exceptional reputation. We have conducted

a long process to find the right partner and have a

well-established relationship with Southport. In their

professionalism, dedication, and integrity we see a team that

shares similar values to our own.

"There are significant growth opportunities in the North and

South American markets and the team at Southport will play a key

part in helping the Group deliver on that potential."

Michael Corey and Peter Tornaben, co-founders of Southport

Maritime, said,

"When we started this company thirty years ago, our primary

objective was to provide our customers with timely dissemination of

market intelligence and assist them in monetizing that

information.

For us, this is the logical step in continuing Southport's core

mission. Being under the Braemar umbrella will enable our team to

bring our boutique service to the next level across a significantly

larger global platform. It will also allow us to provide a wider

array of products and services, and enable us to create additional

value for our clients as we move forward in this competitive

brokering landscape while remaining as Southport Maritime."

ENDS

For further information, contact:

Braemar Plc

James Gundy, Group Chief Executive Officer Tel +44 (0) 20 3142 4100

Nick Stone, Chief Financial Officer

Nick Arthur, Head of Corporate Affairs

Investec Bank plc

Gary Clarence / Harry Hargreaves / Alice Tel +44 (0) 20 7597 5970

King

Cenkos Securities plc Tel +44 (0) 20 7397 8900

Ben Jeynes / Max Gould (Corporate Finance)

Alex Pollen / Leif Powis (Sales)

Buchanan

Charles Ryland / Jamie Hooper / Jack Tel +44 (0) 20 7466 5000

Devoy

About Braemar Plc

Braemar provides expert investment, chartering, and risk

management advice that enable its clients to secure sustainable

returns and mitigate risk in the volatile world of shipping and

energy.

Our experienced brokers work in tandem with specialist

professionals to form teams tailored to our customers' needs, and

provide an integrated service supported by a collaborative

culture.

Braemar joined the Official List of the London Stock Exchange in

November 1997 and trades under the symbol BMS.

For more information, visit Braemar.com , and follow Braemar on

LinkedIn .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTPBTTMTMBTIT

(END) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

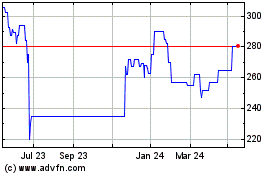

Braemar (AQSE:BMS.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

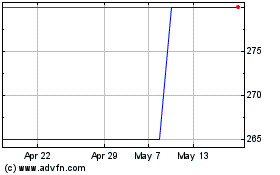

Braemar (AQSE:BMS.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025