SunLink Health Systems, Inc. (NYSE American: SSY) today

announced a loss from continuing operations of $1,070,000 (or a

loss of $0.15 per fully diluted share) for its second fiscal

quarter ended December 31, 2024 compared to a loss from continuing

operations of $407,000 (or a loss of $0.06 per fully diluted share)

for the second fiscal quarter ended December 31, 2023. During the

quarter ended December 31, 2024, the Company recorded an impairment

loss of $100,000 to write down the value of the net assets of its

information technology business which sold in January 2025.

Net loss for the quarter ended December 31, 2024 was $1,343,000

(or a loss of $0.19 per fully diluted share) compared to a net loss

of $3,075,000 (or a loss of $0.44 per fully diluted share) for the

quarter ended December 31, 2023. The net loss for the second fiscal

quarter of 2025 included a loss from discontinued operations of

$273,000 (or a loss of $0.04 fully diluted share), which includes a

loss of $110 on the sale of real estate in Houston, Mississippi.

The net loss for the second fiscal quarter of 2024 included a loss

from discontinued operations of $2,668,000 (or a loss of $0.38 per

fully diluted share), which includes for the quarter an impairment

loss of $2,032,000 on the sale of the Trace Regional Hospital, a

vacant medical office building and three (3) patient clinics and a

loss from operations of $636,000, primarily from operations of

Trace Regional Hospital (prior to its sale) and a nursing home in

Houston, Mississippi.

Consolidated net revenues for the fiscal quarters ended December

31, 2024 and 2023 were $7,935,000 and $8,510,000, respectively,

which consisted primarily of pharmacy net revenues. Pharmacy net

revenues for the quarter ended December 31, 2024 decreased

$575,000, or 7%, from the same period last year. The pharmacy

business had lower retail pharmacy scripts and durable medical

equipment orders filled this year.

SunLink reported an operating loss for the quarter ended

December 31, 2024 of $1,012,000 compared to an operating loss for

the quarter ended December 31, 2023 of $433,000.

SunLink reported a loss from continuing operations of $1,512,000

(or a loss of $0.21 per fully diluted share) for its six months

ended December 31, 2024 compared to a loss from continuing

operations of $835,000 (or $0.12 per fully diluted share) for the

six months ended December 31, 2023. Net loss for the six months

ended December 31, 2024 was $1,892,000 (or a loss of $0.27 per

fully diluted share) compared to a net loss of $4,419,000 (or $0.63

per fully diluted share) for the six months ended December 31,

2023. The net loss for the six months ended December 31, 2024

included a loss from discontinued operations of $380,000 (or a loss

of $0.05 per fully diluted share), compared to a loss from

discontinued operations of $3,584,000 (or a loss of $0.51 per fully

diluted share) for the six months ended December 31, 2023. The

discontinued operations loss for the six months ended December 31,

2024 includes a loss of $110,000 on the October 2024 property sale

in Houston, Mississippi. The discontinued operations loss for the

six months ended December 31, 2023 included an impairment loss of

$2,032,000 on the sale of the Trace Regional Hospital, a vacant

medical office building and three (3) patient clinics and loss from

operations of $1,552,000, primarily from Trace Regional Hospital

(prior to its sale) and a nursing home in Houston, Mississippi.

Consolidated net revenues for each of the six months ended December

31, 2024 and 2023 were $15,858,000 and $17,065,000, respectively.

Pharmacy net revenues for the six months ended December 31, 2023

included $380,000 from the reversal of reserves for certain sales

taxes previously accrued. Excluding the effect of the reversal of

sales tax accruals, net revenues decreased 5% in the six months

ended December 31, 2024 compared to the prior year due primarily to

decreased volume of Retail pharmacy scripts filled.

SunLink reported an operating loss for the six months ended

December 31, 2024 of $2,206,000 compared to an operating loss for

the six months ended December 31, 2023 of $883,000. The operating

loss during the comparable six month period last year resulted

primarily from the lower net revenues partially offset by the

reversal of $380,000 in accrued sales tax reserves.

Merger

On January 6, 2025, the Company and Regional Health Properties,

Inc. (“Regional”) jointly announced that they have entered into a

definitive agreement and plan of merger (the “merger agreement”),

dated January 3, 2025 pursuant to which the Company will merge with

and into Regional (the “merger”) in exchange for the issuance of an

aggregate of 1,410,000 shares of Regional common stock and

1,410,000 shares of Regional’s newly-authorized Series D 8%

Cumulative Convertible Redeemable Preferred Stock with a

liquidation preference of $10 per share. The merger has been

approved unanimously by each company’s board of directors and

completion of the transaction is subject to the receipt of the

approvals of the shareholders of both Regional and the Company,

regulatory approvals, and satisfaction of customary closing

conditions.

COVID-19 Pandemic

The Company continues to experience post-COVID-19 pandemic

after-effects in its quarter and believes it will likely to

continue experience these effects on its assets and operations in

the foreseeable future particularly from salaries and wages

pressure, workforce shortages, supply chain disruption and broad

inflationary pressures. Our ability to make estimates of any such

continuing effects on future revenues, expenses or changes in

accounting judgments that have had or are reasonably likely to have

a material effect on our financial statements is very limited,

depending as they do on the severity and length thereof; as well as

any further government actions and/or regulatory changes intended

to address such effects.

SunLink Health Systems, Inc. is the parent company of

subsidiaries that own and operate a pharmacy business and an

information technology business in the Southeast (the latter of

which sold on January 6, 2025). For additional information on

SunLink Health Systems, Inc., please visit the Company’s

website.

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 including, without limitation, statements regarding the

company’s business strategy. These forward-looking statements are

subject to certain risks, uncertainties, and other factors, which

could cause actual results, performance, and achievements to differ

materially from those anticipated. Certain of those risks,

uncertainties and other factors are disclosed in more detail in the

company’s Annual Report on Form 10-K for the year ended June 30,

2024 and other filings with the Securities and Exchange Commission

which can be located at www.sec.gov.

SUNLINK HEALTH SYSTEMS, INC. ANNOUNCES FISCAL 2025 SECOND

QUARTER RESULTS Amounts in 000's, except per share

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) Three

Months Ended December 31, Six Months Ended December 31,

2024

2023

2024

2023

% of Net % of Net % of Net % of Net

Amount Revenues Amount Revenues Amount Revenues

Amount Revenues Net

revenues

$

7,935

100.0

%

$

8,510

100.0

%

$

15,858

100.0

%

$

17,065

100.0

%

Costs and Expenses: Cost of goods sold

4,618

58.2

%

4,761

55.9

%

9,093

57.3

%

9,532

55.9

%

Salaries, wages and benefits

2,713

34.2

%

2,668

31.4

%

5,791

36.5

%

5,285

31.0

%

Supplies

40

0.5

%

39

0.5

%

74

0.5

%

73

0.4

%

Purchased services

326

4.1

%

281

3.3

%

645

4.1

%

567

3.3

%

Other operating expenses

833

10.5

%

784

9.2

%

1,637

10.3

%

1,690

9.9

%

Rent and leases

93

1.2

%

92

1.1

%

187

1.2

%

183

1.1

%

Depreciation and amortization

324

4.1

%

318

3.7

%

637

4.0

%

618

3.6

%

Operating loss

(1,012

)

-12.8

%

(433

)

-5.1

%

(2,206

)

-13.9

%

(883

)

-5.2

%

Interest Income - net

42

0.5

%

29

0.3

%

100

0.6

%

51

0.3

%

Impairment loss

(100

)

-1.3

%

0

0.0

%

(100

)

-0.6

%

0

0.0

%

Gain on sale of assets

0

0.0

%

0

0.0

%

694

4.4

%

2

0.0

%

Loss from Continuing Operations before Income Taxes

(1,070

)

-13.5

%

(404

)

-4.7

%

(1,512

)

-9.5

%

(830

)

-4.9

%

Income Tax expense

0

0.0

%

3

0.0

%

0

0.0

%

5

0.0

%

Loss from Continuing Operations

(1,070

)

-13.5

%

(407

)

-4.8

%

(1,512

)

-9.5

%

(835

)

-4.9

%

Loss from Discontinued Operations, net of tax

(273

)

-3.4

%

(2,668

)

-31.4

%

(380

)

-2.4

%

(3,584

)

-21.0

%

Net Loss

$

(1,343

)

-16.9

%

$

(3,075

)

-36.1

%

$

(1,892

)

-11.9

%

$

(4,419

)

-25.9

%

Loss Per Share from Continuing Operations: Basic

$

(0.15

)

$

(0.06

)

$

(0.21

)

$

(0.12

)

Diluted

$

(0.15

)

$

(0.06

)

$

(0.21

)

$

(0.12

)

Loss Per Share from Discontinued Operations: Basic

$

(0.04

)

$

(0.38

)

$

(0.05

)

$

(0.51

)

Diluted

$

(0.04

)

$

(0.38

)

$

(0.05

)

$

(0.51

)

Net Loss Per Share: Basic

$

(0.19

)

$

(0.44

)

$

(0.27

)

$

(0.63

)

Diluted

$

(0.19

)

$

(0.44

)

$

(0.27

)

$

(0.63

)

Weighted Average Common Shares Outstanding: Basic

7,041

7,040

7,041

7,039

Diluted

7,041

7,040

7,041

7,039

SUMMARY BALANCE SHEETS December 31,

June 30,

2024

2024

ASSETS Cash and Cash Equivalents

$

8,020

$

7,170

Receivable - net

2,831

3,371

Current Assets Held for Sale

256

1,959

Other Current Assets

3,099

3,164

Property Plant and Equipment, net

2,053

2,809

Long-term Assets

1,613

2,139

$

17,872

$

20,612

LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities

$

3,495

$

4,213

Noncurrent Liabilities

296

426

Shareholders' Equity

14,081

15,973

$

17,872

$

20,612

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212287098/en/

Robert M. Thornton, Jr. Chief Executive Officer

(770) 933-7004

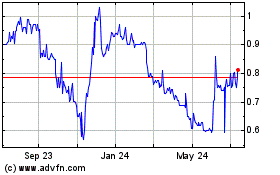

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Jan 2025 to Feb 2025

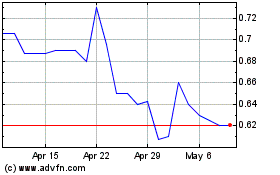

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Feb 2024 to Feb 2025