Current Report Filing (8-k)

June 16 2023 - 8:01AM

Edgar (US Regulatory)

0001864032

false

--12-31

0001864032

2023-06-16

2023-06-16

0001864032

ADTC:UnitsEachConsistingOfOneShareOfCommonStockParValue0.001PerShareAndThreefourthsOfOneRedeemableWarrantToPurchaseOneShareOfCommonStockMember

2023-06-16

2023-06-16

0001864032

ADTC:CommonStockParValue0.001PerShareMember

2023-06-16

2023-06-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 16, 2023

Ault Disruptive Technologies Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-41171 |

|

86-2279256 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

11411 Southern Highlands Parkway, Suite 240,

Las Vegas, Nevada 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 210.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one share of Common Stock, par value $0.001 per share and three-fourths of one Redeemable Warrant to purchase one share of Common Stock |

|

ADRTU |

|

NYSE American LLC |

| Common Stock, par value $0.001 per share |

|

ADRT |

|

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

The information included in Item 5.07 is incorporated

by reference in this item to the extent required.

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On June 15, 2023, Ault

Disruptive Technologies Corporation (the “Company”) held a special meeting of stockholders (the “Special

Meeting”). At the Special Meeting, the Company’s stockholders approved two proposals amending the Company’s

Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to (i) extend the date by which the Company

must complete a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business

combination involving the Company and one or more businesses (a “Business Combination”) from June 20, 2023 to September

20, 2023 (the “Termination Date”) and to allow the Company, without another stockholder vote, to elect to extend the

Termination Date to consummate a Business Combination on a monthly basis up to five times by an additional one month each time after

September 20, 2023, upon the request by Ault Disruptive Technologies Company, LLC (the “Sponsor”), and approval by the Company’s board

of directors until February 20, 2024 or a total of up to eight months, unless the closing of a Business Combination shall have

occurred prior thereto (the “Extension Amendment”) and (ii) delete (a) the limitation that the Company shall not

consummate a Business Combination if it would cause the Company’s net tangible assets (as determined in accordance with Rule

3a51-1(g)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (or any successor rule)) to be less

than $5,000,0001 following such redemptions and (b) the limitation that the Company shall not redeem public shares that would cause

the Company’s net tangible assets to be less than $5,000,001 following such redemptions. (the “Redemption Limitation

Amendment”).

Holders

of 11,754,829 shares of common stock of the Company, par value $0.001 per share (“Common Stock”), held of record as of May 15, 2023,

the record date for the Special Meeting, were present in person or by proxy at the meeting, representing approximately 81.77% of the voting

power of the Common Stock as of the record date for the Special Meeting, and constituting a quorum for the transaction of business.

The voting results for

the proposals were as follows:

Proposal No. 1: The

Extension Amendment Proposal

| For |

|

Against |

|

Abstain |

| 10,582,278 |

|

1,172,551 |

|

0 |

Proposal No. 2: Redemption

Limitation Amendment Proposal

| For |

|

Against |

|

Abstain |

| 10,582,278 |

|

1,172,551 |

|

0 |

Proposal No. 3: The

Adjournment Proposal

| For |

|

Against |

|

Abstain |

| 10,582,278 |

|

1,172,551 |

|

0 |

Although the Adjournment Proposal

received sufficient votes to be approved, no motion to adjourn was made because the adjournment of the Special Meeting was determined

not to be necessary or appropriate.

In addition, on June 15, 2023,

the Company filed the Charter Amendment with the Secretary of State of the State of Delaware. A copy of the Charter Amendment is attached

hereto as Exhibit 3.1.

Additionally, in connection

with the implementation of the Extension Amendment, the Company’s public stockholders elected to redeem 11,353,225 shares of Common Stock

at a redemption price of approximately $10.61 per share (without giving effect to any interest that may be withdrawn to pay taxes), for

an aggregate redemption amount of approximately $120,510,705.46 (the “Redemption”). After the satisfaction of the Redemption (without

giving effect to any interest that may be withdrawn to pay taxes), the balance in the trust account will be approximately $1,557,967.85.

Upon completion of the Redemption, 3,021,775 shares

of Common Stock will remain issued and outstanding, of which 2,875,000 shares are held by the Sponsor.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No. |

|

Description |

| 3.1 |

|

Amendment to Amended and Restated Certificate of Incorporation |

| |

|

|

|

101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted

in Inline XBRL (Inline eXtensible Business Reporting Language). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document

and included in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: June 16, 2023 |

|

|

|

AULT DISRUPTIVE TECHNOLOGIES CORPORATION |

| |

|

|

|

| |

|

|

|

By: |

|

/s/ Henry Nisser |

| |

|

|

|

Name: |

|

Henry Nisser |

| |

|

|

|

Title: |

|

President and General Counsel |

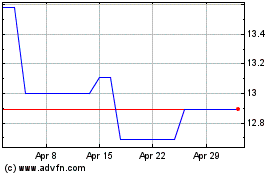

Ault Disruptive Technolo... (AMEX:ADRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ault Disruptive Technolo... (AMEX:ADRT)

Historical Stock Chart

From Feb 2024 to Feb 2025