U.S. Futures Dip in Pre-Market, May WTI and June Brent Crude Prices Edge Higher

April 03 2024 - 7:11AM

IH Market News

U.S. index futures are slightly down in pre-market trading this

Wednesday, reflecting the continuation of a challenging start to

the second quarter of 2024.

At 06:27 AM, Dow Jones futures (DOWI:DJI) fell 35 points, or

0.09%. S&P 500 futures were down 0.21%, and Nasdaq-100 futures

lost 0.34%. The yield on 10-year Treasury notes was at 4.367%.

In the commodities market, West Texas Intermediate crude oil for

May rose 0.36% to $85.46 per barrel. Brent crude oil for June was

up 0.43%, close to $89.30 per barrel. Iron ore traded on the Dalian

exchange fell 2.54% to $103.51 per metric ton.

On Wednesday, the economic agenda highlights important U.S.

indicators, starting with the ADP employment report at 8:15 AM.

This will be followed by the release of the March Services PMI by

S&P Global at 09:45 AM and the ISM Services Index at 10:00 AM.

The DoE’s update on oil inventories is also awaited at 10:30 AM. At

12:10 PM, a speech by Fed Chairman Jerome Powell is on the

radar.

Asian markets closed lower, influenced by Wall Street’s poor

performance, despite the Chinese services PMI meeting expectations.

Concerns about U.S. interest rates overshadowed the positive data,

and Chinese markets are gearing up for a brief hiatus. The Shanghai

SE in China fell 0.18%, the Nikkei in Japan was down 0.97%, the

Hang Seng Index in Hong Kong retreated 1.22%, the Kospi in South

Korea decreased by 1.68%, and the ASX 200 in Australia closed down

1.34%.

Most European markets are trending upwards, driven by the latest

Eurozone inflation data. In March, inflation in the 20-country bloc

dropped to 2.4%, according to preliminary data, defying economists’

expectations, which had anticipated the rate to hold at 2.6%, as

surveyed by Reuters.

After a volatile opening session, U.S. stocks ended Tuesday

lower, with the Dow Jones and S&P 500 moving away from recent

highs. Uncertainty over interest rates, influenced by mixed

economic data, contributed to the decline. The Dow Jones retreated

by 1.00%, while the S&P 500 and Nasdaq saw losses of 0.72% and

0.95%, respectively, reflecting investor caution ahead of

significant economic announcements expected for the week.

In the earnings front, companies scheduled to present financial

reports before the market opens include Acuity

Brands (NYSE:AYI), Icecure Medical

(NASDAQ:ICCM), BiomX (AMEX:PHGE). After the market

closes, financial numbers from BlackBerry

(NYSE:BB), Levi Strauss (NYSE:LEVI),

Simulations Plus (NASDAQ:SLP), Sportsman’s

Warehouse (NASDAQ:SPWH), and Resources

Connection (NASDAQ:RGP) are awaited.

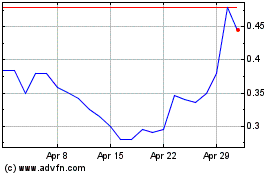

BiomX (AMEX:PHGE)

Historical Stock Chart

From Oct 2024 to Nov 2024

BiomX (AMEX:PHGE)

Historical Stock Chart

From Nov 2023 to Nov 2024