0001337619false00013376192024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: May 7, 2024

Date of Earliest Event Reported: May 7, 2024

ENVESTNET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34835 | | 20-1409613 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | | | | |

1000 Chesterbrook Boulevard, Suite 250, Berwyn, Pennsylvania | | 19312 |

| (Address of principal executive offices) | | (Zip Code) |

(312) 827-2800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of exchange on which registered |

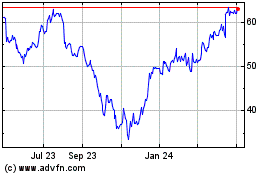

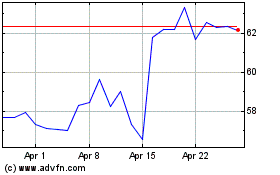

| Common Stock, par value $0.005 per share | ENV | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On May 7, 2024, Envestnet, Inc. (“Envestnet”) issued a press release regarding Envestnet’s financial results for its first quarter ended March 31, 2024 and its first quarter 2024 supplemental presentation. The full text of Envestnet’s press release and supplemental presentation are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in this Item 2.02 and the attached exhibits are being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing of Envestnet under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 7, 2024

| | | | | |

| ENVESTNET, INC. |

|

| By: | /s/ Joshua B. Warren |

| Name: | Joshua B. Warren |

| Title: | Chief Financial Officer |

Exhibit 99.1

Envestnet Reports First Quarter 2024 Financial Results

Berwyn, PA — May 7, 2024 — Envestnet (NYSE: ENV), a leading provider of intelligent systems for wealth management and financial wellness, today reported financial results for the three months ended March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Three months ended | | |

| Key Financial Metrics | | | | | | March 31, | | % |

| (in millions, except per share data) | | | | | | | | 2024 | | 2023 | | Change |

| GAAP: | | | | | | | | | | | | |

| Total revenue | | | | | | | | $ | 325.0 | | | $ | 298.7 | | | 9 | % |

Net income (loss) attributable to Envestnet, Inc. | | | | | | | | $ | 2.5 | | | $ | (41.2) | | | 106 | % |

Net income (loss) attributable to Envestnet, Inc. per diluted share | | | | | | | | $ | 0.05 | | | $ | (0.76) | | | 107 | % |

| | | | | | | | | | | | |

| Non-GAAP: | | | | | | | | | | | | |

Adjusted EBITDA(1) | | | | | | | | $ | 70.4 | | | $ | 54.0 | | | 30 | % |

Adjusted net income(1) | | | | | | | | $ | 39.4 | | | $ | 30.1 | | | 31 | % |

Adjusted net income per diluted share(1) | | | | | | | | $ | 0.60 | | | $ | 0.46 | | | 30 | % |

Free cash flow(1) | | | | | | | | $ | (19.9) | | | $ | (61.7) | | | 68 | % |

"Envestnet continues to be in its leading position because we are executing on what our clients need and we're deepening our relationships with them," said Jim Fox, Board Chair and Interim CEO. "Our first quarter results are a testament to our differentiated products, deepening relationships, and inherent operating leverage in our business. We see tremendous runway for continued growth and margin expansion."

Financial Results for the First Quarter 2024 Compared to the First Quarter 2023

Total revenue increased 9% to $325.0 million for the first quarter of 2024 from $298.7 million for the first quarter of 2023. Asset-based recurring revenue increased 15% and represented 62% of total revenue for the first quarter of 2024, compared to 59% of total revenue for the first quarter of 2023. Subscription-based recurring revenue remained consistent and represented 36% of total revenue for the first quarter of 2024, compared to 39% of total revenue for the first quarter of 2023. Professional services and other non-recurring revenue increased 4% for the first quarter of 2024 from the first quarter of 2023.

Total operating expenses increased 2% to $316.2 million for the first quarter of 2024 from $309.8 million for the first quarter of 2023. Direct expense increased 15% to $126.6 million for the first quarter of 2024 from $109.7 million for the first quarter of 2023. Employee compensation decreased 9% to $103.7 million for the first quarter of 2024 from $114.2 million for the first quarter of 2023. Employee compensation was 32% of total revenue for the first quarter of 2024, compared to 38% of total revenue for the first quarter of 2023. General and administrative expense decreased 4% to $52.1 million for the first quarter of 2024 from $54.4 million for the first quarter of 2023. General and administrative expense was 16% of total revenue for the first quarter of 2024, compared to 18% of total revenue for the first quarter of 2023.

Income from operations was $8.7 million for the first quarter of 2024 compared to a loss from operations of $11.1 million for the first quarter of 2023. Net income attributable to Envestnet, Inc. was $2.5 million, or $0.05 per diluted share, for the first quarter of 2024 compared to a net loss attributable to Envestnet, Inc. of $41.2 million, or $0.76 per diluted share, for the first quarter of 2023.

Adjusted EBITDA(1) increased 30% to $70.4 million for the first quarter of 2024 from $54.0 million for the first quarter of 2023. Adjusted net income(1) increased 31% to $39.4 million, or $0.60 per diluted share, for the first quarter of 2024 from $30.1 million, or $0.46 per diluted share, for the first quarter of 2023. Free cash flow(1) increased 68%, to negative $19.9 million for the first quarter of 2024 from negative $61.7 million for the first quarter of 2023.

Balance Sheet and Liquidity

As of March 31, 2024, Envestnet had $61.2 million in cash and cash equivalents and $892.5 million in outstanding debt. Debt as of March 31, 2024 consisted of $317.5 million in convertible notes maturing in 2025 and $575.0 million in convertible notes maturing in 2027. Envestnet's $500.0 million revolving credit facility was undrawn as of March 31, 2024.

Segment Reporting

On October 1, 2023, the Company changed the composition of its reportable segments to reflect the way that the Company's chief operating decision maker reviews the operating results, assesses performance and allocates resources. All segment information presented within this Exhibit 99.1 for the quarter ended March 31, 2024 is presented in conjunction with the current organizational structure, with prior periods adjusted accordingly.

Correction of Immaterial Error

During the fourth quarter of 2023, the Company identified that the arrangement with a third-party for the use of cloud hosted virtual servers which was previously accounted for as a finance lease transaction and included as a component of property and equipment, net in the condensed consolidated balance sheets should have been recognized as a prepayment included within prepaid expenses and other current assets and other assets in the condensed consolidated balance sheets. The Company concluded that the classification of these transactions was immaterial in prior period financial statements and that amendment of previously filed reports was not required. However, the Company corrected this immaterial error in the prior period reported within this press release.

Outlook

Envestnet provided the following outlook for the second quarter ending June 30, 2024. This outlook is based on the market value of assets under management or administration as of March 31, 2024. We caution that we cannot predict the market value of these assets on any future date. See “Cautionary Statement Regarding Forward-Looking Statements.”

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| In Millions, Except Adjusted EPS | | 2Q 2024 | | |

| GAAP: | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | |

| Asset-based | | $ | 211.5 | | | - | | $ | 214.5 | | | | | | | |

| Subscription-based | | 115.0 | | | - | | 118.0 | | | | | | | |

| Total recurring revenue | | 326.5 | | | - | | 332.5 | | | | | | | |

| Professional services and other revenue | | 10.5 | | | - | | 12.5 | | | | | | | |

| Total revenue | | $ | 337.0 | | | - | | $ | 345.0 | | | | | | | |

| | | | | | | | | | | | |

| Asset-based direct expense | | $ | 125.0 | | | - | | $ | 126.5 | | | | | | | |

| Total direct expense | | $ | 139.5 | | | - | | $ | 141.0 | | | | | | | |

| | | | | | | | | | | | |

| Net income (loss) | | | | (a) | | | | | | | | |

| | | | | | | | | | | | |

| Diluted shares outstanding | | | | 66.5 | | | | | | | | |

| Net income (loss) per diluted share | | | | (a) | | | | | | | | |

| | | | | | | | | | | | |

| Non-GAAP: | | | | | | | | | | | | |

Adjusted EBITDA(1) | | $ | 71.0 | | | - | | $ | 75.0 | | | | | | | |

Adjusted net income per diluted share(1) | | $ | 0.60 | | | - | | $ | 0.65 | | | | | | | |

_______________________________________________________

(a) Envestnet does not forecast net income (loss) and net income (loss) per diluted share due to the unpredictable nature of various items adjusted for non-GAAP disclosure purposes, including the periodic GAAP income tax provision.

Conference Call

Envestnet will host a conference call to discuss first quarter 2024 financial results today at 5:00 p.m. ET. The live webcast and accompanying presentation can be accessed from Envestnet’s investor relations website at http://investor.envestnet.com/. A replay of the webcast will be available on the investor relations website following the call.

About Envestnet

Envestnet, Inc. (NYSE: ENV) is transforming the way financial advice and insight are delivered. Our mission is to empower financial advisors and service providers with innovative technology, solutions and intelligence. Envestnet's clients include more than 109,000 advisors, 17 of the 20 largest U.S. banks, 48 of the 50 largest wealth management and brokerage firms, over 500 of the largest RIAs and hundreds of FinTech companies, all of which leverage Envestnet technology and services that help drive better outcomes for enterprises, advisors and their clients.

For more information on Envestnet, please visit http://www.envestnet.com and follow us on Twitter @ENVintel.

(1) Non-GAAP Financial Measures

“Adjusted EBITDA” represents net income (loss) before deferred revenue fair value adjustment, interest income, interest expense, income tax provision, depreciation and amortization, non‑cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, loss allocations from equity method investments and loss attributable to non‑controlling interest.

“Adjusted net income” represents net income (loss) before income tax provision, deferred revenue fair value adjustment, non‑cash interest expense, cash interest on our Convertible Notes, amortization of acquired intangibles, non‑cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, loss allocations from equity method investments and loss attributable to non‑controlling interest. Reconciling items are presented gross of tax, and a normalized tax rate is applied to the total of all reconciling items to arrive at adjusted net income. The normalized tax rate is based solely on the estimated blended statutory income tax rates in the jurisdictions in which we operate. We monitor the normalized tax rate based on events or trends that could materially impact the rate, including tax legislation changes and changes in the geographic mix of our operations.

“Adjusted net income per diluted share” represents adjusted net income attributable to common stockholders divided by the diluted number of weighted-average shares outstanding. For purposes of the adjusted net income per share calculation, we assume all potential shares to be issued in connection with our convertible notes are dilutive.

"Free cash flow" represents net cash provided by (used in) operating activities less purchases of property and equipment and capitalization of internally developed software.

For further information see reconciliations of Non-GAAP Financial Measures on pages 10-14 of this press release, and the section entitled "Non-GAAP Financial Measures" in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) which are available on the SEC’s website at http://www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. Reconciliations are not provided for guidance on such measures as the Company is unable to predict the amounts to be adjusted, such as the GAAP tax provision. The Company’s Non-GAAP Financial Measures should not be viewed as a substitute for revenue, net income (loss), net income (loss) per share or net cash provided by (used in) operating activities determined in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

The forward-looking statements made in this press release and its attachments concerning, among other things, Envestnet, Inc.’s expected financial performance and outlook for the second quarter of 2024, its strategic and operational plans and growth strategy are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and our actual results could differ materially from the results expressed or implied by such forward-looking statements. Furthermore, reported results should not be considered as an indication of future performance. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this press release include, but are not limited to, our ability to recruit and retain senior executive leadership and other key employees and to successfully manage transitions, including the transition of our chief executive officer; adverse economic or global market conditions, including periods of rising inflation and market interest rates, and governmental responses to such conditions; the conflicts in the Middle East and between Russia and Ukraine, including related sanctions and their impact on the global economy and capital markets; the concentration of our revenue from the delivery of our solutions and services to clients in the financial services industry; our reliance on a limited number of clients for a material portion of our revenue; the renegotiation of fees by our clients; changes in the estimates of fair value of reporting units or of long-lived assets, particularly goodwill and intangible assets; the amount of our debt, our ability to service our debt and risks associated with derivative transactions associated with our debt; limitations on our ability to access information from third parties or charges for accessing such information; the targeting of some of our sales efforts at large financial institutions and large financial technology companies which prolongs sales cycles, requires substantial upfront sales costs and results in less predictability in completing some of our sales; changes in investing patterns on the assets on which we derive revenue and the freedom of investors to redeem or withdraw investments generally at any time; the impact of fluctuations in market conditions and interest rates on the demand for our products and services and the value of assets under management or administration; increased geopolitical unrest and other events outside of our control that could adversely affect the global economy or specific international, regional and domestic markets; our ability to keep up with rapid technological change, evolving industry standards or changing requirements of clients; risks associated with our international operations; the competitiveness of our solutions and services as compared to those of others; liabilities associated with potential, perceived or actual breaches of fiduciary duties and/or conflicts of interest; harm to our reputation; the failure to protect our intellectual property rights; our reliance on outsourcing arrangements; activist shareholders hindering the execution of our business strategy, diverting board and management attention and resources and causing us to incur substantial expenses; public health crises, pandemics or similar events; our ability to successfully identify potential acquisition candidates, complete acquisitions and successfully integrate acquired companies; our ability to successfully execute the conversion of clients’ assets from their technology platform to our technology platforms in a timely and accurate manner; our ability to introduce new solutions and services and enhancements; regulatory compliance failures; our ability to maintain the security and integrity of our systems and facilities and to maintain the privacy of personal information and potential liabilities for cybersecurity breaches; the effect of privacy laws and regulations, industry standards and contractual obligations and changes to these laws, regulations, standards and obligations on how we operate our business and the negative effects of failure to comply with these requirements; failure by our customers to obtain proper permissions or waivers for our use of disclosure of information; adverse judicial or regulatory proceedings against us; failure of our solutions, services or systems, or those of third parties on which we rely, to work properly; potential liability for use of inaccurate information by third parties provided by us; the occurrence of a deemed “change of control”; the uncertainty of the application and interpretation of certain tax laws; issuances of additional shares of common stock or issuances of shares of preferred stock or convertible securities on our existing stockholders; general economic, political and regulatory conditions; global events, natural disasters, environmental disasters, terrorist attacks and pandemics, including their impact on the economy and trading markets; management’s response to these factors. More information regarding these and other risks, uncertainties and factors is contained in our filings with the SEC which are available on the SEC’s website at http://www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. You are cautioned not to unduly rely on these forward-looking statements, which speak only as of the date of this press release. All information in this press release and its attachments is as of May 7, 2024 and, unless required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this press release or to report the occurrence of unanticipated events.

| | | | | | | | |

| Contacts | | |

| Investor Relations | | Media Relations |

| investor.relations@envestnet.com | | media@envestnet.com |

| (312) 827-3940 | | |

Envestnet, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | March 31, | | December 31, |

| | 2024 | | 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 61,226 | | | $ | 91,378 | |

| Fees receivable, net | | 135,630 | | | 120,958 | |

| Prepaid expenses and other current assets | | 53,330 | | | 51,472 | |

| Assets held for deconsolidation | | 55,016 | | | — | |

| Total current assets | | 305,202 | | | 263,808 | |

| Property and equipment, net | | 46,856 | | | 48,223 | |

| Internally developed software, net | | 214,507 | | | 224,713 | |

| Intangible assets, net | | 323,326 | | | 338,068 | |

| Goodwill | | 779,916 | | | 806,563 | |

| Operating lease right-of-use assets, net | | 67,127 | | | 69,154 | |

| Other assets | | 127,111 | | | 126,723 | |

| Total assets | | $ | 1,864,045 | | | $ | 1,877,252 | |

| | | | |

| Liabilities and equity | | | | |

| Current liabilities: | | | | |

| Accounts payable, accrued expenses and other current liabilities | | $ | 201,126 | | | $ | 241,424 | |

| Operating lease liabilities | | 12,479 | | | 12,909 | |

| Deferred revenue | | 34,584 | | | 38,201 | |

| | | | |

| Liabilities held for deconsolidation | | 8,998 | | | — | |

| Total current liabilities | | 257,187 | | | 292,534 | |

| Debt | | 877,842 | | | 876,612 | |

| Operating lease liabilities, net of current portion | | 98,085 | | | 100,830 | |

| Deferred tax liabilities, net | | 15,716 | | | 16,568 | |

| Other liabilities | | 17,897 | | | 16,202 | |

| Total liabilities | | 1,266,727 | | | 1,302,746 | |

| | | | |

| Equity: | | | | |

| Total stockholders’ equity, attributable to Envestnet, Inc. | | 580,897 | | | 568,191 | |

| Non-controlling interest | | 16,421 | | | 6,315 | |

| Total liabilities and equity | | $ | 1,864,045 | | | $ | 1,877,252 | |

Envestnet, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share information)

(unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | | 2024 | | 2023 |

| Revenue: | | | | | | | | |

| Asset-based | | | | | | $ | 202,616 | | | $ | 176,932 | |

| Subscription-based | | | | | | 117,462 | | | 117,079 | |

| Total recurring revenue | | | | | | 320,078 | | | 294,011 | |

| Professional services and other revenue | | | | | | 4,872 | | | 4,696 | |

| Total revenue | | | | | | 324,950 | | | 298,707 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense | | | | | | 126,633 | | | 109,679 | |

| Employee compensation | | | | | | 103,652 | | | 114,215 | |

| General and administrative | | | | | | 52,065 | | | 54,350 | |

| Depreciation and amortization | | | | | | 33,892 | | | 31,520 | |

| Total operating expenses | | | | | | 316,242 | | | 309,764 | |

| | | | | | | | |

| Income (loss) from operations | | | | | | 8,708 | | | (11,057) | |

| Other expense, net | | | | | | (6,664) | | | (7,935) | |

Income (loss) before income tax provision | | | | | | 2,044 | | | (18,992) | |

| | | | | | | | |

Income tax provision | | | | | | 1,505 | | | 23,769 | |

| | | | | | | | |

Net income (loss) | | | | | | 539 | | | (42,761) | |

| Add: Net loss attributable to non-controlling interest | | | | | | 1,974 | | | 1,533 | |

Net income (loss) attributable to Envestnet, Inc. | | | | | | $ | 2,513 | | | $ | (41,228) | |

| | | | | | | | |

Net income (loss) attributable to Envestnet, Inc. per share: | | | | | | | | |

Basic | | | | | | $ | 0.05 | | | $ | (0.76) | |

| | | | | | | | |

| | | | | | | | |

Diluted | | | | | | $ | 0.05 | | | $ | (0.76) | |

| Weighted average common shares outstanding: | | | | | | | | |

Basic | | | | | | 54,884,074 | | | 54,143,259 | |

Diluted | | | | | | 55,385,066 | | | 54,143,259 | |

| | | | | | | | |

| | | | | | | | |

Envestnet, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net income (loss) | | $ | 539 | | | $ | (42,761) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | |

| Depreciation and amortization | | 33,892 | | | 31,520 | |

| Deferred income taxes | | (855) | | | 5,221 | |

| | | | |

| Non-cash compensation expense | | 18,898 | | | 19,453 | |

| Non-cash interest expense | | 4,580 | | | 4,498 | |

| Loss allocations from equity method investments | | 2,283 | | | 2,940 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other | | 2,078 | | | 468 | |

| Changes in operating assets and liabilities: | | | | |

| Fees receivable, net | | (18,841) | | | (21,579) | |

| Prepaid expenses and other assets | | (2,371) | | | (9,858) | |

| Accounts payable, accrued expenses and other liabilities | | (40,659) | | | (31,648) | |

| Deferred revenue | | 2,400 | | | 8,073 | |

| Net cash provided by (used in) operating activities | | 1,944 | | | (33,673) | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | (1,900) | | | (4,402) | |

| Capitalization of internally developed software | | (19,953) | | | (23,664) | |

| | | | |

| Investments in private companies | | (2,805) | | | (950) | |

| Acquisition of proprietary technology | | — | | | (10,000) | |

| Issuance of loan receivable to private company | | — | | | (20,000) | |

| | | | |

| Other | | — | | | 260 | |

| Net cash used in investing activities | | (24,658) | | | (58,756) | |

| Cash flows from financing activities: | | | | |

| | | | |

| | | | |

| | | | |

| Proceeds from exercise of stock options | | 71 | | | 367 | |

| Payments related to tax withholdings for stock-based compensation | | (8,449) | | | (10,732) | |

| Payments related to share repurchases | | — | | | (9,289) | |

| Proceeds from capital contributions received by non-controlling interest | | 12,012 | | | — | |

| Purchase of non-controlling units from third-party shareholders | | — | | | (1,008) | |

| | | | |

| Other | | 3 | | | 2 | |

| Net cash provided by (used in) financing activities | | 3,637 | | | (20,660) | |

| Effect of exchange rate on changes on cash and cash equivalents | | (2) | | | 3,580 | |

| Net change in cash and cash equivalents due to cash reclassified to assets held for deconsolidation | | (11,073) | | | — | |

| Net change in cash and cash equivalents | | (30,152) | | | (109,509) | |

| Cash and cash equivalents, beginning of period | | 91,378 | | | 162,173 | |

| Cash and cash equivalents, end of period | | $ | 61,226 | | | $ | 52,664 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | | 2024 | | 2023 |

Net income (loss) | | | | | | $ | 539 | | | $ | (42,761) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | | | | | — | | | 52 | |

Interest income (b) | | | | | | (1,983) | | | (1,358) | |

Interest expense (b) | | | | | | 6,089 | | | 6,320 | |

Income tax provision | | | | | | 1,505 | | | 23,769 | |

| Depreciation and amortization | | | | | | 33,892 | | | 31,520 | |

Non-cash compensation expense (d) | | | | | | 18,898 | | | 19,453 | |

Restructuring charges and transaction costs (e) | | | | | | 2,056 | | | 4,163 | |

Severance expense (d) | | | | | | 3,425 | | | 6,188 | |

Litigation, regulatory and other governance related expenses (c) | | | | | | 2,288 | | | 3,074 | |

Foreign currency (b) | | | | | | 275 | | | 33 | |

Non-income tax expense adjustment (c) | | | | | | (49) | | | (168) | |

| | | | | | | | |

| | | | | | | | |

Loss allocations from equity method investments (b) | | | | | | 2,283 | | | 2,940 | |

| Loss attributable to non-controlling interest | | | | | | 1,160 | | | 778 | |

| Adjusted EBITDA | | | | | | $ | 70,378 | | | $ | 54,003 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within other expense, net in the condensed consolidated statements of operations.

(c)Included within general and administrative expense in the condensed consolidated statements of operations.

(d)Included within employee compensation expense in the condensed consolidated statements of operations.

(e)For the three months ended March 31, 2024 and 2023, $2.4 million and $4.1 million, respectively, were included within general and administrative expense and $(0.4) million and $0.1 million, respectively, were included within employee compensation expense in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands, except share and per share information)

(unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | | 2024 | | 2023 |

Net income (loss) | | | | | | $ | 539 | | | $ | (42,761) | |

Income tax provision (a) | | | | | | 1,505 | | | 23,769 | |

Income (loss) before income tax provision | | | | | | 2,044 | | | (18,992) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (b) | | | | | | — | | | 52 | |

Non-cash interest expense (d) | | | | | | 1,405 | | | 1,442 | |

Cash interest - Convertible Notes (d) | | | | | | 4,369 | | | 4,565 | |

Amortization of acquired intangibles (e) | | | | | | 14,742 | | | 16,940 | |

Non-cash compensation expense (f) | | | | | | 18,898 | | | 19,453 | |

Restructuring charges and transaction costs (g) | | | | | | 2,056 | | | 4,163 | |

Severance expense (e) | | | | | | 3,425 | | | 6,188 | |

Litigation, regulatory and other governance related expenses (c) | | | | | | 2,288 | | | 3,074 | |

Foreign currency (d) | | | | | | 275 | | | 33 | |

Non-income tax expense adjustment (c) | | | | | | (49) | | | (168) | |

| | | | | | | | |

| | | | | | | | |

Loss allocations from equity method investments (d) | | | | | | 2,283 | | | 2,940 | |

| Loss attributable to non-controlling interest | | | | | | 1,160 | | | 778 | |

| Adjusted net income before income tax effect | | | | | | 52,896 | | | 40,468 | |

Income tax effect (h) | | | | | | (13,489) | | | (10,319) | |

| Adjusted net income | | | | | | $ | 39,407 | | | $ | 30,149 | |

| | | | | | | | |

| Basic number of weighted-average shares outstanding | | | | | | 54,884,074 | | | 54,143,259 | |

| Effect of dilutive shares: | | | | | | | | |

| Convertible Notes | | | | | | 10,811,884 | | | 11,470,645 | |

| Non-vested RSUs and PSUs | | | | | | 473,738 | | | 463,719 | |

| Options to purchase common stock | | | | | | 27,254 | | | 88,323 | |

| | | | | | | | |

| Diluted number of weighted-average shares outstanding | | | | | | 66,196,950 | | | 66,165,946 | |

| | | | | | | | |

| Adjusted net income per diluted share | | | | | | $ | 0.60 | | | $ | 0.46 | |

(a)For the three months ended March 31, 2024 and 2023, the effective tax rate computed in accordance with GAAP equaled 73.6% and (125.2)%, respectively.

(b)Included within subscription-based revenue in the condensed consolidated statements of operations.

(c)Included within general and administrative expense in the condensed consolidated statements of operations.

(d)Included within other expense, net in the condensed consolidated statements of operations.

(e)Included within depreciation and amortization expense in the condensed consolidated statements of operations.

(f)Included within employee compensation expense in the condensed consolidated statements of operations.

(g)For the three months ended March 31, 2024 and 2023, $2.4 million and $4.1 million, respectively, were included within general and administrative expense and $(0.4) million and $0.1 million, respectively, were included within employee compensation expense in the condensed consolidated statements of operations.

(h)An estimated normalized tax rate of 25.5% has been used to compute adjusted net income for the three months ended March 31, 2024 and 2023.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2024 | | 2023 |

| Net cash provided by (used in) operating activities | | $ | 1,944 | | | $ | (33,673) | |

| Less: Purchases of property and equipment | | (1,900) | | | (4,402) | |

Less: Capitalization of internally developed software | | (19,953) | | | (23,664) | |

| Free cash flow | | $ | (19,909) | | | $ | (61,739) | |

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 202,616 | | | $ | — | | | $ | — | | | $ | 202,616 | |

| Subscription-based | | 84,168 | | | 33,294 | | | — | | | 117,462 | |

| Total recurring revenue | | 286,784 | | | 33,294 | | | — | | | 320,078 | |

| Professional services and other revenue | | 3,026 | | | 1,846 | | | — | | | 4,872 | |

| Total revenue | | $ | 289,810 | | | $ | 35,140 | | | $ | — | | | $ | 324,950 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense: | | | | | | | | |

| Asset-based | | $ | 118,403 | | | $ | — | | | $ | — | | | $ | 118,403 | |

| Subscription-based | | 1,431 | | | 6,799 | | | — | | | 8,230 | |

| | | | | | | | |

| Total direct expense | | 119,834 | | | 6,799 | | | — | | | 126,633 | |

| Employee compensation | | 75,196 | | | 11,692 | | | 16,764 | | | 103,652 | |

| General and administrative | | 29,032 | | | 15,314 | | | 7,719 | | | 52,065 | |

| Depreciation and amortization | | 26,818 | | | 7,074 | | | — | | | 33,892 | |

| Total operating expenses | | $ | 250,880 | | | $ | 40,879 | | | $ | 24,483 | | | $ | 316,242 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 38,930 | | | $ | (5,739) | | | $ | (24,483) | | | $ | 8,708 | |

| Add (deduct): | | | | | | | | |

| | | | | | | | |

| Depreciation and amortization | | 26,818 | | | 7,074 | | | — | | | 33,892 | |

Non-cash compensation expense (b) | | 11,387 | | | 1,864 | | | 5,647 | | | 18,898 | |

Restructuring charges and transaction costs (c) | | 43 | | | 679 | | | 1,334 | | | 2,056 | |

Severance expense (b) | | 1,804 | | | 13 | | | 1,608 | | | 3,425 | |

Litigation, regulatory and other governance related expenses (a) | | — | | | 2,288 | | | — | | | 2,288 | |

Non-income tax expense adjustment (a) | | (49) | | | — | | | — | | | (49) | |

| Loss attributable to non-controlling interest | | 1,160 | | | — | | | — | | | 1,160 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 80,093 | | | $ | 6,179 | | | $ | (15,894) | | | $ | 70,378 | |

(a)Included within general and administrative expense in the condensed consolidated statements of operations.

(b)Included within employee compensation expense in the condensed consolidated statements of operations.

(c)$2.4 million was included within general and administrative expense and $(0.4) million was included within employee compensation expense in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information (continued)

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, 2023 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 176,932 | | | $ | — | | | $ | — | | | $ | 176,932 | |

| Subscription-based | | 80,470 | | | 36,609 | | | — | | | 117,079 | |

| Total recurring revenue | | 257,402 | | | 36,609 | | | — | | | 294,011 | |

| Professional services and other revenue | | 3,247 | | | 1,449 | | | — | | | 4,696 | |

| Total revenue | | $ | 260,649 | | | $ | 38,058 | | | $ | — | | | $ | 298,707 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense: | | | | | | | | |

| Asset-based | | $ | 102,623 | | | $ | — | | | $ | — | | | $ | 102,623 | |

| Subscription-based | | 1,778 | | | 5,274 | | | — | | | 7,052 | |

| Professional services and other | | 4 | | | — | | | — | | | 4 | |

| Total direct expense | | 104,405 | | | 5,274 | | | — | | | 109,679 | |

| Employee compensation | | 79,047 | | | 19,242 | | | 15,926 | | | 114,215 | |

| General and administrative | | 29,107 | | | 14,429 | | | 10,814 | | | 54,350 | |

| Depreciation and amortization | | 25,492 | | | 6,028 | | | — | | | 31,520 | |

| Total operating expenses | | $ | 238,051 | | | $ | 44,973 | | | $ | 26,740 | | | $ | 309,764 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 22,598 | | | $ | (6,915) | | | $ | (26,740) | | | $ | (11,057) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | 52 | | | — | | | — | | | 52 | |

| Depreciation and amortization | | 25,492 | | | 6,028 | | | — | | | 31,520 | |

Non-cash compensation expense (c) | | 11,467 | | | 2,437 | | | 5,549 | | | 19,453 | |

Restructuring charges and transaction costs (d) | | 1,139 | | | 243 | | | 2,781 | | | 4,163 | |

Severance expense (c) | | 3,799 | | | 2,205 | | | 184 | | | 6,188 | |

Litigation, regulatory and other governance related expenses (b) | | — | | | 1,324 | | | 1,750 | | | 3,074 | |

Non-income tax expense adjustment (b) | | (102) | | | (66) | | | — | | | (168) | |

| Loss attributable to non-controlling interest | | 778 | | | — | | | — | | | 778 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 65,223 | | | $ | 5,256 | | | $ | (16,476) | | | $ | 54,003 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within general and administrative expense in the condensed consolidated statements of operations.

(c)Included within employee compensation expense in the condensed consolidated statements of operations.

(d)$4.1 million was included within general and administrative expense and $0.1 million was included within employee compensation expense in the condensed consolidated statements of operations.

Envestnet, Inc.

Key Metrics

(in millions, except accounts, advisors and firms data)

(unaudited)

Envestnet Wealth Solutions Segment

The following table provides information regarding the amount of assets utilizing our platforms, financial advisors and investor accounts in the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | March 31, | | June 30, | | September 30, | | December 31, | | March 31, |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2024 |

| Platform Assets | | | | | | | | | | |

| Assets under Management (“AUM”) | | $ | 363,244 | | | $ | 384,773 | | | $ | 375,408 | | | $ | 416,001 | | | $ | 452,464 | |

| Assets under Administration (“AUA”) | | 379,843 | | | 394,078 | | | 398,082 | | | 430,846 | | | 471,401 | |

| Total AUM/A | | 743,087 | | | 778,851 | | | 773,490 | | | 846,847 | | | 923,865 | |

| Subscription | | 4,566,971 | | | 4,643,313 | | | 4,579,248 | | | 4,959,514 | | | 5,158,180 | |

| Total Platform Assets | | $ | 5,310,058 | | | $ | 5,422,164 | | | $ | 5,352,738 | | | $ | 5,806,361 | | | $ | 6,082,045 | |

| Platform Accounts | | | | | | | | | | |

| AUM | | 1,571,862 | | 1,609,677 | | 1,614,873 | | 1,640,879 | | 1,688,044 |

| AUA | | 1,142,166 | | 1,144,375 | | 1,257,094 | | 1,254,962 | | 1,315,442 |

| Total AUM/A | | 2,714,028 | | 2,754,052 | | 2,871,967 | | 2,895,841 | | 3,003,486 |

| Subscription | | 15,779,980 | | 15,916,955 | | 16,072,848 | | 16,248,598 | | 16,641,631 |

| Total Platform Accounts | | 18,494,008 | | 18,671,007 | | 18,944,815 | | 19,144,439 | | 19,645,117 |

| Advisors | | | | | | | | | | |

| AUM/A | | 38,611 | | 38,809 | | 38,078 | | 38,697 | | 38,814 |

| Subscription | | 67,843 | | 68,439 | | 69,318 | | 69,973 | | 70,262 |

| Total Advisors | | 106,454 | | 107,248 | | 107,396 | | 108,670 | | 109,076 |

The following table summarizes the changes in AUM and AUA for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Asset Rollforward - Three Months Ended March 31, 2024 |

| | | As of

December 31, | | Gross | | | | Net | | Market | | | | | | As of

March 31, |

| | | 2023 | | Sales | | Redemptions | | Flows | | Impact | | Reclassifications | | | | 2024 |

| AUM | | $ | 416,001 | | | $ | 32,127 | | | $ | (19,601) | | | $ | 12,526 | | | $ | 22,694 | | | $ | 1,243 | | | | | $ | 452,464 | |

| AUA | | 430,846 | | | 45,596 | | | (25,402) | | | 20,194 | | | 22,683 | | | (2,322) | | | | | 471,401 | |

| Total AUM/A | | $ | 846,847 | | | $ | 77,723 | | | $ | (45,003) | | | $ | 32,720 | | | $ | 45,377 | | | $ | (1,079) | | | | | $ | 923,865 | |

| Fee-Based Accounts | | 2,895,841 | | | | | | | 112,633 | | | | | (4,988) | | | | | 3,003,486 | |

The above AUM/A gross sales figures for the three months ended March 31, 2024 include $29.8 billion in new client conversions. We onboarded an additional $31.1 billion in subscription conversions during the three months ended March 31, 2024 bringing total conversions for the three months ended March 31, 2024 to $60.9 billion.

Asset and account figures in the “Reclassifications” column for the three months ended March 31, 2024 represent immaterial amounts that were reclassified between AUM, AUA and subscription to reflect updated customer billing arrangements. These reclassifications have no impact on total platform assets or accounts.

Envestnet Data & Analytics Segment

The following table provides information regarding the amount of paid-end users and firms using the Envestnet Data & Analytics platform in the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | March 31, | | June 30, | | September 30, | | December 31, | | March 31, |

| | 2023 | | 2023 | | 2023 | | 2023 | | 2024 |

| Number of paying users | | 37.5 | | | 38.0 | | | 42.3 | | | 38.3 | | | 43.8 | |

| Number of firms | | 1,310 | | | 1,339 | | | 1,322 | | | 1,324 | | | 1,323 | |

Envestnet 1Q 2024 Earnings May 7, 2024

2 Disclaimers Cautionary Statement Regarding Forward-Looking Statements The forward-looking statements made in this presentation concerning, among other things, Envestnet, Inc.’s expected financial performance and outlook for the second quarter of 2024, its strategic and operational plans and growth strategy, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties, and the Company’s actual results could differ materially from the results expressed or implied by such forward-looking statements. Furthermore, reported results should not be considered as an indication of future performance. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this presentation include, but are not limited to, our ability to recruit and retain senior executive leadership and other key employees and to successfully manage transitions, including the transition of our chief executive officer; adverse economic or global market conditions, including periods of rising inflation and market interest rates, and governmental responses to such conditions; the conflicts in the Middle East and between Russia and Ukraine, including related sanctions and their impact on the global economy and capital markets; the concentration of our revenue from the delivery of our solutions and services to clients in the financial services industry; our reliance on a limited number of clients for a material portion of our revenue; the renegotiation of fees by our clients; changes in the estimates of fair value of reporting units or of long-lived assets, particularly goodwill and intangible assets; the amount of our debt, our ability to service our debt and risks associated with derivative transactions associated with our debt; limitations on our ability to access information from third parties or charges for accessing such information; the targeting of some of our sales efforts at large financial institutions and large financial technology companies which prolongs sales cycles, requires substantial upfront sales costs and results in less predictability in completing some of our sales; changes in investing patterns on the assets on which we derive revenue and the freedom of investors to redeem or withdraw investments generally at any time; the impact of fluctuations in market conditions and interest rates on the demand for our products and services and the value of assets under management or administration; increased geopolitical unrest and other events outside of our control that could adversely affect the global economy or specific international, regional and domestic markets; our ability to keep up with rapid technological change, evolving industry standards or changing requirements of clients; risks associated with our international operations; the competitiveness of our solutions and services as compared to those of others; liabilities associated with potential, perceived or actual breaches of fiduciary duties and/or conflicts of interest; harm to our reputation; the failure to protect our intellectual property rights; our reliance on outsourcing arrangements; activist shareholders hindering the execution of our business strategy, diverting board and management attention and resources and causing us to incur substantial expenses; public health crises, pandemics or similar events; our ability to successfully identify potential acquisition candidates, complete acquisitions and successfully integrate acquired companies; our ability to successfully execute the conversion of clients’ assets from their technology platform to our technology platforms in a timely and accurate manner; our ability to introduce new solutions and services and enhancements; regulatory compliance failures; our ability to maintain the security and integrity of our systems and facilities and to maintain the privacy of personal information and potential liabilities for cybersecurity breaches; the effect of privacy laws and regulations, industry standards and contractual obligations and changes to these laws, regulations, standards and obligations on how we operate our business and the negative effects of failure to comply with these requirements; failure by our customers to obtain proper permissions or waivers for our use of disclosure of information; adverse judicial or regulatory proceedings against us; failure of our solutions, services or systems, or those of third parties on which we rely, to work properly; potential liability for use of inaccurate information by third parties provided by us; the occurrence of a deemed “change of control”; the uncertainty of the application and interpretation of certain tax laws; issuances of additional shares of common stock or issuances of shares of preferred stock or convertible securities on our existing stockholders; general economic, political and regulatory conditions; global events, natural disasters, environmental disasters, terrorist attacks and pandemics, including their impact on the economy and trading markets; management’s response to these factors. More information regarding these and other risks, uncertainties and factors is contained in our filings with the Securities and Exchange Commission (“SEC”) which are available on the SEC’s website at www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. You are cautioned not to unduly rely on these forward-looking statements, which speak only as of the date of this presentation. All information in this presentation is as of May 7, 2024, and, unless required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this presentation or to report the occurrence of unanticipated events. © 2024 Envestnet, Inc. All rights reserved.

3 Disclaimers Non-GAAP Financial Disclosure Statement This presentation contains the non-GAAP financial measures, “adjusted EBITDA”, “adjusted net income,” “adjusted net income per diluted share” and “free cash flow.” • “Adjusted EBITDA” represents net income (loss) before deferred revenue fair value adjustment, interest income, interest expense, income tax provision, depreciation and amortization, non-cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, loss allocations from equity method investments and loss attributable to non-controlling interest. • “Adjusted net income” represents net income (loss) before income tax provision, deferred revenue fair value adjustment, non-cash interest expense, cash interest on our Convertible Notes, amortization of acquired intangibles, non-cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, loss allocations from equity method investments and loss attributable to non-controlling interest. Reconciling items are presented gross of tax, and a normalized tax rate is applied to the total of all reconciling items to arrive at adjusted net income. The normalized tax rate is based solely on the estimated blended statutory income tax rates in the jurisdictions in which we operate. We monitor the normalized tax rate based on events or trends that could materially impact the rate, including tax legislation changes and changes in the geographic mix of our operations. • “Adjusted net income per diluted share” represents adjusted net income attributable to common stockholders divided by the diluted number of weighted-average shares outstanding. For purposes of the adjusted net income per share calculation, we assume all potential shares to be issued in connection with our convertible notes are dilutive. • "Free cash flow" represents net cash provided by (used in) operating activities less purchases of property and equipment and capitalization of internally developed software. • These measures are not calculated in accordance with GAAP and may be calculated differently than similar non-GAAP measures for other companies. Quantitative reconciliations of our non-GAAP financial information to the most directly comparable GAAP information appear in the appendix to this presentation and more information is contained in our filings with the SEC which are available on the SEC’s website at www.sec.gov or our Investor Relations website at https://investor.envestnet.com/. Reconciliations are not provided for guidance on such measures as we are unable to predict the amounts to be adjusted, such as the GAAP tax provision. Our non-GAAP financial measures should not be viewed as a substitute for revenue, net income (loss), net income (loss) per share or net cash provided by (used in) operating activities determined in accordance with GAAP. Accounting Presentation Certain prior period amounts have been adjusted to conform to the current period presentation, for a change in the composition of the Company’s reportable segments and to correct an immaterial error. See “Note 2 – Summary of Significant Accounting Policies” to our consolidated financial statements contained in our Annual Report on Form 10-K for the year ended December 31, 2023. © 2024 Envestnet, Inc. All rights reserved.

4 Envestnet at-a-Glance © 2024 Envestnet, Inc. All rights reserved. YoY Change(1)1Q231Q24 9%$298.7$325.0Revenue (in $millions) 30%$54.0$70.4Adjusted EBITDA(2) (in $millions) 30%$0.46$0.60Adjusted Net Income per Diluted Share(2) 68%$(61.7)$(19.9)Free Cash Flow(2) 1. YoY change represents 1Q24 results vs. 1Q23 results for Adjusted Results. 2. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. KEY FINANCIAL METRICS KEY BUSINESS METRICS $6.0 trillion+ client assets 109,000+ number of advisors 19.6 million+ number of accounts 43 million+ total number of paying users 1,300+ total firms on Data & Analytics platforms MISSION Our mission is to empower advisors and financial service providers with innovative technology, solutions and intelligence to power the growth of their business. STRATEGY • Deliver the industry leading wealth management platform powered by data and insights • Leverage our scale and maximize efficiency to serve our clients’ needs comprehensively • Provide more holistic solutions and a more connected environment

5© 2024 Envestnet, Inc. All rights reserved. Market Scale with Industry Leading Solutions 43 million+ paid users 109,000+ advisors 17 of 20 of the largest U.S. Banks 400 million+ linked consumer accounts 500+ of the largest RIAs 700+ fintech companies 48 of 50 of the largest wealth management and brokerage firms 19.6+ million investor accounts 19,000+ data sources $6.0 Trillion+ in assets Metrics as of December 31, 2023. © 2024 Envestnet, Inc. All rights reserved. 5

6 Secular Tailwinds Growth Opportunity © 2024 Envestnet, Inc. All rights reserved. 41.7% 43.3% 46.7% 48.3% 49.9% 51.4% 54.1% 54.6% 2015 2016 2017 2018 2019 2020 2021 2022 82% 18% Investment is increasing Investment is not increasing 2023 data excludes certain flows that Cerulli included in its industry figures for the first time in Q3 2023 Source: Cerulli LodestarSource: Cerulli Associates, “U.S. Broker/Dealer Marketplace 2023” 3.10% 3.19% 3.23% 3.22% 3.69% 3.69% 3.73% 2015 2016 2017 2018 2019 2020 2021 Source: InvestmentNews, “2022 InvestmentNews Adviser Technology Study” Source: Wavestone, “2024 Data and AI Leadership Executive Survey”; survey of senior executives at financial services (51%), healthcare/life sciences (15%), and other (34%) companies Wealth Management Firm Tech Expenditure as a Percentage of Revenue (median) Fee-Based Assets as a Percentage of Total Advisor-Managed Assets Organic Asset Growth Rates for the Managed Accounts Industry Percentage of Organizations Reporting an Increase in Data and Analytics Investments 7% 9% 13% 8% 7% 8% 10% 5% 6% 2015 2016 2017 2018 2019 2020 2021 2022 2023

7 Enabling our Clients’ Growth © 2024 Envestnet, Inc. All rights reserved. $6.4 $6.5 $7.9 $9.3 $11.9 $10.6 $12.1(1) $12.8(1) $1.7 $2.8 $3.8 $4.6 $5.7 $5.1 $5.8 $6.1 2017 2018 2019 2020 2021 2022 2023 YTD Q1 2024 Industry Envestnet Industry data was sourced from Cerulli U.S. Broker/Dealer Marketplace 2023 and Cerulli Lodestar. (1) Represents an Envestnet estimate, given 2023 and Q1 2024 industry fee-based asset data are not available. (2) Calculated as Envestnet AUM divided by total managed account industry assets, excluding the wirehouse and direct channels; (3) In Q3 2023, Cerulli included certain assets in its industry managed account figures for the first time, which reduced Envestnet’s calculated market share by 0.08%. Total Assets on Envestnet’s Platform vs. Advice Industry Fee-Based Assets Excluding Wirehouses ($T) AUM/A Net Flows ($B) Platform Accounts (M) Envestnet Metrics Managed Acct Market Share(2) N/A7.3%(3)7.4%7.1%6.5%6.2%5.7%5.6% $33$59$57$89$64$60$68$59 19.619.118.317.513.411.910.97.0

8 Well Positioned for Industry Trends © 2024 Envestnet, Inc. All rights reserved. *2024 T3 Advisor Software Survey Industry trends Envestnet as an industry leader Proof points The push to achieve greater scale • Unmatched breadth & depth of capabilities • Multi-channel leader across B-D and RIA • Ultra-configurable with scaled support and compliance • $6.0T+ of assets • 19.6M+ accounts • Top 3 in 13 different industry categories* The demand for personalization • Modern UMA chassis • Direct indexing 10-year track record • Variety of capabilities including tax overlay, high-net-worth consulting, and more Technology integration & consolidation • Stronger platform connectivity, from financial planning through execution • Next-gen proposal and new client portal • Custodial integrations Evolving practice management • Vast array of analytics to strengthen business intelligence • Pioneer in holistic wealth management • AUM net inflows in 2022- 2023 were 4x that of #2 and #3 TAMPs combined • Planning to execution, insights to proposal • Envestnet | Tamarac to managed account opening • Envestnet | MoneyGuide 17th consecutive year ranked #1 financial planning software*

9 Envestnet Key Metrics © 2024 Envestnet, Inc. All rights reserved. $ $ $ $ $ $ $ $ 75,000 80,000 85,000 90,000 95,000 100,000 105,000 110,000 115,000 120,000 125,000 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1.0T 2.0T 3.0T 4.0T 5.0T 6.0T 7.0T 8.0T 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 ENDING ASSETS OVER TIME ($T) 100, 0 101, 0 102, 0 103, 0 104, 0 105, 0 106,000 107,000 108,000 109,000 110,000 ADVISOR COUNT OVER TIME 10,000,100 12,000,100 14,000,100 16,000,100 18,000,100 20,000,100 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 ENDING ACCOUNTS OVER TIME

10 159.4 170.1 184.0 195.9 202.7 192.0 177.1 166.4 176.9 185.8 193.9 188.6 202.6 66.8 69.6 70.1 73.5 72.0 77.1 80.1 81.0 80.5 79.7 81.0 84.2 84.2 3.0 3.6 3.7 3.9 2.4 6.5 4.2 3.7 3.2 10.3 4.3 6.2 3.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Wealth: Asset-based Revenue Wealth: Subscription Revenue Wealth: Professional Services © 2024 Envestnet, Inc. All rights reserved. (in $millions) Wealth Solutions Revenue Trend KEY DRIVERS • Market Performance • AUM/A Net Flows • Net New Logos • Account & Advisor growth 11% YoY $229.2 $243.2 $257.9 $273.3 $277.1 $275.6 $261.4 $251.1 $260.6 $275.8 $279.2 $279.0 $289.8 01 02 03 04

11 43.0 42.9 43.4 44.6 42.7 41.0 43.7 40.2 36.6 35.2 33.9 33.6 33.3 2.9 2.6 1.7 1.8 1.5 2.3 1.6 1.6 1.4 1.4 3.7 5.1 1.8 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 D&A: Subscription Revenue D&A: Professional Services © 2024 Envestnet, Inc. All rights reserved. Data & Analytics Revenue Trend KEY DRIVERS • Market Environment • Bookings • Open Banking Pipeline (8)% YoY (in $millions) $45.9 $45.5 $45.2 $46.3 $44.3 $43.2 $45.3 $41.8 $38.1 $36.6 $37.6 $38.6 $35.1 01 02 03

12 159.4 170.1 184.0 195.9 202.7 192.0 177.1 166.4 176.9 185.8 193.9 188.6 202.6 66.8 69.6 70.1 73.5 72.0 77.1 80.1 81.0 80.5 79.7 81.0 84.2 84.2 43.0 42.9 43.4 44.6 42.7 41.0 43.7 40.2 36.6 35.2 33.9 33.6 33.3 5.9 6.2 5.5 5.6 3.9 8.8 5.8 5.2 4.7 11.7 8.0 11.2 4.9 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Wealth: Asset-based Revenue Wealth: Subscription Revenue D&A: Subscription Revenue Consolidated: Professional Services © 2024 Envestnet, Inc. All rights reserved. Total Company Revenue Trend 9% YoY 97% of Envestnet’s 2023 Revenue is Recurring (in $millions) $275.1 $288.7 $303.1 $319.6 $321.4 $318.9 $306.7 $292.9 $298.7 $312.4 $316.8 $317.6 $325.0

13 Total Platform Assets and Accounts © 2024 Envestnet, Inc. All rights reserved. Q1 2024 YoY Growth Accounts (M) 2%0.21st Party Managed(1) 7%1.7AUM(1) 15%1.3AUA 5%16.6Subscription 6%19.6Total Q1 2024 YoY Growth Assets ($B) 28%$401st Party Managed(1) 25%$452AUM(1) 24%$471AUA 13%$5,158Subscription 15%$6,082Total 1. 1st party managed represents assets directly managed, and overlay services provided, by Envestnet Asset Management. These accounts and assets are a component of AUM. 1% 6% 8% 85% Assets ($B) Q1’24 1% 7% 7% 85% Accounts (M) Q1’24

14 2024 First Quarter Results © 2024 Envestnet, Inc. All rights reserved. YoY Change %(2)1Q23 Adjusted Results(1)1Q24 Adjusted Results(1)1Q24 GAAP Results 9%$298.7$325.0$325.0Revenue 30%$54.0$70.4--Adjusted EBITDA(1) 30%$0.46$0.60$0.05Net income (loss) per diluted share --$(61.7)$(19.9)--Free cash flow(1) (in $millions except for per share amounts) 1. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. 2. YoY change represents 1Q24 results vs. 1Q23 results for Adjusted Results.

15 Adjusted EBITDA* © 2024 Envestnet, Inc. All rights reserved. INVESTMENT CYCLE Creating Efficiency & Expense Reduction Opportunities • Organization • Outsourcing • Real Estate • Automation • Integration • Platform Modernization Organic Revenue Growth + Accelerants AUM/A • RIA Managed Accounts • Retirement • Insurance • High Net Worth • Brokerage to Managed • Personalized Inv Solutions Subscription • Wealth Data Platform • Retirement • Agg & Verification • Asset Mgr. Partnerships *Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. $275.1 $288.7 $303.1 $319.6 $321.4 $318.9 $306.7 $292.9 $298.7 $312.4 $316.8 $317.6 $325.0 $68.3 $71.1 $66.2 $56.2 $54.8 $56.0 $52.3 $52.4 $54.0 $56.0 $65.3 $75.5 $70.4 25% 25% 22% 18% 17% 18% 17% 18% 18% 18% 21% 24% 22% $- $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 Adjusted Revenue* Adjusted EBITDA* Adjusted EBITDA* Margin ADDITIONAL OPPORTUNITIES Custody UMA Enhancements Scale from Revenue Growth and Operational Efficiency 01 02 03 (in $millions)

16 Balance Sheet and Liquidity © 2024 Envestnet, Inc. All rights reserved. CAPITAL POSITION AS OF MARCH 31, 2024 (in $millions) $18.7(1)Annual Cash Interest Expense$61.2Cash and Cash Equivalents Debt SOFR + spread(2)Revolving Line of Credit$0.0Outstanding on Revolving Line of Credit ($500) 0.75% couponConvertible Debt 2025$317.5Convertible Debt Maturing 2025 2.625% couponConvertible Debt 2027$575.0Convertible Debt Maturing 2027 Net Leverage Ratio 3.1x(3) 1. Annual Cash Interest Expense reflects 2024 forecast based on current debt and includes bank facility fees 2. We estimate the spread to be Adjusted SOFR + 225 bps based on our current leverage ratio 3. Net Leverage Ratio is calculated as of the end of the quarter as Net Debt (Total Debt less Cash)/TTM Adj EBITDA. Net leverage ratio is provided for illustrative purposes only. NET LEVERAGE RATIO 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 NET LEVERAGE RATIO

17 Q2 2024 Outlook © 2024 Envestnet, Inc. All rights reserved. 1. Non-GAAP financial measure. Reconciliations are not provided for guidance on such measures as the Company is unable to predict the amounts to be adjusted, such as the GAAP tax provision. Outlook midpoint compared to 2Q23 2Q24 Outlook (2/22/24) 3Q22 Outlook +9%$337.0 - $345.0Revenue +350 bps of margin improvement$71.0 - $75.0Adjusted EBITDA(1) +36%$0.60 - $0.65Adjusted Net Income per Diluted Share(1) (in $millions except for per share amounts)

Appendix

19 Committed to Corporate Social Responsibility © 2024 Envestnet, Inc. All rights reserved. Social & Human Rights Envestnet conducts our business in a responsible manner for our communities, our employees, our advisors and their clients. We fully support the basic rights of all individuals, follow fair and ethical labor practices and provide meaningful opportunities for development for our employees, promote giving back to the communities where we live and work and offer access to responsible investing. Commitment to the Environment We recognize that a healthy, sustainable future requires environmental stewardship, and we are committed to being mindful of the resources we consume. We continue to explore ways to further improve operational effectiveness and decrease our energy usage and carbon emissions. Strong Corporate Governance We are committed to the long-term success of Envestnet, as well as our shareholders, customers and employees, through strong corporate governance and ethical business practices. Envestnet is committed to empowering Financial Wellness for our communities, our employees, our advisors, and their clients

20 Key factors to our success © 2024 Envestnet, Inc. All rights reserved. 01 Leading competitive market position – WealthTech, Solutions, and Data & Analytics 02 Secular tailwinds and opportunities to seize growth 03 Vast market opportunity with organic growth potential 04 Our investments deepen client engagement and expand addressable market 05 Compelling business model with recurring revenue and operating leverage 06 Integrated offering with partnership and acquisition opportunity

21 Illustrative Market Impact on Annualized Financials © 2024 Envestnet, Inc. All rights reserved. • Assuming +/-5% market change(1) (in $millions) Asset-based revenue ~$39 Direct expense ~$23 Adjusted EBITDA(2) unmitigated ~$16 Management has visibility into expected performance allowing operating decisions that may impact hiring plans, variable compensation and other spending initiatives. 1. Amounts represent annualized impact applicable to a 5% change in asset values on 1Q24 Annualized Revenue 2. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures.

22 Illustrative Market Impact Calculations • Approximately 75% of our asset-based revenue is billed quarterly, in advance. As such, the majority of any market impact would be seen in future quarters. • More than half of our asset-based revenue is paid to third party managers and strategists. This naturally reduces the impact on our profit from a market decline. • This represents the unmitigated impact. Depending on the severity of the impact, management may choose to offset a portion of this impact through lower variable compensation and changing its discretionary hiring and spending plans. (a) Blended Market Change refers to the weighted performance of an equity/bond portfolio. The above calculation assumes a 60/40 portfolio in a situation where both markets decline 5%. *Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. Illustrative Market Impact Model Assumptions ($ in millions) Total Revenue 1Q24 revenue, annualized $1,300 x % asset-based ~60% of total revenue 60% x % Blended Market Change(a) See below calculation -5% = Revenue impact ($39) - Impact on asset-based direct expenses ~60% of asset-based revenue ($23) = Impact on Adjusted EBITDA(*) Unmitigated impact ($16) (a)Blended Market Change % exposure to equity 60% equity allocation 60% x % equity market performance Assuming 5% equity market decline -5% + % exposure to bond market 40% bond allocation 40% x % bond market performance Assuming 5% bond market decline -5% = Blended Market Change -5% © 2024 Envestnet, Inc. All rights reserved.

23 Q1 Revenue Mix © 2024 Envestnet, Inc. All rights reserved. Three Months Ended March 31 20232024 Total Envestnet Data & Analytics Envestnet Wealth SolutionsTotal Envestnet Data & Analytics Envestnet Wealth Solutions (in thousands) Revenue: $ 176,932$ —$ 176,932$ 202,616$ —$ 202,616Asset-based 117,07936,60980,470117,46233,29484,168 Subscription-based 294,01136,609257,402320,07833,294286,784Total recurring revenue 4,6961,4493,2474,8721,8463,026Professional services and other revenue $ 298,707$ 38,058$ 260,649$ 324,950$ 35,140$ 289,810Total Revenue (7)%(14)%(6)%9%(8)%11%YoY % Growth This chart shows Q4 2023 and Q4 2022 with Wealth Analytics as a part of the Wealth Solutions Segment.

24 Outlook Table © 2024 Envestnet, Inc. All rights reserved. The Company provided the following outlook for the quarter ending June 30, 2024. This outlook is based on the market value of assets on March 31, 2024. We caution that we cannot predict the market value of our assets on any future date. See slide 2 for more information. (a) The Company does not forecast net income and net income per diluted share due to the unpredictable nature of various items adjusted for non-GAAP disclosure purposes, including the periodic GAAP income tax provision. (1) Non-GAAP financial measure. Reconciliations are not provided for guidance on such measures as the Company is unable to predict the amounts to be adjusted, such as the GAAP tax provision. 2Q 2024(in millions, except Adjusted EPS) GAAP: Revenue: $ 214.5 -$ 211.5 Asset-based 118.0-115.0Subscription-based 332.5-326.5Total recurring revenue 12.5-10.5Professional services and other revenue $ 345.0 -$ 337.0 Total revenue $ 126.5 -$ 125.0 Asset-based direct expense $ 141.0 -$ 139.5 Total direct expense (a)Net income (loss) 66.5Diluted shares outstanding (a)Net income (loss) per diluted share Non-GAAP: $ 75.0 -$ 71.0 Adjusted EBITDA(1) $ 0.65 -$ 0.60 Adjusted net income per diluted share(1)

25 Reconciliation of Non-GAAP Financial Measures © 2024 Envestnet, Inc. All rights reserved. Three Months Ended March 31, 20232024(in thousands) (unaudited) $ (42,761)$ 539Net income (loss) Add (deduct): 52—Deferred revenue fair value adjustment (1,358)(1,983)Interest income 6,3206,089Interest expense 23,7691,505Income tax provision 31,52033,892Depreciation and amortization 19,45318,898Non-cash compensation expense 4,1632,056Restructuring charges and transaction costs 6,1883,425Severance expense 3,0742,288Litigation, regulatory and other governance related expenses 33275Foreign currency (168)(49)Non-income tax expense adjustment 2,9402,283Loss allocations from equity method investments 7781,160Loss attributable to non-controlling interest $ 54,003$ 70,378Adjusted EBITDA

26 Reconciliation of Non-GAAP Financial Measures © 2024 Envestnet, Inc. All rights reserved. Three Months Ended March 31, 20232024(In thousands, except share and per share information) (unaudited) $ (42,761)$ 539 Net income (loss) 23,7691,505Income tax provision (18,992)2,044Income (loss) before income tax provision Add (deduct): 52 —Deferred revenue fair value adjustment 1,4421,405Non-cash interest expense 4,5654,369Cash interest – Convertible Notes 16,94014,742Amortization of acquired intangibles 19,45318,898Non-cash compensation expense 4,1632,056Restructuring charges and transaction costs 6,1883,425Severance expense 3,0742,288Litigation, regulatory and other governance related expenses 33275Foreign currency (168)(49)Non-income tax expense adjustment 2,9402,283Loss allocations from equity method investments 7781,160Loss attributable to non-controlling interest 40,46852,896Adjusted net income before income tax effect (10,319)(13,489)Income tax effect $ 30,149 $ 39,407 Adjusted net income 54,143,25954,884,074Basic number of weighted-average shares outstanding Effect of dilutive shares: 11,470,64510,811,884Convertible Notes 463,719473,738Non-vested RSUs and PSUs 88,32327,254Options to purchase common stock 66,165,94666,196,950Diluted number of weighted-average shares outstanding $ 0.46 $ 0.60 Adjusted net income per diluted share

27 Reconciliation of Non-GAAP Financial Measures © 2024 Envestnet, Inc. All rights reserved. Three Months Ended March 31, 20232024(in thousands) (unaudited) $ (33,673)$ 1,944Net cash provided by (used in) operating activities (4,402)(1,900)Less: Purchases of property and equipment (23,664)(19,953)Less: Capitalization of internally developed software $ (61,739)$ (19,909)Free cash flow

v3.24.1.u1

Cover Page

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

ENVESTNET, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34835

|

| Entity Tax Identification Number |

20-1409613

|

| Entity Address, Address Line One |

1000 Chesterbrook Boulevard

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Berwyn

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19312

|

| City Area Code |

312

|

| Local Phone Number |

827-2800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.005 per share

|

| Trading Symbol |

ENV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001337619

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |