Current Report Filing (8-k)

May 22 2023 - 4:16PM

Edgar (US Regulatory)

0001864032

false

0001864032

2023-05-22

2023-05-22

0001864032

ADTC:UnitsEachConsistingOfOneShareOfCommonStockParValue0.001PerShareAndThreefourthsOfOneRedeemableWarrantToPurchaseOneShareOfCommonStockMember

2023-05-22

2023-05-22

0001864032

ADTC:CommonStockParValue0.001PerShareMember

2023-05-22

2023-05-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): May

22, 2023

AULT DISRUPTIVE TECHNOLOGIES CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41171 |

|

86-2279256 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

1141 Southern Highlands Parkway, Suite 240, Las

Vegas, NV 89141

(Address of principal executive offices) (Zip Code)

(949) 444-5464

(Registrant's telephone number, including area

code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Common Stock, par value $0.001 per share and three-fourths of one Redeemable Warrant to purchase one share of Common Stock |

|

ADRU |

|

NYSE American |

| Common Stock, par value $0.001 per share |

|

ADRT |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 4.02 |

Non-reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review |

| (a) | On May 22, 2023, the management of Ault Disruptive Technologies

Corporation (the “Company” or “ADRT”) concluded that the Company’s previously issued financial statements

for the year ended December 31, 2022, (the “Restated Period”), which was filed with

the Securities and Exchange Commission (“SEC”) on April 4, 2023, should no longer be relied upon because of

errors in classification with respect to 11,500,000 shares of the Company’s common

stock subject to possible redemption, (the “Redeemable Shares”) and the corresponding asset, cash and marketable securities

held in a trust account (“Cash”). The Redeemable Shares were erroneously

recorded in temporary equity and have been reclassified to correct the error within current liabilities and Cash has been reclassified

to current assets to correspond with the current liability classification of the Redeemable Shares. Additionally, the Company’s

earnings and press releases and similar communications should no longer be relied upon to the extent that they relate to our financial

statements for the Restated Period. The errors described above resulted in the restatement of our financial statements for the Restated

Period. |

The restated balance sheet, specifically current

assets and current and total liabilities, as of December 31, 2022, included in the Amended Form 10-K, differ from the amounts reported

in the original filings due to the reclassifications noted above. The previously reported amounts have been reclassified for the Restated

Period. No correction was needed for the statements of operations, statements of changes in stockholders’ equity or statements of

cash flows for the year ended December 31, 2022. The restated balance sheet as of December 31, 2022 is attached hereto as Exhibit 99.1.

Due to the

restatement described above, the Company's management and Audit Committee reevaluated its Controls and Procedures in the original filings

and concluded that the Company’s disclosure controls and procedures and internal control over financial reporting were not properly

designed to analyze financial instruments for proper classification in the financial statements. The Company has been actively engaged

in developing a remediation plan to address the identified ineffective controls that existed during the Restated Period. Implementation

of the remediation plan is in process.

The Company’s management

has concluded that in light of the restatement described above, a material weakness exists in the Company’s internal control over

financial reporting and that the Company’s disclosure controls and procedures were not effective. The Company’s remediation

plan with respect to such material weakness will be described in more detail in the Amended Form 10-K.

The audit committee of the board of

directors has discussed the matters disclosed herein with Marcum, LLP, the Company’s independent registered public accounting firm.

Note about forward-looking statements

This Current report on Form 8-K contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements relate to future events or our future financial performance. We have attempted to identify forward-looking statements

by terminology including “anticipates,” “believes,” “expects,” “can,” “continue,”

“could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predict,” “should” or “will” or the negative of these terms or other comparable terminology. These

statements are only predictions; uncertainties and other factors may cause our actual results, levels of activity, performance or achievements

to be materially different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking

statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance or achievements. Our expectations are as of the date this Form 8-K is filed, and we do

not intend to update any of the forward-looking statements after the date this Form 8-K is filed to confirm these statements to actual

results, unless required by law.

Item 9.01 Exhibits

and Financial Statements.

| (b) | Pro forma financial information |

The unaudited restated balance

sheet of the Company as of December 31, 2022 is attached hereto as Exhibit 99.1.

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Unaudited restated balance sheet as of December 31, 2022 |

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 22, 2023 |

AULT DISTRUPTIVE TECHNOLOGIES CORPORATION |

| |

|

| |

|

| |

/s/ Kenneth S. Cragun |

|

| |

Kenneth S. Cragun

Chief Financial Officer |

-3-

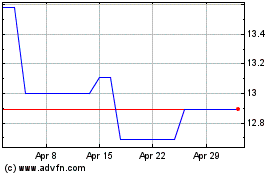

Ault Disruptive Technolo... (AMEX:ADRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ault Disruptive Technolo... (AMEX:ADRT)

Historical Stock Chart

From Feb 2024 to Feb 2025