Miners Say Gold Going Higher - Tactical Trading

November 07 2011 - 7:00PM

Zacks

Think gold is another asset bubble waiting to pop? The strength of

the mining stocks is telling a different story based on a mix of

near-term and secular trends.

The big picture story we know: in an era of fiat

currencies being printed to fulfill quantitative easing policies,

the barbarous relic has renewed its status as a monetary vehicle, a

way for investment managers to diversify their exposure to dollars,

euros, yen, or pounds.

Holders of paper currency, printed to sustain

numerous, ominous bubbles of debt, have an appetite for exchanging

it for "hard" currency. And this hunger is only likely to

continue.

The near-term story is that we are in the midst of

a seasonally strong period for gold where it's very likely the

yellow metal makes a run for its all-time highs above $1,900.

And strong gold stocks are confirming this

likelihood by threatening, if not forging, new highs this week. Two

weeks ago I looked at four attractive names with market caps less

than half the size of the giants Barrick Gold (ABX),

Goldcorp (GG), and Newmont Mining (NEM).

Here again are those "smaller" miners with earnings

momentum leading the charge higher this week. Each is displayed

with market cap, forward multiple, and a 2-year weekly chart for

perspective in this historic gold rush.

Randgold Resources (GOLD): $11 B, 25.4

P/E

Gold Fields (GFI): $13.25 B, 13.25 P/E

AngloGold Ashanti (AU): $18.5 B, 13.25

P/E

Royal Gold (RGLD): $4.4 B, 38 P/E

The New Heavyweights of Gold

The Market Vectors Gold Miners ETF (GDX) is the

most popular basket for trading all these names at once. The "big

3" mentioned earlier, Barrick, Goldcorp, and Newmont, combine to

form 40% of the weighting of GDX with their respective market caps

of $53 B, $43 B, and $35 B.

But part of the reason you are seeing the big moves

in the sub-$20 B names is because three of the four I picked two

weeks ago -- AngloGold, Gold Fields, and Randgold -- are in the top

ten holdings, totaling over 15% of the fund's weighting.

The one that caught me by surprise was Goldfields.

I have been bullish on this stock since it was trading $15 over the

summer. It may still be the one with the most percentage

upside.

The Monetary Phenom

For a fun look back at a bad hair day for me (I

know, they all are), check out this CNBC video clip (link below)

where I was interviewed by Maria Bartiromo about gold becoming a

monetary phenomenon.

My forecast in November 2009, when gold was just

making new highs above $1,150, was that we would see $2,000 within

18 months because central banks were accumulating to diversify

their foreign currency reserves.

Yeah, it took more like 21 months and I fell shy by

75 bucks as only $1,923.70 was reached September 6 of this year.

But, close enough right?

The Gold Standard

Kevin Cook is a Senior Stock Strategist with

Zacks.com

BARRICK GOLD CP (ABX): Free Stock Analysis Report

ANGLOGOLD LTD (AU): Free Stock Analysis Report

GOLD FIELDS-ADR (GFI): Free Stock Analysis Report

RANDGOLD RSRCS (GOLD): Free Stock Analysis Report

Zacks Investment Research

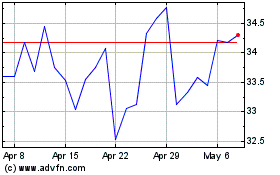

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

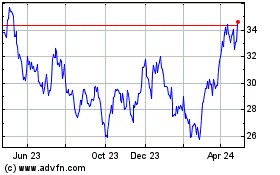

VanEck Gold Miners ETF (AMEX:GDX)

Historical Stock Chart

From Jul 2023 to Jul 2024