UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number 001-38628

| | |

| SilverCrest Metals Inc. |

| (Translation of registrant’s name into English) |

| | |

570 Granville Street, Suite 501 Vancouver, British Columbia V6C 3P1 Canada |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| | | | | |

| | Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| Date: May 14, 2024 | /s/ Anne Yong______________ Anne Yong Chief Financial Officer |

INDEX TO EXHIBITS

Unaudited Condensed Interim Consolidated Financial Statements and Notes

FOR THE THREE MONTHS ENDED MARCH 31, 2024

| | | | | |

| Condensed Interim Consolidated Statements of Financial Position (unaudited, in thousands of U.S. dollars) |

| | | | | | | | |

| March 31, 2024 | December 31, 2023 |

| Assets | | |

| Current assets | | |

| Cash and cash equivalents (Note 19) | $ | 71,085 | | $ | 85,964 | |

| Bullion (Note 7) | 20,039 | | 19,191 | |

| Trade and other receivables | 4,980 | | 114 | |

| Value-added tax receivables | 17,544 | | 16,250 | |

| Inventories (Note 8) | 53,240 | | 49,798 | |

| Prepaids and other assets | 7,741 | | 7,216 | |

| Derivative assets | 548 | | - | |

| 175,177 | | 178,533 | |

| Non-current assets | | |

| Mineral properties, plant and equipment (Note 9) | 254,911 | | 246,728 | |

| Deferred tax assets | 18,255 | | 22,723 | |

| Long-term value-added tax receivables | 14,743 | | 12,190 | |

| Prepaids and other long-term assets | 7,290 | | - | |

| Total assets | $ | 470,376 | | $ | 460,174 | |

| | |

| Liabilities | | |

| Current liabilities | | |

| Accounts payable and accrued liabilities (Note 10, 6(a)) | $ | 20,232 | | $ | 17,924 | |

| Tax liabilities | 6,256 | | 33,614 | |

| Derivative liabilities | 344 | | 168 | |

| Lease obligations | 67 | | 67 | |

| | |

| 26,899 | | 51,773 | |

| Non-current liabilities | | |

| Long-term lease obligations | 210 | | 221 | |

| | |

| | |

| Reclamation provision (Note 12) | 5,986 | | 5,855 | |

| Total liabilities | 33,095 | | 57,849 | |

| | |

| Equity (Note 13) | | |

| Issued capital | 407,837 | | 406,890 | |

| Share option reserve | 11,483 | | 11,338 | |

| Currency translation reserve | (3,538) | | (3,538) | |

| Retained earnings | 21,499 | | (12,365) | |

| Total equity | 437,281 | | 402,325 | |

| Total liabilities and equity | $ | 470,376 | | $ | 460,174 | |

See accompanying notes to the condensed interim consolidated financial statements

Approved by the Board on May 14, 2024

| | | | | | | | | | | | | | |

| "signed" | N. Eric Fier, Director | "signed" | Anna Ladd-Kruger, Director |

| | | | | |

| Condensed Interim Consolidated Statements of Earnings and Comprehensive Earnings (unaudited, in thousands of U.S. dollars except per share amounts) |

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Revenue (Note 14) | $ | 63,646 | | $ | 57,983 | |

| Cost of sales | | |

| Production costs (Note 15) | (18,203) | | (18,038) | |

| Depreciation | (7,776) | | (4,045) | |

| Government royalties | (190) | | (294) | |

| (26,169) | | (22,377) | |

| Mine operating earnings | 37,477 | | 35,606 | |

| General and administrative expenses (Note 16) | (4,695) | | (3,533) | |

| Exploration and project expenses | (222) | | (226) | |

| Foreign exchange gains | 366 | | 1,119 | |

| | |

| | |

| Earnings from operations | 32,926 | | 32,966 | |

| Interest income | 1,638 | | 772 | |

| Interest and finance expense (Note 17) | (315) | | (1,369) | |

| Other income | 1,350 | | — | |

| Earnings before income taxes | 35,599 | | 32,369 | |

| Income tax expense (Note 18) | (1,735) | | (5,204) | |

| Net earnings | $ | 33,864 | | $ | 27,165 | |

| | |

| Other comprehensive income | | |

| Currency translation adjustment | — | | 329 | |

| Total comprehensive earnings | $ | 33,864 | | $ | 27,494 | |

| | |

| Net earnings attributable to common shareholders | | |

| Basic earnings per share | $ | 0.23 | | $ | 0.18 | |

| Diluted earnings per share | $ | 0.23 | | $ | 0.18 | |

| Weighted average shares outstanding (in 000’s) Basic | 146,954 | | 147,200 | |

| Weighted average shares outstanding (in 000’s) Diluted | 147,956 | | 152,414 | |

See accompanying notes to the condensed interim consolidated financial statements

| | | | | |

| Condensed Interim Consolidated Statements of Cash Flows (unaudited, in thousands of U.S. dollars) |

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| | (Note 19) |

| Operating activities | | |

| Net earnings for the period | $ | 33,864 | | $ | 27,165 | |

| Income tax expense (Note 18) | 1,735 | | 5,204 | |

| Depreciation | 7,776 | | 4,067 | |

| Share-based compensation expense | 1,065 | | 1,120 | |

| Unrealized foreign exchange losses (gains) | 484 | | (1,629) | |

| Interest income | (1,638) | | (772) | |

| Interest expense (Note 17) | 147 | | 1,242 | |

| Interest paid (Note 19) | (49) | | (1,077) | |

| Interest received (Note 19) | 1,638 | | 721 | |

| Income taxes paid | (26,164) | | (987) | |

| Other operating activities (Note 19) | (1,244) | | 107 | |

| Change in working capital (Note 19) | (18,735) | | (8,544) | |

| $ | (1,121) | | $ | 26,617 | |

| Investing activities | | |

| Payments for mineral properties, plant and equipment | (14,804) | | (7,930) | |

| | |

| | |

| Purchase of bullion | — | | (1,810) | |

| | |

| Proceeds from derivatives | 161 | | — | |

| | |

| $ | (14,643) | | $ | (9,740) | |

| Financing activities | | |

| Common share proceeds | 658 | | 179 | |

| | |

| | |

| | |

| | |

| Repayment of debt (Note 11) | — | | (25,000) | |

| | |

| | |

| Payments of equipment leases | (11) | | (43) | |

| | |

| $ | 647 | | $ | (24,864) | |

| Effects of exchange rate changes on cash and cash equivalents | 238 | | 2,991 | |

| Decrease in cash and cash equivalents | (14,879) | | (4,996) | |

| Cash and cash equivalents at the beginning of the period | 85,964 | | 50,761 | |

| Cash and cash equivalents at the end of the period | $ | 71,085 | | $ | 45,765 | |

Supplemental cash flow information and restatement of prior period (Note 19)

See accompanying notes to the condensed interim consolidated financial statements

| | | | | |

| Condensed Interim Consolidated Statements of Changes in Equity (unaudited, in thousands of U.S. dollars except for number of shares) |

| | | | | | | | | | | | | | | | | | | | |

| Issued

shares | Issued

capital | Share option reserve | Currency translation reserve | Retained earnings | Total |

| Balance, December 31, 2022 | 147,156 | | $ | 405,811 | | $ | 10,945 | | $ | (13,793) | | $ | (125,969) | | $ | 276,994 | |

| Total comprehensive earnings | | | | | | |

| Net earnings for the period | — | | — | | — | | — | | 27,165 | | 27,165 | |

| Foreign exchange translation | — | | — | | — | | 329 | | — | | 329 | |

| — | | — | | — | | 329 | | 27,165 | | 27,494 | |

| Shares issued on the exercise of stock options | 75 | | 294 | | (115) | | — | | — | | 179 | |

| Stock options forfeited | — | | — | | (36) | | — | | 36 | | — | |

| Share-based compensation on option grants | — | | — | | 674 | | — | | — | | 674 | |

| Share repurchased and cancelled | — | | — | | — | | — | | — | | — | |

| Balance, March 31, 2023 | 147,231 | | 406,105 | | 11,468 | | (13,464) | | (98,768) | | 305,341 | |

| Total comprehensive earnings | | | | | | |

| Net earnings for the year | — | | — | | — | | — | | 89,555 | | 89,555 | |

| Foreign exchange translation | — | | — | | — | | 9,926 | | — | | 9,926 | |

| — | | — | | — | | 9,926 | | 89,555 | | 99,481 | |

| Shares issued on the exercise of stock options | 1,208 | | 4,814 | | (1,862) | | — | | — | | 2,952 | |

| Stock options forfeited | — | | — | | 36 | | — | | (36) | | — | |

| Share-based compensation on option grants | — | | — | | 1,696 | | — | | — | | 1,696 | |

| Share repurchased and cancelled | (1,504) | | (4,029) | | — | | — | | (3,116) | | (7,145) | |

| Balance, December 31, 2023 | 146,935 | | 406,890 | | 11,338 | | (3,538) | | (12,365) | | 402,325 | |

| Total comprehensive earnings | | | | | | |

| Net earnings for the period | — | | — | | — | | — | | 33,864 | | 33,864 | |

| | | | | | |

| — | | — | | — | | — | | 33,864 | | 33,864 | |

| Shares issued on the exercise of stock options | 126 | | 928 | | (270) | | — | | — | | 658 | |

| Shares issued on the settlement of share units | 3 | | 19 | | — | | — | | — | | 19 | |

| Share-based compensation on option grants | — | | — | | 415 | | — | | — | | 415 | |

| | | | | | |

| Balance, March 31, 2024 | 147,064 | | 407,837 | | 11,483 | | (3,538) | | 21,499 | | 437,281 | |

See accompanying notes to the condensed interim consolidated financial statements

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

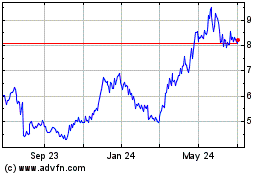

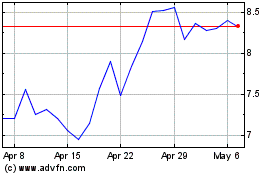

SilverCrest Metals Inc. (the "Company" or "SilverCrest") is a corporation governed by the Business Corporations Act (British Columbia). The Company’s corporate office and principal address is located at 501-570 Granville Street, Vancouver, British Columbia, Canada, V6C 3P1. The Company’s registered office is 19th Floor, 885 West Georgia Street, Vancouver, BC, Canada, V6C 3H4. SilverCrest shares trade on the Toronto Stock Exchange under the symbol SIL and the NYSE-American under the symbol SILV.

SilverCrest engages in silver and gold mining and related activities, including exploration and mine development from its Las Chispas mine located in Sonora, Mexico.

These condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”) applicable to the preparation of interim financial statements, under International Accounting Standard ("IAS") 34 - Interim Financial Reporting and have been condensed with certain disclosures from the Company's audited consolidated financial statements for the year ended December 31, 2023 (the "2023 Annual Financial Statements") omitted. Accordingly, these unaudited condensed interim consolidated financial statements should be read in conjunction with the 2023 Annual Financial Statements.

These unaudited condensed interim consolidated financial statements were approved for issuance by the Board of Directors on May 14, 2024.

| | |

| 3. Material Accounting Policies |

The accounting policies applied in the preparation of these unaudited condensed interim consolidated financial statements, with the exception of those described in Note 4, are consistent with those applied and disclosed in the 2023 Annual Financial Statements.

| | |

4. Changes in Accounting Standards |

Application of New and Revised Accounting Standards

Presentation of Financial Statements (Amendments to IAS 1)

We have adopted the amendments to IAS 1 Presentation of Financial Statements regarding the classification of liabilities as current or non-current based on contractual rights that are in existence at the end of the reporting period and affected by expectations about whether an entity will exercise its right to defer settlement. A liability not due over the next twelve months is classified as non-current even if management intends or expects to settle the liability within twelve months. The amendment also introduces a definition of ‘settlement’ to make clear that settlement refers to the transfer of cash, equity instruments, other assets, or services to the counterparty. The amendment issued in October 2022 also clarifies how conditions with which an entity must comply within twelve months after the reporting period affect the classification of a liability. Covenants to be compiled with after the reporting date do not affect the classification of debt as current or non-current at the reporting date. The amendments are effective for annual reporting periods beginning on or after January 1, 2024. These amendments did not have a material impact on the Company.

Accounting Standards Issued but Not Yet Applied

Presentation and Disclosure in Financial Statements (IFRS 18)

IFRS 18 has been issued to achieve comparability of the financial performance of similar entities. The standard, which replaces IAS 1, impacts the presentation of primary financial statements and notes, mainly the income statement where companies will be required to present separate categories of income and expense for operating, investing, and financing activities with prescribed subtotals for each new category. IFRS 18 will require management-defined performance measures to be explained and included in a separate note within the consolidated financial statement. The standard is effective for financial statements beginning on January 1, 2027, including interim financial statements and requires retrospective application. The Company is currently assessing the impact of this amendment.

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

There are no other standards or amendments or interpretations to existing standards issued but not yet effective that are expected to have a material impact on the Company.

| | |

5. Significant Judgments and Estimates |

In preparing the Company’s unaudited condensed interim financial statements for the three months ended March 31, 2024, the Company applied the critical judgements and estimates, and key sources of estimation uncertainty disclosed in Notes 5 and 6, respectively, of its 2023 Annual Financial Statements.

a)Carrying Values and Measurement of Financial Assets and Liabilities at Amortized Cost or Fair Value through Profit and Loss ("FVTPL")

| | | | | | | | | | | |

| March 31, 2024 | Amortized cost | FVTPL | Total |

| Financial assets | | | |

| Cash and cash equivalents | $ | 71,085 | | $ | - | | $ | 71,085 | |

| Trade and other receivables | 4,980 | | - | | 4,980 | |

| Derivative assets | - | | 548 | | 548 | |

| | | |

| Financial liabilities | | | |

| Accounts payable and accrued liabilities | 16,698 | | 3,534 | | 20,232 | |

| Derivative liabilities | - | | 344 | | 344 | |

| | | | | | | | | | | |

| December 31, 2023 | Amortized cost | FVTPL | Total |

| Financial assets | | | |

| Cash and cash equivalents | $ | 85,964 | | $ | - | | $ | 85,964 | |

| Trade and other receivables | 114 | | - | | 114 | |

| | | |

| Financial liabilities | | | |

| Accounts payable and accrued liabilities | 14,080 | | 3,844 | | 17,924 | |

| Derivative liabilities | - | | 168 | | 168 | |

b)Derivative Instruments

The Company's derivatives are comprised of bullion and foreign currency contracts. During the three months ended March 31, 2024, the Company sold call options and purchased put options on bullion and foreign currency. The Company receives an option premium in cash on selling the option, which is recorded as either an asset or a liability. The value of the option is remeasured using the Black-Scholes option pricing model at each reporting date, with gains or losses recorded as other expense, along with a corresponding increase or decrease to the derivative assets or liabilities.

The gains on derivatives for the three months ended March 31, 2024 were as follows:

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| | |

| Unrealized gains on derivatives (Note 22) | 533 | | - | |

| | |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

c)Fair Value Information

i.Fair Value Measurement

The categories of the fair value hierarchy of inputs used in the valuation techniques are as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities;

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly; and

Level 3: Inputs for the asset or liability based on unobservable market data

The levels in the fair value hierarchy into which the Company’s financial assets and liabilities that are measured and recognized on the Condensed Consolidated Interim Statements of Financial Position at fair value on a recurring basis were categorized as follows:

| | | | | | | | | | | | | | |

| At March 31, 2024 | At December 31, 2023 |

| Level 1 | Level 2 | Level 1 | Level 2 |

| Assets and Liabilities: | | | | |

| Derivative assets | — | | 548 | | — | | — | |

| Derivative liabilities | — | | 344 | | — | | 168 | |

The methodology and assessment of inputs for determining the fair value of financial assets and liabilities as well as the levels of hierarchy for the Company’s financial assets and liabilities measured at fair value remain unchanged from that at December 31, 2023.

ii.Valuation Techniques

Derivative assets and liabilities

The Company’s derivatives were comprised of bullion and foreign currency contracts which are valued using observable market prices.

d)Financial Instruments and Related Risks

The Company has exposure to risks of varying degrees of significance which could affect its ability to achieve its strategic objectives for growth and shareholder returns. The principle financial risks to which the Company is exposed are:

i)Credit risk

ii)Liquidity risk

iii)Market risk

1.Currency risk

2.Interest rate risk

3.Price risk

The Company’s Board of Directors has overall responsibility for the establishment and oversight of the Company’s risk management framework and reviews the Company’s policies on an ongoing basis.

i.Credit Risk

Credit risk is the risk that a counterparty may fail to satisfy its performance obligations under the terms of a financial instrument. Credit risk results from cash and cash equivalents and trade and other receivables.

The Company manages credit risk on its cash and cash equivalents by diversifying these asset holdings with multiple highly rated financial institutions, including the Bank of Montreal ("BMO") and the Bank of Nova Scotia (“BNS”) in Canada and BNS in Mexico. Further, credit risk on trade and other receivables is managed by ensuring amounts are receivable from highly rated financial institutions. The Company has not recognized any expected credit losses with respect to trade and other receivables. For cash and cash equivalents and trade and other receivables, credit risk exposure equals the carrying amount on the balance sheet.

ii.Liquidity Risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company has in place a planning and budgeting process to help determine the funds required to ensure the Company has the appropriate liquidity to meet its operating and growth objectives. The Company's cash and cash

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

equivalents are invested in business accounts with quality financial institutions and are available on demand to fund the Company's operations.

The Company believes its cash and cash equivalents at March 31, 2024 of $71.1 million, bullion of $20.0 million, undrawn $70.0 million Revolving Facility, and continuing revenue and profitable operations are sufficient to settle its commitments through the next 12 months.

iii.Market Risk

1.Currency Risk

The functional and reporting currency of the Company including its subsidiaries is the United States dollar ("USD") and the Company reports results using USD; however, the Company operates in jurisdictions that utilize the Canadian dollar ("CAD") and Mexican peso ("MXN"). As a consequence, the financial results of the Company’s operations as reported in USD are subject to changes in the value of the USD relative to these local currencies. Since the Company’s sales are denominated in USD and a portion of the Company’s operating costs and capital spending are in local currencies, the Company is negatively impacted by changes in local currencies relative to the USD.

In order to mitigate its exposure to currency risk, the Company has entered into option contracts designed to limit the effective exchange rate between the Mexican peso and US dollar. The notional value of open contracts as at March 31, 2024 totaled $34 million, with maturities from April 2024 until January 2025 and exchange rates between 17.06 and 17.74. The positive mark-to-market on open contracts at March 31, 2024 was $0.5 million.

2.Interest Rate Risk

Interest rate risk is the risk that the fair values and future cash flows of the Company will fluctuate because of changes in market interest rates. The average interest rate earned by the Company during the three months ended March 31, 2024 on its cash and cash equivalents was 5.3% (2023 - 5.09%).

On November 29, 2022, the Company's entered into a $120 million senior secured credit facility (the "Credit Facility") comprised of a $50 million term facility (the "Term Facility") and a $70 million revolving facility (the "Revolving Facility") (Note 11). The Company repaid the Term Facility during the first five months of 2023 and incurred a weighted average interest rate of 7.79% during that time. There were no amounts drawn on the Revolving Facility during the three months ended March 31, 2024 or comparative period.

3.Price Risk

The Company is exposed to price risk on precious metals that impact the valuation of the Company’s derivative positions, comprised of gold and silver call options written, which has a direct and immediate impact on net earnings. The prices of precious metals are volatile and affected by many factors beyond the Company’s control, and there can be no assurance that precious metal prices will not be subject to wide fluctuations in the future. A substantial or extended change in precious metal prices could have an adverse effect on the Company’s financial position, income, and cash flows.

The Company purchases gold and silver bullion from a bullion bank as part of its liquidity management program.

Bullion held by the Company was comprised of the following:

| | | | | | | | | | | | | | |

| March 31, 2024 | December 31, 2023 |

| Cost | Fair value | Cost | Fair value |

| Gold bullion | $ | 5,535 | | $ | 6,166 | | $ | 5,535 | | $ | 5,743 | |

| Silver bullion | 13,139 | | 13,873 | | 13,139 | | 13,448 | |

| $ | 18,674 | | $ | 20,039 | | $ | 18,674 | | $ | 19,191 | |

The Company records bullion at fair value with gains of $0.8 million included in other income (note 22) for the three months ended March 31, 2024 and no amount recorded in the comparative period.

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

The Company’s inventories were comprised of the following:

| | | | | | | | |

| March 31, 2024 | December 31, 2023 |

| Stockpile | $ | 30,270 | | $ | 27,115 | |

| In-process | 2,605 | | 2,055 | |

| Finished | 11,465 | | 11,496 | |

| Materials and supplies | 8,900 | | 9,132 | |

| $ | 53,240 | | $ | 49,798 | |

| | |

9. Mineral Properties, Plant, and Equipment |

| | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | December 31, 2023 |

| | Cost | Accumulated Depreciation | Carrying Value | Cost | Accumulated Depreciation | Carrying Value |

| Producing: | | | | | | |

| Mexico | Las Chispas | $ | 298,237 | | $ | (45,814) | | $ | 252,423 | | $ | 281,371 | | $ | (37,130) | | $ | 244,241 | |

| | | | | | | |

| Non-Producing: | | | | | | |

| Mexico | Other | 2,748 | | (260) | | $ | 2,488 | | 2,748 | | (261) | | $ | 2,487 | |

| Canada | Other | 58 | | (58) | | $ | - | | 58 | | (58) | | $ | — | |

| | 2,806 | | (318) | | 2,488 | | 2,806 | | (319) | | 2,487 | |

| Total | | $ | 301,043 | | $ | (46,132) | | $ | 254,911 | | $ | 284,177 | | $ | (37,449) | | $ | 246,728 | |

| | |

10. Accounts Payable and Accrued Liabilities |

Accounts payable and accrued liabilities consist of:

| | | | | | | | |

| March 31, 2024 | December 31, 2023 |

| Trade payables | $ | 5,618 | | $ | 2,938 | |

| Accrued liabilities | 8,424 | | 9,890 | |

| Payroll related liabilities | 2,656 | | 1,957 | |

| Share unit accrued liabilities | 3,534 | | 3,139 | |

| $ | 20,232 | | $ | 17,924 | |

| | | | | |

| SILVERCREST METALS INC. | 10 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

A summary of debt transactions for the three months ended March 31, 2024 and year ended December 31, 2023 is as follows:

| | | | | | | | |

| Three months ended

March 31, 2024 | Year ended

December 31, 2023 |

| Term Facility | | |

| Balance, beginning of period | $ | - | | $ | 49,591 | |

| | |

| | |

| Accretion | - | | 409 | |

| Interest expense | - | | 1,030 | |

| Interest payments | - | | (1,030) | |

| Debt repayment | - | | (50,000) | |

| Balance, end of period | $ | - | | $ | - | |

| | |

| | |

| | |

| | |

Revolving Facility

On November 29, 2022, the Company entered into a $120 million Credit Facility comprised of a $50 million Term Facility, maturing November 28, 2025, and a $70 million Revolving Facility, maturing November 27, 2026. On closing the Credit Facility, the Company drew $50 million from the Term Facility and used $40 million of available cash to repay its $92.9 million secured project financing facility.

The Company fully repaid the Term Facility during the first five months of 2023 and has not drawn from the Revolving Facility in 2024 or 2023. As of March 31, 2024, the Company was in compliance with all financial covenants under the $70 million Revolving Facility.

The Revolving Facility bears interest, and the Term Facility when outstanding bore interest, at a rate based initially on an adjusted Term secured overnight financing rate ("SOFR") as administered by the Federal Reserve Bank of New York, plus an applicable margin ranging from 2.50% to 3.75%. The undrawn portion of the Revolving Facility is subject to a standby fee ranging from 0.5625% to 0.8428% per annum. During the three months ended March 31, 2024, $0.1 million (2023 - $0.2 million) of standby fees and interest were recorded as interest and finance expense.

| | |

12. Reclamation Provision |

Changes to the reclamation and closure provision or the three months ended March 31, 2024 and year ended December 31, 2023 is as follows:

| | | | | | | | |

| March 31, 2024 | December 31, 2023 |

| Balance, beginning of period | $ | 5,855 | | $ | 4,590 | |

| Accretion of reclamation provision (Note 17) | 136 | | 493 | |

| Revisions in estimates and obligations | (5) | | 772 | |

| Balance, end of period | $ | 5,986 | | $ | 5,855 | |

| | |

13. Share Capital and Employee Compensation Plans |

a)Stock Options

For the three months ended March 31, 2024, the total share-based compensation expense relating to stock options was $0.4 million (2023 - $0.3 million) and is presented as a component of general and administrative expense.

Stock options

During the three months ended March 31, 2024, the Company granted 620,800 (2023 - 65,000) stock options. During the three months ended March 31, 2024, the Company issued 125,916 (2023 - 1,282,750) common shares in connection with the exercise of stock options.

| | | | | |

| SILVERCREST METALS INC. | 11 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

The following table summarizes changes in stock options for the three months ended March 31, 2024 and year ended December 31, 2023:

| | | | | | | | | | | | | | |

| Three months ended

March 31, 2024 | Year ended

December 31, 2023 |

| Number of

options | Weighted average

exercised price CAD | Number of

options | Weighted average

exercised price CAD |

| Outstanding, beginning of period | 4,105,200 | $ | 9.16 | | 5,560,450 | $ | 7.87 | |

| Granted | 620,800 | 7.43 | | 65,000 | 7.13 | |

| Exercised | (125,916) | 7.07 | | (1,282,750) | 3.34 | |

| Forfeited | (68,667) | 10.15 | | (237,500) | 9.80 | |

| Outstanding, end of period | 4,531,417 | $ | 8.97 | | 4,105,200 | $ | 9.16 | |

The following table summarizes information about the Company's stock options outstanding at March 31, 2024:

| | | | | | | | | | | | | | | | | |

| Options Outstanding | Options Exercisable |

| Range of Exercise Prices CAD | Number Outstanding as at March 31, 2024 | Weighted Average Remaining Contractual Life (years) | Weighted Average Exercise Price CAD | Number Outstanding as at March 31, 2024 | Weighted Average Exercise Price CAD |

$4.54 - $8.21 | 1,535,550 | | 2.4 | $ | 7.74 | | 833,083 | | $ | 8.02 | |

$8.22 - $8.50 | 1,343,867 | | 2.2 | 8.37 | | 909,699 | | 8.30 | |

$8.51 - $10.80 | 740,000 | | 2.7 | 9.86 | | 493,327 | | 9.86 | |

$10.81 - $12.63 | 912,000 | | 1.9 | 11.18 | | 878,666 | | 11.18 | |

| 4,531,417 | | 2.3 | | $ | 8.97 | | 3,114,775 | | $ | 9.28 | |

b)PSUs

The Company recorded $0.1 million of expense in general and administrative expense for PSUs for the periods ended March 31, 2024 and 2023.

The following table summarizes changes in PSUs for the three months ended March 31, 2024 and year ended December 31, 2023:

| | | | | | | | | | | | | | |

| Three months ended

March 31, 2024 | Year ended

December 31, 2023 |

| Number outstanding | Fair value | Number outstanding | Fair value |

| Outstanding, beginning of period | 153,125 | $ | 705 | | 173,750 | | $ | 764 | |

| Granted | 96,900 | 49 | 61,875 | | 451 | |

| Settled for cash | (61,875) | (405) | (82,500) | | (535) | |

| Change in value | - | 62 | — | | 25 | |

| Outstanding, end of period | 188,150 | $ | 411 | | 153,125 | | $ | 705 | |

c)RSUs

The Company recorded a $0.3 million and $0.1 million expense in general and administrative expense for RSUs for the periods ended March 31, 2024 and 2023, respectively.

| | | | | |

| SILVERCREST METALS INC. | 12 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

The following table summarizes changes in RSUs for the three months ended March 31, 2024 and year ended December 31, 2023:

| | | | | | | | | | | | | | |

| Three months ended

March 31, 2024 | Year ended

December 31, 2023 |

| Number outstanding | Fair value | Number outstanding | Fair value |

| Outstanding, beginning of period | 235,437 | | $ | 1,055 | | 249,498 | | $ | 254 | |

| Granted | 380,800 | | 254 | - | | - | |

| Settled for cash | (87,846) | | (564) | - | | - | |

| Settled for shares | (2,925) | | (16) | - | | - | |

| Forfeited | - | | - | (14,061) | | (20) | |

| Change in value | - | | 83 | - | | 821 | |

| Outstanding, end of period | 525,466 | | $ | 811 | | 235,437 | | $ | 1,055 | |

d)DSUs

The Company recorded a $0.3 million and $0.3 million expense in general and administrative expense for DSUs for the periods ended March 31, 2024 and 2023, respectively.

The following table summarizes changes in DSUs for the three months ended March 31, 2024 and year ended December 31, 2023:

| | | | | | | | | | | | | | |

| Three months ended

March 31, 2024 | Year ended

December 31, 2023 |

| Number outstanding | Fair value | Number outstanding | Fair value |

| Outstanding, beginning of period | 228,000 | | $ | 1,498 | | 228,000 | | $ | 1,364 | |

| Granted | 118,800 | | 790 | | - | | - | |

| Change in value | - | | 20 | | - | | 134 | |

| Outstanding, end of period | 346,800 | | $ | 2,308 | | 228,000 | | $ | 1,498 | |

e)Authorized Shares

The Company's authorized capital stock consists of an unlimited number of common shares and an unlimited number of preferred shares without nominal or par value.

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Gold | $ | 30,923 | | $ | 26,676 | |

| Silver | 32,723 | | 31,307 | |

| $ | 63,646 | | $ | 57,983 | |

| | | | | |

| SILVERCREST METALS INC. | 13 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Materials and consumables | $ | 11,251 | | $ | 9,081 | |

| Salaries and benefits | 2,814 | | 3,155 | |

| Contractors | 5,980 | | 4,127 | |

| Refining and transportation | 452 | | 607 | |

| Other | 514 | | 486 | |

| Changes in inventories | (2,808) | | 582 | |

| $ | 18,203 | | $ | 18,038 | |

| | |

16. General and Administrative Expenses |

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Corporate administration | $ | 3,630 | | $ | 2,815 | |

| Share-based compensation | 1,065 | | 718 | |

| $ | 4,695 | | $ | 3,533 | |

| | |

17. Interest and Finance Expense |

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Interest expense | $ | 147 | | $ | 1,239 | |

| Reclamation accretion expense (Note 12) | 136 | | 107 | |

| Other financing costs | 32 | | 23 | |

| $ | 315 | | $ | 1,369 | |

The income taxes recognized in net earnings and comprehensive earnings are as follows:

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Current tax (recovery) expense | $ | (2,733) | | $ | 2,483 | |

| Deferred tax expense | 4,468 | | 2,721 | |

| $ | 1,735 | | $ | 5,204 | |

| | | | | |

| SILVERCREST METALS INC. | 14 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

The provision for income taxes reported differs from the amounts computed by applying statutory tax rates to the income (loss) before income taxes due to the following:

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Earnings for the period before income taxes | $ | 35,599 | | $ | 32,369 | |

| Statutory tax rate | 27 | % | 27 | % |

| | |

| Income taxes computed at statutory rates | 9,612 | | 8,739 | |

| | |

| | |

| Permanent differences | 404 | | (3,262) | |

| | |

| | |

| | |

| | |

| Effect of other taxes (recovered) paid, mining and withholding | 1,899 | | 2,483 | |

| | |

| Change in unrecognized temporary differences and other | (10,180) | | (2,756) | |

| $ | 1,735 | | $ | 5,204 | |

| | |

19. Supplemental Cash Flow |

The following table summarizes other operating activities adjustments for non-cash income statement items in operating activities:

| | | | | | | | |

| Three months ended

March 31, |

| Other operating activities | 2024 | 2023 |

| Adjustments for non-cash income statement items: | | |

| Reclamation accretion expense (Note 12) | $ | 136 | | $ | 107 | |

| Bullion gains (Note 7) | (847) | | - | |

| Derivative gains (Note 6) | (533) | | - | |

| $ | (1,244) | | $ | 107 | |

The following table summarizes the change in working capital in operating activities:

| | | | | | | | |

| Three months ended

March 31, |

| Change in working capital | 2024 | 2023 |

| Trade and other receivables | $ | (8,712) | | $ | (4,057) | |

| Inventories | (2,532) | | 4,180 | |

| Prepaid expenses | (7,814) | | (239) | |

| Accounts payable | 323 | | (8,428) | |

| Provisions | - | | - | |

| $ | (18,735) | | $ | (8,544) | |

During the year ended December 31, 2023, the Company retrospectively applied an accounting policy change. This adjustment involved the inclusion of cash flows from both interest paid and received within operating activities in the consolidated statements of cash flows. This decision was made as the Company views these forms of financing and investment to be for the benefit of operations, in consideration of a full year of production. The following table provides a reconciliation of the impact of the accounting policy change on the amounts presented for the three months ended March 31, 2023:

| | | | | |

| Amount |

| |

| |

Interest paid(1) | (1,077) | |

Interest received(2) | 721 | |

| |

| |

| |

| |

(1)Previously presented as loan interest payments included in financing activities.

(2)Previously presented in investing activities.

| | | | | |

| SILVERCREST METALS INC. | 15 |

| | | | | |

| Notes to the Condensed Interim Consolidated Financial Statements |

As at March 31, 2024 and December 31, 2023, and for the

three months ended March 31, 2024 and 2023

(unaudited with tabular amounts in thousands of USD$ except number of shares,

options and per share amounts, unless otherwise noted) |

| | |

20. Segmented Information |

The Company’s reportable operating segment, which has separate financial information available, is assessed regularly for performance by the Company’s Chief Executive Officer, who is the Company’s chief operating decision maker ("CODM"). The Company has concluded that it has a single operating segment: Las Chispas Mine, which includes Picacho. Corporate includes the corporate team that provides administrative, technical, financial, and other support to the Company’s business units.

Segments and their performance measures are listed below:

| | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2024 | | | | |

| Segment | Revenue | Production costs and government royalties | Depreciation | Mine operating earnings | Capital expenditures |

| Las Chispas | $ | 63,646 | | $ | 18,393 | | $ | 7,776 | | $ | 37,477 | | $ | 14,804 | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| For the three months ended March 31, 2023 | | | | |

| Segment | Revenue | Production costs and government royalties | Depreciation | Mine operating earnings | Capital expenditures |

| Las Chispas | $ | 57,983 | | $ | 18,332 | | $ | 4,045 | | $ | 35,606 | | $ | 7,930 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | |

| At March 31, 2024 | | | |

| Segment | Assets | Liabilities | Net assets |

| Las Chispas | $ | 431,689 | | $ | 22,205 | | $ | 409,484 | |

| Corporate | 37,216 | | 10,866 | | 26,350 | |

| Other | 1,471 | | 24 | | 1,447 | |

| $ | 470,376 | | $ | 33,095 | | $ | 437,281 | |

| | | | | | | | | | | |

| At December 31, 2023 | | | |

| Segment | Assets | Liabilities | Net assets |

| Las Chispas | $ | 420,613 | | $ | 43,899 | | $ | 376,714 | |

| Corporate | 38,039 | | 13,926 | | 24,113 | |

| Other | 1,522 | | 24 | | 1,498 | |

| $ | 460,174 | | $ | 57,849 | | $ | 402,325 | |

| | |

21. Related Party Transactions |

The Company’s related parties include its subsidiaries, and key management personnel. Transactions with the Company's subsidiaries have been eliminated on consolidation.

| | | | | | | | |

| Three months ended

March 31, |

| 2024 | 2023 |

| Derivative gains (Note 6(b)) | $ | 533 | | $ | - | |

| Bullion gains | 847 | | - | |

| Miscellaneous expense | (30) | | - | |

| Other Income | $ | 1,350 | | $ | - | |

| | | | | |

| SILVERCREST METALS INC. | 16 |

Management's Discussion and Analysis

FOR THE THREE MONTHS ENDED MARCH 31, 2024

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

Forward-Looking Information

This MD&A contains “forward-looking statements” and “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable Canadian and United States securities legislation. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, planned expenditures and plans related to its business and other matters that may occur in the future. In addition, these statements include, but are not limited to: the future price of commodities; the estimation of Mineral Resource and Mineral Reserve Estimates; the realization of Mineral Resource and Mineral Reserve Estimates; the timing and amount of estimated future production; costs of production; capital expenditures; costs and timing of the development of new deposits; timing of completion of exploration programs; technical reports and studies; the success of exploration and development activities and mining operations; future financings, the Company’s share price and on the timing and completion of exploration programs, the productivity and timing of mine operation activities; permitting timelines; currency fluctuations; requirements for additional capital; government regulation of exploration and production operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; completion of acquisitions and their potential impact on the Company and its operations; limitations on insurance coverage; maintenance of adequate internal control over financial reporting; and the development and advancement of the Company’s environmental, social, and corporate governance strategy.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation: the Company’s expectations of future performance, including gold and silver production and planned work programs; present and future business strategies; the environment in which the Company will operate in the future, including the price of gold and silver; currency exchange rates; estimates of capital and operating costs; production estimates; Mineral Resource and Mineral Reserve Estimates, and metallurgical recoveries; and mining operational and development risks. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation: fluctuating prices and availability of commodities; price inflation of goods and services; the timing and content of work programs; interest rate risks; global market conditions; fluctuations in the Company’s share prices; results of exploration activities; the interpretation of drilling results and other geological data; reliability of Mineral Resource and Reserve estimates; receipt, maintenance and security of permits and mineral property titles; enforceability of contractual interests in mineral properties; environmental and other regulatory risks; the effects of climate change; compliance with changing environmental regulations; dependence on local community relationships; risks of local violence; risks related to natural disasters, terrorism, civil unrest, public health concerns (including the impact on operations of health epidemics or outbreaks of communicable diseases such as the COVID-19 pandemic) and other geopolitical uncertainties; reliability of costs estimates; project cost overruns or unanticipated costs and expenses; precious metals price fluctuations; fluctuations in the foreign exchange rate (particularly Mexican peso ("MXN"), Canadian dollar ("CAD"), and United States dollar("USD")); risks associated with taxation in multiple jurisdictions; uncertainty in the Company’s ability to fund the exploration and development of its mineral properties or the completion of further exploration programs; uncertainty as to whether the Company’s exploration programs will result in the discovery, development or production of commercially viable ore bodies or yield reserves; operational, health and safety risks; infrastructure risks; risks associated with costs of reclamation; development plans and costs differing materially from the Company’s expectations; risks and uncertainties related to the timing of mine operation activities; risks related to mineral properties being subject to prior unregistered agreements, transfers, claims, and other defects in title; uncertainty in the ability to obtain financing if required; maintaining adequate internal control over financial reporting; dependence on key personnel; and general market and industry conditions. This list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements.

The Company’s forward-looking statements are based on beliefs, expectations, and opinions of management on the date the statements are made. While the Company has attempted to identify important factors that could cause actual actions, events, or results to differ from those described in forward-looking statements, there may be factors that cause actions, events, or results not to be as anticipated, estimated, or intended. The Company undertakes no obligation to update or

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

revise any forward-looking statements included in this MD&A if these beliefs, expectations and opinions or other circumstances should change, except as otherwise required by applicable law.

Cautionary Note to U.S. Investors

This MD&A includes Mineral Resource and Reserve classification terms that comply with reporting standards in Canada and the Mineral Resource and Reserve estimates are made in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the United States Securities and Exchange Commission (the "SEC") applicable to domestic United States reporting companies. Consequently, Mineral Resource and Reserve information included in this MD&A may not be comparable to similar information that would generally be disclosed by United States domestic reporting companies subject to the reporting and disclosure requirements of the SEC. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with US standards.

Qualified Person

Technical information contained in this MD&A has been prepared by or under the supervision of N. Eric Fier, CPG, P.Eng., and Chief Executive Officer of the Company, who is a Qualified Person for the purpose of NI 43-101.

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

This Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand SilverCrest Metals Inc. (“SilverCrest”, “we”, “our” or the “Company”), our liquidity, capital resources, and operational and financial performance as at, and for the three month period ended March 31, 2024, in comparison to the corresponding prior-year periods.

This MD&A should be read in conjunction with the Company's unaudited condensed interim consolidated financial statements and notes (the "Financial Statements"), prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards”) applicable to the preparation of interim financial statements under International Accounting Standard 34 Interim Financial Reporting (“IAS 34”), for the three months ended March 31, 2024.

This MD&A should also be read in conjunction with the Company’s audited consolidated financial statements and notes for the year ended December 31, 2023 (the “2023 Annual Financial Statements”), related annual MD&A, Form 40-F/Annual Information Form, and other continuous disclosure materials available on our website at www.silvercrestmetals.com, on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, as applicable (For avoidance of doubt, unless specifically noted, no items from these or other websites mentioned in this MD&A are incorporated by reference).

All amounts in this MD&A and the unaudited condensed interim consolidated financial statements for the three months ended March 31, 2024 are presented in United States dollars (“USD”) unless identified otherwise.

The following are other abbreviations used throughout this MD&A: Au (gold), Ag (silver), AgEq (silver equivalent), oz (ounces), koz (kilo-ounces), gpt (grams per tonne), kt (kilotonne), km (kilometres) and tpd (tonnes per day).

The AgEq ratio used in this MD&A is based on the gold to silver ratio of 79.51:1 from the technical report titled “Las Chispas Operation Technical Report” dated September 5, 2023 with an effective date of July 19, 2023 (the “2023 Technical Report”).

The effective date of this MD&A is May 14, 2024.

Non-GAAP Financial Measures

This MD&A refers to various non-GAAP measures which are used by the Company to manage and evaluate operating performance at the Company's Las Chispas mine and though widely reported in the mining industry as benchmarks for performance, do not have standardized meanings under IFRS Accounting Standards, and the methodology by which these measures are calculated may differ from similar measures reported by other companies. To facilitate a better understanding of these non-GAAP measures as calculated by the Company, additional information has been provided in this MD&A. Please refer to the section of this MD&A entitled “Non-GAAP Financial Measures” for a detailed description, and a reconciliation to the most comparable GAAP measure, of the following measures used in this MD&A:

•Average realized gold and silver price

•Sustaining and non-sustaining capital expenditures

•Free cash flow & Free cash flow per share (basic)

•Working capital

•Operating cash flow before change in working capital & Operating cash flow before change in working capital per share (basic)

•Operating cash flow per share (basic)

•Treasury assets

•Cash costs

•All-in sustaining costs ("AISC")

| | |

2. Description of Business |

SilverCrest is a Canadian-based precious metals producer headquartered in Vancouver, BC. The Company's principal focus is operating its Las Chispas silver and gold operation ("Las Chispas" or the "Las Chispas Operation" or the "Las Chispas Mine"). SilverCrest has an ongoing initiative to increase its asset base by expanding current Mineral Resource and Reserve Estimates, acquiring, discovering and developing high value precious metal projects, and ultimately operating multiple silver-gold mines in the Americas. The Company is listed on the Toronto Stock Exchange (Symbol: SIL) and on the NYSE-American (Symbol: SILV).

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

The following highlights refer to free cash flow, cash costs, AISC, and treasury assets which are described in more detail in section "9. Non-GAAP Financial Measures" of this MD&A.

Q1, 2024

•Recovered 14,719 ounces (“oz”) gold (“Au”) and 1.4 million oz silver (“Ag”), or 2.6 million oz silver equivalent (“AgEq”).

•Sold 15,000 oz Au and 1.4 million oz Ag (2.6 million oz AgEq) at average realized prices of $2,062/oz Au and $23.37/oz Ag.

•Revenue of $63.6 million and cost of sales of $26.2 million.

•Mine operating earnings of $37.5 million (59% operating margin), exceeded the $36.9 million generated in Q4, 2023.

•Net earnings of $33.9 million or basic earnings of $0.23 per share.

•Cash costs of $7.09 per oz AgEq sold and AISC of $12.90 per oz AgEq sold.

•Operating cash outflow of $1.1 million and operating cash flow before changes in working capital of $17.6 million or $0.12 per share, after payment of 2023 taxes and duties which totaled $26.2 million.

•Free cash flow was negative $11.4 million or $0.08 per share for the quarter, due largely to the payment of 2023 taxes and duties and a $7.5 million prepayment for mining services.

•Reported retained earnings of $21.5 million on the Company’s balance sheet at the end of the quarter, achieving this milestone in only the sixth quarter since commercial production was declared.

•Ended the quarter with treasury assets totaling $91.1 million ($71.1 million cash and $20.0 million in bullion) and no debt outstanding.

| | |

4. Environmental, Social, and Governance ("ESG") |

In Q1, 2024 installation of two kilometres of pipeline for water conduction for agricultural use in the community was initiated as part of the Company’s ongoing commitment to water stewardship.

Also in the quarter, work continued to advance efforts to integrate renewable solar power at Las Chispas. This program is expected to be underway through 2024 with a target to begin implementation of a solar installation in 2025. The benefits of this program are expected to include cost savings and a reduction in GHG emissions.

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

The following operating performance refers to operating cash flow per share (basic), free cash flow, free cash flow per share (basic), cash costs, AISC, and treasury assets which are described in more detail in section "8. Non-GAAP Financial Measures" of this MD&A.

| | | | | | | | | | | |

| OPERATIONAL | Unit | Q1, 2024 | Q1, 2023 |

| Ore mined | tonnes | 85,737 | 63,600 |

| Underground development | km | 4.2 | 2.8 |

Ore milled(1) | tonnes | 93,373 | 104,400 |

| Average daily mill throughput | tpd | 1,026 | 1,160 |

| | | |

| Gold | | | |

| Average grade | gpt | 4.97 | 4.06 |

| Recovery | % | 98.6 | % | 97.5 | % |

| Recovered | oz | 14,719 | 13,300 |

| Sold | oz | 15,000 | 14,200 |

| | | |

| Silver | | | |

| Average grade | gpt | 479 | 419 |

| Recovery | % | 98.0 | % | 91.9 | % |

| Recovered | million oz | 1.41 | 1.29 |

| Sold | million oz | 1.40 | 1.36 |

| | | |

Silver equivalent(2) | | | |

| Average grade | gpt | 874 | 742 |

| Recovery | % | 98.3 | % | 94.4 | % |

| Recovered | million oz | 2.58 | 2.35 |

| Sold | million oz | 2.59 | 2.49 |

|

| FINANCIAL | Unit | Q1, 2024 | Q1, 2023 |

| Revenue | $ millions | $ | 63.6 | | $ | 58.0 | |

| Cost of sales | $ millions | $ | (26.2) | | $ | (22.4) | |

Mine operating earnings | $ millions | $ | 37.5 | | $ | 35.6 | |

| Earnings for the period | $ millions | $ | 33.9 | | $ | 27.2 | |

| Earnings per share (basic) | $/share | $ | 0.23 | | $ | 0.18 | |

Operating cash flow | $ millions | $ | (1.1) | | $ | 26.6 | |

Operating cash flow (basic) | $/share | $ | (0.01) | | $ | 0.18 | |

| Free cash flow | $ millions | $ | (11.4) | | $ | 19.0 | |

Free cash flow (basic) | $/share | $ | (0.08) | | $ | 0.13 | |

Cash costs(2) | $/oz AgEq | $ | 7.09 | | $ | 7.36 | |

AISC(2) | $/oz AgEq | $ | 12.90 | | $ | 10.90 | |

| Unit | March 31, 2024 | December 31, 2023 |

| Cash and cash equivalents | $ millions | $ | 71.1 | | $ | 86.0 | |

| Bullion | $ millions | $ | 20.0 | | $ | 19.2 | |

| Treasury assets | $ millions | $ | 91.1 | | $ | 105.2 | |

| | | |

| | | |

(1)Ore milled includes material from stockpiles and ore mined.

(2)Q1, 2023 Figures have been recast to align with the current period’s presentation as follows: 1. Silver equivalent ounces sold have been adjusted to reflect a ratio of 79.51:1, used in the 2023 Technical Report, from the previous 86.9:1, and 2. Cash costs increased by $2.1 million from the exclusion of adjustments for corporate salaries and other expenses, and changes in inventories.

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

Underground

In the quarter a total of 85,737 tonnes were mined from the underground. Mining rates in Q1, 2024 averaged 942 tpd, a 10% increase from Q4, 2023. Ramp-up of the underground is planned to continue through 2024 with a target to exit the year at over 1,050 tpd. Key performance indicators which track the quality of mining, such as ore loss and mining dilution, continued to track to or better than plan.

The mobilization of the new underground mining contractor is largely on pace and continuing to progress, with good collaboration and coordination between the new and outgoing contractors contributing to the strong underground mining rates in the quarter. Mobilization of our new contractor is expected to continue through Q3, 2024.

In the quarter, the Company completed 4.2 km of horizontal and vertical underground development. Development rates and costs were inline with expectations.

Processing Plant

Average daily mill throughput was 1,026 tpd in Q1, 2024, a decrease from previous quarters due to planned maintenance that was completed ahead of schedule. Process plant availability returned to 92% in March 2024, which is in the range of planned availability.

Average processed grades of 4.97 gpt Au and 479 gpt Ag, or 874 gpt AgEq marked a record for silver equivalent processed grades. These higher grades were strategically planned to offset the planned downtime in Q1, 2024, facilitated by sizable surface stockpiles and a flexible mine plan. Process grades are expected to moderate in Q2, 2024 as processing plant rates increase to be more inline with the expected average rate for the remainder of 2024 of 1,200 tpd.

Average process recoveries in Q1, 2024 were 98.6% Au and 98.0% Ag, or 98.3% AgEq, setting another record for the plant. These higher recoveries benefited from consistent and higher grade feed.

Sustaining Capital

Sustaining capital totaled $10.2 million in Q1, 2024 which consisted largely of the costs attributed to underground development and infrastructure. Expenditures in the quarter were lower than planned due to the timing of some payments and delay in execution of some surface infrastructure projects which are expected to be made in Q2, 2024. The delay in sustaining capital spending is not expected to impact production, with 2024 sustaining capital still expected to be in the range of $40.0 to $44.0 million.

Costs

During the quarter, cash costs averaged $7.09 per oz AgEq sold. Cash costs were below the 2024 guidance range of $9.50 to $10.00 per oz AgEq sold, mainly due to lower volume processed, higher grades, and lower maintenance costs. Cash costs are expected to increase over the balance of the year to align with 2024 full year guidance.

AISC averaged $12.90 per oz AgEq sold in Q1, 2024, lower than expected due primarily to a combination of lower cash costs and sustaining capital costs. It is anticipated that AISC will increase in Q2, 2024, with 2024 annual AISC guidance of $15.00 to $15.90 per oz AgEq sold reiterated.

Exploration

Beginning in H2, 2023 through Q1, 2024, a combination of infill (75%) and expansion (25%) drilling (161 holes totaling 34,384 metres) was completed to test Inferred resources that were identified as high priority for potential conversion to Indicated resources in the 2023 Technical Report. Approximately 10 million oz AgEq were targeted for potential conversion to Indicated resources in proximity to existing or planned underground development.

Drilling targeted the Babicanora Area where seven veins were tested. Drill results confirmed mineral continuity in these targets, with results in general verifying the grades and thicknesses of the targeted Inferred resource proximal to underground infrastructure as presented in the 2023 Technical Report. Opportunities for further expansion of mineralization were identified in the Babicanora Norte Splay 3 vein (“BAN Splay 3”) and Babicanora Sur vein ("BAS") where drilling extended the mineralized footprint down dip and to the southeast of BAN Splay 3 and to the northwest of BAS beyond the initial area of the targeted Inferred resources. These results are being compiled and assessed for the potential conversion to Indicated resources for reserve consideration.

Drill intercept highlights from 161 drillholes are presented in the following tables. All grades are reported as uncapped and undiluted based on a 150 gpt AgEq cut-off grade. This cut-off grade is used to evaluate exploration targets in the initial

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

stages of work and may differ from the cut-off grade used for future resource and reserve estimations. Please refer to the 2023 Technical Report for resource and reserve cutoff grades used with respect to vein thicknesses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Babicanora Sur (BAS) Infill and Expansion Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| BAS-23-233 | 109.8 | | 110.4 | | 0.6 | | 0.5 | | 7.55 | | 197.0 | | 797 | |

| BAS-23-234 | 120.8 | | 122.5 | | 1.7 | | 1.4 | | 9.07 | | 295.6 | | 1,017 | |

| Includes | 121.5 | | 122.5 | | 1.0 | | 0.8 | | 8.80 | | 415.0 | | 1,115 | |

| BAS-23-243 | 265.2 | | 265.7 | | 0.5 | | 0.4 | | 0.73 | | 105.0 | | 163 | |

| BAS-23-244 | 249.2 | | 254.8 | | 5.6 | | 4.5 | | 5.83 | | 605.0 | | 1,068 | |

| Includes | 249.2 | | 249.7 | | 0.5 | | 0.4 | | 29.70 | | 3,400.0 | | 5,761 | |

| Includes | 254.3 | | 254.8 | | 0.5 | | 0.4 | | 26.10 | | 2,540.0 | | 4,615 | |

| BAS-23-245 | 248.4 | | 249.0 | | 0.5 | | 0.4 | | 1.24 | | 113.0 | | 212 | |

| BAS-23-247 | 250.1 | | 250.9 | | 0.8 | | 0.6 | | 1.04 | | 91.0 | | 174 | |

| BAS-23-249 | 275.5 | | 276.0 | | 0.5 | | 0.4 | | 11.80 | | 1,540.0 | | 2,478 | |

| BAS-23-250 | 245.2 | | 245.8 | | 0.5 | | 0.4 | | 1.98 | | 59.9 | | 217 | |

| BAS-23-251 | 281.5 | | 284.6 | | 3.1 | | 2.5 | | 7.22 | | 517.0 | | 1,091 | |

| Includes | 284.0 | | 284.6 | | 0.6 | | 0.5 | | 28.00 | | 2,070.0 | | 4,296 | |

| BAS-23-252 | 273.8 | | 274.3 | | 0.5 | | 0.4 | | 1.60 | | 179.0 | | 306 | |

| BAS-23-253 | 129.0 | | 135.0 | | 6.0 | | 4.8 | | 1.86 | | 47.2 | | 195 | |

| BAS-23-256 | 95.5 | | 96.0 | | 0.5 | | 0.4 | | 3.97 | | 173.0 | | 489 | |

| BAS-24-263 | 276.5 | | 277.3 | | 0.8 | | 0.6 | | 1.37 | | 100.0 | | 209 | |

| BAS-24-265 | 298.0 | | 298.9 | | 0.8 | | 0.6 | | 0.96 | | 103.0 | | 179 | |

| BAS-24-266 | 288.1 | | 288.8 | | 0.7 | | 0.6 | | 1.35 | | 158.0 | | 265 | |

| BAS-24-267 | 212.0 | | 212.9 | | 0.9 | | 0.7 | | 5.86 | | 588.0 | | 1,054 | |

| BAS-24-268 | 192.1 | | 192.6 | | 0.5 | | 0.4 | | 1.67 | | 66.0 | | 199 | |

Weighted Average | 1.5 | | 1.2 | | 4.35 | | 323.0 | | 669 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Babicanora Sur Footwall (BAS FW) Infill Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| BAS-23-243 | 316.4 | | 316.9 | | 0.5 | | 0.4 | | 12.15 | | 1,025.0 | | 1,991 | |

| BAS-23-247 | 300.0 | | 301.1 | | 1.1 | | 0.9 | | 0.65 | | 138.9 | | 191 | |

| BAS-23-255 | 244.6 | | 245.2 | | 0.6 | | 0.5 | | 4.34 | | 243.0 | | 588 | |

| Weighted Average | 0.7 | | 0.6 | | 4.27 | | 370.4 | | 710 | |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Babicanora Norte Splay 3 (BAN Splay 3) Infill and Expansion Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| UBN-23-26 | 133.8 | | 134.6 | | 0.8 | | 0.6 | | 0.75 | | 115.0 | | 175 | |

| UBN-23-28 | 188.9 | | 191.0 | | 2.1 | | 1.7 | | 2.87 | | 384.0 | | 612 | |

| Includes | 189.4 | | 189.9 | | 0.5 | | 0.4 | | 5.74 | | 687.0 | | 1,143 | |

| UBN-23-29 | 205.3 | | 205.8 | | 0.6 | | 0.4 | | 6.79 | | 854.0 | | 1,394 | |

| UBN-23-31 | 195.9 | | 196.5 | | 0.6 | | 0.4 | | 15.15 | | 1,575.0 | | 2,780 | |

| UBN-23-32 | 199.7 | | 200.2 | | 0.5 | | 0.4 | | 37.70 | | 4,250.0 | | 7,248 | |

| UBN-23-33 | 180.7 | | 181.3 | | 0.7 | | 0.5 | | 2.90 | | 377.0 | | 608 | |

| UBN-23-37 | 201.5 | | 202.7 | | 1.2 | | 0.9 | | 46.35 | | 3,394.6 | | 7,080 | |

| Includes | 202.1 | | 202.7 | | 0.6 | | 0.4 | | 98.30 | | 7,040.0 | | 14,856 | |

| UBN-23-39 | 215.6 | | 216.1 | | 0.5 | | 0.4 | | 0.85 | | 150.0 | | 218 | |

| UBN-23-40 | 235.8 | | 236.3 | | 0.5 | | 0.4 | | 9.42 | | 1,025.0 | | 1,774 | |

| UBN-24-42 | 235.0 | | 235.5 | | 0.5 | | 0.4 | | 20.70 | | 2,630.0 | | 4,276 | |

| UBN-24-44 | 200.9 | | 201.4 | | 0.5 | | 0.4 | | 0.79 | | 151.0 | | 214 | |

| Weighted Average | 0.8 | | 0.6 | | 13.24 | | 1,274.1 | | 2,326 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Babicanora Norte Northwest (BAN NW) Infill Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| BAN-23-448 | 182.4 | | 183.1 | | 0.7 | | 0.6 | | 3.11 | | 429.0 | | 676 | |

| BAN-24-463 | 93.7 | | 94.2 | | 0.5 | | 0.4 | | 2.24 | | 280.0 | | 458 | |

| BAN-24-466 | 91.4 | | 91.9 | | 0.5 | | 0.4 | | 11.80 | | 921.0 | | 1,859 | |

| BAN-24-467 | 92.7 | | 93.3 | | 0.5 | | 0.4 | | 2.43 | | 384.0 | | 577 | |

| Weighted Average | 0.6 | | 0.5 | | 4.79 | | 500.7 | | 882 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Babi Vista Footwall (BAV FW) Infill Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| UBV-23-68 | 91.2 | | 91.7 | | 0.5 | | 0.4 | | 39.40 | | 7,750.0 | | 10,883 | |

| UBV-23-69 | 143.6 | | 144.1 | | 0.5 | | 0.4 | | 0.85 | | 123.0 | | 191 | |

| UBV-23-76 | 131.9 | | 132.4 | | 0.5 | | 0.4 | | 29.90 | | 2,100.0 | | 4,477 | |

| Weighted Average | 0.5 | | 0.4 | | 23.41 | | 3,272.1 | | 5,133 | |

| | | | | |

| SILVERCREST METALS INC. | 10 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

| | | | | | | | | | | | | | | | | | | | | | | |

| El Muerto Splay (EM Splay) Infill Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| EM-23-142 | 343.9 | | 344.4 | | 0.5 | | 0.4 | | 8.33 | | 538.0 | | 1,200 | |

| EM-23-145 | 327.0 | | 327.5 | | 0.5 | | 0.4 | | 8.19 | | 1,205.0 | | 1,856 | |

| EM-23-148 | 365.9 | | 366.4 | | 0.5 | | 0.4 | | 13.85 | | 983.0 | | 2,084 | |

| EM-23-150 | 353.2 | | 353.8 | | 0.6 | | 0.5 | | 1.84 | | 137.0 | | 283 | |

| Weighted Average | 0.5 | | 0.4 | | 7.85 | | 703.4 | | 1,327 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Encinitas Infill Drilling |

| Hole ID | From | To | Drilled | Approx. | Au gpt | Ag gpt | AgEq gpt* |

| Intercept | True |

| (m) | Thickness |

| (m) |

| BAS-23-232 | 149.4 | | 150.5 | | 1.1 | | 0.8 | | 3.07 | | 2.4 | | 246 | |

| BAS-23-240 | 151.6 | | 152.1 | | 0.5 | | 0.4 | | 2.14 | | 10.1 | | 180 | |

| BAS-23-248 | 165.1 | | 165.9 | | 0.8 | | 0.6 | | 6.56 | | 4.3 | | 526 | |

| BAS-23-255 | 33.0 | | 34.8 | | 1.8 | | 1.4 | | 2.56 | | 8.1 | | 212 | |

| BAS-23-257 | 208.2 | | 208.8 | | 0.6 | | 0.5 | | 1.37 | | 48.8 | | 158 | |

| BAS-24-258 | 262.2 | | 262.7 | | 0.5 | | 0.4 | | 4.29 | | 228.0 | | 569 | |

| BAS-24-259 | 184.4 | | 185.4 | | 1.0 | | 0.8 | | 3.09 | | 86.2 | | 332 | |

| BAS-24-261 | 181.6 | | 182.2 | | 0.6 | | 0.5 | | 81.70 | | 52.0 | | 6,548 | |

| BAS-24-266 | 151.4 | | 152.5 | | 1.1 | | 0.9 | | 3.27 | | 90.1 | | 350 | |

| EN-23-09 | 148.1 | | 148.6 | | 0.5 | | 0.4 | | 3.36 | | 17.6 | | 285 | |

| EN-23-10 | 148.5 | | 149.0 | | 0.5 | | 0.4 | | 2.47 | | 14.6 | | 211 | |

| EN-23-15 | 165.2 | | 165.9 | | 0.7 | | 0.6 | | 5.93 | | 68.1 | | 540 | |

| Weighted Average | 0.8 | | 0.6 | | 8.25 | | 47.6 | | 704 | |

* AgEq has been determined using an Ag:Au ratio of 79.51:1, as calculated based on long-term gold and silver prices of $1,650/oz Au and $21.00/oz Ag, metallurgical recovery values of 98% Au/97% Ag, and assuming applicable smelter charge and royalty of 0.5% for both gold and silver.

2024 Las Chispas and Regional Exploration Program

With the majority of the Las Chispas high priority Inferred resources now drill tested, exploration efforts will return to earlier stage targeting at Las Chispas and regionally.

The Company’s strong regional geological knowledge and expertise is being applied to identify potential nearby satellite deposits which could eventually contribute additional feed to the Las Chispas plant. Throughout 2023 a regional evaluation program was carried out to identify priority opportunities. In 2024, a number of targets, including Picacho, have been chosen for further work including mapping, sampling, and drilling.

The 2024 exploration budget of $12.0 to $14.0 million is inclusive of this regional work.

| | | | | |

| SILVERCREST METALS INC. | 11 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2024

(All amounts are in USD with tabular

amounts in thousands of USD) |

Net earnings

During the three months ended March 31, 2024, net earnings were $33.9 million, compared to net earnings of $27.2 million for the three months ended March 31, 2023. Net earnings in both Q1, 2024 and Q1, 2023 benefited from relatively low effective tax rates, well below anticipated long term tax rates which are expected to approximate statutory corporate tax rates. The effective tax rate for Q1, 2024 was 5%.

The following table summarizes the Q1, 2024 vs Q1, 2023 differences in net earnings:

| | | | | | | | | |

| Three months | | Note |

Net earnings, period ended March 31, 2023 | $ | 27,165 | | | |

| Increased revenue | 5,663 | | | 1 |

| Increased production costs and government royalties | (61) | | | |

| Increased depreciation | (3,731) | | | |

| Increased cost of sales | $ | (3,792) | | | 2 |

| Increased mine operating earnings | $ | 1,871 | | | |

| Increased other income | 1,350 | | | 3 |

| Decreased interest and finance expense | 1,054 | | | 4 |

| Increased interest income | 866 | | | |

| Increased general and administrative expenses | (1,162) | | | 5 |

| Decreased foreign exchange gains | (753) | | | |

| | | |

| | | |

| | | |

| | | |

| Other | 3,473 | | | |

Net earnings, period ended March 31, 2024 | $ | 33,864 | | | |

1)Revenue

Q1, 2024 vs Q1, 2023

During Q1, 2024, the Company sold a total of 15,000 oz Au and 1.4 million oz Ag at average realized prices of $2,062/oz Au and $23.37/oz Ag, generating revenue of $63.6 million. During Q1, 2023, the Company sold a total of 14,200 oz Au and 1.4 million oz Ag at average realized prices of $1,879/oz Au and $23.00/oz Ag, generating revenue of $58.0 million. The Q1, 2024 increase in revenue was thus driven by higher Au and Ag prices and higher quantities sold.

The following table reflects quarterly realized metal prices and quantities sold:

| | | | | | | | | | | | | | |

| Realized Metal Prices ($ per oz) | Quantities of Metal Sold (oz) |

| Three months ended

March 31, | Three months ended

March 31, |