false

2024

--12-31

FY

false

0000944075

6509725

6332704

2604137

2816661

3088087

3292033

2604137

2816661

3292033

0000944075

2024-01-01

2024-12-31

0000944075

2024-06-30

0000944075

2024-12-31

0000944075

2023-12-31

0000944075

2023-01-01

2023-12-31

0000944075

us-gaap:CommonStockMember

2022-12-31

0000944075

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000944075

us-gaap:TreasuryStockCommonMember

2022-12-31

0000944075

us-gaap:RetainedEarningsMember

2022-12-31

0000944075

2022-12-31

0000944075

us-gaap:CommonStockMember

2023-12-31

0000944075

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0000944075

us-gaap:TreasuryStockCommonMember

2023-12-31

0000944075

us-gaap:RetainedEarningsMember

2023-12-31

0000944075

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0000944075

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0000944075

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0000944075

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0000944075

us-gaap:CommonStockMember

2024-01-01

2024-12-31

0000944075

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-12-31

0000944075

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-12-31

0000944075

us-gaap:RetainedEarningsMember

2024-01-01

2024-12-31

0000944075

us-gaap:CommonStockMember

2024-12-31

0000944075

us-gaap:AdditionalPaidInCapitalMember

2024-12-31

0000944075

us-gaap:TreasuryStockCommonMember

2024-12-31

0000944075

us-gaap:RetainedEarningsMember

2024-12-31

0000944075

us-gaap:SupplierConcentrationRiskMember

2024-01-01

2024-12-31

0000944075

us-gaap:SupplierConcentrationRiskMember

2023-01-01

2023-12-31

0000944075

SCKT:BlueStarMember

2024-12-31

0000944075

SCKT:ScanSourceMember

2024-12-31

0000944075

SCKT:ScanSourceMember

2023-12-31

0000944075

SCKT:IngramMicroMember

2024-12-31

0000944075

SCKT:IngramMicroMember

2023-12-31

0000944075

SCKT:SynnexMember

2023-12-31

0000944075

SCKT:NipponPrimexMember

2023-12-31

0000944075

srt:AmericasMember

2024-01-01

2024-12-31

0000944075

srt:AmericasMember

2023-01-01

2023-12-31

0000944075

us-gaap:EMEAMember

2024-01-01

2024-12-31

0000944075

us-gaap:EMEAMember

2023-01-01

2023-12-31

0000944075

srt:AsiaPacificMember

2024-01-01

2024-12-31

0000944075

srt:AsiaPacificMember

2023-01-01

2023-12-31

0000944075

SCKT:TotalMember

2024-01-01

2024-12-31

0000944075

SCKT:TotalMember

2023-01-01

2023-12-31

0000944075

SCKT:BlueStarMember

2024-01-01

2024-12-31

0000944075

SCKT:BlueStarMember

2023-01-01

2023-12-31

0000944075

SCKT:IngramMicroMember

2024-01-01

2024-12-31

0000944075

SCKT:IngramMicroMember

2023-01-01

2023-12-31

0000944075

SCKT:ScanSourceMember

2023-01-01

2023-12-31

0000944075

2023-02-01

0000944075

2020-08-31

0000944075

2020-08-31

2023-08-30

0000944075

2020-08-28

0000944075

2021-01-01

2021-12-31

0000944075

2021-12-31

0000944075

2023-05-26

0000944075

2023-05-26

2026-05-26

0000944075

2024-08-21

0000944075

2024-08-21

2027-08-21

0000944075

SCKT:CostOfRevenueMember

2024-01-01

2024-12-31

0000944075

SCKT:CostOfRevenueMember

2023-01-01

2023-12-31

0000944075

SCKT:ResearchAndDevelopmentMember

2024-01-01

2024-12-31

0000944075

SCKT:ResearchAndDevelopmentMember

2023-01-01

2023-12-31

0000944075

SCKT:SalesAndMarketingMember

2024-01-01

2024-12-31

0000944075

SCKT:SalesAndMarketingMember

2023-01-01

2023-12-31

0000944075

SCKT:GeneralAndAdministrativeMember

2024-01-01

2024-12-31

0000944075

SCKT:GeneralAndAdministrativeMember

2023-01-01

2023-12-31

0000944075

2024-06-25

0000944075

us-gaap:StockOptionMember

2022-12-31

0000944075

us-gaap:StockOptionMember

2023-01-01

2023-12-31

0000944075

us-gaap:StockOptionMember

2023-12-31

0000944075

us-gaap:StockOptionMember

2024-01-01

2024-12-31

0000944075

us-gaap:StockOptionMember

2024-12-31

0000944075

us-gaap:EmployeeStockOptionMember

2024-12-31

0000944075

us-gaap:EmployeeStockOptionMember

2023-12-31

0000944075

SCKT:SubordinatedConvertibleNoteMember

2024-12-31

0000944075

SCKT:SubordinatedConvertibleNoteMember

2023-12-31

0000944075

SCKT:WarrantToPurchaseCommonStockMember

2024-12-31

0000944075

SCKT:WarrantToPurchaseCommonStockMember

2023-12-31

0000944075

SCKT:TreasuryStockReservedForFutureGrantsMember

2024-12-31

0000944075

SCKT:TreasuryStockReservedForFutureGrantsMember

2023-12-31

0000944075

2025-01-01

2025-03-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| (X) | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

| ( ) | TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______. |

Commission file number

1-13810

SOCKET MOBILE, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

94-3155066 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

40675 Encyclopedia

Circle Fremont CA 94538

(Address of principal

executive offices including zip code)

(510) 933-3000

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, $0.001 Par Value per Share |

SCKT |

NASDAQ |

Securities registered pursuant to Section 12(g) of the Exchange Act: NONE

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically every Interactive Data File required to be submitted and posted pursuant to Rule405 of Regulation S-T (§ 232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer

[X] Smaller reporting company [X]

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

[ ]

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. [ ]

Indicate by check mark whether any of those error corrections are

restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers

during the relevant recovery period pursuant to §240.10D-1(b). [ ]

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

As of June 30, 2024, the aggregate market value of the

registrant’s Common Stock ($0.001 par value) held by non-affiliates of the registrant was $6,231,799 based on the closing sale

price as reported on the NASDAQ Marketplace system.

The number of shares of Common Stock ($0.001 par value) outstanding as

of March 21, 2025: 7,952,988 shares.

DOCUMENTS INCORPORATED

BY REFERENCE

Items 10, 11, 12, 13, and 14 of Part III are incorporated

by reference from the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held on June 4, 2025. Such Proxy

Statement will be filed within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

TABLE OF CONTENTS

PART I

Forward-Looking Statements

This Annual Report contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These statements include statements forecasting our future financial condition and results, our future operating activities,

market acceptance of our products, expectations for general market growth of mobile computing devices, growth in demand for our data capture

products, expansion of the markets that we serve, expansion of the distribution channels for our products, and the timing of the introduction

and availability of new products, as well as other forecasts discussed under “Management’s Discussion and Analysis of Financial

Condition and Results of Operations.” Words such as “may,” “will,” “predicts,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,”

variations of such words, and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements

are based on current expectations, estimates, and projections about our industry, management’s beliefs and assumptions. These forward-looking

statements are not guarantees of future performance and are subject to risks and uncertainties; therefore, actual results and outcomes

may differ materially from what is expressed or forecasted in any such forward-looking statements. Factors that could cause actual results

and outcomes to differ materially include, but are not limited to: volatility in the world economy generally and in the markets we serve

in particular, including the impact of Russia’s military action against Ukraine; the risk of delays in the availability of our products

due to technological, market or financial factors including the availability of product components and necessary working capital; our

ability to successfully develop, introduce and market future products; our ability to effectively manage and contain our operating costs;

the availability of third-party hardware and software that our products are intended to work with; product delays associated with new

model introductions and product changeovers by the makers of products that our products are intended to work with; continued growth in

demand for barcode scanners; market acceptance of emerging standards such as RFID/Near Field Communications and of our related data capture

products; the ability of our strategic relationships to benefit our business as expected; our ability to enter into additional distribution

relationships; and other factors described in this Form 10-K including “Item 1A. Risk Factors” and recent Form 8-K and Form

10-Q reports filed with the Securities and Exchange Commission. We assume no obligation to update such forward-looking statements or to

update the reasons why actual results could differ materially from those anticipated in such forward-looking statements.

You should read the following discussion in conjunction

with the financial statements and notes included elsewhere in this report, and other information contained in other reports and documents

filed from time to time with the Securities and Exchange Commission.

Item 1. Business

General

We are a leading provider of data capture and delivery

solutions for enhanced productivity in workforce mobilization. Our products are incorporated into mobile applications used in point of

sale (POS), commercial services (field workers), asset tracking, manufacturing process and quality control, transportation and logistics

(goods tracking and movement), event management (ticketing, entry, access control, and identification), medical and education. Our primary

products are cordless data capture devices incorporating barcode scanning or RFID/Near Field Communications (NFC) technologies that connect

over Bluetooth. All products work with applications running on smartphones, mobile computers and tablets using operating systems from

Apple® (iOS), Google™ (Android™) and Microsoft® (Windows®). We offer an easy-to-use software developer kit (CaptureSDK)

to app providers, which enables them to provide their users with our advanced barcode scanning features. Our products are integrated in

their application solutions and are marketed by the app providers or the resellers of their applications. The number of our registered

app providers for data capture applications continues to grow.

We were founded in March 1992 as Socket Communications,

Inc. and reincorporated in Delaware in 1995 prior to our initial public offering in June 1995. We have financed our operations since inception

primarily from selling equity capital or convertible debt, receivables-based revolving lines of credit and term loans with our bank. We

began doing business as Socket Mobile, Inc. in January 2007 to better reflect our market focus on the mobile business market and changed

our legal name to Socket Mobile, Inc. in April 2008. Our common stock trades on the NASDAQ Capital Market under the symbol “SCKT”.

Our principal executive offices are located at 40675 Encyclopedia Circle, Fremont, CA 94538, and our phone number is (510) 933-3000.

Our Internet home page is https://www.socketmobile.com;

however, the information on or that can be accessed through it is not part of this Annual Report. Our annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K, and any amendments to such reports are available free of charge on or through our internet

home page as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange

Commission.

Products

Our primary products are cordless data capture devices

incorporating barcode scanning or RFID/Near Field Communications (NFC) technologies that connect over Bluetooth. All products work with

applications running on smartphones, mobile computers and tablets using operating systems from Apple® (iOS), Google™ (Android™)

and Microsoft® (Windows®). We offer an easy-to-use software developer kit (CaptureSDK) to app providers, which enables them to

provide their consumers with our advanced barcode scanning features. Our products are integrated by the app providers and are marketed

by the app providers or their resellers. The number of app providers supporting our data capture solutions continues to grow.

XtremeScan family. Our XtremeScan product line

consists of three configurations: XtremeScan Case, XtremeScan, and XtremeScan Grip, all designed for iPhone. This product family marks

a significant milestone in our commitment to delivering high-quality data capture solutions for customers in industrial, manufacturing,

warehousing, oil and gas, and airports. XtremeScan enables iPhones to withstand harsh industrial conditions, offering robust scanning

capabilities with military-grade durability. The product family expanded in 2024 with the introduction of several XtremeScan Mag devices,

catering for the growing number of workers using a single phone for both personal and business needs. The Bring Your Own Device ( BYOD)

market is a significant yet underserved segment where we see strong growth potential. XtremeScan is fully compatible with iPhone 16e,

a durable, cost-effective device designed for industrial environments. With an extra-long battery life, enhanced drop resistance, and

the trusted iOS platform, it is expected to become the go-to device for demanding industrial sectors. XtremeScan, combined with iPhones16e,

will empower industrial businesses with durable, adaptable, and future-ready data capture technology.

SocketCam family. Our camera-based barcode

scanning software includes SocketCam C820 and C860, compatible with both iOS and Android. The C820 is a free, easily integrated camera

scanning solution, while the C860 offers a significant upgrade for users with advanced scanning needs. The C860 stands out due to its

swift and accurate reading of damaged barcodes and exceptional performance in poor lighting conditions, setting it apart in the industry.

Both C820 and C860 enable App providers to serve a wide range of customers with diverse data capture requirements, from price-sensitive

to performance-sensitive. End-users needing more than a free camera-based scanners can upgrade to advanced C860 or opt for a Socket hardware

scanner.

DuraScan® Family. Our DuraScan® family

includes the 600 Series NFC & RFID readers (D600), 700 Series companion scanners (D700, D720, D730, D740, D745, D755, D760, D762),

800 Series attachable scanners (D800, D820, D840, D860), and the Wearable 900 Series (DW930, DW940). Designed for rugged work environments,

DuraScan data readers offer exceptional durability, making them ideal for industries such as warehousing, manufacturing, and distribution.

SocketScan family. Our SocketScan family offers

a range of versatile solutions designed for seamless integration into various business applications. It includes the 300 Series countertop

readers (S320, S370), the 500 Series NFC Mobile Wallet Reader (S550), the 700 Series companion scanners (S700, S720, S730, S740), and

the 800 Series attachable scanners (S800, S820, S840, S860). With an easy setup process and user-friendly design, SocketScan enhances

efficiency by delivering fast, high-performance 1D/2D scanning while reducing human errors. Whether scanning barcodes, reading NFC data,

or handling combo applications, SocketScan ensures accuracy and reliability across diverse industries.

DuraSled Family. Our DuraSled (DS800, DS820,

DS840, DS860) integrates a smartphone with a high-performance, protective barcode sled scanner, creating a one-handed solution. Designed

for efficiency, these sled scanners offer native support with select Apple and Samsung smartphones, enabling full application control

of a one-handed data collection experience.

Software Developer Kit (CaptureSDK). Our CaptureSDK

supports all Socket Mobile data capture devices through a single integration, simplifying the process for app developers to incorporate

our data capture capabilities into their applications. By installing our SDK, developers enable their customers to select the most suitable

Socket Mobile products for their needs. CaptureSDK allows developers to modify captured data, control the placement of barcode or RFID

data within their applications, and manage user feedback to confirm successful transactions and data transmissions. Additionally, CaptureSDK

includes SocketCam, a feature that enables the use of a device's built-in camera for occasional or lower-volume data collection requirements.

CaptureSDK is compatible with development tools such as Swift Package Manager, Maven, and NuGet, and supports high-level frameworks including

MAUI, React Native, Java, JavaScript, and Flutter, facilitating seamless integration of our data capture solutions into diverse applications.

We design our own products and are responsible for

all associated test equipment. We subcontract the manufacturing of all our product components to independent third-party contract manufacturers

located in the United States, Mexico, Taiwan, Singapore, Malaysia and China that have the equipment, know-how and capacity to manufacture

products to our specifications. We perform final product assembly, testing and packaging at, and distribute our products from, our Fremont,

California facility. We offer our products worldwide through two-tier distribution enabling customers to purchase from large numbers of

online resellers around the world including app providers who resell their own solutions along with our data capture products. Our products

are also available on our online stores.

We believe growth in mobile applications and the mobile

workforce resulting from technical advances in mobile technologies, cost reductions in mobile devices and the growing adoption by businesses

of mobile applications for smartphones and tablets, builds a growing demand for our products. Our data capture products address the need

for speed and accuracy by today’s mobile workers and by the systems supporting those workers, thereby enhancing their productivity

and allowing them to exploit time-sensitive opportunities and improve customer satisfaction.

Our Mission, Vision, and Core Values

Our mission is to supply innovative and cost-effective

data capture tools for businesses that use mobile platforms to conduct business in mobile environments.

Our vision is to manage the complexity of capturing

and delivering data across a spectrum of data sources, network technologies, and mobile systems so that our customers can concentrate

on applications of the data. Our customers are app providers and their consumers in need of data capture solutions.

We have embraced the following core values:

Accountability: We take ownership and

responsibility for our actions and performance. We learn from our mistakes and celebrate our successes.

Customer Focus: We live by and for our

customer’s success. We want to earn their top-of-mind choice, enhance their final customer experience, and create value through

our relationship.

Excellence: We take pride in what we make

and do and value the creativity, talent, ambition, and drive of each employee to be his or her best and to achieve superior results.

Integrity: We are honest and ethical in

all our dealings with each other, customers, business partners, suppliers, competitors, and other stakeholders. We say what we mean and

mean what we say.

Mutual Respect: We value people's differences

and diverse opinions, and we treat each other fairly.

Marketing Dynamics

Application provider relationships. We actively

support app providers to integrate our data capture solutions into their applications. We provide an easy-to-use software developer kit

(CaptureSDK) and training and technical support to app providers. We support the marketing activities of app providers in promoting the

applications that include our products. Once our data capture products are integrated by the app provider, our products become an ingredient

of the application solution and part of the app provider’s marketing program. We provide regular CaptureSDK updates including updates

that support the latest operating system updates provided by Apple, Google, and Microsoft. We spend extensive engineering time and resources

to ensure that our products are compatible with a wide variety of the most popular smartphones, tablets, and mobile computers running

a variety of operating systems. We comply with the standards set by the standard-setting bodies whose technologies are used in our products

such as Bluetooth SIG, NFC Forum, GS1, AIM Global, CIPURSE, and FeliCa.

Mobile Markets. Our revenues are primarily

driven by sales of barcode scanners integrated into mPOS (mobile Point of Sale) applications used with Apple tablets and other mobile

devices. Many mPOS application providers develop software for smaller retailers using tablets as cash registers. Other mobile markets

addressed by app providers include commercial services (field workers), asset tracking, manufacturing process and quality control, transportation

and logistics (goods tracking and movement), event management (ticketing, entry, access control, and identification), medical and education.

We expect these markets to increase the use of mobile applications and the demand for barcode scanners.

Expanded and improved product offerings. We

offer a wide range of products that enable app providers and their consumers to design their mobile systems to meet their specific requirements,

and we encourage our distributors to support the full range of our products. The goal is for customers to view Socket Mobile as a primary

source for their mobile data capture needs. Our products include stand-alone barcode scanners in both durable and standard cases, attachable

barcode scanners, RFID/NFC reader/writer and camera-based scanning software. We provide a software developer kit to app providers to enable

our advanced data capture software to be easily integrated into applications. See “Item 1 Business. The Company and its Products”

for a more detailed description of our products.

We design our products to comply with the regulations

of the many worldwide agencies that regulate the safety, performance, and use of electronic products.

Competitive pricing. We have designed our products

to be priced competitively although we are subject to changes in component pricing by our suppliers. We update our products from time

to time and work with our vendors to achieve reductions in component pricing.

Worldwide product availability. We distribute

our products through a worldwide distribution network that places products into geographic regions to shorten purchasing time and provides

a credit shield to us. Our largest distributors are Ingram Micro®, ScanSource® and Blue Star, and they support a worldwide network

of online resellers including Shopify®, Amazon.com, and CDW®. We also offer products in our own online stores.

Strong Brand Name. We believe that our products

make a difference in the daily work life of mobile workers and the people they serve. We are building a brand image focused on business

mobility. This image closely associates us with business mobility solutions and to reflect this image, we began doing business as Socket

Mobile, Inc. in January 2007 and changed our legal name to Socket Mobile, Inc. in April 2008. We stress to customers the design of our

products for the markets they serve, emphasizing quality and standards-based connectivity. Mobility requires products that are compact

and designed to be handled while mobile, with low power consumption to extend the time between charges and are easy to use. We strive

to offer high-performance products at a wide range of competitive prices. Through our developer support program, we work closely with

app providers who are developing productivity-enhancing applications for the mobile workforce. Our overall company brand identity and

positioning goal is to be a leading provider of easy-to-deploy business mobility data capture systems to the business mobility market.

Competition and Competitive Risks

The overall market for mobile handheld data capture

solutions is both complex and competitive. Our products compete with similar products in all our markets in the United States, Europe

and Asia, and we differentiate our products with our software developer kit and our underlying data capture software designed to work

with smartphones, tablets, and other mobile computers running the Apple, Android and Windows operating systems. Our longtime focus on

creating innovative mobile solutions for the mobile workforce has resulted in good brand name recognition and reputation. We believe that

our brand name identifies our products as durable, dependable, ergonomic, and easy to use, all features designed for a mobile worker while

mobile, and the breadth of our product offerings, including the extensively advanced features of our software and software developer kit,

will continue to differentiate us relative to our competitors.

Cordless Barcode Scanning. We offer a full

range of cordless barcode scanners designed to connect to smartphones, tablets, and other computing devices via Bluetooth. Our Software

Developer Kit (CaptureSDK) empowers app providers to integrate the capabilities of our Data Capture software into their applications,

setting our products apart. Our cordless barcode scanners face competition from similar products by Koamtec, Code Corporation and Opticon

(Japan). Users may choose a barcode scanner that connects directly to an Apple tablet, iPhone or a computer, as offered by Infinite Peripherals

and Honeywell. Alternatively, users may choose more rugged barcode scanners, with some integrated into computing devices from manufacturers

such as Datalogic, Honeywell®, and Zebra Technologies. Many of these devices lack Apple certification and connect to Apple devices

via Bluetooth in keyboard emulation mode. They may not offer extensive tools for app providers, such as our software developer kit (CaptureSDK),

to integrate the features of our sophisticated data collection scanning software and hardware. This could potentially limit their ability

to meet the consumer’s requirements fully.

NFC & RFID Contactless Reader/Writer. We

offer products that are certified by Apple Pay® Value Added Service (VAS), Google Wallet Smart Tap, NFC Forum, FeliCa®, and Bluetooth

SIG. Additionally, we provide a combo NFC & QR code mobile wallet reader, which combines NFC contactless technology with Bluetooth

barcode scanning data capture. These devices are compatible with Android, Apple iOS and Windows. They support all NFC Forum tag types

and devices compliant with the ISO 18092 standard, as well as ISO 14443 Type A and B smart cards, ISO 15693 tags, MIFARE®, FeliCa®,

NXP, and STMicro tags. They can also read Digital ID / mDL (Mobile Driver’s License). We face

challenges with the limitations on NFC usage in iPhones, although Apple has opened up some NFC capabilities to developers. We are exploring

new markets while working with current App developers to adopt our NFC reader/writer, giving us an advantage against competitors.

Camera Barcode Scanning. We offer two camera-based

barcode scanning products: the C820, a free and easily integrated camera scanning solution, and the C860, an upgraded and advanced scanning

solution. The C860's standout feature is its ability to read damaged barcodes swiftly and accurately, even in poor lighting conditions,

setting it apart from others in the industry. Our camera-scanning solutions face competition from applications provided by Scandit or

Manatee Works. However, our business model ensures affordability and flexibility, making our camera-scanning solutions accessible to a

wide range of businesses. Our App partners receive camera scanning solutions at no charge, which encourages them to adopt our solutions.

Users of their apps pay for the solutions only if the C860 is selected. For end users, most of their needs can be met with our free camera

scanning solution, except for a small percentage of needs requiring the advanced solution, C860. This makes our camera scanning solution

ideal for end users as well.

Proprietary Technology and Intellectual Property

We have been granted U.S. patents and design patents

and have other patent applications under review. We have registered trademarks with the U.S. Patent and Trademark Office for the mark

“Socket”, our logo, DuraScan, SocketScan, SocketCam, and XtremeScan.

We have developed technological building blocks that

enhance our ability to design new hardware and software products, offer products that run on multiple software and hardware platforms,

and manufacture and package products efficiently.

We own and control the design of our products, enabling

us to modify its features or software to meet specific customer requirements.

We have developed software programs that provide unique

functions and features for our data collection products. For example, our data collection software enables our barcode scanning products

to scan a variety of barcodes and to route the data to many different types of data files on operating systems used in Apple, Android,

and Windows mobile devices. We use Bluetooth technology to provide a completely functional Bluetooth solution enabling connections and

data transfers between Bluetooth-enabled devices. Our companion applications assist Apple iOS, Android and Windows users with the proper

setup and use of our data capture products.

We rely on a combination of patent, copyright, trademark

and trade secret laws, and confidentiality procedures to protect our proprietary rights. As part of our confidentiality procedures, we

generally enter into non-disclosure agreements with our employees, distributors and strategic partners, and limit access to our software,

documentation and other proprietary information. Despite these precautions, it may be possible for a third-party to copy or otherwise

obtain and use our products or technology without authorization, or to develop similar technology independently. In addition, we may not

be able to effectively protect our intellectual property rights in certain foreign countries. From time to time, we receive communications

from third parties asserting that our products infringe, or may infringe, their proprietary rights. Litigation could be brought against

us that could result in significant additional expense or compel us to discontinue or redesign some of our products.

Personnel

Our future success will depend in significant part

upon the continued service of certain of our key technical and senior management personnel, and our continuing ability to attract, assimilate

and retain highly qualified technical, managerial, and sales and marketing personnel. Our total employee headcount was 59 and 61 as of

December 31, 2024 and 2023, respectively. Our employees are not represented by a union, and we consider our employee relationships to

be good. As of December 31, 2024, we had 22 persons in sales, marketing, and customer service, 13 persons in development engineering,

7 persons in finance and administration, and 17 persons in operations.

Item 1A. Risk Factors.

Ownership of the Company’s securities involves

a number of risks and uncertainties. Potential investors should carefully consider the risks and uncertainties described below and the

other information in this Annual Report on Form 10-K and our other public filings with the Securities and Exchange Commission before deciding

whether to invest in the Company’s securities. The Company’s business, financial condition or results of operations could

be materially adversely affected by any of these risks. The risks described below are not the only ones facing the Company. Additional

risks that are currently unknown to the Company or that the Company currently considers immaterial may also impair its business or adversely

affect its financial condition or results of operations.

We may not return to profitability.

To return to profitability, we must accomplish numerous

objectives, including achieving continued growth in our business, providing ongoing support to registered App providers whose applications

support the use of our data capture products, and developing successful new products. We cannot foresee with any certainty whether we

will be able to achieve these objectives in the future. Accordingly, we may not generate sufficient revenue or control our expenses enough

to maintain ongoing profitability. If we cannot return to profitability, we will not be able to support our operations from positive cash

flows, and we would be required to use our existing cash to support operating losses. If we are unable to secure the necessary capital

to replace that cash, we may need to suspend some or all of our current operations.

We may require additional capital in the future, but that capital may

not be available on reasonable terms, if at all, or on terms that would not cause substantial dilution to investors’ stock holdings.

We may need to raise capital to fund our growth or

operating losses in future periods. Our forecasts are highly dependent on factors beyond our control, including market acceptance of our

products and delays in deployments by businesses of applications that use our data capture products. Even if we maintain profitable operating

levels, we may need to raise capital to provide sufficient working capital to fund our growth. If capital requirements vary materially

from those currently planned, we may require additional capital sooner than expected. There can be no assurance that such capital will

be available in sufficient amounts or on terms acceptable to us, if at all.

In order to maintain the availability of our bank lines of credit we

must remain in compliance with the covenants as specified under the terms of the credit agreements and the bank may exercise discretion

in making advances to us.

Our credit agreements with our bank require us to

remain in compliance with the covenants specified under the terms of the agreement. The agreements also contain customary affirmative

and negative covenants, including covenants that limit or restrict our ability to, among other things, grant liens, make investments,

incur indebtedness, merge or consolidate, dispose of assets, make acquisitions, pay dividends or make distributions, repurchase stock,

enter into transactions with affiliates and enter into restrictive agreements, in each case subject to customary exceptions for a credit

facility of this size and type. The agreements also contain customary events of default including, among others, payment defaults, breaches

of covenants, bankruptcy and insolvency events, cross defaults with certain material indebtedness, judgment defaults, and breaches of

representations and warranties. Upon an event of default, our bank may declare all or a portion of our outstanding obligations payable

to be immediately due and payable and exercise other rights and remedies provided for under the agreement. During the existence of an

event of default, interest on the obligations could be increased. The agreements may be terminated by us or by our bank at any time. Upon

such termination, our bank would no longer make advances under the credit agreement and outstanding advances would be repaid as receivables

are collected. All advances are at our bank’s discretion and our bank is not obligated to make advances.

If app providers are not successful in their efforts to develop, market

and sell the applications into which our software and products are incorporated, we may not achieve our sales projections.

We are dependent upon App providers to integrate our

scanning and software products into their applications designed for mobile workers using smartphones, tablets and mobile computers, and

to successfully market and sell those application products and solutions into the marketplace. We focus on serving the needs of App providers

as sales of our data capture products are application driven. However, these providers may take considerable time to complete the development

of their applications, may experience delays in their development timelines, may develop competing applications, may be unsuccessful in

marketing and selling their application products and solutions to customers, or may experience delays in customer deployments and implementations,

which would adversely affect our ability to achieve our revenue projections.

A deterioration in global economic conditions may have adverse impacts

on our business and financial condition in ways that we currently cannot predict and may limit our ability to raise additional funds.

If global economic conditions deteriorate, it may

impact our business and our financial condition. We may face significant challenges if conditions in the financial markets worsen. The

impact of such future developments on our business, including the ongoing military action in Ukraine by Russia, is highly uncertain and

cannot be predicted. If the overall economy continues to decline for an extended period, our results of operations, financial position

and cash flows may be materially adversely affected. In addition, a severe prolonged economic downturn could result in a variety of risks

to the business, including impairing our ability to pursue potential opportunities and limiting our ability to raise additional capital

when needed on acceptable terms, if at all.

Failure to maintain effective internal controls could have a material

adverse effect on our business, operating results, and stock price.

We have evaluated and will continue to evaluate our

internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires an annual management

assessment of the design and effectiveness of our internal control over financial reporting. If we fail to maintain the adequacy of our

internal controls, as such standards are modified, supplemented, or amended from time to time, we may not be able to ensure that we can

conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley

Act. Moreover, effective internal controls, particularly those related to revenue recognition and access to assets, are necessary for

us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial

reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial

information, and the trading price of our stock could drop significantly.

Despite security protections, our business records and information could

be hacked by unauthorized personnel.

We protect our business records and information from

access by unauthorized personnel and are not aware of any instances where such data has been compromised. We maintain adequate segregation

of duties in safeguarding our assets and related records and monitor our systems to detect any attempts to bypass our controls and procedures

which we evaluate and update from time to time. We are aware that unauthorized efforts to access our business records and information

with sophisticated tools could bypass our controls and procedures and we remain alert to that possibility.

Deferred tax assets comprise a significant portion of our assets and

are dependent upon future tax profitability to realize the benefits.

We have recorded deferred tax assets on our balance

sheet because we believe that it is more likely than not that we will generate sufficient tax profitability in the future to realize the

tax savings that our deferred tax assets represent. If we do not achieve and maintain sufficient profitability, the tax savings represented

by our deferred tax assets may never be realized and we would need to recognize a loss for those deferred tax assets.

We may be unable to manufacture our products because we are dependent

on a limited number of qualified suppliers for our components.

Several of our component parts are produced by one

or a limited number of suppliers. Shortages or delays could occur in these essential components due to an interruption of supply or increased

demand in the industry. Suppliers may choose to restrict credit terms or require advance payment causing delays in the procurement of

essential materials. If we are unable to procure certain component parts, we could be required to reduce our operations while we seek

alternative sources for these components, which could have a material adverse effect on our financial results. To the extent that we acquire

extra inventory stocks to protect against possible shortages, we would be exposed to additional risks associated with holding inventory,

such as obsolescence, excess quantities, or loss.

If we fail to develop and introduce new products rapidly and successfully,

we will not be able to compete effectively, and our ability to generate sufficient revenues will be negatively affected.

The market for our products is prone to rapidly changing

technology, evolving industry standards and short product life cycles. If we are unsuccessful at developing and introducing new products

and services on a timely basis that include the latest technologies, conform to the newest standards, and that are appealing to end users,

we will not be able to compete effectively, and our ability to generate significant revenues will be seriously harmed.

The development of new products and services can be

very difficult and requires high levels of innovation. The development process is also lengthy and costly. Short product life cycles for

smartphones and tablets expose our products to the risk of obsolescence and require frequent new product upgrades and introductions. We

will be unable to introduce new products and services into the market on a timely basis and compete successfully if we fail to:

| · | invest significant resources in research and development, sales and marketing, and customer support; |

| · | identify emerging trends, demands and standards in the field of mobile computing products; |

| · | enhance our products by adding additional features; |

| · | maintain superior or competitive performance in our products; and |

| · | anticipate our end users’ needs and technological trends accurately. |

We cannot be sure that we will have sufficient resources

to make adequate investments in research and development or that we will be able to identify trends or make the technological advances

necessary to be competitive.

We may not be able to collect receivables from customers who experience

financial difficulties.

Our accounts receivable is derived primarily from

distributors. We perform ongoing credit evaluations of our customers’ financial conditions but generally require no collateral from

our customers. Reserves are maintained for potential credit losses, and such losses have historically been within such reserves. However,

many of our customers may be thinly capitalized and may be prone to failure in adverse market conditions. Although our collection history

has been good, from time to time a customer may not pay us because of financial difficulty, bankruptcy or liquidation. If global financial

conditions have an impact on our customer’s ability to pay us in a timely manner, consequently, we may experience increased difficulty

in collecting our accounts receivable, and we may have to increase our reserves in anticipation of increased uncollectible accounts.

We could face increased competition in the future, which would adversely

affect our financial performance.

The market in which we operate is very competitive.

Our future financial performance is contingent on a number of unpredictable factors, including that:

| · | some of our competitors have greater financial, marketing, and technical resources than we do; |

| · | we periodically face intense price competition, particularly when our competitors have excess inventories and discount their prices

to clear their inventories; and |

| · | certain manufacturers of tablets and mobile phones offer products with built-in functions, such as Bluetooth wireless technology or

barcode scanning, that compete with our products. |

Increased competition could result in price reductions,

fewer customer orders, reduced margins, and loss of market share. Our failure to compete successfully against current or future competitors

could harm our business, operating results, and financial condition.

If we do not correctly anticipate demand for our products, our operating

results will suffer.

The demand for our products depends on many factors

and is difficult to forecast as we introduce and support more products, and as competition in the markets for our products intensifies.

If demand is lower than forecasted levels, we could have excess production resulting in higher inventories of finished products and components,

which could lead to write-downs or write-offs of some or all of the excess inventories, and reductions in our cash balances. Lower than

forecasted demand could also result in excess manufacturing capacity at our third-party manufacturers and in our failure to meet minimum

purchase commitments, each of which may lower our operating results.

If demand increases beyond forecasted levels, we will

have to rapidly increase production at our third-party manufacturers. We depend on suppliers to provide additional volumes of components,

and suppliers might not be able to increase production rapidly enough to meet unexpected demand. Even if we were able to procure enough

components, our third-party manufacturers might not be able to produce enough of our devices to meet our customer demand. In addition,

rapid increases in production levels to meet unanticipated demand could result in higher costs for manufacturing and supply of components

and other expenses. These higher costs could lower our profit margins. Further, if production is increased rapidly, manufacturing yields

could decline, which may also lower operating results.

We rely primarily on distributors to distribute our products, and our

sales would suffer if any of these distributors stopped distributing our products effectively.

Because we distribute and fulfill resellers’

orders for our products primarily through distributors, we are subject to risks associated with channel distribution, such as risks related

to their inventory levels and support for our products. Our distribution channels may build up inventories in anticipation of growth in

their sales. If such growth in their sales does not occur as anticipated, the inventory build-up could contribute to higher levels of

product returns. The lack of sales by any one significant participant in our distribution channels could result in excess inventories

and adversely affect our operating results and working capital liquidity. During the twelve months ended December 31, 2024 and 2023, Ingram

Micro® and BlueStar together represented approximately 48% and 44%, respectively, of our worldwide sales. We expect that a significant

portion of our sales will continue to depend on sales to a limited number of distributors.

Our agreements with distributors are generally nonexclusive

and may be terminated on short notice by them without cause. Our distributors are not within our control, are not obligated to purchase

products from us, and may offer competitive lines of products simultaneously. Sales growth is contingent in part on our ability to enter

into additional distribution relationships and expand our sales channels. We cannot predict whether we will be successful in establishing

new distribution relationships, expanding our sales channels or maintaining our existing relationships. A failure to enter into new distribution

relationships, expand our sales channels, or maintain our existing relationships could adversely impact our ability to grow our sales.

We allow our distribution channels to return a portion

of their inventory to us for full credit against other purchases. In addition, in the event we reduce our prices, we credit our distributors

for the difference between the purchase price of products remaining in their inventory and our reduced price for such products. Actual

returns and price protection may adversely affect future operating results and working capital liquidity by reducing our accounts receivable

and increasing our inventory balances, particularly since we seek to continually introduce new and enhanced products and are likely to

face increasing price competition.

We depend on alliances and other business relationships with third parties,

and a disruption in these relationships would hinder our ability to develop and sell our products.

We depend on strategic alliances and business relationships

with leading participants in various segments of the mobile applications market to help us develop and market our products. Our strategic

partners may revoke their commitment to our products or services at any time in the future or may develop their own competitive products

or services. Accordingly, our strategic relationships may not result in sustained business alliances, successful product or service offerings,

or the generation of significant revenues. Failure of one or more of such alliances could result in delay or termination of product development

projects, failure to win new customers or loss of confidence by current or potential customers.

We have devoted significant research and development

resources to design products to work with a number of operating systems used in mobile devices including Apple® (iOS), Google™

(Android™) and Microsoft® (Windows®). Such design activities have diverted financial and personnel resources from other

development projects. These design activities are not undertaken pursuant to any agreement under which Apple, Google or Microsoft is obligated

to collaborate or to support the products produced from such collaboration. Consequently, these organizations may terminate their collaborations

with us for a variety of reasons, including our failure to meet agreed-upon standards or for reasons beyond our control, such as changing

market conditions, increased competition, discontinued product lines, and product obsolescence.

Our intellectual property and proprietary rights may be insufficient

to protect our competitive position.

Our business depends on our ability to protect our

intellectual property. We rely primarily on patent, copyright, trademark, trade secret laws, and other restrictions on disclosure to protect

our proprietary technologies. We cannot be sure that these measures will provide meaningful protection for our proprietary technologies

and processes. We cannot be sure that any patent issued to us will be sufficient to protect our technology. The failure of any patents

to provide protection for our technology would make it easier for our competitors to offer similar products. In connection with our participation

in the development of various industry standards, we may be required to license certain of our patents to other parties, including our

competitors that develop products based upon the adopted standards.

We also generally enter into confidentiality agreements

with our employees, distributors, and strategic partners, and generally control access to our documentation and other proprietary information.

Despite these precautions, it may be possible for a third-party to copy or otherwise obtain and use our products, services, or technology

without authorization, develop similar technology independently, or design around our patents.

Additionally, effective copyright, trademark, and

trade secret protection may be unavailable or limited in certain foreign countries.

We may become subject to claims of intellectual property rights infringement,

which could result in substantial liability.

In the course of operating our business, we may receive

claims of intellectual property infringement or otherwise become aware of potentially relevant patents or other intellectual property

rights held by other parties. Many of our competitors have large intellectual property portfolios, including patents that may cover technologies

that are relevant to our business. In addition, many smaller companies, universities, and individuals have obtained or applied for patents

in areas of technology that may relate to our business. The industry is moving towards aggressive assertion, licensing, and litigation

of patents and other intellectual property rights.

If we are unable to obtain and maintain licenses on

favorable terms for intellectual property rights required for the manufacture, sale, and use of our products, particularly those products

which must comply with industry standard protocols and specifications to be commercially viable, our results of operations or financial

condition could be adversely impacted.

In addition to disputes relating to the validity or

alleged infringement of other parties’ rights, we may become involved in disputes relating to our assertion of our own intellectual

property rights. Whether we are defending the assertion of intellectual property rights against us or asserting our intellectual property

rights against others, intellectual property litigation can be complex, costly, protracted, and highly disruptive to business operations

by diverting the attention and energies of management and key technical personnel. Plaintiffs in intellectual property cases often seek

injunctive relief, and the measures of damages in intellectual property litigation are complex and often subjective or uncertain. Thus,

any adverse determinations in this type of litigation could subject us to significant liabilities and costs.

New industry standards may require us to redesign our products, which

could substantially increase our operating expenses.

Standards for the form and functionality of our products

are established by standards committees. These independent committees establish standards, which evolve and change over time, for different

categories of our products. We must continue to identify and ensure compliance with evolving industry standards so that our products are

interoperable and we remain competitive. Unanticipated changes in industry standards could render our products incompatible with products

developed by major hardware manufacturers and software developers. Should any major changes, even if anticipated, occur, we would be required

to invest significant time and resources to redesign our products to ensure compliance with relevant standards. If our products are not

in compliance with prevailing industry standards for a significant period of time, we would miss opportunities to sell our products for

use with new hardware components from mobile computer manufacturers and OEMs, thus affecting our business.

Undetected flaws and defects in our products may disrupt product sales

and result in expensive and time-consuming remedial action

Our hardware and software products may contain undetected

flaws, which may not be discovered until customers have used the products. From time to time, we may temporarily suspend or delay shipments

or divert development resources from other projects to correct a particular product deficiency. Efforts to identify and correct errors

and make design changes may be expensive and time-consuming. Failure to discover product deficiencies in the future could delay product

introductions or shipments, require us to recall previously shipped products to make design modifications, or cause unfavorable publicity,

any of which could adversely affect our business and operating results.

The loss of one or more of our senior personnel could harm our existing

business.

A number of our officers and senior managers have

been employed for more than twenty years by us, including our President, Chief Financial Officer, Vice President of Operations and Vice

President of Engineering/Chief Technical Officer. Our future success will depend upon the continued service of key officers and senior

managers. Competition for officers and senior managers is intense, and there can be no assurance that we will be able to retain our existing

senior personnel. The loss of one or more of our officers or key senior managers could adversely affect our ability to compete.

The expensing of stock options and restricted stocks will continue to

reduce our operating results such that we may find it necessary to change our business practices to attract and retain employees.

We have been using stock options and restricted stocks

as key components of our employee compensation packages. We believe that stock options and restricted stocks provide an incentive to our

employees to maximize long-term stockholder value and, through the use of vesting, encourage valued employees to remain with us. The expensing

of employee stock options and restricted stocks adversely affects our net income and earnings per share, will continue to adversely affect

future quarters, and will make profitability harder to achieve. In addition, we may decide in response to the effects of expensing stock

options and restricted stocks on our operating results to reduce the number of stock options or restricted stocks granted to employees

or to grant to fewer employees. This could adversely affect our ability to retain existing employees or attract qualified candidates,

and also could increase the cash compensation we would have to pay to them.

If we are unable to attract and retain highly skilled sales and marketing

and product development personnel, our ability to develop and market new products and product enhancements will be adversely affected.

We believe our ability to achieve increased revenues

and to develop successful new products and product enhancements will depend in part upon our ability to attract and retain highly skilled

sales and marketing and product development personnel. Our products involve a number of new and evolving technologies, and we frequently

need to apply these technologies to the unique requirements of mobile products. Our personnel must be familiar with both the technologies

we support and the unique requirements of the products to which our products connect. Competition for such personnel is intense, and we

may not be able to attract and retain such key personnel. In addition, our ability to hire and retain such key personnel will depend upon

our ability to raise capital or achieve increased revenue levels to fund the costs associated with such key personnel. Failure to attract

and retain such key personnel will adversely affect our ability to develop and market new products and product enhancements.

Our operating results could be harmed by economic, political, regulatory

and other risks associated with export sales.

Our operating results are subject to the risks inherent

in export sales, including:

| · | unexpected changes in regulatory requirements, import and export restrictions and tariffs; |

| · | difficulties in managing foreign operations; |

| · | the burdens of complying with a variety of foreign laws; |

| · | greater difficulty or delay in accounts receivable collection; |

| · | potentially adverse tax consequences; and |

| · | political and economic instability (such as Russia’s military action against Ukraine). |

Our export sales are primarily denominated in Euros

for our sales to European distributors and in British pounds for our sales to UK distributors. Accordingly, an increase in the value of

the United States dollar relative to the Euro or British pound could make our products more expensive and therefore potentially less competitive

in European markets. Declines in the value of the Euro or pound relative to the United States dollar may result in foreign currency losses

relating to the collection of receivables denominated if left unhedged.

Our facilities or operations could be adversely affected by events outside

our control, such as natural disasters or health epidemics.

Our corporate headquarters is located in a seismically

active region in Northern California. If major disasters such as earthquakes occur, or our information system or communications network

breaks down or operates improperly, our headquarters and production facilities may be seriously damaged, or we may have to stop or delay

production and shipment of our products. In addition, we may be affected by health epidemic or pandemics, such as the COVID-19 pandemic,

or geopolitical instability, such as Russia’s military action against Ukraine. We may incur expenses or delays relating to such

events outside of our control, which could have a material adverse impact on our business, operating results and financial condition.

Our quarterly operating results may fluctuate in future periods, which

could cause our stock price to decline.

We expect to experience quarterly fluctuations in

operating results in the future. Quarterly revenues and operating results depend on the volume and timing of orders received, which sometimes

are difficult to forecast. Historically, we have recognized a substantial portion of our revenue in the last month of the quarter. This

subjects us to the risk that even modest delays in orders or in the manufacture of products relating to orders received, may adversely

affect our quarterly operating results. Our operating results may also fluctuate due to factors such as:

| · | the demand for our products; |

| · | the size and timing of customer orders; |

| · | unanticipated delays or problems in our introduction of new products and product enhancements; |

| · | the introduction of new products and product enhancements by our competitors; |

| · | the timing of the introduction and deployment of new applications that work with our products; |

| · | changes in the revenues attributable to royalties and engineering development services; |

| · | timing of software enhancements; |

| · | changes in the level of operating expenses; |

| · | competitive conditions in the industry including competitive pressures resulting in lower average selling prices; |

| · | timing of distributors’ shipments to their customers; |

| · | delays in supplies of key components used in the manufacturing of our products; and |

| · | general economic conditions and conditions specific to our customers’ industries. |

Because we base our staffing and other operating expenses

on anticipated revenues, unanticipated declines or delays in the receipt of orders can cause significant variations in operating results

from quarter to quarter. As a result of any of the foregoing factors, or a combination, our results of operations in any given quarter

may be below the expectations of public market analysts or investors, in which case the market price of our common stock would be adversely

affected.

The sale of a substantial number of shares of our common stock could

cause the market price of our common stock to decline.

Sales of a substantial number of shares of our common

stock in the public market could adversely affect the market price for our common stock. The market price of our common stock could also

decline if one or more of our significant stockholders decided for any reason to sell substantial amounts of our common stock in the public

market.

As of March 20, 2025, we had 7,952,988 shares of

common stock outstanding. Substantially all of these shares are freely tradable in the public market, either without restriction or subject,

in some cases, only to Form S-3 prospectus delivery requirements and, in other cases, only to the manner of sale, volume, and notice

requirements of Rule 144 under the Securities Act.

As of March 20, 2025, we had 1,114,698 shares of

common stock subject to outstanding options under our stock option plans, 1,140,202 shares of restricted stock outstanding, and 328,166

shares of common stock available for future issuance under the plans. We have registered the shares of common stock subject to outstanding

options and restricted stock and reserved them for issuance under our stock option plans. Accordingly, the shares of common stock underlying

vested options and unvested restricted stock will be eligible for resale in the public market as soon as the options are exercised or

the restricted stock vests, as applicable.

Volatility in the trading price of our common stock could negatively

impact the price of our common stock.

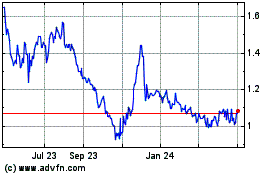

During the period from January 1, 2024 through the

date of the report, our common stock price fluctuated between a high of $1.72 and a low of $0.91. We have experienced low trading volumes

in our stock, and thus relatively small purchases and sales can have a significant effect on our stock price. The trading price of our

common stock could be subject to wide fluctuations in response to many factors, some of which are beyond our control, including general

economic conditions and the outlook of securities analysts and investors on our industry. In addition, the stock markets in general,

and the markets for high technology stocks in particular, have experienced high volatility that has often been unrelated to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cybersecurity

We recognize the importance of assessing, identifying

and managing material risks associated with cybersecurity threats. These risks include, among other things: operational risks, intellectual

property theft, fraud, extortion, harm to employees or customers and violation of data privacy or security laws. Our cybersecurity programs

are built on operations and compliance foundations. Operations focus on continuous detection, prevention, measurement, analysis and response

to cybersecurity alerts and incidents, and on emerging threats. Compliance establishes oversight of our cybersecurity programs by creating

risk-based controls to protect the integrity, confidentiality, accessibility and availability of company data stored, processed or transferred.

Our cybersecurity program is integrated within our overall risk management processes.

Our cybersecurity program is led by our Chief Information

Officer (“CIO”) who is responsible for our overall information security strategy, policy, security engineering, operations

and cyber threat detection and response. Our CIO has extensive information technology and program management experience and many years

of experience with our organization. Our CIO reports to our president and CEO.

Recognizing the complexity and evolving nature of

cybersecurity threats, we engage with external experts in evaluating and testing our risk management systems. The partnerships enable

us to leverage specialized knowledge and insights, ensuring our cybersecurity strategies and processes remain at the forefront of industry

best practices. Our collaboration with the third-party includes threat assessments and consultation on security enhancements. All employees

are required to complete cybersecurity training at least once a year and have access to more frequent cybersecurity training through online

updates.

Our board of directors oversees management’s

processes for identifying and mitigating risks, including cybersecurity risks, to help align our risk exposure with our strategic objectives.

Senior leadership briefs the board of directors on our cybersecurity and information security posture, and our board of directors is informed

of cybersecurity incidents deemed to have a high or critical business impact, even if immaterial to us.

While acknowledging the existence of various cybersecurity

risks, to date, they have not materially affected our business strategy, results of operations or financial condition. Although we have

not experienced any breaches, we have encountered occasional attempts, albeit of minor significance, targeting our data and systems, including

instances of malware and computer virus infiltration. Thus far all such incidents have been minor.

Item 2. Properties

In February 2022, the Company entered into an

87-month operating lease agreement for an approximately 35,913 square-foot facility in Fremont, California, where our office and

manufacturing operations are located. The current monthly rent obligation

is $53,340, subject to annual 3% increases each May.

Item 3. Legal Proceedings

We are currently not a party to any material legal

proceedings.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities

Common Stock

The Company’s common stock is traded on the

NASDAQ Marketplace under the symbol “SCKT.”

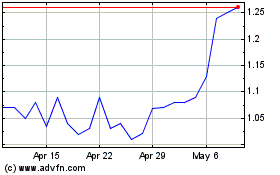

On March 20, 2025, the closing sales price for our

common stock of 7,952,988 shares as reported on the NASDAQ Marketplace, was $1.15. We have

not paid dividends on our common stock, and we currently intend to retain future earnings for use in our business and do not anticipate

paying dividends in the foreseeable future.

The information required by this item regarding equity

compensation plans is incorporated by reference to the information set forth in Item 12 of this Annual Report on Form 10-K.

Performance Graph

As a “smaller reporting company,” as defined

by Rule 12b-2 of the Exchange Act, we have elected scaled disclosure reporting and therefore are not required to provide the stock performance

graph.

Recent Sales of Unregistered Securities.

None.

Item 6. Selected Financial Data

The following selected financial data should be read

in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and the financial statements and the notes thereto in Item 8, “Financial Statements and Supplementary Data.”

| | |

Years Ended December 31, |

| (Amounts in thousands, except per share) | |

2020 | |

2021 | |

2022 | |

2023 | |

2024 |

| Income Statement Data: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenues | |

$ | 15,700 | | |

$ | 23,199 | | |

$ | 21,238 | | |

$ | 17,034 | | |

$ | 18,763 | |

| Gross profit | |

$ | 8,335 | | |

$ | 12,436 | | |

$ | 10,366 | | |

$ | 8,463 | | |

$ | 9,311 | |

| Operating expenses | |

$ | 12,686 | | |

$ | 9,739 | | |

$ | 10,812 | | |

$ | 11,584 | | |

$ | 11,914 | |

| Net income (loss) before income taxes | |

$ | (3,330 | ) | |

$ | 2,564 | | |

$ | (621 | ) | |

$ | (3,363 | ) | |

$ | (2,793 | ) |

| Income tax benefit (expense) | |

$ | 51 | | |

$ | 1,903 | | |

$ | 708 | | |

$ | 1,444 | | |

$ | 551 | |

| Net income (loss) | |

$ | (3,279 | ) | |

$ | 4,466 | | |

$ | 87 | | |

$ | (1,919 | ) | |

$ | (2,242 | ) |

Net income (loss) per share:

Basic | |

$ | (0.51 | ) | |

$ | 0.58 | | |

$ | 0.01 | | |

$ | (0.27 | ) | |

$ | (0.30 | ) |

| Diluted | |

$ | (0.51 | ) | |

$ | 0.48 | | |