UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2023.

Commission File Number: 001-40673

Cybin Inc.

(Exact Name of Registrant as Specified in Charter)

100 King Street West, Suite 5600, Toronto, Ontario, M5X 1C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F □ Form 40-F ⊠

INCORPORATION BY REFERENCE

Exhibit 99.1 of this Form 6-K of Cybin Inc. (the “Company”) is hereby incorporated by reference into the Registration Statement on Form F-10 (File No. 333-272706) of the Company, as amended or supplemented.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | |

| | CYBIN INC. | |

| | (Registrant) | |

| | | | |

| Date: | September 12, 2023 | By: | /s/ Doug Drysdale | |

| | Name: | Doug Drysdale | |

| | Title: | Chief Executive Officer | |

EXHIBIT INDEX

FORM 51-102F3

MATERIAL CHANGE REPORT

| | | | | |

| Item 1 | Name and Address of Company Cybin Inc. (the “Company” or “Cybin”) 100 King Street West, Suite 5600 Toronto, Ontario M5X 1C9

|

| Item 2 | Date of Material Change August 28, 2023

|

| Item 3 | News Release A joint news release announcing the material change referred to in this report was disseminated on August 28, 2023 through BusinessWire and has been filed under Cybin’s profile on SEDAR at www.sedarplus.com.

|

| Item 4 | Summary of Material Change On August 28 2023, Cybin and Small Pharma Inc. (“Small Pharma”) entered into a definitive agreement (the “Arrangement Agreement”) pursuant to which Cybin will acquire all the issued and outstanding common shares of Small Pharma pursuant to a court-approved plan of arrangement (the “Transaction”).

Under the terms of the Transaction, Small Pharma shareholders will receive 0.2409 common shares of Cybin (each whole such share, a “Cybin Share”) for each Small Pharma common share (“Small Pharma Share”) held.

|

| Item 5 | Full Description of Material Change

On August 28, 2023, Cybin and Small Pharma announced that they had entered into the Arrangement Agreement pursuant to which Cybin will acquire all the issued and outstanding securities of Small Pharma pursuant to a court-approved plan of arrangement.

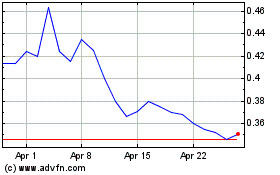

Under the terms of the Transaction, Small Pharma shareholders will receive 0.2409 Cybin Shares for each Small Pharma Share held. The exchange ratio implies consideration of approximately $0.10 per Small Pharma Share based on the closing price of the Cybin Shares on the Cboe Canada exchange (“Cboe Canada”) on August 25, 2023, representing a 43.64% premium based on the 30-day volume weighted average prices of the Cybin Shares on the Cboe Canada and the Small Pharma Shares on the TSX Venture Exchange (“TSXV”) for the period ended on August 25, 2023.

Holders of options to purchase Small Pharma Shares that are “in-the-money” based on the volume weighted average trading price of the Small Pharma Shares on the TSXV for the five trading days immediately preceding the effective time of the Transaction (the “Small Pharma Share Value”) will receive from Small Pharma a number of Small Pharma Shares equal to the number of Small Pharma options held, multiplied by the amount by which the Small Pharma Share Value exceeds the exercise price of such Small Pharma options, divided by the Small Pharma Share Value. Such newly issued Small Pharma Shares will be acquired by Cybin on the same terms as the other Small Pharma Shares. Each Small Pharma option that is “out-of-the-money” based on the Small Pharma Share Value will be deemed to be surrendered to Small Pharma for $0.001 and cancelled.

As of the date of the Arrangement Agreement, it is expected that Cybin shareholders and Small Pharma securityholders will own approximately 74.5% and 25.5% of the outstanding Cybin shares, respectively, following completion of the Transaction. |

| | | | | |

| The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of at least 66 2/3% of the votes cast by the shareholders of Small Pharma. Pursuant to the requirements of the Cboe Canada, because the total number of Cybin Shares issuable pursuant to the Transaction is more than 25% of the total number of Cybin Shares issued and outstanding, the Transaction must be approved by a majority of the votes cast by shareholders of Cybin. Each of Small Pharma and Cybin has called an annual and special meeting of its shareholders to vote on the Transaction. The shareholders’ meetings are expected to occur on or about October 12, 2023. In addition to shareholder approval, the Transaction is subject to approval by the Supreme Court of British Columbia, receipt of the approvals of the Cboe Canada, NYSE American, and TSXV, other applicable regulatory approvals, and the satisfaction of certain other closing conditions customary in transactions of this nature. Subject to receipt of all necessary approvals and the satisfaction of other closing conditions, the Transaction is expected to close in late October 2023.

In connection with the Transaction, each of Small Pharma’s directors and officers, and Small Pharma’s largest shareholder, who collectively beneficially hold or exercise control or direction over, directly or indirectly, an aggregate of approximately 28.8% of the outstanding Small Pharma Shares, have entered into support and voting agreements with Cybin, pursuant to which each of them has agreed, among other things, to support and vote their Small Pharma Shares in favour of the Transaction. In addition, each of Cybin’s directors and officers, and certain Cybin shareholders, who collectively hold or exercise control or direction over an aggregate of approximately 17% of the outstanding Cybin Shares, have entered into voting and support agreements with Small Pharma, pursuant to which each of them has agreed, among other things, to support and vote their Cybin Shares in favour of the Transaction.

The foregoing description of the Arrangement Agreement is a summary. Reference should be made to the full text of the Arrangement Agreement, which is available under Cybin’s SEDAR+ profile at www.sedarplus.com and on EDGAR at www.sec.gov.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This material change report does not constitute an offer to sell or the solicitation of an offer to buy any securities. |

| Item 6 | Reliance on Subsection 7.1(2) of National Instrument 51-102 Not applicable.

|

| Item 7 | Omitted Information Not applicable.

|

| Item 8 | Executive Officer Further information regarding the matters described in this report may be obtained from Gabriel Fahel, Chief Legal Officer of Cybin, who is knowledgeable about the details of the material change and may be contacted at 1-866-292-4601. |

| Item 9 | Date of Report September 7, 2023 |

Cautionary Note Regarding Forward-Looking Information and Statements

Certain statements contained in this material change report, and in certain documents incorporated by reference herein, constitute “forward-looking information” and “forward-looking statements”, within the meaning of applicable securities laws (collectively, “forward-looking statements”). All statements other than statements of

historical fact, including, without limitation, those regarding future financial position, business strategy, budgets, research and development, plans and objectives of management for future operations, and any statements preceded by, followed by or that include the words “expect”, “likely”, “may”, “will”, “should”, “intend”, or “anticipate”, “potential”, “proposed”, “estimate”, “pro forma”, and “post-Arrangement” and other similar words, including negative and grammatical variations thereof, or Transaction that certain events or conditions “may” or “will” happen, or by discussions of strategy, are forward-looking statements.

The forward-looking Statements in this material change report may include, without limitation, statements about the expected timing and completion of the proposed Transaction; the anticipated timing for the meetings of Cybin and Small Pharma shareholders; the consideration to be received by Small Pharma shareholders; the estimated value of the Transaction; the satisfaction of closing conditions to the Transaction, including, without limitation (i) the required Cybin shareholder approval; (ii) the required Small Pharma shareholder approval; (iii) necessary court approval in connection with the plan of arrangement; (iv) Cybin obtaining the necessary approvals from the Cboe Canada and NYSE American for the listing of securities in connection with the Transaction; (v) the proportionate shareholdings of the Cybin shareholders and Small Pharma securityholders in Cybin following closing of the Transaction; and (vi) other closing conditions, including, without limitation, obtaining certain consents and other regulatory approvals.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are beyond the ability of Cybin to control or predict and which may cause actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such factors, among other things, include: that the Transaction may not be completed on the expected terms or within expected timelines, or at all; the Transaction may fail to receive the required shareholder, court, stock exchange, regulatory, or other approvals necessary to effect the proposed Transaction; fluctuations in securities markets; the potential for a third party to make a superior proposal to the proposed Transaction; any of which may have a material adverse effect on Cybin’s or Small Pharma’s business, capital resources, financial results and/or ability to complete the Transaction or realize the anticipated benefits thereof.

Although the forward-looking statements contained in this material change report are based upon what management of Cybin believes are reasonable assumptions at the time they were made, such statements are made as of the date hereof and Cybin disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that these forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

ARRANGEMENT AGREEMENT

BETWEEN

CYBIN INC.

– AND –

SMALL PHARMA INC.

August 28, 2023

| | | | | |

ARTICLE 1 INTERPRETATION | |

| |

| |

| |

| |

| |

| |

| |

| 18 |

ARTICLE 2 THE ARRANGEMENT | 18 |

| 18 |

| 18 |

| 19 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 28 |

| 28 |

| 28 |

ARTICLE 3 REPRESENTATIONS AND WARRANTIES | 28 |

| 28 |

| 29 |

| 29 |

| 29 |

ARTICLE 4 COVENANTS | |

| |

| |

| 37 |

| 38 |

| |

| 40 |

| 40 |

TABLE OF CONTENTS

(continued)

Page

| | | | | |

| |

| 41 |

| |

| |

| |

| |

ARTICLE 5 COVENANTS REGARDING NON-SOLICITATION | |

| |

| |

| |

| 45 |

| 46 |

| 48 |

| 48 |

ARTICLE 6 CONDITIONS PRECEDENT | 48 |

| 48 |

| |

| |

| |

ARTICLE 7 TERMINATION OF AGREEMENT | |

| 53 |

| 55 |

| 56 |

ARTICLE 8 REMEDIES, FEES AND EXPENSES | 56 |

| 56 |

| 57 |

| 57 |

| 58 |

| 58 |

| 59 |

ARTICLE 9 GENERAL | 59 |

| 59 |

| 59 |

| |

| |

| |

| |

| |

| |

| |

TABLE OF CONTENTS

(continued)

Page

ARRANGEMENT AGREEMENT

THIS AGREEMENT is dated as of August 28, 2023,

BETWEEN:

CYBIN INC., a corporation existing under the laws of the Province of Ontario

(“Buyer”)

- and -

SMALL PHARMA INC., a company existing under the laws of British Columbia

(“Target”)

CONTEXT:

A. Buyer proposes to acquire all of the outstanding Target Shares pursuant to an arrangement under the provisions of Part 9, Division 5 of the Business Corporations Act (British Columbia).

B. Upon the effectiveness of the Arrangement, holders of Target Shares will receive Buyer Shares in accordance with the Arrangement.

C. The Target Board has unanimously determined, upon the unanimous recommendation of the Special Committee that the Arrangement is fair to the Target Shareholders and that the Arrangement is in the best interests of the Target, and the Target Board has resolved to recommend that the Target Shareholders vote in favour of the Arrangement Resolution, all subject to the terms and conditions of this Agreement.

D. Buyer has entered into the Target Voting Agreements with all of the Target Supporting Shareholders, pursuant to which each of the Target Supporting Shareholders has agreed to vote their Target Shares in favour of the Arrangement on the terms and subject to the conditions set forth in the Target Voting Agreements.

E. Target has entered into the Buyer Voting Agreements with all of the Buyer Supporting Shareholders, pursuant to which each of the Buyer Supporting Shareholders has agreed to vote their Buyer Shares in favour of the Arrangement on the terms and subject to the conditions set forth in the Buyer Voting Agreements.

THEREFORE, the Parties agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Agreement, including the recitals hereto, the following terms have the following meanings:

“2020 EMI Plan” means the Rules of the Small Pharma Ltd 2020 Employee Share Option Plan, as adopted by the board of directors of Small Pharma Ltd. (predecessor to the Target) on 24 March 2020.

“Acquisition Agreement” means an agreement to implement the Superior Proposal contemplated in Section 5.5(a) (but does not include a confidentiality and standstill agreement contemplated in Section 5.4(b)(v)(A)).

“Acquisition Proposal” means, other than the Arrangement and the transactions required for the Parties to effect the Arrangement under this Agreement or as otherwise contemplated by this Agreement, any proposal, inquiry or offer (written or oral) made by any Person, alone or with others, other than a Party or one or more of its affiliates, relating to (in each case whether in one transaction or a series of transactions, and whether directly or indirectly): (a) an issuance or acquisition of 20% or more of any class of voting or equity securities (and/or securities convertible into or exchangeable or exercisable for voting or equity securities, assuming, if applicable, the conversion, exchange or exercise of such securities) of a Party or any of its Subsidiaries (except, with respect to Buyer, a Buyer Permitted Financing); (b) a take-over bid, tender offer, exchange offer, or other transaction that, if consummated, would result in a Person, together with any Persons acting jointly or in concert, beneficially owning, or exercising control or direction over, 20% or more of any class of voting or equity securities (and/or securities convertible into or exchangeable or exercisable for voting or equity securities, assuming, if applicable, the conversion, exchange or exercise of such securities) of a Party or any of its Subsidiaries; (c) a direct or indirect acquisition or sale, disposition or joint venture (or a lease, long-term supply agreement or other arrangement having a similar economic effect as a sale or disposition) of assets that represent 20% or more of the consolidated assets of a Party and its Subsidiaries (based on the financial statements of the Party most recently filed on SEDAR before the date of the proposal, inquiry or offer), as determined in good faith by the board of directors of such Party; (d) an amalgamation, arrangement, merger, business combination, consolidation, recapitalization, issuer bid, liquidation, dissolution, reorganization or similar transaction involving a Party or any of its Subsidiaries; (e) a recapitalization, liquidation, dissolution, reorganization or similar transaction involving a Party or any of its Subsidiaries; or (f) any other transaction, the consummation of which would or could reasonably be expected to interfere with, prevent or materially delay the transactions contemplated by this Agreement or the Arrangement.

“Adelia Support Agreement” means the support agreement dated December 14, 2020, between Buyer, Cybin U.S. and the former shareholders of Adelia Therapeutics Inc.

“Agreement” means this arrangement agreement, including all Schedules, as it may be amended, supplemented or restated from time to time in accordance with its terms.

“Anti-Money Laundering Laws” means Laws relating to money laundering, including financial recordkeeping and reporting requirements, which apply to the business or the dealings of the Company, its Subsidiaries or its affiliates. Anti-Money Laundering Laws include the U.S. Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the USA Patriot Act), the Currency and Foreign Transaction Reporting Act of 1970 (United States), the Money Laundering Control Act of 1986 (United States), the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada), the anti-money laundering provisions of the Criminal Code of Canada, the Proceeds of Crime Act 2002 (United Kingdom), the Terrorism Act 2000 (United Kingdom), Money Laundering Regulations 2007, Sanctions and Anti-Money Laundering Act 2018 and the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (SI 2017/692).

“Arm’s Length” means arm’s length determined under the Tax Act.

“Arrangement” means the arrangement under Part 9, Division 5 of the BCBCA on the terms and subject to the conditions set out in the Plan of Arrangement, subject to any amendments or variations to the Plan of Arrangement made in accordance with the terms of this Agreement, the Plan of Arrangement or made at the direction of the Court in the Final Order with the prior written consent of Target and Buyer, each acting reasonably.

“Arrangement Resolution” means the resolution of the Target Shareholders to approve the Arrangement substantially in the form set out in Schedule B.

“BCBCA” means the Business Corporations Act (British Columbia).

“Books and Records” means, with respect to a Party, the books, ledgers, files, lists, reports, plans, logs, deeds, surveys, correspondence, operating records, Tax Returns and other data and information, including all data and information stored on computer-related or other electronic media, maintained with respect to that Party and its Subsidiaries and their respective business and assets, that have been provided by that Party to the Other Party.

“Business Day” means any day excluding a Saturday, Sunday or statutory holiday in the Province of British Columbia or the Province of Ontario, and also excluding any day on which the principal chartered banks located in the Cities of Toronto or Vancouver are not open for business during normal banking hours or any day on which the Court is not sitting during normal hours.

“Buyer Articles” means the certificate and articles of continuance of Buyer dated November 5, 2020.

“Buyer Board” means the board of directors of Buyer.

“Buyer Board Recommendation” is defined in Section 10 of Schedule E.

“Buyer Change in Recommendation” is defined in Section 7.1(b)(iv).

“Buyer Circular” means the notice of meeting and accompanying management information circular of Buyer, including all of its schedules and exhibits and all information it incorporates by reference, to be sent by Buyer to the Buyer Shareholders in connection with the Buyer Meeting, as amended, supplemented or otherwise modified from time to time.

“Buyer Disclosure Letter” means the disclosure letter delivered by Buyer to Target, contemporaneously with the execution and delivery of this Agreement, with respect to certain matters in this Agreement.

“Buyer Financial Statements” means: (a) the audited comparative financial statements of Buyer as at and for the year ended March 31, 2023, together with their associated notes and the auditors’ report on them; and (b) the unaudited comparative financial statements of Buyer as at and for the three-month period ended June 30, 2023, together with their associated notes.

“Buyer Information” means the information describing Buyer and its business, operations and affairs.

“Buyer Material Contract” means, with respect to Buyer, a Contract to which Buyer or any of its Subsidiaries is a party, or by which Buyer or any of its Subsidiaries is bound or affected or to which any of their properties or assets are subject:

(a) the termination of which, or under which the loss of rights, would or would reasonably be expected to have a material and adverse effect on the business, condition (financial or otherwise), properties, assets (tangible or intangible), liabilities (contingent or otherwise), capitalization, operations, prospects or results of operations of Buyer and its Subsidiaries, on a consolidated basis;

(b) that relates to indebtedness for borrowed money, or the guarantee of any liabilities or obligations;

(c) that creates a right of first offer or refusal or an exclusive dealing arrangement, or that limits the scope of Persons to whom Buyer or any of its Subsidiaries may sell products or provide services, or with whom Buyer or any of its Subsidiaries may conduct business;

(d) that contains any non-competition or non-solicitation obligation or other restrictions that limit the ability of Buyer or any of its Subsidiaries to engage in any line of business or to carry on business in any geographic territory;

(e) that relates to any joint venture, strategic alliance, partnership, sharing of profits or revenue or similar arrangement;

(f) that restricts the incurrence of indebtedness for borrowed money by Buyer or any of its Subsidiaries or the incurrence of any Encumbrances on any properties or assets of Buyer or any of its Subsidiaries, or restricting the payment of dividends by Buyer or any of its Subsidiaries;

(g) that is a collective bargaining agreement, a labour union contract or any other memorandum of understanding or other agreement with a union;

(h) with a Governmental Authority;

(i) under which Buyer or any of its Subsidiaries assigns or obtains ownership in any material Owned Intellectual Property (including, for clarity, any Owned Intellectual Property that is used in, or is necessary to conduct, the business of Buyer and its Subsidiaries as currently conducted);

(j) pursuant to which Buyer or any of its Subsidiaries licenses or otherwise provides a right to practice or any other material interest in any material Intellectual Property of Buyer, or any Inbound IP License pursuant to which Buyer or any of its Subsidiaries obtains rights in any material Licensed Intellectual Property;

(k) regarding an arrangement with respect to any combination trial; or

(l) that imposes any co-promotion or collaboration obligations with respect to any product or product candidate.

“Buyer Meeting” means the special meeting of Buyer Shareholders (which may be an annual and special meeting of Buyer Shareholders) to be held to consider, among other things, as applicable, the Buyer Resolution, and any adjournment(s) or postponement(s) thereof.

“Buyer Options” means options to purchase Buyer Shares.

“Buyer Permitted Financing” means one or more offerings of Buyer Shares (and/or securities convertible into or exchangeable or exercisable for Buyer Shares) for aggregate gross proceeds of up to US$50,000,000.

“Buyer Public Record” means all documents publicly filed by or on behalf of Buyer on SEDAR on or after July 1, 2020.

“Buyer Resolution” means the resolution of the Buyer Shareholders to approve the acquisition of Target, substantially in the form set out in Schedule C.

“Buyer Shareholder Approval” means the approval of the Buyer Resolution by a majority of the votes cast on the Buyer Resolution by Buyer Shareholders present in person or by proxy at the Buyer Meeting, together with, if required by MI 61-101, minority approval in accordance with MI 61-101, and any other approval of Buyer Shareholders required by the Cboe or NYSE American.

“Buyer Shareholders” means the holders of Buyer Shares from time to time.

“Buyer Shares” means the common shares in the authorized share capital of Buyer.

“Buyer Superior Proposal” means a Superior Proposal in respect of Buyer.

“Buyer Supporting Shareholders” means all of the directors, officers, and certain shareholders of Buyer, all of whom have entered into the Buyer Voting Agreements.

“Buyer Termination Fee” is defined in Section 8.2.

“Buyer Termination Fee Event” is defined in Section 8.2.

“Buyer Voting Agreement” mean the voting support agreements (including all amendments thereto) between Target and the Buyer Supporting Shareholders.

“Buyer Warrant” means a warrant entitling the holder to purchase Buyer Shares.

“Canadian Securities Laws” means the Securities Act (Ontario) and the Securities Act (British Columbia), as applicable, and all other applicable Canadian provincial and territorial securities laws, rules, regulations and published policies.

“Cboe” means the Cboe Canada exchange.

“Change in Recommendation” means, with respect to Buyer, a Buyer Change in Recommendation, and with respect to Target, a Target Change in Recommendation, as applicable.

“Claim” means any claim, demand, action, cause of action, suit, arbitration, investigation, proceeding, complaint, grievance, charge, prosecution, assessment or reassessment, including any appeal or application for review.

“Clinical Development Plan” means the Target clinical development plan disclosed by Target to Buyer prior to the date of this Agreement.

"CMA" means the UK Competition and Markets Authority.

“Communication” means any notice, demand, request, consent, approval or other communication that is required or permitted by this Agreement to be given or made by a Party.

“Confidentiality Agreement” means the confidentiality agreement between Target and Buyer dated June 21, 2023.

“Consideration” means the consideration to be received by Target Shareholders pursuant to the Plan of Arrangement as consideration for their Target Shares, consisting of 0.2409 Buyer Shares for each Target Share (the “Exchange Ratio”), subject to adjustment in the manner and in the circumstances contemplated in Section 2.11 of this Agreement.

“Consideration Shares” means the Buyer Shares to be issued as the Consideration pursuant to the Plan of Arrangement.

“Contract” means any agreement, understanding, undertaking, commitment, licence, or lease, whether written or oral.

“Court” means the Supreme Court of British Columbia.

“Cure Notice” is defined in Section 7.2(b).

“Curing Party” is defined in Section 7.2(b).

“Cybin U.S.” means Cybin U.S. Holdings Inc.. a Subsidiary of Buyer.

“Cybin U.S. Class B Shares” means non-voting Class B shares in the capital of Cybin U.S.

“Depositary” means Odyssey Trust Company, or any other Person that may be appointed by Target with the consent of Buyer, acting reasonably, to act as depositary in connection with the Arrangement.

“Disclosed Personal Information” is defined in Section 4.11(a).

“Dissent Rights” means the rights of Target Shareholders to dissent in respect of the Arrangement described in the Plan of Arrangement.

“Drug Regulatory Agencies” means the United States Food and Drug Administration (FDA), the European Medicines Agency (EMA), the United Kingdom Medicines and Healthcare products Regulatory Agency (MHRA), the United States Drug Enforcement Administration (DEA), and Health Canada (HC) and any corresponding drug, biologic, natural health product, controlled drug substance, narcotic, and medical device regulatory agencies within the world having jurisdiction over a Party and its business, including those that govern or implement health products and related activities (including personal health information), including development, regulatory and commercial activities.

“Effective Date” means the date the Arrangement becomes effective, being the third (3rd) Business Day following the date upon which all conditions to the completion of the Arrangement set forth in Article 6 (other than the delivery of items to be delivered on the Effective Date and the satisfaction of those conditions that, by their terms, cannot be satisfied until immediately prior to the Effective Date) have been satisfied or waived (subject to applicable Laws), or such other date as the Parties may agree in writing.

“Effective Time” means the time on the Effective Date that the Arrangement becomes effective, as set out in the Plan of Arrangement.

“Electing Party” is defined in Section 7.2(b).

“EMI Plans” means (a) the 2020 EMI Plan; and (b) Schedule C (EMI Overseas Sub-Plan) to the Rolling Plan.

“Employee Plan” means any health, welfare, supplemental unemployment benefit, bonus, profit sharing, option, stock appreciation, savings, insurance, incentive, incentive compensation, deferred compensation, share purchase, share compensation, disability, pension or supplemental retirement plans and other similar or material employee or director compensation or benefit plans, policies, trusts, funds, agreements or arrangements for the benefit of current or former directors, officers, or Employees of a Party or any of its Subsidiaries, which is maintained by, contributed to or binding upon that Party or any of its Subsidiaries or in respect of which a Party or any of its Subsidiaries has any actual or potential liability.

“Employees” means all personnel and independent contractors employed, engaged or retained by Target or any of its Subsidiaries, including any that are on medical or long-term disability leave, or other statutory or authorized leave or absence.

“Encumbrance” means any security interest, mortgage, charge, pledge, hypothec, lien, encumbrance, restriction, option, adverse claim, right of others or other encumbrance of any kind.

“Environment” means the ambient air, all layers of the atmosphere, all water including surface water and underground water, all land, all living organisms and the interacting natural systems that include components of air, land, water, living organisms and organic and inorganic matter, and includes indoor spaces.

“Environmental Laws” means any applicable Laws relating to the Environment and protection of the Environment, the regulation of chemical substances or products, health and safety including occupational health and safety, and the transportation of dangerous goods.

“ETA” means the Excise Tax Act (Canada).

“Expense Reimbursement Amount” is defined in Section 8.6(c).

“Expense Reimbursement Event” is defined in Section 8.6(c).

“Final Order” means the final order of the Court, after being informed of the intention to rely upon the Section 3(a)(10) Exemption and similar exemptions from applicable United States Laws with respect to the issuance of the Consideration Shares to be issued pursuant to the Arrangement to Target Shareholders in the United States, in a form acceptable to the Parties, acting reasonably, approving the Arrangement as that order may be amended by the Court at any time before the Effective Time with the consent of the Parties, acting reasonably, or, if appealed then, unless that appeal is withdrawn or denied, as affirmed or amended on appeal, provided that any such amendment is acceptable to the Parties, acting reasonably.

“GAAP” means Canadian generally accepted accounting principles applicable to publicly accountable enterprises under Part I of the CPA Canada Handbook of the Chartered Professional Accountants of Canada.

“Good Clinical Practices” means applicable Drug Regulatory Agency standards (including principles, guidance and policies) for the design, conduct, performance, monitoring, auditing, recording, analysis, and reporting of clinical trials, including as applicable, the standards, guidance and policies of the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH).

“Good Laboratory Practices” means applicable Drug Regulatory Agency standards, principles, guidance, policies and systems for conducting non-clinical laboratory studies, including the organizational process and conditions under which non-clinical laboratory studies are planned, performed, monitored, recorded and archived.

“Good Manufacturing Practices” means applicable Drug Regulatory Agency principles, policies and guidelines of good manufacturing practice in respect of medicinal products for human use and investigational medicinal products for human use, including those for ensuring that products are consistently produced and controlled according to said quality standards.

“Governmental Authority” means: (a) any federal, provincial, state, local, municipal, regional, territorial, aboriginal, or other government, governmental or public department, branch, ministry, or court, domestic or foreign, including any district, agency (including any Drug Regulatory Agency), commission, board, arbitration panel or authority and any subdivision of any of them exercising or entitled to exercise any administrative, executive, judicial, ministerial, prerogative, legislative, regulatory, or taxing authority or power of any nature; (b) any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of them, and any subdivision of any of them; and (c) any stock exchange or trading market, including the Cboe, TSXV, NYSE American, and the OTCQB.

“Hazardous Substance” means any substance, waste, liquid, gaseous or solid matter, fuel, micro-organism, sound, vibration, ray, heat, odour, radiation, energy vector, plasma, or organic or inorganic matter that is or is deemed to be, alone or in any combination, hazardous, hazardous waste, solid or liquid waste, toxic, a pollutant, a deleterious substance, a contaminant or a source of pollution or contamination, regulated by any Environmental Laws.

“Healthcare Laws” means, to the extent related to the business of a Party or any of its Subsidiaries, as of the date of this Agreement, all applicable Laws relating to research,

development, manufacture, market approval, pricing, reimbursement, procurement and commercialization (including promotion/marketing) of healthcare products (including drug, controlled drug substances, narcotics, natural health, biological products and medical devices) and related privacy Laws (including related to personal health information) including the Canadian Food and Drugs Act, the United States Federal Food, Drug and Cosmetic Act, the United Kingdom Medicines and Medical Devices Act, 2021, the European Regulation (EU) No 2019/6, Regulation (EC) No 726/2004 and Directive 2001/83/EC, and related Laws, regulations, policies and guidance in all applicable jurisdictions.

“Inbound IP Licenses” means, collectively, each license or other Contract pursuant to which a Party or any of its Subsidiaries is granted rights under, in or to Intellectual Property owned by a third party.

“Institutional Review Board” means the entity defined in 21 C.F.R. §50.3 (i).

“Intellectual Property” means domestic and foreign: (a) patents, applications for patents and reissues, divisions, continuations, renewals, extensions and continuations-in-part of patents or patent applications; (b) proprietary and non-public business information, including inventions (whether patentable or not), invention disclosures, improvements, discoveries, trade secrets, confidential information, know-how, methods, processes, designs, technology, technical data, schematics, formulae and customer lists, and documentation relating to any of the foregoing; (c) copyrights, copyright registrations and applications for copyright registration; (d) mask works, mask work registrations and applications for mask work registrations; (e) designs, design registrations, design registration applications and integrated circuit topographies; (f) trade names, business names, corporate names, domain names, social media accounts (including the rights to the content therein) and social media handles, website names and world wide web addresses, common law trade-marks, trade-mark registrations, trade mark applications, trade dress and logos, and the goodwill associated with any of the foregoing; (g) software; (h) all Owned Intellectual Property; and (i) any other intellectual property and industrial property used in, or necessary to conduct the business of a Party or its Subsidiaries as currently conducted.

“Intellectual Property Authorities” means the UK Intellectual Property Office, the European Patent Office, the United States Patent and Trademark Office, and the Canadian Intellectual Property Office.

“Interim Order” means the interim order of the Court, after being informed of the intention to rely upon the Section 3(a)(10) Exemption and similar exemptions from applicable United States Laws with respect to the issuance of the Consideration Shares to be issued pursuant to the Arrangement to Target Shareholders in the United States, in a form acceptable to the Parties, acting reasonably, providing for, among other things, the calling and holding of the Target Meeting, as the same may be amended, supplemented or varied by the Court, with the consent of the Parties, acting reasonably.

“IP Registrations” means, with respect to a Party, all Owned Intellectual Property of the Party that is the subject of an active registration, or for which a pending application for registration has been filed, with any Internet domain registry or any patent, trademark or copyright office.

“Law” means all laws, statutes, codes, ordinances, decrees, rules, regulations, by-laws, statutory rules, principles of law, published policies and guidelines, judicial or arbitral or administrative or ministerial or departmental or regulatory judgments, orders (including the Interim Order and the Final Order), decisions, rulings or awards, including general principles of common and civil law, and the applicable terms and conditions of any grant of approval, permission, authority or licence of any Governmental Authority or self-regulatory authority, and the term “applicable” with respect to Law and in a context that refers to one or more Persons, means such Laws as are binding upon such Person or its assets.

“Licensed Intellectual Property” means all Intellectual Property that is licensed by a third party to a Party or its Subsidiaries, including without limitation, written Inbound IP Licenses.

“Lock-Up Agreements” means the lock-up agreements to be entered into between Buyer and each of the Target Supporting Shareholders at the Effective Time, substantially in the form appended to the Buyer Disclosure Letter.

“Match Period” is defined in Section 5.5(a).

“Material Adverse Effect” means, with respect to a Party, any effect, event, change, occurrence or state of facts that, individually or in the aggregate with other effects, events, changes, occurrences or states of facts, is, or would reasonably be expected to be, material and adverse to the business, condition (financial or otherwise), properties, assets (tangible or intangible), liabilities (contingent or otherwise), capitalization, operations, prospects or results of operations of that Party and its Subsidiaries, on a consolidated basis, other than:

(a) any effect, event, change, occurrence or state of facts resulting from or arising in connection with:

(i) any change affecting the psychedelic or pharmaceutical industries generally;

(ii) any change in GAAP or its interpretation by any Governmental Authority;

(iii) any change or proposed change in Law, or the interpretation, application or non-application of Law by any Governmental Authority;

(iv) any change in general economic or political conditions in Canada, the United Kingdom, the United States, or the European Union or any of its member states;

(v) any change in financial, credit, or securities markets in general;

(vi) any natural disaster or calamity;

(vii) any pandemic, epidemic or similar health emergency; or

(viii) war, armed hostilities or acts of terrorism;

unless it relates primarily to (or has the effect of relating primarily to) that Party and its Subsidiaries, on a consolidated basis, or adversely affects that Party and its Subsidiaries disproportionately, compared to other businesses operating in the same industry and geographic areas as that Party; or

(b) any effect, event, change, occurrence or state of facts resulting from or arising in connection with:

(i) any change to the trading price or trading volume of any securities of that Party on the Cboe or NYSE American (in the case of the Buyer Shares) or the TSXV or the OTCQB (in the case of the Target Shares) (but the state of facts underlying that change may be considered to determine whether a Material Adverse Effect has occurred if such underlying cause does not otherwise fall within any of the exceptions to this definition);

(ii) the announcement or pending consummation of this Agreement or the Arrangement; or

(iii) any action taken (or not taken) by a Party that is required to be taken (or not taken) under this Agreement or that is consented to by the Other Party in writing;

and provided that references in this Agreement to dollar amounts are not intended to be, and will not be deemed to be, illustrative or interpretive for purposes of determining whether a Material Adverse Effect has occurred.

“MI 61-101” means Multilateral Instrument 61-101—Protection of Minority Security Holders in Special Transactions.

“misrepresentation” has the meaning given to that term in the Securities Act (Ontario).

“NSIA Condition” is defined in Section 6.1(g)(iii).

“NYSE American” means the NYSE American exchange.

“Ordinary Course” means, with respect to an action taken by a Party or its Subsidiary, that such action is consistent with the past practices of such Party or such Subsidiary and is taken in the ordinary course of the normal day-to-day operations of the business of such Party or such Subsidiary.

“OTCQB” means the OTCQB Venture Market.

“Other Party” means (a) with respect to Buyer, Target, and (b) with respect to Target, Buyer.

“Outside Date” means November 30, 2023, or such later date as the Parties may agree in writing.

“Owned Intellectual Property” means, in respect of a Party, the Intellectual Property owned by that Party or any of its Subsidiaries.

“Parties” means Buyer and Target, collectively, and “Party” means either of them.

“Permits” means authorizations, registrations, permits, certificates of approval, approvals, grants, licences, quotas, consents, commitments, rights or privileges issued or granted by any Governmental Authority, including applications or submissions for any of the foregoing.

“Person” will be broadly interpreted and includes: (a) a natural person, whether acting in their own capacity, or in their capacity as executor, administrator, estate trustee, trustee or personal or legal representative, and the heirs, executors, administrators, estate trustees, trustees or other personal or legal representatives of a natural person; (b) a corporation or a company of any kind, a partnership of any kind, a sole proprietorship, a trust, a joint venture, an association, an unincorporated association, an unincorporated syndicate, an unincorporated organization or any other association, organization or entity of any kind; and (c) a Governmental Authority.

“Pharmaceutical Product” means, in respect of a Party, any pharmaceutical or medicinal compound (including any biologic) or product developed, or currently being researched or developed, by or on behalf of that Party or its Subsidiaries.

“Plan of Arrangement” means the plan of arrangement in substantially the form set out in Schedule A, as amended or varied from time to time at the direction of the Court with the consent of the Parties, acting reasonably, or in accordance with the terms of this Agreement or the applicable provisions of the Plan of Arrangement.

“Pre-Acquisition Reorganization” is defined in Section 4.12.

“Providing Party” is defined in Section 4.11(a).

“Recipient Party” is defined in Section 4.11(a).

“Regulatory Approvals” means approvals, consents, waivers, sanctions, rulings, determinations, clearances, permissions of Governmental Authorities (including the lapse, without objection, of a prescribed time under a statute or regulation that states that a transaction may be implemented if the prescribed time has lapsed without an objection being made following the giving of notice) or written confirmations of no intention to initiate legal proceedings from Governmental Authorities, in each case required or desirable to consummate the transactions contemplated by this Agreement.

“Release” means to release, spill, leak, pump, pour, emit, empty, discharge, deposit, inject, leach, dispose, dump or permit to escape.

“Remedial Order” means, in respect of a Party, any remedial order, including any notice of non-compliance, order, other complaint, direction or sanction issued, filed or imposed by any Governmental Authority under Environmental Laws, with respect to the existence of Hazardous Substances on, in or under lands or premises owned or leased by that Party or any of its Subsidiaries, or neighbouring or adjoining properties, or the Release of any Hazardous Substance from, at or on the lands or premises owned or leased by that Party or any of its Subsidiaries, or with respect to any failure or neglect by such Party or any of its Subsidiaries to comply with Environmental Laws.

“Representatives” means, with respect to a Person, its Subsidiaries, and its and their directors, officers, employees, consultants, financial advisors, legal counsel, agents or other representatives.

“Rolling Plan” means the current 10% rolling stock option plan of Target.

“Sanctions” means any economic or financial sanctions or trade embargoes imposed, authorized, administered or enforced by a Governmental Authority, including Global Affairs Canada, the Office of Foreign Assets Control of the U.S. Department of the Treasury, the United Nations Security Council, the European External Action Service of the European Union, Her Majesty’s Treasury of the United Kingdom, or any other applicable sanctions authority.

“Section 3(a)(10) Exemption” means the exemption from the registration requirements of the U.S. Securities Act provided by section 3(a)(10) of the U.S. Securities Act.

“SEDAR” means the System for Electronic Document Analysis and Retrieval, or its successor, the System for Electronic Data Analysis and Retrieval +.

“Special Committee” means the special committee of the Target Board formed in connection with the Arrangement and the transactions contemplated by this Agreement.

“Superior Proposal” means any unsolicited bona fide written Acquisition Proposal received by a Party after the date of this Agreement that:

(a) did not result from or involve a breach of this Agreement by the Party or any of its Representatives;

(b) complies with Laws;

(c) is for:

(i) the acquisition of all of the voting securities of the Party (that are not already owned by the Person making the Acquisition Proposal and any joint actors and any of their respective affiliates); or

(ii) the acquisition of all or substantially all of the assets of the Party on a consolidated basis;

(d) is not subject to any financing condition, and in respect of which it has been demonstrated to the satisfaction of the board of directors of the Party, acting in good faith and after consulting with the Party’s financial advisors and outside legal counsel, that adequate arrangements have been made in respect of any financing required;

(e) is not subject to any due diligence or access condition;

(f) is on terms that the Party, acting in good faith, reasonably believes, after consulting with the Party’s financial advisors and outside legal counsel:

(i) is reasonably capable of being completed without undue delay relative to the Arrangement, taking into account all legal, financial, regulatory and other aspects of that proposal and the Person making that proposal; and

(ii) would, if consummated in accordance with its terms, result in a transaction more favourable to the Party’s shareholders from a financial perspective than the Arrangement.

“Target Articles” means the notice of articles and articles of Target dated November 26, 2021.

“Target Board” means the board of directors of Target.

“Target Board Recommendation” is defined in Section 10 of Schedule D.

“Target Change in Recommendation” is defined in Section 7.1(c)(iv).

“Target Circular” means the notice of meeting and accompanying management information circular of Target, including all of its schedules and exhibits and all information it incorporates by reference, to be sent by Target to the Target Shareholders in connection with the Target Meeting, as amended, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Target Disclosure Letter” means the disclosure letter delivered by Target to Buyer, contemporaneously with the execution and delivery of this Agreement, with respect to certain matters in this Agreement.

“Target Financial Statements” means: (a) the audited comparative financial statements of Target as at and for the year ended February 28, 2023, together with their associated notes and the auditors’ report on them; and (b) the unaudited comparative financial statements of Target as at and for the three-month period ended May 31, 2023, together with their associated notes.

“Target Information” means the information describing Target and its business, operations and affairs.

“Target Material Contract” means, with respect to Target, a Contract to which Target or any of its Subsidiaries is a party, or by which Target or any of its Subsidiaries is bound or affected or to which any of their properties or assets are subject:

(a) the termination of which, or under which the loss of rights, would or would reasonably be expected to have a material and adverse effect on the business, condition (financial or otherwise), properties, assets (tangible or intangible), liabilities (contingent or otherwise), capitalization, operations, prospects or results of operations of Target and its Subsidiaries, on a consolidated basis;

(b) that involves or may result in the payment of money or money’s worth by or to Target or any of its Subsidiaries in an amount in excess of $250,000 over any 12-month period, or $500,000 over the remaining life of the Contract;

(c) that relates to indebtedness for borrowed money, or the guarantee of any liabilities or obligations;

(d) that creates a right of first offer or refusal or an exclusive dealing arrangement, or that limits the scope of Persons to whom Target or any of its Subsidiaries may sell products or provide services, or with whom Target or any of its Subsidiaries may conduct business;

(e) that contains any non-competition or non-solicitation obligation or other restrictions that limit the ability of Target or any of its Subsidiaries to engage in any line of business or to carry on business in any geographic territory;

(f) that relates to any joint venture, strategic alliance, partnership, sharing of profits or revenue or similar arrangement;

(g) that restricts the incurrence of indebtedness for borrowed money by Target or any of its Subsidiaries or the incurrence of any Encumbrances on any properties or assets of Target or any of its Subsidiaries, or restricting the payment of dividends by Target or any of its Subsidiaries;

(h) that provides for retention, change of control or similar payments;

(i) that is a collective bargaining agreement, a labour union contract or any other memorandum of understanding or other agreement with a union;

(j) with a Governmental Authority;

(k) under which Target or any of its Subsidiaries assigns or obtains ownership in any material Owned Intellectual Property (including, for clarity, any Owned Intellectual Property that is used in, or is necessary to conduct, the business of Target and its Subsidiaries as currently conducted);

(l) pursuant to which Target or any of its Subsidiaries licenses or otherwise provides a right to practice or any other material interest in any material Intellectual Property of Target, or any Inbound IP License pursuant to which Target or any of its Subsidiaries obtains rights in any material Licensed Intellectual Property;

(m) under which Target or any of its Subsidiaries grants or obtains any license or other rights with respect to any material Intellectual Property (other than licenses of widely available commercial off-the-shelf software with total annual license, maintenance, support and other fees not in excess of $100,000 in the aggregate per vendor), including any right to receive royalties or other payments, or providing for the purchase, sale or exchange of, or option to purchase, sell or exchange, any material Owned Intellectual Property (including, for clarity, any Owned Intellectual Property that is used in, or is necessary to conduct, the business of Target and its Subsidiaries as currently conducted);

(n) with any clinical research organization or other agreement with a third party which is conducting one or more clinical studies on behalf of Target or any of its Subsidiaries;

(o) regarding an arrangement with respect to any combination trial;

(p) that imposes any co-promotion or collaboration obligations with respect to any product or product candidate;

(q) is a “single source” supply Contract, in accordance with which Target or any of its Subsidiaries procures goods or materials from one source, or any other material supply Contract;

(r) pursuant to which Target or any of its Subsidiaries has contingent obligations that upon satisfaction of certain conditions precedent will result in the payment by Target or any of its Subsidiaries of more than $250,000 in the aggregate over a 12-month period or $500,000 over the remaining life of the Contract, in either milestone payments or royalties, upon (i) the achievement of regulatory or commercial milestones or (ii) the receipt of revenue or income based on product sales;

(s) relating to the acquisition or disposition of any Person, business or operations or assets constituting a business pursuant to which Target or any of its Subsidiaries has any outstanding obligations or rights as of the date of this Agreement (including any such Contract under which contemplated transactions were consummated but under which one or more of the parties thereto has executory indemnification, earn-out or other material liabilities);

(t) is a settlement agreement with future payment obligations in excess of $250,000, or which creates or could create an Encumbrance on any asset of Target or any of its Subsidiaries;

(u) that has an unexpired term of more than two years (including renewals);

(v) that cannot be terminated by Target or any of its Subsidiaries without penalty upon less than 60 days’ notice; or

(w) that is otherwise material to Target on a consolidated basis.

“Target Meeting” means the annual general and special meeting of Target Shareholders to be held to consider the Arrangement Resolution, among other thing, and any adjournment(s) or postponement(s) thereof.

“Target Nominee Agreement” means an agreement governing the Target Nominee’s relationship as a director of Buyer, substantially in the form appended to the Buyer Disclosure Letter.

“Target Option Plans” means, collectively, the Rolling Plan and the EMI Plans, as amended, restated and/or supplemented from time to time.

“Target Optionholders” means at any time the registered holders at that time of Target Options.

“Target Options” means options to purchase Target Shares.

“Target Public Record” means all documents publicly filed by or on behalf of Target on SEDAR on or after July 1, 2020.

“Target Securityholders” means, collectively, the Target Shareholders and Target Optionholders.

“Target Shareholder Approval” is defined in Section 2.2(d).

“Target Shareholders” means the holders of Target Shares from time to time.

“Target Shares” means the common shares in the authorized share capital of Target.

“Target Superior Proposal” means a Superior Proposal in respect of Target.

“Target Supporting Shareholders” means all of the directors, officers, and certain shareholders of Target, all of whom have entered into the Target Voting Agreements.

“Target Termination Fee” is defined in Section 8.1.

“Target Termination Fee Event” is defined in Section 8.1.

“Target Voting Agreement” mean the voting support agreements (including all amendments thereto) between Buyer and the Target Supporting Shareholders.

“Tax” or “Taxes” means all taxes, duties, fees, premiums, assessments, imposts, levies, rates, withholdings, dues, government contributions and other charges of any kind whatsoever imposed by any Governmental Authority, whether direct or indirect, together with all interest, penalties, fines, additions to tax or other additional amounts imposed in connection with them, including those levied on, or measured by, or referred to as income, gross income, gross receipts, net proceeds, profits, capital gains, alternative or add-on, or minimum, capital, transfer, land transfer, sales, retail sales, consumption, use, goods and services, harmonized sales, value-added, ad valorem, turnover, excise, stamp, non-resident withholding, business, franchising, business licenses, real and personal property (tangible and intangible), environmental, transfer, payroll, employee withholding, employment, health, employer health, social services, development, occupation, education or social security, and all contributions, premiums and surtaxes, all customs duties, countervail, anti-dumping, special import measures and import and export taxes, all licence, franchise and registration fees, all provincial workers’ compensation payments, and all employment insurance, health insurance and Canada, Québec and other government pension plan contributions.

“Tax Act” means the Income Tax Act (Canada), R.S.C. 1985 (5th Supp.) c.1, and the regulations thereunder, as amended.

“Tax Law” means any Law that imposes Taxes or that deals with the administration or enforcement of liabilities for Taxes.

“Tax Return” means any return, report, declaration, designation, election, undertaking, waiver, notice, filing, information return, statement, form, certificate or any other document or materials relating to Taxes, including any related or supporting information with respect to any of those documents or materials listed above in this definition filed or to be filed with any Governmental Authority in connection with the determination, assessment, collection or administration of Taxes.

“Termination Fee” means, in the case of Buyer, the Buyer Termination Fee, and in the case of Target, the Target Termination Fee.

“Termination Fee Event” means, in the case of Buyer, a Buyer Termination Fee Event, and in the case of Target, a Target Termination Fee Event.

“Trade Authorization” means a Permit concerning the exportation, re-exportation, and temporary importation of any products, technology, technical data and services.

“Trade Laws” means the applicable export control, sanctions, import, customs and trade, and anti-boycott Laws of any jurisdiction in which a Party or any of its Subsidiaries is incorporated or continued, exists or does business.

“TSXV” means the TSX Venture Exchange Inc.

"UK Enterprise Act" means the Enterprise Act 2002 (United Kingdom).

"UK Investment Security Unit" means the Investment Security Unit in the Cabinet Office, which is responsible for the operation of the UK NSIA.

"UK NSIA" means the National Security and Investment Act 2021 (United Kingdom).

"UK Secretary of State in the Cabinet Office" means the Secretary of State in the Cabinet Office acting as decision maker for the purposes of the UK NSIA.

“U.S. Exchange Act” means the United States Securities Exchange Act of 1934, as amended.

“U.S. Securities Act” means the United States Securities Act of 1933, as amended.

“U.S. Securities Laws” means the federal and state securities legislation of the United States, and the rules and regulations promulgated thereunder.

“U.S. Tax Code” is defined in Section 2.17.

“United States” means the United States of America, its territories and possessions, any state of the United States, and the District of Columbia.

1.2 Certain Rules of Interpretation

(a) Gender, etc. In this Agreement, words signifying the singular number include the plural and vice versa, and words signifying gender include all genders.

(b) Including. Every use of the words “including” or “includes” in this Agreement is to be construed as meaning “including, without limitation” or “includes, without limitation”, respectively.

(c) Division and Headings. The division of this Agreement into Articles and Sections, the insertion of headings and the inclusion of a table of contents are for convenience of reference only and do not affect the construction or interpretation of this Agreement.

(d) Articles, Sections, etc. References in this Agreement to an Article, Section or Schedule are to be construed as references to an Article, Section or Schedule of or to this Agreement unless otherwise specified.

(e) Definitions. Any capitalized terms used in the Target Disclosure Letter or Buyer Disclosure Letter, or any exhibit or Schedule hereto and not otherwise defined therein or herein, shall have the meaning as defined in this Agreement.

(f) Time Periods. Unless otherwise specified in this Agreement, time periods within which or following which any calculation or payment is to be made, or action is to be taken, will be calculated by excluding the day on which the period begins and including the day on which the period ends. If the last day of a time period is not a Business Day, the time period will end on the next Business Day.

(g) Statutory Instruments. Unless otherwise specified, any reference in this Agreement to any statute includes all regulations and subordinate legislation made under or in connection with that statute at any time, and is to be construed as a reference to that statute as amended, restated, supplemented, extended, re-enacted, replaced or superseded at any time.

(h) Knowledge. References to the “knowledge” of a Party mean the knowledge that, in the case of Buyer, Douglas Drysdale and Greg Cavers, and in the case of Target, George Tziras and David Steel either has, or would have obtained, after having made or caused to be made all reasonable inquiries necessary to obtain informed knowledge, including inquiries of the records of the Party and management employees of the Party who are reasonably likely to have knowledge of the relevant matter.

(i) Time of Day. Unless otherwise specified, references to time of day or date mean the local time or date in the City of Toronto, in the Province of Ontario.

1.3 Governing Law

This Agreement is governed by, and is to be construed and interpreted in accordance with, the laws of the Province of Ontario and the laws of Canada applicable in that Province.

1.4 Entire Agreement

This Agreement and any other agreements and documents to be delivered under this Agreement, constitutes the entire agreement between the Parties pertaining to the subject matter of this Agreement and supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written, of the Parties, other than the provisions of the Confidentiality Agreement, and there are no representations, warranties or other agreements between the Parties in connection with the subject matter of this Agreement except as specifically set out in this Agreement or, if applicable, in any other agreements and documents delivered under this Agreement. No Party has been induced to enter into this Agreement in reliance on, and there will be no liability assessed, either in tort or contract, with respect to, any warranty, representation, opinion, advice or assertion of fact, except to the extent it has been reduced to writing and included as a term in this Agreement.

1.5 Business Day

Whenever any calculation or payment to be made or action to be taken under this Agreement is required to be made or taken on a day other than a Business Day, the calculation or payment is to be made or action is to be taken on the next Business Day.

1.6 Payment and Currency

Unless otherwise specified, any money to be advanced, paid or tendered by a Party under this Agreement must be advanced, paid or tendered by bank draft, certified cheque or wire transfer of immediately available funds payable to the Person to whom the amount is due. Unless otherwise specified, the word “dollar” and the “$” sign refer to Canadian currency, and all amounts to be advanced, paid, tendered or calculated under this Agreement are to be advanced, paid, tendered or calculated in Canadian currency.

1.7 Affiliates and Subsidiaries

For the purpose of this Agreement, a Person is an “affiliate” of another Person if one of them is a Subsidiary of the other or each one of them is controlled, directly or indirectly, by the same Person. A “Subsidiary” means a Person that is controlled directly or indirectly by another Person and includes a Subsidiary of that Subsidiary. A Person is considered to “control” another Person if: (a) the first Person beneficially owns or directly or indirectly exercises control or direction over securities of the second Person carrying votes which, if exercised, would entitle the first Person to elect a majority of the directors of the second Person, unless that first Person holds the voting securities only to secure an obligation, or (b) the second Person is a partnership, other than a limited partnership, and the first Person holds more than 50% of the

interests of the partnership, or (c) the second Person is a limited partnership, and the general partner of the limited partnership is the first Person.

1.8 Schedules

The following is a list of Schedules, which form part of this Agreement:

| | | | | |

| Schedule | Subject Matter |

| A | Plan of Arrangement |

| B | Form of Arrangement Resolution |

| C | Form of Buyer Resolution |

| D | Representations and Warranties of Target |

| E | Representations and Warranties of Buyer |

| |

ARTICLE 2

THE ARRANGEMENT

2.1 Arrangement

Buyer and Target agree to implement the Arrangement in accordance with, and subject to the terms and conditions of, this Agreement and the Plan of Arrangement.

2.2 Interim Order

Target will, as soon as reasonably practicable, and in any event in sufficient time to mail and file the Target Circular in accordance with Section 2.4(a), apply to the Court in a manner acceptable to Buyer, acting reasonably, under section 291 of the BCBCA and, in cooperation with Buyer, prepare, file, and diligently pursue an application for the Interim Order. The Interim Order will provide, among other things:

(a) for the classes of Persons to whom notice is to be provided in respect of the Arrangement and the Target Meeting and for the manner in which that notice is to be provided;

(b) for confirmation of the record date for the Target Meeting (which date shall be fixed by Target in consultation with Buyer, acting reasonably);

(c) that the only securities of Target in connection with which holders will be entitled to vote on the Arrangement Resolution at the Target Meeting will be the Target Shares;

(d) that the requisite approval for the Arrangement Resolution will be 66⅔% of the votes cast on the Arrangement Resolution by Target Shareholders present in person or by proxy at the Target Meeting, together with, if required by MI 61-101, minority approval in accordance with MI 61-101 (together, the “Target Shareholder Approval”);

(e) that the Target Meeting may be adjourned or postponed from time to time by Target, subject to the terms of this Agreement, without the need for additional approval of the Court;

(f) that the record date to determine the Target Shareholders entitled to notice of, and to vote at, the Target Meeting will not change in connection with any adjournments or postponements of the Target Meeting;

(g) that the terms, restrictions and conditions of Target’s constating documents (in effect on the date of this Agreement), including quorum requirements, will apply in connection with the Target Meeting, except as set out in this Section 2.2;

(h) for the grant of the Dissent Rights;

(i) for the notice requirements with respect to the presentation of the application to the Court for the Final Order;

(j) that it is the Parties’ intention to rely on the Section 3(a)(10) Exemption and similar exemptions from applicable United States Laws with respect to the issuance of Consideration Shares to Target Securityholders in the United States entitled to receive Consideration Shares pursuant to the Arrangement, subject to and conditional upon the Court’s determination that the Arrangement is substantively and procedurally fair to all such Target Securityholders and based on the Court’s approval of the Arrangement; and

(k) for any other matters that Target and Buyer may reasonably require, subject to obtaining the prior consent of the Other Party, which consent will not be unreasonably withheld, delayed or conditioned.

2.3 Target Circular

(a) The Parties will cooperate in the preparation of the Target Circular and any related documents. As promptly as practicable following the execution of this Agreement:

(i) Target will prepare the Target Circular together with any other documents required by the Interim Order and applicable Laws in connection with the Target Meeting, ensuring compliance with the Interim Order, other applicable Laws, and this Agreement. Target will ensure that the Target Circular provides the Target Shareholders with information in sufficient detail to permit them to form a reasoned judgment concerning the matters to be placed before them at the Target Meeting. The Target Circular shall include, among other things, (A) the Target Board Recommendation, (B) a statement that each of the Target Supporting Shareholders has signed a Target Voting Agreement, pursuant to which each of them has agreed to, among other things, vote all of their Target Shares in favour of the Arrangement Resolution and any other resolution presented at the Target Meeting required to give effect to the Arrangement, (C) a summary and copy of the Target’s financial advisor’s fairness opinion; and (D) information in sufficient detail to allow the Buyer to rely upon the Section 3(a)(10) Exemption with respect to the issuance of Consideration Shares pursuant to the transactions described in this Agreement;

(ii) Buyer will prepare the Buyer Information, in accordance with the Interim Order and applicable Laws, for inclusion or incorporation by reference in the Target Circular and provide the Buyer Information (together with any required consents of experts relating to it) to Target in a timely manner; and

(iii) Buyer shall use commercially reasonable efforts to obtain any necessary consents from its auditor and any other advisors to the use of any financial, technical or other expert information required to be included in the Target Circular and to the identification in the Target Circular of each such advisor.

(b) During the course of the preparation of the Target Circular and any related documents, Target will:

(i) provide Buyer and its legal and other advisors with reasonable opportunity to review and comment on the Target Circular and those related documents; and

(ii) give reasonable consideration to comments made by Buyer and its legal and other advisors, provided that all information relating solely to Buyer included in the Target Circular, and all information describing the terms and conditions of this Agreement, the Target Voting Agreements, or the Plan of Arrangement will be in form and content reasonably satisfactory to the Buyer.

(c) Target will ensure that the Target Circular does not contain any misrepresentations (except that Target shall not be responsible for any Buyer Information included in the Target Circular that was provided by Buyer expressly for inclusion in the Target Circular pursuant to Section 2.3(a)(ii)).

(d) Buyer will ensure that the Buyer Information provided for inclusion or incorporation by reference in the Target Circular does not contain any misrepresentations concerning Buyer.

(e) Subject to the issuance of the Interim Order and compliance by Buyer with its obligations under this Section 2.3, Target will promptly cause the Target Circular and any related documents to be distributed to the Target Shareholders and other appropriate Persons, and filed with applicable Governmental Authorities, in accordance with the Interim Order and applicable Laws.

(f) Each Party will promptly notify the Other Party if at any time before the Target Shareholder Approval is obtained it becomes aware that the Target Circular contains a misrepresentation, or information that otherwise requires an amendment or supplement to the Target Circular. The Parties will cooperate in the preparation of any amendment or supplement as required or appropriate, and Target will promptly cause the amendment or supplement to be distributed to the Target Shareholders and other appropriate Persons, and filed with applicable Governmental Authorities, in each case as required by the Court or by Law.

(g) Target shall promptly advise Buyer of any communication (written or oral) received by Target from the TSXV, or any other Governmental Authority (in particular any securities regulatory authority) in connection with the Target Circular.

2.4 Target Meeting

(a) Subject to Section 2.4(b) and receipt of the Interim Order, Target will convene and conduct the Target Meeting, in accordance with applicable Laws (including the Interim Order) and Target’s constating documents (except as varied by the Interim Order), on or before October 12, 2023. Target will provide notice to Buyer of the Target Meeting and allow Representatives of Buyer to attend and speak at the Target Meeting. Target will submit the Arrangement Resolution to the Target Shareholders at the Target Meeting regardless of whether the Target Board has withdrawn, modified or qualified the Target Board Recommendation. Target will not propose or submit for consideration at the Target Meeting any business other than the Arrangement Resolution without Buyer’s consent, which consent will not be unreasonably withheld, delayed or conditioned.

(b) Target will not adjourn, postpone or cancel the Target Meeting (or propose to do so), or fail to call the Target Meeting, except:

(i) if a quorum is not present at the Target Meeting (in which case the Target Meeting will be adjourned and not cancelled);

(ii) if required by Law or a Governmental Authority;

(iii) in the circumstances contemplated in Section 5.5(d) or Section 7.2(c) (which contemplate the adjournment or postponement, but not the cancellation, of the Target Meeting); or

(iv) if otherwise agreed with Buyer.

(c) Target will, in consultation with Buyer, set a record date for the determination of Target Shareholders entitled to vote at the Target Meeting and, except as required by Law, Target will not change the record date without the prior consent of Buyer.

(d) Subject to the terms of this Agreement, other than following a Target Change in Recommendation, Target will make all commercially reasonable efforts to solicit proxies for the approval of the Arrangement Resolution, and against any resolution submitted by any Person that is inconsistent with the Arrangement Resolution and the completion of the transactions contemplated by this Agreement, including, if requested by Buyer, using proxy solicitation services firms and cooperating with any Persons engaged by Buyer to solicit proxies for the approval of the Arrangement Resolution.

(e) Target will promptly provide Buyer with copies of or access to information regarding the Target Meeting generated by Target’s transfer agent or any proxy solicitation services firm retained by Target, as Buyer may reasonably request.

(f) Target will make all commercially reasonable efforts:

(i) within five (5) Business Days of the date of this Agreement, to deliver to Buyer a list of Target Shareholders (including their names, addresses and holdings of Target Shares), as well as a security position listing from each depository of its securities (including the name, address and holdings of each non-objecting beneficial owner of Target Shares); and