Form 497 - Definitive materials

May 29 2024 - 3:43PM

Edgar (US Regulatory)

SUPPLEMENTAL PROSPECTUS DATED MAY 29, 2024

SPDR® DOW JONES INDUSTRIAL

AVERAGE® ETF Trust

(the “Trust”)

(formerly known as “DIAMONDS® Trust, Series 1”)

(A Unit Investment Trust constituted outside Singapore and organized in the United States)

A copy of this Supplemental Prospectus has been lodged with the Monetary Authority of Singapore (the “Authority”) who takes no responsibility

for its contents.

This Supplemental Prospectus is lodged pursuant to Section 298 of the Securities and Futures Act 2001 of Singapore and is

supplemental to the prospectus relating to the Trust registered by the Authority on February 27, 2024 (the “Prospectus”).

Terms

used in this Supplemental Prospectus will have the same meaning and construction as ascribed to them in the Prospectus. References to “paragraphs” and “sections” are to the paragraphs and sections of the Prospectus. This

Supplemental Prospectus should be read and construed in conjunction with and as one document with the Prospectus and should not be distributed without the Prospectus.

The Prospectus is amended as follows effective May 28, 2024 (U.S. time), whereby paragraph 16 (“Distributions to Beneficial Owners”) of the

section entitled “GENERAL AND STATUTORY INFORMATION” on Page S-18 of the Prospectus is hereby deleted and replaced in its entirety as follows:

“The Trustee receives all dividends and other cash distributed with respect to the underlying securities in the Trust (including monies realized by the

Trustee from the sale of securities options, warrants or other similar rights received on such securities), and distributes them (less fees, expenses and any applicable taxes) through DTC and the DTC Participants to the beneficial owners of the

Units. A description of the distribution process is contained on pages 12 and 63 to 65 of the U.S. Prospectus. These distribution arrangements will be the same for holders of Units in Singapore, who will receive their entitlements through CDP,

except that, effective on the Settlement Cycle Change Date, while the record date for holders of Units in Singapore will be the same as the Record Date for the holders of Units in the U.S., the ex-dividend

date for holders of Units in Singapore will be one trading day prior to the Record Date. Cash dividends distributed to investors in Singapore will be net of expenses incurred by CDP. Where such expenses equal or exceed the amount of the dividend,

investors will not receive any dividend.”

PLEASE RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

1

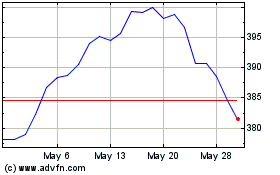

SPDR DJ Industrial Avera... (AMEX:DIA)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPDR DJ Industrial Avera... (AMEX:DIA)

Historical Stock Chart

From Feb 2024 to Feb 2025