Enservco Corporation Reports Results for Second Quarter 2024

August 14 2024 - 4:32PM

Enservco Corporation (NYSE American: ENSV) (“Enservco”, or the

“Company”), a diversified provider of energy logistics solutions

and specialized well-site services to the domestic energy industry,

today announced operational and financial results for the second

quarter of 2024.

The Company announced on August 9, 2024 the sale

of certain Colorado based frac water heating assets of Heat Waves

Hot Oil Service, LLC, a wholly owned subsidiary of Enservco, and

its exit from the frac water heating business in Colorado. The

financial results for Colorado frac water heating services are

reported in the Company’s “Completion and Other Services” segment

in Enservco’s financial statements, including its Form 10-Q filed

earlier today with the Securities and Exchange Commission (“SEC”).

In addition, the Company announced on August 12, 2024 the closing

of the immediately accretive acquisition of Buckshot Trucking and

closing on a share exchange with Star Equity Holdings, including an

exchange of respective equity investments between the companies and

short-term debt financing discussed in more detail in its Form 10-Q

filed earlier today and Form 8-K filed Monday. As a result, the

consolidated financial performance shown below and the Company’s

SEC filings for the three and six months ended June 30, 2024 is not

indicative of future results, which the Company believes will be a

material improvement due to the Company’s repositioned portfolio of

assets.

FINANCIAL SUMMARY(in 000’s,

except per share data)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2024 |

|

|

2023 |

|

% Change |

|

|

2024 |

|

|

2023 |

|

% Change |

|

Revenues |

|

$3,764 |

|

|

$3,729 |

|

1% |

|

|

$13,556 |

|

|

$12,641 |

|

7% |

| (Loss) income

from operations |

|

($1,104) |

|

|

($2,089) |

|

47% |

|

|

$157 |

|

|

($2,549) |

|

NM |

| Net

loss |

|

($2,327) |

|

|

($2,554) |

|

9% |

|

|

($1,587) |

|

|

($3,558) |

|

55% |

|

|

Per diluted share |

|

($0.08) |

|

|

($0.12) |

|

NM |

|

|

($0.06) |

|

|

($0.20) |

|

NM |

| Adjusted

EBITDA(1) |

|

($667) |

|

|

($1,101) |

|

39% |

|

|

$1,567 |

|

|

($107) |

|

NM |

NM: Not meaningful.

(1) A non-GAAP

financial measure; see the “Non-GAAP Information” section in this

release for more information including reconciliations to the most

comparable GAAP measures.Q2 2024 HIGHLIGHTS & RECENT

EVENTS

- Grew revenues to

$3.8 million – up slightly from Q2 2023;

- Improved profit

position to a net loss of $2.3 million, or $0.08 per diluted share,

from a net loss of $2.6 million, or $0.12 per diluted share, for Q2

2023;

- Generated

Adjusted EBITDA to $1.6 million for the first six months of 2024

versus an Adjusted EBITDA loss of $0.1 million in prior year;

- Made significant progress on

multiple fronts to drive increased overall operational and

financial flexibility in support of the Company’s recent strategic

announcements including:

- Sale of its seasonal frac water

heating business in Colorado;

- Closing of the immediately

accretive acquisition of Buckshot Trucking – a highly-regarded and

well-positioned energy logistics business offering year-round

growth potential; and

- Entrance into a

new relationship with Star Equity Holdings, including respective

equity investments between the companies.

MANAGEMENT COMMENTARY

Rich Murphy, the Company’s CEO and Chairman

stated “Our second quarter results marked an overall improvement on

both a quarterly and year-to-date basis as well as a continued

focus on controlling costs, which places us in a good position for

the second half of 2024 as we begin to benefit from the positive

financial performance and substantial opportunities provided by our

recent transactions.”

Murphy continued, “The Company has evaluated and

just recently executed a number of strategic initiatives designed

to enhance our financial position and further rationalize our asset

base as we reduced reliance on our seasonal frac water heating

services business. In support of these efforts, we recently

divested certain non-core assets and invested in opportunities such

as logistics that generate solid cash flow and provide visible near

and long-term growth. Over the past week, we announced the exit of

our seasonal-focused Colorado frac water heating business and the

closing of the immediately accretive Buckshot acquisition that

provides a complementary customer base and increased profitable

expansion opportunities. Importantly, we also announced our

strategic financial relationship with Star Equity Holdings, which

included respective equity investments by both companies. We are

excited to have Rick Coleman – as CEO and a Director at Star – join

the Board to add his insight and expertise as we look to further

prudently expand our market position to enhance our service

offerings and customer base.”

Mr. Murphy concluded, “I am extremely proud of

the team here at Enservco. Over the past year and a half, we have

been fortunate to materially improve our business and financial

health through several key transactions and milestones. Many of

these required significant organizational changes, and I want to

thank everyone for their support and dedication as we critically

repositioned the Company for long-term success – both operationally

and financially. We look forward to shifting our nearer-term

efforts to ensuring the successful integration of Buckshot’s people

and assets into Enservco’s business, with five months of Buckshot’s

operations to be reflected in our second half results. This

provides a solid outlook for the remainder of 2024 and the

expectation of a strong 2025 assuming current or improved market

conditions. Finally – and as important – I want to thank our

shareholders for their ongoing confidence and continued

support.”

CONFERENCE CALL & ADDITIONAL

INFORMATION

The Company has scheduled a conference call on

Thursday, August 15, 2024 at

10:00 a.m. ET to discuss its second quarter 2024

operational and financial results, and provide further details

concerning its recent transactions and outlook. To participate,

interested parties should dial 888-506-0062 at

least five minutes before the call is to begin. Please reference

the “Enservco 2024 Second Quarter Earnings Call” or use the

participant access code of 790636. International

callers may participate by dialing 973-528-0011.

The call will also be webcast and available on Enservco’s website

at www.enservco.com under “Investors” on the “Events” page.

In addition, interested parties can participate

through the webcast by accessing the following link:

https://www.webcaster4.com/Webcast/Page/2228/51082

Like callers, participants should access the

webcast at least five minutes prior to start time. In addition, a

replay of the webcast will be available following the call through

the above link.

ABOUT ENSERVCO

Enservco provides a range of logistics solutions

and oilfield services through its various operating subsidiaries in

major domestic oil and gas basins across the United States.

Additional information is available at www.enservco.com.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

denoting future possibilities, are forward-looking statements. The

accuracy of these statements cannot be guaranteed as they are

subject to a variety of risks, which are beyond Enservco's ability

to predict, or control and which may cause actual results to differ

materially from the projections or estimates contained herein.

Among these risks are those set forth in Enservco’s annual report

on Form 10-K for the year ended December 31, 2023, and subsequently

filed documents with the Securities and Exchange Commission

(“SEC”). Forward looking statements in this news release that are

subject to risks also include (a) the ability of Enservco to

successfully integrate Buckshot’s market opportunities, personnel

and operations and to achieve expected benefit; and (b) our ability

to further transform into a logistics business; (c) the ability to

restructure our debt; and (d) the ability to maintain compliance

with the NYSE/American Stock Markets. Enservco disclaims any

obligation to update any forward-looking statement made herein.

CONTACT

Mark PattersonChief Financial OfficerEnservco

Corporationmpatterson@enservco.com

ENSERVCO CORPORATION AND

SUBSIDIARYCondensed Consolidated Statements of

Operations(In thousands, except per share

amounts)(Unaudited)

| |

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production services |

|

$ |

2,618 |

|

|

$ |

2,889 |

|

|

$ |

5,103 |

|

|

$ |

5,752 |

|

|

Completion and other services |

|

|

1,146 |

|

|

|

840 |

|

|

|

8,453 |

|

|

|

6,889 |

|

| Total revenues |

|

|

3,764 |

|

|

|

3,729 |

|

|

|

13,556 |

|

|

|

12,641 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production services |

|

|

2,499 |

|

|

|

2,601 |

|

|

|

4,403 |

|

|

|

4,775 |

|

|

Completion and other services |

|

|

916 |

|

|

|

1,315 |

|

|

|

5,543 |

|

|

|

6,038 |

|

|

Sales, general, and administrative |

|

|

1,188 |

|

|

|

882 |

|

|

|

2,420 |

|

|

|

2,386 |

|

|

Gain on disposal of assets |

|

|

(23) |

|

|

|

(175) |

|

|

|

(23) |

|

|

|

(175) |

|

|

Impairment loss |

|

|

- |

|

|

|

250 |

|

|

|

- |

|

|

|

250 |

|

|

Depreciation and amortization |

|

|

288 |

|

|

|

945 |

|

|

|

1,056 |

|

|

|

1,916 |

|

| Total operating expenses |

|

|

4,868 |

|

|

|

5,818 |

|

|

|

13,399 |

|

|

|

15,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from

operations |

|

|

(1,104) |

|

|

|

(2,089) |

|

|

|

157 |

|

|

|

(2,549) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(415) |

|

|

|

(518) |

|

|

|

(993) |

|

|

|

(1,108) |

|

|

Other (expense) income |

|

|

(808) |

|

|

|

53 |

|

|

|

(751) |

|

|

|

83 |

|

| Total other expense, net |

|

|

(1,223) |

|

|

|

(465) |

|

|

|

(1,744) |

|

|

|

(1,025) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before taxes |

|

|

(2,327) |

|

|

|

(2,554) |

|

|

|

(1,587) |

|

|

|

(3,574) |

|

| Deferred income tax

benefit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

16 |

|

| Net loss |

|

$ |

(2,327) |

|

|

$ |

(2,554) |

|

|

$ |

(1,587) |

|

|

$ |

(3,558) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share - basic and

diluted |

|

$ |

(0.08) |

|

|

$ |

(0.12) |

|

|

$ |

(0.06) |

|

|

$ |

(0.20) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding - basic and diluted |

|

|

30,033 |

|

|

|

21,240 |

|

|

|

28,579 |

|

|

|

18,042 |

|

ENSERVCO CORPORATION AND

SUBSIDIARYCondensed Consolidated Balance

Sheets(In thousands, except share and per share

amounts)

| |

|

June 30, 2024 |

|

|

December 31, 2023 |

|

| |

|

(unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

332 |

|

|

$ |

201 |

|

|

Accounts receivable, net |

|

|

1,518 |

|

|

|

4,190 |

|

|

Prepaid expenses and other current assets |

|

|

2,124 |

|

|

|

1,047 |

|

|

Inventories |

|

|

211 |

|

|

|

209 |

|

|

Note receivable |

|

|

75 |

|

|

|

75 |

|

|

Assets held for sale |

|

|

3,878 |

|

|

|

- |

|

| Total Current Assets |

|

|

8,138 |

|

|

|

5,722 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

2,087 |

|

|

|

6,923 |

|

| Intangible assets, net |

|

|

92 |

|

|

|

- |

|

| Right-of-use asset - finance,

net |

|

|

3 |

|

|

|

9 |

|

| Right-of-use asset -

operating, net |

|

|

1,009 |

|

|

|

891 |

|

| Note receivable, less current

portion |

|

|

106 |

|

|

|

144 |

|

| Other assets |

|

|

181 |

|

|

|

183 |

|

| |

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

11,616 |

|

|

$ |

13,872 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

2,847 |

|

|

$ |

3,967 |

|

|

Utica Facility |

|

|

1,886 |

|

|

|

1,595 |

|

|

LSQ Facility |

|

|

1,173 |

|

|

|

2,472 |

|

|

September and October 2023 Convertible Notes, related parties |

|

|

664 |

|

|

|

- |

|

|

November 2022 Convertible Note, related party |

|

|

- |

|

|

|

1,027 |

|

|

Financed insurance |

|

|

1,161 |

|

|

|

318 |

|

|

Lease liability - finance |

|

|

17 |

|

|

|

10 |

|

|

Lease liability - operating |

|

|

360 |

|

|

|

441 |

|

|

Other current liabilities |

|

|

135 |

|

|

|

198 |

|

| Total Current Liabilities |

|

|

8,243 |

|

|

|

10,028 |

|

| |

|

|

|

|

|

|

|

|

|

Utica Facility, less current portion |

|

|

622 |

|

|

|

1,690 |

|

|

September and October 2023 Convertible Notes, related parties, less

current portion |

|

|

- |

|

|

|

1,656 |

|

|

Utica Residual Liability |

|

|

330 |

|

|

|

256 |

|

|

Lease liability - finance, less current portion |

|

|

- |

|

|

|

6 |

|

|

Lease liability - operating, less current portion |

|

|

678 |

|

|

|

528 |

|

|

Deferred tax liabilities |

|

|

222 |

|

|

|

222 |

|

|

Other non-current liabilities |

|

|

24 |

|

|

|

58 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

10,119 |

|

|

|

14,444 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity

(Deficit): |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.005 par value, 10,000,000 shares authorized, no

shares issued or outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.005 par value, 100,000,000 shares authorized;

37,288,845 and 26,592,637 shares issued as of June 30, 2024 and

December 31, 2023, respectively; 6,907 shares of treasury stock as

of June 30, 2024 and December 31, 2023; and 37,281,938 and

26,585,730 shares outstanding as of June 30, 2024 and December 31,

2023, respectively |

|

|

184 |

|

|

|

131 |

|

|

Additional paid-in capital |

|

|

52,573 |

|

|

|

48,970 |

|

|

Accumulated deficit |

|

|

(51,260) |

|

|

|

(49,673) |

|

| Total Stockholders' Equity

(Deficit) |

|

|

1,497 |

|

|

|

(572) |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity (Deficit) |

|

$ |

11,616 |

|

|

$ |

13,872 |

|

ENSERVCO CORPORATION AND

SUBSIDIARYCondensed Consolidated Statements of

Cash Flows(In

thousands)(Unaudited)

| |

|

For the Six Months Ended |

|

| |

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Operating Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,587) |

|

|

$ |

(3,558) |

|

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,056 |

|

|

|

1,916 |

|

|

Gain on disposal of equipment |

|

|

(23) |

|

|

|

(175) |

|

|

Impairment loss |

|

|

- |

|

|

|

250 |

|

|

Interest paid-in-kind on LSQ Facility |

|

|

181 |

|

|

|

- |

|

|

Stock-based compensation |

|

|

123 |

|

|

|

180 |

|

|

Amortization of debt issuance costs and discount |

|

|

127 |

|

|

|

139 |

|

|

Inducement costs related to note conversions |

|

|

908 |

|

|

|

- |

|

|

Deferred income tax benefit |

|

|

- |

|

|

|

(16) |

|

|

Bad debt recovery |

|

|

(25) |

|

|

|

(100) |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

2,697 |

|

|

|

3,251 |

|

|

Inventories |

|

|

(3) |

|

|

|

(27) |

|

|

Prepaid expense and other current assets |

|

|

508 |

|

|

|

470 |

|

|

Amortization of operating lease assets |

|

|

250 |

|

|

|

282 |

|

|

Other assets |

|

|

1 |

|

|

|

19 |

|

|

Accounts payable and accrued liabilities |

|

|

(812) |

|

|

|

(1,667) |

|

|

Operating lease liabilities |

|

|

(300) |

|

|

|

(297) |

|

|

Other liabilities |

|

|

82 |

|

|

|

(281) |

|

| Net cash provided by operating

activities |

|

|

3,183 |

|

|

|

386 |

|

| |

|

|

|

|

|

|

|

|

| Investing Activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(92) |

|

|

|

(84) |

|

|

Proceeds from disposals of property and equipment |

|

|

23 |

|

|

|

225 |

|

|

Purchase of intangible |

|

|

(92) |

|

|

|

- |

|

|

Collections on note receivable |

|

|

38 |

|

|

|

44 |

|

| Net cash (used in) provided by

investing activities |

|

|

(123) |

|

|

|

185 |

|

| |

|

|

|

|

|

|

|

|

| Financing Activities: |

|

|

|

|

|

|

|

|

|

Proceeds from February 2023 Offering, net |

|

|

- |

|

|

|

2,952 |

|

|

Proceeds from exercise of pre-funded warrants |

|

|

- |

|

|

|

3 |

|

|

Net LSQ Facility repayments |

|

|

(1,480) |

|

|

|

(2,153) |

|

|

Utica Facility repayments |

|

|

(808) |

|

|

|

(608) |

|

|

Repayments of long-term debt |

|

|

- |

|

|

|

(30) |

|

|

Payments on financed insurance |

|

|

(641) |

|

|

|

(329) |

|

|

Payments of finance leases |

|

|

- |

|

|

|

(10) |

|

| Net cash used in financing

activities |

|

|

(2,929) |

|

|

|

(175) |

|

| |

|

|

|

|

|

|

|

|

| Net Increase in Cash and Cash

Equivalents |

|

|

131 |

|

|

|

396 |

|

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents,

beginning of period |

|

|

201 |

|

|

|

35 |

|

| |

|

|

|

|

|

|

|

|

| Cash and Cash Equivalents, end

of period |

|

$ |

332 |

|

|

$ |

431 |

|

| |

|

|

|

|

|

|

|

|

NON-GAAP INFORMATION

This press release and the accompanying tables

include a discussion of EBITDA and Adjusted EBITDA, which are

non-GAAP financial measures provided as a complement to the results

provided in accordance with generally accepted accounting

principles ("GAAP"). The term "EBITDA" refers to a financial

measure that we define as earnings (net income or loss) plus or

minus net interest taxes, depreciation, and amortization. Adjusted

EBITDA excludes from EBITDA stock-based compensation and, when

appropriate, other items that management does not utilize in

assessing Enservco’s operating performance (as further described in

the attached financial schedules). None of these non-GAAP financial

measures are recognized terms under GAAP and do not purport to be

an alternative to net income as an indicator of operating

performance or any other GAAP measure. We have reconciled Adjusted

EBITDA to GAAP net loss in the table below. We intend to continue

to provide these non-GAAP financial measures as part of our future

earnings discussions and, therefore, the inclusion of these

non-GAAP financial measures will provide consistency in our

financial reporting.

| |

|

For the Three Months Ended |

|

| |

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Reconciliation from Net Loss to Adjusted

EBITDA |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,327) |

|

|

$ |

(2,554) |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

415 |

|

|

|

518 |

|

|

Depreciation and amortization |

|

|

288 |

|

|

|

945 |

|

|

EBITDA (non-GAAP) |

|

|

(1,624) |

|

|

|

(1,091) |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

46 |

|

|

|

(16) |

|

|

Non-recurring legal and transaction costs |

|

|

151 |

|

|

|

84 |

|

|

Gain on disposal of assets |

|

|

(23) |

|

|

|

(175) |

|

|

Bad debt recovery |

|

|

(25) |

|

|

|

(100) |

|

|

Impairment loss |

|

|

- |

|

|

|

250 |

|

|

Other expense (income) |

|

|

808 |

|

|

|

(53) |

|

| Adjusted EBITDA

(non-GAAP) |

|

$ |

(667) |

|

|

$ |

(1,101) |

|

| |

|

For the Six Months Ended |

|

| |

|

June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

Reconciliation from Net Loss to Adjusted

EBITDA |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,587) |

|

|

$ |

(3,558) |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

993 |

|

|

|

1,108 |

|

|

Deferred income tax benefit |

|

|

- |

|

|

|

(16) |

|

|

Depreciation and amortization |

|

|

1,056 |

|

|

|

1,916 |

|

|

EBITDA (non-GAAP) |

|

|

462 |

|

|

|

(550) |

|

| Add back (deduct): |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

123 |

|

|

|

180 |

|

|

Severance and transition |

|

|

- |

|

|

|

1 |

|

|

Non-recurring legal and transaction costs |

|

|

279 |

|

|

|

370 |

|

|

Gain on disposal of assets |

|

|

(23) |

|

|

|

(175) |

|

|

Bad debt recovery |

|

|

(25) |

|

|

|

(100) |

|

|

Impairment loss |

|

|

- |

|

|

|

250 |

|

|

Other expense (income) |

|

|

751 |

|

|

|

(83) |

|

| Adjusted EBITDA

(non-GAAP) |

|

$ |

1,567 |

|

|

$ |

(107) |

|

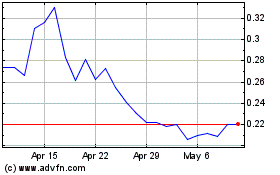

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Dec 2024 to Jan 2025

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Jan 2024 to Jan 2025