Are Solar ETFs in Trouble? - ETF News And Commentary

December 10 2013 - 10:00AM

Zacks

The Solar ETF space has had a pretty rocky—and for the most

part—unfavorable history. However, 2013 was a banner year for the

space with a number of solar power stocks accelerating and seeing

huge gains.

In fact, thanks to solid earnings and a bright outlook, the solar

ETF segment easily outperformed the market in the YTD time frame.

Both the

Guggenheim Solar ETF (TAN) and the

Market Vectors Solar ETF (KWT) have surged more

than 80% YTD, thoroughly crushing the broad market’s performance

over the same time period.

Still, most of these gains came earlier in the year and especially

over the summer when solar ETFs were roaring higher. As of late,

the solar ETF market has been a bit choppier as investors have

sought to lock in some gains in this impressive market segment (see

3 Sector ETFs Crushing the Market in 2013).

This profit taking—coupled with some concerns over high flying

stocks thanks to the Fed and their easing program—has sent solar

shares sharply lower in the past few weeks. Concerns are really

starting to build over this space, particularly if you take a

technical look at the most popular ETF in the segment, TAN.

A Technical Look at TAN

While TAN had strong momentum earlier in the year, events have

become far choppier as of late. The product is now well off of its

52 week high, and recent trading has been pretty negative.

In fact, TAN recently saw its 9 Day SMA (Simple Moving Average)

fall below its 50 Day SMA, suggesting short term bearishness. The

product is also seeing a sluggish reading in its Parabolic SAR,

further confirming the short term bearishness for the solar space

(see Go Green with These 3 Clean Energy ETFs).

Fundamental Factors

Beyond these worrying technicals, there have also been some

concerns creeping up in the fundamental side of the equation as

well. This is particularly true on the earnings front, as results

have come in a bit more mixed as of late. Two companies that have

been great examples of this recent trend are

SolarCity

(SCTY) and

ReneSola (SOL).

SCTY saw solid earnings and revenues for the most recent quarter,

but its guidance definitely disappointed investors. It is now

looking for a loss between 55 and 65 cents a share, compared to a

loss of 47 cents a share before. This was ill-received by the

market—which was having increasingly high expectations for SCTY—so

a drop in share price was pretty much inevitable following this

news (see Did SolarCity Earnings Crush the Solar ETF Rally?).

Meanwhile, RenaSola is a great example of the concerns building

over the Chinese segment of the solar market. The company recently

announced it would be closing a polysilicon factory, sending shares

of this company, and other Chinese solar firms, plunging.

Furthermore, there are also concerns that utility-scale projects

will be capped in China for 2014. So while there is likely to be a

12 GW installation target, this could assist smaller solar firms

more than their larger counterparts, hurting components of products

like TAN or KWT in the process.

So with this kind of backdrop, solar ETFs have been hit relatively

hard as of late, sending prices of both sharply lower. In fact, TAN

is down almost 15% in the past month, while KWT is sporting a loss

that is approaching 10% over the same time period as well,

suggesting these securities are definitely in a serious slump.

Bottom Line

While the short term isn’t looking great for TAN and KWT, there is

hope for the longer term for both of these products. Solar still

makes up a very small part of the total energy mix in the U.S. so

there is plenty of market share that can be gained by this energy

type.

Plus, the segment has weeded out many of its weakest players

already, so the few that remain are among the strongest and most

efficient players, meaning they are well positioned even if there

is a prolonged downturn in the market (see all the Alternative

Energy ETFs here).

So, if you have been thinking about solar ETFs lately, consider

waiting for a bottoming out of this short term trend, but be ready

to buy for the long term once this recent bear run subsides.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

MKT VEC SOLAR (KWT): ETF Research Reports

SOLARCITY CORP (SCTY): Free Stock Analysis Report

RENESOLA LT-ADR (SOL): Free Stock Analysis Report

GUGG-SOLAR (TAN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

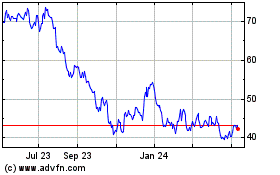

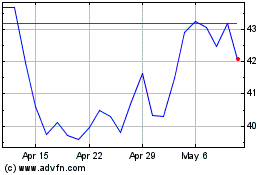

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Invesco Solar ETF (AMEX:TAN)

Historical Stock Chart

From Jan 2024 to Jan 2025