UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| |

|

| Filed by the Registrant |

x |

| Filed by a Party other than the Registrant |

¨ |

| |

|

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| x |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 |

| |

|

|

AULT ALLIANCE, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required |

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

(5) |

Total fee paid: |

| ¨ |

Fee paid previously with preliminary materials: |

| |

|

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

DEFINITIVE PROXY STATEMENT

AULT ALLIANCE, INC.

11411 Southern Highlands Pkwy, Suite 240

Las Vegas, NV 89141

Telephone: (949) 444-5464

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Virtual Meeting Only – No Physical Meeting

Location

To Be Held on June 28, 2024

We cordially invite you to

attend the Annual Meeting (the “Meeting”) of stockholders of Ault Alliance, Inc. (the “Company”).

In the interest of providing our stockholders with greater access and flexibility to attend the Meeting, notice is hereby given that the

location, date and time of the Meeting will be held in a virtual meeting format only on June 28, 2024 at 12:00 P.M. Eastern Time. You

will not be able to attend the Meeting in person.

To access the virtual meeting

please click the Virtual Stockholder Meeting link: meetnow.global/M2WDDH5. To login to the virtual meeting you have two options:

Join as a “Guest” or Join as a “Stockholder.” If you join as a “Stockholder” you will be required

to have a control number.

Details regarding logging

onto and attending the meeting over the website and the business to be conducted are described in the Proxy Card included with this Proxy

Statement.

The Meeting will be held for

the following purposes:

| · | To elect the six (6) director nominees named in the Proxy Statement to hold office until the next annual

meeting of stockholders (the “Director Proposal”); |

| · | To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024 (the “Auditor Proposal”); |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the exercise of the warrants to purchase

the Company’s Class A Common Stock (the “Common Stock”), which were issued pursuant to the Note Purchase Agreement

dated October 13, 2023 (the “Warrant Exercise Proposal”); |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the conversion of an aggregate of 75,000

shares of Series C convertible preferred stock (the “Series C Preferred Stock”) into Common Stock and warrants to purchase

Common Stock (the “Series C Warrants” and with the Series C Preferred Stock, the “SPA Securities”),

an increase of $25,000,000 beyond the original $50,000,000 for a total purchase price of up to $75,000,000, pursuant to an Amendment dated

March 25, 2024 to the Securities Purchase Agreement dated November 6, 2023 (the “Series C Proposal”); |

| · | To approve an amendment to our Certificate of Incorporation (the “Certificate of Incorporation”)

to effect a reverse stock split of our Common Stock by a ratio of not less than one for two and not more than one for thirty-five at any

time prior to June 27, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors

in its sole discretion (the “Reverse Stock Split Proposal”); |

| · | To approve the Ault Alliance, Inc. 2024 Stock Incentive Plan (the “2024 Plan”) described

below (the “SIP Proposal”); and |

| · | To approve the adjournment of the Meeting to a later date or time, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Meeting, there are not sufficient votes to approve any of the

other proposals before the Meeting (the “Adjournment Proposal”). |

The accompanying proxy statement

sets forth additional information regarding the Meeting and provides you with detailed information regarding the business to be considered

at the Meeting. We encourage you to read the proxy statement carefully and in its entirety.

Only stockholders of record

at the close of business on May 6, 2024, the record date for the Meeting, will be entitled to vote at the Meeting or any adjournments

or postponements thereof. The proxy materials will be mailed to stockholders on or about May 13, 2024.

Important Notice Regarding the Availability

of Proxy Materials for the Meeting of Stockholders to be held on June 28, 2024:

This Notice of Meeting of Stockholders and the

accompanying Proxy Statement are available on the Internet at www.envisionreports.com/AULT for registered holders and http://www.edocumentview.com/AULT

for street holders.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Milton C. Ault III

Executive Chairman

May 8, 2024

HOW TO VOTE: Your

vote is important. Whether or not you plan to virtually attend the Meeting, we hope you will vote as soon as possible by either (1) mailing

your completed and signed proxy card(s) to Ault Alliance, Inc., 11411 Southern Highlands Pkwy, Suite 240, Las Vegas, NV 89141, Attention:

Corporate Secretary, (2) calling the toll-free number printed on your proxy card(s) and following the recorded instructions or (3) visiting

the website indicated on your proxy card(s) and following the on-line instructions. You may revoke a previously submitted proxy at any

time prior to the Meeting. If you decide to attend the Meeting and wish to change your proxy vote, you may do so automatically by voting

at the Meeting.

| TABLE OF CONTENTS |

|

| |

Page |

| INFORMATION CONCERNING THE MEETING |

1 |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

3 |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS |

8 |

| Information about the Nominees |

8 |

| Involvement in Certain Legal Proceedings |

10 |

| Family Relationships |

11 |

| Board Independence |

11 |

| Stockholder Communications with the Board |

11 |

| Meetings and Committees of the Board |

11 |

| Board Committees |

11 |

| Code of Ethics |

12 |

| Director Compensation |

13 |

| Required Vote and Board Recommendation |

13 |

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM |

14 |

| Review of the Company’s Audited Financial Statements for the Fiscal Year Ended December 31, 2023 |

14 |

| Fees Paid to Auditor |

14 |

| Pre-Approval Policies and Procedures |

14 |

| Report of the Audit Committee of the Board of Directors |

15 |

| Required Vote and Board Recommendation |

15 |

| PROPOSAL NO. 3: APPROVAL, PURSUANT TO NYSE AMERICAN LISTING RULE 713(a) & (b), OF THE EXERCISE OF THE WARRANTS ISSUED PURSUANT TO THE NOTE PURCHASE AGREEMENT WITH AULT & COMPANY |

16 |

| Description of the Warrants |

16 |

| Stockholder Approval Requirement |

16 |

| Reasons for Transaction |

17 |

| Effect on Current Stockholders; Dilution |

17 |

| Required Vote and Board Recommendation |

17 |

| PROPOSAL NO. 4: APPROVAL, PURSUANT TO NYSE AMERICAN LISTING RULE 713(a) & (b), OF THE CONVERSION OF SHARES OF OUR SERIES C PREFERRED STOCK AND EXERCISE OF WARRANTS PURSUANT TO THE SECURITIES PURCHASE AGREEMENT, AS AMENDED, WITH AULT & COMPANY |

18 |

| Description of the Securities Purchase Agreement and the SPA Securities |

18 |

| Stockholder Approval Requirement |

20 |

| Reasons for Transaction |

20 |

| Effect on Current Stockholders; Dilution |

20 |

| Required Vote and Board Recommendation |

20 |

| PROPOSAL NO. 5: AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK |

21 |

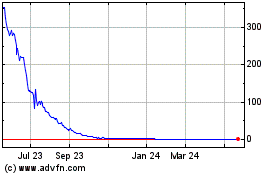

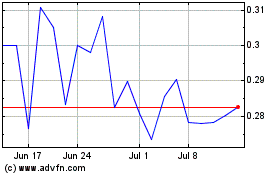

| Background and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split |

21 |

| Procedure for Implementing the Reverse Stock Split |

22 |

| Effect of the Reverse Stock Split on Holders of Outstanding Common Stock |

22 |

| Beneficial Holders of Common Stock (i.e. stockholders who hold in street name) |

23 |

| Registered “Book-Entry” Holders of Common Stock (i.e. stockholders that are registered on the transfer agent’s books and records but do not hold stock certificates) |

23 |

| Holders of Certificated Shares of Common Stock |

23 |

| Fractional Shares |

23 |

| Effect of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards, Warrants and Convertible or Exchangeable Securities |

24 |

| Accounting Matters |

24 |

| Certain Federal Income Tax Consequences of the Reverse Stock Split |

24 |

| U.S. Holders |

25 |

| No Appraisal Rights |

25 |

| Required Vote and Board Recommendation |

25 |

| PROPOSAL NO. 6: APPROVAL OF THE 2024 STOCK INCENTIVE PLAN |

26 |

| Overview |

26 |

| Summary of the 2024 Stock Incentive Plan |

26 |

| Types of Awards |

28 |

| New Plan Benefits under the 2024 Stock Incentive Plan |

30 |

| U.S. Federal Income Tax Considerations |

30 |

| Required Vote and Board Recommendation |

32 |

| INFORMATION ABOUT THE EXECUTIVE OFFICERS |

33 |

| Executive Officers |

33 |

| Involvement In Certain Legal Proceedings |

33 |

| EXECUTIVE COMPENSATION |

34 |

| Summary Compensation Table |

34 |

| Employment Agreement with Milton C. Ault, III |

35 |

| Employment Agreement with William B. Horne |

35 |

| Employment Agreement with Henry Nisser |

36 |

| CEO Pay Ratio |

36 |

| Pay Versus Performance |

37 |

| Policies on Ownership, Insider Trading, 10b5-1 Plans and Hedging |

38 |

| Advisory Vote on Executive Compensation |

38 |

| Outstanding Equity Awards at Fiscal Year-End |

38 |

| Director Compensation |

40 |

| Stock Incentive Plans |

40 |

| 401(k) Plan |

41 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

43 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

44 |

| PROPOSALS OF STOCKHOLDERS FOR THE 2025 MEETING |

49 |

| OTHER BUSINESS |

50 |

| ANNEX A – ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023 |

A-1 |

| ANNEX B – 2024 STOCK INCENTIVE PLAN |

B-1 |

| ANNEX C – PROXY CARDS |

C-1 |

AULT ALLIANCE, INC.

11411 Southern Highlands Pkwy, Suite 240,

Las Vegas, NV

Telephone: (949) 444-5464

DEFINITIVE PROXY STATEMENT

FOR THE MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 28, 2024

INFORMATION CONCERNING THE ANNUAL MEETING

General

The enclosed proxy is solicited

by the Board of Directors (the “Board”) of Ault Alliance, Inc. (the “Company”), for use at the Annual

Meeting of the Company’s stockholders (the “Meeting”) to be held in virtual format on June 28, 2024 at 12:00

P.M. Eastern Time and at any adjournments thereof. Whether or not you expect to attend the Meeting, please vote your shares as promptly

as possible to ensure that your vote is counted. The proxy materials will be furnished to stockholders on or about May 13, 2024.

The Meeting will be held in

a virtual meeting format only. You will not be able to attend the Meeting in person. To access the virtual meeting please click the Virtual

Stockholder Meeting link: meetnow.global/M2WDDH5. To login to the virtual meeting you have two option: Join as a “Guest”

or Join as a “Stockholder.” If you join as a “Stockholder” you will be required to have a control number.

Action to be taken under Proxy

Unless otherwise directed

by the giver of the proxy, the persons named in the form of proxy, namely, Milton C. “Todd” Ault, III, the Company’s

Executive Chairman and William B. Horne, its Chief Executive Officer, or either one of them who acts, will vote:

| · | To elect the six (6) director nominees named in the Proxy Statement to hold office until the next annual

meeting of stockholders (the “Director Proposal”); |

| · | To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024 (the “Auditor Proposal”); |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the exercise of the warrants to purchase

the Company’s Class A Common Stock (the “Common Stock”), which were issued pursuant to the Note Purchase Agreement

dated October 13, 2023 (the “Warrant Exercise Proposal”); |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the conversion of an aggregate of 75,000

shares of Series C convertible preferred stock (the “Series C Preferred Stock”) into Common Stock and warrants to purchase

Common Stock (the “Series C Warrants” and with the Series C Preferred Stock, the “SPA Securities”),

an increase of $25,000,000 beyond the original $50,000,000 for a total purchase price of up to $75,000,000, pursuant to an Amendment dated

March 25, 2024 to the Securities Purchase Agreement dated November 6, 2023 (the “Series C Proposal”); |

| · | To approve an amendment to our Certificate of Incorporation (the “Certificate of Incorporation”)

to effect a reverse stock split of our Common Stock by a ratio of not less than one for two and not more than one for thirty-five at any

time prior to June 27, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors

in its sole discretion (the “Reverse Stock Split Proposal”); |

| · | To approve the Ault Alliance, Inc. 2024 Stock Incentive Plan (the “2024 Plan”) described

below (the “SIP Proposal”); and |

| · | To approve the adjournment of the Meeting to a later date or time, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Meeting, there are not sufficient votes to approve any of the

other proposals before the Meeting (the “Adjournment Proposal”). |

By submitting your proxy (via

the Internet, telephone or mail), you authorize Milton C. “Todd” Ault, III, the Company’s Executive Chairman and William

B. Horne, the Company’s Chief Executive Officer, to represent you and vote your shares at the Meeting in accordance with your instructions.

They also may vote your shares to adjourn the Meeting and will be authorized to vote your shares at any postponements or adjournments

of the Meeting.

YOUR VOTE IS IMPORTANT.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY VOTE YOUR SHARES OVER THE INTERNET, BY TELEPHONE OR BY MAIL.

Who is Entitled to Vote; Vote Required; Quorum

As of the record date of May

6, 2024 (the “Record Date”), there were (i) 30,065,339 shares of Common Stock issued and outstanding, and (ii) 44,000

shares of the Company’s Series C Convertible Preferred Stock (the “Preferred Stock” and with the Common Stock,

the “Capital Stock”), which as of the Record Date were convertible into 138,665,658 shares of Common Stock, which together

constitute all of the outstanding voting capital stock of the Company. Stockholders are entitled to one vote for each share of Common

Stock held by them.

However, Ault & Company,

Inc. (“A&C”), the owner of the Preferred Stock, will not be permitted to vote more than 19.99% of the aggregate

number of Preferred Stock originally issuable under the Securities Purchase Agreement dated November 6, 2023, or 452,214 shares of Common

Stock, until such time as Proposal No. 4 has been approved by the Company’s stockholders. Further, A&C will not be permitted

to vote on Proposal Nos. 3 or 4.

Thirty-five percent (35%)

of the 30,517,553 outstanding shares of Capital Stock, or 10,681,144 such shares, will constitute a quorum at the Meeting, provided that

no more than 452,214 shares of Preferred Stock that may be voted will be counted as part of the Capital Stock (the “Eligible

Capital Stock”), as only a portion of the Preferred Stock will be eligible to vote on the matters to be presented to the stockholders.

Brokers holding shares of

record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions

from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received such instructions

from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner

does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter.

In connection with the treatment of abstentions and broker non-votes, all but four of the proposals at this Meeting are considered “non-routine”

matters, and brokers are not entitled to vote uninstructed shares with respect to these proposals. Only the Auditor Proposal, the Reverse

Stock Split Proposal and the Adjournment Proposal are routine matters that brokers are entitled to vote upon without receiving instructions.

Determination of whether a

matter specified in the Notice of Annual Meeting of Stockholders has been approved will be determined as follows:

| · | Those persons will be elected directors who receive a plurality of the votes cast at the Meeting in person

or by proxy and entitled to vote on the election. Accordingly, abstentions or directions to withhold authority will have no effect on

the outcome of the vote; and |

| · | For each other matter specified in the Notice of Meeting of Stockholders, the affirmative vote of a majority

of the shares of Eligible Capital Stock present at the meeting in person or by proxy and entitled to vote on such matter is required for

approval. Abstentions will be considered shares present by proxy and entitled to vote and, therefore, will have the effect of a vote against

the proposal. Broker non-votes will be considered shares not present for this purpose and will have no effect on the outcome of the vote.

Notwithstanding the foregoing, for purposes of Proposal Nos. 3 and 4, only the shares of Common Stock issued and outstanding as of the

Record Date will be eligible to vote on such proposals. |

Directions to withhold authority

to vote for directors, abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present for the

Meeting.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

AND VOTING

What is the purpose of the Meeting?

At the Meeting, the stockholders will be asked:

| · | To elect the six (6) director nominees named in the Proxy Statement to hold office until the next annual

meeting of stockholders (the “Director Proposal”); |

| · | To ratify the appointment of Marcum LLP, as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024 (the “Auditor Proposal”); |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the exercise of the warrants to purchase

such shares of Common Stock (the “Warrant Exercise Proposal”), each as issued pursuant to the Note Purchase Agreement

dated October 13, 2023; |

| · | To approve, pursuant to Rule 713(a) and (b) of the NYSE American, the conversion of an aggregate of 75,000

shares of Series C convertible preferred stock (the “Series C Preferred Stock”) into Common Stock and warrants to purchase

Common Stock (the “Series C Warrants” and with the Series C Preferred Stock, the “SPA Securities”),

an increase of $25,000,000 beyond the original $50,000,000 for a total purchase price of up to $75,000,000, pursuant to an Amendment dated

March 25, 2024 to the Securities Purchase Agreement dated November 6, 2023 (the “Series C Proposal”); |

| · | To approve an amendment to our Certificate of Incorporation (the “Certificate of Incorporation”)

to effect a reverse stock split of our Common Stock by a ratio of not less than one for two and not more than one for thirty-five at any

time prior to June 27, 2025, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors

in its sole discretion (the “Reverse Stock Split Proposal”); and |

| · | To approve the adjournment of the Meeting to a later date or time, if necessary, to permit further solicitation

and vote of proxies if, based upon the tabulated vote at the time of the Meeting, there are not sufficient votes to approve any of the

other proposals before the Meeting (the “Adjournment Proposal”). |

Who is entitled to vote?

The Record Date for the Meeting is May 6, 2024.

Only stockholders of record at the close of business on that date are entitled to vote at the Meeting. Stockholders are entitled to one

vote for each share of Common Stock held by them.

Thirty-five percent (35%) of the 30,519,553 outstanding

shares of Eligible Capital Stock, or 10,681,144 such shares of Eligible Capital Stock, will constitute a quorum at the Meeting.

Why am I receiving these materials?

We have sent you these proxy materials because

the Board of the Company is soliciting your proxy to vote at the Meeting. According to our records, you were a stockholder of the Company

as of the end of business on the Record Date for the Meeting.

You are invited to vote on the proposals described

in this proxy statement.

The Company intends to mail these proxy materials

on or about May 13, 2024, to all stockholders of record on the Record Date.

What is included in these materials?

These materials include:

| · | the Notice of Annual Meeting of Stockholders; |

| · | this Proxy Statement for the Meeting; |

| · | our Annual Report on Form 10-K for the year ended December 31, 2023; and |

What is the proxy card?

The proxy card enables you to appoint Milton C.

“Todd” Ault, III, the Company’s Executive Chairman, and William B. Horne, the Company’s Chief Executive Officer,

as your representatives at the Meeting. By completing and returning a proxy card, you are authorizing these individuals to vote your shares

at the Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you log in to

the Meeting.

Can I view these proxy materials over the Internet?

Yes. The Notice of Meeting, this Proxy Statement

and accompanying proxy card are available at www.envisionreports.com/AULT.

How can I attend the Meeting?

The Meeting will be a completely virtual meeting

of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Meeting only if you were a stockholder

of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Meeting. No physical meeting will

be held.

You will be able to attend the Meeting online

by visiting meetnow.global/M2WDDH5. To log in to the virtual meeting you have two options: Join as a “Guest” or Join

as a “Stockholder.” If you join as a “Stockholder” you will be required to have a control number. You also will

be able to vote your shares online by attending the Meeting by webcast.

To participate in the Meeting, you will need to

review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary,

such as a bank or broker, you must register in advance using the instructions below. The online meeting will begin promptly at 12:00 P.M.

Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration

instructions as outlined in this proxy statement.

How do I register to attend the Meeting virtually

on the Internet?

If you are a registered stockholder (i.e., you

hold your shares through our transfer agent, Computershare), you do not need to register to attend the Meeting virtually on the Internet.

Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary,

such as a bank or broker, you must register in advance to attend the Meeting virtually on the Internet.

To register to attend the Meeting online by webcast

you must submit proof of your proxy power (legal proxy) reflecting your ownership of Common Stock along with your name and email address

to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 P.M., Eastern

Time, on June 27, 2024.

You will receive a confirmation of your registration

by email after we receive your registration materials.

Requests for registration should be directed to

us at the following:

By email:

Forward the email from your broker, or attach

an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Why are you holding a virtual meeting instead

of a physical meeting?

We are embracing the latest technology in order

to provide expanded access, improved communication and cost savings for our stockholders and the Company. We believe that hosting a virtual

meeting will enable more of our stockholders to attend and participate in the meeting since our stockholders can participate from any

location around the world with Internet access.

How do I vote?

Either (1) mail your completed and signed proxy

card(s) to Ault Alliance, Inc., 11411 Southern Highlands Pkwy, Suite 240, Las Vegas, NV 89141, Attention: Corporate Secretary, (2) call

the toll-free number printed on your proxy card(s) and follow the recorded instructions or (3) visit the website indicated on your proxy

card(s) and follow the on-line instructions. If you are a registered stockholder and attend the Meeting, then you may deliver your completed

proxy card(s) or vote pursuant to the instructions on the proxy card. If your shares are held by your broker or bank, in “street

name,” then you will receive a form from your broker or bank seeking instructions as to how your shares should be voted. If you

do not give instructions to your record holder, it will nevertheless be entitled to vote your shares in its discretion on the (i) Auditor

Proposal, (ii) the Reverse Stock Split Proposal, and (iii) the Adjournment Proposal, but not on any other proposal.

Am I entitled to vote if my shares are held in “street name”?

If your shares are held by a bank, brokerage firm

or other nominee, you are considered the “beneficial owner” of shares held in “street name.” If your shares are

held in street name, the proxy materials are being made available to you by your bank, brokerage firm or other nominee (the “record

holder”), along with voting instructions. As the beneficial owner, you have the right to direct your record holder how to vote your

shares, and the record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to

your record holder, it will not be entitled to vote your shares on any proposal.

As the beneficial owner of shares, you are invited

to attend the Meeting. If you are a beneficial owner, however, you may not vote your shares at the Meeting unless you obtain a legal proxy,

executed in your favor, from the record holder of your shares.

How many shares must be present to hold the Meeting?

A quorum must be present at the meeting for any

business to be conducted. The presence at the meeting, (i) by logging in to meetnow.global/M2WDDH5; there is no password required,

or (ii) by proxy, of the holders of thirty-five percent (35%) of the shares of Eligible Capital Stock outstanding on the Record Date will

constitute a quorum. Proxies received but marked as abstentions will be counted towards the quorum.

What if a quorum is not present at the Meeting?

If a quorum is not present or represented at the

Meeting, the holders of a majority of Eligible Capital Stock entitled to vote at the Meeting who are present in person or represented

by proxy, or the chairman of the Meeting, may adjourn the Meeting until a quorum is present or represented. The time and place of the

adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given.

Is there a deadline for submitting proxies

electronically or by telephone or mail?

Proxies submitted electronically or by telephone

as described above must be received by 11:59 A.M. Eastern Time on June 28, 2024. Proxies submitted by mail should be received before 12:00

P.M. Eastern Time on June 27, 2024.

Can I revoke my proxy and change my vote?

You may change your vote at any time prior to

the taking of the vote at the Meeting. If you are the stockholder of record, you may change your vote by (1) granting a new proxy bearing

a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline

for each method), (2) providing a written notice of revocation to the Company’s Executive Chairman at Ault Alliance, Inc., 11411

Southern Highlands Pkwy, Suite 240, Las Vegas, NV 89141, prior to your shares being voted, or (3) virtually attending the Meeting and

voting in accordance with the instructions on the proxy card. Attendance at the Meeting will not cause your previously granted proxy to

be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting

new voting instructions to your broker, bank, trustee or nominee following the instructions they provided, or, if you have obtained a

legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the Meeting and voting.

Who can participate in the Meeting?

Only stockholders eligible to vote or their authorized

representatives in possession of a valid control number will be admitted as participants to the Meeting.

Will my vote be kept confidential?

Yes, your vote will be kept confidential and not

disclosed to the Company unless:

| • | you expressly request disclosure on your proxy; or |

| • | there is a proxy contest. |

How does the Board of Directors recommend I vote on the proposals?

Our Board unanimously recommends that you vote

your shares “FOR” each of the proposals presented in this Proxy Statement, consisting of:

| (i) | The Director Proposal; |

| (ii) | The Auditor Proposal; |

| (iii) | The Warrant Exercise Proposal; |

| (iv) | The Series C Proposal; |

| (v) | The Reverse Stock Split Proposal; and |

| (vi) | The Adjournment Proposal. |

Unless you provide other instructions on your

proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board as set

forth in this Proxy Statement.

What if I do not specify how my shares are to be voted?

If you are a stockholder of record and do not

vote by completing your proxy card, by telephone, through the Internet or online at the Meeting, your shares will not be voted.

If you return a signed and dated proxy card or

otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the election of each nominee

for director and “FOR” the Auditor Proposal, the Warrant Exercise Proposal, the Series C Proposal and the Reverse Stock

Split Proposal. If any other matter is properly presented at the Meeting, your proxyholder (one of the individuals named on your proxy

card) will vote your shares using his or her best judgment.

Will any other business be conducted at the Meeting?

The Company’s bylaws require stockholders

to give advance notice of any proposal intended to be presented at the Meeting. We have not received any such notices. Accordingly, the

Company does not anticipate any additional business will be conducted at the Meeting.

How many votes are needed to approve each proposal?

For the election of directors, each of the six

(6) nominees receiving the most “FOR” votes at the Meeting in person or by proxy will be elected. Approval of all other

matters requires the favorable vote of a majority of the votes cast on the applicable matter at the Meeting.

How will abstentions be treated?

Abstentions will be considered shares present

by proxy and entitled to vote and, therefore, will have the effect of a vote against any proposal other than Proposal No. 1.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner

of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on

matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled

to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions,

the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with

respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, “non-routine”

matters include director elections (whether contested or uncontested) and matters involving a contest or a matter that may substantially

affect the rights or privileges of stockholders.

In connection with the treatment of abstentions

and broker non-votes, the proposals at this meeting to approve the (i) Director Proposal, (ii) Warrant Exercise Proposal, (iii) Series

C Proposal and (iv) SIP Proposal, are considered “non-routine” matters, and brokers are not entitled to vote uninstructed

shares with respect to these proposals. The proposals to approve the (i) Auditor Proposal, (ii) Reverse Stock Split Proposal, and (iii)

Adjournment Proposal are routine matters that brokers are entitled to vote upon without receiving instructions.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting

proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone or

by other means of communication. The Board has engaged Georgeson to assist in the solicitation of proxies for a fee of approximately $13,500,

plus an additional per holder fee for any solicitation of individual holders and reimbursement of out-of-pocket expenses. Directors and

employees will not be paid any additional compensation for soliciting proxies but may be reimbursed for out-of-pocket expenses incurred

in connection with the solicitation. We will also reimburse brokerage firms, banks and other agents for their reasonable out-of-pocket

expenses incurred in forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials,

your shares may be registered in more than one name or in different accounts. Please complete, sign and return each proxy card to ensure

that all of your shares are voted.

I share the same address with another stockholder

of the Company. Why has our household only received one set of proxy materials?

The rules of the Securities and Exchange Commission’s

(“SEC”) permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders.

This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered

only one set of proxy materials to stockholders who hold their shares through a bank, broker or other holder of record and share a single

address, unless we received contrary instructions from any stockholder at that address.

How can I find out the results of the voting

at the Meeting?

Final voting results will be disclosed in a Form

8-K filed after the Meeting.

Who can help answer my questions?

You can contact our corporate headquarters, at

Ault Alliance, Inc., 11411 Southern Highlands Pkwy, Suite 240, Las Vegas, NV 89141, by sending a letter to Milton C. “Todd”

Ault, III, our Executive Chairman, with any questions about the proposals described in this Proxy Statement or how to execute your vote.

In addition, you can also contact:

Georgeson

Telephone (toll-free in North America): (866) 548-4144

Telephone (outside of North America): (781) 896-3650

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Information about the Nominees

At the Meeting, the stockholders will elect six

(6) directors to serve until the next annual meeting of stockholders or until their respective successors are elected and qualified. In

the event any nominee is unable or unwilling to serve as a director at the time of the Meeting, the proxies may be voted for the balance

of those nominees named and for any substitute nominee designated by the present Board or the proxy holders to fill such vacancy, or for

the balance of the nominees named without nomination of a substitute, or the size of the Board may be reduced in accordance with the Bylaws

of the Company. The Board has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee

or as a director if elected.

Assuming a quorum is present, the six (6) nominees

receiving the highest number of affirmative votes of shares entitled to be voted for them will be elected as directors of the Company

for the ensuing year. Unless marked otherwise, proxies received will be voted “FOR” the election of each of the seven nominees

named below. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies

received by them in such a manner as will ensure the election of as many of the nominees listed below as possible, and, in such event,

the specific nominees to be voted for will be determined by the proxy holders. All of the director nominees currently serve as directors.

| Name |

Age |

Current Position |

Served As a Director and Officer Since |

| Milton C. Ault, III |

53 |

Executive Chairman |

2017 |

| William B. Horne |

55 |

Chief Executive Officer and Vice Chairman |

2016 |

| Henry Nisser |

55 |

President, General Counsel and Director |

2019 |

| Robert O. Smith (1) (5) (6) |

79 |

Lead Independent Director |

2016 |

| Jeffrey A. Bentz (2) (4) (6) |

64 |

Independent Director |

2018 |

| Mordechai Rosenberg (3) (4) (5) |

76 |

Independent Director |

2015 |

| (1) | Chair of the Audit Committee |

| (2) | Chair of the Compensation Committee |

| (3) | Chair of the Nominating and Corporate Governance Committee |

| (4) | Member of the Audit Committee |

| (5) | Member of the Compensation Committee |

| (6) | Member of the Nominating and Corporate Governance Committee |

The following information with respect to the

principal occupation or employment of each nominee for director, the principal business of the corporation or other organization in which

such occupation or employment is carried on, and such nominee’s business experience during the past five years, as well as the specific

experiences, qualifications, attributes and skills that have led the Board to determine that such Board members should serve on our Board,

has been furnished to the Company by the respective director nominees:

Milton C. Ault, III

On January 19, 2021, Mr. Ault resigned as Chief

Executive Officer and was appointed as the Executive Chairman of the Board. On December 28, 2017, Mr. Ault was appointed Chief Executive

Officer. On March 16, 2017, Mr. Ault was appointed Executive Chairman of the Board. Mr. Ault entered into an employment agreement with

us on June 17, 2018. Mr. Ault has served as the Chairman of the Board of Ault Disruptive Technologies Corporation (“ADTC”),

an NYSE listed Special Purpose Acquisition Company, or SPAC, since its incorporation in February 2021. On February 25, 2016, Mr. Ault

founded Alzamend Neuro, Inc. (“Alzamend”), a biotechnology firm dedicated to finding the treatment, prevention and

cure for Alzheimer’s Disease and has served as its Chairman until its IPO, when he became Alzamend’s Chairman Emeritus and

a consultant. Since January 2024, Mr. Ault has served as the Chairman of the Board and Chief Executive

Officer of RiskOn International, Inc., a publicly traded company (“ROI”).

Mr. Ault was appointed as the Executive Chairman of the board of directors of the Singing Machine Company, Inc., an issuer listed on the

Nasdaq Stock Market (“MICS”) in April of 2023. Mr. Ault has served as Chairman and Chief Executive Officer of Ault

& Company, Inc. (“Ault & Company”), a Delaware holding company, since December 2015, and as Chairman of Avalanche

International Corp. (“Avalanche”), a publicly traded Nevada company and a “voluntary filer,” which as such

is not required to file periodic reports, since September 2014. Since January 2011, Mr. Ault has been the Vice President of Business Development

for MCKEA Holdings, LLC, a family office. Mr. Ault is a seasoned business professional and entrepreneur who has spent more than twenty-seven

years identifying value in various financial markets including equities, fixed income, commodities, and real estate. Throughout his career,

Mr. Ault has consulted for a few publicly traded and privately held companies, providing each of them the benefit of his diversified experience,

that range from development stage to seasoned businesses. We believe that Mr. Ault’s business background demonstrates he has the

qualifications to serve as one of our directors and as Executive Chairman.

William B. Horne

Mr. Horne has served as a member of our Board

since October 2016. On January 19, 2021, Mr. Horne resigned as President and was appointed as the Chief Executive Officer. On August 19,

2020, Mr. Horne resigned as our Chief Financial Officer and was appointed as our President. He was appointed as our Chief Financial Officer

on January 25, 2018. Prior to his appointment as our Chief Financial Officer, Mr. Horne served as one of our independent directors. Mr.

Horne has served as the Chief Executive Officer and on the board of directors of ADTC since its incorporation in February 2021. Mr. Horne

has served on the board of directors of Giga-Tronics Incorporated (“GIGA”) since September of 2022. Mr. Horne has served

on the board of directors of Alzamend since June 1, 2016 and became its Chairman of the board upon consummation of its IPO. Mr.

Horne has served as a director and Chief Financial Officer of Avalanche since June 2016. Mr. Horne has served as a director and Chief

Financial Officer of Ault & Company since October 2017. Mr. Horne previously held the position of Chief Financial Officer

in various public and private companies in the healthcare and high-tech field. Mr. Horne has a Bachelor of Arts Magna Cum Laude in Accounting

from Seattle University. We believe that Mr. Horne's extensive financial and accounting experience in diversified industries and with

companies involving complex transactions give him the qualifications and skills to serve as one of our directors.

Henry C. W. Nisser

Mr. Nisser has served as a member of our Board

since September 17, 2020 and was appointed as our Executive Vice President and General counsel on May 1, 2019. On January 19, 2021, Mr.

Nisser resigned as Executive Vice President and was appointed as our President. Mr. Nisser has served as a member of the board of directors

and as the President and General Counsel of ROI since March of 2023. Mr. Nisser is the Executive Vice President and General Counsel of

Avalanche. Mr. Nisser has served as the President, General Counsel and on the board of directors of ADTC since its incorporation in February

2021. Mr. Nisser has served on the board of directors of Alzamend since September 1, 2020 and has served as its Executive Vice President

and General Counsel since May 1, 2019. Mr. Nisser has served on the board of directors of MICS since April of 2023. From October 31, 2011

through April 26, 2019, Mr. Nisser was an associate and subsequently a partner with Sichenzia Ross Ference LLP (“SRF”), a

law firm based in New York City. While with SRF, his practice was concentrated in national and international corporate law, with a particular

focus on U.S. securities compliance, public as well as private M&A, equity and debt financings and corporate governance. Mr. Nisser

drafted and negotiated a variety of agreements related to reorganizations, share and asset purchases, indentures, public and private offerings,

tender offers and going private transactions. Mr. Nisser also represented clients’ special committees established to evaluate M&A

transactions and advised such committees’ members with respect to their fiduciary duties. Mr. Nisser received his B.A. from Connecticut

College in 1992, where he majored in International Relations and Economics. He received his LLB from the University of Buckingham School

of Law in 1999. We believe that Mr. Nisser’s extensive legal experience involving complex transactions and comprehensive knowledge

of securities laws and corporate governance requirements applicable to listed companies give him the qualifications and skills to serve

as one of our directors.

Robert O. Smith

Mr. Smith serves as our lead independent director.

Previously, he served as a member of our Board from November 2010 until May 2015, and served as a member of our Advisory Board from 2002

until 2015. He is currently a C-level executive consultant working with Bay Area high-tech firms on various strategic initiatives in all

aspects of their business. Mr. Smith has served on the board of directors of ADTC, an NYSE listed SPAC, since its IPO in December 2021.

Mr. Smith has served on the board of directors of GIGA since September of 2022. Mr. Smith has served on the board of directors of ROI

since October of 2023, where he acts as ROI’s lead independent director as well as the chairman of its audit committee. From 2004

to 2007, he served on the board of directors of Castelle Corporation. From 1990 to 2002, he was our President, Chief Executive Officer

and Chairman of our Board. From 1980 to 1990, he held several management positions with Computer Products, Inc., the most recent being

President of their Compower/Boschert Division. From 1970 to 1980, he held managerial accounting positions with Ametek/Lamb Electric and

with the JM Smucker Company. Mr. Smith received his BBA degree in Accounting from Ohio University. We believe that Mr. Smith’s executive-level

experience, including his previous service as our President, Chief Executive Officer and Chairman of our Board, his extensive experience

in the accounting industry, and his service on our Board from November 2010 until May 2015, give him the qualifications and skills to

serve as one of our directors.

Jeffrey A. Bentz

Mr. Bentz serves as one of our independent directors.

Mr. Bentz is an experienced businessman who served from 1994 to 2022 as President of North Star Terminal & Stevedore Company, a full-service

stevedoring company located in Alaska and whose major areas of business include terminal operations and management, stevedore services,

and heavy equipment operations. Mr. Bentz has served on the board of directors of ADTC, an NYSE listed SPAC, since its IPO in December

2021. Mr. Bentz has served on the board of directors of GIGA since September of 2022. He also has served as a director and advisor to

several private companies and agencies. Mr. Bentz obtained a B.A. in Business and Finance from Western Washington University in 1981.

We believe that Mr. Bentz’s executive-level experience, including his operational and financial oversight of companies with multiple

profit centers and his extensive experience in the real estate and commercial services industries give him the qualifications and skills

to serve as one of our directors.

Mordechai Rosenberg

Mr. Rosenberg serves as one of our independent

directors. He has served as an independent consultant to various companies in the design and implementation of homeland security systems

in Europe and Africa since 2010. From 2004 to 2009, he served as a special consultant to Bullet Plate Ltd., a manufacturer of armor protection

systems, and NovIdea Ltd., a manufacturer of perimeter and border security systems. From 2000 to 2003, Mr. Rosenberg was the general manager

of ZIV U.P.V.C Products Ltd.’s doors and window factory. Mr. Rosenberg is an active reserve officer and a retired colonel from the

Israeli Defense Force (IDF), where he served for 26 years and was involved in the development of weapon systems. In the IDF, Mr. Rosenberg

served in various capacities, including, company, battalion and brigade commander, head of the training center for all IDF infantry, and

head of the Air Force’s Special Forces. Mr. Rosenberg received a B.A in History from the University of Tel Aviv and a Master of

Arts in Political Science from the University of Haifa in Israel. Mr. Rosenberg graduated from the course of Directors & Officers

at the College of Management, Tel Aviv. We believe that Mr. Rosenberg’s business background gives him the qualifications to serve

as one of our directors.

Directors serve until the next annual meeting

of stockholders or until their successors are elected and qualified. Officers serve at the discretion of the Board.

Status of Certain Issuers with which Messrs. Ault, Horne and Nisser

Are Involved.

Avalanche International Corp.

As of the Record Date, Avalanche had not filed

its (i) Annual Reports on Form 10-K for its fiscal years ended November 30, 2016, November 30, 2017, November 30, 2018, November 30, 2019,

November 30, 2020, November 30, 2021, November 30, 2022 or November 30, 2023 (ii) its Quarterly Reports for its fiscal quarters ended

February 28, 2017, May 31, 2017, August 31, 2017, February 28, 2018, May 31, 2018, August 31, 2018, February 28, 2019, May 31, 2019, August

31, 2019, February 29, 2020, May 31, 2020, August 31, 2020, February 28, 2021, May 31, 2021, August 31, 2021, February 28, 2022, May 31,

2022, August 31, 2022 February 28, 2023, May 31, 2023, August 31, 2023 or February 29, 2024. While Avalanche is a “voluntary filer,”

it has not filed a Form 15, nor does it intend to.

Avalanche’s results of operations are consolidated

with the Company’s. As of the Record Date, Avalanche had 11 employees and one principal consultant, total assets of approximately

$200,000, total liabilities of approximately $39.0 million, total stockholders’ deficit of approximately $31.0 million, total annual

operating expenses of approximately $3.0 million and a net loss of approximately $28.0 million. None of the foregoing figures has been

audited.

Involvement in Certain Legal Proceedings

To our knowledge, and except as disclosed below,

none of our current directors has, during the past ten years:

| ● | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic

violations and other minor offenses); |

| ● | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership,

corporation or business association of which he or she was a general partner or executive officer, either at the time of the bankruptcy

filing or within two years prior to that time; |

| ● | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any

court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise

limiting, his or her involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or

insurance activities, or to be associated with persons engaged in any such activity; |

| ● | been found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures

Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended,

or vacated; * |

| ● | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree,

or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants),

relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting

financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement

or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation

prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| ● | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated,

of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section

1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority

over its members or persons associated with a member. |

* Please see the press release issued by the Company

on August 15, 2023.

Except as set forth in our discussion below in

“Certain Relationships and Related Transactions,” none of our directors or executive officers has been involved in any transactions

with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules

and regulations of the SEC.

Family Relationships

None.

Board Independence

Our Board has undertaken a review of the independence

of each director and director nominee and has determined that Messrs. Smith, Bentz, and Rosenberg are independent, and that each director

who serves on or is nominated for each of its committees is independent, as such term is defined by standards of the SEC and the NYSE

American. None of Messrs. Ault, Horne or Nisser meets the independence standards.

Stockholder Communications with the Board

The Company’s stockholders may communicate

with the Board, including non-executive directors or officers, by sending written communications addressed to such person or persons in

care of Ault Alliance, Inc., Attention: Secretary, 11411 Southern Highlands Pkwy, Suite 240, Las Vegas, NV 89141. All communications will

be compiled by the Secretary and submitted to the addressee. If the Board modifies this process, the revised process will be posted on

the Company’s website.

Meetings and Committees of the Board

During the fiscal year ended December 31, 2023,

the Board held 10 meetings and acted by unanimous written consent 25 times, the Audit Committee held 5 meetings, the Nominating and Corporate

Governance Committee and the Compensation Committee held zero meetings. The Audit Committee, the Compensation Committee and the Nominating

and Corporate Governance Committee approved no actions by unanimous written consent. We encourage, but do not require, our Board members

to attend the annual meeting of stockholders.

Board Committees

The Board has standing Audit, Nominating and Corporate

Governance and Compensation Committees. Information concerning the membership and function of each committee is as follows:

| Name |

|

Audit Committee |

|

Nominating and Corporate Governance Committee |

Compensation Committee |

| Robert O. Smith |

|

** *** |

|

* |

* |

| Jeffrey A. Bentz |

|

* |

|

* |

** |

| Moti Rosenberg |

|

* |

|

** |

* |

* Member of Committee

** Chairman of Committee

*** “Audit committee financial expert” as defined in SEC

regulations.

Audit Committee

Messrs. Smith, Bentz and Rosenberg currently comprise

the Audit Committee of our Board. Our Board has determined that each of the current members of the Audit Committee satisfies the requirements

for independence and financial literacy under the standards of the SEC and the NYSE American. Our Board has also determined that each

of Mr. Smith qualifies as an “audit committee financial expert” as defined in SEC regulations and satisfies the financial

sophistication requirements set forth in the NYSE American rules. Mr. Smith serves as Chairman of the Audit Committee.

The Audit Committee is responsible for, among

other things, selecting and hiring our independent auditors, approving the audit and pre-approving any non-audit services to be performed

by our independent auditors; reviewing the scope of the annual audit undertaken by our independent auditors and the progress and results

of their work; reviewing our financial statements, internal accounting and auditing procedures, and corporate programs to ensure compliance

with applicable laws; and reviewing the services performed by our independent auditors to determine if the services rendered are compatible

with maintaining the independent auditors’ impartial opinion. The Audit Committee reviewed and discussed with management the Company’s

audited financial statements for the year ended December 31, 2023.

Compensation Committee

Messrs. Bents, Smith and Rosenberg currently comprise

the Compensation Committee of our Board. Our Board has determined that each of the current members of the Compensation Committee meets

the requirements for independence under the standards of the NYSE American. Mr. Bentz serves as Chairman of the Compensation Committee.

The Compensation Committee is responsible for,

among other things, reviewing and approving executive compensation policies and practices; reviewing and approving salaries, bonuses and

other benefits paid to our officers, including our Executive Chairman, Chief Executive Officer and President; and administering our stock

option plans and other benefit plans.

Nominating and Governance Committee

Messrs. Rosenberg, Smith and Bentz currently comprise

the Nominating and Governance Committee of our Board. Our Board has determined that each of the current members of the Nominating and

Governance Committee meets the requirements for independence under the standards of the NYSE American. Mr. Rosenberg serves as Chairman

of the Nominating and Governance Committee.

The Nominating and Governance Committee is responsible

for, among other things, assisting our Board in identifying prospective director nominees and recommending nominees for each annual meeting

of stockholders to the Board; developing and recommending governance principles applicable to our Board; overseeing the evaluation of

our Board and management; and recommending potential members for each Board committee to our Board.

The Nominating and Governance Committee considers

diversity when identifying Board candidates. In particular, it considers such criteria as a candidate’s broad-based business and

professional skills, experiences and global business and social perspective.

In addition, the Committee seeks directors who

exhibit personal integrity and a concern for the long-term interests of stockholders, as well as those who have time available to devote

to Board activities and to enhancing their knowledge of the various industries in which we operate. Accordingly, we seek to attract and

retain highly qualified directors who have sufficient time to attend to their substantial duties and responsibilities.

Board Leadership Structure and Role

in Risk Oversight

Our Board as a whole is responsible for our risk

oversight. Our executive officers address and discuss with our Board our risks and the manner in which we manage or mitigate such risks.

While our Board has the ultimate responsibility for our risk oversight, our Board works in conjunction with its committees on certain

aspects of its risk oversight responsibilities. In particular, our Audit Committee focuses on financial reporting risks and related controls

and procedures; our Compensation Committee evaluates the risks associated with our compensation philosophy and programs and strives to

create compensation practices that do not encourage excessive levels of risk taking that would be inconsistent with our strategies and

objectives; and our Nomination and Governance Committee oversees risks associated with our Code of Ethical Conduct and other policies

encompassed within corporate governance.

Code of Ethics

The Board has adopted an Amended and Restated

Code of Business Conduct and Ethics for Employees, Executive Officers and Directors (the “Code”) which qualifies as

a “code of ethics” as defined by Item 406 of Regulation S-K of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). The Code applies to our principal executive officer, principal financial officer, principal accounting officer, controller

or person performing similar functions as well as all our employees. The Code is designed to deter wrongdoing and to promote honest and

ethical conduct and compliance with applicable laws and regulations. The full text of our Code is published on our website at www.ault.com.

We will disclose any substantive amendments to the Code or any waivers, explicit or implicit, from a provision of the Code on our website

or in a current report on Form 8-K. Upon request to our Executive Chairman, Milton C. Ault, III, we will provide without charge, a copy

of our Code.

Among other matters, the Code is designed to deter

wrongdoing and to promote:

| · | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest

between personal and professional relationships; |

| · | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| · | compliance with applicable governmental laws, rules and regulations; |

| · | prompt internal reporting of violations of the Code to appropriate persons identified in the code; and |

| · | accountability for adherence to the Code. |

Waivers to the Code may be granted only by the

Board upon recommendation of the Audit Committee. In the event that the Board grants any waivers of the elements listed above to any of

our officers, we expect to promptly disclose the waiver as required by law or the private regulatory body.

Director Compensation

The Company pays each independent director an

annual base amount of $45,000 annually, other than Messrs. Smith and Ash, who each received a base amount of $55,000 annually due to the

additional services provided by Mr. Smith as a lead independent director and Mr. Ash as Audit Committee Chairman. Additionally, our Board

makes recommendations for adjustments to an independent director’s compensation when the level of services provided is significantly

above what was anticipated. In addition, independent directors are eligible, at the Board’s discretion, to receive a bonus.

The table below sets forth, for each non-employee

director, the total amount of compensation related to his service during the year ended December 31, 2023:

| |

|

Fees earned or |

|

|

Stock |

|

|

Option |

|

|

All other |

|

|

|

|

| Name |

|

paid in cash ($) |

|

|

awards ($) |

|

|

awards ($) |

|

|

compensation ($) |

|

|

Total ($) |

|

| Robert O. Smith |

|

|

55,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55,000 |

|

| Jeffrey A. Bentz |

|

|

45,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

45,000 |

|

| Mordechai Rosenberg |

|

|

45,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

45,000 |

|

| Howard Ash (1) |

|

|

55,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55,000 |

|

| (1) | Mr. Ash resigned from the Board effective April 16, 2024. |

Required Vote and Board Recommendation

The election of the directors of the Company requires

the affirmative vote of a plurality of the shares of the Company’s Eligible Capital Stock present in person or represented by proxy

at the Meeting, which will be the nominees receiving the largest number of votes, which may or may not constitute a majority.

The Board unanimously recommends that the stockholders

vote “for” each of the director nominees.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of

Marcum LLP, as the independent registered public accounting firm of the Company for the year ending December 31, 2024, subject to ratification

of the appointment by the Company’s stockholders. No representative of Marcum LLP is expected to attend the Meeting.

Review of the Company’s Audited Financial

Statements for the Fiscal Year Ended December 31, 2023

The Audit Committee met and held discussions with

management and the independent auditors. Management represented to the Audit Committee that the Company’s consolidated financial

statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee reviewed

and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with

the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 114 (Codification of Statements on

Auditing Standards, AU 380), as amended.

In addition, the Audit Committee discussed with

the independent auditors the auditors’ independence from the Company and its management, and the independent auditors provided to

the Audit Committee the written disclosures and letter required by the Independence Standards Board Standard No. 1 (Independence Discussions

with Audit Committees).

The Audit Committee discussed with the Company’s

independent auditors the overall scope and plans for their respective audits. The Audit Committee met with the independent auditors, with

and without management present, to discuss the results of their examinations and the overall quality of the Company’s internal controls

and financial reporting.

Based on the reviews and discussions referred

to above, the Audit Committee approved the audited financial statements be included in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023 for filing with the SEC.

Fees Paid to Auditor

Audit Fees

The aggregate fees billed for each of the last

two fiscal years for professional services rendered by the principal accountants Marcum, LLP, with respect to the years ended December

31, 2023 and December 31, 2022, for our audit of annual financial statements and review of financial statements included in our quarterly

reports or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for

those fiscal years were:

| 2023 |

|

$ |

2,241,000 |

|

| 2022 |

|

$ |

3,280,000 |

|

Audit-Related Fees

We did not incur fees to our independent registered

public accounting firm for audit related fees during the fiscal years ended December 31, 2023 or 2022.

Tax and Other Fees

We did not incur fees to our independent registered

public accounting firm for tax services during the fiscal years ended December 31, 2023 or 2022.

Pre-Approval Policies and Procedures

Consistent with SEC policies and guidelines regarding

audit independence, the Audit Committee is responsible for the pre-approval of all audit and permissible non-audit services provided by

our principal accountants on a case-by-case basis. Our Audit Committee has established a policy regarding approval of all audit and permissible

non-audit services provided by our principal accountants. Our Audit Committee pre-approves these services by category and service. Our

Audit Committee has pre-approved all of the services provided by our principal accountants.

Report of the Audit Committee of the Board of Directors

The Audit Committee

of the Board of Ault Alliance, Inc. has furnished the following report on its activities during the fiscal year ended December 31, 2023.

The report is not deemed to be “soliciting material” or “filed” with the SEC or subject to the SEC’s proxy

rules or to the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed to be incorporated by reference into

any prior or subsequent filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange

Act, except to the extent that Ault Alliance, Inc. specifically incorporates it by reference into any such filing.

The Audit Committee oversees

the financial reporting process on behalf of the Board. Management has the primary responsibility for the financial reporting process,

principles and internal controls as well as preparation of our financial statements. For the fiscal year ended December 31, 2023, the

members of the Audit Committee were Messrs. Ash, Smith and Bentz, each of whom was an independent director as defined by the applicable

NYSE American and SEC rules. Effective April 16, 2024, Mr. Ash resigned from the Board (including the Audit Committee) and Mr. Rosenberg

was appointed to the Audit Committee.

In fulfilling its responsibilities,

the Audit Committee appointed independent auditors Marcum LLP, for the fiscal year ended December 31, 2023. The Audit Committee reviewed

and discussed with the independent auditors the overall scope and specific plans for their audit. The Audit Committee also reviewed and

discussed with the independent auditors and with management the Company’s audited financial statements and the adequacy of its internal

controls. The Audit Committee met with the independent auditors, without management present, to discuss the results of our independent

auditor’s audits, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial

reporting.

The Audit Committee monitored

the independence and performance of the independent auditors. The Audit Committee discussed with the independent auditors the matters

required to be discussed by Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 16—Communications

with Audit Committees. The Company’s independent auditors have provided the Audit Committee with the written disclosures and the

letter required by applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee

concerning independence, and the Audit Committee has discussed with the independent auditor the independent auditor’s independence.

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements

be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023, for filing with the SEC.

Mr. Mr. Robert O.

Smith, Mr. Jeffrey Bentz and Mr. Mordechai Rosenberg

Required Vote and

Board Recommendation

The ratification of the appointment of the Company’s

independent auditors requires the receipt of the affirmative vote of a majority of the shares of the Company’s Eligible Capital

Stock present in person or by proxy and voting at the Meeting.

The Board unanimously recommends that the stockholders

vote “for” the ratification of Marcum LLP, as the Company’s independent registered public accounting firm for the year

ending December 31, 2024.

PROPOSAL NO. 3

APPROVAL, PURSUANT TO NYSE AMERICAN LISTING

RULE 713(a) & (b), OF THE EXERCISE OF THE WARRANTS ISSUED PURSUANT TO THE NOTE PURCHASE AGREEMENT WITH AULT & COMPANY

We are asking our stockholders to approve (i)

exercise of the warrants (the “Warrants”) issued to Ault & Company, Inc., a Delaware corporation (“A&C”)

(the “Warrants”) to purchase shares of Common Stock for a total purchase price of $17,519,832 (the “Note Transaction”)

pursuant to that certain Note Purchase Agreement (the “NPA”) by and between the Company and A&C dated October 13,

2023 (the “Closing Date”).

In the proxy statement for our annual meeting

of stockholders held on January 12, 2024, we originally requested approval for the conversion by the Company of a senior secured convertible

promissory note in the principal face amount of $17,519,832 (the “Note”) issued to A&C, though we subsequently

removed this proposal since we knew we would be unable to obtain quorum for the 2023 annual meeting. However, the Note was used by A&C

to purchase shares of the Company’s Series C Convertible Preferred Stock on December 14, 2023 and we are therefore not seeking stockholder

approval for the conversion of the Note as it has been extinguished.

The purchase price for the Note and Warrants

was comprised of the following: (i) cancellation of $4,625,000 of cash loaned by A&C to the Company since June 8, 2023 pursuant to

a short-term loan agreement; (ii) cancellation of $11,644,832 of term loans made by the Company to A&C in exchange for A&C assuming

liability for the payment of $11,644,832 of secured notes; and (iii) the retirement of $1,250,000 in stated value of 125,000 shares of

the Company’s Series B Convertible Preferred Stock (representing all shares issued and outstanding of that series) being transferred

from A&C to the Company.

The NPA contains customary representations, warranties